Radioimmunotherapy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435305 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Radioimmunotherapy Market Size

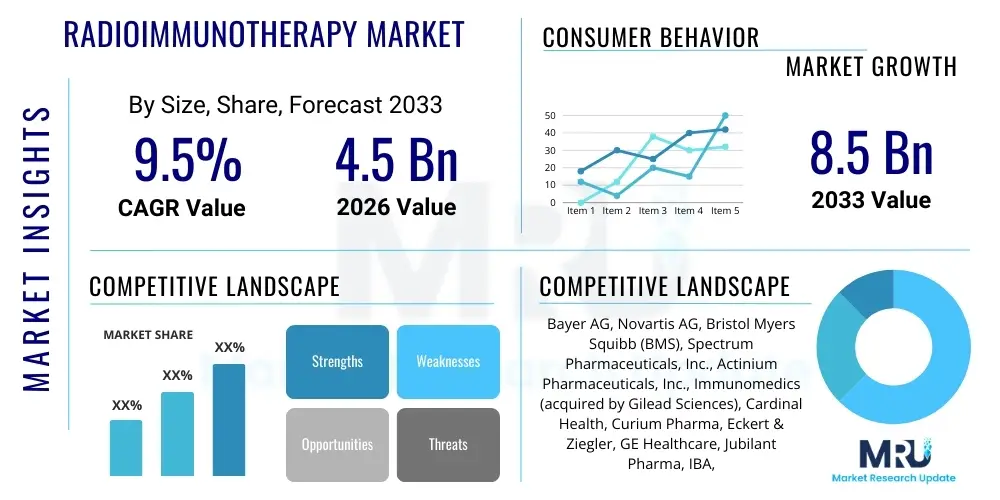

The Radioimmunotherapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.5 Billion by the end of the forecast period in 2033.

Radioimmunotherapy Market introduction

The Radioimmunotherapy (RIT) Market encompasses specialized cancer treatments that leverage the precision of monoclonal antibodies (mAbs) linked to therapeutic radioisotopes to target and destroy cancer cells. This highly selective approach, often termed molecular radiotherapy, ensures that high doses of radiation are delivered directly to the tumor site, minimizing systemic toxicity and damage to adjacent healthy tissues. Key products driving this market include established treatments like Zevalin (Ibritumomab Tiuxetan) and newer radiopharmaceuticals such as Pluvicto (Lutetium-177 PSMA-617), which are increasingly being adopted for treating complex malignancies.

Major applications for radioimmunotherapy currently focus on hematological cancers, particularly Non-Hodgkin’s Lymphoma (NHL), and increasingly, prostate cancer and neuroendocrine tumors (NETs). The mechanism of action involves the targeted antibody binding to specific antigens expressed on the surface of tumor cells, followed by the radioactive isotope (like Yttrium-90 or Lutetium-177) emitting cytotoxic radiation (beta or alpha particles), leading to DNA damage and apoptosis within the cancer cells. This specificity offers a significant advantage over traditional external beam radiation therapy or systemic chemotherapy, leading to improved efficacy and better patient outcomes, especially for relapsed or refractory diseases.

The market’s substantial growth is primarily driven by the rising global incidence of various cancers, coupled with robust advancements in radiopharmaceutical science, chelator technology, and medical imaging (theranostics). The integration of diagnostic imaging agents with therapeutic radiopharmaceuticals—the theranostics paradigm—allows for patient selection based on target expression and real-time monitoring of treatment efficacy, significantly enhancing the utility and safety profile of RIT. Furthermore, increased investment in clinical trials exploring RIT combinations with immunotherapy agents and chemotherapy regimens is expanding the addressable patient population and securing the market’s positive long-term outlook.

Radioimmunotherapy Market Executive Summary

The Radioimmunotherapy market is poised for significant expansion, fueled by regulatory approvals of novel radiopharmaceuticals and the accelerating adoption of the theranostics approach globally. Current business trends indicate a shift towards targeted alpha therapy (TAT), which utilizes highly potent alpha-emitting isotopes (e.g., Actinium-225) to deliver highly localized energy transfer, promising superior efficacy in microscopic disease or small metastases. Furthermore, strategic collaborations between pharmaceutical majors, biotech firms specializing in antibody development, and cyclotron operators are crucial for overcoming the complex manufacturing and supply chain challenges inherent to radiopharmaceuticals, ensuring wider market availability and streamlining distribution channels worldwide.

Regional trends highlight North America and Europe as dominant markets, primarily due to advanced healthcare infrastructure, high patient willingness to adopt innovative cancer therapies, and substantial R&D expenditure supporting clinical research. However, the Asia Pacific (APAC) region is projected to register the highest CAGR, driven by increasing cancer prevalence, improving access to specialized cancer centers, and governmental initiatives supporting nuclear medicine infrastructure development, particularly in countries like China, Japan, and India. The rising demand for personalized medicine across all major regions reinforces the criticality of RIT's targeted nature.

Segmentation analysis confirms that Lutetium-177 based products are expected to maintain market leadership, primarily due to their favorable half-life characteristics and expanding application across solid tumors, most notably prostate cancer. The End-User segment will see hospitals and specialized cancer centers retaining the largest share, although the fastest growth is anticipated in Ambulatory Surgical Centers (ASCs) and standalone Nuclear Medicine Clinics, reflecting the shift towards outpatient administration of certain RIT procedures. Successfully navigating regulatory hurdles, managing the short shelf-life of radioisotopes, and ensuring adequate reimbursement coverage remain critical factors influencing segment performance across the forecast period.

AI Impact Analysis on Radioimmunotherapy Market

Common user questions regarding AI's influence on the Radioimmunotherapy market often revolve around how AI can enhance targeting precision, optimize treatment planning, predict patient response, and streamline the complex manufacturing and quality control processes associated with radiopharmaceuticals. Users express concerns about the integration complexity of AI algorithms with existing nuclear medicine workflows and the validation required for regulatory acceptance of AI-driven diagnostics or dosimetry. The consensus expectation is that AI will primarily serve as an accelerant, improving efficiency from the initial discovery of novel radiotracers to the final personalized dose administration, thereby reducing costs and improving overall treatment efficacy and safety margins for RIT patients.

AI's role in RIT is multifaceted, extending beyond just image analysis. In the discovery phase, machine learning models can predict the binding affinity and toxicity profiles of new radiolabeled antibodies or small molecules, drastically reducing the time and expense associated with preclinical screening. Furthermore, AI algorithms are becoming indispensable in the critical area of personalized dosimetry. By analyzing complex, multi-modal imaging data (SPECT, PET, CT) post-administration, AI can accurately model the absorbed radiation dose within the tumor and critical organs. This capability allows nuclear medicine physicians to calculate and adjust the precise therapeutic dose for each individual patient, moving RIT further away from fixed-dose regimens towards truly personalized radiation delivery, which is paramount for balancing therapeutic effect and avoiding organ toxicity.

On the operational side, AI is proving transformative in radiopharmaceutical production and supply chain management. Given the short half-lives of many therapeutic isotopes, minimizing production downtime and optimizing logistics is essential. AI-powered predictive maintenance models can monitor cyclotron performance and manufacturing equipment in real-time, preventing costly delays. Moreover, in clinical trials, AI can accelerate data processing, identify optimal patient cohorts based on molecular markers, and automate the intricate regulatory documentation required for novel RIT agents, ultimately shortening the timeline from lab bench to patient bedside and accelerating market penetration of new radioimmunotherapy drugs.

- AI enhances personalized dosimetry by analyzing patient-specific pharmacokinetics and biodistribution data from SPECT/PET imaging.

- Machine learning accelerates radiopharmaceutical discovery by predicting compound efficacy, toxicity, and stability profiles.

- AI optimizes manufacturing logistics and supply chain management, crucial for handling isotopes with short half-lives.

- Natural Language Processing (NLP) aids in rapidly synthesizing large volumes of clinical trial data for faster regulatory submission.

- Advanced image segmentation algorithms improve tumor boundary delineation, leading to more precise radiation targeting and reduced off-target exposure.

DRO & Impact Forces Of Radioimmunotherapy Market

The Radioimmunotherapy market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities. Key drivers include the escalating global prevalence of cancer, the strong clinical evidence supporting RIT in refractory cancers, and continuous innovation in radiopharmaceutical synthesis and delivery systems, particularly the pivot towards alpha-particle emitters offering higher potency. The compelling therapeutic benefits and the rise of the theranostics paradigm, enabling precise patient selection and monitoring, further solidify the market's upward trajectory. These forces collectively create a high-growth environment characterized by increasing investment in nuclear medicine infrastructure globally, especially within major hospital systems.

Conversely, significant restraints hinder market growth and adoption. The most prominent challenges are the high cost associated with RIT procedures, which can be prohibitive in developing economies, and the inherent complexities of the radiopharmaceutical supply chain. The short half-lives of critical radioisotopes necessitate highly coordinated, time-sensitive manufacturing, transport, and administration protocols, making disruptions costly and patient scheduling difficult. Furthermore, the limited availability of specialized nuclear medicine physicians, technologists, and appropriate handling facilities (cyclotrons and hot labs) acts as a bottleneck, restricting widespread clinical deployment, especially in rural areas or regions with less developed healthcare systems.

Opportunities for market expansion are abundant, centered on expanding RIT applications into prevalent solid tumors (e.g., lung, breast, colorectal) where current treatments often fail, moving beyond its historical focus on lymphoma and NETs. Strategic opportunities also lie in integrating RIT into combination therapies, particularly alongside checkpoint inhibitors, potentially enhancing the immune response against cancer. Furthermore, technological breakthroughs in automating radiolabeling processes and developing centralized radiopharmacies, coupled with increasing governmental funding for cancer research and regulatory fast-tracking mechanisms for breakthrough designations, promise to mitigate existing restraints and unlock substantial commercial potential in emerging and established markets alike.

Segmentation Analysis

The Radioimmunotherapy market is systematically segmented based on Product Type, Application, and End-User, providing granular insights into market dynamics and growth potential across various dimensions. The analysis highlights that market performance is heavily influenced by the regulatory status and clinical success of specific radioisotopes. Products based on Lutetium-177 (177Lu) currently dominate the landscape, capitalizing on recent successful clinical trials and subsequent commercialization in advanced prostate cancer, driving significant revenue. The Application segment is witnessing a crucial pivot, with solid tumors rapidly gaining market share against the traditional stronghold of Non-Hodgkin’s Lymphoma (NHL), reflecting the success of new targeted therapies like PSMA and SSTR antagonists.

The segmentation data underscores the evolving therapeutic landscape. While hematological malignancies were the initial target for RIT, ongoing research in targeted alpha therapy (TAT) promises to expand efficacy into complex solid tumor indications that are poorly responsive to beta-emitters. End-user analysis reveals that specialized cancer research centers are key drivers of innovation, performing the critical clinical trials necessary for product approval and refinement. However, the largest volume consumption remains within large hospitals due to their capacity for managing high-risk procedures, specialized nuclear waste disposal, and multidisciplinary teams required for comprehensive RIT delivery and post-treatment management, ensuring continued market relevance across all geographical areas.

- By Product Type:

- Iodine-131 (131I)

- Yttrium-90 (90Y)

- Lutetium-177 (177Lu)

- Actinium-225 (225Ac)

- Others (e.g., Rhenium-186/188, Copper-67)

- By Application:

- Non-Hodgkin's Lymphoma (NHL)

- Neuroendocrine Tumors (NETs)

- Prostate Cancer (PSMA-targeted RIT)

- Liver Cancer (Hepatocellular Carcinoma)

- Thyroid Cancer

- Other Solid Tumors (e.g., Colorectal, Breast, Lung)

- By End-User:

- Hospitals and Cancer Centers

- Specialty Clinics and Ambulatory Surgical Centers (ASCs)

- Academic and Research Institutes

Value Chain Analysis For Radioimmunotherapy Market

The value chain for the Radioimmunotherapy market is highly specialized, beginning with the complex and resource-intensive upstream activities involving the production and sourcing of medical radioisotopes, often requiring specialized infrastructure like nuclear reactors or cyclotrons. Upstream analysis focuses on securing stable supply contracts for critical radionuclides (such as Lutetium-177 and Actinium-225), which are subject to geopolitical stability and regulatory constraints. This phase also includes the development and manufacturing of high-quality monoclonal antibodies (mAbs) or targeting ligands in specialized biomanufacturing facilities. The efficient synthesis of the radioconjugate—linking the isotope to the antibody using sophisticated chelator chemistry—is a crucial, high-value step that determines the final product's stability and therapeutic efficacy, demanding stringent regulatory oversight.

The midstream segment centers on manufacturing and distribution. Manufacturing involves cGMP compliant radiolabeling, formulation, and quality control (QC) testing, often executed through centralized radiopharmacies or by the pharmaceutical manufacturer directly. Given the short half-life of most RIT agents, the distribution channel must be highly efficient and time-critical, relying on specialized logistics providers capable of handling hazardous materials under strict temperature and time constraints. Direct distribution models are often preferred for newly approved, high-value products to maintain tight control over inventory and quality, whereas indirect channels might be used for established products through specialized distributors who interface directly with hospitals and nuclear medicine departments.

Downstream analysis involves the final delivery and administration of the therapy to the patient. End-users—primarily specialized cancer centers and hospitals—require substantial investment in dedicated nuclear medicine facilities, specialized shielded rooms, dosimetry equipment, and highly trained personnel (nuclear medicine physicians, radiation safety officers, and pharmacists). The market success at this stage is contingent upon favorable reimbursement policies, comprehensive clinical guidelines for administration, and the ability of healthcare providers to effectively manage patient scheduling, radiation safety, and the disposal of radioactive waste, completing a value chain that is inherently complex, capital-intensive, and heavily regulated.

Radioimmunotherapy Market Potential Customers

The primary potential customers and end-users of Radioimmunotherapy products are specialized healthcare institutions and professionals focused on oncology and nuclear medicine. These include large tertiary care hospitals, comprehensive cancer centers affiliated with academic institutions, and dedicated specialty clinics offering advanced radiation oncology and nuclear medicine services. These institutions serve as the primary sites for RIT administration due to their requisite infrastructure, including hot labs, shielded preparation areas, advanced SPECT/CT or PET/CT imaging capabilities for pre-treatment theranostic workups, and specialized waste disposal procedures necessary for handling radioactive materials safely and legally. The decision-makers within these institutions, such as department heads of Oncology, Nuclear Medicine, and Pharmacy directors, are critical target audiences for market stakeholders.

A rapidly expanding segment of potential customers includes smaller, specialized nuclear medicine clinics and Ambulatory Surgical Centers (ASCs) that are increasingly being equipped to handle less complex, often outpatient RIT procedures, particularly for treatments with established safety profiles. These smaller facilities are attracted by the potential for high-value procedures and reduced operational overhead compared to large hospitals, presenting a viable expansion channel for RIT manufacturers, provided that supply chain reliability is guaranteed. Furthermore, global governmental and private entities funding cancer research, including National Cancer Institutes and large philanthropic organizations, are indirect but highly influential customers, driving demand through research grants and funding for clinical trials exploring new RIT agents and indications.

Ultimately, the individual patient suffering from specific forms of cancer—particularly relapsed or refractory Non-Hodgkin’s Lymphoma, metastatic castration-resistant prostate cancer (mCRPC), and certain neuroendocrine tumors—is the ultimate consumer. The purchasing decisions, however, are made by oncology and hematology specialists who prescribe RIT based on diagnostic confirmation (often utilizing companion theranostic diagnostics) and clinical guidelines. Therefore, successful market penetration requires effective clinical education, robust data demonstrating superior efficacy and safety profiles, and establishing strong clinical champions within the prescribing community, ensuring RIT is positioned as a preferred option in the complex treatment landscape of advanced malignancies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Novartis AG, Bristol Myers Squibb (BMS), Spectrum Pharmaceuticals, Inc., Actinium Pharmaceuticals, Inc., Immunomedics (acquired by Gilead Sciences), Cardinal Health, Curium Pharma, Eckert & Ziegler, GE Healthcare, Jubilant Pharma, IBA, Lantheus Holdings, Inc., Fusion Pharmaceuticals, Clarity Pharmaceuticals, Telix Pharmaceuticals, POINT Biopharma (acquired by Eli Lilly), Debiopharm, Orano Med, ITM Isotope Technologies Munich SE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radioimmunotherapy Market Key Technology Landscape

The technological landscape of the Radioimmunotherapy market is rapidly evolving, driven primarily by innovations in radionuclide production, targeted delivery systems, and enhanced imaging modalities. A pivotal technological shift involves the transition from traditional beta emitters, such as Yttrium-90, to highly potent alpha emitters like Actinium-225 (225Ac) and Thorium-227 (227Th). Alpha particles deliver high linear energy transfer (LET) over a very short range, making them exceptionally effective at killing cancer cells with minimal damage to surrounding healthy tissue. However, the scarcity and complex production of these alpha isotopes, typically requiring specialized high-power reactors or accelerators, constitute a major technological hurdle that companies are aggressively addressing through new cyclotron technologies and alternative sourcing pathways.

Another foundational technology driving RIT growth is the theranostics approach, which merges diagnostic and therapeutic capabilities into a single molecular entity. This paradigm relies on pairing a diagnostic radioisotope (e.g., Gallium-68 or Fluorine-18) with a therapeutically active radioisotope (e.g., Lutetium-177) that targets the same tumor antigen (e.g., PSMA for prostate cancer). This dual-functionality allows clinicians to first image the tumor to confirm antigen expression and precisely map biodistribution, and subsequently administer the therapy, ensuring that treatment is confined only to patients likely to respond, thereby maximizing efficacy and improving resource utilization. Advanced SPECT and PET scanners capable of high-resolution quantitative imaging are crucial technological components enabling accurate theranostic applications.

Furthermore, significant technological advancements are centered on improving the conjugation chemistry—the method used to chemically link the radionuclide to the antibody or targeting ligand. The development of advanced chelators (e.g., DOTA and DTPA derivatives) ensures that the radioisotope remains stably attached in vivo, preventing premature release and subsequent systemic toxicity. Research into pre-targeting strategies, where the targeting moiety and the radiolabeled component are injected separately, aims to further enhance tumor-to-background ratios, increasing therapeutic index while reducing bone marrow toxicity. These technological efforts collectively are aimed at improving RIT's safety, expanding its therapeutic window, and enabling broader application across a wider spectrum of oncological indications.

Regional Highlights

North America: North America remains the leading regional market for Radioimmunotherapy, characterized by high adoption rates, sophisticated healthcare infrastructure, and favorable reimbursement policies, particularly in the United States. The region benefits from intense R&D activities, substantial governmental and private funding for oncology research, and the presence of major pharmaceutical companies and specialized biotech firms that drive product innovation and clinical trial volume. The dominance is further solidified by the early and widespread adoption of the theranostics paradigm, especially in prostate and neuroendocrine tumor treatment, ensuring rapid market access for novel agents like Lutetium-177 PSMA. High cancer incidence rates and a culture of early adoption of advanced treatments contribute significantly to North America’s sustained revenue growth and commanding market share.

Europe: Europe represents the second-largest market, exhibiting strong growth driven by robust regulatory support from the European Medicines Agency (EMA) and increasing collaboration between academic hospitals and industry partners. Countries such as Germany, France, and the UK have well-established nuclear medicine facilities and a growing emphasis on personalized cancer treatment. However, the market faces constraints related to fragmented reimbursement policies across different member states and challenges in securing a stable, centralized supply of radioisotopes. Despite these hurdles, rising investment in cyclotrons and centralized radiopharmacies, coupled with increasing patient awareness of molecular radiotherapy options, positions Europe for continued steady market expansion, particularly in high-value, targeted therapies.

Asia Pacific (APAC): The Asia Pacific region is forecast to be the fastest-growing market globally, presenting immense untapped potential. Growth is stimulated by rapidly improving healthcare expenditure, increasing public awareness campaigns regarding advanced cancer treatment options, and the modernization of healthcare infrastructure, particularly in emerging economies like China, India, and South Korea. While regulatory pathways can be complex and varied, large patient populations suffering from common cancers drive significant market opportunity. Investment in local manufacturing capabilities for radiopharmaceuticals and strategic alliances between multinational corporations and local distributors are key to overcoming logistical challenges and accelerating the adoption of RIT across the diverse economies of the APAC region.

Latin America (LATAM) and Middle East & Africa (MEA): LATAM and MEA currently hold smaller market shares but demonstrate high potential for future growth. In LATAM, Brazil and Mexico are leading the charge, driven by private healthcare sector investment and rising medical tourism for advanced cancer treatments. Market penetration is often hindered by economic instability and variable public healthcare budgets. In MEA, the Gulf Cooperation Council (GCC) countries are rapidly investing in specialized oncology centers and nuclear medicine facilities, backed by significant government spending on healthcare diversification. However, access challenges, high procedure costs, and the lack of comprehensive reimbursement structures across vast regions require substantial infrastructure development before RIT can achieve widespread adoption in these emerging geographical areas.

- North America: Market leader due to advanced infrastructure, high R&D spending, and established theranostics adoption.

- Europe: Strong second market, characterized by government support for nuclear medicine and increasing patient pool in Germany and France.

- Asia Pacific (APAC): Highest projected CAGR, driven by rising cancer incidence and substantial investment in healthcare modernization in China and India.

- Latin America (LATAM): Emerging market driven by private sector growth and increasing access in major economies like Brazil.

- Middle East & Africa (MEA): Growth concentrated in GCC nations due to high government investment in specialized cancer care facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radioimmunotherapy Market.- Bayer AG

- Novartis AG

- Bristol Myers Squibb (BMS)

- Spectrum Pharmaceuticals, Inc.

- Actinium Pharmaceuticals, Inc.

- Immunomedics (acquired by Gilead Sciences)

- Cardinal Health

- Curium Pharma

- Eckert & Ziegler

- GE Healthcare

- Jubilant Pharma

- IBA

- Lantheus Holdings, Inc.

- Fusion Pharmaceuticals

- Clarity Pharmaceuticals

- Telix Pharmaceuticals

- POINT Biopharma (acquired by Eli Lilly)

- Debiopharm

- Orano Med

- ITM Isotope Technologies Munich SE

Frequently Asked Questions

Analyze common user questions about the Radioimmunotherapy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Radioimmunotherapy (RIT) and how does it work to treat cancer?

Radioimmunotherapy is a targeted cancer treatment where a specific monoclonal antibody (mAb) is chemically linked to a therapeutic radioisotope (e.g., Lutetium-177 or Yttrium-90). This radiolabeled antibody selectively binds to antigens expressed on the surface of cancer cells, delivering a lethal dose of radiation directly to the tumor while minimizing exposure to healthy tissues. The radiation emission destroys the DNA of the cancer cells, leading to tumor regression.

What are the primary applications of RIT currently driving market growth?

The market growth is primarily driven by successful applications in hematological malignancies, such as Non-Hodgkin’s Lymphoma (NHL), and increasingly, solid tumors, notably metastatic castration-resistant prostate cancer (mCRPC) through PSMA-targeted therapies, and neuroendocrine tumors (NETs). Clinical trials expanding RIT into lung, breast, and colorectal cancers are key growth opportunities, leveraging the specificity offered by targeted delivery systems.

How does the theranostics approach impact the effectiveness of Radioimmunotherapy?

Theranostics significantly enhances RIT effectiveness by combining diagnostic and therapeutic agents that target the same biomarker. A diagnostic tracer (often PET/SPECT based) is used first to confirm antigen expression, assess biodistribution, and select patients most likely to benefit. This personalized approach optimizes treatment planning, ensures accurate dosing (dosimetry), and allows for real-time monitoring of therapeutic response, thereby improving safety and clinical outcomes.

What are the major challenges facing the radiopharmaceutical supply chain?

The primary challenges stem from the inherent properties of radioisotopes, including their short half-lives, which necessitate rapid, highly coordinated production and delivery logistics. Constraints also arise from limited global production capacity of specialized isotopes (like Actinium-225), reliance on specialized infrastructure (cyclotrons and nuclear reactors), and the need for stringent regulatory compliance in handling and transporting hazardous radioactive materials across international borders.

Which type of radioisotope technology is expected to drive future RIT innovation?

Targeted Alpha Therapy (TAT) utilizing alpha-emitting isotopes (e.g., Actinium-225) is expected to be the key driver of future innovation. Alpha emitters possess high linear energy transfer capabilities over a very short range, offering superior cytotoxic potency against microscopic disease and highly resistant tumors. Although production challenges exist, TAT is viewed as the next generation of highly potent, precision radiotherapy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager