Railway Air Spring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432145 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Railway Air Spring Market Size

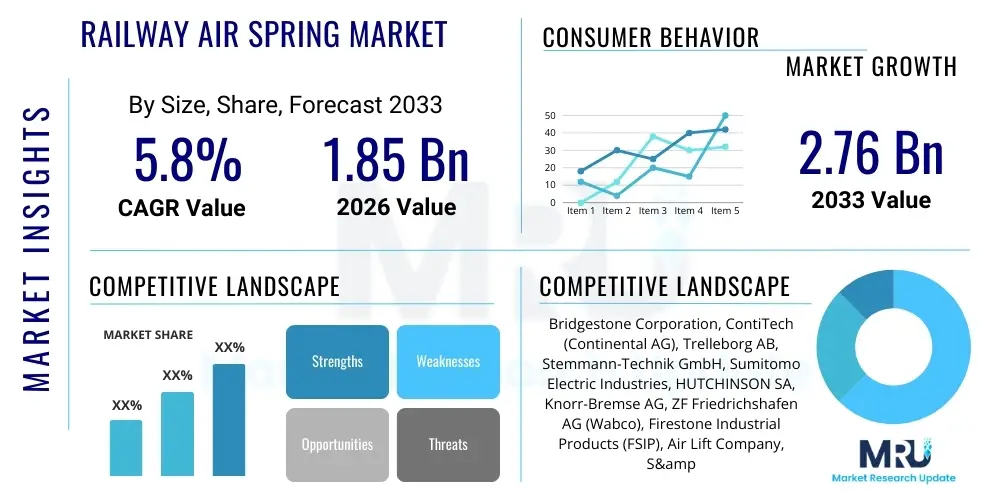

The Railway Air Spring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally driven by global infrastructure investments targeting rail network expansion and modernization, particularly the proliferation of high-speed rail corridors across Asia and Europe. The increasing emphasis on passenger comfort, safety standards, and reduced noise pollution necessitates the adoption of highly advanced secondary suspension systems like air springs, ensuring long-term market stability and revenue generation.

The valuation reflects robust demand from both the Original Equipment Manufacturer (OEM) segment, fueled by new rolling stock production, and the highly essential Aftermarket segment, driven by scheduled maintenance and replacement cycles. Developed economies in Western Europe and North America emphasize longevity and efficiency, leading to higher spending on technologically advanced air springs featuring enhanced materials and sensor integration. Conversely, emerging economies, particularly in the Asia Pacific region, contribute significantly to market volume due to massive national rail projects and urban transit system expansions, positioning the market for sustained high-single-digit growth throughout the projected period.

Railway Air Spring Market introduction

The Railway Air Spring Market encompasses specialized pneumatic suspension components designed primarily for railway vehicles, serving as the critical element in the secondary suspension system positioned between the bogie frame and the car body. These sophisticated components use pressurized air, often in conjunction with rubber components, to support the weight of the car body and its payload while maintaining a constant floor height regardless of loading conditions. The air springs effectively isolate the car body from vibrations and shocks generated by track irregularities, thereby significantly enhancing passenger comfort, reducing structural fatigue on the rolling stock, and minimizing maintenance requirements associated with mechanical wear.

Major applications for railway air springs span across diverse segments of the rail industry, including high-speed trains, metropolitan subway systems, light rail vehicles (LRVs), and specialized freight wagons requiring precise cargo protection. The core benefits derived from their implementation are multifold: superior vibration damping, automatic leveling capabilities for improved safety during cornering and entry/exit, and tunable suspension characteristics achieved by adjusting internal air pressure. These advantages make air springs indispensable components in modern rail transport systems where ride quality and operational efficiency are paramount concerns, replacing or complementing traditional mechanical spring arrangements like coil and leaf springs.

The market growth is substantially driven by global urbanization trends leading to increased demand for efficient and safe public transit, alongside governmental mandates prioritizing rail network expansion and electrification efforts. Furthermore, stringent regulations regarding noise emissions and passenger safety across Europe and Asia Pacific compel rolling stock manufacturers to adopt state-of-the-art suspension technologies. Technological advancements focusing on integrating sensors for real-time diagnostics and condition monitoring also act as potent driving forces, promising enhanced operational uptime and reduced lifecycle costs for rail operators worldwide.

Railway Air Spring Market Executive Summary

The Railway Air Spring Market is undergoing a transformation characterized by strong business trends centered on digitalization and sustainability. Current business trends indicate a definitive shift towards 'smart' air spring systems incorporating Internet of Things (IoT) sensors for predictive maintenance (PdM), allowing operators to monitor pressure, temperature, and damping characteristics in real-time. This integration minimizes unscheduled downtime and optimizes replacement schedules, contributing to favorable total cost of ownership (TCO) models. Investment in composite materials and specialized rubber blends aimed at reducing weight and improving durability is also a key corporate strategy, primarily driven by Original Equipment Manufacturers (OEMs) seeking to enhance rolling stock energy efficiency and performance over extended lifespans.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, India, and Southeast Asian nations, dominates in terms of volume due to expansive infrastructure projects, particularly new metro lines and high-speed rail construction. Europe, however, leads in value and technological adoption, maintaining high standards for passenger experience, thus driving the demand for advanced, electronically controlled air suspension systems. North America shows stable growth, largely influenced by replacement cycles and moderate expansion in high-capacity commuter rail, while the Middle East and Africa (MEA) represent nascent but high-potential regions poised for rapid infrastructure development that will spur future air spring procurement.

Segment trends highlight the continuous strength of the Aftermarket, which consistently accounts for a significant portion of revenue due to the long operational life of railway vehicles requiring cyclical replacement of rubber components—typically every 5 to 8 years. Within application segmentation, the High-Speed Rail segment exhibits the highest growth rate, as these systems demand superior isolation and stability capabilities that only advanced air springs can reliably provide. Furthermore, there is a growing trend of customization, with suppliers developing application-specific air spring designs tailored for extreme operating environments, such as very high temperatures or heavily abrasive conditions found in mining and heavy freight operations.

AI Impact Analysis on Railway Air Spring Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can improve the reliability and reduce the operational costs associated with railway suspension systems. The primary user concerns revolve around the feasibility of integrating AI with existing legacy rail infrastructure, the required initial investment for sensor implementation and data analytics platforms, and the accuracy of AI models in predicting component failure under highly variable operational loads and environmental conditions. Users seek reassurance that AI-driven maintenance scheduling will provide a clear return on investment (ROI) by significantly reducing catastrophic failures and maximizing the service life of critical components like air springs. They are specifically interested in closed-loop systems where AI autonomously manages air pressure adjustments for optimal ride comfort based on real-time track geometry data.

The practical application of AI in the Railway Air Spring market centers on enhancing Predictive Maintenance (PdM) regimes. By leveraging data streamed from integrated sensors (pressure, acceleration, temperature), AI algorithms analyze patterns indicative of material degradation, minor leaks, or abnormal stress accumulation far earlier than traditional inspection methods. This transition from time-based or mileage-based maintenance to true condition-based monitoring drastically reduces maintenance costs and minimizes unexpected downtime, which is crucial for high-utilization rail networks. AI also plays a role in optimizing the air supply system by predicting peak demands and ensuring compressed air availability without excessive energy consumption, contributing to overall operational efficiency.

Furthermore, AI is increasingly being used during the design and manufacturing phases. Generative design algorithms can simulate millions of operational scenarios, allowing engineers to optimize the geometric configuration and material composition of air springs for specific rolling stock models, ensuring maximum fatigue resistance and performance under complex dynamic loads. This reduces the prototyping cycle and ensures that newly deployed air springs are inherently more reliable and durable from their inception. The ability of AI to process vast quantities of operational data across an entire fleet provides invaluable feedback loops, accelerating product iteration and delivering suspension solutions perfectly tailored to diverse geographical and operational requirements.

- AI enables highly accurate Predictive Maintenance (PdM) by analyzing real-time sensor data, forecasting potential air spring failures up to months in advance.

- Machine Learning algorithms optimize dynamic air pressure settings based on passenger load, speed, and track conditions, maximizing ride quality and energy efficiency.

- AI integration assists in identifying subtle operational anomalies and deviations in damping characteristics that may indicate early signs of rubber deterioration or diaphragm wear.

- Generative design tools utilize AI to optimize the structural integrity and material usage of new air spring components, improving durability and reducing overall weight.

- Automated diagnostics systems, powered by AI, reduce the need for manual inspection, streamlining maintenance processes and reducing labor costs in inspection yards.

DRO & Impact Forces Of Railway Air Spring Market

The Railway Air Spring Market is profoundly influenced by a confluence of driving factors, restrictive elements, and strategic opportunities, which collectively shape the competitive landscape and growth trajectory. The dominant drivers include the relentless global expansion of high-speed rail networks, particularly in populous regions like China, India, and Southeast Asia, where superior suspension systems are non-negotiable for achieving high operating speeds and mandated passenger comfort levels. Coupled with this is the continuous global emphasis on upgrading urban transit systems (metros and light rail) to handle burgeoning city populations, further bolstering demand for reliable pneumatic suspension. Restraints primarily involve the high initial capital investment required for air spring systems compared to traditional steel suspension, complex installation and maintenance procedures demanding specialized training, and significant market consolidation which can limit price competition among Tier 1 suppliers. Opportunities lie in the technological advancement towards 'smart' air springs with integrated diagnostics, the vast untapped potential in emerging African and South American rail markets, and the increasing adoption of composites for lighter, more efficient components.

The interplay of these factors creates significant impact forces on market dynamics. The shift towards higher passenger experience standards (a key driver) exerts upward pressure on product quality and innovation, necessitating continuous Research and Development (R&D) in advanced elastomers and control technologies. Conversely, the restraint imposed by the cyclical and highly regulated nature of the railway industry means product qualification and market entry are lengthy processes, creating high barriers for new competitors. The impact force of substitution risk is relatively low, as air springs offer unparalleled performance attributes (self-leveling, variable stiffness) that mechanical springs cannot fully replicate, solidifying the product’s position as the preferred technology for modern, high-performance rolling stock.

Furthermore, the competitive environment is heavily influenced by the OEM-supplier relationships; air spring manufacturers must demonstrate absolute reliability and adherence to stringent industry standards (like EN 13272 or specific operator specifications). The ongoing need for replacement units in the Aftermarket segment acts as a stabilizing force, providing predictable long-term revenue streams independent of new rolling stock procurement cycles. Government funding for infrastructure projects remains a pivotal external impact force, directly correlating rail network development schedules with the demand spikes for new air spring installations, making political stability and economic climate crucial determinants of market performance.

Segmentation Analysis

The Railway Air Spring market is rigorously segmented based on product type, application, and end-user, providing a granular view of demand patterns and technological preferences across the global rail industry. Segmentation by Type differentiates between primary and secondary air springs, with secondary suspension systems dominating the market due to their direct impact on passenger comfort and ride stability. Application segmentation highlights the specific demands of passenger rail (high-speed, commuter, metro), which prioritize comfort and reliability, versus freight rail, which emphasizes robustness and high load capacity. The end-user dichotomy between OEM (Original Equipment Manufacturer) and Aftermarket remains crucial, reflecting the differing requirements for new installation components versus maintenance and replacement units, with the Aftermarket providing essential long-term revenue predictability for market players.

- By Type:

- Primary Air Springs

- Secondary Air Springs

- By Application:

- Passenger Rail (High-Speed Trains, Regional/Commuter Trains, Metro/Subway)

- Freight Rail

- Light Rail Vehicles (LRV)

- By End-User:

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO and Replacement)

Value Chain Analysis For Railway Air Spring Market

The value chain for the Railway Air Spring market is complex and highly specialized, beginning with the upstream procurement of critical raw materials, primarily high-grade synthetic rubbers (e.g., neoprene, natural rubber blends), textile reinforcing fabrics (e.g., nylon or polyester cord), and specialized metal components (bead plates, piston assemblies). Upstream suppliers are vital as the quality and durability of the elastomer directly determine the longevity and performance of the air spring in demanding railway environments. Manufacturers often collaborate closely with specialized chemical and material providers to develop proprietary compounds optimized for fatigue resistance, ozone resistance, and operational temperature extremes. Managing material volatility and ensuring a secure supply chain for these specialized inputs is a critical element of maintaining cost efficiency and production consistency.

The midstream involves the core manufacturing process, which includes material compounding, molding, assembly, vulcanization, and stringent quality control testing, including burst pressure and fatigue life tests. Due to the critical safety function of air springs, manufacturers require advanced facilities and adhere to demanding quality certifications (like IRIS or ISO/TS standards). Downstream activities focus heavily on distribution and installation. Distribution is characterized by two distinct channels: direct sales and long-term supply agreements with major global Rolling Stock OEMs (e.g., Siemens, Alstom, CRRC) for new vehicle production, and indirect distribution through certified MRO (Maintenance, Repair, and Overhaul) service providers and specialized rail parts distributors for the Aftermarket segment. The effectiveness of the indirect channel is paramount for capitalizing on replacement demand.

The downstream phase is highly customer-centric, requiring extensive technical support, maintenance training, and rapid logistics to minimize rolling stock downtime. The distribution channel for the OEM segment is typically direct, involving just-in-time delivery to assembly lines. In contrast, the Aftermarket relies heavily on localized or regional warehousing by distributors who stock various air spring models to service aging fleets worldwide. The value added in the downstream section includes comprehensive technical documentation, product traceability, and expert installation guidance, which are often bundled with the product sale to ensure optimal performance and adherence to safety protocols throughout the product's operational life. Effective lifecycle management and monitoring services are increasingly becoming a part of the value proposition.

Railway Air Spring Market Potential Customers

The potential customer base for the Railway Air Spring Market is concentrated within the highly capitalized and safety-regulated global rail industry, segmented primarily into Rolling Stock Manufacturers, Public and Private Rail Operating Companies (ROCs), and specialized Maintenance, Repair, and Overhaul (MRO) providers. Rolling stock manufacturers represent the Original Equipment Manufacturer (OEM) segment, requiring high-volume, customized air spring units during the construction of new trains, including high-speed sets, metro trains, and freight locomotives. Key buyers in this segment include global giants like CRRC Corporation, Alstom, Siemens Mobility, and Stadler Rail, who demand stringent quality control, global logistical support, and long-term product lifecycle guarantees from their suppliers.

Rail Operating Companies (ROCs), whether government-owned (like national railway bodies) or privately operated entities, constitute the primary end-users and major consumers in the Aftermarket segment. These buyers are responsible for the safe and efficient operation of their fleets, generating consistent demand for replacement air springs as part of scheduled maintenance programs. Their procurement decisions are driven by factors such as component lifespan, resistance to extreme weather conditions, and component compatibility with existing rolling stock. Major ROCs globally, such as Deutsche Bahn (Germany), SNCF (France), Amtrak (USA), and Indian Railways, prioritize suppliers capable of providing reliable, long-lasting components with rapid delivery times to minimize fleet downtime.

MRO service providers, often independent third-party companies or specialized subsidiaries of the ROCs, form the tertiary layer of potential customers. These entities execute the actual maintenance and replacement work. They require accessible inventory, competitive pricing, and technical manuals for a wide array of air spring models used across diverse fleet compositions. For air spring manufacturers, nurturing strong relationships with these MRO providers is essential for capturing the high-value replacement market, ensuring that their products are specified during overhaul activities. These end-users demand rigorous documentation proving compliance with international safety and reliability standards before any purchase decision is finalized.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, ContiTech (Continental AG), Trelleborg AB, Stemmann-Technik GmbH, Sumitomo Electric Industries, HUTCHINSON SA, Knorr-Bremse AG, ZF Friedrichshafen AG (Wabco), Firestone Industrial Products (FSIP), Air Lift Company, S&T Dynamics, LORD Corporation, Shanghai Rubber Products, VIBRAC Corporation, Nanjing Iron & Steel Co. Ltd., Dellner Couplers AB, RHI Magnesita N.V., Tokyu Car Corporation, Mersen, Tenneco Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railway Air Spring Market Key Technology Landscape

The technological landscape of the Railway Air Spring market is rapidly evolving, driven by the need for lighter weight, greater resilience, and enhanced operational intelligence. A central focus is the development and adoption of advanced elastomeric materials, moving beyond traditional rubber formulations to specialized high-performance compounds that offer superior fatigue life, improved resistance to ozone, UV exposure, and extreme temperature fluctuations common in global rail environments. Manufacturers are heavily investing in proprietary rubber blends and reinforced plastic materials to ensure compliance with increasingly strict fire safety standards (such as EN 45545-2 in Europe) while simultaneously reducing the overall weight of the bogie, thereby improving energy efficiency and reducing track wear over time. This material science push is critical for competitive differentiation.

Another major technological advancement is the integration of electronic monitoring and smart system capabilities. Modern air springs are frequently being equipped with sophisticated sensors, including high-precision pressure transducers and accelerometers, transforming them into intelligent components within the larger rolling stock control system. These integrated smart components facilitate continuous, real-time diagnostics (Condition-Based Monitoring, or CBM), allowing the suspension system to communicate its health status, pressure deviations, and damping performance to the centralized control unit. This real-time data exchange is foundational for implementing predictive maintenance strategies and ensuring the consistent tuning of the secondary suspension system to optimize both comfort and stability under varying operating conditions, a feature crucial for high-speed applications.

Furthermore, innovation is centered around sophisticated control mechanisms, specifically Electronically Controlled Pneumatic (ECP) systems, which regulate air flow and pressure with unparalleled precision. These advanced systems allow for instantaneous adjustments to the air spring's stiffness and height, compensating dynamically for changes in speed, loading, and track characteristics. The continuous refinement of control valve technology and associated software algorithms ensures a smoother, safer ride, minimizing body roll during curves and maintaining consistent coupler height. The combination of resilient materials, integrated sensors, and precision control is defining the next generation of railway air suspension, promising significantly lower lifecycle costs and higher levels of operational reliability compared to previous generations of passive pneumatic systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, largely dominated by China and India. The immense demand is fueled by government-led initiatives for massive rail network expansion, including high-speed rail projects (China) and extensive urban metro development (India, Southeast Asia). The region focuses heavily on localization of manufacturing and volume procurement, driving strong OEM activity.

- Europe: Europe represents a mature market characterized by high regulatory standards and a strong emphasis on technological sophistication and premium quality. Countries like Germany, France, and the UK drive demand for advanced, sensor-equipped air spring systems for high-speed and intercity trains, maintaining high value due to stringent safety and comfort requirements. The region is a hub for R&D in elastomeric technology and ECP systems.

- North America: The market is stable, driven primarily by replacement cycles within existing passenger commuter rail and moderate growth in freight operations, particularly demanding robust, high-capacity air springs for heavy-haul locomotives and specialized wagons. Infrastructure spending, while increasing, is focused on modernization and efficiency, supporting steady Aftermarket demand.

- Latin America (LATAM): A developing market with significant future potential. Brazil and Mexico are leading the adoption of modern rail transit systems, creating sporadic but substantial demand for new rolling stock and corresponding air springs. Market growth is heavily contingent upon economic stability and government investment in public infrastructure.

- Middle East and Africa (MEA): Currently the smallest market but exhibiting high potential growth rates, particularly in the Middle East (e.g., UAE, Saudi Arabia) due to large-scale, often luxury, rail projects requiring premium suspension technology. Africa’s demand is concentrated in resource transport and modernization of legacy networks, often preferring robust, lower-maintenance solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railway Air Spring Market.- ContiTech (Continental AG)

- Bridgestone Corporation

- Firestone Industrial Products (FSIP)

- Trelleborg AB

- HUTCHINSON SA

- Knorr-Bremse AG

- ZF Friedrichshafen AG (Wabco)

- Stemmann-Technik GmbH

- Sumitomo Electric Industries

- Air Lift Company

- S&T Dynamics

- LORD Corporation (Parker Hannifin)

- Shanghai Rubber Products Co., Ltd.

- VIBRAC Corporation

- Dellner Couplers AB

- Kawasaki Heavy Industries, Ltd.

- Mersen

- Vossloh AG

- Tenneco Inc.

- CRRC Corporation Limited

Frequently Asked Questions

Analyze common user questions about the Railway Air Spring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan of a railway air spring?

The operational lifespan of a railway air spring typically ranges between 5 to 8 years in secondary suspension applications, heavily depending on operating environment, load cycles, and maintenance quality. Advanced systems integrating high-grade materials and predictive monitoring may extend this significantly.

How do smart railway air springs enhance operational efficiency?

Smart air springs, equipped with integrated sensors (IoT), enhance efficiency by enabling Condition-Based Monitoring (CBM). This allows operators to schedule maintenance precisely when necessary, minimizing unexpected downtime, optimizing ride comfort automatically, and preventing catastrophic component failure.

What are the primary factors driving the demand for secondary air suspension systems?

The demand is primarily driven by the global expansion of high-speed and urban rail networks, the requirement for superior passenger comfort, stringent safety regulations, and the need for automatic self-leveling capabilities regardless of passenger load.

Is the Aftermarket or the OEM segment larger in the Railway Air Spring market?

While the OEM segment provides large volume demand during new train construction, the Aftermarket segment, driven by mandatory replacement and maintenance cycles over the long life of rolling stock, often accounts for a higher and more consistent portion of the total market revenue.

Which region dominates the global Railway Air Spring Market in terms of volume?

The Asia Pacific (APAC) region, largely fueled by massive infrastructure investments in China and India, dominates the market in terms of volume and is projected to exhibit the highest growth rate due to ongoing high-speed and metro rail development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager