Railway Friction Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437389 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Railway Friction Material Market Size

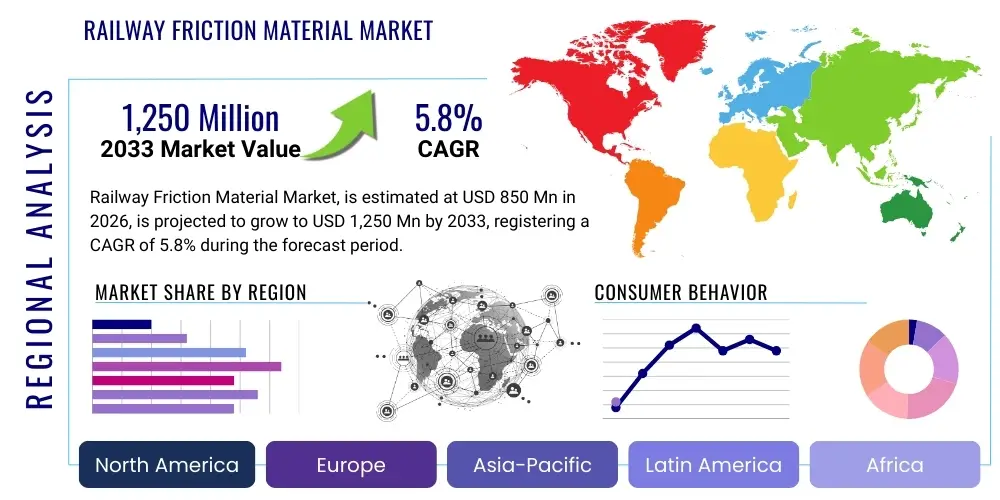

The Railway Friction Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by robust global investment in high-speed rail networks, particularly across the Asia Pacific region, coupled with the mandatory periodic replacement cycles of critical braking components necessary for maintaining railway safety standards and operational efficiency. The transition from traditional cast iron materials to advanced composite and sintered friction materials, offering superior performance characteristics such as reduced noise, extended lifespan, and stable friction coefficients under extreme conditions, is a core driver escalating the market valuation over the forecast period.

Railway Friction Material Market introduction

The Railway Friction Material Market encompasses specialized components designed to generate controlled frictional force necessary for braking and deceleration in various rail vehicles, including high-speed trains, freight wagons, and urban transit systems. These materials, primarily categorized into composite, sintered, and organic compositions, are critical for ensuring operational safety, passenger comfort, and efficient rail network throughput. The core function involves converting kinetic energy into thermal energy during braking, demanding materials with exceptional thermal stability, wear resistance, and consistent performance across diverse operational environments and load requirements. The continuous innovation within this sector focuses heavily on developing asbestos-free and eco-friendly formulations that adhere to stringent international safety and environmental regulations, pushing manufacturers toward advanced engineering plastics, ceramics, and metal matrix composites.

Major applications of railway friction materials include brake pads, brake blocks (tread brakes), disc brake linings, and specialized braking components used in various types of rolling stock. Brake blocks are predominantly utilized in freight applications and older rolling stock, typically acting directly on the wheel tread, while brake pads and linings are essential components of disc braking systems, which are standard in modern high-speed and passenger trains due to their superior heat dissipation capabilities and braking consistency. The materials must withstand immense pressure and high temperatures generated during emergency braking while minimizing wear on both the friction material itself and the mating surface (wheel or disc).

Key driving factors accelerating market expansion include significant governmental spending on modernizing railway infrastructure, especially in developing economies prioritizing sustainable and efficient transportation alternatives, such as electrified metro systems and regional high-speed corridors. Furthermore, strict regulatory mandates enforced by bodies like the International Union of Railways (UIC) and national safety agencies require high-performance friction materials that guarantee reliability and shorter stopping distances. The benefits derived from utilizing high-performance friction materials include enhanced passenger safety, reduced maintenance downtime due to increased component longevity, decreased noise pollution in urban areas, and improved energy efficiency through lighter-weight components, reinforcing their indispensable role in the modern railway ecosystem.

Railway Friction Material Market Executive Summary

The Railway Friction Material Market is characterized by intense technological evolution and shifting material preferences driven by environmental compliance and performance mandates. Business trends indicate a strong focus on strategic acquisitions and partnerships among key players to consolidate expertise in advanced materials, particularly in high-performance composite formulations required for next-generation rolling stock. The increasing demand for lightweight and environmentally conscious braking solutions, coupled with the shift towards disc braking systems globally, represents a significant commercial opportunity. Manufacturers are aggressively investing in R&D to optimize material structures for superior thermal management and reduced dust emission, thereby addressing both maintenance costs and environmental concerns, resulting in a competitive landscape defined by quality certification and product longevity.

Regional trends distinctly highlight the Asia Pacific (APAC) region, led by China and India, as the primary engine of market growth, driven by expansive investments in new high-speed rail construction and massive urbanization projects necessitating new metro and transit systems. Europe remains a critical market, defined by strict safety standards, continuous network modernization, and a high replacement rate for existing rolling stock, emphasizing premium, low-noise composite materials adhering to strict EU interoperability directives. North America’s growth is steady, concentrated largely on upgrading freight rail fleets and adopting advanced braking technologies to enhance operational safety and load capacity, particularly focusing on robust, durable friction materials capable of handling heavy axle loads over long distances.

Segment trends reveal that the composite material segment is dominating the market due to its versatility, superior thermal fade resistance compared to traditional organics, and longer service life. Among applications, the High-Speed Rail segment is projected to exhibit the fastest growth CAGR, directly proportional to the global proliferation of bullet train projects requiring high-precision braking solutions. In terms of component analysis, brake pads, essential for disc braking systems in modern passenger carriages, are rapidly gaining market share over traditional brake blocks. Overall, the market trajectory is highly sensitive to capital expenditure cycles within the railway industry and global economic stability affecting infrastructure financing, necessitating strategic supply chain management to mitigate raw material price volatility.

AI Impact Analysis on Railway Friction Material Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the longevity and predictive performance of railway friction materials, specifically questioning the application of Machine Learning (ML) in predicting material failure, optimizing manufacturing efficiency, and improving quality control. The key themes revolve around leveraging AI for non-destructive testing, simulating wear patterns under various operational loads, and creating "smart" friction materials integrated with sensors for real-time performance monitoring. Concerns often focus on the required capital investment for implementing these technologies and ensuring the reliability of predictive algorithms when dealing with complex, multi-variable factors like temperature, humidity, and varying track conditions. Expectations are high regarding AI's potential to drastically reduce unscheduled maintenance, extend the lifespan of components through personalized usage models, and refine R&D processes by accelerating material formulation testing and validation.

The integration of AI, particularly through predictive maintenance platforms, is set to revolutionize the aftermarket for railway friction materials. By analyzing vast datasets derived from sensor-equipped braking systems—including temperature profiles, vibration analysis, and braking force consistency—ML models can accurately predict the remaining useful life (RUL) of brake pads and blocks. This shift moves maintenance planning from fixed schedules to condition-based intervention, minimizing premature replacement and avoiding catastrophic failures, thereby optimizing inventory levels and operational expenditures for rail operators. AI also aids manufacturers by simulating complex material interactions and optimizing sintering and curing processes, ensuring higher batch consistency and reducing waste materials, which directly impacts production cost efficiencies and final product quality assurance.

- AI-driven Predictive Maintenance (PdM) algorithms enhance the forecasting of friction material wear, optimizing replacement cycles and minimizing unplanned downtime.

- Machine Learning is utilized in material science for rapid testing and simulation of new composite formulations, significantly reducing R&D lead times.

- AI-powered quality control systems use computer vision and sensor data analysis to ensure uniformity in manufacturing (e.g., density, porosity) across large batches.

- Real-time monitoring systems, integrated with friction components, feed data back to AI platforms for instantaneous performance assessment and safety alerts.

- Optimization of production parameters, such as curing temperature and pressure, through genetic algorithms and neural networks, improves energy efficiency and product consistency.

DRO & Impact Forces Of Railway Friction Material Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, significantly shaped by inherent Impact Forces related to global infrastructure spending and environmental regulations. Key drivers include mandatory upgrades to aging rolling stock globally, stringent governmental safety regulations dictating component replacement schedules, and the escalating demand for high-speed rail that necessitates superior thermal-resistant braking materials. Counterbalancing these drivers are significant restraints, notably the high initial cost associated with advanced composite and sintered materials compared to traditional counterparts, and the stringent, time-consuming certification processes required by various national rail authorities, creating substantial barriers to entry for new innovations. Furthermore, volatility in the price of raw materials, such as non-ferrous metals and specialized synthetic fibers, poses continuous challenges to manufacturer profitability and stable supply chain operations.

Opportunities within the market largely stem from the global push toward sustainable transportation, specifically the demand for eco-friendly, non-toxic, and low-noise friction materials, fostering niche growth in specialized polymer-based composites. The increasing proliferation of metro and light rail transit (LRT) systems in rapidly urbanizing regions presents a consistent demand stream for braking components tailored for frequent stopping cycles. Furthermore, the integration of smart components and IoT sensors into friction materials for predictive maintenance offers significant value-added services and unlocks premium pricing potential. The convergence of these trends suggests manufacturers focusing on life-cycle cost efficiency and superior environmental performance are best positioned for long-term strategic success, moving beyond simple price competition.

The impact forces influencing the market are profound. Regulatory mandates, such as the implementation of Technical Specifications for Interoperability (TSIs) in Europe, compel rail operators to adopt certified materials, impacting procurement decisions and market entry strategies. Economic stability directly correlates with government expenditure on railway modernization projects; a global economic downturn can rapidly decelerate infrastructure investments, dampening market growth. Technological innovation, particularly in advanced manufacturing techniques like additive manufacturing (3D printing) for complex component shapes and specialized material application, acts as a disruptive force, potentially lowering production costs and customization barriers, while continuously raising the performance benchmarks expected from railway braking systems worldwide.

Segmentation Analysis

The Railway Friction Material Market is strategically segmented based on Material Type, Component, Application, and Rolling Stock Type, providing a granular view of market dynamics and adoption patterns across the global rail industry. Material composition defines performance characteristics and cost structure, with the market shifting decisively toward high-performance composites and sintered materials due to their enhanced durability and thermal resilience required for modern high-speed operation. Analyzing the component segment helps understand the adoption rate of disc braking versus tread braking systems, indicating modernization trends. Application segmentation further differentiates demand based on operational requirements, contrasting the needs of heavy-haul freight services against those of high-frequency urban transit, which necessitate materials optimized for distinct duty cycles and braking environments.

The dominance of the Composite Material segment is undeniable, largely replacing organic and semi-metallic materials in passenger and high-speed rail applications due to their superior thermal fade characteristics and improved service life. These composites typically consist of complex mixtures of reinforcing fibers, binders (phenolic resins), fillers, and performance modifiers. Simultaneously, the Sintered Material segment, utilizing powder metallurgy to create extremely durable and high-friction components, remains vital for heavy freight and extremely high-performance braking where maximum friction stability under extreme pressure and temperature is required, often found in specialized locomotives and heavy-haul wagons. Understanding these segment dynamics is crucial for manufacturers to tailor their product portfolios, focusing on materials that meet the evolving standards of safety, longevity, and environmental performance mandated by global regulatory bodies.

- By Material Type:

- Composite Materials (e.g., Non-Asbestos Organics (NAO), Resin-based)

- Sintered Materials (e.g., Copper-based, Iron-based)

- Organic/Semi-Metallic Materials

- By Component:

- Brake Pads/Linings (Disc Braking Systems)

- Brake Blocks (Tread Braking Systems)

- Clutch Facings and Dampers

- By Application:

- High-Speed Rail

- Freight Trains (Heavy Haul)

- Passenger Trains (Intercity/Regional)

- Urban Transit (Metro, Tram, LRT)

- By Rolling Stock Type:

- Locomotives

- Passenger Coaches and Wagons

- Freight Wagons

- Mass Transit Vehicles (EMUs, DMUs)

Value Chain Analysis For Railway Friction Material Market

The value chain for the Railway Friction Material Market is intricate, spanning from the sourcing of specialized raw materials to the final installation and aftermarket maintenance support. The upstream analysis begins with the extraction and processing of critical materials, including high-grade phenolic resins, metallic powders (copper, iron, steel wool), synthetic fibers (aramid, carbon), and various mineral fillers (barite, mica). The quality and consistency of these raw materials are paramount, as they directly determine the final friction coefficient, wear rate, and thermal resistance of the end product. Supplier relationships in the upstream segment are highly specialized, often involving long-term contracts for niche materials, and are subject to stringent quality control standards due to the safety-critical nature of the final components. Managing raw material price volatility, particularly for metallic powders and petroleum-derived resins, is a constant challenge for manufacturers in this stage.

The core manufacturing stage involves complex processes such as mixing, hot pressing, curing, and sometimes sintering (for metallic components). High capital investment in specialized machinery, including high-tonnage hydraulic presses and controlled atmosphere furnaces, is necessary. Manufacturers in this segment, primarily OEMs and specialized friction material companies, focus heavily on obtaining necessary regulatory certifications (e.g., UIC, AAR approval), which requires extensive testing and validation under simulated and real-world operational conditions. Production is highly tailored based on the rolling stock type and braking system, demanding precise formulation control and rigorous in-process quality checks to ensure compliance with performance specifications related to noise, friction stability, and thermal conductivity. Manufacturing competitiveness is often derived from proprietary binding agents and process optimization techniques.

The downstream analysis focuses on distribution channels and the end-user market. Direct distribution is common for Original Equipment Manufacturers (OEMs), who supply friction components directly to rolling stock manufacturers (e.g., CRRC, Alstom, Siemens) during the production phase of new trains. Indirect distribution, leveraging specialized railway component distributors, maintenance repair and overhaul (MRO) service providers, and railway operators’ internal workshops, dominates the lucrative aftermarket segment, which accounts for the majority of sales volume due to mandatory replacement schedules. Key success factors in the distribution phase include efficient inventory management, rapid delivery capabilities, and providing robust technical support and certified installation services, ensuring the consistent and safe supply of safety-critical components to maintenance depots globally.

Railway Friction Material Market Potential Customers

The potential customer base for railway friction materials primarily consists of three major categories: Rolling Stock Manufacturers (OEMs), National and Private Rail Operators, and Independent Maintenance, Repair, and Overhaul (MRO) service providers. Rolling stock manufacturers, such as Alstom, Siemens Mobility, Bombardier Transportation (now Alstom), and CRRC Corporation, represent the initial procurement point, consuming friction materials for brand-new train sets, particularly high-speed and modern urban transit vehicles, focusing heavily on integration and material compatibility with new braking technologies. Their purchasing decisions are driven by lightweighting requirements, compliance with new noise standards, and long-term material performance guarantees offered by friction material suppliers, requiring intense collaborative R&D.

National and private rail operators (e.g., Deutsche Bahn, Union Pacific, Indian Railways, SNCF) constitute the largest segment of potential customers due to their ongoing, continuous need for replacement parts through the aftermarket. These operators manage vast fleets and are responsible for the safe and efficient operation of their networks, making periodic replacement of brake pads and blocks mandatory. Their purchasing criteria center on total cost of ownership (TCO), material longevity, reliable supply chain, and compliance with the regulatory standards of their operating region. Buyers for these entities prioritize materials that offer extended service intervals and minimize wear on adjacent components like wheels and brake discs, leading to significant emphasis on performance specifications and proven track records.

Independent MRO providers and specialized component repair workshops also form a crucial customer group, particularly in regions where rail operators outsource significant portions of their maintenance activities. These entities require access to certified, high-quality friction materials in smaller, diverse volumes to service multiple rail operator contracts. For these buyers, product availability, competitive pricing, and certification validation are essential. The purchasing behavior across all customer types is highly influenced by safety audits, life-cycle cost analysis, and the implementation of predictive maintenance programs, which shift procurement from volume purchasing to value-based material selection, driving demand for technologically superior and certified products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Knorr-Bremse, Wabtec Corporation, Federal-Mogul, Rane Brake Linings, Akebono Brake Industry, Tenneco (Federal-Mogul), Miba AG, Bremskerl, ASK Automotive, Trelleborg, CRRC Corporation, Jiangsu Railteco, Frenos, ITT Corporation, AAR, Morgan Advanced Materials, Shandong Hengtian, Dalian Friction, Beijing Railway. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railway Friction Material Market Key Technology Landscape

The technological landscape of the Railway Friction Material Market is rapidly evolving, driven by the need for materials that can perform reliably under increasingly severe operational conditions, such as higher speeds and greater axle loads, while adhering to stricter environmental standards. A paramount technological advancement is the widespread adoption of high-performance Composite Materials, which utilize complex formulations involving high-temperature phenolic resins, aramid fibers, specialized carbon reinforcements, and advanced non-ferrous metal powders. These composites are engineered using sophisticated computer modeling techniques to ensure stable friction coefficients across a wide range of speeds and temperatures, a crucial factor for modern high-speed railway braking systems that rely on disc brakes for precise deceleration control. This shift mandates substantial investment in blending and hot pressing technologies to achieve optimal density and structural integrity, differentiating leading manufacturers.

Another pivotal technological area is the refinement of Sintered Friction Materials, predominantly employed in heavy-duty and high-power applications like locomotives and specialized freight wagons. Sintering technology involves powder metallurgy where metallic components (iron, copper, molybdenum) are pressed and heated below their melting point to form a dense, resilient structure. Recent innovations in this field focus on using improved particle size distribution and specialized alloying elements to enhance heat dissipation capabilities, wear resistance, and noise reduction compared to previous generations of sintered products. The development of advanced testing rigs that can simulate extreme braking conditions with high accuracy, often integrated with real-time data acquisition, is also critical in validating these new material technologies before market deployment and certification.

Furthermore, digital technologies are playing an increasing role, moving beyond material composition itself and into operational integration. The development of "Smart Friction Materials" incorporating embedded or proximity sensors (e.g., thermal, acoustic) is gaining traction. These sensors enable real-time monitoring of temperature, wear depth, and vibration characteristics, transmitting data wirelessly to predictive maintenance systems. This technology allows rail operators to transition from manual inspection to condition-based monitoring, optimizing component life and enhancing fleet reliability. Coupled with advancements in surface engineering and friction-reducing coatings for brake discs, these technological shifts collectively aim to maximize safety, minimize life-cycle costs, and ensure compliance with stringent noise and dust pollution regulations, establishing high technological barriers for market participation.

Regional Highlights

The global market exhibits distinct regional dynamics shaped by infrastructure investment levels, technological maturity, and regulatory frameworks. Asia Pacific (APAC) holds the largest market share and is expected to be the fastest-growing region throughout the forecast period. This dominance is primarily attributed to unprecedented infrastructural expansion in China and India, driven by massive investments in high-speed rail (HSR) networks and metropolitan rail systems (metros and suburban rail). The continuous modernization of rolling stock fleets in Japan and South Korea, coupled with significant growth in emerging economies like Southeast Asia, ensures persistent demand for high-performance composite and sintered materials. The region's focus is currently centered on rapid capacity expansion and safety enhancements, leading to high consumption rates for new OEM components.

Europe represents a mature but highly sophisticated market, characterized by stringent safety and environmental regulations, particularly concerning noise emissions and material toxicity (low-dust and asbestos-free mandates). The European market is defined by high replacement demand within existing, extensive regional and international rail networks, driven by mandatory maintenance cycles and the implementation of standardized performance specifications (TSIs). Germany, France, and the UK are key contributors, emphasizing premium, certified friction materials that offer superior life-cycle performance. Innovation in Europe is often concentrated on achieving maximum energy efficiency and utilizing advanced, specialized materials that cater specifically to the high-demand environment of high-density, integrated continental rail traffic.

North America is dominated by the massive freight rail sector, requiring extremely robust and durable friction materials (mostly brake blocks and sintered pads) capable of handling heavy axle loads and severe weather conditions over long distances. Investment cycles are influenced heavily by Class I railroad capital expenditure and regulatory mandates from the Association of American Railroads (AAR) focused on operational safety and efficiency improvements. While passenger rail, including Amtrak and urban transit, drives demand for composite disc pads, the sheer volume of freight operations makes heavy-haul braking components a primary market focus. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging regions, where market growth is project-specific, tied directly to large-scale urban transit projects in major cities (e.g., Riyadh, Dubai, São Paulo) and the development of key resource-related freight lines, often relying on imported technology and materials meeting international safety standards.

- Asia Pacific (APAC): Market leader and fastest-growing region; driven by China's HSR expansion and extensive metro projects across India, requiring high volumes of composite materials.

- Europe: Highly regulated, mature market focused on low-noise, eco-friendly composites; high demand from continuous fleet modernization and stringent EU safety standards.

- North America: Market dominated by the heavy-haul freight segment, emphasizing highly durable sintered materials and AAR compliance for large Class I railroad operations.

- Latin America: Growth concentrated in urban centers (e.g., Brazil, Mexico) due to new metro and light rail construction, often relying on global OEM suppliers.

- Middle East & Africa (MEA): Growth dependent on specific large-scale infrastructure projects (e.g., GCC rail, urban metros) and investment in freight lines serving resource extraction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railway Friction Material Market.- Knorr-Bremse AG

- Wabtec Corporation

- Federal-Mogul (Tenneco Inc.)

- Rane Brake Linings Ltd.

- Akebono Brake Industry Co., Ltd.

- Miba AG

- Bremskerl Reibbelagwerke GmbH & Co. KG

- ASK Automotive Pvt. Ltd.

- Trelleborg AB

- CRRC Corporation Limited (Through Subsidiaries)

- Jiangsu Railteco Equipment Co., Ltd.

- Frenos S.A.

- ITT Corporation (Motion Technologies)

- AAR Corporation

- Morgan Advanced Materials plc

- Shandong Hengtian Friction Material Co., Ltd.

- Dalian Friction Material Co., Ltd.

- Beijing Railway Friction Material Co., Ltd.

- SGL Carbon SE (Material Suppliers)

- Voith Group (Braking Systems Division)

Frequently Asked Questions

Analyze common user questions about the Railway Friction Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are currently replacing traditional cast iron brake blocks in railway applications?

Traditional cast iron brake blocks are being steadily replaced by advanced composite materials, particularly high-performance non-asbestos organic (NAO) and resin-based composites. These modern materials offer significantly reduced wheel wear, lower noise generation, stable friction coefficients across varying temperatures, and are lighter, contributing to overall energy efficiency and reduced maintenance costs for rail operators globally.

How do regulatory standards, such as UIC or AAR, impact the adoption and development of railway friction materials?

Regulatory bodies like the International Union of Railways (UIC) and the Association of American Railroads (AAR) impose mandatory, stringent performance and safety standards that friction materials must meet before deployment. This necessitates extensive testing and long certification cycles, significantly influencing product development, favoring suppliers capable of consistent quality, and acting as a major barrier to entry for new, uncertified composite or sintered formulations.

What is the primary difference in friction material requirements between high-speed rail and heavy-haul freight?

High-Speed Rail demands materials (typically composites used in disc brakes) optimized for extreme thermal stability and rapid, controlled deceleration over short distances, prioritizing consistent performance at high kinetic energy levels. Heavy-haul freight requires highly durable, often sintered or semi-metallic, materials designed for maximum wear resistance and mechanical strength under heavy axle loads and prolonged, demanding braking cycles, prioritizing longevity and structural integrity.

What role does predictive maintenance (PdM) technology play in the future of the friction material aftermarket?

Predictive maintenance, often utilizing AI and IoT sensors integrated into braking systems, allows rail operators to transition from time-based component replacement to condition-based monitoring. This technology accurately estimates the remaining useful life (RUL) of brake pads and blocks, leading to optimized inventory management, reduced unscheduled maintenance, maximized component lifespan, and a subsequent shift in aftermarket demand toward 'smart' component suppliers.

Which geographical region is currently experiencing the highest growth rate in the demand for railway friction materials?

The Asia Pacific (APAC) region, specifically driven by massive infrastructure investments in high-speed rail and urban transit networks in countries like China and India, exhibits the highest growth rate. This rapid expansion necessitates large-volume procurement of advanced friction materials for new rolling stock (OEM demand) and subsequent aftermarket servicing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager