Railway Li-ion Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433063 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Railway Li-ion Battery Market Size

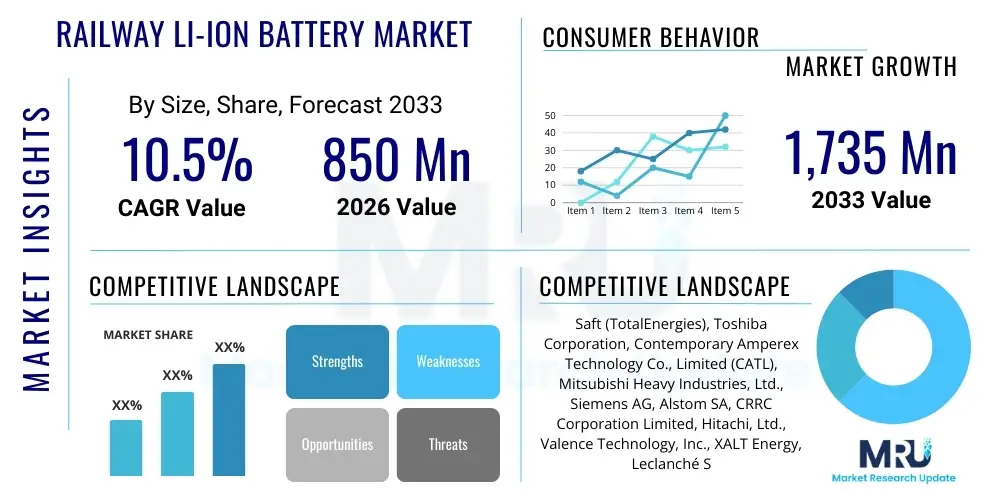

The Railway Li-ion Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,735 Million by the end of the forecast period in 2033.

Railway Li-ion Battery Market introduction

The Railway Li-ion Battery Market encompasses advanced energy storage systems specifically designed for various applications within the railway industry, including auxiliary power supply, starting power for diesel-electric locomotives, and primary energy storage in Battery Electric Multiple Units (BEMUs) and hybrid trains. Lithium-ion technology is rapidly replacing conventional Nickel-Cadmium (Ni-Cd) batteries due to its superior energy density, longer cycle life, lower maintenance requirements, and overall reduced weight, which contributes significantly to operational efficiency and fuel consumption reduction. The product description centers on high-power, high-safety battery packs incorporating sophisticated Battery Management Systems (BMS) that ensure optimal performance under extreme operational conditions, including vibration, temperature fluctuations, and stringent safety standards required by global railway authorities (such as EN 50121 and EN 45545).

Major applications of these batteries include powering critical onboard systems like lighting, HVAC, communication systems, and door controls (auxiliary power). Increasingly, they are vital components in modern traction systems, supporting regenerative braking energy recapture and providing zero-emission motive power in non-electrified or partially electrified segments of rail networks. The transition towards sustainable transportation infrastructure is a key benefit derived from adopting Li-ion technology in railways, allowing operators to meet stringent decarbonization targets set by governmental and international bodies. Furthermore, the robust nature of railway-grade Li-ion batteries ensures reliability and redundancy, which is paramount for passenger safety and schedule adherence.

The market is primarily driven by the global imperative to electrify railway lines and modernize aging rolling stock. Governments and railway operators are investing heavily in hybrid and purely electric trains to reduce diesel dependency and operational expenditure associated with maintenance and fuel. Key driving factors include technological advancements in battery chemistry, such as Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC), which offer improved safety profiles and longevity suitable for heavy-duty railway applications. Supportive regulations promoting green mobility and favorable public-private partnerships for infrastructure development further accelerate market penetration across established and emerging railway networks worldwide.

Railway Li-ion Battery Market Executive Summary

The Railway Li-ion Battery Market is undergoing a rapid transition driven by technological maturity and sustained infrastructure investment. Business trends indicate a shift towards localized manufacturing and strategic partnerships between traditional railway equipment suppliers (rolling stock manufacturers) and specialized battery technology providers to integrate customized energy storage solutions directly into train designs. The focus is heavily placed on developing highly scalable and modular battery packs that can be adapted across diverse train types—from light rail vehicles and metros to high-speed trains and freight locomotives. Innovation in thermal management systems and fire suppression technologies remains a central business focus, aiming to address critical safety concerns associated with high-energy density storage and meet increasingly rigorous global safety certifications.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive railway expansion projects in China, India, and Southeast Asia, coupled with government mandates promoting indigenous manufacturing and electrification. Europe follows closely, driven by stringent environmental regulations, extensive network modernization, and the increasing adoption of hybrid trains to bridge non-electrified sections efficiently. North America is showing accelerating growth, primarily centered on upgrading freight locomotive fleets and implementing micro-grid solutions within railway infrastructure. The competitive landscape in all major regions is characterized by intense R&D activities focused on reducing total cost of ownership (TCO) for operators through enhanced battery longevity and reduced operational downtime.

Segmentation trends reveal that the Auxiliary Battery segment currently holds the larger market share due to its immediate applicability across the entire existing rail fleet for retrofitting and new production. However, the Traction Battery segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period, directly correlating with the proliferation of pure electric and hybrid trains. Chemically, Lithium Iron Phosphate (LFP) batteries maintain strong preference due to their superior safety characteristics and longevity, despite the higher energy density offered by NMC formulations. Application-wise, Metros and High-Speed Rail segments are major consumers, demanding high-performance, rapid-charging capabilities, while the Locomotive segment focuses on robust, long-duration power for heavier duty cycles and challenging terrains.

AI Impact Analysis on Railway Li-ion Battery Market

Common user questions regarding AI's influence on the Railway Li-ion Battery Market typically revolve around enhancing predictive maintenance, optimizing charging infrastructure, extending battery lifespan, and ensuring overall operational safety. Users are keenly interested in how Artificial Intelligence can move beyond traditional BMS functions to provide deep learning analytics on battery degradation patterns specific to harsh railway operating environments (e.g., extreme temperatures, high vibration loads, and varied charging/discharging cycles specific to regenerative braking). A central theme is the expectation that AI-driven diagnostics will drastically reduce unexpected failures, minimizing costly service disruptions and maximizing the effective utilization of expensive battery assets. Furthermore, there is significant curiosity regarding AI's role in optimizing energy flows across complex electrified networks, particularly in real-time management of distributed battery resources aboard multiple trains.

The application of AI in battery management systems (BMS) for railway applications involves leveraging vast datasets—including temperature, voltage, current, internal resistance, geographic location, and operational history—to train sophisticated algorithms. These algorithms enable accurate State-of-Health (SOH) and State-of-Charge (SOC) estimation, significantly surpassing the accuracy achievable through traditional electrochemical models. This precision allows operators to schedule maintenance proactively, precisely when necessary, rather than relying on fixed time intervals or generalized usage metrics. The integration of machine learning facilitates highly customized thermal management strategies, ensuring that battery packs operate within optimal temperature windows, which is crucial for preventing thermal runaway and maximizing calendar life under high-power demand scenarios typical of railway traction applications.

Moreover, AI plays a pivotal role in optimizing energy usage and planning charging operations within depots and along railway lines. Predictive modeling can forecast energy demand based on scheduled routes, passenger load, and weather conditions, allowing the train's power management system to optimize charging and discharging cycles for peak grid efficiency and reduced energy costs. This data-driven approach not only ensures reliable power delivery but also contributes to the longevity and sustainability of the battery infrastructure. By analyzing vast amounts of real-time operational data, AI ensures that the railway Li-ion battery market moves towards a truly smart, connected, and highly resilient energy storage ecosystem, bolstering the overall safety and reliability of modern rail transport.

- AI optimizes real-time Battery Management System (BMS) performance by analyzing complex operational data points.

- Predictive maintenance algorithms drastically reduce unexpected battery failures, enhancing operational reliability and safety.

- Machine Learning (ML) models improve State-of-Health (SOH) and State-of-Charge (SOC) estimations, extending asset lifespan.

- AI-driven optimization maximizes regenerative braking energy capture and storage efficiency.

- Intelligent thermal management systems, guided by AI, prevent thermal runaway and ensure optimal performance in harsh environments.

- Automated charging infrastructure utilizes predictive analytics for efficient power delivery and reduced energy costs at depots.

DRO & Impact Forces Of Railway Li-ion Battery Market

The dynamics of the Railway Li-ion Battery Market are shaped by powerful Drivers, persistent Restraints, and significant Opportunities, which collectively constitute the Impact Forces influencing long-term market trajectory. Key drivers include the global push for decarbonization in transport, leading to widespread railway electrification and the retirement of diesel locomotives. This transition is strongly supported by regulatory mandates favoring low-emission solutions and substantial government funding for green railway infrastructure upgrades. Concurrently, the superior performance metrics of Li-ion batteries—specifically their high energy density, reduced weight compared to legacy technologies (like Ni-Cd), and rapid charging capability—make them indispensable for modern, high-efficiency rolling stock, particularly for hybrid and battery-operated trains designed for non-electrified lines.

However, significant Restraints challenge market acceleration. The primary concern is the high initial capital expenditure (CAPEX) required for purchasing and integrating Li-ion battery packs, often involving complex retrofitting processes for existing fleets. Furthermore, inherent safety concerns, primarily the risk of thermal runaway and fire, necessitate the implementation of highly sophisticated, redundant, and expensive safety protocols and specialized fire suppression systems that comply with stringent railway safety standards (e.g., EN 45545). The scarcity and geopolitical sourcing risks associated with critical raw materials (lithium, cobalt, nickel) also introduce supply chain volatility and price instability, affecting long-term planning for major railway operators. Another restraint is the development of robust, high-power charging infrastructure across diverse railway networks, which requires substantial investment and complex logistical coordination.

Opportunities for growth are vast, particularly in leveraging advances in solid-state battery technology and developing specialized Li-ion chemistries (like LFP) optimized for severe cycling and high safety demands. The potential for providing auxiliary power and energy storage for trackside infrastructure (e.g., signaling and switch operations) represents an untapped revenue stream beyond rolling stock applications. Moreover, the emergence of 'Battery-as-a-Service' (BaaS) models, offering leasing and maintenance contracts, mitigates the high initial investment barrier for railway operators, making advanced Li-ion solutions more accessible. Finally, the modernization of aging rail infrastructure, especially across developing economies in APAC and MEA, provides a substantial long-term opportunity for new installations and complete fleet replacements using integrated Li-ion battery technology, driving innovation in battery longevity and recyclability to address end-of-life environmental concerns.

Segmentation Analysis

The Railway Li-ion Battery Market is strategically segmented based on crucial parameters including application, chemistry, rolling stock type, and capacity, enabling stakeholders to analyze market dynamics and target specific high-growth areas. The primary division revolves around the battery’s function within the train: either providing high-power, short-duration output for starting and auxiliary systems (Auxiliary Batteries) or delivering high-energy, sustained power for movement (Traction Batteries). The choice of segmentation parameters is critical, as railway operational requirements vary dramatically; a metro train requires rapid acceleration and frequent regenerative braking cycles, favoring high-power batteries, while a long-haul freight locomotive requires robustness and high capacity for sustained operations, demanding high-energy solutions.

Chemistry segmentation, involving Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), and other emerging chemistries, dictates performance metrics such as energy density, cycle life, thermal stability, and cost. LFP remains highly favored for auxiliary and metro applications due to its superior safety profile and extended cycle life, despite having a lower energy density than NMC. Conversely, NMC is sometimes utilized where weight reduction and maximum energy storage are paramount, such as in certain high-speed applications. Rolling stock type segmentation—covering locomotives, metros, light rail, and trams—reflects distinct market needs, with metro systems being a dominant application due to their intensive duty cycles and commitment to emission reduction in urban environments.

Capacity segmentation, categorized as low, medium, and high capacity (e.g., below 100 kWh, 100–300 kWh, and above 300 kWh), directly aligns with the size and operational requirements of the rail vehicle. High-capacity batteries are essential for full traction power in BEMUs and long-haul hybrid locomotives, demanding sophisticated cooling and monitoring systems. Analyzing these segments provides critical insights for manufacturers focusing on specialization—whether developing lightweight, rapidly chargeable packs for urban transport or heavy-duty, robust solutions for mainline freight operations, ensuring that technological development meets precise operational specifications and stringent regulatory compliance.

- By Application:

- Auxiliary Batteries (Powering lighting, HVAC, communication)

- Traction Batteries (Primary motive power for BEVs and hybrid trains)

- By Chemistry:

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Others (e.g., Lithium Titanate Oxide - LTO)

- By Rolling Stock Type:

- Locomotives (Diesel-Electric and Electric)

- Metro and Light Rail Vehicles (LRV)

- Passenger Coaches and Electric Multiple Units (EMU/BEMU)

- Trams and Monorails

- By Capacity:

- Below 100 kWh (Mostly Auxiliary Applications)

- 100 kWh – 300 kWh (Hybrid Locomotives, Metros)

- Above 300 kWh (BEMUs, Mainline Electric Locomotives)

Value Chain Analysis For Railway Li-ion Battery Market

The value chain for the Railway Li-ion Battery Market is highly specialized, beginning with the Upstream Analysis involving the sourcing and refinement of critical raw materials, such as lithium, cobalt, nickel, and graphite. This stage is characterized by significant geopolitical influence and high capital intensity due to the specialized nature of material processing required for battery-grade precursors. Key upstream activities include material extraction and the manufacturing of cathode and anode active materials, where quality control and long-term supply agreements are crucial for ensuring the stability and performance of the final battery cell. Strategic partnerships between miners, chemical processing firms, and major battery cell manufacturers are essential to secure a reliable supply chain and mitigate price volatility, which directly impacts the final product cost and market competitiveness.

Midstream activities involve the cell manufacturing process, followed by module and pack assembly, which is particularly complex in the railway sector due to the requirement for ruggedization, thermal management systems (TMS), and the integration of highly sophisticated Battery Management Systems (BMS). Unlike automotive applications, railway battery packs must adhere to extremely strict standards for vibration resistance (EN 61373), fire safety (EN 45545), and electromagnetic compatibility (EN 50121). Downstream analysis focuses on the distribution channels and the end-user integration. Distribution is predominantly indirect, relying heavily on established partnerships between battery pack assemblers and major Rolling Stock Manufacturers (OEMs) like Alstom, Siemens, and CRRC, who integrate the packs during the construction of new trains or as part of fleet modernization contracts. Direct sales often occur for smaller auxiliary power requirements or specialized retrofit projects.

The distribution channel efficiency hinges on technical support, warranty provision, and maintenance services, given the critical nature of railway operations. Indirect channels through OEMs dominate for traction batteries, ensuring seamless integration and validation under official railway certifications. Post-sale services, including scheduled replacements and advanced recycling solutions, are emerging as critical components of the downstream value chain, aimed at minimizing the environmental impact and maximizing the circular economy potential of end-of-life railway batteries. Effective value chain management, particularly optimizing logistics for large, heavy battery packs, and standardizing certification processes across different regions, remains vital for reducing delivery times and overall system costs for railway operators globally.

Railway Li-ion Battery Market Potential Customers

The primary potential customers and End-Users of the Railway Li-ion Battery Market fall into three distinct categories: Rolling Stock Manufacturers (OEMs), National and Private Railway Operators, and specialized Rail Infrastructure Contractors. Rolling Stock Manufacturers (like Alstom, Siemens Mobility, CRRC, and Stadler Rail) represent the largest initial buyers, as they integrate these batteries directly into new train platforms—ranging from high-speed trains and commuter EMUs to shunting and mainline freight locomotives. Their buying criteria prioritize deep technical integration, adherence to rigid safety standards (e.g., high ingress protection and specialized fire suppression), lightweight design, and long-term contractual support, often requiring customized solutions rather than off-the-shelf products to meet specific train architectural constraints and performance guarantees.

National and Private Railway Operators (such as Deutsche Bahn, SNCF, Indian Railways, and major freight operators like Union Pacific) are crucial end-users, focusing on both new fleet procurement and the large-scale retrofitting of existing diesel and electric fleets, particularly for auxiliary power systems replacement or conversion to hybrid operations. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), operational reliability, battery longevity (cycle life), and ease of maintenance. Operators seek solutions that minimize train downtime and offer proven performance in challenging climate conditions. The demand from this segment is driven by the necessity to comply with new emission reduction targets and to utilize regenerative braking efficiently across their networks, seeking batteries with high power capability for energy recapture.

A smaller but growing segment of customers includes rail infrastructure maintenance and signaling contractors. These entities utilize high-capacity Li-ion batteries for stationary applications, such as providing backup power for critical signaling systems, trackside monitoring equipment, and remote operations where grid connection is unstable or unavailable. For this customer group, key requirements include extreme reliability, resilience to environmental factors (temperature and humidity), and minimal maintenance intervention over extended periods. The long-term trend suggests increasing demand from regional and light rail operators (trams and metros) in densely populated urban areas prioritizing rapid charging capabilities and compact battery footprints to maximize passenger space and operational frequency within strict urban environmental regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,735 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saft (TotalEnergies), Toshiba Corporation, Contemporary Amperex Technology Co., Limited (CATL), Mitsubishi Heavy Industries, Ltd., Siemens AG, Alstom SA, CRRC Corporation Limited, Hitachi, Ltd., Valence Technology, Inc., XALT Energy, Leclanché SA, Akasol AG, Microvast Holdings, Inc., PowerCell Sweden AB, Exide Industries Ltd., Foton Bus (Auviter), EnerSys, Hoppecke Batterien GmbH & Co. KG, LG Energy Solution, Samsung SDI Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railway Li-ion Battery Market Key Technology Landscape

The technological landscape of the Railway Li-ion Battery Market is dominated by advancements in cell chemistry, sophisticated Battery Management Systems (BMS), and innovative thermal management solutions designed to meet the extreme safety and operational durability requirements of rail applications. While Lithium Iron Phosphate (LFP) chemistry remains a staple due to its inherent thermal stability, longer cycle life, and safety profile, continuous research is pushing the boundaries of Nickel Manganese Cobalt (NMC) formulations to achieve higher energy densities suitable for long-range traction applications, while mitigating safety risks through enhanced packaging and cell-to-cell isolation techniques. Furthermore, Lithium Titanate Oxide (LTO) batteries are gaining niche traction in applications requiring extremely high power density and ultra-fast charging capabilities, such as urban light rail systems with limited turnaround times, despite their lower volumetric energy density.

Central to the performance and safety of railway Li-ion batteries is the BMS technology. Modern railway BMS are high-redundancy, distributed intelligence systems that monitor hundreds of parameters per cell—including voltage, temperature, current, and impedance—with microsecond precision. They utilize complex algorithms for cell balancing, charge optimization, and most critically, fault detection and isolation. Key technological focus areas include developing BMS capable of integrating with the train's central control unit (TCMS) using railway communication protocols (like MVB or Ethernet Train Bus) to ensure seamless data exchange and adherence to functional safety standards (SIL classification). The increasing integration of wireless BMS technologies reduces harness weight and complexity, enhancing the overall system reliability and facilitating easier maintenance access for diagnostics and updates, a significant technical advantage in the modular battery pack architectures prevalent in railway designs.

Thermal management is perhaps the most critical technological hurdle, given the high power outputs and the necessity of preventing thermal runaway under any circumstance. Railway battery systems employ advanced liquid cooling or specialized dielectric immersion cooling solutions to maintain precise temperature uniformity across the large battery packs (often exceeding 500 kWh). The technological push is toward highly efficient, passively or semi-passively managed systems that reduce auxiliary energy consumption associated with cooling, thereby improving the net energy efficiency of the train. Furthermore, significant R&D is focused on fire barrier technologies and passive fire suppression materials integrated within the module structure to contain any potential thermal event, ensuring compliance with the stringent EN 45545 fire protection standard, which is mandatory for rolling stock operating in confined spaces like tunnels and metropolitan areas.

Regional Highlights

- Asia Pacific (APAC): APAC is the global frontrunner in the Railway Li-ion Battery Market, primarily driven by massive government-led railway infrastructure investments in China and India. China, possessing the largest high-speed rail network and an aggressive push towards urban metro expansion, represents the single largest market for traction battery integration. Growth in this region is characterized by capacity expansion, local manufacturing dominance (CATL, CRRC), and the rapid adoption of LFP chemistry due to cost-effectiveness and safety. India’s focus on electrifying its vast existing network and upgrading rolling stock provides substantial growth opportunities, particularly for auxiliary battery retrofitting and hybrid locomotive development.

- Europe: Europe represents a mature but dynamically growing market, fueled by stringent EU mandates on carbon emissions and aggressive fleet modernization programs (Shift2Rail initiative). The region exhibits a high adoption rate of hybrid trains (e.g., Alstom’s Coradia iLint, utilizing fuel cells and batteries) to service non-electrified corridors. European railway operators emphasize safety, standardization (TSI, EN standards), and high-performance, lightweight batteries for high-speed rail. Germany, France, and the UK are key markets, focusing on TCO reduction through long-life battery systems and advanced recycling infrastructure, often favoring integrated battery systems provided by multinational giants like Saft and Siemens.

- North America: The North American market is primarily driven by the massive freight rail sector, focusing on improving efficiency and reducing emissions in heavy-duty diesel-electric locomotives through hybrid systems and auxiliary power replacement. While passenger rail adoption is slower than in Europe or APAC, investment in urban transit (metros and commuter rail) in major metropolitan areas (e.g., New York, California) is accelerating the demand for robust, high-power Li-ion battery solutions. Key focuses include operational resilience against extreme temperatures and robust packaging suitable for the heavy-haul environment, with stringent requirements for safety certifications mandated by organizations like the Federal Railroad Administration (FRA).

- Latin America (LATAM): The LATAM market is nascent but growing, primarily concentrated in modernization projects for urban metro systems in Brazil, Mexico, and Chile. Investment is currently focused on enhancing auxiliary power reliability and small-scale fleet electrification. Market growth is heavily dependent on public sector investment and international financing for infrastructure projects. The adoption rate is slower due to economic constraints, making TCO a critical factor, often favoring more cost-effective LFP chemistries for reliability enhancement in existing networks.

- Middle East and Africa (MEA): Growth in the MEA region is project-specific, centered around new high-profile rail developments, such as high-speed lines in the GCC countries (Saudi Arabia, UAE) and ambitious metro projects in North Africa. These regions prioritize cutting-edge technology and high-performance systems to cope with extreme heat and desert conditions. The demand is often for specialized cooling solutions and highly reliable auxiliary power for remote railway segments. Key purchasing decisions are influenced by global OEMs executing large-scale turnkey infrastructure contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railway Li-ion Battery Market.- Saft (TotalEnergies)

- Toshiba Corporation

- Contemporary Amperex Technology Co., Limited (CATL)

- Mitsubishi Heavy Industries, Ltd.

- Siemens AG

- Alstom SA

- CRRC Corporation Limited

- Hitachi, Ltd.

- Valence Technology, Inc.

- XALT Energy

- Leclanché SA

- Akasol AG

- Microvast Holdings, Inc.

- PowerCell Sweden AB

- Exide Industries Ltd.

- Foton Bus (Auviter)

- EnerSys

- Hoppecke Batterien GmbH & Co. KG

- LG Energy Solution

- Samsung SDI Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Railway Li-ion Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Li-ion batteries over traditional Ni-Cd batteries in railway applications?

Li-ion batteries offer significantly higher energy density, resulting in lighter weight and smaller volume, which improves vehicle efficiency. They also provide a longer cycle life, require minimal maintenance, and possess superior charging efficiency, leading to a reduced Total Cost of Ownership (TCO) for railway operators.

Which battery chemistry is predominantly used for auxiliary power in trains, and why?

Lithium Iron Phosphate (LFP) chemistry is predominantly used for auxiliary power and often in metros due to its excellent thermal stability, intrinsic safety profile, and robust cycle life, making it highly reliable for continuous, critical onboard power supply despite lower energy density compared to NMC.

What major safety and certification standards must railway Li-ion batteries adhere to?

Railway Li-ion batteries must adhere to stringent global standards, most notably EN 45545 for fire protection and flammability, EN 50121 for electromagnetic compatibility (EMC), and EN 61373 for resistance to vibration and shock, ensuring operational safety and reliability within the demanding rail environment.

How does AI impact the operational efficiency and lifespan of railway Li-ion batteries?

AI integrates with the Battery Management System (BMS) to provide predictive maintenance, accurately forecast battery State-of-Health (SOH), and optimize charging/discharging cycles based on real-time operational data. This predictive capability minimizes downtime, extends battery lifespan, and maximizes energy recapture from regenerative braking.

Which regions are currently driving the highest demand for railway Li-ion batteries?

Asia Pacific (APAC), particularly China and India, drives the highest market volume due to rapid metro expansion and mainline electrification projects. Europe is also a key growth region, driven by strict decarbonization policies and the accelerated adoption of hybrid and battery-electric multiple units (BEMUs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager