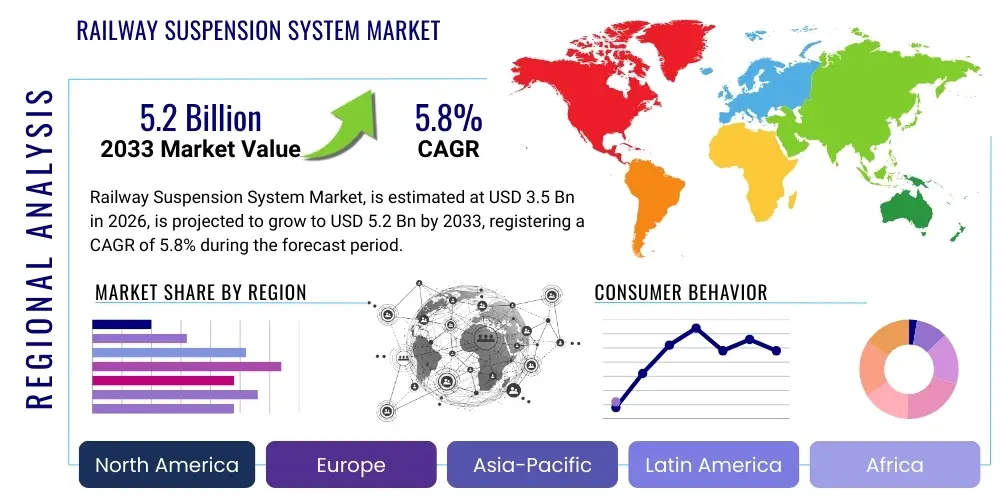

Railway Suspension System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438410 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Railway Suspension System Market Size

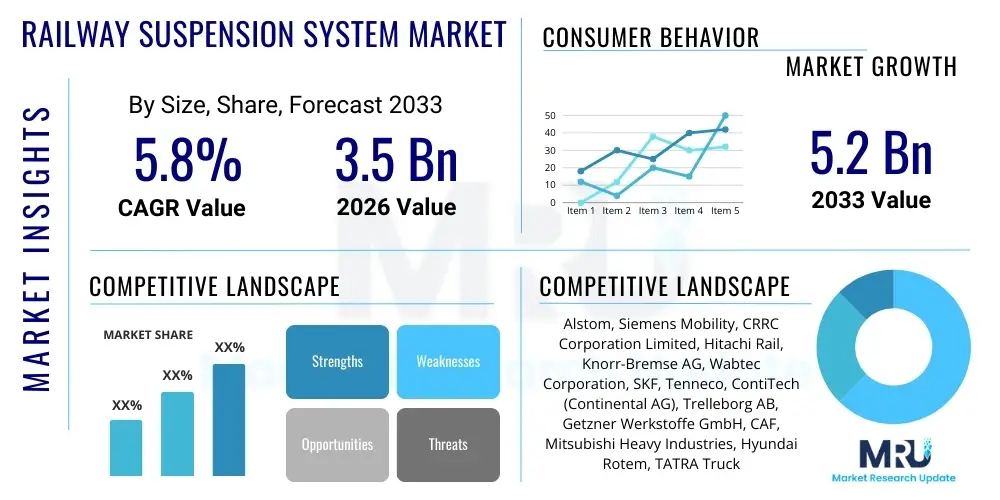

The Railway Suspension System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Railway Suspension System Market introduction

The Railway Suspension System Market encompasses components and integrated assemblies designed to isolate the car body from track irregularities, ensuring passenger comfort, reducing noise, and crucially enhancing the operational safety and longevity of rolling stock. These systems manage vertical and lateral dynamic forces, absorbing shocks and vibrations generated during high-speed travel or heavy freight movement. Essential components include primary suspension (between wheelset and bogie frame) and secondary suspension (between bogie frame and car body), utilizing various spring types (coil, air, rubber) and damping mechanisms (hydraulic shock absorbers, friction dampers).

Major applications span across high-speed rail networks, urban mass transit systems (metros and light rail), heavy-haul freight trains, and intercity passenger coaches. The increasing global focus on sustainable transportation infrastructure and the expansion of high-speed rail corridors, particularly in Asia Pacific and Europe, are pivotal in driving demand. Furthermore, the mandatory requirements for improved ride quality and adherence to stringent safety standards necessitate continuous innovation in suspension technologies, moving towards lighter, more resilient, and digitally integrated systems.

The primary benefits delivered by advanced railway suspension systems include enhanced operational stability, minimized wear and tear on track infrastructure and rolling stock components, and significant improvements in noise, vibration, and harshness (NVH) levels for occupants. Driving factors include governmental investments in railway electrification and modernization projects, the necessity to retrofit existing fleets with advanced pneumatic or hydraulic damping systems, and the strategic shift towards composite materials that offer superior performance-to-weight ratios compared to traditional steel components. The development of smart suspension systems capable of real-time monitoring and predictive maintenance represents the next critical phase of market evolution.

Railway Suspension System Market Executive Summary

The Railway Suspension System market exhibits robust growth driven by massive infrastructural investment across emerging economies, coupled with stringent regulatory standards mandating superior operational safety and passenger comfort in developed nations. Business trends are characterized by consolidation among Tier 1 suppliers focused on integrated bogie solutions, emphasizing modular designs that facilitate easier maintenance and faster deployment. Furthermore, there is an accelerating shift toward active and semi-active suspension technologies utilizing sensor feedback and adaptive control algorithms to optimize performance across varying track conditions, thereby mitigating risks associated with conventional passive systems, especially in high-speed applications.

Regionally, the Asia Pacific (APAC) dominates the market, largely propelled by China and India's expansive new rail construction projects, including dedicated high-speed corridors and metro systems. Europe remains a key market focusing on the modernization of intercity networks and the implementation of advanced European Rail Traffic Management System (ERTMS) compatible rolling stock, demanding highly reliable and low-maintenance suspension components. North America shows steady growth, primarily in the freight sector, focusing on heavy-haul suspension components that maximize load capacity and minimize track damage, alongside significant investments in passenger rail revitalization initiatives.

Segment trends highlight the dominance of secondary suspension systems, particularly sophisticated air suspension units, which are crucial for achieving premium ride comfort in modern passenger trains. Within components, air springs and advanced hydraulic dampers are experiencing the fastest uptake due to their superior tunable characteristics and ability to provide constant floor height irrespective of passenger load. The high-speed rail segment demands extremely high-performance components capable of handling speeds exceeding 250 km/h, pushing manufacturers toward lighter composite materials and complex magnetic damping technologies, thus commanding premium pricing and driving technological advancement across the entire industry value chain.

AI Impact Analysis on Railway Suspension System Market

User inquiries regarding AI's influence on railway suspension systems commonly revolve around predictive maintenance capabilities, the optimization of component lifespan, and the potential for real-time adaptive ride control. Users frequently ask how AI algorithms can process vast amounts of sensor data—such as vibration patterns, temperature fluctuations, and pressure readings—to anticipate failure before it occurs, thereby minimizing costly downtime and improving fleet utilization rates. Another major concern focuses on whether AI can truly enhance safety by dynamically adjusting damping characteristics based on track irregularities detected instantaneously, moving beyond fixed or semi-active settings. The overarching expectation is that AI integration will fundamentally transform suspension systems from passive mechanical assemblies into intelligent, self-optimizing mechatronic units, offering unprecedented levels of reliability and customizability tailored to specific operational routes and conditions.

- AI-driven Predictive Maintenance: Analyzing vibration signatures and operational telemetry to forecast component wear (springs, dampers) and schedule maintenance proactively, reducing unscheduled stops.

- Real-time Adaptive Damping: Utilization of machine learning models to adjust active or semi-active suspension settings instantly based on sensor input regarding track geometry and vehicle speed, optimizing ride comfort and stability.

- Fault Diagnostics and Isolation: AI algorithms rapidly identifying the source of anomalous suspension behavior, providing immediate feedback to operators and maintenance crews.

- Optimized Spare Parts Management: Forecasting demand for specific suspension components based on AI analysis of historical usage and predictive wear data across the entire fleet.

- Design Optimization: Using generative design AI tools to create lighter, stronger, and more energy-efficient suspension components tailored for specific route profiles.

DRO & Impact Forces Of Railway Suspension System Market

The market dynamics are governed by several strong drivers, counterbalancing restraints, and emerging opportunities, all subjected to intense competitive and regulatory impact forces. A primary driver is the global governmental commitment to railway infrastructure expansion and fleet modernization, particularly in populous countries aiming to reduce road traffic congestion and carbon emissions. Opportunities arise from the development of modular and lightweight composite suspension materials, significantly reducing energy consumption and increasing payload capacity, appealing directly to freight operators and high-speed rail developers seeking operational efficiencies.

However, significant restraints include the high initial capital investment required for deploying advanced suspension systems, especially those incorporating active control and sophisticated sensor arrays. Furthermore, the stringent and prolonged certification processes required for new railway components often slow down the adoption of innovative technologies. The long lifespan of rolling stock means replacement cycles for suspension systems are infrequent, relying heavily on the aftermarket sector for sustained revenue, which can be inconsistent compared to original equipment manufacturer (OEM) sales.

Impact forces are exerted chiefly by safety regulatory bodies (such as the Federal Railroad Administration (FRA) in the US and the European Union Agency for Railways (ERA)), whose mandates for stability and crashworthiness dictate design specifications. Competitive forces are high, driven by a few dominant global players possessing the proprietary technology and scale necessary to supply large governmental contracts. These forces push the industry towards continuous technological refinement, focusing on achieving superior performance metrics (e.g., lower dynamic loading, higher frequency isolation) while maintaining competitive pricing in a highly specialized, technical manufacturing environment.

Segmentation Analysis

The Railway Suspension System Market is meticulously segmented based on the component type, the layer of suspension, the specific application of the rolling stock, and the materials utilized. Component segmentation provides granular insights into the demand trends for distinct parts like springs, dampers, and linkages, with air springs dominating the high-comfort passenger segment, while hydraulic dampers maintain prevalence in both passenger and freight applications due to their robust energy dissipation capabilities. The suspension layer segmentation distinguishes between primary, secondary, and tertiary systems, reflecting the complexity and hierarchy of vibration isolation within modern bogie designs. Analyzing application allows for targeted market strategies, differentiating the needs of high-speed rail, which prioritizes speed and dynamic stability, versus heavy-haul freight, which emphasizes durability and load tolerance.

- By Suspension Layer:

- Primary Suspension (between wheelset and bogie frame)

- Secondary Suspension (between bogie frame and car body)

- Tertiary Suspension (used in specialized applications like tilting trains)

- By Component:

- Springs (Coil Springs, Leaf Springs, Air Springs, Rubber Springs)

- Dampers/Shock Absorbers (Hydraulic Dampers, Friction Dampers, Magnetic Dampers)

- Anti-roll bars and Stabilizers

- Linkages and Bushings

- By Application/Rolling Stock:

- High-Speed Rail

- Passenger Trains (Intercity and Regional)

- Freight Trains (Heavy Haul, Standard)

- Urban Transit (Metro, Light Rail/Tram)

- Locomotives

- By Train Technology:

- Conventional Rail

- Maglev/Magnetic Levitation Trains

- By Material Type:

- Steel and Iron

- Aluminum Alloys

- Composite Materials (Fiber Reinforced Polymers)

- Elastomers and Rubber

Value Chain Analysis For Railway Suspension System Market

The value chain for railway suspension systems commences with upstream activities involving the sourcing of highly specialized raw materials, primarily high-grade steel alloys for springs and linkages, complex elastomers for bushings and air spring bellows, and precision machined components for hydraulic dampers. Key upstream suppliers include metallurgical companies and specialized chemical manufacturers who must meet stringent international standards for material fatigue and resilience. Technological innovation often occurs at this stage, focusing on developing lighter, more durable composites and alloys that can withstand extreme environmental and operational stresses.

The manufacturing and assembly phase involves precision engineering, where Tier 1 suppliers integrate components into complex bogie sub-assemblies. Quality control, testing, and certification are critical processes, given the non-negotiable safety requirements of the rail industry. Direct distribution channels involve original equipment manufacturers (OEMs) of rolling stock—such as Alstom, Siemens, and CRRC—who integrate the suspension systems into new trains. Indirect channels are vital for the extensive aftermarket and maintenance, repair, and overhaul (MRO) sector, relying on specialized distributors and service centers to supply replacement parts and refurbishment kits globally.

Downstream analysis focuses on the end-users: national and private railway operators (e.g., Deutsche Bahn, SNCF, BNSF Railway) and municipal transit authorities. These entities are responsible for the long-term operation and maintenance, driving demand for robust MRO services and spare parts. The value chain is characterized by long-term contractual relationships and high barriers to entry, necessitated by the need for established credibility, rigorous testing, and compliance with national and regional railway standards, making efficient logistics and global service networks essential competitive differentiators for major suspension system suppliers.

Railway Suspension System Market Potential Customers

Potential customers for advanced railway suspension systems are fundamentally segmented into three major categories: Rolling Stock Manufacturers (OEMs), National and Private Railway Operating Companies, and Urban Mass Transit Authorities. Rolling Stock Manufacturers represent the primary immediate customer base for new systems, integrating components into newly produced high-speed trains, metro cars, and locomotives. These buyers demand systems that are highly customized, lightweight, certified, and compatible with specific bogie designs and performance envelopes, often negotiating long-term supply agreements for proprietary technology packages that offer a competitive edge in overall train performance.

Railway Operating Companies, whether state-owned or private entities managing vast networks (e.g., freight carriers or intercity passenger services), are crucial customers for the aftermarket and MRO sector. Their purchasing decisions are driven by the total cost of ownership (TCO), reliability, ease of maintenance, and the need to retrofit older fleets to meet contemporary safety and comfort standards. They seek robust, durable components, particularly springs and dampers, that minimize downtime and require minimal intervention over their operational lifespan, emphasizing partnerships that offer comprehensive service contracts and reliable spare parts supply chains.

Urban Mass Transit Authorities, responsible for metro and light rail operations, constitute another significant customer segment. Their unique requirements focus on low noise and vibration levels crucial for dense urban environments, high reliability for frequent stop-start cycles, and systems that can accommodate varied passenger loads efficiently, often favoring sophisticated air suspension systems that maintain precise floor height for accessibility. These authorities often work closely with system integrators during procurement, focusing on compliance with local environmental and noise pollution regulations as key purchasing criteria for suspension technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alstom, Siemens Mobility, CRRC Corporation Limited, Hitachi Rail, Knorr-Bremse AG, Wabtec Corporation, SKF, Tenneco, ContiTech (Continental AG), Trelleborg AB, Getzner Werkstoffe GmbH, CAF, Mitsubishi Heavy Industries, Hyundai Rotem, TATRA Trucks, Lord Corporation, Dellner Couplers AB, Nanjing Compas System Engineering Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railway Suspension System Market Key Technology Landscape

The technological landscape of the railway suspension system market is rapidly evolving, moving beyond conventional passive mechanical systems toward highly sophisticated, interconnected, and adaptive solutions. The primary technological advancements center on active and semi-active suspension systems. Semi-active systems, utilizing continuously variable damping mechanisms like Magneto-Rheological (MR) fluid dampers, adjust damping forces in real-time based on acceleration and displacement inputs from sensors, optimizing the trade-off between ride comfort and stability. Active systems go a step further, using external power sources and actuators to dynamically lift or push the car body, effectively neutralizing external disturbances and achieving near-perfect isolation, particularly crucial for high-speed rail stability and reducing track wear.

Another crucial technological focus is the integration of advanced lightweight materials, particularly fiber-reinforced polymer (FRP) composites, in components like springs and anti-roll bars. These composites offer significant weight reduction compared to traditional steel, contributing directly to energy efficiency and reduced dynamic loading on the track infrastructure. Furthermore, the development of intelligent, self-monitoring components is a key trend. Modern air springs are now frequently equipped with embedded pressure and temperature sensors linked to the train’s central control unit, enabling precise load monitoring and height adjustment, essential for consistent performance under varied passenger loads and for predictive maintenance scheduling.

Digitalization forms the backbone of the next generation of suspension systems. This involves the widespread adoption of Internet of Things (IoT) sensors for continuous condition monitoring of critical components like bushings, linkages, and dampers. The resulting large data sets are then processed using edge computing and cloud-based AI analytics to provide prescriptive diagnostics, moving from simple fault detection to complex prognostics regarding remaining useful life (RUL). This technological convergence—combining advanced material science, sophisticated hydraulics, and cutting-edge data analytics—is setting the standard for reliable, efficient, and exceptionally comfortable rail travel, cementing the market shift toward fully integrated mechatronic bogie systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the powerhouse of the global railway suspension market, driven by unprecedented expansion in railway networks, especially in China, India, and Southeast Asian nations. China's massive high-speed rail and metro projects, supported by government initiatives to improve interconnectivity, create huge demand for OEM systems. India’s ambitious plan to modernize its vast legacy rail system and introduce semi-high-speed corridors is driving significant aftermarket and new component procurement. The region demands systems that balance high performance with cost efficiency.

- Europe: Europe is characterized by a mature, interconnected network and a strong focus on compliance with the Technical Specifications for Interoperability (TSIs). Market growth is fueled primarily by fleet replacement, standardization efforts (e.g., adoption of active tilting technologies for better curve negotiation), and strict requirements for NVH reduction. Germany, France, and the UK are key markets, emphasizing high quality, low maintenance, and advanced sensor integration for safety and operational efficiency.

- North America: The North American market is highly segmented, with heavy-haul freight dominating demand for rugged, high-load suspension components designed for extreme duty cycles. The passenger rail segment, though smaller, is gaining traction due to high-profile projects like California High-Speed Rail and Amtrak fleet replacement, focusing on high-speed stability and crash energy management compliant with strict FRA regulations.

- Latin America: This region presents emerging opportunities linked to industrial growth and resource transportation. Investment in modernization and expansion is concentrated in Brazil and Mexico, driven by the need for better connectivity for mining and agricultural exports. Demand is often focused on durable, reliable systems suited to challenging operating environments and infrastructure limitations.

- Middle East and Africa (MEA): Growth in MEA is project-based, centered around large-scale infrastructure developments in the Gulf Cooperation Council (GCC) nations (e.g., Saudi Arabia, UAE) for high-speed desert lines, requiring specialized suspension systems robust enough to handle extreme temperatures and sand ingress. Africa’s demand is centered on upgrading existing colonial-era networks and new regional passenger lines, emphasizing robust, low-tech, easy-to-maintain components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railway Suspension System Market.- Alstom

- Siemens Mobility

- CRRC Corporation Limited

- Hitachi Rail

- Knorr-Bremse AG

- Wabtec Corporation

- SKF

- Tenneco (DRiV)

- ContiTech (Continental AG)

- Trelleborg AB

- Getzner Werkstoffe GmbH

- CAF

- Mitsubishi Heavy Industries

- Hyundai Rotem

- TATRA Trucks

- Lord Corporation (Parker Hannifin)

- Dellner Couplers AB

- Nanjing Compas System Engineering Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Railway Suspension System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of secondary suspension in railway rolling stock?

The secondary suspension system is located between the bogie frame and the car body, and its primary function is to optimize passenger comfort and protect the train structure from excessive vibration and shocks transmitted from the track, primarily achieved through air springs and hydraulic dampers.

How is the adoption of composite materials impacting the suspension system market?

Composite materials, such as Fiber Reinforced Polymers (FRP), are replacing traditional steel in components like springs and anti-roll bars, leading to significant weight reduction, improved energy efficiency, and enhanced component lifespan, particularly beneficial for high-speed and light rail applications.

What role does predictive maintenance play in modern railway suspension systems?

Predictive maintenance utilizes embedded sensors and AI analytics to monitor the real-time condition of suspension components, forecasting potential failures and wear based on vibration data, thereby allowing operators to schedule maintenance precisely and minimize costly unscheduled downtime.

Which geographical region dominates the global market for railway suspension systems?

The Asia Pacific (APAC) region currently dominates the market, driven by large-scale governmental investments in new high-speed rail networks, extensive metro system expansion, and continuous fleet modernization projects, particularly in China and India.

What is the difference between passive and semi-active suspension in rail applications?

Passive suspension systems use fixed mechanical properties (spring rates, damping coefficients). Semi-active systems, by contrast, dynamically adjust their damping coefficients in real-time using sensor feedback and control algorithms to optimize ride quality based on current track and speed conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager