Railway Vehicle Toilet System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433266 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Railway Vehicle Toilet System Market Size

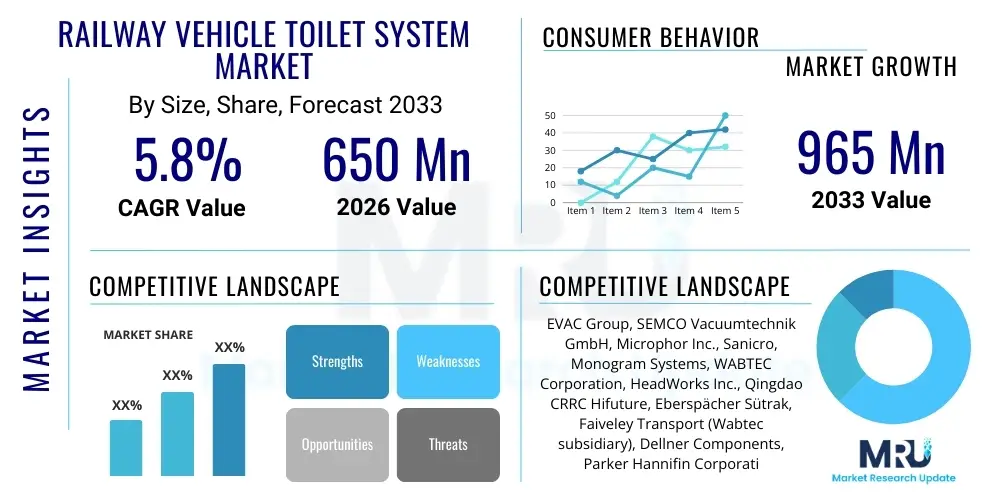

The Railway Vehicle Toilet System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 965 Million by the end of the forecast period in 2033.

Railway Vehicle Toilet System Market introduction

The Railway Vehicle Toilet System Market encompasses the design, manufacturing, installation, and maintenance of specialized sanitation facilities integrated within passenger train carriages. These systems are critical components ensuring passenger comfort and adherence to strict environmental and hygiene standards mandated by rail authorities globally. Historically dominated by conventional gravity-based flushing mechanisms, the market has rapidly shifted towards sophisticated vacuum toilet systems, driven by their significant advantages in water conservation, weight reduction, enhanced cleanliness, and efficient waste handling, especially in high-speed and long-distance rail operations. The core product offering includes toilet modules, retention tanks, waste treatment units, control systems, and associated plumbing infrastructure, tailored for compatibility with diverse railway vehicle designs, ranging from commuter trains and metros to intercity and high-speed rail networks.

Major applications of these systems span the entire spectrum of rail transport, primarily focusing on new rolling stock procurement and comprehensive refurbishment projects for existing fleets. Key driving factors include rigorous governmental regulations prohibiting the discharge of untreated sewage onto railway tracks, particularly prevalent in densely populated regions like Europe and Asia Pacific, necessitating the adoption of closed-loop or advanced retention systems. Moreover, the global push towards sustainable public transportation and the continuous investment in modernizing aging rail infrastructure globally are providing robust momentum for market growth. The increasing focus on premium passenger experience, which directly correlates with the quality and reliability of onboard amenities, further compels rail operators to invest in cutting-edge, low-maintenance toilet technologies.

The benefits derived from advanced railway toilet systems extend beyond simple passenger comfort; they significantly contribute to operational efficiency and environmental stewardship. Modern vacuum systems minimize water usage—often requiring less than 1 liter per flush compared to 10-15 liters for older gravity systems—leading to reduced operating costs and extended intervals between tank emptying operations. Furthermore, the modular design and increased automation enhance system reliability, decrease the frequency of maintenance, and improve overall hygiene levels through effective sealing and rapid waste removal. The development of intelligent monitoring systems that track usage, tank levels, and potential maintenance issues in real-time is a key differentiator, enabling predictive maintenance strategies and minimizing service disruptions, thereby maximizing the availability of rolling stock across busy rail corridors.

Railway Vehicle Toilet System Market Executive Summary

The global Railway Vehicle Toilet System Market is characterized by robust growth, primarily propelled by massive investments in high-speed rail networks, particularly across the Asia Pacific region, and stringent environmental mandates in Europe. Business trends indicate a strong move towards comprehensive system integration and lifecycle management services, where key market players are transitioning from mere component suppliers to offering complete, tailored sanitation solutions, including predictive maintenance software and advanced waste processing units. Technological differentiation is critical, with vacuum technology dominating new installations due to its superior efficiency and environmental compliance. Furthermore, partnerships between established rolling stock manufacturers and specialized sanitation technology providers are becoming essential for securing large-scale government and private sector contracts for new fleet deployment and legacy system upgrades, focusing heavily on enhancing modularity and standardization across different train platforms.

Regional trends highlight the Asia Pacific as the primary growth engine, driven by China's extensive high-speed rail expansion and India's substantial efforts to modernize its vast passenger rail network, replacing older "open chute" systems with modern retention toilets. Europe continues to be a mature but highly regulatory-driven market, emphasizing compliance with TSI (Technical Specifications for Interoperability) standards and prioritizing sustainability, driving demand for advanced wastewater recycling and treatment capabilities onboard. North America exhibits steady demand stemming from freight rail modernization efforts that also include passenger segments, focusing on robustness and low maintenance required by long-haul operations. Regulatory harmonization efforts across regions are beginning to shape global product design, ensuring cross-market applicability and reducing complexity for multinational suppliers, while local manufacturing capabilities are increasingly sought after to meet localization requirements in emerging markets.

Segmentation trends reveal that the vacuum-based toilet systems segment maintains the largest market share and is projected to exhibit the highest CAGR, primarily due to their efficiency in dealing with varied operational environments and their alignment with modern high-speed rail standards. The segment related to retention tanks and waste disposal units is seeing substantial innovation, focusing on smart sensor integration for optimal capacity management and efficient servicing turnarounds. Regarding rolling stock type, high-speed trains and commuter/metro vehicles represent the core application areas, benefiting from high passenger volumes and frequent usage cycles, thereby justifying investment in premium, durable, and reliable sanitation infrastructure. Refurbishment projects, driven by the need to extend the operational life of existing fleets while meeting new hygiene standards, also constitute a significant and growing revenue stream within the segmentation landscape.

AI Impact Analysis on Railway Vehicle Toilet System Market

Common user questions regarding AI's impact on the Railway Vehicle Toilet System Market center around how machine learning can enhance maintenance predictability, optimize fluid usage, and improve overall operational uptime. Users are keen to understand if AI can effectively analyze sensor data from complex vacuum and chemical systems to detect minor malfunctions before they escalate into service-disrupting failures. A central theme is the expectation that AI-driven diagnostics will shift maintenance from reactive scheduling to condition-based monitoring, reducing costs associated with unexpected breakdowns and maximizing the operational availability of rolling stock. There is also significant interest in leveraging AI to analyze passenger usage patterns across different routes and times, optimizing fluid distribution, tank management, and cleaning cycles to meet fluctuating demand efficiently, thereby enhancing passenger experience while minimizing resource consumption.

The application of Artificial Intelligence within this niche market primarily revolves around advanced telemetry and data analysis collected from various system components, including flushing mechanisms, vacuum pumps, retention tank levels, and odor sensors. AI algorithms enable the creation of highly accurate predictive models that monitor the health of critical electromechanical parts, flagging anomalies that standard diagnostics might miss. This proactive approach ensures that maintenance teams can intervene precisely when needed, extending component lifespan and drastically minimizing the financial impact of out-of-service rolling stock. Furthermore, AI contributes to environmental efficiency by optimizing cleaning chemical dispersion and managing water reclamation processes within the system, ensuring compliance with strict wastewater discharge regulations while maximizing resource use.

- AI facilitates predictive maintenance schedules by analyzing sensor data (vibration, temperature, pressure) in pumps and valves, preventing catastrophic failures.

- Machine Learning optimizes water and chemical consumption based on real-time usage patterns, enhancing sustainability and operational cost efficiency.

- Advanced diagnostics using AI quickly isolate fault locations, significantly reducing mean time to repair (MTTR) for onboard technicians.

- AI algorithms can analyze passenger flow data to dynamically manage cleaning requirements and stock levels of consumables (e.g., soap, paper).

- Integration with fleet management systems allows AI to forecast maintenance resource needs across the entire rail network, improving logistical planning.

DRO & Impact Forces Of Railway Vehicle Toilet System Market

The market dynamics are defined by a powerful convergence of regulatory mandates, technological evolution, and infrastructural investment, encapsulated within the Drivers, Restraints, and Opportunities (DRO) framework. Key drivers include stringent global regulations against track discharge and the unprecedented expansion of modern, high-speed rail networks, demanding sophisticated, reliable closed-loop sanitation systems. Restraints predominantly involve the high initial investment required for sophisticated vacuum systems compared to legacy installations, and the complex logistical challenges associated with retrofitting aging fleets with modern technologies, often requiring long service interruptions. Opportunities are abundant in developing specialized smart maintenance solutions, integrating IoT sensors and AI for predictive diagnostics, and targeting lucrative refurbishment markets in established regions like Europe and North America where fleets are being modernized to meet contemporary passenger expectations and environmental standards. These forces collectively dictate the pace and direction of technological adoption and market penetration.

Drivers strongly influence the mandatory adoption curve, compelling rail operators to decommission outdated gravity-based systems. The primary driver remains governmental and international environmental standards, such as those set by the European Union, which necessitate full retention capabilities and efficient waste treatment. Coupled with this, the massive capital expenditure by countries like China, India, and Saudi Arabia on high-speed rail infrastructure inherently demands the most advanced, lightweight, and reliable toilet systems, predominantly favoring vacuum technology which saves critical space and weight on high-speed trains. Furthermore, the growing expectation of seamless travel experience among global passengers means onboard hygiene and functionality are no longer luxury features but essential requirements, pushing operators towards systems with higher reliability and less frequent mechanical issues.

Conversely, market restraints present barriers to accelerated adoption. The high upfront cost of premium vacuum systems—including complex piping, specialized pumps, and robust control units—is a significant deterrent, particularly for budget-conscious regional or freight rail operators who may opt for simpler retention solutions. Additionally, the technical complexity of integrating sophisticated new systems into older rolling stock presents significant engineering challenges, requiring customized solutions and extended vehicle downtime, which directly impacts operator revenue. Finally, while opportunities exist in innovation, the fragmented global regulatory landscape, despite harmonization efforts, sometimes requires bespoke system modifications for different countries or railway authorities, increasing manufacturing complexity and costs for global suppliers, acting as a soft restraint on standardization.

Segmentation Analysis

The Railway Vehicle Toilet System Market is comprehensively segmented based on technology type, application (rolling stock type), and component. This segmentation is crucial for understanding specific demands and technological preferences across different rail environments globally. Technological segmentation highlights the ongoing dominance and rapid adoption of vacuum systems, which offer superior efficiency in water consumption and hygiene compared to their gravity and chemical counterparts. Application segmentation clearly delineates the market potential within high-speed rail, commuter/metro, and long-distance passenger segments, each demanding unique structural and durability specifications for their sanitation modules. Finally, the component segment analyzes the value contribution of retention tanks, control units, flushing mechanisms, and waste treatment systems, identifying key areas of innovation and procurement expenditure across the value chain.

The component segment, specifically, is seeing considerable growth driven by "smart" system integration. Modern control units incorporating IoT capabilities are increasingly sought after, enabling remote monitoring of water levels, pump efficiency, and fault detection, which transitions maintenance processes from time-based to condition-based servicing. Retention tanks are being designed using advanced composites to reduce weight while maximizing capacity, optimizing the balance between passenger services and vehicle payload limits. The trend towards modular construction is also profound, allowing rail manufacturers to rapidly install and replace self-contained toilet units during routine vehicle maintenance or refurbishment, thereby improving overall operational efficiency and reducing vehicle time spent in the depot.

Analyzing segmentation by rolling stock type reveals distinctive market needs. High-speed trains require lightweight, highly reliable, and aesthetically integrated systems that can handle high dynamic loads and pressures. Commuter and metro systems, characterized by high usage frequency over short durations, prioritize robustness, vandal resistance, and ease of maintenance due to rapid turnaround requirements. Long-distance and sleeper trains necessitate larger retention capacities and often incorporate advanced water recycling or chemical treatment capabilities to minimize the need for frequent servicing stops. This differentiation underscores the necessity for suppliers to offer highly customized product portfolios addressing the specific performance parameters, regulatory environments, and passenger profiles of each distinct rail sector.

- By Technology Type:

- Vacuum Toilet Systems (Dominant due to efficiency)

- Gravity Toilet Systems (Legacy and low-cost applications)

- Chemical Recirculating Toilet Systems (Specialized niche, less common)

- By Rolling Stock Type:

- High-Speed Trains

- Long-Distance Passenger Trains

- Commuter and Regional Trains

- Metro and Light Rail Vehicles

- By Component:

- Toilet Modules (Bowls, seats, cubicles)

- Retention Tanks and Storage Units

- Flushing Mechanisms and Control Systems (Including sensors and IoT modules)

- Piping and Vacuum Generation Units (Pumps, ejectors)

- Waste Treatment and Disposal Interfaces

Value Chain Analysis For Railway Vehicle Toilet System Market

The value chain for the Railway Vehicle Toilet System Market begins with the upstream suppliers of specialized components, materials, and complex electronic controls. Upstream activities involve sourcing high-grade plastics, composite materials for retention tanks, precision-engineered mechanical components (valves, pumps), and sophisticated control electronics (sensors, microprocessors). Key challenges in the upstream segment include maintaining strict quality control and ensuring compliance of materials with stringent rail safety and fire protection standards (e.g., EN 45545-2). Successful upstream players differentiate themselves through material science expertise, offering lightweight and highly durable components that withstand the harsh operating environment of rail vehicles, thus minimizing the downstream risk of premature system failure.

The midstream phase is dominated by specialized system integrators and Original Equipment Manufacturers (OEMs) who design, assemble, and test the complete toilet modules and systems. This phase involves integrating components, developing proprietary vacuum technology, and ensuring the final product meets the complex interface requirements of various rolling stock manufacturers (e.g., Siemens, Alstom, CRRC). Distribution channels are predominantly direct, involving direct negotiations and long-term contracts between the system suppliers and the train builders or national railway operators. Indirect channels are often utilized for smaller aftermarket components or specialized maintenance services provided through authorized regional distributors, particularly in less centralized markets where local support is crucial for timely repairs and upgrades.

The downstream segment involves installation, testing, and, most critically, the long-term maintenance and servicing of the installed systems. Installation is performed either by the rolling stock manufacturer during vehicle assembly or by specialized maintenance depots during fleet refurbishment. Post-sales servicing constitutes a significant recurring revenue stream, encompassing spare parts provision, scheduled maintenance checks, software updates for control units, and crucial technical support. Direct interaction with the end-users—the railway operators—is vital in the downstream segment, as feedback on system reliability, ease of cleaning, and water management efficiency directly influences future product design iterations and the competitive positioning of suppliers in upcoming tenders.

Railway Vehicle Toilet System Market Potential Customers

The primary customers for Railway Vehicle Toilet Systems are broadly categorized into three major groups: global Rolling Stock Manufacturers (OEMs), National and Private Railway Operators, and specialized Rail Vehicle Refurbishment and Maintenance Depots. Rolling Stock Manufacturers, such as Alstom, Siemens Mobility, CRRC, and Bombardier Transportation (now largely integrated into Alstom), represent the largest volume buyers. These companies integrate the toilet systems into new train sets under large government contracts for high-speed, commuter, and metro projects. Suppliers must demonstrate seamless integration capabilities, adherence to tight production schedules, and competitive pricing for bulk orders to secure these major OEM partnerships globally, often involving multi-year framework agreements.

National and Private Railway Operators (the end-users) are crucial customers for aftermarket services, spare parts, and, importantly, fleet modernization projects. Organizations like Deutsche Bahn (DB), SNCF, Amtrak, and Indian Railways make direct procurement decisions when undertaking mid-life vehicle refurbishment projects aimed at upgrading legacy systems (e.g., moving from open-chute to closed vacuum systems) to comply with new environmental regulations and enhance passenger amenities. For these customers, reliability, low maintenance costs, and energy efficiency are paramount, as system failures directly impact operational schedules and reputation. Suppliers often engage directly with the operator's technical and engineering departments to tailor solutions specific to their operating environment and maintenance infrastructure.

The third customer category comprises specialized maintenance and overhaul firms that handle vehicle lifespan extensions and complex repairs. While often acting under the instruction of the primary railway operator, these firms require access to standardized spare parts, detailed technical documentation, and efficient supply chain logistics. Targeting these potential customers requires a robust regional distribution network and dedicated technical support teams capable of providing rapid assistance. The sustained demand for replacement components and system upgrades throughout the 30-40 year lifespan of a railway vehicle ensures a continuous, high-margin revenue opportunity beyond the initial installation phase, making lifecycle service contracts highly valuable to market participants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 965 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EVAC Group, SEMCO Vacuumtechnik GmbH, Microphor Inc., Sanicro, Monogram Systems, WABTEC Corporation, HeadWorks Inc., Qingdao CRRC Hifuture, Eberspächer Sütrak, Faiveley Transport (Wabtec subsidiary), Dellner Components, Parker Hannifin Corporation, Chengdu HuaMing Technology Co. Ltd., Konvekta AG, Thetford Corporation, Korita Aviation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railway Vehicle Toilet System Market Key Technology Landscape

The technological landscape of the Railway Vehicle Toilet System Market is predominantly defined by the shift from legacy gravity and chemical systems toward high-efficiency vacuum technology, which utilizes differential air pressure to evacuate waste quickly and cleanly using minimal water. Vacuum systems offer significant operational advantages, including the ability to install retention tanks virtually anywhere on the vehicle (not strictly below the bowl), allowing for greater flexibility in rolling stock design and weight distribution. Furthermore, continuous innovation is focused on enhancing the reliability of vacuum generators and control valves, which are crucial points of failure in complex systems. The integration of advanced sensors—monitoring variables like tank fill levels, flushing cycles, odor levels, and component performance—is becoming standard, providing real-time data crucial for operational management and compliance reporting.

A burgeoning area of technological advancement is centered around sustainability and closed-loop operation. Market leaders are investing heavily in research and development for sophisticated wastewater recycling and treatment units designed to operate reliably within the limited space and dynamic environment of a moving train. These systems aim to treat and reuse greywater (from sinks) for flushing purposes, dramatically reducing the volume of potable water required onboard and extending the intervals between maintenance stops for waste disposal. Furthermore, modular design principles are being applied to toilet units, promoting standardized interfaces and quick-change cartridges for components, thereby simplifying maintenance procedures and reducing the Mean Time To Repair (MTTR) when rolling stock is in the depot, which is a critical operational metric for rail operators.

The future technology trajectory is heavily influenced by digitalization and IoT integration, aligning sanitation systems with broader Smart Train initiatives. This involves leveraging high-bandwidth train networks to transmit detailed operational data to centralized maintenance platforms, facilitating AI-driven predictive maintenance and fleet optimization. Cybersecurity considerations are also becoming pertinent for these connected control systems. Furthermore, the development of advanced materials for interior surfaces and piping—such as antimicrobial coatings and non-stick internal piping—is improving hygiene and reducing the frequency of deep cleaning required. The overall technological focus is on creating systems that are highly autonomous, resource-efficient, lightweight, and robust enough to meet the rigorous demands of modern high-frequency and high-speed rail operations globally.

Regional Highlights

Regional dynamics are critical drivers of the Railway Vehicle Toilet System Market, reflecting varied levels of rail infrastructure development, regulatory pressures, and investment cycles. Asia Pacific (APAC) currently dominates the market in terms of volume and growth potential, primarily driven by massive government-led initiatives in China and India. China's unparalleled expansion of its high-speed rail (HSR) network necessitates the continuous procurement of modern, high-specification rolling stock equipped exclusively with reliable vacuum toilet systems. Similarly, India's extensive railway network modernization program, including the replacement of open-discharge toilets on passenger carriages, presents a vast, sustained demand for advanced retention systems compliant with evolving environmental norms, positioning APAC as the undisputed epicenter of market activity throughout the forecast period.

Europe represents a mature market characterized by stringent technical standards and a focus on retrofitting and sustainability. European Union regulations, particularly the Technical Specifications for Interoperability (TSI), impose high standards on waste containment and disposal across transnational rail services, driving demand for innovative solutions that offer maximum efficiency and minimal environmental footprint. Consequently, European railway operators prioritize systems featuring advanced water recycling capabilities and comprehensive digital diagnostics. While growth rates are generally slower than in APAC due to already established infrastructure, the significant market value is sustained by continuous fleet renewal cycles and the mandatory upgrade of legacy vehicles to meet evolving environmental legislation and high passenger expectations across countries like Germany, France, and the UK.

North America, encompassing the U.S. and Canada, presents a distinct market profile influenced by substantial freight rail dominance but steady growth in passenger rail (Amtrak and commuter lines). Demand in this region is focused on robust, low-maintenance systems that can endure extreme weather variations and long operational routes. The replacement cycle for commuter rail vehicles and the expansion of key metropolitan transit systems provide consistent market volume. Meanwhile, emerging markets in the Middle East (e.g., Saudi Arabia, UAE) and Africa are gaining prominence due to newly launched high-speed rail projects and urban transit investments, representing high-value, albeit intermittent, opportunities requiring tailored, durable, and climate-resistant sanitation solutions compatible with imported European or Asian rolling stock standards.

- Asia Pacific (APAC): Leads market growth due to massive HSR development in China and extensive fleet modernization and sanitation upgrades in India.

- Europe: High-value market focused on regulatory compliance (TSI), fleet renewal, and advanced sustainable technologies like water recycling and predictive maintenance integration.

- North America: Stable demand driven by commuter rail expansion and the steady replacement cycles of Amtrak and private passenger rail services, valuing durability and robustness.

- Middle East & Africa (MEA): Emerging high-potential region characterized by large, isolated infrastructure projects (e.g., dedicated high-speed lines) and significant reliance on imported technology.

- Latin America: Moderate market activity centered on urban metro and light rail upgrades in major cities, prioritizing cost-effective and reliable retention systems for high-frequency use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railway Vehicle Toilet System Market.- EVAC Group

- SEMCO Vacuumtechnik GmbH

- Microphor Inc.

- Sanicro

- Monogram Systems

- WABTEC Corporation

- HeadWorks Inc.

- Qingdao CRRC Hifuture

- Eberspächer Sütrak

- Faiveley Transport (Wabtec subsidiary)

- Dellner Components

- Parker Hannifin Corporation

- Chengdu HuaMing Technology Co. Ltd.

- Konvekta AG

- Thetford Corporation

- Korita Aviation

- Bombardier Transportation (Acquired by Alstom)

- TCM Systems

- Knorr-Bremse AG (Through certain subsidiaries)

- Geberit AG

Frequently Asked Questions

Analyze common user questions about the Railway Vehicle Toilet System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the Railway Vehicle Toilet System Market?

The primary growth driver is Vacuum Toilet System technology. Vacuum systems offer significant advantages over traditional gravity or chemical toilets by requiring minimal flush water (less than 1 liter), enabling flexible installation, reducing vehicle weight, and adhering effectively to stringent modern environmental standards against track discharge. This technology is essential for high-speed rail and new commuter fleets.

How do stringent environmental regulations impact the design requirements of modern rail toilet systems?

Environmental regulations, particularly those in Europe and rapidly modernizing Asian markets, mandate closed-loop systems, prohibiting the discharge of untreated waste onto the tracks. This necessitates the use of retention tanks, and increasingly, onboard waste treatment or recycling capabilities. Compliance drives the adoption of advanced sensor technology and sophisticated control systems to ensure proper containment and disposal protocols are followed.

Which geographical region holds the largest market share and exhibits the highest growth potential?

The Asia Pacific (APAC) region currently represents the largest and fastest-growing market. This dominance is primarily attributed to extensive government investment in high-speed rail infrastructure, particularly in China, and major modernization initiatives in India focused on replacing legacy open-chute sanitation systems with modern, hygienic, and environmentally compliant retention toilets.

What role does Artificial Intelligence (AI) play in the future of railway sanitation systems?

AI's primary role is in enabling predictive and condition-based maintenance. By analyzing real-time data from IoT sensors monitoring pumps, valves, and tank levels, AI algorithms can predict component failures, optimize scheduled maintenance interventions, and efficiently manage resource consumption (water/chemicals), significantly improving system uptime and reducing operational costs for railway operators.

What are the main components of a typical vacuum toilet system in a modern rail vehicle?

A modern vacuum system comprises several key components: the specialized toilet module (bowl), a vacuum generator unit (pumps or ejectors) which creates the necessary differential pressure, the retention or holding tank for waste storage, a complex network of durable piping, and an electronic control unit that manages flushing cycles, water usage, and monitors system diagnostics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager