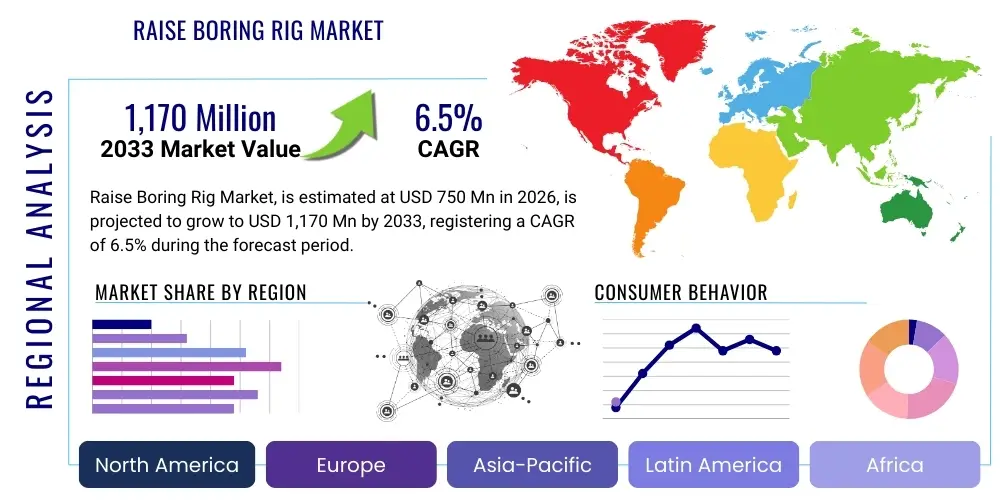

Raise Boring Rig Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436879 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Raise Boring Rig Market Size

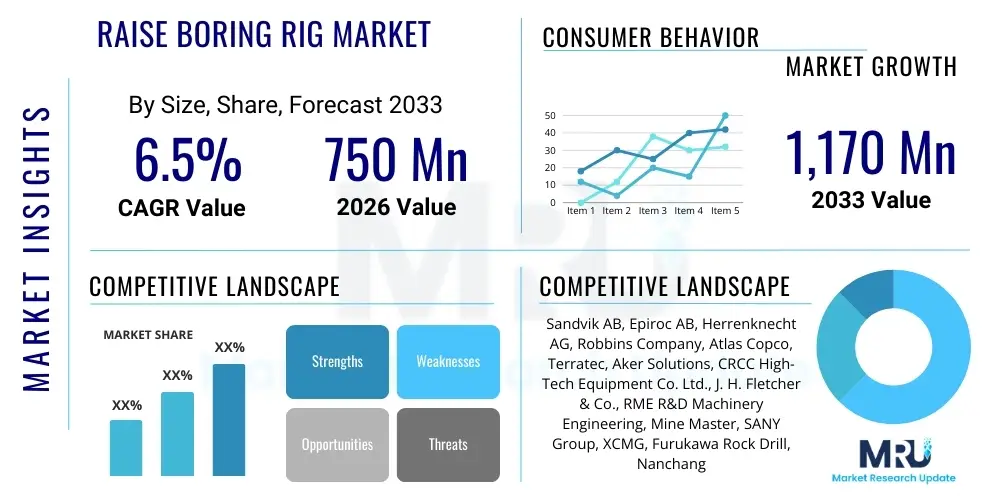

The Raise Boring Rig Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,170 Million by the end of the forecast period in 2033.

Raise Boring Rig Market introduction

The Raise Boring Rig Market encompasses specialized heavy machinery utilized primarily in the mining and civil construction sectors for creating vertical or near-vertical shafts, known as raises, without the need for personnel entry during the drilling process. These rigs operate by first drilling a pilot hole upwards or downwards, which is then reamed to the final required diameter using a large-diameter cutting head pulled upwards toward the rig foundation. The core product offering includes various sizes and configurations of raise boring machines, categorized generally by torque capacity, reaming diameter, and pull force, designed to efficiently excavate ventilation shafts, ore passes, and service shafts in hard rock environments.

Major applications for raise boring rigs span deep underground mining operations, including gold, copper, and iron ore extraction, where reliable ventilation systems are critical for worker safety and operational efficiency. Furthermore, civil engineering projects, such as hydropower schemes, subway construction, and storage facilities requiring vertical access, utilize these rigs due to their high precision, speed, and safety advantages over conventional drilling and blasting methods. The inherent benefits of raise boring include reduced environmental impact, superior wall stability, minimized vibrations, and significantly enhanced safety records, driving their increased adoption across geographically diverse project sites.

Key factors driving market expansion include the global surge in mineral exploration spurred by the energy transition (demanding critical minerals like cobalt and lithium), coupled with the need for deeper mining operations where conventional sinking methods become cost-prohibitive or excessively risky. Technological advancements focusing on automation, remote operation capabilities, and improved cutter technology are further propelling market growth by enhancing operational productivity and reducing downtime. The rising focus on worker safety mandates within the heavily regulated mining industry provides a substantial, long-term impetus for adopting mechanized, non-entry excavation techniques like raise boring.

Raise Boring Rig Market Executive Summary

The Raise Boring Rig Market is characterized by robust growth, driven primarily by sustained global demand for essential minerals and increasing infrastructure investments in emerging economies. Key business trends include a strategic shift towards automated and electric-powered rigs to comply with stringent environmental regulations and maximize operational efficiency in increasingly remote and challenging environments. Leading manufacturers are investing heavily in telemetry and data analytics solutions, integrating predictive maintenance features to minimize costly downtime, thereby offering higher lifecycle value to end-users. Consolidation activities and strategic partnerships focused on developing integrated drilling solutions that incorporate ground support planning and real-time geological mapping are also defining the competitive landscape, pushing the market towards higher technological sophistication and comprehensive service contracts.

Regionally, the market exhibits strong expansion in the Asia Pacific (APAC) region, largely fueled by extensive mining activities in Australia, China, and India, alongside significant infrastructure development, particularly in Southeast Asia. North America and Europe remain mature but stable markets, focusing heavily on technology upgrades and replacement cycles, particularly adopting electric and automated large-diameter rigs suitable for deep underground applications. Latin America, rich in copper and gold reserves, continues to present substantial opportunities, although market penetration can be challenging due to volatile commodity prices and varying regulatory frameworks. The demand trend across all regions heavily favors high-torque, versatile rigs capable of handling diverse rock hardness levels and large reaming diameters, optimizing capital expenditure for mining companies.

Segment trends indicate that large-diameter rigs (over 3.0 meters reaming diameter) are expected to witness the fastest growth, particularly within major tier-one mining operations requiring extensive ventilation and bulk material handling shafts. Furthermore, the segmentation by application shows that the mining sector dominates the market share, although the civil construction segment is rapidly expanding, fueled by major tunneling and underground storage projects. In terms of product type, mobile and modular rigs are gaining traction due to their enhanced portability and faster setup times, addressing the urgent needs of contract miners and temporary construction sites, thereby providing flexibility unmatched by fixed or crawler-mounted systems.

AI Impact Analysis on Raise Boring Rig Market

Common user questions regarding AI’s impact on the Raise Boring Rig Market often revolve around operational efficiency, predictive failure, automation of drilling parameters, and the potential for fully autonomous operation in hazardous environments. Users are highly interested in how AI algorithms can optimize the complex interaction between cutter selection, feed rate, torque management, and ground condition variations to maximize penetration rates and minimize wear on expensive components. There is also significant concern regarding data security, the required skill upgrade for technicians managing these advanced systems, and the return on investment (ROI) associated with integrating sophisticated machine learning models into traditional heavy machinery. The central theme emerging from these inquiries is the expectation that AI will transition raise boring from a highly skilled, manually intensive process to a precise, data-driven, and intrinsically safer operation.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the raise boring process by enabling real-time decision-making previously unattainable through conventional control systems. AI algorithms analyze vast datasets streaming from sensors monitoring torque, rotation speed, penetration rate, vibration, and geological feedback (e.g., specific energy consumption) to dynamically adjust drilling parameters. This capability ensures that the rig operates continuously at its optimal efficiency point, minimizing energy consumption while significantly extending the Mean Time Between Failure (MTBF) for critical components such as reaming heads and stabilizers. This optimized performance translates directly into reduced operational costs and improved cycle times, crucial metrics for profitability in deep mining contexts.

Furthermore, AI is pivotal in enhancing safety and asset integrity through advanced predictive maintenance. By analyzing historical performance data and recognizing subtle deviations from baseline operational profiles, ML models can predict component failures days or weeks in advance. This foresight allows maintenance scheduling to be proactive rather than reactive, drastically reducing unplanned downtime—a major financial burden in the capital-intensive raise boring sector. Beyond maintenance, AI contributes to enhanced training simulations and augmented reality tools for operators, making complex rig management more intuitive and reliable, ultimately fostering a safer working environment by removing human subjectivity from high-risk parameter adjustments.

- AI optimizes drilling parameters (torque, thrust, speed) in real-time based on geological feedback, maximizing penetration rates.

- Machine Learning models predict component wear and failure, facilitating condition-based, predictive maintenance and reducing costly unplanned downtime.

- Integration of computer vision and sensor fusion enhances automated guidance and alignment, improving shaft accuracy and reducing deviations.

- AI-driven data analytics processes voluminous operational data to provide deep insights into energy consumption and overall operational efficiency (OEE).

- Development of semi-autonomous and fully autonomous drilling cycles reduces human exposure to hazardous underground environments.

- AI enhances training simulators by creating realistic operational scenarios, improving operator competency and reaction time to unexpected rock conditions.

DRO & Impact Forces Of Raise Boring Rig Market

The dynamic forces shaping the Raise Boring Rig Market involve a complex interplay of robust drivers centered on global resource demands, significant technological constraints, and lucrative opportunities emerging from automation and decarbonization efforts. The primary drivers stem from the continuous global expansion of underground mining operations necessitated by the depletion of easily accessible surface reserves, particularly for transition metals vital for electric vehicles and renewable energy storage. Concurrently, high capital expenditure and the inherent technical challenges associated with drilling in extremely hard or geologically unstable rock formations impose substantial restraints on rapid market penetration, especially for smaller contract miners.

Major driving forces include the non-negotiable industry requirement for improved safety standards, which favors the remotely operated nature of raise boring over manual shaft sinking. The escalating costs of labor and energy also push operators towards high-efficiency, fully mechanized systems, where modern rigs offer superior rates of excavation per hour compared to conventional methods. Opportunities abound in the development of customized, small-footprint rigs for civil construction projects in dense urban areas, and crucially, in the retrofit and digitalization of existing fleets. The move towards electrification is a significant opportunity, reducing ventilation requirements underground and lowering operational costs, thereby enhancing the economic viability of new projects.

Conversely, market restraints include the cyclical nature of the global mining industry, which is highly sensitive to commodity price fluctuations, impacting capital equipment purchase decisions. The logistical challenges associated with transporting and assembling large, heavy rigs in remote locations, often requiring extensive site preparation, further complicate market deployment. Impact forces, driven by regulatory pressure for safer operations and environmental mandates (ESG criteria), intensify the need for innovation in dust suppression and noise reduction, compelling manufacturers to adhere to increasingly strict performance benchmarks. The competitive force of alternative shaft sinking technologies, although generally less preferred, still exerts pressure, requiring raise boring technology providers to continuously prove superior cost-efficiency and safety performance.

- Drivers: Increased demand for critical minerals from deep mines; stringent safety regulations favoring non-entry methods; adoption of automation and precision mining techniques; reduced total cost of ownership through higher efficiency rigs.

- Restraints: High initial capital investment and operational complexity; vulnerability to volatile global commodity price cycles; scarcity of highly skilled operators and maintenance personnel; logistical difficulties in mobilizing large equipment to remote mining sites.

- Opportunities: Electrification and battery-powered rigs reducing environmental footprint; expansion into large-scale civil infrastructure projects (e.g., tunnels, underground storage); integration of IoT and predictive analytics for enhanced uptime; growth in specialized, modular rigs for diverse rock types.

- Impact Forces: ESG (Environmental, Social, Governance) mandates pushing for cleaner and safer equipment; rapid technological obsolescence necessitating frequent upgrades; competitive pricing pressure from regional manufacturers; global supply chain disruptions affecting component lead times.

Segmentation Analysis

The Raise Boring Rig Market is extensively segmented based on key criteria including reaming diameter, product type, application, and end-user, allowing for precise market targeting and strategic decision-making. Segmentation by reaming diameter—small (under 1.5m), medium (1.5m to 3.0m), and large (over 3.0m)—is critical as it dictates the primary function and scale of the projects the rig can undertake. The large diameter segment is experiencing substantial growth due to the construction of major ventilation and material handling shafts required by deep, high-production mines globally. This technical segmentation underscores the shift towards larger, more powerful machines capable of excavating greater volumes rapidly and safely.

Segmentation by product type typically differentiates between conventional, mobile (truck or trailer mounted), and specialized rigs (such as slant or down-reaming rigs). Conventional fixed-base rigs remain the mainstay for permanent, long-term operations, offering maximum power and stability. However, the mobile rig segment is seeing increased demand from contract mining organizations that require flexibility and rapid deployment across multiple short-term projects. Furthermore, the segmentation by application—Mining versus Civil Construction—highlights the contrasting demands of these two primary sectors. While mining requires durability and high torque for hard rock, civil construction often demands precision, lower noise profiles, and adaptability for urban environments.

The granularity of segmentation allows market players to tailor their research and development efforts, focusing on specific niche needs. For instance, the demand for modular rigs that can be disassembled and reassembled quickly is high in mines with constrained access points. Understanding the end-user profile—Major Mining Companies, Contract Miners, and Construction Firms—helps manufacturers align their sales models, technical support, and service level agreements (SLAs) accordingly. Contract miners, for example, prioritize high utilization rates and robust service packages to minimize downtime, making after-sales support a crucial competitive differentiator within this segment.

- By Reaming Diameter:

- Small Diameter (Under 1.5 meters)

- Medium Diameter (1.5 meters to 3.0 meters)

- Large Diameter (Over 3.0 meters)

- By Product Type:

- Conventional Rigs

- Mobile Rigs (Truck/Trailer Mounted)

- Modular Rigs

- Specialized Rigs (Slant/Down-Reaming)

- By Application:

- Mining (Ventilation, Ore Pass, Service Shafts)

- Civil Construction (Hydropower, Tunnels, Underground Storage)

- By End-User:

- Major Mining Corporations

- Contract Mining Service Providers

- Civil Engineering & Construction Firms

Value Chain Analysis For Raise Boring Rig Market

The value chain for the Raise Boring Rig Market begins with upstream activities dominated by raw material suppliers and specialized component manufacturers. This upstream segment involves sourcing high-grade steel alloys for structural components, specialized hydraulic systems (pumps, valves, hoses), and precision electronics necessary for control systems and automation. Component quality, particularly for cutter heads and reaming tools, is paramount, heavily influencing the rig's performance and operational lifespan. Strong, reliable supplier relationships ensure the stable supply of specialized, often custom-engineered, components, which is critical given the long lead times associated with high-capacity manufacturing processes.

The central phase involves the original equipment manufacturers (OEMs), who design, assemble, and rigorously test the raise boring rigs. OEMs integrate the specialized components and proprietary software, focusing on safety compliance, torque capacity optimization, and integrating advanced features like telematics and remote monitoring. Distribution channels play a vital role in connecting the OEMs to the end-users. Due to the high value and technical complexity of the equipment, direct sales by the OEM or exclusive, highly specialized authorized distributors are the most common methods. These direct channels ensure that comprehensive technical support, financing options, and required training packages are included with the sale, managing the complexity inherent in deploying such capital-intensive machinery.

Downstream activities are characterized by extensive after-sales support, maintenance, and the supply of consumable drilling tools, which often generate significant recurring revenue for the OEMs and their service partners. This phase includes preventive maintenance, on-site technical assistance, refurbishment, and the supply of specialized parts (e.g., cutters, bearings, stabilizers). Direct interaction with end-users allows OEMs to gather crucial operational feedback, driving continuous improvement and new product development tailored to specific geological or safety requirements. The success in the downstream market is highly dependent on quick response times, inventory management of critical spares, and the availability of highly skilled service technicians capable of working in remote mining environments.

Raise Boring Rig Market Potential Customers

Potential customers for Raise Boring Rigs are primarily concentrated within industries requiring the creation of deep, stable vertical shafts for operational and infrastructural purposes. The dominant end-users are large, multinational mining corporations engaged in underground extraction of hard rock minerals such as gold, copper, platinum, and iron ore. These major miners invest in raise boring technology for high-volume applications like primary ventilation shafts, emergency escapeways, and highly efficient ore and waste passes, prioritizing rigs that offer maximum pulling capacity and large reaming diameters to meet stringent production targets and safety standards.

A rapidly growing segment of customers includes contract mining and specialized drilling service providers. These companies purchase or lease rigs to offer turnkey shaft excavation services to miners who prefer to outsource non-core activities. Contract miners typically favor mobile or modular rigs due to the need for flexibility, rapid deployment, and reduced setup time across diverse project locations. Their purchasing decisions are often highly sensitive to the rig's utilization rate and the effectiveness of included maintenance and support agreements, ensuring minimal downtime and maximum profitability per operational hour.

Additionally, various civil engineering and government-backed infrastructure development firms constitute a significant customer base. These entities utilize raise boring rigs for non-mining applications, including the construction of pressure shafts for hydroelectric power generation, underground wastewater management systems, deep geological repositories, and access shafts for major urban tunneling projects (e.g., subways). In the civil segment, criteria such as precision, minimal ground disturbance (vibrations), and compliance with urban noise regulations are often prioritized alongside technical drilling capacity, requiring specialized or smaller-diameter units adaptable to constrained environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,170 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Epiroc AB, Herrenknecht AG, Robbins Company, Atlas Copco, Terratec, Aker Solutions, CRCC High-Tech Equipment Co. Ltd., J. H. Fletcher & Co., RME R&D Machinery Engineering, Mine Master, SANY Group, XCMG, Furukawa Rock Drill, Nanchang Kama, China Coal Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Raise Boring Rig Market Key Technology Landscape

The technology landscape of the Raise Boring Rig Market is rapidly evolving, moving away from purely mechanical systems toward sophisticated, data-integrated drilling platforms designed for superior precision, safety, and efficiency. A primary technological focus is on enhanced automation, utilizing advanced sensor technology (e.g., gyroscopic guidance systems, laser profiling) coupled with programmable logic controllers (PLCs) to ensure the accuracy of the pilot hole and the subsequent reaming process. This precision engineering minimizes shaft deviation, which is crucial for deep shafts, thereby reducing operational risks and eliminating the costly need for correction. Furthermore, manufacturers are increasingly developing modular and compact rig designs that facilitate rapid transportation and assembly, addressing the logistical complexities faced by underground mining operations with restricted access.

Another significant development involves the advancement of cutter technology and reaming head metallurgy. Traditional tungsten carbide inserts are being supplemented or replaced by specialized disc cutters and improved geometries designed for ultra-hard rock formations, drastically increasing the tool life and penetration rates while lowering vibration and maintenance requirements. The integration of advanced telemetry and the Industrial Internet of Things (IIoT) is transforming asset management; rigs are now equipped with hundreds of sensors that stream operational data in real-time, enabling remote monitoring, diagnostics, and performance benchmarking. This shift towards smart drilling allows operators to perform critical parameter adjustments from surface control rooms, boosting productivity and enabling true predictive maintenance cycles.

In response to global sustainability mandates and the need to improve working conditions underground, there is a pronounced technological shift towards electric and battery-powered raise boring rigs. Electric rigs eliminate localized diesel particulate matter emissions, significantly reducing the ventilation load and costs associated with air management in deep mines. This electrification trend aligns perfectly with modern mining strategies focused on achieving net-zero carbon targets and improving operator health. Future technological trajectories also heavily involve the maturation of autonomous operation capabilities, where rigs can execute predefined drilling plans with minimal human intervention, leveraging AI and machine learning to navigate unexpected geological conditions and optimize energy consumption autonomously.

- Advanced Automation and Robotics: Implementation of automated drilling cycles, remote operation capabilities, and auto-alignment systems for enhanced safety and precision.

- Integrated Telemetry and IIoT: Real-time data transmission for remote diagnostics, performance monitoring, and integration into overall mine planning systems.

- Cutting Tool Innovations: Development of specialized reaming heads and cutter materials (e.g., improved disc cutters) optimized for extended wear life in high-abrasion, hard rock environments.

- Electrification and Power Systems: Transition from traditional diesel-hydraulic systems to high-efficiency electric and battery-powered rigs to reduce emissions and ventilation costs underground.

- Precision Guidance Systems: Use of gyroscopic and inertial navigation systems to ensure highly accurate pilot hole trajectory and minimize deviation in deep shaft applications.

- Modular and Compact Design: Engineering of rigs that can be broken down into smaller components for easier transport and assembly in confined underground spaces.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market for raise boring rigs, driven by the massive scale of mining operations in Australia (iron ore, gold, copper) and the sustained infrastructure boom in China and India. Countries like Indonesia and the Philippines, rich in nickel and gold, are investing in modern underground mining techniques to exploit deeper reserves. The regional growth is characterized by high demand for large-diameter, high-power rigs suitable for bulk mining and significant government investment in deep underground transportation and water projects, particularly in densely populated urban centers. Furthermore, local manufacturing capabilities in China are intensifying competition, focusing on delivering cost-effective, high-capacity equipment customized for regional geological variance. The need for continuous safety upgrades across the region is compelling rapid adoption of mechanized non-entry systems.

- North America: North America represents a mature, high-value market focused on technological replacement and adherence to stringent safety regulations. The demand is dominated by major mining companies in Canada and the U.S. that prioritize advanced automation, electric rigs, and long-term service contracts. Growth drivers include the renewed focus on critical mineral extraction (e.g., lithium, copper, rare earths) and significant investment in upgrading aged underground infrastructure. The market penetration of AI-integrated, data-driven rigs is highest here, reflecting the industry's willingness to invest heavily in optimization and remote operational control. Service quality and predictive maintenance capabilities are key differentiators in this region.

- Europe: The European market, while smaller in volume compared to APAC, is a leader in technology adoption, particularly concerning ESG standards and rig electrification. Countries like Sweden and Finland, with extensive deep mining operations, drive demand for highly specialized, environmentally friendly rigs. Civil construction applications, especially in tunneling for major cross-border infrastructure projects (e.g., rail and road), also contribute significantly. The European market demands highly customized, low-vibration machines compliant with strict environmental and urban operational standards. Research and development activities, often government-backed, prioritize innovation in cutter technology and efficiency.

- Latin America (LATAM): LATAM is a crucial market due to its vast reserves of copper, gold, and silver, particularly in Chile, Peru, and Mexico. The market growth is subject to volatility caused by commodity price cycles but maintains long-term potential fueled by numerous large-scale, deep-seated projects. Demand is strong for robust, reliable rigs capable of handling highly abrasive and variable rock conditions. The region presents significant opportunities for contract miners providing specialized raise boring services, often requiring flexible financing and extensive on-site technical support due to the remote nature of many operations. Safety improvements and maximizing operational throughput remain central purchasing criteria.

- Middle East and Africa (MEA): The MEA region is emerging as a growth area, particularly driven by large infrastructure projects in the Middle East and renewed investment in gold and platinum mining in South Africa and West Africa. While geological challenges are significant, the imperative to modernize and mechanize older mines is pushing the adoption of raise boring technology. Market dynamics are heavily influenced by regulatory stability and foreign direct investment into mineral exploration. The primary demand is centered around reliable, heavy-duty rigs that can withstand harsh operating environments and require simplified maintenance procedures due to infrastructure limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Raise Boring Rig Market.- Sandvik AB

- Epiroc AB

- Herrenknecht AG

- The Robbins Company

- Atlas Copco

- Terratec Ltd.

- Aker Solutions ASA

- CRCC High-Tech Equipment Co. Ltd.

- J. H. Fletcher & Co.

- RME R&D Machinery Engineering

- Mine Master

- SANY Group Co., Ltd.

- XCMG Group

- Furukawa Rock Drill Co., Ltd.

- Nanchang Kama Co., Ltd.

- China Coal Group

- Dalian Huarui Heavy Industry Group Co., Ltd. (DHHI)

- Wirth (A Kerrington Company)

- Jining Bafang Mining Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Raise Boring Rig market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of raise boring technology over conventional shaft sinking methods?

Raise boring rigs offer significantly enhanced safety, as they eliminate the need for personnel to enter the shaft during the primary excavation process (non-entry method). They also provide superior shaft accuracy, better rock stability (due to reduced blasting vibration), faster cycle times, and generally lower lifetime operational costs, especially in hard rock deep mining applications, making them safer and more efficient.

How is automation transforming the efficiency and safety of raise boring operations?

Automation, driven by AI and advanced sensors, allows for real-time optimization of drilling parameters (torque, thrust) based on geological conditions, maximizing penetration rates and tool life. This shift reduces human error, allows for remote operation from the surface (enhancing worker safety), and facilitates predictive maintenance, drastically minimizing costly unplanned downtime and improving overall equipment effectiveness (OEE).

Which segment—small, medium, or large diameter—is showing the highest growth potential in the forecast period?

The Large Diameter (over 3.0 meters) segment is expected to show the highest growth potential. This is primarily driven by the global trend toward deeper, larger-scale underground mining operations which require extensive, high-volume ventilation shafts and ore passes. Major mining companies are investing in these high-capacity rigs to ensure efficient air circulation and bulk material movement essential for increasing production volumes.

What role do ESG criteria play in driving technological innovation within the Raise Boring Rig Market?

ESG (Environmental, Social, and Governance) criteria are major drivers, compelling manufacturers to develop electric and battery-powered rigs to eliminate diesel emissions underground, thereby reducing the environmental footprint and improving air quality for workers. Furthermore, the inherent safety of the raise boring method strongly aligns with the 'S' component of ESG, favoring mechanized, remote operation over manual, high-risk tasks.

What is the current challenge regarding the deployment and maintenance of modern raise boring rigs?

A significant challenge is the high initial capital expenditure required for purchasing advanced rigs and the scarcity of highly skilled operators and maintenance technicians capable of managing complex, automated machinery. Furthermore, the logistical challenge of transporting and assembling massive equipment in remote mining areas often adds complexity and cost to project deployment. Manufacturers are addressing this through modular designs and comprehensive training packages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager