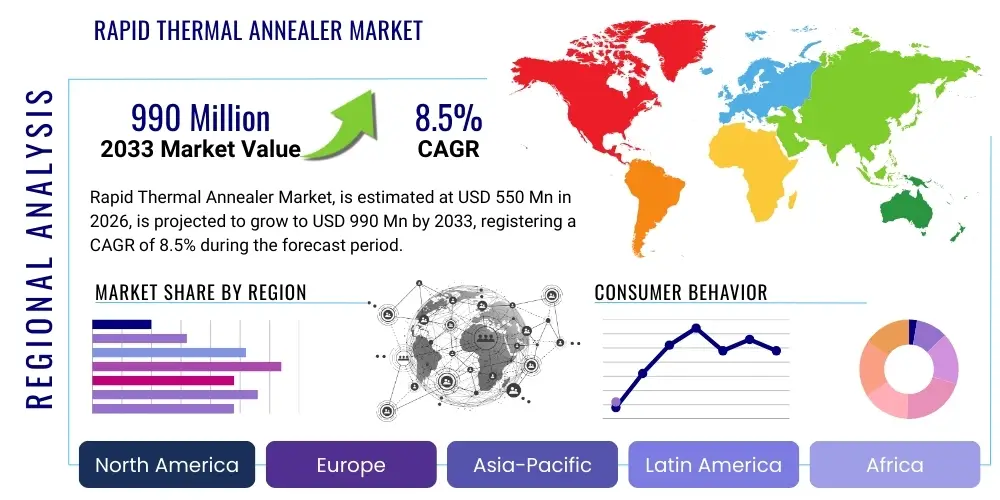

Rapid Thermal Annealer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436451 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Rapid Thermal Annealer Market Size

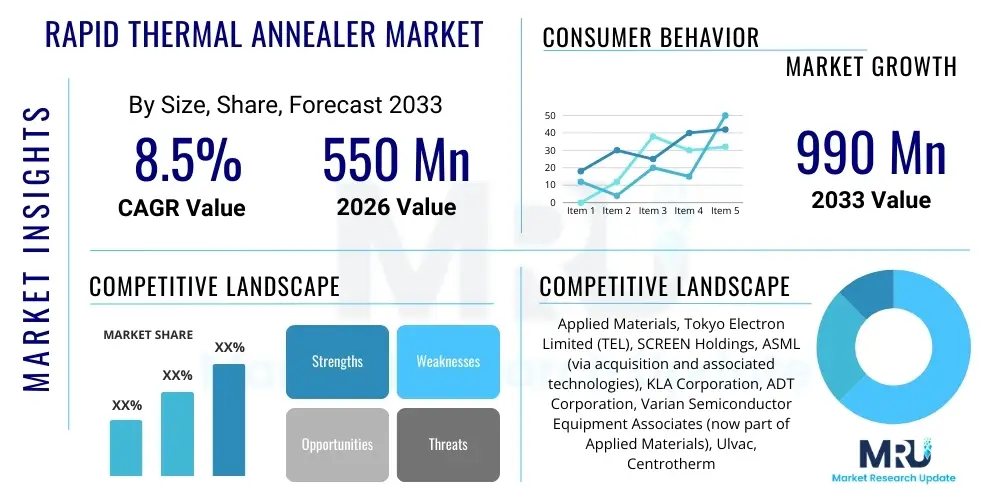

The Rapid Thermal Annealer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $990 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the relentless scaling of semiconductor devices, particularly in advanced manufacturing nodes below 10nm, where precise thermal budget control is critical for junction formation and activation. The efficiency and throughput capabilities of modern RTA systems are increasingly essential for mass production, solidifying the market’s positive trajectory.

The semiconductor industry’s capital expenditure, particularly in Asia Pacific, acts as the primary accelerator for this market size growth. Foundries and Integrated Device Manufacturers (IDMs) are consistently upgrading their fabrication lines to handle larger wafer sizes (300mm and transitioning toward 450mm research) and adopting complex 3D structures like FinFETs and Gate-All-Around (GAA) transistors. Each of these structural advancements necessitates highly customized and extremely fast thermal processing steps, minimizing Transient Enhanced Diffusion (TED) and ensuring high electrical activation of dopants without compromising device stability or structure. The specialized nature of these requirements inherently raises the capital value of the installed RTA base.

Furthermore, diversification into non-silicon materials and applications, such as silicon carbide (SiC) and gallium nitride (GaN) power electronics, contributes significantly to the market valuation. RTA techniques are vital for activating dopants in these wide bandgap materials, optimizing device performance for high-power and high-frequency applications crucial for electric vehicles and 5G infrastructure. Market valuation is bolstered by the increasing demand for high-cost, advanced RTA systems featuring capabilities like millisecond annealing (MSA) and laser spike annealing (LSA), which command higher price points due to their technological complexity and necessity for cutting-edge device fabrication.

Rapid Thermal Annealer Market introduction

Rapid Thermal Annealing (RTA) refers to a semiconductor manufacturing process used to subject wafers to brief, high-temperature cycles, typically utilizing high-intensity lamps or lasers, to induce physical or chemical changes. The primary goal of RTA is to activate ion-implanted dopants, repair lattice damage, and form silicides with minimal diffusion of the dopants, thereby maintaining sharp device junctions essential for high-performance transistors. Unlike traditional furnace annealing, which uses long exposure times, RTA operates within seconds or even milliseconds, providing critical control over the thermal budget—a key metric in modern microelectronics fabrication, especially as device dimensions shrink significantly.

The product portfolio within the RTA market includes various specialized systems tailored for specific application needs. These include Rapid Thermal Processing (RTP) systems, which use halogen lamps; Laser Thermal Annealing (LTA) systems, employing focused lasers for highly localized heating; and Flash Lamp Annealing (FLA) systems, used for ultra-shallow junction formation. Major applications span across integrated circuit (IC) manufacturing, where RTA is indispensable for logic and memory devices, Micro-Electro-Mechanical Systems (MEMS) fabrication, and the production of high-efficiency solar cells. RTA provides benefits such as improved wafer throughput, enhanced electrical properties of junctions, and superior defect management compared to conventional methods.

Driving factors for this market include the global expansion of data centers, leading to high demand for high-density memory chips (DRAM, NAND), and the pervasive adoption of advanced consumer electronics requiring high-speed processors built on leading-edge process nodes. Additionally, governmental and private investments in semiconductor self-sufficiency, particularly in regions like North America and Europe, are compelling foundries to procure advanced RTA equipment to establish competitive fabrication capabilities. The necessity of adopting new materials and complex device architectures further cements RTA’s role as a cornerstone technology in the semiconductor equipment market, driving consistent market revenue and innovation.

Rapid Thermal Annealer Market Executive Summary

The Rapid Thermal Annealer Market is characterized by intense technological competition and concentrated demand originating primarily from the top-tier global semiconductor manufacturers. Business trends indicate a strong move toward system integration, where RTA capabilities are often bundled or modularized within larger integrated processing platforms, enhancing manufacturing flexibility and reducing footprint in the cleanroom. Strategic partnerships between equipment manufacturers and leading research institutions are accelerating the development of sub-millisecond annealing techniques (e.g., laser spike annealing) required for 3nm and 2nm nodes. Financial performance is highly sensitive to the cyclical nature of semiconductor capital expenditure, though the long-term trend remains positive due to persistent technological scaling demands.

Regional trends highlight the Asia Pacific (APAC) region, particularly Taiwan, South Korea, Mainland China, and Japan, as the dominant hub for both RTA demand and manufacturing capacity installation. This dominance is attributed to the concentration of major contract foundries and leading memory manufacturers in the area. North America and Europe are exhibiting resurgence driven by governmental incentives (e.g., the CHIPS Act, European Chips Act) aimed at localizing advanced fabrication capabilities, translating into significant future procurement orders for sophisticated RTA systems necessary for cutting-edge processing. The Middle East and Africa (MEA) and Latin America remain nascent, focusing primarily on maintenance and legacy fabrication capabilities, limiting high-end RTA system adoption.

Segmentation trends reveal that the Logic & Foundry segment dominates the market share due to the highly stringent thermal budget requirements of advanced CPU and GPU manufacturing. Memory manufacturing (NAND/DRAM) represents the fastest-growing application segment, driven by massive data consumption needs globally. Technologically, the Lamp-Based RTA segment currently holds the largest revenue share, offering reliability and scalability for diverse processes, but the Laser-Based Annealing segment is exhibiting superior growth rates as manufacturers pivot to ultra-short thermal pulses to achieve ultra-shallow junction integrity without causing unintended diffusion in sophisticated transistor architectures.

AI Impact Analysis on Rapid Thermal Annealer Market

Common user questions regarding AI's influence on the Rapid Thermal Annealer market frequently revolve around how artificial intelligence can enhance process control, predictive maintenance, and overall yield optimization in highly sensitive thermal processing environments. Users are particularly interested in whether AI can dynamically adjust annealing parameters in real-time based on in-situ sensor data to compensate for subtle wafer-to-wafer variations, thereby increasing uniformity and throughput. Key themes identified include utilizing machine learning for precise defect classification and minimizing the reliance on costly, time-consuming offline metrology. Expectations are high that AI will lead to the development of 'self-optimizing' RTA systems capable of autonomously managing complex recipes for next-generation material stacks and device geometries, significantly reducing startup time and enhancing operational efficiency, thus lowering the cost of advanced manufacturing.

The integration of advanced AI and machine learning (ML) models is transforming RTA equipment utilization from static recipe execution to dynamic, data-driven processing. ML algorithms are deployed to analyze vast datasets collected from pyrometers, reflectance monitors, and wafer handling systems within the RTA chamber. This analysis enables the identification of subtle drifts in equipment performance or process variations (e.g., lamp aging, slight temperature non-uniformity), allowing for immediate, microscopic parameter corrections that are impossible to execute manually. This predictive capability significantly reduces the likelihood of scrapping expensive wafers, which is a major concern when dealing with high-value processes like advanced doping activation and silicide formation.

Furthermore, AI-driven digital twins of RTA chambers are emerging as essential tools for recipe development and optimization. These twins simulate the thermal profiles and stress induction under various conditions, enabling semiconductor engineers to validate complex processing sequences much faster than physical experimentation. The long-term impact involves maximizing equipment uptime through predictive maintenance schedules generated by AI, which forecast potential component failures (such as lamp degradation or pump wear) far in advance, preventing unplanned downtime which is exceptionally detrimental in high-volume manufacturing environments where RTA is often a bottleneck step.

- AI-driven Predictive Maintenance: Reduces unplanned downtime and forecasts component failure in critical heating elements and vacuum systems, boosting equipment utilization rates.

- Real-Time Process Control: Uses machine learning to dynamically adjust temperature ramps and dwell times based on in-situ wafer measurements, optimizing dopant activation uniformity.

- Yield Optimization: AI models correlate annealing parameters with electrical test results (e.g., sheet resistance), leading to automated adjustments that maximize functional chip yield.

- Digital Twin Simulation: Facilitates rapid development and validation of complex thermal recipes for new materials (e.g., SiC, GaN) and advanced node geometries (FinFET, GAA).

- Defect Classification: Enhances automated optical inspection (AOI) capabilities by accurately identifying and classifying annealing-induced defects like slip lines or thermal stress points.

DRO & Impact Forces Of Rapid Thermal Annealer Market

The dynamics of the Rapid Thermal Annealer market are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and the resulting Impact Forces. The primary drivers stem from the continuous demand for faster, smaller, and more power-efficient electronic devices, which necessitates ultra-precise thermal control to achieve high dopant activation and lattice repair at deep submicron levels. Conversely, the market faces significant restraints related to the extremely high capital cost of advanced RTA systems and the operational complexity associated with maintaining precise uniformity across large-diameter wafers, particularly during millisecond processing, leading to stringent maintenance requirements.

Key opportunities are centered on the rapid expansion of emerging technologies that rely heavily on advanced thermal processing. This includes the massive scale-up of 3D NAND flash memory production, which requires multi-step RTA for stacked layers, and the burgeoning market for Compound Semiconductor devices (SiC, GaN) essential for high-power electronics in electric vehicles (EVs) and industrial power management. The ongoing shift toward advanced packaging and heterogenous integration also presents an opportunity, requiring specialized low-temperature RTA processes to manage thermal stress between dissimilar materials and maintain the integrity of through-silicon vias (TSVs).

The cumulative effect of these factors generates strong impact forces. Technological advancements exert a high impact force, pushing manufacturers toward innovation in laser and flash annealing techniques to meet the ultra-short processing demands of next-generation nodes. Economic forces, represented by the substantial capital expenditure required, create a barrier to entry for smaller manufacturers and consolidate market power among established equipment providers. Regulatory forces, particularly those related to safety and environmental standards in cleanroom environments, also influence equipment design, though the demand driven by foundational technological needs remains the most potent impact force shaping investment and development strategies across the global RTA ecosystem.

Segmentation Analysis

The Rapid Thermal Annealer market is meticulously segmented based on the core technology utilized, the major application area within semiconductor fabrication, and the end-use industry. This structure allows for a detailed analysis of market dynamics, revealing where investment is focused and which technological solutions are gaining traction. The segmentation by technology—primarily lamp-based versus laser-based systems—reflects the trade-off between throughput scalability and the need for ultra-high spatial and temporal precision required for advanced manufacturing nodes. While lamp-based systems remain the workhorse for standard processes, laser-based systems are capturing the high-growth, high-value segments.

The application segmentation is crucial, distinguishing processes like dopant activation, silicide formation, and oxidation/nitridation. Dopant activation, particularly in ultra-shallow junctions, remains the dominant segment, necessitating the continuous evolution of RTA performance to combat transient enhanced diffusion (TED). Furthermore, segmenting by end-use highlights the varying demands from different sectors; Logic & Foundries require the absolute highest level of thermal precision and customization, whereas solar cell manufacturers prioritize high throughput and cost efficiency for large-area processing.

Understanding these segments is essential for strategic planning, as distinct RTA solutions are required for different needs. For instance, manufacturers focusing on mature nodes or legacy devices may opt for cost-effective, high-throughput lamp-based systems, while those targeting 5nm and below must invest heavily in specialized millisecond annealing technologies. The increasing complexity of materials, including high-k dielectrics and metal gates, further reinforces the necessity of technology-specific segmentation, driving specialized R&D efforts within the market.

- By Technology

- Lamp-Based RTA (Rapid Thermal Processing, RTP)

- Laser-Based RTA (Laser Spike Annealing, LSA)

- Flash Lamp Annealing (FLA)

- Microwave Annealing

- By Application

- Dopant Activation

- Silicide Formation

- Oxidation and Nitridation

- Stress Relief and Film Densification

- Post-Metallization Annealing (PMA)

- By Wafer Size

- 200mm Wafer

- 300mm Wafer

- 450mm Wafer (Research & Development Stage)

- By End-Use Industry

- Logic & Foundries

- Memory Devices (DRAM, NAND)

- Power Devices (SiC, GaN)

- MEMS and Sensors

- Solar Cells and Optoelectronics

Value Chain Analysis For Rapid Thermal Annealer Market

The value chain of the Rapid Thermal Annealer market begins with upstream activities involving the sourcing and refinement of highly specialized components necessary for ultra-high temperature and precision control. Key upstream suppliers provide sophisticated heating elements (e.g., halogen lamps, specialized laser sources), advanced temperature sensors (pyrometers), high-purity quartzware, and vacuum system components. The quality and reliability of these upstream materials are paramount, as any variance directly impacts the thermal uniformity and repeatability of the RTA process, making the supply chain for these specialized components highly concentrated and critical.

The middle segment of the value chain is dominated by the Original Equipment Manufacturers (OEMs) who design, integrate, and test the complex RTA systems. This stage involves extensive R&D, software development for complex recipe management, and precision engineering for wafer handling and chamber sealing. OEMs invest heavily in intellectual property related to thermal modeling and gas flow management to ensure optimal processing results for advanced semiconductor nodes. Integration and commissioning services, often performed on-site at the customer’s fabrication plant, form a high-value activity within this segment, ensuring the equipment meets stringent operational specifications.

Downstream activities focus on the distribution, installation, maintenance, and long-term service agreements for the equipment. Distribution channels are predominantly direct, given the high cost and complexity of the equipment, requiring specialized sales engineers and dedicated technical support teams. Indirect channels, involving authorized distributors, are sometimes utilized in emerging or geographically remote markets for sales support and logistics, but the critical service and maintenance loop remains direct. End-users, primarily large foundries and IDMs, depend heavily on robust maintenance contracts to maximize equipment uptime, leading to long-term revenue streams for the RTA manufacturers through consumables and spare parts supply.

Rapid Thermal Annealer Market Potential Customers

The potential customer base for Rapid Thermal Annealer technology is highly specialized and capital-intensive, concentrated within the global microelectronics and advanced materials fabrication ecosystem. Primary buyers are Integrated Device Manufacturers (IDMs) and pure-play semiconductor foundries, such as TSMC, Samsung Foundry, Intel, and GlobalFoundries, who require RTA systems for manufacturing leading-edge logic processors, high-performance computing components, and high-density memory chips. These customers continuously purchase new generations of RTA equipment to migrate to smaller process nodes (e.g., 5nm, 3nm) and maintain competitiveness in the fabrication technology race, representing the largest and most valuable customer segment.

Secondary but rapidly growing customer segments include specialized manufacturers focusing on Compound Semiconductor (CS) devices, specifically those producing Silicon Carbide (SiC) and Gallium Nitride (GaN) power devices for the automotive and energy sectors. Companies specializing in EV components and industrial power conversion solutions are significant purchasers, as RTA is essential for high-temperature dopant activation in these materials, optimizing their unique electrical properties. Additionally, manufacturers of advanced optoelectronics, including LED and VCSEL manufacturers, and MEMS (Micro-Electro-Mechanical Systems) sensor producers utilize RTA for specialized film crystallization and stress management, rounding out the customer portfolio.

Furthermore, major academic research institutions and national research laboratories focused on material science and next-generation device architectures also constitute an important segment, particularly for purchasing specialized, smaller-scale RTA systems for R&D purposes. These organizations serve as crucial testing grounds for pilot technologies before they are commercialized and adopted by large foundries. The ultimate end-users, or beneficiaries, are the companies that incorporate these semiconductor devices into final products, such as consumer electronics manufacturers (Apple, Sony), automotive OEMs (Tesla, VW), and telecommunications providers (Nokia, Ericsson), whose performance hinges on the quality and precision enabled by RTA processing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $990 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Tokyo Electron Limited (TEL), SCREEN Holdings, ASML (via acquisition and associated technologies), KLA Corporation, ADT Corporation, Varian Semiconductor Equipment Associates (now part of Applied Materials), Ulvac, Centrotherm, Veeco Instruments, Hitachi High-Tech, SUSS MicroTec, J.A. Woollam Co., AIXTRON, Jusung Engineering, Oxford Instruments, Annealsys, SEMCO Technologies, Fusion Systems, Picosun. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rapid Thermal Annealer Market Key Technology Landscape

The technology landscape of the Rapid Thermal Annealer market is defined by a continuous push toward reducing thermal exposure time while maintaining precise temperature uniformity, a necessity driven by the physical limits of Moore’s Law. Conventional Rapid Thermal Processing (RTP) utilizes banks of high-intensity halogen lamps to heat the entire wafer rapidly and uniformly. This technology remains prevalent for processes requiring seconds of thermal exposure, such as high-k dielectric annealing and post-implantation activation in older nodes. However, for advanced nodes where dopant diffusion must be minimized to maintain junction sharpness, these systems are being supplemented or replaced by ultra-fast alternatives.

The cutting edge of RTA technology involves millisecond and sub-millisecond annealing techniques, primarily Laser Spike Annealing (LSA) and Flash Lamp Annealing (FLA). LSA systems use a highly focused line beam laser that rapidly scans across the wafer surface, creating extremely localized, controlled heating that lasts only milliseconds. This process is essential for achieving ultra-shallow junctions (USJs) required in 10nm technology and below, offering unparalleled control over dopant profiles and reducing transient enhanced diffusion effects to negligible levels. FLA systems, employing xenon flash lamps, heat the entire wafer surface instantaneously for a duration of less than one millisecond, often used in conjunction with a base temperature provided by an RTP system to pre-heat the wafer.

Another area of technological innovation is the integration of advanced metrology and control systems directly into the RTA chamber. These include sophisticated multi-point pyrometry systems that accurately measure temperature across the wafer surface in real-time and closed-loop control algorithms that adjust lamp power instantaneously to compensate for edge effects or pattern dependencies. Furthermore, the development of specialized RTA equipment for non-silicon materials, such as vacuum-based RTA for compound semiconductors and specialized atmospheric control systems for annealing sensitive materials like graphene or 2D materials, is expanding the technological scope beyond traditional CMOS manufacturing and fueling innovation in equipment design.

Regional Highlights

The geographical analysis of the Rapid Thermal Annealer market reveals a highly concentrated demand profile, mirroring the global distribution of advanced semiconductor manufacturing facilities. Asia Pacific (APAC) stands out as the undisputed leader, driven by the massive capital investment cycles of global titans such as Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and SK Hynix. The concentration of memory and foundry production in South Korea, Taiwan, and Mainland China dictates that these regions procure the highest volume of both mainstream RTP and specialized laser annealing systems for continuous fabrication line expansion and technology upgrades, creating unparalleled market velocity within APAC.

North America and Europe, while historically holding smaller shares in terms of pure fabrication volume, are experiencing significant revitalization. Governmental initiatives aimed at repatriating advanced semiconductor manufacturing capabilities (e.g., US CHIPS and Science Act, EU Chips Act) are fueling substantial investment in new greenfield fabrication plants (fabs). These new fabs require the latest generation of RTA equipment capable of processing 300mm wafers at advanced nodes (5nm and 3nm), guaranteeing strong growth in procurement within these regions during the forecast period. The focus in these regions tends to be on establishing state-of-the-art pilot and high-volume manufacturing lines with the absolute lowest thermal budget capabilities.

Latin America and the Middle East & Africa (MEA) currently represent marginal markets for advanced RTA systems. Demand in these regions is primarily centered on maintenance and upgrades for older fabrication facilities or specialized R&D centers attached to academic institutions or niche electronics assembly operations. While there is emerging interest in establishing local electronics manufacturing capabilities, the capital intensity required for advanced RTA infrastructure acts as a barrier, suggesting slower adoption rates for cutting-edge laser and flash annealing systems in the short to medium term. Their participation is largely limited to servicing local industrial needs rather than participating in the global leading-edge semiconductor race.

- Asia Pacific (APAC): Dominant Market Share

- Driven by sustained capacity expansion in Taiwan (TSMC), South Korea (Samsung, SK Hynix), and Mainland China (SMIC, YMTC).

- High concentration of foundry and memory manufacturing requires continuous adoption of high-throughput 300mm RTA systems.

- Leading region for adoption of Millisecond Annealing (MSA) technologies for 7nm and below nodes.

- North America: Resurgent Growth

- Growth fueled by federal investment (CHIPS Act) promoting domestic fabrication capacity (e.g., Intel, GlobalFoundries expansions).

- Focus on establishing R&D centers and pilot lines for next-generation material stacks and 3D integration, requiring specialized LSA and FLA equipment.

- Europe: Strategic Investment Focus

- Investments linked to the European Chips Act aimed at securing local supply chains, driving demand for RTA in German and Irish fabrication centers.

- Strong niche demand driven by leading automotive power semiconductor manufacturers utilizing SiC and GaN, requiring specialized high-temperature RTA.

- Latin America & MEA: Emerging Markets

- Limited adoption of high-end equipment; demand focuses on maintenance and upgrades of existing facilities and small-scale assembly operations.

- Potential future growth linked to local industrialization and technology transfer initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rapid Thermal Annealer Market.- Applied Materials Inc.

- Tokyo Electron Limited (TEL)

- SCREEN Holdings Co. Ltd.

- Ulvac, Inc.

- Centrotherm International AG

- Veeco Instruments Inc.

- Hitachi High-Tech Corporation

- SUSS MicroTec SE

- KLA Corporation

- J.A. Woollam Co., Inc.

- Annealsys

- Fusion Systems

- Jusung Engineering Co., Ltd.

- Semiconductor Equipment Corporation (SEC)

- ASML Holding N.V. (via related integration technologies)

- AIXTRON SE

- Oxford Instruments plc

- Picosun Oy (now part of Applied Materials)

- Semco Technologies

- ADTEC Plasma Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rapid Thermal Annealer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between Lamp-Based RTA and Laser Spike Annealing (LSA)?

Lamp-Based RTA (RTP) heats the entire wafer uniformly using halogen lamps for several seconds, controlling temperature typically within a range of 700°C to 1100°C, suitable for thicker junctions. LSA utilizes a focused line laser beam that provides intense, highly localized heat exposure lasting only milliseconds, specifically designed to form ultra-shallow junctions below 10nm without causing dopant diffusion in the surrounding device structure.

How does Rapid Thermal Annealing contribute to advanced semiconductor node scaling?

RTA is essential for node scaling because it minimizes the thermal budget applied to the wafer. As transistor dimensions shrink (e.g., 5nm, 3nm), excessive heat exposure causes implanted dopants to diffuse laterally and vertically (Transient Enhanced Diffusion or TED). RTA, particularly millisecond annealing, allows for precise dopant activation and lattice repair in a fraction of a second, preserving the sharp, shallow junctions critical for high device performance and low power consumption.

Which geographic region dominates the market for Rapid Thermal Annealer equipment?

The Asia Pacific (APAC) region, specifically encompassing Taiwan, South Korea, and Mainland China, overwhelmingly dominates the RTA market. This leadership is due to the concentration of the world’s largest integrated device manufacturers (IDMs) and pure-play foundries, which are responsible for the highest volume of global semiconductor capital expenditure and subsequent procurement of advanced RTA systems.

What are the key application areas driving future growth in the RTA market?

Future growth is primarily driven by the expansion of 3D NAND manufacturing, which requires multiple complex annealing steps for stacked structures, and the rapidly growing power semiconductor sector. The demand for high-performance SiC and GaN devices, crucial for electric vehicles and 5G infrastructure, necessitates specialized high-temperature RTA processes for efficient dopant activation and material crystallization.

What challenges do RTA equipment manufacturers currently face regarding wafer processing?

Manufacturers face significant challenges in achieving perfect thermal uniformity across large 300mm wafers, especially during ultra-fast heating cycles. Pattern dependencies (differences in heating caused by varying chip densities across the wafer) and edge effects can lead to non-uniform dopant activation or thermal stress, reducing yield. Advanced RTA systems must incorporate sophisticated real-time temperature sensing and dynamic control mechanisms to overcome these uniformity challenges.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager