Rapid Thermal Annealing (RTA) Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433591 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Rapid Thermal Annealing (RTA) Equipment Market Size

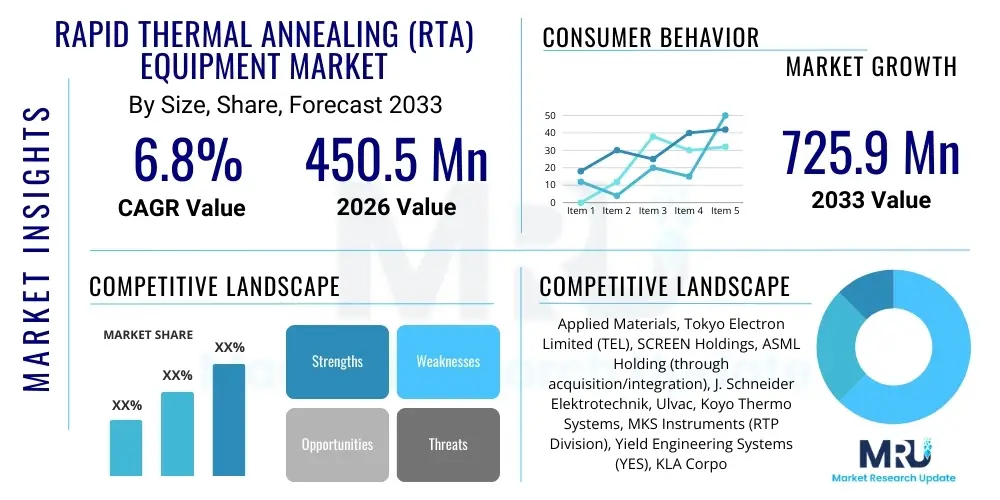

The Rapid Thermal Annealing (RTA) Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 725.9 Million by the end of the forecast period in 2033.

Rapid Thermal Annealing (RTA) Equipment Market introduction

The Rapid Thermal Annealing (RTA) Equipment Market encompasses advanced thermal processing systems critical for semiconductor manufacturing, primarily used for ultra-shallow junction formation, dopant activation, and material phase transformation following ion implantation. RTA equipment, which utilizes high-intensity lamps (halogen, xenon) or lasers to rapidly heat and cool silicon wafers (typically reaching temperatures of 800°C to 1200°C in seconds), is essential for minimizing thermal budget, preventing dopant redistribution, and maintaining the integrity of increasingly complex device structures, particularly in the sub-10 nm technology nodes. Key applications include post-implantation activation, silicide formation (e.g., NiSi, TiSi2), and contact alloying in advanced logic, memory (DRAM, NAND), and power devices, driven by the persistent need for faster processing speeds, smaller feature sizes, and enhanced device performance demanded by computing and consumer electronics sectors.

The core advantage of RTA technology lies in its precision control over thermal exposure time, measured in milliseconds to a few seconds. This transient heating capability contrasts sharply with traditional furnace annealing, which often involves minutes or hours, leading to undesirable lateral and vertical dopant diffusion. Modern RTA systems offer superior temperature uniformity across large wafer sizes (300mm), utilizing complex feedback loops and pyrometry to ensure process repeatability and yield maximization. The necessity for these high-precision, low-thermal-budget processes directly ties RTA market growth to the scaling challenges inherent in Moore's Law, particularly the transition to complex gate architectures like FinFET and Gate-All-Around (GAA) structures, which are highly sensitive to thermal processes.

Driving factors for this market include the global expansion of semiconductor fabrication capacity (fabs), especially in Asia Pacific, the proliferation of sophisticated memory technologies (HBM, advanced NAND), and the increasing demand for high-performance computing (HPC) components requiring stringent material engineering. Benefits derived from RTA adoption include reduced manufacturing cycle times, improved junction abruptness, minimized defects, and enhanced electrical performance of transistors. However, the market faces constraints related to the high initial capital investment required for RTA tools and the complexity associated with integrating these systems into highly automated production lines, especially concerning pyrometry calibration for novel materials.

Rapid Thermal Annealing (RTA) Equipment Market Executive Summary

The RTA Equipment Market is undergoing significant evolution driven by major business trends centered on the transition to 3D integrated circuits and advanced materials (e.g., high-k dielectrics, III-V semiconductors). Business trends emphasize the development of multi-mode annealing platforms capable of executing sequential processes like RTA, Rapid Thermal Processing (RTP), and Laser Spike Annealing (LSA) within a single system, enhancing throughput and flexibility for manufacturers. Regionally, Asia Pacific, specifically Taiwan, South Korea, and China, dominates market growth due to intense investment in leading-edge foundry and memory production capacity, establishing the region as the principal consumer and driver of innovation in high-throughput RTA tools. Segment trends show a pronounced shift toward advanced lamp-based RTA systems and the increasing adoption of Laser Annealing (LA) technology for hyper-critical processes that require extreme spatial and temporal temperature control, particularly for ultra-shallow junction creation in logic devices below 5 nm geometry.

Furthermore, the competitive landscape is defined by technological leadership, where key players continually invest in optimizing system uniformity and thermal ramp rates to meet the demanding specifications of chip designers. There is a notable trend towards customization and process-specific RTA configurations, moving away from generalized equipment. For instance, tools designed specifically for silicon carbide (SiC) or gallium nitride (GaN) power device manufacturing require specialized temperature profiles and inert atmospheres, representing a growing niche segment. The market's profitability is increasingly tied to providing comprehensive service contracts and advanced process control software that leverages data analytics to optimize recipe management and predictive maintenance, thereby maximizing equipment uptime and wafer yield.

Financial performance across the market is resilient, bolstered by sustained global chip shortages and massive government subsidies aimed at securing domestic semiconductor supply chains (e.g., the U.S. CHIPS Act and similar initiatives in Europe). This influx of capital ensures robust demand for essential front-end equipment like RTA systems. The shift towards sustainable manufacturing practices is also impacting equipment design, with manufacturers focusing on reducing energy consumption during high-temperature cycling, aligning with broader ESG (Environmental, Social, and Governance) corporate mandates and operational efficiency goals.

AI Impact Analysis on Rapid Thermal Annealing (RTA) Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on RTA equipment center on automation, process optimization, and predictive maintenance capabilities. Common questions explore how machine learning (ML) models can refine complex RTA recipes (e.g., temperature ramp-up rates, soak times) to compensate for variations in precursor materials or ambient conditions, thus enhancing yield consistency and reducing the need for manual parameter tuning by engineers. There is significant interest in using AI for anomaly detection in real-time pyrometry data to flag potential defects before processing is complete. Overall, users expect AI integration to transition RTA processes from reactive control to predictive optimization, particularly concerning fault prediction, temperature uniformity correction across 300mm wafers, and accelerating the development cycle for new RTA recipes targeting novel device structures.

- AI-driven Predictive Maintenance (PdM) for critical RTA components, reducing unscheduled downtime.

- Machine Learning (ML) optimization of annealing recipes based on real-time sensor data and historical yield outcomes.

- Enhanced process control through deep learning algorithms analyzing high-dimensional pyrometry and reflectivity data for instantaneous uniformity correction.

- Automated fault detection and classification (FDC) in RTA systems, minimizing scrap rates.

- Accelerated new material introduction (NMI) by simulating optimal annealing parameters via AI modeling, reducing physical test runs.

DRO & Impact Forces Of Rapid Thermal Annealing (RTA) Equipment Market

The market for RTA equipment is significantly propelled by technological drivers, chiefly the necessity for low thermal budget processing required by advanced semiconductor nodes (7nm, 5nm, and below) and the corresponding growth in 3D integration architectures such as FinFETs and GAAFETs, which mandate extremely precise dopant activation without diffusion. However, the high complexity and capital expenditure associated with procuring and maintaining these sophisticated tools pose substantial restraints, particularly for smaller foundries or specialty manufacturers. Opportunities are arising through the expansion into non-silicon materials, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN), used in electric vehicle (EV) power electronics and 5G infrastructure, which require high-temperature, specific atmosphere annealing cycles. These market dynamics are shaped by impact forces including the cyclical nature of the semiconductor industry, geopolitical tensions affecting supply chain localization, and relentless competition among equipment manufacturers to achieve sub-millisecond thermal control.

A primary driver is the ongoing investment cycle in global semiconductor manufacturing capacity. With major regions focusing on supply chain resilience, new fabrication plants require full suites of advanced front-end equipment, with RTA systems being indispensable for achieving target transistor performance metrics. Furthermore, the massive proliferation of advanced memory chips (3D NAND stacks requiring complex annealing cycles) and sophisticated logic chips for generative AI and data center applications fuels continuous demand for higher throughput, more uniform RTA platforms. Manufacturers are compelled to innovate rapidly to ensure their systems can handle increasingly large and fragile wafers with exotic material layers.

Restraints are often operational and financial. The cost of RTA systems remains prohibitive, demanding massive depreciation cycles. Additionally, maintaining the ultra-clean vacuum and thermal environment required for advanced processing necessitates rigorous maintenance protocols and specialized personnel. Technologically, pyrometry challenges—accurately measuring and controlling temperature in complex structures with varying emissivity (e.g., patterned wafers)—limit performance, creating a significant technical hurdle that equipment suppliers must continuously address through advanced sensing and calibration mechanisms.

Opportunities are robust in emerging markets and specialized applications. The shift towards compound semiconductors (SiC, GaN) offers a greenfield market for specialized RTA systems capable of handling extremely high temperatures (up to 1800°C for SiC activation) and demanding atmospheric control. Moreover, the integration of RTA processes with measurement and inspection (metrology) tools using proprietary software offers differentiation and added value, providing manufacturers with integrated process control solutions rather than just standalone equipment.

Segmentation Analysis

The RTA Equipment Market is segmented based on the mechanism of heat application (Type), the specific purpose within the semiconductor fabrication flow (Application), and the ultimate manufacturing sector utilizing the equipment (End-User). The core segmentation relies heavily on distinguishing between traditional lamp-based systems, which dominate high-volume manufacturing due to their proven reliability, and advanced laser-based systems, which are reserved for the most critical, highly localized annealing steps in advanced nodes. The primary applications, particularly ion implantation activation and silicide formation, define the volume of the market, while end-user segmentation underscores the foundational reliance of the semiconductor industry on this technology compared to niche areas like solar cell production.

Further analysis of segmentation reveals that technological advancements are blurring the lines between these categories. For instance, certain advanced lamp-based RTA systems now incorporate features previously exclusive to laser annealing, such as pattern-dependent thermal control using localized heating elements or dynamic temperature adjustments based on real-time wafer mapping. This convergence drives competition in the high-end market segment, emphasizing precision control and throughput metrics. The shift towards larger wafer sizes, specifically 300mm and the developmental stages of 450mm, also impacts segmentation, necessitating RTA equipment designed with enhanced capabilities for uniformity across these vast surface areas, reinforcing the importance of the Equipment Type segmentation.

The end-user segment is undergoing diversification. While integrated device manufacturers (IDMs) and pure-play foundries remain the dominant buyers, the burgeoning outsourced semiconductor assembly and test (OSAT) market is also beginning to require certain types of RTA capacity for specialized back-end processes, although front-end fabrication remains the main driver. This detailed segmentation helps in precisely targeting sales efforts and R&D investment towards the fastest-growing and most technologically demanding segments of the market.

- By Type:

- Lamp-based RTA (Halogen, Xenon Flash)

- Laser Thermal Annealing (LTA) / Laser Spike Annealing (LSA)

- Electron Beam RTA (Emerging)

- By Application:

- Ion Implantation Dopant Activation

- Silicide Formation

- Contact Alloying

- Gate Dielectric Annealing

- Oxidation and Nitridation

- By End-User:

- Semiconductor Manufacturing (Foundries, IDMs)

- Memory Device Manufacturing (DRAM, NAND)

- Power Device Manufacturing (SiC, GaN)

- Research and Development Institutions

Value Chain Analysis For Rapid Thermal Annealing (RTA) Equipment Market

The RTA equipment value chain is characterized by high barriers to entry, deep technological reliance, and concentrated specialization. Upstream activities involve specialized suppliers providing critical components such as high-intensity halogen lamps, xenon flash tubes, advanced pyrometers, high-purity gas delivery systems, and sophisticated robotics for wafer handling. These components are often sourced from niche suppliers globally. The middle segment is dominated by Original Equipment Manufacturers (OEMs) like Applied Materials and Tokyo Electron, who design, integrate, and manufacture the final RTA systems, involving complex software development for thermal modeling and process control. Downstream analysis focuses on the direct sales and distribution channels to end-users (major foundries and IDMs) through direct sales forces, minimizing the use of indirect distributors due to the high-value, highly technical nature of the installation and commissioning process. Post-sale, the value chain extends into lucrative service contracts, training, and spares provision, which often contribute significantly to the OEMs’ recurring revenue streams and overall profitability.

Rapid Thermal Annealing (RTA) Equipment Market Potential Customers

The primary customers for Rapid Thermal Annealing equipment are global semiconductor manufacturers requiring advanced front-end processing capabilities. These include large integrated device manufacturers (IDMs) like Intel and Samsung, which control the entire process from design to fabrication, and leading pure-play foundries such as TSMC and GlobalFoundries, which require cutting-edge RTA capacity to service their diverse customer base utilizing the latest process nodes. Additionally, specialized memory manufacturers (e.g., Micron, SK Hynix) are key buyers, given the heavy reliance on RTA for complex 3D NAND and advanced DRAM structures. The secondary, high-growth customer segment comprises emerging power electronics firms focused on wide-bandgap semiconductors (SiC and GaN), seeking specialized high-temperature RTA tools for dopant activation in high-power applications for automotive and renewable energy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 725.9 Million |

| Growth Rate | CAGR 6.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Tokyo Electron Limited (TEL), SCREEN Holdings, ASML Holding (through acquisition/integration), J. Schneider Elektrotechnik, Ulvac, Koyo Thermo Systems, MKS Instruments (RTP Division), Yield Engineering Systems (YES), KLA Corporation, Semilab, Advanced Technology & Materials (AT&M), ACCEL Instruments, Fusion Semiconductor, Axcelis Technologies, AIXTRON SE, Centrotherm Photovoltaics AG, Planar Systems, Mattson Technology (now part of E-Town Capital). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rapid Thermal Annealing (RTA) Equipment Market Key Technology Landscape

The technological landscape of the RTA equipment market is fundamentally shaped by the constant pressure to achieve tighter thermal budgets and greater temperature uniformity across larger wafers. Traditional RTA systems rely heavily on sophisticated high-intensity lamp modules, often using halogen or xenon arc lamps, strategically positioned around the wafer chamber to ensure rapid heating rates of up to 200°C per second. The key technological focus here is on developing advanced pyrometry systems—non-contact thermometers that measure temperature by detecting thermal radiation—that can accurately read the temperature of patterned wafers despite varying emissivity caused by different materials and structures, a crucial challenge in 3D device fabrication. This has led to the development of multi-wavelength pyrometers and calibration techniques utilizing acoustic or thermal wave metrology.

A significant innovation driving advanced nodes is the integration of Laser Thermal Annealing (LTA) or Laser Spike Annealing (LSA). LSA uses a highly focused line beam, typically from a high-power diode laser or CO2 laser, scanned rapidly across the wafer surface. This technique allows for heating the top few nanometers of the wafer surface to extremely high temperatures (up to 1350°C) for mere milliseconds (sub-millisecond dwell times), followed by ultra-fast cooling. This process is essential for activating dopants in ultra-shallow junctions without disturbing the underlying device layers or causing excessive diffusion, which is critical for 5nm and 3nm logic manufacturing. The technological sophistication lies in controlling the laser power, spot size, and scan speed with microsecond precision to prevent melting or damage.

The transition to compound semiconductors and power devices introduces another key technological challenge: annealing at extremely high temperatures (1500°C to 1800°C) under controlled, often nitrogen or argon, atmospheres. Specialized RTA systems designed for Silicon Carbide (SiC) or Gallium Nitride (GaN) require robust chamber materials (e.g., graphite heating elements or specialized ceramics) and advanced thermal insulation to handle these extreme conditions while maintaining high-purity environments necessary to prevent contamination, setting them apart from standard silicon processing RTA tools. Furthermore, the integration of advanced process control software utilizing big data analytics and AI for recipe generation and fault correction represents the frontier of technological development, enhancing both throughput and yield.

Regional Highlights

The regional analysis of the Rapid Thermal Annealing Equipment market reveals a significant concentration of demand and manufacturing capacity within Asia Pacific, while North America and Europe maintain strong positions in R&D and specialized equipment manufacturing. This dynamic spatial distribution reflects the global flow of semiconductor production and innovation.- Asia Pacific (APAC): APAC is the epicenter of RTA equipment consumption, driven by massive investments in new fabrication facilities (fabs) across China, Taiwan, and South Korea. Taiwan (home to TSMC) and South Korea (Samsung, SK Hynix) are the largest consumers due to their dominance in leading-edge logic and memory production, respectively, requiring the highest volume of advanced RTA systems (LSA and advanced lamp-based). China's accelerated efforts toward semiconductor self-sufficiency further boost demand, particularly for both high-end and mid-range equipment for domestic foundries.

- North America: North America remains a crucial hub for R&D, innovation, and equipment manufacturing (led by key players like Applied Materials). The U.S. market is experiencing resurgence due to the CHIPS Act, spurring domestic fab expansion (e.g., Intel, TSMC, Samsung new facilities), which guarantees sustained, high-value demand for advanced RTA systems specializing in 300mm wafer processing and next-generation device structures.

- Europe: The European market is characterized by robust demand in the automotive and industrial sectors, particularly for power electronics (SiC/GaN) manufacturing, requiring specialized high-temperature RTA tools. Countries like Germany and France are investing heavily in establishing sovereign fabrication capabilities (European Chips Act), focusing on specialty semiconductors, and maintaining a strong market presence for European equipment vendors specializing in niche RTA solutions.

- Latin America and Middle East & Africa (MEA): These regions currently represent nascent markets for RTA equipment, primarily driven by academic research institutions and minor localized assembly or packaging operations. Future growth potential exists if major global foundries establish manufacturing footprints in these areas, particularly in countries offering attractive investment incentives, though this remains a long-term prospect.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rapid Thermal Annealing (RTA) Equipment Market.- Applied Materials

- Tokyo Electron Limited (TEL)

- SCREEN Holdings

- ASML Holding (Indirectly through technology influence)

- J. Schneider Elektrotechnik

- Ulvac

- Koyo Thermo Systems

- MKS Instruments (RTP Division)

- Yield Engineering Systems (YES)

- KLA Corporation (Metrology & Process Control Integration)

- Semilab

- Advanced Technology & Materials (AT&M)

- ACCEL Instruments

- Fusion Semiconductor

- Axcelis Technologies

- AIXTRON SE

- Centrotherm Photovoltaics AG

- Planar Systems

- Mattson Technology (Part of E-Town Capital)

Frequently Asked Questions

Analyze common user questions about the Rapid Thermal Annealing (RTA) Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Rapid Thermal Annealing (RTA) in semiconductor fabrication?

The primary function of RTA is the thermal activation of dopants implanted into silicon wafers, enabling ultra-shallow junction formation essential for modern transistor operation, while limiting the overall thermal budget to prevent undesirable diffusion and maintain device integrity in sub-10nm nodes.

How does Laser Spike Annealing (LSA) differ from traditional lamp-based RTA?

LSA utilizes a fast-moving laser beam to heat the wafer surface for extremely short durations (milliseconds or less), achieving higher localized peak temperatures than lamp-based RTA, making it superior for critical, non-melt processing required for the most advanced logic device junctions.

Which regional market drives the highest demand for RTA equipment?

Asia Pacific (APAC), specifically Taiwan, South Korea, and Mainland China, drives the highest demand due to their large-scale investments in cutting-edge semiconductor foundries and advanced memory fabrication (DRAM and 3D NAND), which require high-throughput RTA systems.

What technological challenge poses the biggest restraint on RTA equipment performance?

The primary restraint is accurate temperature measurement (pyrometry) on patterned wafers. Complex device structures cause varying surface emissivity, making it difficult for pyrometers to ensure uniform, repeatable temperature control across the entire wafer, critical for yield optimization.

Is RTA equipment utilized for non-silicon power devices like SiC and GaN?

Yes, specialized RTA equipment is increasingly utilized for Silicon Carbide (SiC) and Gallium Nitride (GaN) power devices, requiring systems capable of operating reliably at extremely high temperatures (up to 1800°C) under controlled inert or specialized gas atmospheres for optimal dopant activation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager