Rapid Thermal Processing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434496 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Rapid Thermal Processing Equipment Market Size

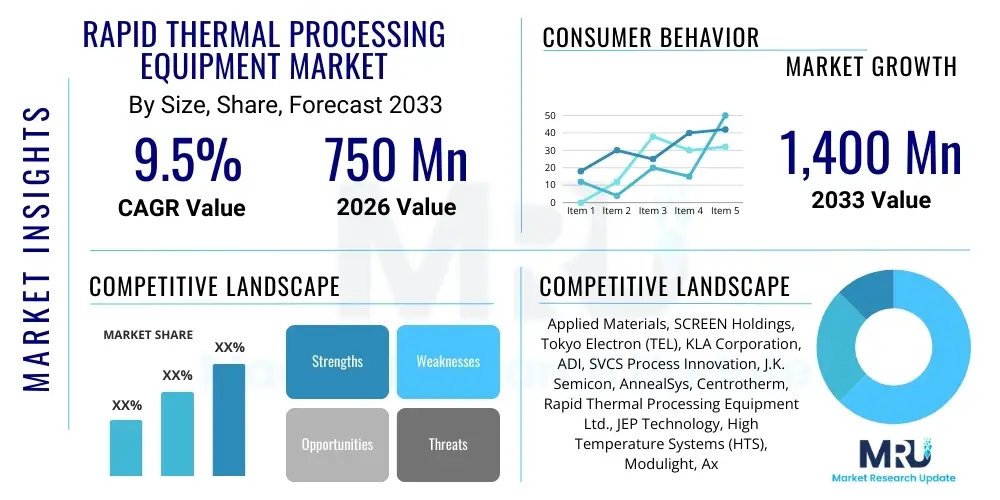

The Rapid Thermal Processing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,400 Million by the end of the forecast period in 2033.

Rapid Thermal Processing Equipment Market introduction

The Rapid Thermal Processing (RTP) Equipment Market encompasses advanced systems utilized in semiconductor manufacturing to heat single or multiple wafers to high temperatures for short periods, typically ranging from a few seconds to a few minutes. RTP is a crucial technology replacing traditional furnace annealing processes, offering superior control over the thermal budget, which is essential for manufacturing modern microelectronic devices with shrinking feature sizes and complex material stacks. The primary objective of RTP is to execute critical thermal steps such as dopant activation, silicidation, thin dielectric formation, and reflow processes with minimal diffusion, thereby preserving the sharpness of device junctions and maximizing device performance.

RTP equipment leverages highly controlled heating sources, predominantly halogen lamps, arc lamps, or increasingly, specialized lasers, to ensure extremely rapid temperature ramp-up and cool-down rates. This capability is paramount in advanced manufacturing nodes (14nm and below), where the thermal exposure must be precisely limited to prevent unintended movement of dopant atoms, which would otherwise degrade transistor characteristics. Major applications include the annealing of ion implantation damage following lithography steps, the formation of high-quality silicide layers on source/drain regions to reduce contact resistance, and the activation of complex III-V and other compound semiconductor materials used in high-frequency applications.

The core benefits driving the adoption of RTP include improved process repeatability, reduced contamination risks due to its single-wafer processing nature, and significant enhancement in wafer uniformity compared to batch furnaces. Furthermore, the increasing complexity of semiconductor architectures, particularly the shift towards FinFET and Gate-All-Around (GAA) structures, necessitates the precise thermal control that only RTP can deliver. Key driving factors include the relentless miniaturization trend (Moore's Law), escalating demand for high-performance computing (HPC) and artificial intelligence accelerators, and the global expansion of advanced wafer fabrication capacities, especially in Asia Pacific.

Rapid Thermal Processing Equipment Market Executive Summary

The Rapid Thermal Processing Equipment Market is characterized by intense technological competition focused on achieving tighter temperature uniformity and higher throughput, directly driven by the semiconductor industry's transition to smaller process nodes and complex material integration. Business trends indicate a strategic focus among major equipment manufacturers on developing hybrid RTP systems that combine lamp-based and laser annealing capabilities to address diverse thermal requirements across the wafer processing flow. Furthermore, there is a strong emphasis on integrating advanced sensing and real-time process monitoring tools, often leveraging machine learning algorithms, to optimize recipes and ensure zero-defect manufacturing, particularly crucial for high-volume foundry operations supplying next-generation consumer electronics and automotive components. Strategic collaborations between equipment vendors and leading Integrated Device Manufacturers (IDMs) are defining the technological roadmap, pushing the boundaries of thermal budget control.

Regionally, Asia Pacific maintains its dominance as the primary consumption and manufacturing hub for RTP equipment, spurred by massive investments in semiconductor fabrication plants (fabs) across Taiwan, South Korea, and Mainland China. These regions are capitalizing on government incentives and soaring global demand for memory (DRAM, NAND) and logic chips, necessitating continuous capacity expansion and technology upgrades featuring state-of-the-art RTP tools. North America and Europe, while smaller in volume, represent critical centers for R&D and the manufacturing of niche, high-value components, such as power devices and specialized compound semiconductors, thereby maintaining a steady demand for highly specialized RTP systems capable of handling non-silicon substrates. The intensifying geopolitical landscape is also subtly influencing supply chain resilience, prompting localized production strategies in several key markets.

Segment trends reveal a rapid shift towards specialized Laser Rapid Thermal Processing (LRTP) tools, particularly for critical steps like laser spike annealing (LSA) and millisecond annealing, necessary for 7nm and 5nm nodes to activate dopants while minimizing diffusion. The application segment dominated by ion implantation activation continues to hold the largest market share, but the silicidation and high-K/metal gate formation segments are demonstrating faster growth rates due to the pervasive adoption of new transistor architectures. By end-user, Foundries (pure-play and IDM) remain the largest consumers, demanding high-throughput, highly reliable systems to support multi-client manufacturing environments. The increasing necessity for faultless performance validation is boosting the market for specialized metrology and inspection systems integrated with or adjacent to the RTP equipment.

AI Impact Analysis on Rapid Thermal Processing Equipment Market

Common user questions regarding AI's influence on the Rapid Thermal Processing Equipment Market frequently center on how AI can enhance process control, predict equipment failure, and optimize the highly sensitive thermal recipes essential for advanced semiconductor nodes. Users are keenly interested in the integration of predictive maintenance (PdM) algorithms to maximize uptime and the application of machine learning (ML) to analyze complex sensor data (temperature uniformity, lamp status, wafer stress) in real-time. Key themes include the feasibility of achieving ‘self-optimizing’ RTP chambers, concerns over data security and proprietary recipe protection when implementing cloud-based AI solutions, and the tangible economic benefits, such as yield improvement and energy efficiency gains, resulting from AI-driven thermal management. Expectations are high that AI will transform RTP from a manually monitored tool to a highly autonomous system capable of dynamic recipe adjustment based on wafer-to-wafer variations, critical for achieving high yields at sub-10nm fabrication processes.

- AI enhances Real-Time Process Control: Machine learning models analyze thousands of temperature measurements per second, allowing for immediate and autonomous adjustments to lamp power profiles, ensuring optimal thermal uniformity across the wafer surface, mitigating hotspots, and reducing thermal stress.

- Predictive Maintenance (PdM) Implementation: AI algorithms monitor component degradation (e.g., lamp aging, susceptor wear) and predict potential system failures, drastically reducing unplanned downtime and optimizing maintenance schedules, thereby improving the overall equipment effectiveness (OEE).

- Recipe Optimization and Tuning: ML models explore vast parameter spaces to automatically discover and fine-tune complex thermal recipes for new materials or process requirements, significantly accelerating R&D cycles and time-to-market for advanced chip designs.

- Defect Reduction through Anomaly Detection: AI-driven image processing and sensor fusion identify subtle anomalies in the thermal profile or wafer characteristics during processing, enabling immediate flagging or rejection of potentially defective wafers before further costly steps.

- Enhanced Yield Management: Integrating RTP process data with downstream metrology results allows AI systems to correlate thermal variations with final device performance, driving root cause analysis and continuous improvement in fabrication yields.

- Energy Efficiency Management: Optimization algorithms dynamically adjust the energy consumption of heating elements based on precise thermal budget needs, leading to significant reduction in operational energy costs associated with high-temperature processing.

DRO & Impact Forces Of Rapid Thermal Processing Equipment Market

The market dynamics for Rapid Thermal Processing (RTP) equipment are shaped by a confluence of accelerating drivers related to miniaturization and high-performance demands, stringent restraints concerning capital expenditure and technical complexity, and significant opportunities arising from emerging semiconductor technologies and new application fields. The fundamental driver is the ongoing necessity to achieve tighter thermal control and minimize the thermal budget during critical doping activation and material modification steps, directly corresponding to the shift to sub-10nm geometries where traditional annealing techniques are insufficient. Restraints predominantly involve the extremely high cost of acquiring and maintaining these highly complex, multi-sensor systems, coupled with the necessity for highly skilled personnel to manage and troubleshoot advanced thermal recipes. The primary opportunity lies in the expanding adoption of specialized semiconductor materials, such as SiC (Silicon Carbide) and GaN (Gallium Nitride), crucial for power electronics and 5G/6G applications, which require custom, highly precise thermal annealing profiles that RTP systems are uniquely positioned to deliver.

Impact forces are centered on two major axes: technological obsolescence speed and geopolitical manufacturing shifts. The rapid pace of technological innovation in transistor architecture (e.g., GAA transition) compels equipment manufacturers to continuously invest in R&D, often shortening product lifecycles and requiring significant capital reinvestment from end-users to stay competitive. Geopolitical tensions, particularly regarding semiconductor supply chains, are driving a massive proliferation of localized fabrication capacity, most notably in the U.S. and Europe (CHIPS Act equivalent initiatives), which significantly increases the immediate addressable market for all types of semiconductor processing equipment, including RTP. Furthermore, environmental regulations and the focus on sustainable manufacturing are beginning to exert pressure, demanding RTP systems with lower energy footprints and minimized process gas usage, creating both a challenge and an opportunity for innovation in chamber design and heating mechanisms.

The balancing act between maintaining production efficiency (high throughput) and ensuring stringent process control (low thermal budget) creates a perpetual state of innovation pressure. Equipment providers must constantly optimize hardware reliability while integrating advanced software solutions for real-time monitoring and fault detection. Market forces thus favor established players who can offer integrated solutions that bundle RTP tools with critical metrology and inspection capabilities, ensuring seamless process flow and high yields for the most demanding fabrication processes. The transition to 300mm and eventually 450mm wafer sizes, although slow, also remains a structural force impacting future equipment design and capacity scaling requirements across the industry.

Segmentation Analysis

The Rapid Thermal Processing Equipment Market is fundamentally segmented based on the technology utilized for heating (Type), the specific step in the fabrication process where it is deployed (Application), and the primary facility where the equipment operates (End-User). The complexity of semiconductor manufacturing necessitates diverse RTP solutions; consequently, the segmentation reflects the varying thermal requirements—from ultra-fast millisecond annealing needed for junction activation in advanced logic chips to longer, more controlled processes required for dielectric film formation. Analyzing these segments provides a clear view of where capital expenditures are being directed and which technological advancements are gaining traction, particularly the ongoing transition from traditional lamp-based systems toward more precise laser-based and hybrid technologies designed specifically for thermal budget minimization and handling novel substrate materials.

- Type

- Lamp-based RTP (Halogen/Arc Lamp)

- Laser Rapid Thermal Processing (LRTP)

- Furnace Rapid Thermal Processing (Specialized, smaller batch)

- Hybrid RTP Systems (Combining lamp and laser/microwave)

- Application

- Ion Implantation Activation and Dopant Annealing

- Silicidation (Formation of self-aligned silicide - SALICIDE)

- Dielectric Film Formation (High-K materials)

- Ohmic Contact Formation

- Compound Semiconductor Annealing (GaN, SiC, GaAs)

- Stress Relaxation and Metallization Annealing

- End-User

- Foundries (Pure-play and IDM)

- Integrated Device Manufacturers (IDMs)

- OSAT (Outsourced Semiconductor Assembly and Test)

- Research and Development Institutes (Universities, National Labs)

- Power Electronics Manufacturers

- Wafer Size

- 200mm Wafer

- 300mm Wafer

- Others (150mm, 450mm development)

Value Chain Analysis For Rapid Thermal Processing Equipment Market

The value chain for Rapid Thermal Processing Equipment is intricate, beginning with highly specialized upstream suppliers providing critical components such as high-intensity halogen lamps, sophisticated pyrometry systems, vacuum pumps, and advanced quartzware. Upstream activities are dominated by specialized component manufacturers who must maintain rigorous quality control, as the performance and longevity of the RTP system rely heavily on the reliability of the heating source and temperature sensing accuracy. This segment is characterized by high barriers to entry due to stringent performance specifications and intellectual property surrounding thermal engineering. Major equipment manufacturers then integrate these components, adding proprietary software for recipe control, automated wafer handling systems, and advanced metrology integration, transforming components into high-value, complex capital equipment systems. The core value addition at this stage is the system integration and software intellectual property that ensures precise, repeatable thermal processing tailored to specific semiconductor nodes.

Downstream activities involve the distribution, installation, and extensive post-sales support required by the end-users—primarily large semiconductor fabrication facilities (fabs). Distribution channels are typically direct, leveraging the equipment manufacturers' highly trained field service engineers and sales teams due to the specialized nature and immense cost of the systems. Direct sales ensure that the manufacturer maintains control over the system setup and can provide immediate technical support crucial for minimizing fab downtime. Indirect channels, involving local agents or specialized distributors, are sometimes utilized for smaller regional markets or for supplying refurbishment services, but the core capital equipment procurement remains direct. The downstream phase is critical for long-term customer relationships, relying heavily on maintenance contracts, software upgrades, and process consultation services to optimize throughput and yield in the client’s facility.

Crucially, the high complexity of RTP tools mandates that service and maintenance form a significant part of the overall value capture post-sale. The rapid evolution of semiconductor processes requires frequent software updates and, occasionally, hardware modifications (e.g., transitioning from one generation of heating lamps to the next) to accommodate new thermal recipes. This continuous engagement ensures a sustained revenue stream for the original equipment manufacturers (OEMs). The direct interaction between OEMs and end-users (Foundries and IDMs) also facilitates a rapid feedback loop, allowing equipment design to be quickly iterated based on real-world yield data and advanced process development needs, effectively blurring the line between equipment supply and co-development of manufacturing processes.

Rapid Thermal Processing Equipment Market Potential Customers

The primary customers for Rapid Thermal Processing equipment are organizations heavily involved in the front-end fabrication of semiconductor devices, where precise thermal management is non-negotiable for producing high-functioning microchips. The core buying entities are Integrated Device Manufacturers (IDMs) such as Intel, Samsung, and Micron, who design and manufacture their own chips, requiring RTP tools for critical steps like memory cell formation and complex logic transistor creation. Secondly, pure-play Foundries, exemplified by TSMC and GlobalFoundries, represent the largest volume buyers, as they cater to hundreds of fabless design companies and require the most advanced, high-throughput RTP systems to maintain competitiveness across various technology nodes, from mature processes to bleeding-edge 3nm and beyond.

A rapidly growing segment of potential customers includes specialized manufacturers focusing on emerging materials and applications, particularly in the fields of power electronics, photonics, and compound semiconductors. These include companies manufacturing SiC or GaN devices for electric vehicles (EVs) and 5G infrastructure, which demand highly stable and customized RTP tools for high-temperature activation and defect repair. Finally, research and development institutions, including universities and national laboratories specializing in material science and nanotechnology, constitute a steady customer base, albeit for lower-volume, more flexible RTP systems used for prototyping and process discovery before commercial scaling. These diverse end-users share the common requirement for extreme temperature accuracy and wafer uniformity control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,400 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, SCREEN Holdings, Tokyo Electron (TEL), KLA Corporation, ADI, SVCS Process Innovation, J.K. Semicon, AnnealSys, Centrotherm, Rapid Thermal Processing Equipment Ltd., JEP Technology, High Temperature Systems (HTS), Modulight, Axcelis Technologies, Semco Engineering, ULVAC, AIXTRON, Advanced Semiconductor Equipment Corporation (ASE), ASM International, Daewoo Semiconductor Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rapid Thermal Processing Equipment Market Key Technology Landscape

The technological landscape of the Rapid Thermal Processing (RTP) market is defined by continuous innovation focused on achieving ultrafast heating rates and exceptional temperature uniformity across larger wafers (300mm). The dominant technology remains Lamp-based RTP, utilizing high-intensity halogen or arc lamps, which provide rapid ramp rates (up to 200°C per second) and are cost-effective for general annealing applications like dopant activation at mature nodes. However, for leading-edge nodes (7nm and below), the requirement for millisecond thermal exposure to prevent junction broadening necessitates the increasing adoption of Laser Rapid Thermal Processing (LRTP), including Laser Spike Annealing (LSA) and Flash Lamp Annealing (FLA). LSA focuses a laser line across the wafer surface, allowing for extremely localized, rapid heating and cooling cycles, which is indispensable for maintaining the integrity of highly constrained FinFET and GAA structures. This dual technological approach—optimized lamp systems for throughput and laser systems for precision—drives market innovation.

A critical technical challenge facing all RTP technologies is accurate, non-contact temperature measurement, which is primarily achieved through advanced pyrometry. Modern systems utilize multi-wavelength pyrometers combined with sophisticated calibration techniques to precisely map the wafer's thermal profile in real-time, compensating for emissivity changes caused by varying thin films on the wafer surface. Furthermore, the development of specialized chambers and advanced gas flow management systems is essential to ensure atmospheric control, often employing ultra-high vacuum or specific inert gas environments to prevent oxidation and contamination during high-temperature processing. Integration with advanced process control (APC) software, leveraging complex algorithms to manage lamp zones and power feedback, is now a standard feature, moving RTP from a passive heating step to an active, intelligence-driven thermal management process.

Emerging technologies include microwave annealing, which offers selective heating of certain materials, and the development of specialized hybrid RTP systems that combine the bulk heating efficiency of lamps with the precision of localized laser heating to achieve optimized thermal budgets for complex 3D stacking processes. As the industry moves towards 3D integration (e.g., stacking logic on memory), the necessity to anneal lower layers without degrading previously formed metallic interconnects demands extremely selective and low-temperature thermal processing, which these hybrid and advanced laser techniques are specifically designed to address. The technology landscape is thus characterized by high complexity, intellectual property concentration, and a dependency on materials science breakthroughs related to heating sources and chamber materials that can withstand extreme thermal cycling.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC is the undisputed largest market for Rapid Thermal Processing equipment, driven by colossal investments in new fabrication plants and capacity expansion in countries like China, South Korea, and Taiwan. These nations host the world's leading foundries (TSMC, Samsung Foundry) and memory manufacturers (SK Hynix, Micron), which are continuously upgrading facilities to support sub-10nm logic and advanced 3D NAND memory technologies. The high concentration of front-end manufacturing activities, coupled with significant government subsidies supporting local semiconductor ecosystems, guarantees sustained high demand for high-throughput, advanced RTP systems.

- North America Technological Leadership: North America remains a crucial hub for RTP R&D and specialized manufacturing, particularly in the areas of compound semiconductors (SiC, GaN) and cutting-edge process development. With renewed focus via government initiatives (e.g., CHIPS Act), there is significant planned investment in new fabs (e.g., Intel, TSMC, Samsung expansion in the US), driving substantial, albeit less volume-intensive than APAC, demand for the latest generation of advanced RTP and laser annealing tools necessary for high-value product fabrication and prototyping.

- Europe Specialized Growth: The European market exhibits moderate but steady growth, focusing primarily on niche, high-performance applications, including automotive electronics, industrial power devices, and specialized sensors. Countries such as Germany, France, and Ireland are key centers for manufacturing SiC and GaN power devices, necessitating custom RTP equipment capable of handling these wide-bandgap materials that require very high processing temperatures (often above 1600°C) with exceptional temperature stability and ramp control.

- China's Capacity Buildup: Mainland China represents a rapidly expanding segment, fueled by aggressive national self-sufficiency goals in semiconductor production. Domestic and international fab construction in China has created an unprecedented demand for RTP equipment, often favoring domestic suppliers where possible, but still heavily relying on established international vendors for the most advanced sub-28nm technology nodes, creating a bifurcated market demand structure.

- Latin America and MEA Emerging Demand: While significantly smaller, the markets in Latin America and the Middle East & Africa (MEA) are seeing nascent demand tied primarily to assembly, test, and packaging operations (OSAT), and basic research institutions. RTP demand in these regions is typically focused on 200mm or smaller legacy systems used for sensor manufacturing or academic research, though future expansion depends heavily on successful establishment of local front-end fabrication capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rapid Thermal Processing Equipment Market.- Applied Materials

- SCREEN Holdings

- Tokyo Electron (TEL)

- KLA Corporation

- ADI (Advanced Development International)

- SVCS Process Innovation

- J.K. Semicon

- AnnealSys

- Centrotherm

- Rapid Thermal Processing Equipment Ltd.

- JEP Technology

- High Temperature Systems (HTS)

- Modulight

- Axcelis Technologies

- Semco Engineering

- ULVAC

- AIXTRON

- Advanced Semiconductor Equipment Corporation (ASE)

- ASM International

- Daewoo Semiconductor Equipment

Frequently Asked Questions

Analyze common user questions about the Rapid Thermal Processing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Rapid Thermal Processing (RTP) equipment in semiconductor manufacturing?

RTP equipment is designed to rapidly heat semiconductor wafers to high temperatures (up to 1300°C) for short, controlled durations, typically a few seconds. Its primary function is to perform critical thermal steps such as activating implanted dopants, forming low-resistance silicide contacts (salicidation), or growing thin dielectric layers, all while meticulously controlling the thermal budget to prevent excessive diffusion and maintain the performance integrity of nanoscale devices.

How does Laser Rapid Thermal Processing (LRTP) differ from traditional Lamp-based RTP, and why is it essential for advanced nodes?

Lamp-based RTP uses high-intensity halogen or arc lamps for bulk, large-area heating, suitable for general annealing processes. LRTP, including techniques like Laser Spike Annealing (LSA), uses a focused laser beam to heat the wafer surface in milliseconds. This extremely short thermal exposure time is critical for advanced nodes (7nm and below) to activate dopants without allowing them to diffuse, thereby preserving the sharpness of ultra-shallow device junctions, which is impossible with conventional lamp-based systems due to their longer ramp-down times.

Which regions are driving the highest demand and technological innovation in the RTP equipment market?

Asia Pacific (APAC), particularly Taiwan, South Korea, and Mainland China, drives the highest volumetric demand due to massive investments in foundry and memory fabrication capacity (300mm wafer production). However, technological innovation, especially regarding advanced laser annealing systems and novel material processing (SiC/GaN), is frequently pioneered by research institutions and leading equipment manufacturers predominantly based in North America and Japan.

What role does Artificial Intelligence (AI) play in modern Rapid Thermal Processing equipment?

AI is increasingly integrated into RTP systems to enhance process robustness and efficiency. AI algorithms are used for real-time Advanced Process Control (APC) by analyzing sensor data to dynamically adjust heating zones and ensure exceptional temperature uniformity. Furthermore, AI drives Predictive Maintenance (PdM) programs, forecasting component failures (e.g., lamp burnout) to maximize equipment uptime and overall manufacturing yield.

What are the primary challenges limiting the widespread adoption of the most advanced RTP equipment?

The main challenges are the extremely high capital expenditure required for purchasing state-of-the-art LRTP and hybrid systems, coupled with the inherent technical complexity. These tools require highly specialized maintenance, continuous calibration, and sophisticated process development expertise to manage the sensitive thermal recipes necessary for advanced semiconductor device fabrication, posing barriers for smaller or less experienced manufacturing facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager