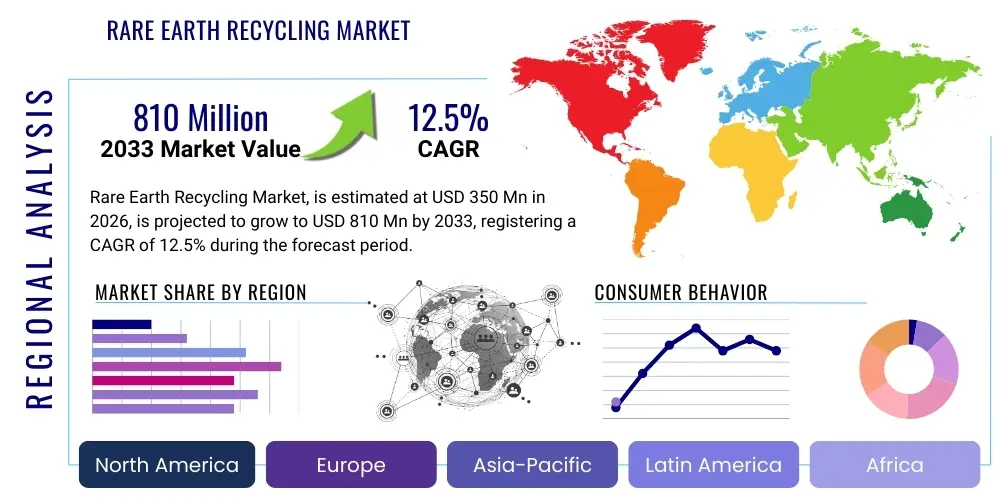

Rare Earth Recycling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436004 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Rare Earth Recycling Market Size

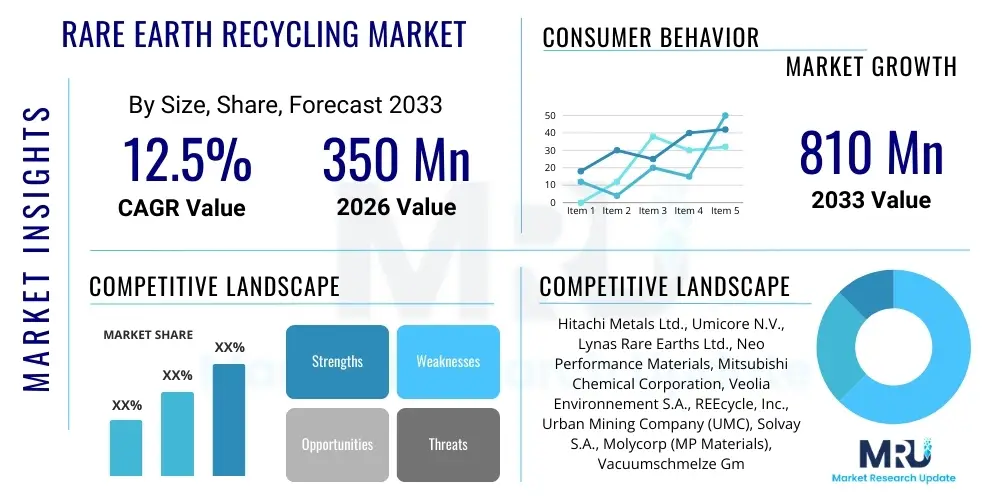

The Rare Earth Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 810 Million by the end of the forecast period in 2033.

Rare Earth Recycling Market introduction

The Rare Earth Recycling Market encompasses the recovery and reprocessing of rare earth elements (REEs) from end-of-life products, manufacturing waste, and electronic scrap. This market is fundamentally driven by the critical need to secure a stable, diversified supply chain for these strategic materials, which are essential components in high-technology applications such as electric vehicles (EVs), wind turbines, and advanced electronics. Market participants employ sophisticated metallurgical and chemical processes—including hydrometallurgy and pyrometallurgy—to extract elements like Neodymium, Dysprosium, Praseodymium, and Terbium from complex matrices, aiming to mitigate the environmental impact associated with primary mining and reduce geopolitical supply risks. The market’s increasing maturity is linked directly to governmental mandates promoting resource efficiency and the rising global demand for green technologies.

Rare Earth Recycling Market Executive Summary

The global Rare Earth Recycling Market is experiencing robust acceleration driven by evolving business trends favoring circular economy models and heightened regulatory pressure regarding e-waste management. Key business strategies involve significant investments in advanced separation technologies and the establishment of dedicated collection infrastructure, particularly in high-volume waste streams like automotive magnets and consumer electronics. Regionally, the Asia Pacific (APAC) dominates the market due to its concentration of manufacturing and e-waste processing facilities, while Europe and North America are focused on technological innovation and supply security through stricter domestic recycling targets. Segmentally, the recycling of permanent magnets, crucial for EV motors and wind generators, represents the most lucrative and fastest-growing segment, followed closely by the recovery of phosphors from lighting applications. Overall, market growth is intrinsically linked to the global energy transition and the strategic imperative to decrease reliance on primary REE extraction, positioning recycling as a vital component of future material security.

AI Impact Analysis on Rare Earth Recycling Market

User inquiries frequently focus on how Artificial Intelligence (AI) can enhance the efficiency and scalability of complex rare earth separation processes, which traditionally rely on highly specialized chemical and physical methods. Common questions revolve around AI’s role in optimizing sorting processes, predicting material yields from varying waste streams, and managing complex supply logistics. Users are keen to understand if machine learning algorithms can significantly lower operational costs and improve the purity of recovered materials, which are critical constraints in widespread commercial adoption. The underlying expectation is that AI will transform recycling from a labor-intensive, batch-focused activity into a highly automated, precise, and continuous industrial operation capable of handling the increasing complexity of modern electronic waste.

AI’s influence is expected to be transformative, primarily by optimizing the preliminary sorting and separation stages. Machine vision systems coupled with deep learning models can accurately identify and categorize different alloys or component types containing REEs with unprecedented speed and accuracy, surpassing human capabilities, especially when dealing with heterogeneous waste streams. Furthermore, predictive maintenance models utilizing AI ensure that highly specialized and expensive recycling equipment, such as complex solvent extraction circuits, operate at peak efficiency, minimizing downtime and chemical consumption. This predictive capability translates directly into lower operating expenditure and enhanced resource utilization, crucial for maintaining competitive pricing against newly mined REEs.

The application of Generative AI is also emerging in the R&D sphere, where it is being used to simulate and optimize novel hydrometallurgical or bioleaching processes. By running millions of virtual experiments, AI can rapidly identify optimal processing parameters, including ideal temperature, pH levels, and solvent concentrations, thereby accelerating the development of more environmentally friendly and energy-efficient extraction techniques. This capability reduces the reliance on traditional, lengthy laboratory testing cycles, fostering faster innovation and deployment of next-generation recycling infrastructure necessary to handle the influx of end-of-life batteries and complex electronic devices.

- AI-driven image recognition enhances the automated sorting and grading of complex e-waste prior to processing.

- Machine learning algorithms optimize chemical processes (e.g., solvent extraction efficiency) by adjusting parameters in real-time based on material input characteristics.

- Predictive modeling improves yield estimation and reduces operational costs in large-scale hydrometallurgical plants.

- Generative AI assists in the rapid development of novel, energy-efficient separation chemistries and novel recycling infrastructure designs.

- AI integration aids in supply chain transparency, tracking REE-containing products from usage to end-of-life recovery point.

DRO & Impact Forces Of Rare Earth Recycling Market

The Rare Earth Recycling Market is heavily influenced by dynamic forces. Key drivers include accelerating electric vehicle production and stringent governmental policies requiring minimum recycled content in new products, coupled with the critical desire for supply chain security away from geopolitically concentrated primary sources. Conversely, major restraints involve the technical complexity and high cost of separating rare earth elements from complex alloys and compounds, challenges in establishing efficient, large-scale collection networks for dispersed end-of-life products, and the volatility of primary REE prices which can undermine the economic viability of recycling operations. Significant opportunities lie in scaling up innovative technologies like membrane separation and bio-extraction, and expanding recycling capacity into emerging sectors like offshore wind power generation. These factors collectively exert a substantial impact on market dynamics, forcing companies to balance high R&D investment with the increasing political and environmental imperative to secure domestic material supply.

Segmentation Analysis

The Rare Earth Recycling Market is typically segmented based on the source of the rare earth elements, the technology employed for recovery, and the final application of the recovered materials. This structure helps market participants understand the most profitable streams and technological requirements. Source segmentation highlights permanent magnets as the dominant and most valuable category due to their high REE concentration in critical applications like automotive and renewable energy. Technology segmentation reveals the ongoing shift toward advanced hydrometallurgical processes offering higher purity yields. Application segmentation underscores the strong connection between market growth and the massive expansion of the electric vehicle and consumer electronics industries globally, which are rapidly generating large volumes of recyclable scrap.

- By Source:

- Permanent Magnets (NdFeB, SmCo)

- Catalysts (Automotive Catalytic Converters, Fluid Catalytic Cracking)

- Phosphors (Fluorescent Lamps, LEDs, Display Screens)

- Batteries (NiMH, Li-ion components)

- Metal Alloys and Polishing Powders

- By Technology:

- Hydrometallurgy (Solvent Extraction, Precipitation)

- Pyrometallurgy (Smelting, Refining)

- Hybrid Processes

- Ion Exchange/Chromatography

- Electrochemistry

- By Application:

- Automotive (EV Motors, Sensors)

- Electronics (Hard Drives, Consumer Devices)

- Renewable Energy (Wind Turbine Generators)

- Defense and Aerospace

- Medical Devices and Imaging

Value Chain Analysis For Rare Earth Recycling Market

The value chain for Rare Earth Recycling is intricate, starting with complex upstream processes involving collection and pre-treatment, followed by specialized midstream separation, and concluding with downstream refinement and market integration. Upstream analysis focuses heavily on the efficiency of sourcing end-of-life products (EOL) containing REEs. This stage involves establishing robust collection schemes—be it through original equipment manufacturers (OEMs), municipal waste management systems, or dedicated e-waste collectors—and conducting initial mechanical processing such as shredding, sorting, and manual dismantling to isolate REE-rich components like magnets or circuit boards. The inherent challenge here is the variability and low concentration of REEs in mixed waste streams, necessitating significant logistical and technical investments to create a reliable feedstock.

The core of the value chain lies in the midstream recycling technologies, including hydrometallurgy and pyrometallurgy. Hydrometallurgy involves dissolving the REE components in acid solutions followed by complex solvent extraction or precipitation methods to separate individual rare earth oxides with high purity. This is highly technical and capital-intensive but yields high-purity products suitable for direct reintroduction into manufacturing. Downstream, the recovered rare earth oxides or metals are sold directly to specialized alloy producers or magnet manufacturers, completing the loop. Effective downstream integration requires stringent quality control to ensure the recycled materials meet the exact specifications demanded by high-tech industries, such as precise magnetic performance for EV motors.

Distribution channels in this market are predominantly direct and highly specialized. Since REEs are strategic materials, transactions often involve long-term supply agreements between the rare earth recycler (or refiner) and major end-users (like automotive or wind power manufacturers). Indirect channels might involve trading houses or brokers for certain bulk materials, but high-purity rare earth materials typically bypass intermediaries to maintain quality assurance and supply security. The successful navigation of this value chain relies on developing strong partnerships upstream to secure feedstock, optimizing the midstream processes for cost and purity, and ensuring seamless downstream integration into critical manufacturing supply chains.

Rare Earth Recycling Market Potential Customers

The primary customers and end-users of recycled rare earth elements are large-scale manufacturers operating in sectors reliant on high-performance materials. The largest customer segment is the automotive industry, specifically Electric Vehicle (EV) manufacturers and their component suppliers (Tier 1 suppliers). These companies require vast quantities of Neodymium and Dysprosium for permanent magnet motors, and recycled materials offer a crucial alternative source to mitigate supply chain risks and meet sustainability mandates. As EV fleets age, these manufacturers are also increasingly interested in establishing closed-loop recycling partnerships, making them both suppliers (of end-of-life vehicles) and consumers of recycled REEs.

Another significant customer base comprises the producers of renewable energy infrastructure, particularly wind turbine manufacturers. Modern direct-drive offshore wind turbines use magnets containing significant amounts of REEs, demanding large, stable supplies of high-quality recycled materials. Furthermore, the electronics sector, including manufacturers of hard disk drives (HDDs), high-fidelity audio equipment, and advanced computing systems, represents a constant customer stream. Although individual electronic devices contain smaller amounts of REEs compared to an EV, the sheer volume of production generates consistent demand for recycled elements used in specialized alloys and polishing powders, with Scandium, Yttrium, and Lanthanum often being sought.

Finally, governmental agencies, particularly defense and aerospace contractors, are vital, albeit specialized, customers. Rare earth elements are indispensable for advanced guidance systems, radar, and communication equipment. For these sectors, supply security and domestic sourcing are paramount strategic concerns, meaning recycled rare earths, especially those recovered within national borders, carry a significant premium and are critical for national security mandates. The convergence of sustainability goals and national security interests significantly shapes purchasing decisions across this entire spectrum of potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 810 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals Ltd., Umicore N.V., Lynas Rare Earths Ltd., Neo Performance Materials, Mitsubishi Chemical Corporation, Veolia Environnement S.A., REEcycle, Inc., Urban Mining Company (UMC), Solvay S.A., Molycorp (MP Materials), Vacuumschmelze GmbH & Co. KG, Ganzhou Rare Earth Group, Treibacher Industrie AG, Commerce Resources Corp., Rare Earth Salts, Rhodia (now Solvay), MagneGas Corporation, Shenghe Resources Holding Co., Ltd., Bekaert NV, Rare Earth Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rare Earth Recycling Market Key Technology Landscape

The technological landscape for rare earth recycling is dominated by two fundamental approaches: hydrometallurgy and pyrometallurgy, though hybrid and novel bio-extraction methods are gaining traction. Hydrometallurgy, which involves the selective dissolution of REEs in acidic or basic aqueous solutions, is highly valued for its ability to recover individual rare earth oxides with high purity, often exceeding 99%. This technique requires intricate separation steps, primarily utilizing solvent extraction—a process requiring significant capital expenditure and careful management of chemical waste. Advances in this field are focused on developing greener, less toxic chelating agents and improving the speed and selectivity of the extraction phases to reduce processing time and cost, making it economically competitive with primary mining.

Pyrometallurgy involves high-temperature smelting to concentrate REEs into an intermediate alloy or slag. While this method is generally simpler and can handle complex, unsorted input materials (like mixed e-waste), it typically results in a lower concentration and requires further refining steps, often using hydrometallurgy, to achieve marketable purity. The integration of pyrometallurgy as an initial concentration step followed by targeted hydrometallurgical refinement represents the prevalent hybrid strategy. Current technological innovation in pyrometallurgy is focused on optimizing furnace design and energy efficiency to reduce the massive power consumption typically associated with high-heat processes, and minimizing harmful flue gas emissions.

Emerging technologies, critical for future market scalability, include membrane separation and bioleaching. Membrane processes offer an environmentally benign alternative to solvent extraction, utilizing specialized membranes to selectively filter and separate metal ions based on size and charge, promising reduced reagent usage and simpler continuous operation. Bioleaching, or bio-extraction, leverages natural or engineered microorganisms to selectively dissolve rare earth metals from scrap material under mild conditions. While still largely in the research and pilot phase, bioleaching holds significant potential for lower energy consumption and reduced chemical footprint, particularly appealing for processing low-concentration waste streams that are currently uneconomical for traditional recycling methods.

Regional Highlights

The Rare Earth Recycling Market exhibits distinct growth patterns and maturity levels across key geographical regions, driven primarily by localized technological capabilities, regulatory frameworks, and the concentration of high-tech manufacturing.

- Asia Pacific (APAC): APAC, led by China, Japan, and South Korea, is the dominant region both in terms of e-waste generation and established recycling infrastructure. China's control over primary rare earth supply and its expanding manufacturing base necessitate robust domestic recycling capabilities. Japan and South Korea, heavily reliant on imported REEs for their electronics and automotive industries, have pioneered advanced urban mining and closed-loop recycling systems, emphasizing the recovery of rare earth magnets from consumer electronics and industrial scrap. The region focuses heavily on scaling up pyrometallurgical processing due to the large volume of feedstock.

- Europe: Europe is characterized by strong regulatory drivers, notably the Circular Economy Action Plan and stringent WEEE (Waste Electrical and Electronic Equipment) directives, which mandate high collection and recycling rates. This regulatory push, combined with a strategic imperative to reduce reliance on foreign supply, fuels high investment in R&D, particularly in sophisticated hydrometallurgical and bioleaching techniques. Countries like Belgium, Germany, and France are actively positioning themselves as centers for high-purity rare earth refining for the European automotive and wind energy sectors.

- North America: North America, primarily the United States and Canada, is prioritizing rare earth recycling as a matter of national economic and defense security. Government funding and initiatives (such as those from the Department of Energy) are driving the establishment of domestic processing facilities and the development of new extraction technologies. The focus is heavily skewed toward securing magnet materials (Nd, Dy) for EV production and military applications, often through direct processing of end-of-life military hardware and industrial scrap.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets in the recycling domain. While MEA has significant potential for primary mining, recycling efforts are primarily concentrated on managing rapidly growing e-waste streams in urban centers. Growth is currently constrained by nascent collection infrastructure and reliance on imported, large-scale recycling technology. However, increased foreign investment and developing national waste management strategies are expected to accelerate market maturity during the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rare Earth Recycling Market.- Umicore N.V.

- Hitachi Metals Ltd.

- Lynas Rare Earths Ltd.

- Neo Performance Materials

- Mitsubishi Chemical Corporation

- Veolia Environnement S.A.

- REEcycle, Inc.

- Urban Mining Company (UMC)

- Solvay S.A.

- MP Materials (formerly Molycorp)

- Vacuumschmelze GmbH & Co. KG

- Ganzhou Rare Earth Group

- Treibacher Industrie AG

- Commerce Resources Corp.

- Rare Earth Salts

- Shenghe Resources Holding Co., Ltd.

- Bekaert NV

- MagneGas Corporation

- Aachener Verfahrenstechnik (AVT)

- Nippon Rare Earth Recycling

Frequently Asked Questions

Analyze common user questions about the Rare Earth Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the massive growth in the Rare Earth Recycling Market?

Growth is primarily driven by three critical factors: the exponential demand for high-performance magnets used in Electric Vehicles (EVs) and wind turbines, stringent governmental mandates promoting the circular economy and minimizing e-waste, and the geopolitical necessity of securing stable, non-Chinese rare earth element (REE) supply chains.

Which rare earth elements are the most critical and profitable to recycle?

Neodymium (Nd) and Dysprosium (Dy) are the most critical elements for recycling, due to their essential role in NdFeB permanent magnets used in motors and generators. The high market value and concentrated presence in end-of-life products like EV batteries and hard drives make their recovery highly profitable compared to other REEs.

What are the primary technological challenges in Rare Earth Recycling?

Key challenges include the difficulty of efficiently collecting and dismantling complex electronic scrap, the high energy consumption and complex logistics associated with hydrometallurgical separation processes, and the necessity of achieving ultra-high purity levels to satisfy demanding manufacturing specifications in the automotive and defense sectors.

How does the volatility of primary rare earth prices affect recycling operations?

Primary REE price volatility directly impacts the economic viability of recycling. When mined REE prices drop significantly, recycled materials, which carry higher processing costs, become less competitive, potentially hindering investment in new recycling infrastructure and posing a significant economic restraint on market scalability.

Which geographical region leads the global Rare Earth Recycling efforts?

Asia Pacific (APAC), particularly China and Japan, leads the global recycling efforts due to its extensive manufacturing base, high volume of e-waste generation, and early adoption of large-scale urban mining technologies, making it the geographical hub for both processing capability and market demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager