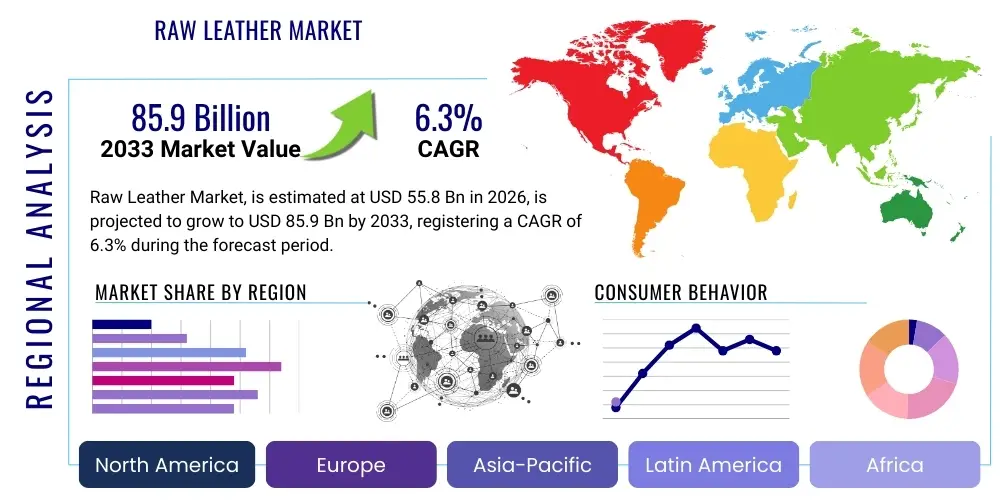

Raw Leather Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437275 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Raw Leather Market Size

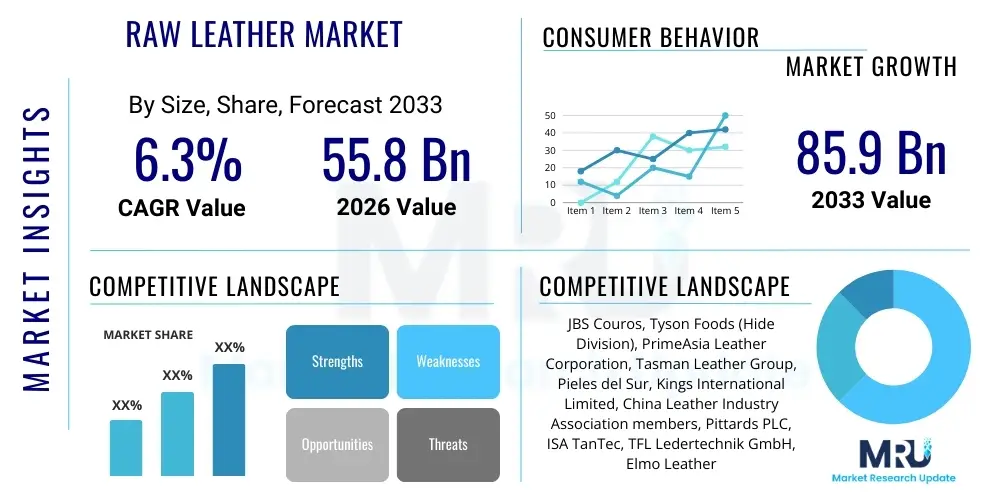

The Raw Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 55.8 Billion in 2026 and is projected to reach USD 85.9 Billion by the end of the forecast period in 2033. This steady growth is attributed primarily to the surging demand from the automotive upholstery and premium footwear sectors, alongside increasing global disposable incomes that drive consumption of luxury leather goods. Furthermore, innovations in tanning processes, focusing on reduced environmental impact, are making leather a more attractive material choice for sustainable-minded brands, thereby ensuring robust market expansion over the forecast horizon. The valuation reflects the raw, untreated or semi-finished hides and skins entering the global supply chain for further processing.

Raw Leather Market introduction

The Raw Leather Market encompasses the trade and processing of untreated hides and skins derived primarily from bovine, ovine, caprine, and porcine sources, which serve as the essential input material for the global leather industry. Raw leather, defined by its state before undergoing the rigorous tanning process, is characterized by specific properties such as thickness, texture, and origin, dictating its final application suitability. This material forms the backbone of numerous downstream industries including luxury goods, automotive interiors, high-end furniture, and durable apparel. Key applications include the manufacturing of footwear soles and uppers, automotive seat covers requiring high abrasion resistance, and garment production where softness and pliability are crucial. The inherent benefits of raw leather—durability, breathability, timeless aesthetic appeal, and natural strength—ensure its persistent demand despite the emergence of synthetic alternatives.

Major driving factors influencing the robust expansion of the raw leather market include the rising global population and urbanization, leading to an increased demand for value-added products like designer bags and leather accessories. The burgeoning automotive sector, particularly in emerging economies, requires large volumes of high-quality raw hides for luxury vehicle upholstery, demanding specific tensile strengths and consistency. Additionally, advancements in hide preservation and storage technologies minimize waste and spoilage, improving the efficiency of the upstream supply chain. However, the market faces constraints related to stringent environmental regulations concerning tanneries and the volatile pricing of raw material derived from the livestock industry, necessitating continuous technological innovation to remain competitive and sustainable.

The diverse product portfolio within the raw leather sector ranges from heavy steer hides used in industrial applications to delicate lambskins favored for high-fashion garments. The market structure is highly fragmented upstream, involving numerous smaller slaughterhouses and collection centers, but becomes more consolidated downstream among large tanners and processors who apply advanced chemical treatments. Successful market participation relies on establishing resilient global logistics networks capable of quickly transporting perishable raw materials from sources, predominantly located in livestock-heavy regions like Brazil, the US, and Australia, to major processing hubs, primarily concentrated in Asia Pacific nations such as China and India. This complex global interplay of supply logistics, processing capabilities, and end-user demand defines the market’s operational landscape.

Raw Leather Market Executive Summary

The Raw Leather Market trajectory is defined by a critical pivot towards sustainability and supply chain traceability, driven by increasing consumer and regulatory scrutiny. Business trends indicate a movement away from conventional chrome tanning processes towards vegetable and bio-based alternatives, significantly influencing the demand for specific grades of raw material suitable for these eco-friendly methods. Geographically, Asia Pacific remains the dominant consumption and processing hub due to lower operational costs and the presence of massive manufacturing bases for footwear and garments, while regions like Europe focus intensively on premium, certified, and ethical sourcing, setting global quality benchmarks. This dual market dynamic requires suppliers to implement flexible sourcing and processing strategies to meet varying regional demands for volume, quality, and environmental compliance.

In terms of segmentation trends, bovine hide continues to command the largest market share, driven by its extensive use in automotive, furniture, and heavy-duty footwear sectors, valued for its size and resilience. However, the sheep and goat skin segments are experiencing faster growth, primarily fueled by the luxury fashion industry's pursuit of softer, lighter materials for high-end accessories and apparel. Furthermore, the market for wet blue and wet white leather (partially processed raw leather) is expanding, as it simplifies global trade by reducing the material's perishable nature and enabling tanneries to import partially processed goods instead of completely raw hides, thereby optimizing logistics and reducing potential spoilage risks.

Looking forward, technological advancements in material preservation, such as advanced brine curing and cryogenic storage techniques, are enhancing the lifespan and quality of raw hides prior to tanning, thereby minimizing overall material loss. Strategic partnerships between major meat producers and large-scale tanneries are becoming crucial for securing stable, consistent supply chains. The market's competitiveness is increasingly judged not merely on price or volume but on the implementation of ethical practices, verifiable animal welfare standards, and the adoption of water-saving and zero-discharge tanning technologies. These factors are compelling smaller market participants to consolidate or specialize in niche, certified product lines to maintain viability in a rapidly evolving, high-stakes global commodity market.

AI Impact Analysis on Raw Leather Market

Users frequently inquire about how Artificial Intelligence (AI) can mitigate the inherent inefficiencies and ethical complexities associated with the raw leather supply chain, particularly concerning traceability, quality control, and environmental compliance. Key themes emerging from these inquiries revolve around the potential for AI to introduce automated grading systems for raw hides, forecast fluctuations in hide supply based on livestock market data, and optimize complex inventory management across global storage facilities. Users express strong concerns regarding the transparency of sourcing, leading to expectations that AI and machine learning algorithms can provide verifiable provenance tracking from the farm level through to the tannery gate, ensuring adherence to animal welfare and deforestation standards. Furthermore, the interest is high in utilizing AI for predictive maintenance of tanning machinery and optimizing chemical consumption in processing to reduce the heavy environmental footprint traditionally associated with the leather industry, driving demand for intelligent, resource-efficient solutions.

- AI-Powered Grading and Inspection: Implementation of image recognition and machine vision systems to automatically assess raw hide quality, defects, and dimensions, leading to standardized grading and reduced human error in sorting processes.

- Predictive Supply Chain Analytics: Use of machine learning models to analyze livestock cycles, seasonal slaughter rates, and global logistics data, providing highly accurate forecasts for raw hide availability and pricing volatility, enabling better procurement strategies.

- Enhanced Traceability and Provenance: Deployment of blockchain integrated with AI algorithms to securely track the origin of hides, verify compliance with ethical sourcing standards (e.g., anti-deforestation), and ensure transparency throughout the value chain for end-users and regulatory bodies.

- Optimizing Tanning Processes: Application of AI to monitor real-time parameters (pH, temperature, chemical concentration) during the complex tanning cycle, dynamically adjusting inputs to minimize chemical waste, water usage, and energy consumption, resulting in substantial environmental savings.

- Smart Inventory Management: Utilization of AI to manage highly perishable raw material inventories, predicting potential spoilage based on storage conditions and optimizing stock rotation across various cold storage facilities worldwide to reduce material loss.

- Risk Assessment for Sustainability Compliance: AI systems analyzing supplier certifications and historical data to predict compliance risks associated with environmental, social, and governance (ESG) factors, enabling proactive supplier auditing and mitigation efforts.

DRO & Impact Forces Of Raw Leather Market

The Raw Leather Market is primarily driven by expanding luxury and automotive industries, coupled with the natural durability and quality that leather provides, ensuring a constant replacement demand. Conversely, the market is restrained by stringent global environmental regulations, high costs associated with chemical waste disposal, and intense competition from sophisticated synthetic and plant-based leather alternatives which often carry lower environmental footprint perceptions. Opportunities reside in developing certified sustainable sourcing networks and leveraging bio-tanning technologies to meet the growing consumer demand for ethical products. The primary impact forces include volatile commodity pricing tied to the global meat industry cycle, shifts in consumer perceptions regarding animal-derived products, and mandatory governmental policies aiming to curb water pollution originating from tanning facilities, compelling innovation and compliance.

Key drivers sustaining market growth include the robust expansion of the middle class in Asia, particularly China and India, leading to increased purchasing power for premium goods like luxury bags, high-quality footwear, and upholstered furniture. The global automotive industry, especially the luxury vehicle segment, continues to rely heavily on genuine leather for interior finishes due to its superior feel, longevity, and perceived value, requiring consistent large volumes of bovine hides. Furthermore, technical advancements in preservation techniques, such as non-toxic biocides and advanced refrigeration methods, have significantly improved the shelf life and quality of raw hides during transportation, reducing waste and enhancing the reliability of the global supply chain, which boosts market confidence and efficiency.

Restraints pose persistent challenges to sustained profitability. Environmental compliance costs represent a significant barrier, as tanneries must invest heavily in wastewater treatment plants and adopt resource-intensive pollution control technologies to meet international standards. Moreover, the raw material supply is intrinsically linked to the meat industry, making prices highly volatile and unpredictable based on livestock health, feed costs, and disease outbreaks, which complicates long-term operational planning. The rise of sophisticated, high-performance synthetic leathers and emerging materials like mushroom or pineapple leaf leather, which market themselves on ethical sourcing and zero animal input, presents a credible and rapidly growing competitive threat, diverting a portion of market demand, particularly in fast fashion and mid-range footwear.

Segmentation Analysis

The Raw Leather Market segmentation provides a crucial framework for understanding supply dynamics, processing requirements, and end-user demands, typically analyzed across source type, product type, and key application areas. Source type segmentation, encompassing bovine, ovine, caprine, and exotic hides, is fundamental as each source material possesses distinct physical characteristics—bovine offers thickness and tensile strength for automotive and heavy goods, whereas ovine (sheep/lamb) provides softness and flexibility suitable for garments and gloves. Product type analysis distinguishes between raw, salted, pickled, wet blue, and wet white conditions, reflecting various stages of preservation and pre-tanning processing, which dictate logistics, storage needs, and the subsequent tanning methodologies employed by buyers globally.

Analyzing the segmentation by product type is critical for assessing processing efficiency and trade logistics. The transition towards wet blue and wet white segments has been accelerating, driven by the desire to stabilize the raw material before long-distance shipping, thereby reducing freight costs associated with water content and minimizing the risk of bacterial degradation. Wet blue, stabilized using chromium salts, remains dominant due to its consistency and ease of re-tanning, although the environmentally sensitive wet white segment, which utilizes alternative, often organic, chemicals, is projected to witness the highest growth rate as tanneries globally seek less toxic input materials. This shift highlights a strong market signal favoring sustainability and reduced environmental impact in material handling.

Segmentation by application clarifies end-market demand dynamics; footwear continues to be the largest consumer of raw leather globally, requiring a diverse range of quality and texture grades for various shoe components (uppers, linings, soles). The automotive upholstery sector demands the highest quality, most consistent, and highly durable raw hides, often bovine, while the garment and accessories markets emphasize aesthetic appeal, softness, and light weight, favoring ovine and caprine hides. The furniture segment requires large, consistent panels of robust leather. Understanding these distinct needs allows suppliers and tanneries to tailor sourcing and initial processing methods specifically to maximize yield and value for the intended final product category, optimizing the highly resource-intensive initial stages of the value chain.

- By Source Type:

- Bovine Hides (Cattle, Calf, Ox)

- Ovine Skins (Sheep, Lamb)

- Caprine Skins (Goat, Kid)

- Porcine Skins (Pig)

- Exotic Hides (Reptiles, Others)

- By Product Type (Processing Stage):

- Raw Hides (Fresh/Green)

- Cured Hides (Salted, Brined, Dried)

- Pickled Skins

- Wet Blue Leather (Chrome Tanned Intermediate)

- Wet White Leather (Chrome-Free Intermediate)

- By Application:

- Footwear (Uppers, Linings, Soles)

- Automotive Upholstery (Seats, Interior Trim)

- Garments (Jackets, Gloves)

- Leather Goods and Accessories (Bags, Wallets, Belts)

- Furniture and Upholstery

- Others (Industrial, Bookbinding)

Value Chain Analysis For Raw Leather Market

The Raw Leather Market value chain begins with highly fragmented upstream activities centered on livestock farming and slaughterhouses, which constitute the primary source of hides and skins. Upstream analysis focuses on efficient collection, short-term preservation (such as salting or brining), and classification of raw hides based on quality, size, and source, often involving specialized hide collectors or dealers who consolidate volume from numerous suppliers. The quality of the raw hide is significantly influenced by animal husbandry practices, feed quality, and slaughter techniques. Critical steps in this phase include rapid transportation to ensure minimal microbial degradation, as raw hides are highly perishable, demanding robust cold chain logistics or immediate preservation treatments before shipment to major tanning clusters.

Midstream activities involve the primary processing and tanning, where raw hides are converted into stable, usable leather. This is the most resource-intensive step, involving depilation, liming, fleshing, pickling, and the critical tanning process (chrome or vegetable). Distribution channels are bifurcated into direct and indirect routes. Direct sales often involve large integrated companies that own both slaughterhouses and tanneries, supplying specialized end-users like premium automotive manufacturers under long-term contracts. Indirect channels rely heavily on global traders, distributors, and agents, particularly for cross-border trade of partially processed goods like wet blue leather, facilitating the movement of material from primary producing countries (e.g., Brazil, USA) to processing hubs (e.g., China, Italy). Downstream activities focus on the fabrication of final goods, where tanneries supply finished leather to manufacturers in the footwear, garment, and luxury accessories sectors, often demanding just-in-time delivery and highly customized finishes.

The efficiency of the distribution system is paramount, necessitating specialized cold storage infrastructure and regulatory compliance expertise for international shipment of animal-derived products. Digital platforms and B2B marketplaces are increasingly utilized to streamline transactions and improve transparency between suppliers and buyers globally. Vertical integration, while complex, offers superior quality control and predictability, particularly in specialized high-grade leather markets. However, the majority of the market relies on robust indirect channels that manage the logistics, financial risks, and quality assurance necessary to link diverse sources across continents with centralized manufacturing and finishing centers in key consumption regions.

Raw Leather Market Potential Customers

Potential customers for raw leather primarily consist of industrial tanneries and specialized leather processors who purchase the material in its raw, cured, or semi-processed state (e.g., wet blue or wet white) for conversion into finished leather products. These buyers are differentiated based on their scale, technological capabilities, and the end-market they serve. Major tanneries, often concentrated in clusters in Italy, China, and India, require consistent, high-volume supply and focus on establishing long-term sourcing contracts to minimize supply chain volatility. Small-to-medium tanneries often specialize in niche, high-value leathers (e.g., exotic or vegetable-tanned) and prioritize sourcing for specific quality or ethical certifications, willing to pay a premium for verified provenance.

The end-user industries represent the ultimate consumers of the material, significantly influencing the demand for specific grades of raw leather. The footwear industry stands as the largest buyer, requiring diverse grades for different shoe parts, with a strong demand for bovine and caprine hides, balancing cost efficiency with wear resistance. Automotive manufacturers, through their specialized upholstery suppliers, demand pristine, large-surface-area bovine hides that meet strict regulatory standards for fire resistance, light fastness, and durability, representing a highly profitable segment. The garment and accessories sectors, including major fashion houses, prioritize aesthetics, lightness, and tactile quality, favoring lambskin and specialized calf hides, often dictating trends in leather finishes and colors, directly impacting tannery investment decisions.

Beyond the major sectors, other significant buyers include manufacturers of technical products like industrial gloves, safety apparel, and highly durable sporting goods, which necessitate leathers optimized for extreme performance characteristics. Furniture manufacturers, particularly those focusing on high-end residential and commercial furnishings, also consume substantial quantities of raw leather for upholstery, demanding consistent coloring and large, defect-free panels. The buying behavior across these customer segments is increasingly governed by sustainability metrics; therefore, customers increasingly demand verifiable evidence of ethical sourcing, waste management compliance, and the use of eco-friendly processing chemicals, pushing the market towards greater transparency and certified supply chains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.8 Billion |

| Market Forecast in 2033 | USD 85.9 Billion |

| Growth Rate | 6.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JBS Couros, Tyson Foods (Hide Division), PrimeAsia Leather Corporation, Tasman Leather Group, Pieles del Sur, Kings International Limited, China Leather Industry Association members, Pittards PLC, ISA TanTec, TFL Ledertechnik GmbH, Elmo Leather AB, Ecco Leather, Hermann Oak Leather Co., Nera Tanning, Pavoni, Leather Italia, Atlantic Leather, Al-Khazna Tannery, Heller-Leder GmbH, and Xingye Leather Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Raw Leather Market Key Technology Landscape

The technology landscape in the Raw Leather Market is primarily focused on achieving sustainability, enhancing material quality, and improving supply chain traceability, moving away from century-old processes. Key technological advancements are centered around chemical innovation, specifically the widespread adoption of chrome-free tanning agents (known as wet white processes) and biodegradable, vegetable-based tanning materials, drastically reducing the toxicity and environmental impact of wastewater discharge. Automation and robotics are increasingly applied in the initial stages—such as automated hide scraping, fleshing, and trimming—to improve yield consistency, reduce manual labor costs, and ensure higher quality material preparation before the complex tanning sequence begins, particularly in high-volume processing facilities.

Another crucial area is the implementation of advanced preservation and storage technologies to combat the perishable nature of raw hides. This includes sophisticated brine curing methods using optimized salt mixtures and low-temperature storage logistics, extending the shelf life of hides and enabling efficient global transport over longer distances without quality degradation. Furthermore, the integration of Industry 4.0 principles, including sensor technology, Internet of Things (IoT) devices, and data analytics, is optimizing tannery operations. These systems monitor chemical bath concentrations, temperature, and processing times in real-time, ensuring optimal resource utilization, minimizing chemical overdosing, and guaranteeing lot-to-lot consistency, which is vital for high-end automotive and luxury goods customers.

Traceability technology, incorporating RFID tagging, QR codes, and blockchain ledgers, is becoming a mandatory requirement, driven by consumer ethical concerns and strict European Union (EU) regulations regarding animal welfare and origin verification. These technologies enable precise tracking of the raw hide from the farm of origin through every stage of processing. The goal is to provide irrefutable provenance data, thereby validating claims of ethical sourcing, compliance with deforestation-free policies, and adherence to environmental standards. Investment in effluent treatment technologies, such as membrane filtration and anaerobic digestion systems for sludge management, also represents a significant technological expenditure, aimed at achieving zero liquid discharge (ZLD) mandates in environmentally sensitive regions, ensuring the longevity and social license to operate for tanneries.

Regional Highlights

The Raw Leather Market exhibits pronounced regional disparities, driven by livestock populations, processing capabilities, and end-user market concentration. Asia Pacific (APAC) stands as the undisputed powerhouse, both in terms of raw hide processing capacity and final product consumption, largely dominated by China, India, and Vietnam. This region benefits from lower labor costs, proximity to vast consumer markets, and well-established infrastructure for high-volume manufacturing of footwear and leather goods. Countries like China not only process domestically sourced hides but also import massive volumes of wet blue and raw hides from major livestock-producing nations in the Americas and Australia to feed their extensive tanning and manufacturing operations, ensuring APAC's continued global market leadership throughout the forecast period.

Europe, particularly Italy, is recognized less for raw material sourcing and more for its premium finishing expertise, setting global standards for high-quality, fashion-forward, and ethically sourced leathers. European tanneries often specialize in highly sophisticated vegetable tanning and produce smaller volumes of luxury-grade finished leather destined for high-fashion houses and elite automotive brands. The European market, however, is characterized by the world’s most stringent environmental regulations (e.g., REACH), compelling intensive technological investment in pollution control and favoring suppliers who can provide certified, low-impact, or organic raw materials. This focus on sustainability and quality over volume defines Europe’s unique and influential market position.

North America and Latin America are critical raw material exporters. The US and Brazil are among the world's largest bovine hide producers, capitalizing on their massive beef industries. Brazil’s raw leather sector is highly efficient in producing large volumes of raw and wet blue hides for export, often destined for APAC processing centers. The North American market, while a net exporter of raw hides, maintains a stable domestic demand for high-quality finished leather used in furniture and domestic automotive manufacturing. Meanwhile, the Middle East and Africa (MEA) offer growth opportunities, especially in countries like Ethiopia and South Africa, which possess significant livestock populations and are gradually developing localized, value-added processing capabilities aimed at regional consumption and specialty exports like exotic skins, though these markets currently face challenges related to political instability and inadequate infrastructure.

- Asia Pacific (APAC): Dominant hub for raw leather processing and manufacturing of finished goods (footwear, garments); characterized by massive import volumes of raw and intermediate hides; China and India are the primary market drivers.

- Europe: Focuses on premium, specialized, and highly certified leather finishing (e.g., Italy); characterized by stringent environmental regulations (REACH) and high demand for sustainable and traceable raw materials for the luxury market.

- North America: Key supplier of high-quality bovine hides due to the large cattle industry (US); stable domestic consumption for automotive and furniture upholstery, driving demand for heavy-duty grades.

- Latin America: Major global exporter of raw and wet blue hides (Brazil, Argentina); market growth is strongly linked to global meat production cycles and international trade dynamics; critical for global commodity supply.

- Middle East and Africa (MEA): Emerging market with significant livestock resources (Ethiopia, South Africa); potential for growth through localized processing investments, but currently constrained by infrastructural limitations and trade complexities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Raw Leather Market.- JBS Couros (Brazil/Global)

- Tyson Foods, Inc. (Hide Division, USA)

- PrimeAsia Leather Corporation (Hong Kong)

- Tasman Leather Group (New Zealand/Australia)

- Pieles del Sur S.A. (Argentina)

- Kings International Limited (India)

- Pittards PLC (UK)

- ISA TanTec (USA/Global)

- TFL Ledertechnik GmbH (Germany)

- Elmo Leather AB (Sweden)

- Ecco Leather (Netherlands/Global)

- Hermann Oak Leather Co. (USA)

- Nera Tanning (Italy)

- Pavoni S.p.A. (Italy)

- Leather Italia (China/USA)

- Atlantic Leather (Iceland)

- Al-Khazna Tannery (UAE)

- Wolverine World Wide Inc. (USA)

- Heller-Leder GmbH (Germany)

- Xingye Leather Technology Co., Ltd. (China)

Frequently Asked Questions

Analyze common user questions about the Raw Leather market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Raw Leather Market?

Market expansion is primarily driven by the escalating demand from the global luxury goods and automotive sectors, particularly in Asia Pacific, coupled with leather’s intrinsic properties of durability, quality, and aesthetic appeal. Technological advancements in preservation and sustainable processing techniques also contribute significantly to reducing waste and improving supply chain efficiency.

How do environmental regulations impact the cost structure of raw leather processing?

Stringent global environmental regulations, such as the EU’s REACH directives, necessitate substantial investment in advanced wastewater treatment facilities and the costly adoption of chrome-free (wet white) or vegetable tanning agents. This increases operational complexity and capital expenditure for tanneries, ultimately raising the wholesale price of processed leather and driving up the cost structure throughout the value chain.

Which segmentation segment holds the largest market share by source type, and why?

Bovine hides (cattle hides) command the largest market share by source type. This dominance is due to the enormous volume generated by the global beef industry, coupled with the superior size, thickness, and inherent strength of bovine leather, making it the preferred raw material for high-volume applications like automotive upholstery, durable footwear, and furniture.

What is the role of Wet Blue and Wet White in international Raw Leather trade?

Wet Blue (chrome-tanned) and Wet White (chrome-free) are semi-processed forms of raw leather that are stable and less perishable than raw hides. They dominate international trade as they simplify logistics, reduce freight costs by eliminating excess water weight, and allow processing tanneries globally to import pre-stabilized material for final finishing, optimizing the supply chain efficiency.

How is technological integration, such as AI and Blockchain, being utilized in the raw leather supply chain?

AI and Blockchain are increasingly utilized to enhance supply chain transparency and traceability. Blockchain ensures immutable records of provenance, confirming ethical sourcing and animal welfare standards from farm to tannery. AI systems are deployed for automated hide grading, quality defect identification, and predicting material supply/pricing volatility, optimizing resource utilization and minimizing inventory spoilage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager