Razor Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433809 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Razor Blade Market Size

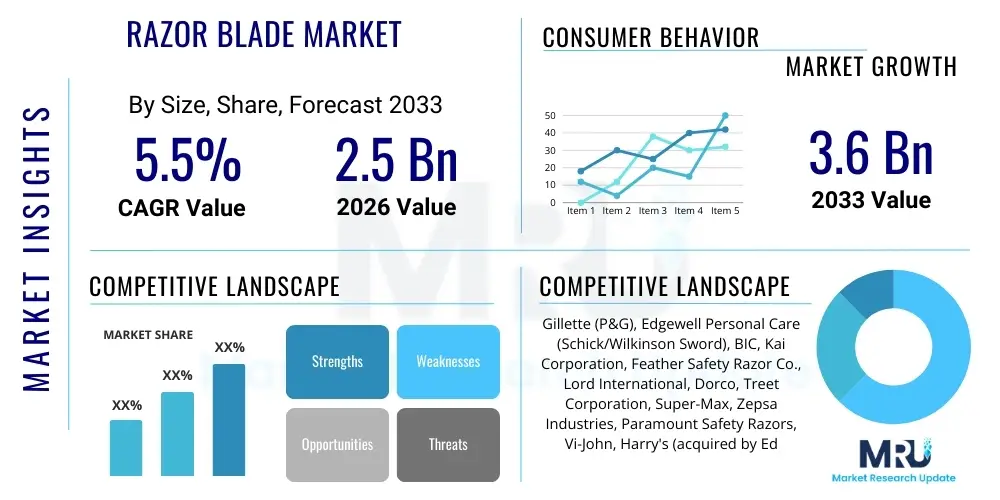

The Razor Blade Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% CAGR between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033. This consistent growth is primarily driven by expanding global populations, heightened consumer awareness regarding personal hygiene and grooming standards, and the continual innovation in blade technology focused on reducing irritation and increasing longevity. Market expansion is particularly noticeable in emerging economies where rising disposable incomes facilitate the adoption of branded and technologically advanced shaving products over traditional methods.

Razor Blade Market introduction

The Razor Blade Market encompasses the manufacturing, distribution, and sale of sharp metal implements used primarily for removing unwanted body hair, known broadly as shaving. Products range from low-cost disposable plastic razors with integrated blades to highly sophisticated multi-blade cartridge systems and specialized professional tools like straight razors or safety razors. Key applications span personal grooming (shaving facial hair, legs, and other body parts), specialized medical preparation (pre-surgical site cleaning), and, less commonly, specific industrial cutting tasks. The major benefits delivered by modern razor blades include speed, closeness of shave, minimizing skin irritation through lubrication strips and flexible heads, and ensuring portability and ease of use, making them an indispensable element of daily personal care routines across the globe.

Driving factors for the market include demographic shifts, specifically the growing youth population entering the shaving age bracket, and the pervasive influence of social media trends emphasizing aesthetic perfection and meticulous personal presentation. Moreover, manufacturers continually introduce high-value products, such as five-blade systems, precision trimmers, and subscription services, which maintain consumer engagement and elevate the Average Selling Price (ASP). The foundational technology rests upon metallurgy, specifically high-quality stainless steel and carbon steel, treated with advanced coatings like chromium, ceramic, or polytetrafluoroethylene (PTFE) to enhance durability, sharpness retention, and smoothness of glide.

Razor Blade Market Executive Summary

The global Razor Blade Market is characterized by intense competition, high barriers to entry due to necessary capital investment in precision manufacturing, and a strong dominance of established multinational corporations. Current business trends heavily favor the Direct-to-Consumer (DTC) model, facilitated by subscription services that ensure recurring revenue and foster deep brand loyalty, challenging the traditional retail monopoly previously held by market leaders. Regional trends indicate that Asia Pacific (APAC) is the fastest-growing geographical segment, propelled by immense population density, urbanization, and rapid expansion of middle-class consumers adopting Western grooming habits. Meanwhile, North America and Europe remain high-value markets, emphasizing premiumization, eco-friendly materials, and technologically superior features.

Segment trends reveal a significant bifurcation in consumer preference. While disposable razors maintain a large volume share, particularly in developing markets or for travel convenience, the replaceable cartridge segment commands the highest revenue share due to the associated recurring purchases and higher pricing of advanced multi-blade systems. Furthermore, there is a resurgence of traditional shaving methods, driven by millennials and Gen Z seeking a more ritualistic, sustainable, and less irritating shave, thereby boosting the niche segments of safety razors and straight razors. Sustainability is a critical emerging trend across all segments, pressuring manufacturers to minimize plastic usage and explore recycling programs for spent blades and handles.

AI Impact Analysis on Razor Blade Market

User queries regarding the impact of Artificial Intelligence (AI) on the Razor Blade Market predominantly center on how technology can personalize the shaving experience, optimize complex manufacturing processes, and revolutionize the supply chain. Users are keenly interested in predictive analytics for inventory management, personalized subscription box curation based on usage patterns and skin sensitivity, and the potential for AI-driven robots in precision grinding and quality control of ultra-sharp edges. The primary concerns revolve around job displacement in factory settings and data privacy associated with sophisticated consumer usage tracking implemented by subscription services utilizing AI algorithms. The overarching expectation is that AI will move the market toward hyper-efficient production and highly individualized consumer offerings, moving away from a one-size-fits-all product strategy.

AI’s role is becoming indispensable in analyzing vast datasets generated by e-commerce platforms and Direct-to-Consumer models. This data allows for precise demand forecasting, minimizing stockouts or overstocking—a critical challenge given the low margin, high-volume nature of disposable products. Moreover, AI algorithms are being integrated into augmented reality (AR) apps developed by key players, helping consumers determine the optimal blade type and handle ergonomics based on specific hair density and skin type, thereby improving customer satisfaction and reducing return rates. In manufacturing, machine learning models analyze video feeds from high-speed production lines to detect microscopic imperfections on blade edges, ensuring consistent quality that human inspection might miss, thereby significantly enhancing product safety and performance.

- AI-driven personalized subscription management based on consumption rates and skin profile analysis.

- Predictive maintenance and quality control in manufacturing using machine vision and machine learning models for defect detection.

- Optimization of global supply chain logistics, inventory positioning, and route planning to reduce costs and delivery times.

- Enhanced consumer engagement via AI chatbots and personalized recommendations for associated grooming products (creams, aftershaves).

- Development of smart devices that track shaving pressure and technique, feeding data back to AI models for customized user coaching.

DRO & Impact Forces Of Razor Blade Market

The Razor Blade Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces. Key drivers include the universal need for personal hygiene, rising aesthetic standards globally fueled by media influence, and increasing disposable income, especially in the developing Asia Pacific region. However, the market faces substantial restraints, primarily concerning environmental sustainability due to the immense volume of non-recyclable plastic and metal waste generated by disposable razors and cartridges. Furthermore, the market structure is highly monopolistic, making it difficult for new entrants to compete against established brand recognition and distribution networks. Opportunities arise from technological advancements, such as the introduction of specialized hypoallergenic coatings, the expansion of the high-margin women's grooming segment, and the continued shift towards flexible, recurring revenue DTC models that capture customer lifetime value.

The primary impact force remains technological innovation. Companies must continuously invest in materials science and precision engineering to produce sharper, longer-lasting, and safer blades. Failure to innovate leads to rapid market share erosion, given the high level of brand switching potential when a superior product offering emerges. The secondary impact force is consumer activism regarding sustainability; brands failing to address the plastic waste crisis risk significant reputational damage and consumer boycotts, particularly among environmentally conscious younger demographics in Western markets. The third major force is price elasticity; while premium products command high margins, a large segment of the global population is highly sensitive to price, meaning competition remains fierce in the value segment, necessitating extreme operational efficiency to maintain profitability.

Segmentation Analysis

The Razor Blade Market is meticulously segmented based on product type, material composition, end-user demographic, and distribution channel, reflecting diverse consumer needs and purchasing behaviors globally. The product segmentation, covering disposable, cartridge, and traditional razors, demonstrates the dual demand for convenience (disposable) and performance/quality (cartridge systems). Material segmentation highlights the shift from basic carbon steel to highly durable, corrosion-resistant stainless steel, often treated with advanced coatings for enhanced glide. End-user demographics clearly distinguish between the dominant men's shaving market and the rapidly expanding, yet often higher-priced, women's depilation market, which requires specific ergonomic and aesthetic designs. Distribution is undergoing a massive transformation, with the high-margin, flexible e-commerce and subscription segment rapidly displacing traditional reliance on hypermarkets and pharmacies.

- By Product Type:

- Disposable Razor Blades

- Replaceable Cartridge Razor Blades (The highest revenue generator)

- Safety Razor Blades (Traditional double-edge blades)

- Straight Razor Blades (Professional use and niche enthusiasts)

- By Material:

- Stainless Steel Blades

- Carbon Steel Blades

- Platinum Coated Blades

- Ceramic Blades (Emerging)

- By End-User:

- Men

- Women

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Drug Stores

- E-commerce (including Brand Websites and Subscription Models)

Value Chain Analysis For Razor Blade Market

The Razor Blade Market value chain is highly complex, starting with the specialized procurement of high-grade steel, which requires stringent quality control given the necessity for ultra-sharp, thin, and durable edges. Upstream analysis involves sourcing steel alloys (typically martensitic stainless steel) and securing specialized coating materials (Teflon, platinum). Manufacturing represents the most significant value-add step, encompassing precision stamping, specialized grinding, honing, and advanced coating deposition processes like Physical Vapor Deposition (PVD) to ensure blade performance and longevity. This capital-intensive stage acts as a high barrier to entry for potential competitors, as expertise in micro-engineering is essential.

Downstream analysis focuses heavily on marketing and distribution. Given that razor blades are consumable, frequently purchased goods, effective distribution channels are paramount. The traditional channels involve large-scale logistics to supply hypermarkets and pharmacies globally, demanding strong relationships with major retailers. However, the rapidly expanding DTC model bypasses much of the traditional retail markup, transferring margin back to the manufacturer while providing valuable consumer data. Both direct (online subscription boxes) and indirect (mass retail) channels are utilized, but the industry is seeing a notable strategic shift towards prioritizing direct sales to control pricing, branding, and customer experience, minimizing the risk of counterfeit products and maximizing customer lifetime value.

The efficiency of the value chain is increasingly determined by the intellectual property surrounding blade geometry and coating technology, rather than merely the cost of raw materials. Successful companies optimize their supply chain to be lean and highly responsive to demand fluctuations, particularly those driven by promotional activities or seasonal gifting. This necessitates robust integration between manufacturing capacity planning and demand forecasting, often utilizing AI tools to maintain optimal stock levels across geographically dispersed markets, while ensuring strict adherence to global health and safety regulations pertinent to consumer products intended for skin contact.

Razor Blade Market Potential Customers

Potential customers for the Razor Blade Market are broadly categorized into personal consumers, professional service providers, and niche industrial or medical segments. The largest and most visible segment consists of personal consumers aged 15 and above engaging in routine body hair removal, predominantly encompassing facial shaving for men and leg/underarm/bikini shaving for women. Within this demographic, there is segmentation based on purchasing power: those seeking maximum value opt for low-cost disposables, while affluent consumers drive demand for premium, multi-blade systems and traditional high-end safety razors, often marketed as a luxury or sustainable lifestyle choice.

Professional customers form the second key segment. This includes barbershops, hair salons, and specialized aesthetic clinics that require highly sterile, single-use, or reusable-with-disposable-blade razors (like shavettes) for precision work. In the professional setting, performance consistency, hygiene standards, and reliability are prioritized over cost, driving demand for specific high-quality products. Additionally, medical facilities represent a niche but critical market, where sterile disposable blades are necessary for pre-operative shaving procedures, often requiring specialized designs that minimize skin micro-abrasions and infection risk.

The market also heavily targets customers through the concept of "ritual" and "self-care," appealing to younger consumers who prioritize experiences and detailed grooming routines. This has led to the successful marketing of high-end accessories, specialized creams, and personalized kits, effectively converting the routine task of shaving into a premium, recurring expenditure. The market’s resilience stems from the non-discretionary nature of personal hygiene, ensuring a stable baseline demand despite economic fluctuations, although consumer spending may shift between premium and value brands based on economic confidence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gillette (P&G), Edgewell Personal Care (Schick/Wilkinson Sword), BIC, Kai Corporation, Feather Safety Razor Co., Lord International, Dorco, Treet Corporation, Super-Max, Zepsa Industries, Paramount Safety Razors, Vi-John, Harry's (acquired by Edgewell), Shave-Lab, OneBlade, Rockwell Razors, Persona, Tiger Blades, Astra, QShave. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Razor Blade Market Key Technology Landscape

The technology landscape in the Razor Blade Market is highly advanced and focuses on two core aspects: metallurgy and ergonomics. Metallurgical innovation centers on producing thinner, stronger, and more flexible stainless steel that can be sharpened to microscopic precision. Key technologies include advanced hardening and annealing processes to optimize the crystal structure of the steel, ensuring the blade maintains its integrity and sharpness over multiple uses. Furthermore, the application of multi-layer coatings is crucial; these coatings, often involving chromium, platinum, and PTFE (Teflon), are applied using processes like plasma deposition or PVD (Physical Vapor Deposition). These coatings minimize friction between the blade and the skin, enhancing glide, reducing irritation, and significantly prolonging the effective sharpness life of the blade, thereby justifying the premium pricing of cartridge systems.

Ergonomic innovation focuses on the razor head and handle design, particularly in multi-blade cartridge systems. Modern cartridges utilize sophisticated spring-mounted or pivoting head mechanisms designed to maintain optimal contact with the skin's contours, minimizing nicks and maximizing hair capture. The development of flexible elastomer fins preceding the blades helps to stretch the skin and lift hair follicles for a closer cut. Furthermore, lubrication strips integrated into the cartridge, which release moisturizing agents (like Aloe Vera or Vitamin E) upon contact with water, represent a chemical technology designed to soothe the skin during the shaving process. The continuous drive is towards creating products that offer the closest possible shave while reducing post-shave irritation, which is the primary consumer pain point.

Emerging technologies also involve the integration of sensor technology and IoT capabilities, particularly in high-end electric razor handles that pair with razor blades. While the blade itself remains a mechanical component, the handle can incorporate gyroscopes or pressure sensors to detect optimal shaving pressure, feeding data back to a smartphone application. This data aggregation is pivotal for subscription services to personalize recommendations and enhance the overall user experience. Sustainability technology is another critical area, focusing on developing handles from recycled or bio-based plastics, and optimizing cartridge design for easier disassembly, though fully recyclable razor blades remain a significant engineering challenge due to the composite nature of the final product (steel, plastic, coatings).

Regional Highlights

The global Razor Blade Market exhibits substantial regional variation in terms of market maturity, growth trajectory, and consumer preferences, warranting a customized strategic approach for manufacturers targeting global dominance. North America, characterized by high disposable income and established grooming routines, serves as a testbed for premium innovation and high-priced cartridge systems. The market here is mature but driven by the expansion of direct-to-consumer subscription services, which have successfully captured significant market share by offering convenience and competitive pricing against traditional retail giants. Consumers prioritize brand loyalty, performance (closeness and smoothness), and increasingly, environmental responsibility, forcing companies to implement recycling programs.

Asia Pacific (APAC) stands out as the engine of future market growth. Countries like China, India, and Indonesia possess vast populations, rapidly increasing urbanization, and a burgeoning middle class transitioning from traditional, low-cost methods (like basic safety razors) to more convenient, aspirational products such as disposable and modern cartridge systems. Economic growth, coupled with the pervasive influence of global media setting higher aesthetic standards, fuels demand, making APAC the region with the highest volume potential and fastest CAGR. Distribution challenges remain due to fragmented retail structures, but the explosive growth of e-commerce platforms is rapidly overcoming these hurdles.

Europe represents a high-value market defined by stringent quality standards and a strong consumer emphasis on sustainability and traditional shaving heritage. Western European consumers often prefer high-quality, long-lasting products, leading to a significant presence for both premium cartridge brands and niche traditional safety razor manufacturers. Regulatory adherence regarding material safety and environmental impact is stricter here than in other regions. Meanwhile, Latin America and the Middle East & Africa (MEA) present varied markets, generally characterized by high price sensitivity but also growing demand for entry-level and mid-range disposable and cartridge options, driven by population growth and modernization of personal care habits.

- North America: Mature market, dominated by cartridge systems and premium DTC brands, high adoption rate of sustainability initiatives and technological features.

- Europe: Focus on premiumization, traditional shaving revival (safety razors), and strict adherence to environmental and material safety regulations.

- Asia Pacific (APAC): Fastest-growing market due to demographic dividend, urbanization, and rising disposable incomes; significant shift from traditional methods to disposable/cartridge razors.

- Latin America: Price-sensitive market with strong demand for value-for-money disposable razors, gradually adopting mid-range cartridge systems.

- Middle East & Africa (MEA): Emerging markets with varying levels of development; growth driven by hygiene awareness and expanding retail infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Razor Blade Market.- Gillette (Procter & Gamble)

- Edgewell Personal Care (Schick/Wilkinson Sword)

- BIC

- Kai Corporation

- Feather Safety Razor Co.

- Lord International

- Dorco

- Treet Corporation

- Super-Max

- Zepsa Industries

- Paramount Safety Razors

- Vi-John

- Harry's

- Shave-Lab

- OneBlade

- Rockwell Razors

- Persona

- Tiger Blades

- Astra

- QShave

Frequently Asked Questions

Analyze common user questions about the Razor Blade market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Razor Blade Market?

The primary driver is the increasing global emphasis on personal grooming standards and aesthetics, coupled with demographic expansion (rising youth population) and the success of subscription-based Direct-to-Consumer (DTC) models that ensure convenient recurring purchases, thereby increasing customer lifetime value.

Which segmentation product type holds the largest revenue share in the market?

The replaceable cartridge razor blade segment commands the largest revenue share due to their higher average selling price (ASP), the need for frequent replacement cartridges, and the continuous technological innovation (multi-blade systems, lubrication strips) which justifies premium pricing compared to basic disposables.

How is sustainability impacting razor blade manufacturing and consumer choice?

Sustainability is a critical restraint and opportunity; consumers are demanding reduced plastic usage. Manufacturers are responding by using recycled materials for handles, establishing blade recycling programs, and promoting durable, reusable safety razors, particularly in environmentally conscious markets like Europe and North America.

What role does the Asia Pacific region play in the future market outlook?

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally due to its vast population base, rapidly increasing disposable incomes, and the ongoing shift among consumers from traditional methods to modern, convenient, and aspirational shaving products like multi-blade cartridges.

What is the significance of advanced coatings like PTFE and Platinum on razor blades?

Advanced coatings, such as Polytetrafluoroethylene (PTFE) and Platinum, are applied to high-end razor blades to significantly reduce friction against the skin, allowing for a smoother, less irritating shave, and crucially, protecting the micro-fine cutting edge from rapid corrosion, thereby extending the effective life of the blade.

What distinguishes safety razors from cartridge systems in terms of consumer appeal?

Safety razors appeal to consumers seeking a traditional, highly precise, cost-effective, and sustainable shaving experience, as they use inexpensive, easily recyclable double-edge blades. Cartridge systems prioritize speed, convenience, flexibility (pivoting heads), and built-in lubrication, appealing to the broader market segment focused on quick, modern grooming.

How does the Direct-to-Consumer (DTC) model affect pricing strategy in the razor market?

The DTC model, exemplified by companies like Harry's and Dollar Shave Club, disrupts traditional retail pricing by minimizing middlemen costs, offering competitive subscription pricing, and utilizing consumer data to optimize product offerings and inventory, putting downward pressure on retail prices while increasing market accessibility.

Are disposable razors expected to be phased out due to environmental concerns?

While environmental concerns are intensifying, disposable razors are not expected to be phased out entirely in the short term, as they fulfill critical roles in value-sensitive markets, travel, and institutional/medical use where hygiene and low unit cost are paramount. However, market share growth will be constrained by stricter environmental regulations and consumer shifts toward reusable options.

What is the key technological challenge for manufacturers?

The key technological challenge is achieving the perfect balance between extreme sharpness and extended durability. This requires significant investment in advanced metallurgical research and proprietary coating techniques (like PVD and plasma coatings) to maintain a microscopic edge profile while resisting corrosion and mechanical stress during repeated use.

Which sector, men's or women's, is showing faster growth in product innovation?

While the men's segment remains the larger revenue generator, the women's grooming sector is experiencing faster product innovation and premiumization. Manufacturers are increasingly designing specialized ergonomic handles, distinct color palettes, and unique lubrication formulations specifically tailored to women's shaving habits and larger skin surface areas, commanding higher margins in the process.

How does AI contribute to supply chain efficiency in this market?

AI algorithms analyze historical sales data, promotional impacts, and seasonal trends to provide predictive demand forecasting with high accuracy. This allows manufacturers to optimize raw material procurement (steel) and finished product inventory positioning, minimizing logistical costs, reducing warehouse storage, and ensuring product availability across global distribution points.

What are the high barriers to entry for new companies in the razor blade manufacturing?

The high barriers include the substantial capital expenditure required for precision grinding and honing machinery, the need for deep intellectual property regarding blade geometry and coating technology, and the overwhelming dominance of established multinational brands (like P&G and Edgewell) with entrenched global distribution networks and massive marketing budgets.

What are the major raw materials utilized in modern razor blade production?

The primary raw material is high-carbon or stainless steel (typically specialized martensitic grades for superior hardness). Secondary but critical materials include various polymers for the plastic handle and cartridge housing, and specialized chemical coatings such as PTFE (Teflon), chromium, and platinum used to enhance blade performance and corrosion resistance.

How significant is the influence of social media on razor blade consumer behavior?

Social media significantly drives consumer behavior by amplifying aesthetic trends, promoting detailed grooming routines (self-care), and enabling micro-influencers to advocate for niche products like safety razors or specific subscription services. This platform is crucial for building brand identity among younger, digitally native demographics.

What is the difference between a safety razor and a straight razor?

A safety razor (or double-edge razor) uses a single, disposable, protected blade and is designed for safe home use. A straight razor uses a long, permanently affixed blade that must be manually sharpened (honed and stropped) and is generally used by professional barbers or highly skilled enthusiasts due to the high skill requirement and risk of injury.

What challenges do razor blade companies face in Latin America?

Razor blade companies in Latin America primarily face challenges related to economic volatility affecting consumer spending power, leading to strong price sensitivity. Additionally, fragmented distribution networks outside major metropolitan areas necessitate significant investment in localized supply chain solutions to effectively penetrate the market.

How are manufacturers ensuring consistent quality in mass production of razor blades?

Manufacturers ensure consistent quality through stringent quality control at every stage, involving sophisticated sensor technology and high-speed machine vision systems that inspect the blade edge profile for microscopic defects. Advanced automation and AI-driven monitoring systems ensure that grinding and coating parameters remain within ultra-tight tolerance limits across millions of units.

Why are safety razors often promoted as a more economical option in the long term?

Safety razors are economical because while the initial cost of the handle may be higher, the replacement blades (double-edge blades) are produced in high volumes, utilize minimal material, and lack the complex plastic molding of cartridges, making them significantly cheaper per unit compared to proprietary multi-blade cartridge systems.

How does the medical application segment differ from the personal grooming segment?

The medical segment requires razor blades designed primarily for pre-operative skin preparation, emphasizing sterility, minimized risk of micro-abrasions (to prevent infection), and usually demanding specific sterile packaging and regulatory compliance, differentiating them from mass-market grooming products focused on closeness and comfort.

What is the role of ergonomics in modern razor handle design?

Ergonomics in modern razor handle design focuses on improving grip, weight distribution, and maneuverability, ensuring comfort and control during use, especially when wet. Features like rubberized grips, optimal handle length, and weight are crucial for minimizing hand fatigue and maximizing the effectiveness of the cartridge system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Razor Blade Market Size Report By Type (Singlle Edge Razor Blades, Double Edge Razor Blades), By Application (Female, Male), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Double Edge Razor Blade Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Carbon Steel Blade, Stainless Steel Blade), By Application (Supermarket/Hypermarket, Convenience Stores, Specialist Stores, Online Retailers, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager