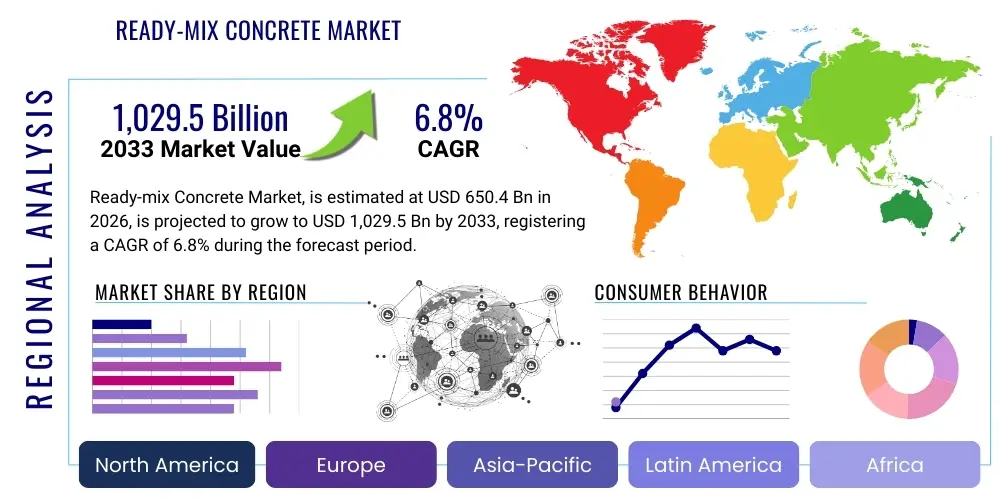

Ready-mix Concrete Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436324 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ready-mix Concrete Market Size

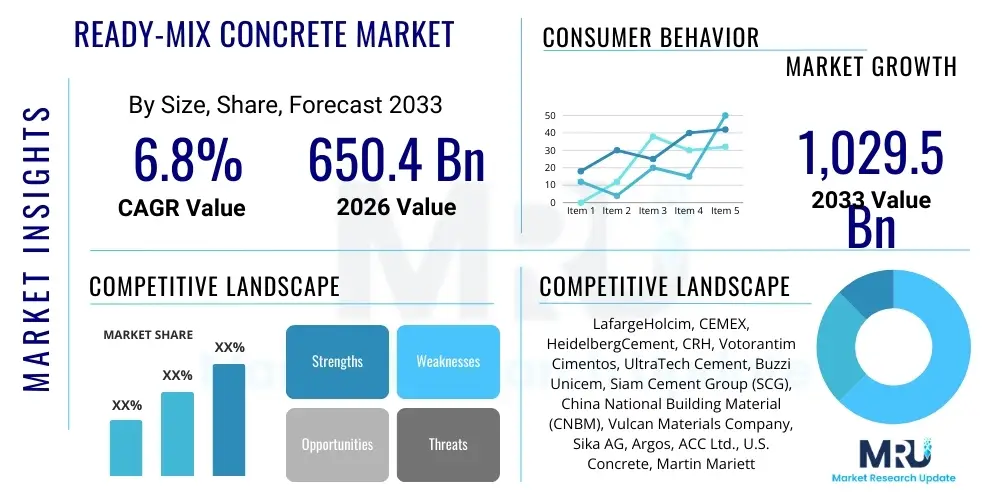

The Ready-mix Concrete Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650.4 Billion in 2026 and is projected to reach USD 1,029.5 Billion by the end of the forecast period in 2033.

Ready-mix Concrete Market introduction

Ready-mix concrete (RMC) is a construction material manufactured in a batching plant according to specific engineering specifications and delivered to the construction site in a plastic condition, usually in mixer trucks. Unlike site-mixed concrete, RMC offers superior quality control, reduced material wastage, and enhanced construction speed, making it the preferred choice for large-scale infrastructure and high-rise commercial projects globally. The product is essentially a composition of cement, aggregates (sand and gravel), water, and admixtures, batched in precise proportions to achieve predetermined performance characteristics such as strength, workability, and durability. The utilization of RMC mitigates logistical complexities at crowded urban construction sites, eliminating the need for on-site raw material storage and labor-intensive mixing processes, thereby contributing significantly to operational efficiency and site safety.

Major applications of RMC span across residential, commercial, and infrastructure sectors. In residential construction, RMC is crucial for foundations, slabs, and structural elements of multi-unit dwellings. For commercial applications, it is indispensable for towering structures, requiring high-strength and rapid-setting formulations. The infrastructure segment, encompassing roads, bridges, tunnels, airports, and dams, remains the largest consumer, driven by extensive government investments in public works. The primary benefits of RMC include consistency in quality, cost-effectiveness through minimized on-site labor, precise inventory management, and reduced environmental impact due to centralized dust and noise control at batching plants. This centralized production model ensures compliance with stringent quality standards and construction timelines, which is paramount in modern, complex engineering projects.

The market is primarily driven by rapid urbanization, particularly in emerging economies of the Asia Pacific region, necessitating robust and timely construction of housing and supporting infrastructure. Furthermore, increasing governmental emphasis on sustainable construction practices and the implementation of stricter building codes favoring certified, quality-assured materials are boosting RMC adoption over traditional site mixing. Technological advancements in admixture chemistry, allowing for enhanced performance characteristics like high fluidity or ultra-high strength, further broaden the scope of RMC applications in specialized construction. These factors collectively establish RMC as a foundational element in the global building industry, guaranteeing sustained growth throughout the forecast period.

Ready-mix Concrete Market Executive Summary

The Ready-mix Concrete (RMC) market is poised for significant expansion, underpinned by robust global construction spending and pivotal business trends centered around sustainability and digitalization. A major business trend involves the consolidation of smaller RMC suppliers by large multinational cement and construction materials conglomerates, aiming to optimize production capacity, streamline supply chains, and gain localized competitive advantages. Furthermore, there is a pronounced shift towards specialized and value-added RMC products, such as green concrete utilizing supplementary cementitious materials (SCMs), self-compacting concrete (SCC), and temperature-controlled mixes, catering to complex architectural demands and stringent environmental regulations. The integration of IoT and telematics in mixer trucks to optimize delivery logistics and ensure concrete freshness remains a critical area of technological investment for maximizing operational efficiency and improving customer service reliability.

Regionally, Asia Pacific continues to dominate the RMC market, fueled by massive government investments in smart cities, high-speed rail networks, and large-scale industrial park development in countries like China, India, and Southeast Asian nations. While developed markets like North America and Europe demonstrate slower volume growth, they lead in adopting premium, high-performance, and low-carbon concrete solutions, driven by aggressive decarbonization targets and mature regulatory frameworks promoting sustainable building practices. The Middle East and Africa region presents significant opportunistic growth, particularly in the Gulf Cooperation Council (GCC) states, where mega-projects related to economic diversification and global events mandate the use of high volumes of standardized RMC, although political and oil price volatility occasionally restrains sustained high growth.

Segment-wise, the Infrastructure application segment is expected to maintain its lead due to ongoing global commitments to refurbish aging transportation networks and develop new public utilities. In terms of RMC type, Transit Mixed Concrete holds the majority share owing to its flexibility and applicability across diverse project types, though Central Mixed Concrete is gaining traction for very large projects requiring exceptionally high-volume throughput and precise quality control. Trends indicate growing investment in automating batching plants to minimize human error and energy consumption, further bolstering the reliability and economic viability of high-quality RMC production, aligning the industry with the standards demanded by modern, efficiency-focused construction processes.

AI Impact Analysis on Ready-mix Concrete Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the RMC sector primarily revolve around supply chain optimization, predictive quality control, and automation within batching operations. Users frequently ask how AI can predict variations in raw material quality (especially aggregates), optimize complex delivery routes considering real-time traffic and setting time constraints (slump life), and reduce production inconsistencies that lead to waste. A core theme is the expectation that AI integration will lead to significant cost reductions through energy efficiency, material savings, and minimized delays on construction sites. Additionally, there is keen interest in using AI for real-time monitoring of concrete properties during transit and placement, ensuring structural integrity and longevity, thereby moving the industry toward a data-driven quality assurance model rather than reliance on post-placement testing.

AI technologies are being deployed to transform the RMC production and delivery cycle by enabling high-fidelity process optimization. Within batching plants, AI algorithms analyze sensor data from moisture meters, temperature probes, and weighing systems to make instantaneous adjustments to mix designs, compensating for natural variations in raw material inputs and environmental conditions. This capability minimizes batch-to-batch variability, which is critical for high-performance concrete specifications. Furthermore, AI-powered predictive maintenance models analyze historical equipment performance and operational parameters of mixers and conveyors to forecast potential mechanical failures, allowing for scheduled interventions rather than costly, unplanned downtime, ensuring continuous operation and maximizing plant utilization rates.

The profoundest impact of AI is observed in logistics and demand forecasting. Machine learning models analyze historical order data, weather patterns, local economic indicators, and seasonal trends to predict future RMC demand with high accuracy, enabling manufacturers to optimize raw material procurement and inventory levels. Concurrently, dynamic routing software utilizes deep reinforcement learning to navigate complex urban landscapes, factoring in delivery window requirements, potential bottlenecks, and the critical setting time of the concrete load. This intelligent dispatching minimizes fuel consumption, reduces truck idle time, and critically ensures the delivery of concrete before it loses optimal workability, thus guaranteeing timely construction progress and significantly enhancing overall operational reliability.

- AI optimizes batching processes by adjusting mix designs based on real-time raw material variability.

- Predictive maintenance driven by AI minimizes plant downtime and prolongs equipment lifespan.

- Machine Learning enhances demand forecasting, leading to optimized inventory and procurement strategies.

- AI-powered logistics systems optimize delivery routes considering traffic, weather, and concrete slump life.

- Computer vision and sensors utilize AI for non-destructive, real-time quality control during production and transit.

- AI facilitates the development of sustainable, specialized concrete formulations by analyzing large datasets of material interactions.

DRO & Impact Forces Of Ready-mix Concrete Market

The Ready-mix Concrete market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. Key drivers include aggressive infrastructure spending by governments globally, rapid urbanization demanding timely construction solutions, and the stringent adoption of building codes favoring standardized, quality-controlled materials like RMC. Conversely, the market faces significant restraints, notably the high transportation costs associated with the product’s weight and limited shelf life (workability window), and acute volatility in the prices of key raw materials, especially cement and aggregates. Opportunities are abundant in sustainable concrete innovations (geopolymer, carbon-capture technologies), digitalization of the supply chain, and expansion into developing regions where construction activity is accelerating but RMC penetration is currently low, presenting large untapped markets for structured growth.

The primary impact forces shaping the market trajectory relate strongly to regulatory pressures and technological advancements. Regulatory impacts manifest through mandates for green building certifications and sustainable procurement policies, effectively compelling RMC producers to invest in low-carbon alternatives and efficient production methods. Technological disruption, particularly the adoption of advanced sensor technology, IoT, and telematics, acts as a pivotal force by mitigating the traditional restraint of quality consistency and logistical inefficiency. These forces push the industry toward higher levels of service quality, precision delivery, and environmental stewardship. The cyclical nature of the construction industry and fluctuating interest rates on construction financing also exert a strong macroeconomic impact, influencing the pacing of large-scale project execution and, consequently, RMC demand volume.

Effectively navigating these forces requires strategic investment. Overcoming the restraint of transportation costs necessitates localized plant establishment and optimized fleet management facilitated by predictive analytics. Capitalizing on opportunities requires dedicated R&D towards specialty concrete formulations that command premium pricing and meet niche application demands, such as specialized mixes for extreme weather conditions or marine environments. The continuous pressure to decarbonize the construction sector ensures that RMC producers who integrate carbon capture technologies or significantly increase the use of sustainable SCMs will gain a competitive edge, transforming environmental compliance from a mere constraint into a powerful market differentiator and growth driver.

Segmentation Analysis

The Ready-mix Concrete market is comprehensively segmented based on product type, application, and geographical region, providing detailed insights into market dynamics and growth potential across various dimensions. Segmentation by type differentiates RMC based on the method of mixing and delivery, influencing its quality and suitability for specific project scales. Segmentation by application allows for the analysis of end-user demand across major sectors—Infrastructure, Commercial, and Residential—reflecting differing requirements for volume, strength, and durability. Understanding these segments is crucial for manufacturers to tailor their production capabilities and strategic marketing efforts, ensuring that specialized products are effectively deployed where technical specifications are most demanding.

The dominance of the Infrastructure segment highlights the correlation between public sector spending and RMC consumption, particularly in large-scale civil engineering projects that require high volumes of consistent material delivered over extended periods. Within the Product Type segmentation, Transit Mixed Concrete holds the largest share due to its versatility and lower initial capital outlay requirements compared to establishing large central batching plants, making it popular for moderate-sized urban projects. However, the fastest growth is observed in specialty concrete types, which include concrete designed for extreme chemical resistance, self-curing properties, or high early strength gain, demanded increasingly by specialized industrial and high-rise commercial structures requiring sophisticated materials engineering.

Geographical segmentation reveals stark contrasts in market maturity and growth potential. Mature markets in North America and Europe prioritize the quality and sustainability segments, driving demand for high-cost, high-performance RMC, while rapidly developing markets in Asia Pacific focus primarily on maximizing volume and speed to keep pace with explosive urbanization. This diverse demand profile necessitates a localized supply chain and differentiated product portfolio strategy for global RMC suppliers. The nuanced understanding derived from segmentation analysis facilitates precise resource allocation, risk mitigation concerning raw material sourcing, and targeted capacity expansion planning to meet anticipated regional demand surges efficiently.

- By Type

- Transit Mixed Concrete

- Shrink Mixed Concrete

- Central Mixed Concrete

- By Application

- Residential Sector

- Commercial Sector (Offices, Retail, Hospitality)

- Infrastructure (Roads, Bridges, Dams, Airports)

- Industrial Sector (Manufacturing Plants, Warehouses)

- By End-Use Scale

- Large Scale Projects

- Small and Medium Scale Projects

- By Strength Grade

- Low-Strength Concrete (M10 - M20)

- Standard Strength Concrete (M25 - M40)

- High Performance Concrete (M45 and above)

Value Chain Analysis For Ready-mix Concrete Market

The Ready-mix Concrete value chain initiates with the sourcing and processing of core raw materials—cement, aggregates (sand and gravel), water, and chemical admixtures. The upstream segment is characterized by complex procurement strategies due to the bulk nature of materials and their regional availability, which heavily influences production costs and market competitiveness. Cement, being the most critical and energy-intensive component, often determines the profitability of RMC operations, leading manufacturers to either integrate backward with cement production or secure long-term contracts with major cement suppliers. The quality assurance of aggregates is also crucial, requiring rigorous testing and processing before they enter the batching stage, ensuring compliance with strict engineering standards and preventing potential structural defects in the final product.

The midstream segment involves the centralized manufacturing process at the RMC batching plants. These plants are sophisticated facilities where raw materials are precisely weighed and mixed according to customized formulas. Operational efficiency in this segment is paramount, focusing on automated batching systems, energy optimization, and stringent quality control protocols. The integration of sensors and digital twin technology is becoming standard practice to monitor moisture content, temperature, and mixing time in real-time. The distribution channel, which immediately follows production, is highly critical due to the perishable nature of RMC. This relies heavily on a dedicated fleet of transit mixer trucks, often equipped with GPS and telematics, to deliver the concrete within the specified time frame (typically 90 minutes) and condition, maintaining the required slump and workability until placement.

The downstream segment includes direct and indirect sales channels serving construction contractors, developers, and government agencies. Direct sales dominate for large infrastructure and commercial projects where RMC producers work closely with site engineers to provide specialized mixes and logistical support. Indirect channels, such as local distributors or smaller partnerships, are sometimes utilized for smaller, localized residential projects. Successful downstream operations require exceptional customer service, reliable scheduling, and technical support on site regarding concrete placement and curing processes. This tight coupling between production, specialized logistics, and end-user technical support underscores the service-oriented nature of the RMC value chain, where reliability and timely delivery translate directly into competitive advantage.

Ready-mix Concrete Market Potential Customers

The primary end-users and buyers of Ready-mix Concrete are entities engaged in large-scale construction and infrastructure development across public and private sectors. The most significant customer base comprises general contractors specializing in commercial and residential high-rise construction, as RMC guarantees the speed, consistency, and structural integrity required for large, complex buildings in dense urban environments. These customers require high-volume, reliable supply chains, often demanding specialized concrete mixes (e.g., self-consolidating or high-early-strength mixes) to meet demanding schedules and specifications. Their procurement decisions are driven equally by price competitiveness, consistency of quality, and the supplier's logistical capability to handle large, time-sensitive deliveries, often involving multiple pours over numerous days.

Government bodies and public works agencies, through their appointed construction management firms, represent another crucial customer segment. These entities are responsible for developing major national infrastructure projects such as highways, railways, metro systems, bridges, power plants, and utility structures. For these long-term projects, RMC procurement emphasizes durability, adherence to rigorous standards, and environmental compliance, favoring suppliers who can demonstrate proven quality control and sustainability certifications (e.g., LEED requirements for low-carbon concrete). The sheer volume requirements of such projects often necessitate dedicated batching plants established near the construction site, creating a specialized customer relationship focused on consistent supply over several years.

Furthermore, specialized industrial customers, including precast manufacturers and firms building large industrial facilities like ports, manufacturing hubs, and chemical processing plants, constitute a growing segment. These buyers often require RMC with specific characteristics, such as extreme chemical resistance, thermal stability, or ultra-high strength for heavy-duty floor slabs and machine bases. The increasing trend of residential developers focusing on planned communities and high-density housing also secures them as consistent buyers, valuing the speed and standardized quality RMC provides over traditional site mixing, thus accelerating the market penetration into the standardized housing sector globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.4 Billion |

| Market Forecast in 2033 | USD 1,029.5 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LafargeHolcim, CEMEX, HeidelbergCement, CRH, Votorantim Cimentos, UltraTech Cement, Buzzi Unicem, Siam Cement Group (SCG), China National Building Material (CNBM), Vulcan Materials Company, Sika AG, Argos, ACC Ltd., U.S. Concrete, Martin Marietta Materials, Vicat S.A., InterCement, Kirby Building Systems, R.W. Sidley, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ready-mix Concrete Market Key Technology Landscape

The technological landscape of the Ready-mix Concrete market is rapidly evolving, moving towards advanced automation, precise quality assurance, and sustainable production methods. A core technological advancement is the integration of fully automated batching systems utilizing programmable logic controllers (PLCs) and sophisticated sensor networks. These systems ensure highly accurate measurement of raw materials, minimizing human error and maximizing batch-to-batch consistency. Furthermore, modern batching plants incorporate advanced moisture content measurement systems that automatically adjust the water-to-cement ratio in real-time, which is crucial for controlling the final concrete strength and workability, thereby guaranteeing compliance with demanding project specifications and significantly reducing material waste associated with off-spec batches.

Another critical area of innovation involves logistics and delivery technologies. GPS tracking systems and IoT devices are universally deployed across transit mixer fleets, enabling real-time monitoring of truck location, speed, and delivery status. More advanced applications include telematics systems that monitor the rotational speed of the mixing drum and the temperature of the concrete, ensuring that the material remains workable throughout the entire journey. Furthermore, the use of specialized chemical admixtures, including high-range water reducers (superplasticizers) and set retarders, allows RMC producers to precisely control the setting time and fluidity of the concrete, expanding the delivery radius and the complexity of projects RMC can service without compromising quality or safety standards, thereby enhancing market reach and operational versatility.

Sustainability-focused technologies are driving significant innovation, responding to global pressures to decarbonize construction materials. This includes the development and scaling of RMC containing high volumes of supplementary cementitious materials (SCMs) such as fly ash, slag, and calcined clay, which significantly reduce the clinker content and associated carbon footprint. Emerging technologies also include carbon capture and mineralization techniques (e.g., using CO2 curing), where captured industrial carbon dioxide is permanently sequestered within the concrete matrix, potentially transforming concrete into a carbon sink. These sustainable material innovations are critical for future market positioning, enabling producers to meet green building mandates and secure contracts for large, environmentally responsible infrastructure projects.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed leader in the Ready-mix Concrete market, primarily driven by unprecedented infrastructure development and rapid urbanization, especially in economies like China, India, and Indonesia. These nations are channeling massive government funds into smart city projects, housing for rapidly growing populations, and large-scale transportation networks (e.g., high-speed rail, metro expansions). The sheer volume demand, coupled with increasing regulatory pressure to adopt standardized, quality-assured construction materials over traditional site mixing, ensures APAC maintains the highest consumption rate and fastest growth trajectory globally. Manufacturers are aggressively expanding their batching plant networks in key metropolitan and industrial corridors to meet this continuous surge in demand.

North America and Europe represent mature markets characterized by replacement demand, renovation projects, and a strong focus on high-performance and specialty concrete. Growth in these regions is driven less by raw volume and more by technological sophistication and sustainability targets. European Union directives pushing for net-zero construction and circular economy principles compel RMC suppliers to prioritize the use of recycled aggregates and low-clinker cements, creating a competitive environment focused on innovation in green concrete and specialized high-strength mixes for civil engineering projects like wind turbine foundations and complex bridge structures. High labor costs and stringent safety regulations further reinforce the necessity of RMC’s centralized, automated production model.

Latin America (LATAM) and the Middle East & Africa (MEA) regions present dynamic, high-potential markets. LATAM's growth is often localized, dependent on national economic stability and major public works initiatives in countries like Brazil and Mexico. The MEA market, particularly the Gulf Cooperation Council (GCC) states, is characterized by large, immediate-term mega-projects (e.g., Saudi Arabia’s NEOM, UAE’s urban expansion), which generate enormous short-to-medium-term RMC demand, requiring suppliers to quickly mobilize high-capacity batching facilities. Although these markets face geopolitical risks, the long-term trend towards economic diversification away from oil ensures a sustained pipeline of infrastructure and commercial construction projects, maintaining strong demand for high-quality RMC solutions.

- Asia Pacific (APAC): Dominant market share and highest growth rate, driven by Chinese and Indian infrastructure spending and rapid urbanization.

- North America: Focus on high-performance RMC, sustainability compliance, and replacement of aging infrastructure.

- Europe: High adoption of green concrete, driven by stringent decarbonization goals and investment in energy-efficient buildings.

- Middle East & Africa (MEA): Significant demand spikes from urban mega-projects and economic diversification initiatives in GCC countries.

- Latin America (LATAM): Growth tied to major national infrastructure developments and housing shortages in key economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ready-mix Concrete Market.- LafargeHolcim (Holcim Group)

- CEMEX S.A.B. de C.V.

- HeidelbergCement AG

- CRH plc

- Votorantim Cimentos S.A.

- UltraTech Cement Ltd.

- Buzzi Unicem S.p.A.

- Siam Cement Group (SCG)

- China National Building Material (CNBM)

- Vulcan Materials Company

- Sika AG (Admixtures and specialty materials)

- Argos (Cementos Argos S.A.)

- ACC Ltd.

- U.S. Concrete (now part of Vulcan Materials Company)

- Martin Marietta Materials, Inc.

- Vicat S.A.

- InterCement S.A.

- Taiheiyo Cement Corporation

- Cosmos Cement

- Summit Materials, LLC

Frequently Asked Questions

Analyze common user questions about the Ready-mix Concrete market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the growth of the Ready-mix Concrete Market?

The market growth is primarily propelled by rapid urbanization, significant global government investments in large-scale infrastructure projects (roads, bridges, utilities), and the need for high-quality, standardized construction materials that expedite project timelines while adhering to strict building codes. Technological advancements in admixture chemistry also enable high-performance RMC formulations.

How do logistical challenges impact the competitiveness of Ready-mix Concrete suppliers?

Logistical efficiency is paramount due to RMC's limited setting time (slump life). High transportation costs, traffic congestion, and the need for precise timing constrain delivery radiuses. Suppliers overcome this through localized batching plants, sophisticated GPS tracking, and telematics systems to ensure timely, high-quality delivery, making reliable logistics a core competitive differentiator.

What role does sustainability play in modern Ready-mix Concrete production?

Sustainability is a major trend, focusing on reducing the high carbon footprint associated with cement production. RMC producers are increasing the use of supplementary cementitious materials (SCMs), utilizing recycled aggregates, and exploring carbon capture technologies (like CO2 mineralization) to meet global green building certifications and reduce the embodied carbon of construction projects.

Which application segment accounts for the highest demand for Ready-mix Concrete globally?

The Infrastructure application segment, including large-scale civil engineering projects such as public transit systems, highways, and utility development, accounts for the highest volume of RMC consumption globally, especially driven by long-term government spending in emerging and developed economies.

What is the projected Compound Annual Growth Rate (CAGR) for the Ready-mix Concrete Market?

The Ready-mix Concrete Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% over the forecast period from 2026 to 2033, driven by sustained global construction activity and increased adoption of standardized concrete solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ready-Mix Concrete Market Size Report By Type (Transit Mix Concrete, Central Mix Concrete, Shrink Mix Concrete), By Application (Commercial Building, Residential Building, Infrastructure, Industrial Utilities), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Ready-mix Concrete Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Transit Mixed Concrete, Shrink Mixed Concrete, Central Mixed Concrete), By Application (Residential Use, Commercial Use, Infrastructure Use, Industrial Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager