Reagent Grade Methyl Phenylacetate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434765 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Reagent Grade Methyl Phenylacetate Market Size

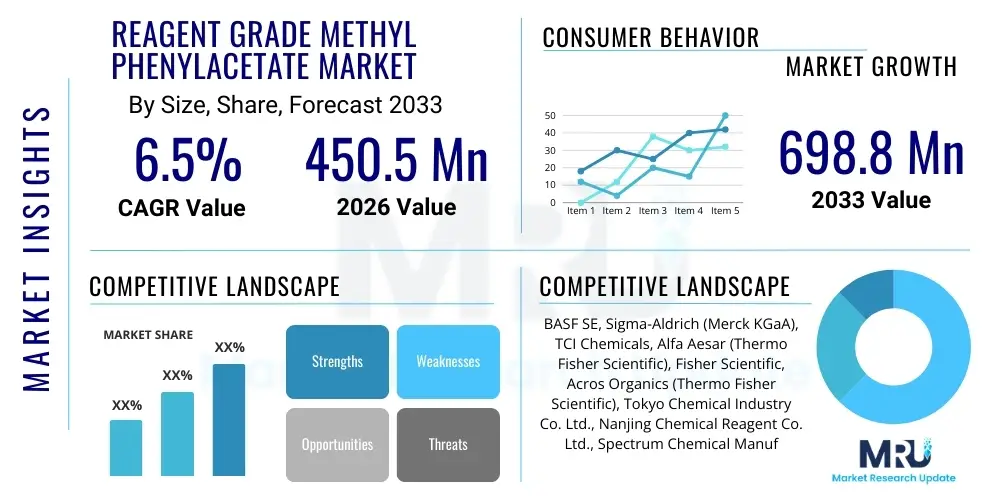

The Reagent Grade Methyl Phenylacetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 698.8 Million by the end of the forecast period in 2033.

Reagent Grade Methyl Phenylacetate Market introduction

Reagent Grade Methyl Phenylacetate (RGMPA) is a high-purity chemical compound recognized for its critical role as an intermediate in various fine chemical syntheses. Characterized by its specific molecular structure, it is primarily employed in pharmaceutical manufacturing, especially in the synthesis of specialized APIs, as well as in the flavor and fragrance industry where it contributes essential sweet, honey-like notes. The stringent requirement for high purity, often exceeding 99%, dictates its classification as 'reagent grade,' suitable for applications where minimal impurities are tolerated, such as analytical chemistry and high-stakes research and development activities. The inherent versatility and stability of RGMPA make it indispensable across sectors requiring precise chemical building blocks.

The market expansion for RGMPA is fundamentally driven by the accelerating demand from the global pharmaceutical sector, which utilizes this compound as a foundational component for various drug molecules, including certain pain management and anti-inflammatory agents. Furthermore, the persistent growth in the personal care and cosmetics industry sustains a robust demand for high-quality aromatic compounds, positioning RGMPA as a key ingredient for premium fragrance formulations. The increasing expenditure on advanced chemical research and the establishment of new dedicated R&D facilities, particularly in emerging economies, further solidify the market's trajectory. These factors collectively underscore the strategic importance of RGMPA within the specialized chemical supply chain, linking basic chemical production to complex downstream applications.

The key benefits derived from using RGMPA include its reliable chemical reactivity, its consistent high-purity profile which minimizes batch variation in final products, and its proven efficiency as a precursor in complex organic transformations. Major applications span from synthesizing key pharmaceutical intermediates, acting as a crucial building block in novel material development, to serving as an essential component in creating sophisticated synthetic floral and honey accords for perfumes and toiletries. Driving factors encompass the rising incidence of chronic diseases boosting API demand, evolving consumer preferences for personalized and high-quality fragrance products, and continuous technological advancements in catalytic synthesis methods which improve yield and reduce production costs for reagent grade materials.

Reagent Grade Methyl Phenylacetate Market Executive Summary

The Reagent Grade Methyl Phenylacetate market demonstrates robust growth, underpinned by favorable business trends focused on supply chain resilience and quality assurance. Global business strategies are shifting towards securing regionalized supply networks to mitigate geopolitical risks and ensuring compliance with increasingly strict global regulatory standards regarding chemical purity and handling. Technological advancements, particularly in continuous flow chemistry and enantioselective synthesis, are enabling manufacturers to achieve higher yields and consistent reagent grade quality more efficiently, thereby influencing competitive dynamics. Furthermore, strategic collaborations between chemical producers and major pharmaceutical CMOs (Contract Manufacturing Organizations) are becoming prevalent, securing long-term procurement contracts and stabilizing pricing structures across the specialized chemical segment.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, expansive growth in generic drug manufacturing, and substantial governmental investments in domestic chemical R&D infrastructure. North America and Europe, characterized by mature pharmaceutical and specialty chemical markets, maintain significant market share due to stringent quality requirements and established regulatory frameworks that favor high-grade reagents. These regions focus heavily on innovation, driving demand for the ultra-high purity (>99%) segment necessary for advanced clinical trials and specialized analytical applications. Meanwhile, Latin America and MEA are exhibiting high growth potential as local manufacturing capabilities develop, seeking reliable, imported RGMPA supplies to support nascent fine chemical industries.

Segmentation trends highlight a pronounced shift toward higher purity grades, specifically 99% and above, driven by the exacting standards of the pharmaceutical sector which demands minimal impurities for Active Pharmaceutical Ingredient (API) synthesis. Application-wise, the pharmaceutical intermediate segment remains the dominant consumer, although the flavor and fragrance segment shows steady, premiumized growth due to rising consumer spending on luxury items. Key segment drivers include the expanding scope of drug discovery programs globally, which necessitates diverse and high-quality chemical building blocks, and the trend toward personalized medicine requiring specialized small-batch synthesis supported by reagent-grade materials.

AI Impact Analysis on Reagent Grade Methyl Phenylacetate Market

Common user questions regarding AI's impact on the Reagent Grade Methyl Phenylacetate market primarily revolve around predictive synthesis capabilities, optimization of manufacturing processes, and quality control automation. Users are particularly keen to understand how AI-driven predictive modeling can shorten the drug discovery timeline that utilizes RGMPA, and how Machine Learning (ML) algorithms can be employed to optimize reaction conditions (temperature, pressure, catalyst load) to maximize the yield and purity of the reagent grade material, thus reducing batch-to-batch variability. There are also significant concerns about the integration costs of AI systems into existing chemical production facilities and the requirement for specialized data science skills within traditional chemical engineering teams. Users expect AI to revolutionize quality assurance by automating spectroscopic analysis (like high-throughput screening and impurity detection) far beyond current conventional methods, ensuring unparalleled consistency in the 'reagent grade' standard.

- AI-driven predictive modeling accelerates the identification of optimal synthetic routes for Methyl Phenylacetate derivatives, reducing R&D time.

- Machine Learning algorithms optimize reaction kinetics and purity profiles, ensuring consistent reagent grade quality (e.g., minimizing side product formation).

- Automation of spectroscopic analysis (e.g., using AI for interpreting HPLC and GC-MS data) enhances quality control and reduces human error in purity certification.

- AI optimizes supply chain logistics and inventory management for precursor chemicals, ensuring stable supply of raw materials necessary for RGMPA production.

- Predictive maintenance schedules, powered by AI, minimize downtime in chemical reactors, maximizing manufacturing throughput and efficiency.

DRO & Impact Forces Of Reagent Grade Methyl Phenylacetate Market

The market dynamics for Reagent Grade Methyl Phenylacetate are characterized by a strong interplay of positive drivers, structural restraints, and emerging opportunities, all shaping the competitive landscape and growth trajectory. The primary driver is the pervasive and sustained demand from the global pharmaceutical industry, which relies heavily on RGMPA as a high-purity intermediate for complex drug synthesis; this demand is further amplified by the expansion of clinical trials and API manufacturing capacity worldwide. Concurrently, the robust growth of the specialized flavor and fragrance sector, driven by consumer willingness to invest in premium aromatic products, ensures diversification of demand away from solely medical applications. These demand-side forces create continuous pressure on manufacturers to maintain both high output volumes and uncompromising purity standards.

However, the market faces significant restraints, chiefly stemming from the high regulatory barriers associated with producing and distributing reagent-grade chemicals. Compliance with global pharmacopoeia standards (USP, EP, JP) and stringent environmental regulations adds considerable complexity and cost to manufacturing processes, particularly concerning waste management and solvent recycling. Furthermore, the volatility of key raw material prices, such as Phenylacetic Acid and methanol, introduces cost instability, potentially squeezing profit margins for producers who must maintain competitive pricing while ensuring consistent high quality. These restraining factors necessitate substantial investment in advanced, compliant manufacturing technologies and robust risk management strategies to ensure operational continuity.

Opportunities for growth are primarily concentrated in two areas: geographical expansion into underpenetrated markets, such as developing countries in Southeast Asia and Africa, which are rapidly building their domestic pharmaceutical and fine chemical industries; and technological innovation focused on 'green chemistry.' The push for sustainable production methods, including the adoption of bio-based catalysts and solvent-free synthesis, offers manufacturers a competitive edge by reducing environmental impact and potentially lowering long-term operating costs. These opportunities, coupled with the increasing adoption of automated synthesis technologies, position the market for sustainable long-term expansion, provided that supply chain risks are effectively managed.

The impact forces influencing the RGMPA market are primarily dictated by the delicate balance between quality demand and manufacturing cost. Buyer bargaining power is moderate to high, particularly from large pharmaceutical companies that purchase in bulk and demand strict purity certifications and fixed pricing over multi-year contracts. Supplier bargaining power is also significant due to the specialized nature of raw material supply and the intellectual property surrounding high-yield synthetic routes. The threat of substitutes is low in high-end pharmaceutical applications where RGMPA's specific chemical structure is indispensable, but moderate in the flavor/fragrance sector where alternative aromatic compounds could be used. Finally, regulatory intensity acts as a high impact force, dictating market entry barriers and operational compliance for all participants.

Segmentation Analysis

The Reagent Grade Methyl Phenylacetate market is segmented based on Purity Level, Application, and End-User, reflecting the diverse and specialized requirements of its consumer base. Segmentation by Purity Level (e.g., 98%, 99%, >99%) is paramount, as purity directly correlates with the end-use application; pharmaceutical and analytical research demands the highest grade, while certain industrial syntheses may tolerate slightly lower levels. This segmentation highlights the premium pricing associated with ultra-high purity grades due to more complex purification processes and rigorous quality assurance protocols required.

Analysis of the Application segment reveals that Pharmaceutical Intermediates constitute the largest and most growth-intensive area, driven by global healthcare spending and drug development pipelines. The Flavor & Fragrance sector maintains a critical, albeit smaller, share, characterized by stable demand for high-quality aromatic components in consumer goods. Segmentation also allows manufacturers to tailor their production capabilities and marketing efforts, focusing specialized resources on meeting the stringent requirements of high-value markets, such as advanced chemical synthesis where unique derivative properties are explored.

The End-User segmentation provides insight into consumption patterns, differentiating between large-scale industrial consumers (Chemical Synthesis, Pharma Manufacturing) and specialized, lower-volume users (Academia and Government Research Labs). This distribution helps in understanding channel requirements, with industrial users typically relying on direct procurement and long-term contracts, while research labs utilize specialized chemical distributors. Understanding these segment dynamics is crucial for strategic planning, resource allocation, and maintaining a competitive edge through targeted product development and distribution strategies.

- By Purity Level:

- 98% Purity

- 99% Purity

- >99% Purity (Ultra-High Grade)

- By Application:

- Pharmaceutical Intermediates

- Flavor & Fragrance Synthesis

- Chemical Synthesis (General)

- Research & Development (R&D)

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Specialty Chemical Manufacturers

- Academic & Research Institutions

- Contract Manufacturing Organizations (CMOs)

Value Chain Analysis For Reagent Grade Methyl Phenylacetate Market

The value chain for Reagent Grade Methyl Phenylacetate begins with upstream activities involving the sourcing and refinement of key raw materials, primarily Phenylacetic Acid and Methanol. The quality and stable supply of these precursors are crucial, as they directly impact the final purity of the RGMPA product. Upstream complexity is further compounded by the need for reliable suppliers who can meet high volume demands while adhering to strict material specifications. Manufacturers in this stage focus on optimizing esterification processes, often utilizing specialized catalysts, to synthesize crude Methyl Phenylacetate efficiently.

The midstream stage centers on purification and certification. This is the most crucial step for achieving ‘Reagent Grade’ status, requiring advanced separation techniques such as fractional distillation, crystallization, or specialized chromatography to remove trace impurities and achieve purity levels of 99% or higher. Quality control (QC) protocols, including comprehensive analytical testing (e.g., HPLC, GC-MS), are rigorous and mandatory for compliance. Successful firms invest heavily in automation and QC infrastructure to minimize batch variance and secure necessary regulatory certifications for pharmaceutical applications.

Downstream activities involve the distribution channel and eventual consumption. Distribution channels are bifurcated into direct sales to large industrial end-users (like major pharmaceutical companies or high-volume flavor houses) via long-term contracts, and indirect sales through specialized chemical distributors who serve academic institutions, smaller R&D labs, and niche specialty manufacturers. End-users in the pharmaceutical sector typically integrate RGMPA into their API synthesis workflows, while fragrance companies blend it into their formulations. The efficiency of the distribution network, particularly the ability to handle chemical logistics safely and promptly, significantly influences the downstream profitability and customer satisfaction.

Reagent Grade Methyl Phenylacetate Market Potential Customers

The potential customer base for Reagent Grade Methyl Phenylacetate is highly specialized and spans several technically demanding sectors, all requiring high assurance of chemical purity and consistency. Pharmaceutical and biotechnology companies represent the largest and most valuable customer segment. Within this sector, the primary buyers are R&D departments engaged in drug discovery and process development, and manufacturing units that rely on RGMPA as a guaranteed high-quality intermediate for scaling up Active Pharmaceutical Ingredient (API) production. Their demand is driven by regulatory necessities, meaning any deviation in purity can halt multi-million dollar production runs or compromise clinical trials.

Another significant group of buyers includes specialty chemical manufacturers and Contract Manufacturing Organizations (CMOs). CMOs, in particular, serve as key intermediaries, purchasing large volumes of RGMPA to synthesize custom chemicals or specialized drug intermediates on behalf of pharmaceutical clients. Their business model depends on efficiency and quality compliance, making them loyal customers of suppliers capable of delivering consistent, certified reagent-grade material under tight timelines. Furthermore, the flavor and fragrance industry, specifically leading global fragrance houses, constitutes a steady customer base, utilizing RGMPA's aromatic properties in high-end cosmetic and consumer products, where quality dictates brand reputation.

Finally, academic institutions, government research laboratories, and specialized analytical service providers form a critical niche customer segment. These buyers require smaller, bespoke quantities but demand the highest possible purity (>99%) for highly sensitive analytical tests, calibration standards, and fundamental chemical research. Their procurement often relies on robust relationships with regional distributors who can provide detailed Certificate of Analysis (CoA) documentation and rapid, reliable delivery of various batch sizes. These groups often drive the adoption of new, ultra-high purity grades and novel applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 698.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Sigma-Aldrich (Merck KGaA), TCI Chemicals, Alfa Aesar (Thermo Fisher Scientific), Fisher Scientific, Acros Organics (Thermo Fisher Scientific), Tokyo Chemical Industry Co. Ltd., Nanjing Chemical Reagent Co. Ltd., Spectrum Chemical Manufacturing Corp., Wako Pure Chemical Industries, MP Biomedicals, Apollo Scientific, Parchem Fine & Specialty Chemicals, Santa Cruz Biotechnology, VWR International (Avantor). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reagent Grade Methyl Phenylacetate Market Key Technology Landscape

The production of Reagent Grade Methyl Phenylacetate relies fundamentally on classic esterification reactions, typically involving Phenylacetic Acid and Methanol under acidic catalysis. The key technological differentiators in the market, however, lie not in the initial synthesis but in the subsequent purification and quality verification stages necessary to meet 'reagent grade' standards. Advanced process optimization techniques, including the use of solid-acid catalysts or heterogeneous catalysts, are increasingly employed to improve reaction selectivity, minimize side product formation, and facilitate easier product separation, thereby reducing energy consumption and waste generation during the initial production phase.

To achieve ultra-high purity (>99%), manufacturers utilize sophisticated purification technologies. These include high-efficiency fractional distillation columns capable of separating compounds with extremely close boiling points, and large-scale preparative chromatography, particularly high-performance liquid chromatography (HPLC) or simulated moving bed (SMB) chromatography, which are essential for removing trace organic and metallic impurities critical to pharmaceutical standards. Investment in these technologies is capital intensive but necessary to service the highly regulated API market, where impurity profiles must be meticulously controlled to parts per million (ppm) levels. Furthermore, continuous flow chemistry is gaining traction, allowing for safer, faster, and more scalable production of intermediates while offering superior control over reaction parameters compared to traditional batch processing.

The quality control landscape is dominated by highly precise analytical instrumentation. Gas Chromatography-Mass Spectrometry (GC-MS) and High-Performance Liquid Chromatography (HPLC) are the industry standards for measuring purity and identifying trace impurities. Nuclear Magnetic Resonance (NMR) spectroscopy and Fourier-Transform Infrared (FTIR) spectroscopy are utilized for structural confirmation and verification of chemical identity. The adoption of Laboratory Information Management Systems (LIMS) and integration of automated sampling and testing protocols ensures that every batch of RGMPA receives verifiable documentation (Certificate of Analysis) that meets global regulatory benchmarks, crucial for maintaining the "reagent grade" classification and assuring customer confidence across all downstream applications.

Regional Highlights

The global Reagent Grade Methyl Phenylacetate market exhibits distinct growth patterns influenced by regional regulatory environments, industrial output, and R&D spending priorities.

- North America (NA): Characterized by a high demand for ultra-high purity grades driven by large pharmaceutical and biotechnology R&D centers, especially in the US. The market here is mature, highly regulated, and focused on innovative drug discovery. NA firms prioritize consistent quality and speed of supply, often paying a premium for materials certified under USP standards.

- Europe: Similar to North America, Europe maintains strict quality controls, led by standards set by the European Pharmacopoeia (EP). Germany, Switzerland, and the UK are key consumption hubs due to their leading positions in fine chemicals and advanced fragrance synthesis. Growth is driven by compliance and sustainability mandates, pushing demand toward suppliers utilizing green synthesis technologies.

- Asia Pacific (APAC): Represents the fastest-growing region, primarily fueled by the burgeoning manufacturing capacity in China and India. These countries are dominating the global generic drug market, requiring vast quantities of reagent-grade intermediates. Lower manufacturing costs and increasing investment in localized R&D facilities contribute significantly to market expansion, although quality assurance remains a critical competitive differentiator.

- Latin America (LATAM): This region is an emerging market with moderate demand, primarily focused on supporting local pharmaceutical production and agricultural chemical sectors. Market growth is gradually accelerating due to increased foreign direct investment into manufacturing capabilities, improving the logistics and supply chain efficiency for specialized chemical imports.

- Middle East and Africa (MEA): Currently holds the smallest market share, with consumption concentrated in high-income Gulf countries supporting nascent pharmaceutical and petrochemical industries. Growth is dependent on governmental initiatives to diversify economies away from oil and establish localized manufacturing bases for essential chemicals and drug production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reagent Grade Methyl Phenylacetate Market.- BASF SE

- Sigma-Aldrich (Merck KGaA)

- TCI Chemicals

- Alfa Aesar (Thermo Fisher Scientific)

- Fisher Scientific

- Acros Organics (Thermo Fisher Scientific)

- Tokyo Chemical Industry Co. Ltd.

- Nanjing Chemical Reagent Co. Ltd.

- Spectrum Chemical Manufacturing Corp.

- Wako Pure Chemical Industries

- MP Biomedicals

- Apollo Scientific

- Parchem Fine & Specialty Chemicals

- Santa Cruz Biotechnology

- VWR International (Avantor)

- Chem-Impex International

- Jinan Haohua Industry Co., Ltd.

- Aarti Industries Limited

- Ochem Inc.

- ChemScene

Frequently Asked Questions

Analyze common user questions about the Reagent Grade Methyl Phenylacetate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors classify Methyl Phenylacetate as 'Reagent Grade'?

Methyl Phenylacetate is classified as 'Reagent Grade' when its purity level consistently meets or exceeds defined analytical standards (typically 99% or higher), demonstrating minimal presence of impurities, solvents, or moisture, making it suitable for high-precision analytical and pharmaceutical synthesis applications.

Which application segment drives the highest demand for RGMPA globally?

The pharmaceutical intermediates segment drives the highest demand globally for Reagent Grade Methyl Phenylacetate, utilizing it as a foundational high-ppurity building block in the synthesis of specialized Active Pharmaceutical Ingredients (APIs) and critical drug precursors.

How does the volatility of raw material prices affect the RGMPA market?

Volatility in the prices of key precursor chemicals, particularly Phenylacetic Acid and Methanol, directly impacts the manufacturing cost and profit margins of RGMPA producers, often leading to fluctuating market prices and necessitating sophisticated cost hedging strategies.

Which region is expected to experience the fastest growth rate for this market?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, driven by rapid expansion of generic drug manufacturing capabilities, increasing investment in local chemical R&D infrastructure, and lower operational costs compared to Western markets.

What are the primary technological challenges in RGMPA production?

Primary technological challenges involve implementing highly efficient and cost-effective purification methods, such as preparative chromatography, necessary to achieve ultra-high purity levels consistently while navigating strict global environmental and waste disposal regulations associated with complex chemical synthesis.

The comprehensive analysis of the Reagent Grade Methyl Phenylacetate market clearly indicates a trajectory of sustained expansion, intrinsically linked to the global evolution of the pharmaceutical and specialty chemicals sectors. The increasing stringency of regulatory standards across North America and Europe continues to reinforce the importance of certified, high-purity reagents, ensuring stable demand from established markets. Simultaneously, the manufacturing shift toward Asian powerhouses like China and India is reshaping the supply chain dynamics, favoring suppliers who can efficiently balance high volume production with rigorous quality control protocols. Strategic investment in purification technologies, coupled with the leveraging of AI and automation in quality assurance, will be crucial for companies aiming to capitalize on the premium segments of this specialized market.

Future growth will likely be concentrated in two key areas: the continued diversification of RGMPA applications beyond traditional pharmaceutical synthesis into advanced material science and novel polymer development, and the successful adoption of green chemistry principles. Manufacturers demonstrating robust sustainability practices alongside exceptional purity certification will gain a significant competitive advantage, meeting the evolving procurement mandates of major global corporations. Furthermore, proactive supply chain diversification and strategic alliances will be necessary to mitigate geopolitical risks and raw material price volatility, ensuring reliable access to essential precursors. The market's resilience is fundamentally tied to the health of the global pharmaceutical pipeline, making it a critical, yet highly specialized, component of the chemical economy.

The Reagent Grade Methyl Phenylacetate market is anticipated to evolve towards greater technological integration, particularly in the quality control domain where digital tools enhance transparency and traceability. This heightened focus on verifiable quality data is a direct response to the demands of AEO strategies and the overall push for supply chain integrity within sensitive sectors. As drug discovery moves toward personalized medicine and complex small-molecule therapies, the demand for ultra-high purity grades will intensify, compelling manufacturers to push the boundaries of current synthetic and purification techniques. This convergence of quality demand, technological innovation, and regulatory pressure defines the strategic outlook for all participants in the Reagent Grade Methyl Phenylacetate sector throughout the forecast period.

Further examination into the Purity Level segmentation reveals critical market dynamics. The 98% purity grade, while essential for certain bulk chemical synthesis applications and less sensitive industrial processes, faces price competition and relatively lower margins compared to higher grades. This segment is characterized by high volume transactions and fierce competition, primarily serving standardized manufacturing needs where trace impurities are less detrimental to the final product's performance. The manufacturing focus for this grade is on maximizing throughput and minimizing production costs through optimized catalytic methods.

Conversely, the 99% Purity segment constitutes the core market standard for quality-sensitive applications, including most flavor and fragrance compositions and early-stage pharmaceutical intermediates. Buyers in this segment demand reliable documentation and consistent batch quality, driving suppliers to implement sophisticated quality management systems (QMS). The Ultra-High Grade (>99% Purity) segment commands a significant price premium due to the expensive purification technologies required (e.g., SMB chromatography) and its absolute necessity for late-stage clinical trials, analytical standards, and specialized academic research. Growth in this ultra-high segment directly reflects the expansion of advanced scientific research globally.

The Application analysis underscores the dominance of Pharmaceutical Intermediates. RGMPA's chemical structure is integral to synthesizing specific moieties used in diverse drug classes, ensuring its central position in the value chain. As the global population ages and the prevalence of chronic diseases rises, the need for new and existing drug synthesis continuously bolsters demand for certified reagent-grade material. The secondary, yet stable, contribution from the Flavor & Fragrance Synthesis segment is driven by the discretionary spending habits of consumers, where high-purity starting materials are essential to ensure the longevity and fidelity of complex aromatic compositions.

The General Chemical Synthesis and Research & Development applications represent strategic growth pockets. General synthesis utilizes RGMPA for creating various specialty chemicals, polymers, and other industrial inputs, providing market volume stability. The R&D segment, encompassing government and university laboratories, acts as a leading indicator of future applications, often serving as the testing ground for novel uses of the reagent. Supplying these specialized users requires highly flexible logistics and exceptional technical support, highlighting a key area for distributor competition.

In terms of End-Users, Pharmaceutical and Biotechnology Companies exert the strongest influence over market standards and pricing, due to their volume requirements and stringent regulatory oversight. Their procurement strategies prioritize supplier reliability and compliance above minor cost savings. Specialty Chemical Manufacturers utilize RGMPA both as a final product component and as a reagent for synthesizing other fine chemicals, placing importance on technical specifications and long-term supply contracts. Academic and Research Institutions, while purchasing lower volumes, require the most extensive documentation and highest purity grades for fundamental scientific exploration.

The role of Contract Manufacturing Organizations (CMOs) is expanding rapidly within the End-User segment. As pharmaceutical companies increasingly outsource synthesis and manufacturing steps, CMOs become large-scale, aggregated purchasers of RGMPA. Their purchasing decisions are highly sensitive to lead times, quality certificates, and scale-up capabilities, making them highly attractive partners for RGMPA producers who can guarantee consistent supply and immediate access to necessary compliance documentation. This trend consolidates purchasing power among fewer, larger entities, intensifying competition among suppliers to secure these pivotal CMO contracts.

The detailed value chain reveals that controlling the cost and quality upstream is non-negotiable for success downstream. Manufacturers must establish deep, often proprietary, relationships with Phenylacetic Acid suppliers to hedge against price fluctuations and ensure input quality. Midstream efficiency gains, such as those achieved through process intensification (e.g., microreactor technology), directly translate into competitive advantages in the highly purity-sensitive market segments. The investment required for achieving and maintaining reagent grade certification acts as a significant barrier to entry, protecting incumbent players who possess the necessary capital and technical expertise.

Downstream, the choice between direct sales and utilizing specialized distributors depends heavily on the target customer's size and geographic location. Direct sales secure high-volume, long-term contracts, offering stability and control. Indirect distribution via specialized chemical supply houses allows producers to penetrate fragmented research markets efficiently, leveraging the distributors' existing logistics networks and customer relationships. Effective inventory management across both channels is critical to prevent product degradation and ensure rapid fulfillment of time-sensitive research and manufacturing orders globally.

Examining the technology landscape further, the development of robust, analytical quality control methods remains paramount. The sheer volume of data generated by modern GC-MS and HPLC instruments necessitates advanced data processing and analysis capabilities. Integration of Artificial Intelligence (AI) and Machine Learning (ML) in analytical workflows allows for faster identification of unexpected impurities and predictive quality modeling, transitioning the industry from reactive testing to proactive quality assurance. This technological evolution not only supports AEO by providing authoritative, verifiable data but also contributes directly to the reagent’s market value by reducing risk for end-users.

Furthermore, sustainable synthesis methods represent a critical area of technological innovation. Research into biocatalysis—using enzymes instead of harsh chemical catalysts—offers pathways to synthesize Methyl Phenylacetate derivatives under milder conditions, reducing energy use and minimizing hazardous waste. While currently nascent, these green chemistry techniques are crucial for long-term compliance in Europe and other regions with stringent environmental mandates, potentially unlocking future market opportunities by appealing to environmentally conscious specialty chemical buyers.

Finally, the strategic relevance of regional market characteristics dictates tailored business approaches. In North America and Europe, successful companies focus on premium pricing, rapid innovation support, and maintaining impeccable regulatory compliance. Conversely, in the APAC region, the strategy centers on scale, operational efficiency, and establishing secure, high-volume supply chains to meet the booming generic drug production requirements. Understanding these regional specificities allows for optimized resource allocation and targeted marketing, maximizing market penetration across diverse global landscapes.

The high regulatory landscape associated with pharmaceutical application in regions like North America (FDA) and Europe (EMA) acts as a powerful barrier to entry for smaller or less established manufacturers. Only those producers capable of consistently adhering to Good Manufacturing Practice (GMP) and providing fully traceable documentation can successfully compete in the highest-value segments of the reagent grade market. This emphasis on compliance translates into higher operational costs, but also guarantees premium status for certified suppliers, effectively segmenting the market based on regulatory capacity.

The ongoing trend toward pharmaceutical outsourcing globally continues to elevate the role of Contract Development and Manufacturing Organizations (CDMOs). These entities are rapidly becoming the dominant procurement hubs for RGMPA. For manufacturers, securing supply contracts with major CDMOs provides market stability and volume consistency, often outweighing the slightly lower margins compared to direct sales to small R&D labs. The technical requirement placed on suppliers by CDMOs are exceptionally high, focusing not just on purity but also on scalability and consistency across global production sites.

In the flavor and fragrance sector, while volumes are generally lower than pharma, the demand for natural or nature-identical aromatic compounds is rising. RGMPA, often used synthetically, faces pressure from biosynthetically derived alternatives. However, the cost-effectiveness and consistency of the high-purity reagent-grade synthetic material ensure its continued dominance in industrial-scale fragrance production. Innovation here focuses on finding ways to produce RGMPA with minimal residual odorants that could interfere with delicate fragrance formulations, ensuring its status as a high-quality ingredient.

The influence of technology extends deeply into inventory management. The quality integrity of Reagent Grade Methyl Phenylacetate must be maintained throughout its shelf life, requiring specialized storage conditions and precise tracking. Advanced warehouse management systems (WMS) utilizing IoT sensors help monitor environmental factors such as temperature and humidity in real-time. This level of meticulous handling is required to prevent degradation, a necessary overhead cost that reinforces the premium pricing associated with certified reagent grade chemicals.

Ultimately, the competitive advantage in the Reagent Grade Methyl Phenylacetate market belongs to integrated manufacturers who control their raw material supply, employ advanced, energy-efficient purification technologies, and possess robust, AI-enhanced quality control systems capable of meeting the diverse and demanding purity requirements of global pharmaceutical, fragrance, and research consumers. Market growth will be sustained by innovation in application and adherence to evolving standards of purity and sustainability.

The focus on ultra-high purity (>99%) is not merely a preference but a necessity driven by the regulatory bodies' increasing scrutiny over extractables and leachables (E&L) in pharmaceutical processes. Trace impurities in reagents, even at parts per million levels, can react during synthesis or contaminate the final drug product, posing serious regulatory risks. Therefore, suppliers who can guarantee an exceptionally low and consistent impurity profile for RGMPA become preferred partners, justifying their premium pricing structure and capturing the high-value segment of the market where risk mitigation is paramount.

Geopolitical stability plays an increasingly critical role, particularly in the sourcing of precursor chemicals. Manufacturers heavily dependent on single-source regions for Phenylacetic Acid are highly vulnerable to trade disputes, natural disasters, or logistical bottlenecks. This risk factor is accelerating the push towards dual-sourcing strategies and regionalized production capabilities, ensuring continuity of supply for RGMPA manufacturers, especially those catering to the time-sensitive clinical trial supply chain.

Market penetration into academic research facilities is vital for long-term engagement. Researchers often require novel packaging formats, precise lot-to-lot consistency, and detailed safety data sheets (SDS). Suppliers who offer extensive technical documentation and responsive customer support tailored to the scientific community often build brand loyalty that translates into industrial preference as these researchers transition into commercial roles within pharmaceutical companies or specialty chemical firms.

The overall market outlook remains positive, underpinned by the indispensable chemical function of Methyl Phenylacetate in synthesizing crucial aromatic compounds. However, achieving and sustaining the 'Reagent Grade' status demands ongoing, significant investment in compliance infrastructure, advanced analytical instrumentation, and continuous process optimization. This barrier to entry ensures the market remains concentrated among technically proficient, financially stable chemical producers who prioritize verifiable quality above all else.

In conclusion, the Reagent Grade Methyl Phenylacetate market is defined by its dichotomy: high volume demand from industrial segments contrasting with hyper-sensitive quality requirements from R&D and pharmaceutical sectors. Navigating this landscape requires strategic agility, technological superiority in purification, and an unwavering commitment to regulatory adherence, positioning the industry for moderate yet highly profitable expansion through the forecasted period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager