Real Estate Appraisal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433404 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Real Estate Appraisal Market Size

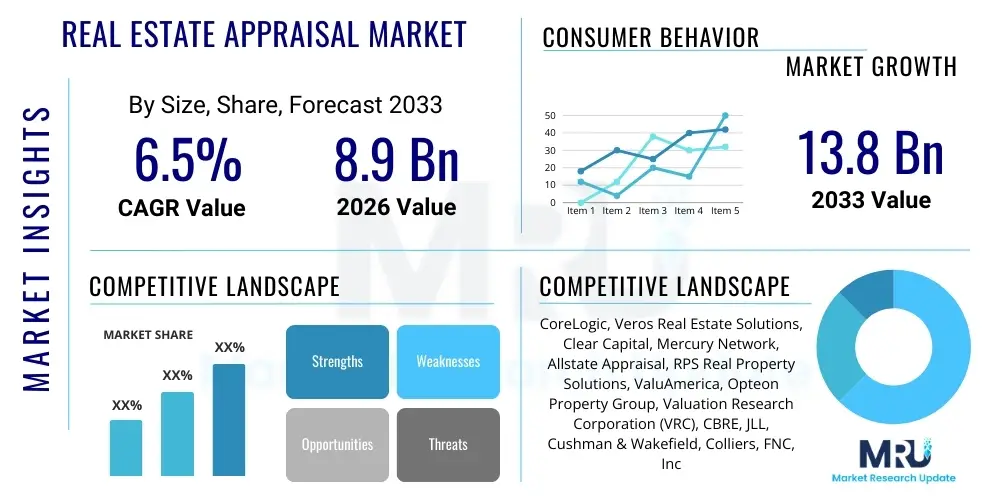

The Real Estate Appraisal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 8.9 Billion in 2026 and is projected to reach USD 13.8 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by sustained global investment in real estate assets, coupled with increasing regulatory requirements mandating independent, professional valuations for lending and insurance purposes. The integration of advanced technological solutions, particularly Automated Valuation Models (AVMs) and hybrid appraisal methodologies, is significantly influencing both the market size and efficiency.

Real Estate Appraisal Market introduction

The Real Estate Appraisal Market encompasses the services and technologies employed to determine the fair market value of properties—including residential, commercial, industrial, and agricultural assets. These valuations are critical for a wide array of financial transactions, legal proceedings, and governmental functions. Core services involve analyzing property characteristics, comparing them to recent sales of similar properties, and applying professional judgment based on economic trends and market conditions. The necessity for objective valuation is deeply embedded in the modern financial system, ensuring stability and transparency in property transactions and mortgage lending processes. The increasing sophistication of data analytics and geographic information systems (GIS) is fundamentally changing how these valuations are conducted, enhancing accuracy and reducing turnaround times.

Major applications for appraisal services span mortgage financing, property tax assessment, litigation support (divorce, eminent domain), investment portfolio management, and insurance underwriting. The continuous demand across these diverse sectors provides resilience to the market, even during regional economic fluctuations. The product, which is essentially the appraisal report, offers stakeholders a comprehensive, unbiased opinion of value, crucial for risk management and informed decision-making. As global wealth increasingly flows into real assets, the reliance on credible appraisal services grows proportionally, cementing its indispensable role in the global economy. This formalized process mitigates risks for both lenders and borrowers, acting as a crucial safeguard against market volatility.

Key driving factors fueling market expansion include stringent regulatory frameworks globally, which mandate third-party appraisals for federally backed mortgages, and the rapid pace of urbanization, particularly in emerging economies, necessitating valuation services for new developments. Furthermore, the rise of complex investment vehicles like Real Estate Investment Trusts (REITs) and cross-border property investments demands standardized and internationally compliant appraisal methods. Technological adoption, specifically the deployment of AI and machine learning in AVMs, is a significant enabler, enhancing productivity, lowering costs, and addressing the increasing volume of valuation requests while maintaining high standards of objectivity and compliance, thereby offering clear benefits to market participants.

Real Estate Appraisal Market Executive Summary

The Real Estate Appraisal Market is characterized by a steady digital transformation, shifting emphasis from purely manual evaluations to hybrid models incorporating sophisticated data analytics and AI-driven Automated Valuation Models (AVMs). Business trends indicate a consolidation among traditional appraisal firms, alongside aggressive growth from technology providers specializing in valuation software and data platforms. The need for quicker, more cost-effective valuations, driven by the demanding pace of the housing and commercial real estate markets, is pushing service providers to invest heavily in data integration tools and predictive modeling capabilities. Geographically, North America remains the dominant revenue generator due to mature regulatory structures and high transaction volumes, while the Asia Pacific region is demonstrating the highest growth rates, fueled by rapid infrastructural development and evolving property rights legislation that requires formalized valuation frameworks for legal clarity and investment security.

Segmentation trends highlight the increasing importance of the Automated Valuation Models (AVMs) segment within the Technology component, specifically driven by large mortgage lenders seeking portfolio risk assessment and instant, preliminary valuations. However, traditional, human-led appraisals continue to hold significant market share for high-value and complex commercial properties where local expertise and subjective condition analysis remain paramount. The Residential segment dominates in volume due to continuous refinancing and sales activities, yet the Commercial segment provides higher revenue per transaction, maintaining its strategic importance. The regulatory environment is also fostering growth in niche segments, such as environmental impact assessments and specialized appraisals for infrastructure projects, requiring highly specialized expertise.

Overall, the market is moving towards a tiered service model: low-complexity, high-volume properties are increasingly handled by technology, while high-complexity, high-value assets necessitate specialized professional involvement augmented by data technology. The industry’s future trajectory is heavily dependent on resolving regulatory acceptance issues surrounding AVMs in specific jurisdictions and successfully integrating diverse, unstructured data sources (like aerial imagery and virtual reality scans) into standard appraisal methodologies. This dual trend underscores the necessity for appraisers to evolve into data analysts and hybrid evaluators rather than relying solely on traditional methods, ensuring the market continues its robust growth trajectory through 2033.

AI Impact Analysis on Real Estate Appraisal Market

Users frequently inquire about AI's role in accuracy versus human judgment, the threat of job displacement for appraisers, and the regulatory acceptance of fully Automated Valuation Models (AVMs) in sensitive financial transactions. Key themes emerging from user concerns center on algorithmic transparency, data bias inherent in AI models, and the perceived inability of machines to assess unique property features or local market nuances that influence value. There is strong user expectation that AI will standardize routine valuations, enhance efficiency, and reduce costs, but a deep-seated concern remains regarding AI's application in complex, high-stakes commercial appraisals, where human expertise in market forecasting and negotiation strategy is irreplaceable. This dichotomy suggests that the market seeks a balanced approach where AI acts as a powerful assistant and validator, rather than a total replacement for the human appraiser.

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the appraisal workflow, primarily through the refinement and widespread deployment of AVMs. These models utilize massive datasets, including transaction histories, public records, geophysical data, and even demographic trends, to produce rapid, objective valuation estimates. For simple, homogenous residential properties, AVMs offer significant time and cost savings, allowing lenders to speed up loan origination processes and handle high volumes of refinancing applications efficiently. AI is also being utilized in automated data verification and anomaly detection, reducing the manual effort required to cleanse input data and identify potential fraud or errors in property records.

However, the impact is not limited to simple automation. AI tools are increasingly being integrated into the workflows of human appraisers, providing sophisticated tools for market analysis, predictive modeling of future property values, and advanced comparable sales selection. This augmentation allows appraisers to focus on complex qualitative assessments—such as property condition, neighborhood appeal, and the impact of specific legal encumbrances—thereby elevating the professional standard of the final report. While AI improves efficiency, regulatory bodies, especially in regions governed by stringent appraisal independence rules, are cautiously evaluating the role of AVMs in federally regulated lending, often requiring human oversight to ensure compliance and accountability, thus solidifying the future role of the augmented appraiser.

- AI-driven Automated Valuation Models (AVMs) streamline residential and simple commercial property valuations, increasing efficiency.

- Machine learning algorithms enhance comparable sales selection and identify data anomalies, improving data quality and reducing manual error.

- AI tools provide predictive modeling capabilities, aiding appraisers in forecasting market movements and future property values.

- Increased algorithmic transparency and auditability are becoming essential to meet evolving regulatory requirements for AVM deployment.

- Potential for deskilling in basic valuation tasks, shifting the appraiser’s role towards specialized analysis, condition verification, and complex problem-solving.

- Advanced image recognition software processes aerial and street-level imagery to assess property condition and verify exterior features remotely.

- AI assists in portfolio valuation risk management for large financial institutions by rapidly assessing collateral exposure.

DRO & Impact Forces Of Real Estate Appraisal Market

The Real Estate Appraisal Market is dynamically influenced by powerful internal and external forces. Key drivers include stringent governmental regulations globally, which mandate unbiased property valuations for mortgage lending and tax purposes, ensuring financial stability and protecting consumers. Restraints primarily involve the high cost and complexity associated with integrating new technologies like AI and blockchain into legacy systems, alongside the persistent industry resistance to fully automated appraisal processes due to concerns over accountability and the inability of algorithms to assess subjective factors. Opportunities are abundant in emerging markets, where rapid formalization of property ownership rights and expanding middle classes are generating massive demand for professional valuation services. Furthermore, technological leaps offer avenues for new service lines, such as remote appraisals utilizing drone and virtual reality technology. These forces collectively propel the industry toward a technology-augmented service model, emphasizing efficiency while retaining the critical human element necessary for complex risk assessment.

Impact forces acting upon the market include economic cycles—where interest rate fluctuations directly affect transaction volumes and, consequently, appraisal demand—and demographic shifts, particularly the migration towards suburban or secondary cities, altering valuation patterns. The increasing scrutiny by regulatory bodies regarding appraisal independence and potential bias is forcing firms to adopt standardized, transparent processes, often leveraging technology for verification. The competitive landscape is intensifying, not only between traditional appraisal firms but also with technology giants and PropTech startups offering alternative valuation solutions, thereby compelling established players to innovate or face market erosion. Successfully navigating these forces requires a strategic balance between maintaining high standards of professional integrity and aggressively adopting efficiency-enhancing technologies to meet modern market demands for speed and accuracy.

Market stability is further underpinned by the fundamental necessity of accurate collateral assessment, which acts as a non-negotiable requirement for the multi-trillion-dollar mortgage industry. Even during market downturns, demand for appraisal services persists for refinancing, foreclosure, and loss mitigation, stabilizing the industry against severe volatility. The primary constraint impacting future scaling is the shortage of experienced, licensed appraisers in many developed regions, which accelerates the reliance on AVMs but simultaneously elevates the value of specialized human expertise. Capitalizing on opportunities such as offering compliance consulting services related to AVM deployment and integrating green building certifications into valuation models will define the market leaders over the forecast period, positioning them favorably within the evolving regulatory and technological landscape.

Segmentation Analysis

The Real Estate Appraisal Market is primarily segmented based on the type of property being valued, the technology used to perform the valuation, and the end-users requiring the service. This segmentation reflects the diversity of real estate assets and the evolving methods employed across the industry. While the residential segment holds the largest volume share, the commercial segment often dictates technological advancements and complex methodology development due to the high values and varied nature of assets like skyscrapers, industrial parks, and specialized agricultural holdings. Technological segmentation is increasingly dominated by the rise of Automated Valuation Models (AVMs), which are challenging traditional manual processes, necessitating a hybrid approach for optimal accuracy and market speed.

- By Property Type:

- Residential Real Estate

- Commercial Real Estate

- Agricultural Real Estate

- Industrial Real Estate

- Special Purpose Properties (e.g., healthcare facilities, infrastructure)

- By Technology/Methodology:

- Traditional (Manual) Appraisals

- Automated Valuation Models (AVMs)

- Hybrid Appraisals (Appraiser supplemented by AVMs/Data)

- Desktop Appraisals (Remote verification)

- BPO (Broker Price Opinions)

- By End-User:

- Mortgage Lenders and Financial Institutions

- Government Agencies (Taxation, Eminent Domain)

- Real Estate Investment Trusts (REITs) and Investment Firms

- Insurance Companies

- Property Buyers and Sellers

- Legal and Accounting Firms

Value Chain Analysis For Real Estate Appraisal Market

The value chain in the Real Estate Appraisal Market begins with the upstream analysis, which is heavily reliant on data providers, technology platforms, and regulatory bodies. Data providers, including public record databases, Multiple Listing Services (MLS), and spatial data firms, form the foundational input necessary for any valuation. Technology vendors supplying specialized software, cloud infrastructure, and AVM algorithms are critical upstream components, providing the tools that define the efficiency and scalability of appraisal operations. Furthermore, educational and licensing bodies play a crucial role in the upstream process by ensuring a pipeline of qualified, certified appraisers who adhere to standards like USPAP (Uniform Standards of Professional Appraisal Practice), thereby maintaining professional credibility and market integrity.

The core midstream activities involve the valuation process itself, encompassing data collection, comparable sales analysis, property inspection (physical or remote), reconciliation of value approaches (cost, sales comparison, income capitalization), and the final report generation. Direct distribution channels primarily involve licensed appraisers or appraisal management companies (AMCs) providing services directly to mortgage lenders, who are the largest institutional buyers. Indirect distribution channels include real estate brokerages, technology platforms facilitating AVM access, and legal firms that utilize appraisal services indirectly for litigation or estate settlement purposes. The increasing role of AMCs serves to centralize the ordering process, ensuring appraiser independence and regulatory compliance, thereby adding a layer of transparency and efficiency to the service delivery.

Downstream analysis focuses on the end-users and the final impact of the appraisal report. The primary consumer is the mortgage market, where the report dictates loan-to-value ratios and collateral risk. Other significant downstream users include tax authorities utilizing valuations for assessment, and investors making acquisition or divestiture decisions based on appraised values. The feedback loop from the downstream entities—such as regulatory audits or lender quality control reviews—influences the upstream technology and training requirements, driving continuous improvement in data accuracy and methodological rigor. Successful optimization of the value chain requires seamless integration between data suppliers, technology platforms, and the certified appraiser/AMC network to deliver reliable, timely, and compliant valuation reports.

Real Estate Appraisal Market Potential Customers

The principal potential customers for real estate appraisal services are institutional entities involved in property finance and risk management. Mortgage lenders, including commercial banks, credit unions, and non-bank financial institutions, represent the largest segment of demand, as regulatory requirements mandate an independent valuation before collateralizing real property for a loan. These customers rely on appraisals to establish the loan-to-value ratio, mitigate default risk, and ensure compliance with federal and state lending laws. Their continuous demand, driven by fluctuations in refinancing activities and new property purchases, makes them the cornerstone of the appraisal market, constantly seeking solutions that offer faster turnaround times and validated accuracy.

Government agencies constitute another significant customer base, requiring appraisals for specialized purposes that transcend typical transactional needs. This includes federal and local tax authorities who need objective valuations for property tax assessments and equalization studies. Furthermore, agencies involved in infrastructure projects or land conservation often require eminent domain appraisals to determine fair compensation for property acquisition. This segment often demands highly specialized reports adhering to specific governmental valuation standards, requiring appraisers with deep expertise in complex regulatory environments and specialized property types, such as utility corridors or environmentally protected lands.

The final crucial customer segment includes investors, asset managers, and insurance providers. Real Estate Investment Trusts (REITs) and large private equity firms rely on detailed portfolio appraisals for financial reporting, capital raising, and strategic investment decisions. Insurance companies utilize valuations to determine appropriate coverage levels against potential casualty losses, while legal and accounting firms require appraisals for estate planning, litigation support, and partnership dissolution. These non-lending customers prioritize comprehensive analysis, long-term valuation modeling, and expert witness support, often leading to demand for high-fee, complex commercial appraisal assignments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.9 Billion |

| Market Forecast in 2033 | USD 13.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CoreLogic, Veros Real Estate Solutions, Clear Capital, Mercury Network, Allstate Appraisal, RPS Real Property Solutions, ValuAmerica, Opteon Property Group, Valuation Research Corporation (VRC), CBRE, JLL, Cushman & Wakefield, Colliers, FNC, Inc., ValueLink Software, SitusAMC, Land Gorilla, HouseCanary, Zillow Group (Zestimates), eAppraisal. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Real Estate Appraisal Market Key Technology Landscape

The current technology landscape in the Real Estate Appraisal Market is defined by the convergence of big data analytics, geospatial technology, and artificial intelligence, moving away from purely manual data compilation. Automated Valuation Models (AVMs) stand as the central technological innovation, utilizing sophisticated statistical modeling and machine learning algorithms to produce instantaneous, algorithmically derived property valuations. These systems rely on vast, curated datasets of historical transactions, property characteristics, and neighborhood demographics. The primary technological challenge is ensuring data freshness and integrity across diverse municipal databases, necessitating advanced data aggregation and cleansing tools to feed reliable inputs into the AVMs. Furthermore, the integration of APIs allows appraisal management companies (AMCs) and lenders to seamlessly plug these valuation engines directly into their loan origination and risk management platforms, significantly accelerating the entire lending lifecycle.

Beyond AVMs, the market is leveraging geospatial technologies like Geographic Information Systems (GIS) and high-resolution aerial and drone photography. GIS tools enable appraisers to visualize complex spatial data, such as flood zones, proximity to amenities, and environmental hazards, which significantly influence property value but are difficult to assess manually. Drone technology facilitates remote physical inspections, particularly useful for large commercial or rural properties, reducing travel time and improving safety, while providing high-quality visual documentation that verifies the property’s condition and neighborhood context. These technologies support the development of "Desktop Appraisals" and "Hybrid Appraisals," methodologies that blend remote data verification with human review, offering a balance between speed and compliance requirements.

Blockchain technology is an emerging force, holding potential to revolutionize the foundational data layer of the appraisal market. By creating immutable, decentralized ledgers for property ownership, transaction history, and structural modifications, blockchain could eliminate disputes regarding data authenticity and provenance, thereby increasing the trustworthiness of valuation inputs. While still nascent, blockchain adoption promises enhanced transparency and reduced fraud risks. Furthermore, advanced appraisal software platforms are incorporating virtual reality (VR) and augmented reality (AR) tools for immersive remote inspections and comparative analysis, allowing appraisers to virtually walk through comparable properties and assess their internal finishes and layouts without physical travel, optimizing resource allocation and expanding geographical coverage for individual appraisers.

Regional Highlights

Regional dynamics within the Real Estate Appraisal Market are shaped by local regulatory frameworks, the maturity of the mortgage industry, and the pace of technological adoption. North America, encompassing the United States and Canada, represents the largest market share, driven by a highly standardized, regulated mortgage finance sector that legally mandates independent appraisals for most transactions. The US market, in particular, is a hotbed for AVM development and hybrid appraisal models, propelled by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac encouraging technological efficiency. This region benefits from exceptionally rich and standardized public data records, facilitating higher AVM accuracy compared to other global markets.

Europe demonstrates significant variability, with appraisal markets segmented along national lines reflecting diverse legal traditions and financial structures. Western European nations, such as the UK and Germany, have mature, regulated markets where robust collateral assessment is critical, particularly for commercial lending. However, the adoption of standardized valuation metrics (like those promoted by RICS) is ongoing, aiming for pan-European consistency. The rapid growth of property investment in Eastern Europe is increasing demand for formal valuation services as these economies harmonize their financial practices with EU standards. Technological integration varies, with strong interest in AVMs, though regulatory skepticism about full automation remains higher than in North America.

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive urbanization, infrastructure spending, and the formalization of property ownership in economies like China, India, and Southeast Asia. As financial markets deepen and the middle class expands, the demand for mortgage and investment-related appraisals surges. The challenge in APAC lies in the fragmented nature of property data and registration systems, often necessitating more intensive, manual data collection. However, significant opportunities exist for technology providers offering solutions that can aggregate and structure diverse, localized data inputs, supporting the emerging professional appraisal standards across the region.

- North America: Dominant market, characterized by strict regulatory oversight (USPAP) and leading adoption of AVMs and hybrid valuation models supported by GSE initiatives.

- Europe: Fragmented market structure influenced by national legal systems; increasing harmonization efforts (RICS standards) are driving professionalism and cross-border appraisal services.

- Asia Pacific (APAC): Highest growth trajectory due to rapid urbanization, increasing foreign investment, and the formalization of property markets requiring standardized valuation.

- Latin America (LATAM): Developing market focused on increasing transparency; demand driven by foreign institutional investors and modernization of mortgage lending practices.

- Middle East and Africa (MEA): Growth centered around Gulf Cooperation Council (GCC) nations, driven by large-scale real estate megaprojects and evolving regulations aimed at diversifying economies away from oil dependency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Real Estate Appraisal Market.- CoreLogic

- Veros Real Estate Solutions

- Clear Capital

- Mercury Network

- Allstate Appraisal

- RPS Real Property Solutions

- ValuAmerica

- Opteon Property Group

- Valuation Research Corporation (VRC)

- CBRE

- JLL (Jones Lang LaSalle)

- Cushman & Wakefield

- Colliers

- FNC, Inc. (acquired by CoreLogic)

- ValueLink Software

- SitusAMC

- Land Gorilla

- HouseCanary

- Zillow Group (Zestimates/Zillow Appraisal Services)

- eAppraisal

Frequently Asked Questions

Analyze common user questions about the Real Estate Appraisal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current CAGR projection for the Real Estate Appraisal Market?

The Real Estate Appraisal Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. This growth is primarily fueled by mandatory regulatory requirements for collateral valuation, increased complexity in real estate transactions, and the rising global adoption of technology, particularly Automated Valuation Models (AVMs), to enhance efficiency and scale service delivery across diverse property types and regions.

How are Automated Valuation Models (AVMs) impacting the demand for licensed human appraisers?

AVMs are not eliminating the need for human appraisers but are fundamentally redefining their role. AVMs excel at rapid, low-cost valuations for standardized, low-complexity properties (like typical residential homes). This shifts the human appraiser's focus towards high-value, unique, or complex commercial properties where local market knowledge, physical inspection, and subjective analysis of property condition and legal factors are essential, leading to an augmented, specialized role rather than displacement.

Which segmentation technology currently holds the highest growth potential in the appraisal market?

The Hybrid Appraisals segment holds the highest growth potential. Hybrid models combine the efficiency and speed of Automated Valuation Models (AVMs) and sophisticated data technology with the necessary oversight and condition verification performed by a certified human professional. This model satisfies regulatory demands for accountability while meeting market needs for speed and cost-effectiveness, making it increasingly favored by large mortgage lenders seeking regulatory compliance and operational flexibility across varied asset classes.

What are the primary regulatory constraints affecting the global Real Estate Appraisal Market?

Primary constraints include strict mandates regarding appraiser independence, data security protocols, and the need for compliance with locally specific valuation standards (such as USPAP in the U.S. or RICS globally). Regulatory bodies are cautious about fully endorsing AVMs without substantial human oversight, particularly for federally insured mortgages, due to inherent concerns about algorithmic bias, data transparency, and ensuring accountability in collateral valuation decisions that underpin the stability of the financial system.

Which geographic region is expected to demonstrate the fastest growth in appraisal services, and why?

The Asia Pacific (APAC) region is projected to demonstrate the fastest growth rate. This accelerated expansion is attributed to large-scale urbanization projects, rapid infrastructure development, the expansion of middle-class homeownership, and the formalization of property rights and financial systems across developing economies within the region. These factors necessitate the establishment of credible, professional valuation frameworks for lending, investment, and tax assessment purposes, driving substantial market demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager