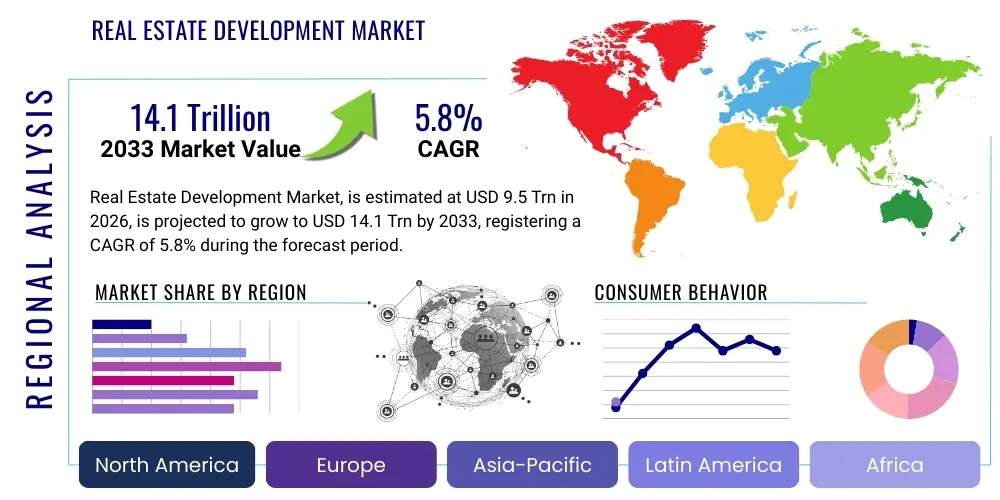

Real Estate Development Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436860 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Real Estate Development Market Size

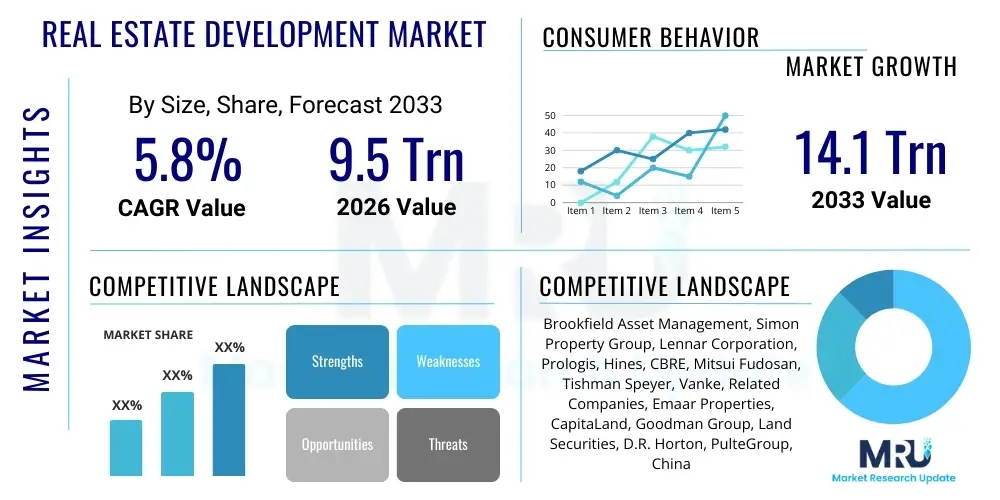

The Real Estate Development Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 9.5 Trillion in 2026 and is projected to reach USD 14.1 Trillion by the end of the forecast period in 2033.

Real Estate Development Market introduction

The Real Estate Development Market encompasses the comprehensive processes involved in acquiring land, financing projects, constructing or renovating buildings, and leasing, marketing, or selling the resulting properties. This sector serves as a fundamental pillar of the global economy, directly influencing infrastructure, employment rates, and urbanization patterns. Market dynamics are currently driven by demographic shifts, sustained global economic recovery, and unprecedented technological integration aimed at improving efficiency and sustainability. Key sub-sectors include residential, commercial (office and retail), and industrial (logistics and manufacturing), each responding distinctly to macro-economic forces such as interest rate environments and supply chain resilience. The increasing demand for sustainable and smart buildings, often termed 'green development,' is reshaping investment priorities across all geographic regions, necessitating new regulatory compliance and construction methodologies.

The core product offered by this market is tangible infrastructure—spaces designed to support human habitation, commerce, and industrial activity. Major applications span from developing affordable housing solutions in densely populated areas and creating sprawling logistics centers catering to e-commerce, to constructing technologically advanced Grade A office spaces tailored for modern hybrid work models. Benefits derived from robust real estate development include enhanced urban infrastructure, revitalization of underserved communities, provision of essential housing stock, and creation of economic hubs that stimulate local economies. Furthermore, the market acts as a stable asset class for institutional investors seeking long-term, inflation-hedged returns, cementing its critical role in global capital markets.

Driving factors propelling market growth include rapid global urbanization, particularly across the Asia Pacific and African continents, which generates acute demand for new residential and commercial structures. Concurrently, technological advancements, such as Building Information Modeling (BIM) and prefabricated construction techniques, are reducing project timelines and operational costs, thereby enhancing developer margins and increasing project feasibility. Supportive government policies focusing on infrastructure spending, tax incentives for affordable housing, and regulatory frameworks promoting Foreign Direct Investment (FDI) in real estate further bolster expansion. These drivers collectively create a fertile environment for sustained market appreciation, despite intermittent challenges posed by geopolitical risks and material price volatility.

Real Estate Development Market Executive Summary

The Real Estate Development Market exhibits robust business trends dominated by a pronounced shift towards digitalization, ESG (Environmental, Social, and Governance) compliance, and flexible space utilization. Business models are evolving rapidly, moving away from purely traditional ownership structures towards blended models incorporating PropTech platforms, fractional ownership, and subscription-based leasing. Institutional capital is increasingly prioritizing sectors demonstrating resilience against economic downturns, such as data centers, specialized cold storage facilities, and multifamily residential complexes. Furthermore, the post-pandemic recovery has solidified the demand for high-quality, amenity-rich assets that prioritize occupant well-being and connectivity, forcing developers to integrate wellness features and advanced air filtration systems into new designs. This emphasis on sustainability and tenant experience defines the prevailing investment mandate for the foreseeable future.

Regional trends reveal a distinct bifurcation in growth drivers. The Asia Pacific (APAC) region continues to lead in terms of volume and pace of construction, fueled by massive government infrastructure initiatives and rapid population expansion, particularly in emerging economies like India and Southeast Asia. Conversely, North America and Europe are focusing heavily on quality over quantity, driving renovation cycles, brownfield development, and the adoption of cutting-edge smart building technologies to optimize energy consumption and operational costs. While North America shows strong demand in the industrial and life sciences real estate sectors, Europe is heavily influenced by stringent EU Taxonomy regulations mandating transparency and green certifications for real estate assets, thus positioning sustainable development as a primary differentiator.

Segmentation trends highlight the increasing dominance of the industrial and logistics segment, largely driven by the continued expansion of e-commerce and the need for resilient global supply chains. Residential development remains highly fragmented but sees strong growth in the build-to-rent and single-family rental segments, catering to demographic preferences for flexibility. The commercial office segment is undergoing structural changes; while overall demand might stabilize at lower levels due to remote work, the flight to quality is intensely concentrated in prime, energy-efficient locations, leaving secondary and older assets facing obsolescence. Technology integration is no longer optional but essential across all segments, dictating the success parameters for new developments in areas ranging from security to utility management.

AI Impact Analysis on Real Estate Development Market

Users frequently inquire about AI's capacity to revolutionize traditional real estate workflows, specifically addressing concerns related to risk assessment accuracy, construction efficiency gains, and long-term asset management viability. Key themes that emerge include how AI can be leveraged to predict future property valuations more accurately than traditional models, the ethical implications of using AI in tenant or buyer screening, and the potential displacement of manual labor in architecture and construction management. Users are also keen on understanding AI’s role in optimizing energy usage and maintenance schedules in smart buildings post-construction. The overarching expectation is that AI will introduce unprecedented levels of precision and automation, transforming the industry from a traditionally manual sector into a data-driven enterprise, simultaneously addressing labor shortages and sustainability goals.

AI's influence extends deeply into the pre-development phase by facilitating advanced site selection and feasibility studies. Machine learning algorithms analyze vast datasets encompassing zoning regulations, demographic shifts, transport infrastructure, and competitor activity to pinpoint optimal development locations and forecast absorption rates with superior accuracy. This predictive modeling minimizes investment risk and allows developers to tailor project scopes precisely to market demand. For instance, AI can simulate multiple design iterations rapidly, optimizing layouts for daylight exposure, energy performance, and structural efficiency before ground is even broken. This early-stage optimization is proving crucial for maintaining project budgets and meeting stringent sustainability targets set by investors.

During the construction phase, AI enhances productivity and safety significantly. Computer vision systems monitor construction sites, tracking progress against schedules, identifying potential safety hazards in real-time, and managing material flow to prevent delays. Furthermore, generative design algorithms assist architects in creating complex, highly optimized structural elements that traditional methods struggle to achieve. Post-construction, AI is integral to smart building management, using sensor data to dynamically adjust HVAC systems, lighting, and security protocols, leading to substantial reductions in operating expenses and fulfilling the promise of truly autonomous building operations. This lifecycle management capability makes AI a cornerstone technology for modern real estate investment.

- AI-driven predictive analytics for land acquisition and valuation forecasting.

- Optimization of building design and spatial layouts using generative AI.

- Enhanced construction project management via computer vision for progress monitoring and risk identification.

- Integration of machine learning for dynamic energy management in smart buildings (PropTech).

- Improved tenant experience and facility maintenance through predictive maintenance scheduling.

- Automation of legal documentation and contract analysis, speeding up due diligence processes.

DRO & Impact Forces Of Real Estate Development Market

The market is predominantly driven by accelerated global urbanization trends, necessitating continuous investment in both residential and supporting commercial infrastructure, coupled with the increasing availability of sophisticated PropTech solutions that enhance project viability and operational performance. However, significant restraints include persistently high global inflation rates, leading to escalating construction material costs and labor shortages, compounded by interest rate volatility that raises the cost of capital and negatively impacts project financing viability, thereby slowing down the pace of new development starts. These dual pressures create a challenging financial environment, forcing developers to seek innovative financing mechanisms and cost-saving construction techniques to maintain profitability margins.

Opportunity abounds in the emerging sectors focusing on sustainability, digital infrastructure, and affordable housing. The strong institutional shift towards ESG-compliant investing opens lucrative pathways for developers specializing in green building certifications, retrofitting existing assets, and developing infrastructure specifically for the renewable energy transition (e.g., battery storage facilities). Furthermore, the substantial unmet demand for affordable and workforce housing globally presents a long-term, structurally supported investment opportunity, often benefiting from government subsidies and public-private partnerships. The adoption of advanced construction methods like modular and prefabricated building is also creating market efficiencies that were previously unattainable, lowering barriers to entry in certain specialized segments.

The impact forces currently shaping the market are diverse and interconnected, chief among them being stringent government regulatory oversight related to environmental permits and zoning restrictions, which can heavily influence project timelines and costs. Geopolitical tensions and regional conflicts impact global supply chains for critical construction materials, injecting significant uncertainty into cost projections. Furthermore, the persistent evolution of the hybrid work model is an undeniable force structurally reshaping commercial real estate demand, requiring developers to rapidly adapt to a preference for flexible, decentralized office locations and high-quality, collaborative spaces. Ultimately, financial market stability, heavily reliant on central bank policies, remains the paramount impact force dictating the overall capital flow into the development sector.

Segmentation Analysis

The Real Estate Development Market is comprehensively segmented based on Property Type, End-User, Funding Source, and Construction Technology, reflecting the varied nature of global development activities. Property Type segments, including Residential, Commercial, Industrial, and Institutional, respond differentially to economic cycles and demographic shifts; for example, the Industrial segment (warehousing, logistics) has shown exceptional resilience and growth. The End-User segmentation provides insight into the primary consumers of developed spaces, separating individual home buyers from institutional tenants and large corporate occupants, revealing distinct requirements for space utilization, lease terms, and technological integration. Understanding these segment dynamics is crucial for developers tailoring their portfolios to maximize returns in specific regional markets.

Segmentation by Funding Source—Public, Private, and Hybrid—determines the risk profile and scale of projects; government-backed or public funding often targets large infrastructure or affordable housing projects, while private equity drives luxury, commercial, and speculative developments. The increasing popularity of Public-Private Partnerships (PPPs) is blurring these lines, particularly in large urban redevelopment projects. Lastly, the segmentation by Construction Technology reflects the industry's modernization drive, distinguishing between conventional methods and advanced techniques such as Modular Construction, 3D Printing, and adoption of Building Information Modeling (BIM). This technological shift is fundamentally altering the cost structures and speed of delivery across all property types, especially favoring standardized, repeatable residential and logistics developments.

- Property Type:

- Residential (Single-family, Multi-family, Condominiums, Build-to-Rent)

- Commercial (Office Spaces, Retail, Hospitality, Data Centers)

- Industrial (Warehouses, Logistics Centers, Manufacturing Facilities)

- Institutional/Mixed-Use (Healthcare, Education, Government Buildings)

- End-User:

- Corporate Tenants

- Individual Homeowners

- Government/Public Sector

- Institutional Investors

- Funding Source:

- Private Equity & Institutional Investment

- Public/Government Funding

- Debt Financing (Banks/Lenders)

- Construction Technology:

- Conventional Construction

- Modular and Prefabrication

- 3D Printing Technology

- Sustainable/Green Building Methods

Value Chain Analysis For Real Estate Development Market

The Real Estate Development value chain begins with extensive upstream activities centered on land acquisition, comprehensive due diligence, and securing necessary entitlements and permits. Upstream suppliers are pivotal and include land aggregators, specialized legal and environmental consulting firms, and financial institutions providing initial construction loans and equity financing. The efficient management of this phase, characterized by complex regulatory navigation and detailed risk assessment, dictates the viability and eventual profitability of the entire project. Strong relationships with reliable local surveyors and specialized zoning attorneys are often key differentiators in high-growth, regulated markets, ensuring projects move from conceptualization to the execution phase swiftly and compliantly.

Midstream activities involve the actual design and physical construction processes. This segment relies heavily on architects, structural engineers, general contractors, and material suppliers (e.g., steel, concrete, sustainable timber). Distribution channels for construction materials are critical, requiring robust supply chain logistics to ensure timely delivery and manage cost fluctuations, a challenge that has become increasingly prominent in recent years. Direct engagement often occurs between the developer and the general contractor (GC), who manages the vast network of subcontractors and specialized trades. Quality control and schedule adherence during this phase determine the asset’s long-term operational performance and market attractiveness, pushing developers toward technologies like BIM for better coordination.

Downstream analysis focuses on the final stage: leasing, sales, property management, and asset disposition. The distribution channel for the final product (the developed property) involves direct sales to end-users (individual buyers or corporate tenants) or indirect sales through real estate brokers, investment banks, and property management firms. Property management firms, using advanced PropTech, play an essential role in maximizing the asset’s lifecycle value through efficient operation and maintenance. The chain concludes with the long-term owner or institutional investor, who realizes returns through rental income or eventual asset sale (exit strategy). The increasing prevalence of digital platforms facilitates direct engagement with potential tenants and buyers, streamlining the sales process and reducing reliance on traditional intermediary channels.

Real Estate Development Market Potential Customers

The primary customer base for the Real Estate Development Market is highly diversified, encompassing both individual purchasers and large institutional entities with distinct investment objectives and occupancy needs. Residential properties are predominantly sold or leased to individual end-users—families, young professionals, and retirees—who value location, amenities, and community infrastructure. In contrast, commercial properties target corporate entities requiring office space, retail chains needing storefronts, and logistics firms demanding state-of-the-art warehousing. These buyers/tenants are typically focused on efficiency, employee access, operational cost minimization, and compliance with corporate sustainability mandates, requiring a far more sophisticated and tailored product offering from developers.

A crucial and growing segment of the market consists of institutional investors, including pension funds, sovereign wealth funds, Real Estate Investment Trusts (REITs), and private equity funds. These financial entities act as significant buyers of stabilized, income-generating assets, particularly in the multifamily, industrial, and specialized commercial sectors (e.g., life sciences labs, data centers). Their purchasing decisions are driven by factors entirely different from individual consumers: they prioritize long-term asset appreciation, stable rental yields, low vacancy rates, and the adherence of the property to strict ESG criteria. Developers targeting this sophisticated buyer group must ensure projects are built to institutional grade standards, with robust financial projections and detailed operational data.

Furthermore, government agencies and public sector organizations represent substantial end-users, especially for infrastructure development, affordable housing projects, educational facilities, and healthcare complexes. These contracts often involve long-term commitments and specific social mandates, frequently executed through PPPs. Developers seeking public sector contracts must navigate rigorous bidding processes and adhere to strict regulatory compliance, prioritizing social impact and community integration alongside economic returns. The diversification of these end-users necessitates that developers possess comprehensive capabilities across various property types and financing structures to effectively capture market share.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Trillion |

| Market Forecast in 2033 | USD 14.1 Trillion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brookfield Asset Management, Simon Property Group, Lennar Corporation, Prologis, Hines, CBRE, Mitsui Fudosan, Tishman Speyer, Vanke, Related Companies, Emaar Properties, CapitaLand, Goodman Group, Land Securities, D.R. Horton, PulteGroup, China Evergrande Group, Ayala Land, Macquarie Group, Skanska AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Real Estate Development Market Key Technology Landscape

The technology landscape in real estate development is rapidly shifting from manual processes to integrated digital ecosystems, primarily driven by the need for efficiency, risk reduction, and sustainability compliance. Building Information Modeling (BIM) stands as a foundational technology, enabling comprehensive digital representation of physical and functional characteristics of a facility. BIM facilitates enhanced collaboration among architects, engineers, and contractors throughout the project lifecycle, minimizing design errors, optimizing material usage, and streamlining scheduling. Furthermore, the integration of BIM with cloud-based platforms allows real-time data sharing, significantly improving transparency and accountability across complex, multi-party development projects, making it indispensable for large-scale urban developments.

Another transformative technology is the deployment of Internet of Things (IoT) sensors and digital twins within new constructions. IoT devices gather massive amounts of operational data on energy consumption, air quality, and occupant behavior, which feeds into sophisticated Digital Twin models—virtual replicas of the physical building. These twins are utilized for rigorous performance testing before commissioning and continue to serve as dynamic management tools post-occupancy, allowing property managers to simulate maintenance scenarios, track asset health, and optimize building systems proactively. This capability moves the industry towards predictive, rather than reactive, maintenance, dramatically improving operational uptime and reducing lifetime energy costs, which is highly valued by institutional owners focused on maximizing net operating income (NOI).

Finally, sustainable construction technologies (PropTech) are gaining critical prominence. This includes the widespread adoption of modular and prefabricated construction techniques, which reduce on-site waste, minimize construction timelines, and enhance quality control by moving a significant portion of the building process into factory settings. Coupled with the use of advanced green materials (e.g., low-carbon concrete, mass timber), these technologies directly address the market’s growing imperative for achieving net-zero or low-carbon building targets. Investment in AI and robotics, particularly for site monitoring and repetitive construction tasks, is also a critical technological trend that addresses persistent skilled labor shortages and improves overall site safety, positioning technology adoption as a core competitive advantage for modern developers.

Regional Highlights

- North America (NA): The North American market is characterized by high levels of institutional investment, sophisticated financial mechanisms, and rapid technological adoption, particularly in PropTech and sustainable retrofitting. The industrial segment, driven by robust e-commerce growth and supply chain restructuring, shows exceptional strength, with strong demand for logistics and specialized data center facilities across the US and Canada. Residential markets, while facing affordability challenges, are seeing high growth in the Build-to-Rent (BTR) and multifamily segments. Regulatory environments are generally stable, though local zoning and permitting processes can vary widely and influence project timelines.

- Europe: The European real estate development landscape is heavily influenced by stringent environmental, social, and governance (ESG) standards, especially those mandated by the EU Green Deal and the EU Taxonomy. This regulatory framework drives innovation in green building materials, energy efficiency, and retrofitting older stock. Core markets like Germany, France, and the UK prioritize quality over volume, with significant investment directed toward modern, well-connected office spaces and residential projects near urban centers. The region also leads in specialized segments like life science campuses, leveraging strong pharmaceutical and technology industries.

- Asia Pacific (APAC): APAC is the global volume leader, defined by immense scale and rapid urbanization, particularly in emerging economies such as India, Vietnam, and Indonesia. Development here is often characterized by large-scale, vertically integrated mixed-use projects and extensive infrastructure spending, frequently supported by government initiatives. While China remains a massive market, growth momentum is increasingly shifting to Southeast Asia. The region faces challenges related to infrastructure readiness and regulatory complexity, but the massive, growing middle class ensures sustained, long-term demand across all property sectors.

- Latin America (LATAM): The LATAM market presents varied opportunities, often tied to commodity cycles and political stability. Key urban centers in Brazil, Mexico, and Chile are focusing on modernizing commercial office stock and addressing substantial deficits in high-quality affordable housing. Technological adoption is accelerating, especially in digital property management, though access to capital and currency volatility remain significant constraints for large-scale, long-duration projects. Public-private partnerships are crucial mechanisms for funding necessary infrastructure developments.

- Middle East and Africa (MEA): The MEA region is characterized by ambitious, large-scale, government-led mega-projects, especially in the Gulf Cooperation Council (GCC) nations (e.g., Saudi Arabia’s Vision 2030 and UAE’s economic diversification). These projects focus heavily on luxury residential, hospitality, and specialized commercial assets designed to attract global tourism and foreign investment. Africa’s market, though highly fragmented, offers tremendous long-term growth potential driven by demographic explosion and urbanization, with immediate focus on logistics, essential retail, and affordable housing solutions in key economic hubs like Nigeria and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Real Estate Development Market.- Brookfield Asset Management

- Simon Property Group

- Lennar Corporation

- Prologis

- Hines

- CBRE

- Mitsui Fudosan

- Tishman Speyer

- Vanke

- Related Companies

- Emaar Properties

- CapitaLand

- Goodman Group

- Land Securities

- D.R. Horton

- PulteGroup

- China Evergrande Group

- Ayala Land

- Macquarie Group

- Skanska AB

- BAM PPP

- Mitsubishi Estate

- Sino-Ocean Group

- Boston Properties

Frequently Asked Questions

Analyze common user questions about the Real Estate Development market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Real Estate Development Market?

The Real Estate Development Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by global urbanization and technological adoption in construction.

Which key technologies are most significantly impacting modern real estate development?

Key technologies include Building Information Modeling (BIM) for collaborative design, IoT sensors and Digital Twins for asset management optimization, and modular construction methods that enhance efficiency and sustainability compliance.

What are the primary drivers of growth in the Industrial Real Estate Development segment?

The industrial segment's growth is predominantly driven by the robust expansion of global e-commerce, the resultant demand for sophisticated warehousing and logistics facilities, and strategic reshoring initiatives requiring specialized manufacturing space.

How is ESG compliance influencing investment decisions in real estate development?

ESG compliance is becoming mandatory, shifting institutional capital towards certified green buildings, energy-efficient retrofits, and developments that prioritize resource efficiency and occupant well-being to meet increasingly strict investor and regulatory standards.

What are the major restraints hindering market expansion globally?

Major restraints include sustained high interest rates increasing capital costs, volatility in construction material pricing due to geopolitical disruptions, and persistent shortages of skilled labor across key development markets.

The global real estate development landscape is currently undergoing a transformative period marked by intense innovation and heightened scrutiny on environmental impact, profoundly reshaping investment strategies and project execution across all asset classes. Institutional investors, driven by fiduciary responsibility and evolving market expectations, are demanding transparent, data-driven operational models, pushing developers to adopt sophisticated PropTech solutions that manage risk and maximize long-term asset value. The residential segment, particularly the multifamily and build-to-rent categories, continues to demonstrate strong performance, reflecting shifting demographic preferences towards flexible living arrangements and accessible urban amenities. This structural demand contrasts sharply with the challenges faced by older, secondary office assets, which often require extensive capital expenditures for modernization to compete with new, prime, highly sustainable developments, underscoring a market where quality and location are increasingly non-negotiable premiums.

Furthermore, the interplay between technological integration and urbanization is creating unique sub-market opportunities. The development of specialized real estate, such as life science clusters, cold storage logistics, and high-capacity data centers, is outpacing traditional retail and standard office construction in many developed economies. These specialized properties demand highly technical construction expertise and tailored regulatory compliance, often representing joint ventures between experienced developers and technology or healthcare firms. The sustainability push is not merely a trend but a fundamental economic recalculation; assets that fail to meet high energy performance standards face increasing risks of obsolescence and 'brown discounts' in valuation, thus embedding green construction techniques into the core project feasibility analysis from the initial planning stages. Developers who proactively embrace modular construction and low-carbon materials are positioned for a significant competitive advantage in procurement and speed-to-market.

Regional variations in regulatory frameworks and capital accessibility heavily influence localized development trajectories. In mature markets like North America and Western Europe, developers are focusing on density, adaptive reuse, and complex urban infill projects, seeking to maximize returns in constrained geographical areas while adhering to stringent environmental regulations. Conversely, in the rapidly expanding economies of Asia Pacific and parts of the Middle East, the focus remains on large-scale greenfield projects, driven by massive population increases and infrastructural necessity. The availability and pricing of construction debt, determined by global central bank policies, remains a critical vulnerability across all regions, necessitating diversified funding sources, including increasing reliance on private equity and institutional joint ventures to mitigate project financing risk. This complex blend of localized demand, global financial constraints, and technological imperative defines the strategic environment for all major market participants.

The evolution of digital tools, specifically in project management and supply chain logistics, is central to mitigating the inherent risks associated with real estate development. Advanced software solutions are now commonplace, allowing developers to manage hundreds of subcontractors, track billions of dollars in material procurement, and ensure regulatory compliance across multiple jurisdictions simultaneously. The adoption of AI in risk modeling is moving beyond simple financial forecasts to encompass complex operational risks, such as climate change vulnerability and future regulatory changes regarding emissions caps. This focus on proactive risk management is transforming the developer role from merely coordinating construction to acting as an integrated risk and data manager, further professionalizing the industry and raising the performance benchmark for all new market entrants. The continued professionalization and standardization of development processes, largely through technological mandates, will dictate which firms maintain profitability in the increasingly competitive global environment.

Labor market dynamics also exert a considerable impact on development capacity and cost structures. The global shortage of skilled construction labor is prompting accelerated investment in automation, robotics, and off-site manufacturing processes like modular construction. While initial capital expenditure for these automated solutions is high, the long-term benefits in terms of reduced reliance on volatile labor markets, consistent quality control, and accelerated project timelines are compelling developers to make these structural investments. Furthermore, attracting and retaining specialized talent—especially in areas like PropTech implementation, ESG consulting, and complex financial structuring—is becoming a critical strategic necessity for leading development firms seeking to differentiate their offerings and handle increasingly complex, large-scale international projects. The capacity to successfully deploy technology and manage complex multinational supply chains is now directly correlated with market leadership.

The residential sector's future is increasingly defined by flexibility and convenience, with developers actively designing buildings that support community integration and remote work models. This includes incorporating sophisticated co-working spaces, enhanced digital infrastructure, and wellness amenities into standard residential offerings. The growth of specialized housing, such as senior living facilities and student accommodation, demonstrates resilience and specific investment thesis opportunities, often characterized by stable, long-term leasing contracts. Commercial development, particularly in the realm of modern office design, now focuses on providing highly experiential environments that incentivize employees to return to the physical workplace. This requires significant investment in smart building technology, premium material finishes, and high-quality ventilation systems, fundamentally changing the cost base and market pricing for prime commercial assets.

In summary, the Real Estate Development Market trajectory is one of resilient growth, albeit highly influenced by external macroeconomic factors and internal technological disruption. Success hinges on a developer's ability to navigate financial market volatility, embrace mandatory sustainability requirements, and integrate advanced digital tools across the entire project lifecycle, from initial concept to post-occupancy management. The structural shift towards specialized asset classes, coupled with the global urbanization mega-trend, ensures strong underlying demand, provided that supply chain integrity and affordable capital access can be maintained throughout the forecast period. The convergence of financial rigor, environmental stewardship, and technological fluency is the definitive blueprint for market leadership in the coming decade.

The institutionalization of real estate investment has placed immense pressure on developers to achieve consistent returns and mitigate volatility inherent in construction cycles. This environment favors large, diversified development companies that possess both global reach and deep local market expertise, enabling them to capitalize on opportunities across varied economic landscapes. These large players leverage their scale to secure favorable financing terms, negotiate bulk material purchases, and attract high-caliber anchor tenants or institutional buyers, further consolidating market influence. Their focus is not just on building new structures, but on creating integrated, resilient portfolios that can withstand economic downturns and swiftly adapt to regulatory shifts, particularly those related to climate change resilience and carbon reduction mandates. This sophisticated approach dictates capital allocation across continents and asset types.

The challenge of affordable housing remains a critical social and economic factor influencing development policy worldwide. In many high-cost urban areas, the gap between market-rate construction costs and the price point accessible to median-income earners continues to widen. This necessitates creative solutions, often involving public subsidies, tax incentives, and the implementation of innovative construction techniques like modular building to reduce per-unit costs. Developers engaging in affordable housing projects often face complex bureaucratic processes but benefit from stable government backing and a reliable long-term demand structure. The necessity of balancing profitability with social responsibility is a growing theme, with investors increasingly scrutinizing the 'Social' (S) component of ESG frameworks, expecting developers to contribute positively to community welfare and equitable housing provision.

The industrial and logistics sector continues its meteoric rise, benefiting from the sustained momentum of e-commerce penetration and the strategic need for inventory diversification and localization (the 'just-in-case' strategy replacing 'just-in-time'). Developers are responding by creating multi-story logistics hubs in dense urban areas to facilitate last-mile delivery, and developing massive, technologically advanced distribution centers in proximity to major transport nodes. These assets require specialized construction that accommodates sophisticated automation systems, high-clearance storage, and robust power infrastructure. The ability to integrate sustainability features, such as rooftop solar panels and efficient loading docks, has become a key selling point for institutional investors and large corporate tenants prioritizing operational efficiency and low-carbon footprints throughout their supply chain networks.

Finally, the long-term impact of AI on the architectural and engineering workforce is a growing area of concern, yet also a source of immense opportunity. While generative AI can automate routine design tasks and optimize structural analysis, it frees up human creativity to focus on more complex, experiential, and culturally resonant designs. Developers who invest in training their teams to work alongside AI tools will realize benefits in accelerated design cycles and enhanced competitive bidding processes. The successful integration of these advanced tools ultimately supports the market trajectory by making complex, sustainable, and high-performance building achievable within tighter budgetary and time constraints, ensuring the sector remains attractive to global capital seeking reliable infrastructure assets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager