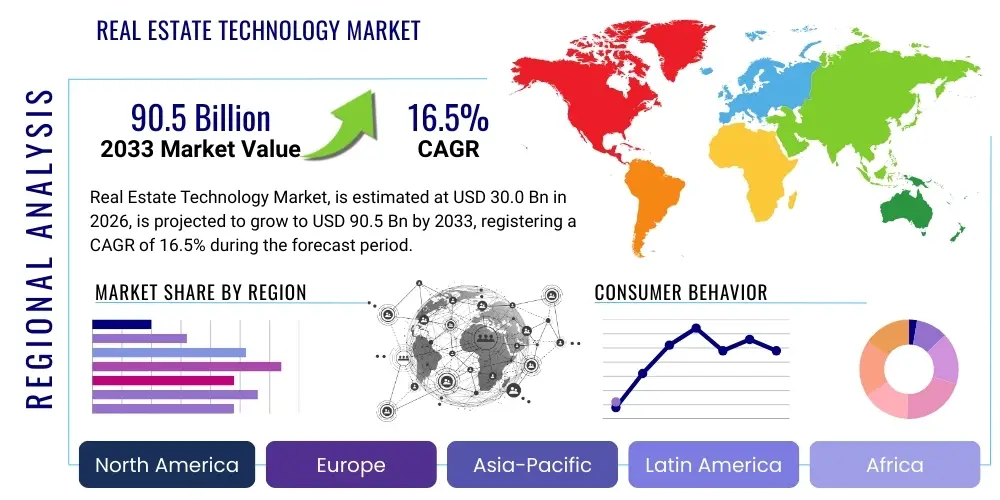

Real Estate Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438783 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Real Estate Technology Market Size

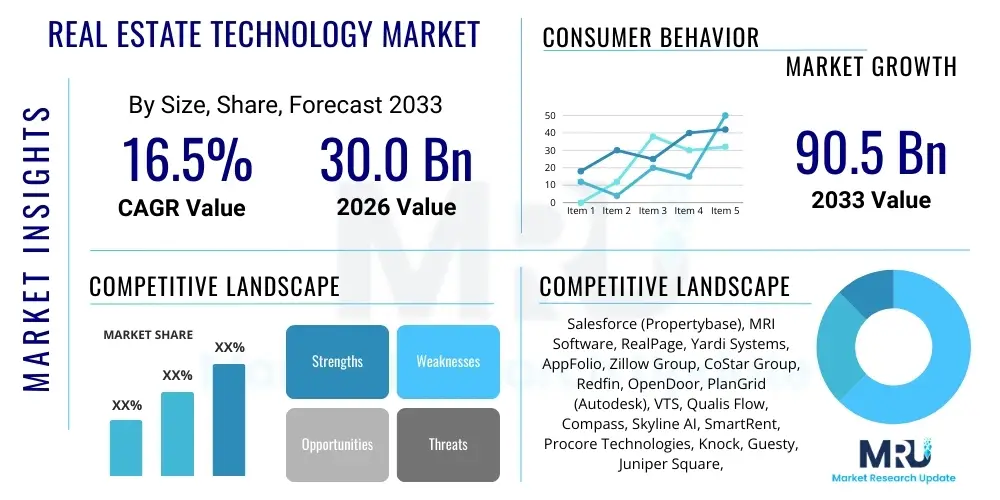

The Real Estate Technology Market, commonly known as PropTech, is experiencing robust expansion driven by digital transformation across property transactions, management, and financing. This market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 30.0 Billion in 2026 and is projected to reach USD 90.5 Billion by the end of the forecast period in 2033. This substantial growth is primarily attributed to the increasing adoption of cloud-based solutions, artificial intelligence, and Internet of Things (IoT) devices aimed at optimizing operational efficiencies and enhancing the customer experience within the global real estate ecosystem.

Real Estate Technology Market introduction

The Real Estate Technology Market encompasses a broad spectrum of software, hardware, and digital services designed to optimize the ways in which real estate is bought, sold, leased, managed, and financed. PropTech solutions serve residential, commercial, and industrial sectors, integrating advanced technological components such as big data analytics, blockchain, virtual reality (VR), and augmented reality (AR) to streamline complex processes. The primary objectives of these technological integrations are to increase transparency, reduce transaction times, improve decision-making through data-driven insights, and lower operational costs associated with property management and maintenance. Key product descriptions include Property Management Software (PMS), Customer Relationship Management (CRM) tools tailored for real estate professionals, and advanced listing platforms utilizing immersive media.

Major applications of PropTech span across various critical functions within the real estate lifecycle. These include asset management for large portfolios, facility management focusing on smart building operations and energy efficiency, and transactional services such as digital closing platforms and online mortgage processing. Benefits derived from adopting these technologies are multi-faceted, ranging from improved resource allocation and predictive maintenance capabilities in commercial buildings to enhanced lead generation and personalized property viewing experiences for residential consumers. Furthermore, the integration of FinTech components into PropTech facilitates alternative financing models and fractional ownership, democratizing real estate investment opportunities.

Driving factors for the market’s acceleration include the rising global urbanization trends, which necessitate smarter and more efficient management of densely populated urban spaces, and the growing demand from millennials and Generation Z consumers for seamless, technology-enabled services. Regulatory environments in several key economies are also evolving to support digital documentation and contract execution, reducing bureaucratic friction and accelerating digital adoption. The continuous venture capital investment inflow into specialized PropTech startups globally further validates the market potential, fostering innovation across niche segments like sustainability tracking (Green PropTech) and cybersecurity specifically tailored for property data.

Real Estate Technology Market Executive Summary

The Real Estate Technology Market Executive Summary reveals a dynamic environment characterized by rapid convergence between traditional real estate practices and cutting-edge digital infrastructure. Current business trends indicate a strong move toward platform consolidation, where holistic, end-to-end solutions are replacing fragmented, siloed applications. This shift is particularly evident in the commercial real estate (CRE) sector, where integrated Building Information Modeling (BIM) and Internet of Things (IoT) platforms are becoming standard for new developments, emphasizing operational efficiency and tenant experience. Investor interest is pivoting towards technologies that deliver quantifiable returns on investment (ROI), such as predictive analytics for rent optimization and automated lease management systems, driving mergers and acquisitions among established tech firms and agile startups.

Regional trends demonstrate North America maintaining its leadership position, primarily due to high technological readiness, significant venture funding, and the early adoption of advanced solutions like digital twins and blockchain for title management. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive urbanization, government initiatives supporting smart cities in countries like Singapore, China, and India, and a burgeoning tech-savvy population demanding digital property services. Europe shows mature adoption, particularly in areas like sustainable building management (ESG compliance), driven by stringent European Union environmental regulations, while emerging markets in Latin America and the Middle East and Africa (MEA) are showing strong foundational growth focused initially on essential property management software and online listing services.

Segment trends highlight the dominance of the software segment, specifically Software-as-a-Service (SaaS) models, due to their scalability, lower initial capital expenditure, and ease of deployment. Within the application landscape, the Property Management segment continues to hold the largest market share, essential for managing multi-family units and large commercial portfolios efficiently. Nevertheless, the Investment and Financing segment, driven by technologies like crowdfunding platforms and tokenization (utilizing blockchain), is forecast to experience the fastest expansion, promising greater liquidity and accessibility to real estate assets globally. The residential sector remains a primary adopter of marketing and sales technology, including VR tours and sophisticated CRM systems, while the commercial sector drives adoption of facility management and operational optimization tools.

AI Impact Analysis on Real Estate Technology Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Real Estate Technology market center on its practical applications in valuation, lead scoring, and displacement of human agents. Key themes frequently analyzed include: how AI algorithms can provide instantaneous and highly accurate property valuations (Automated Valuation Models or AVMs), the extent to which AI can personalize and automate customer relationship management (CRM) for agents, and the feasibility of using generative AI for dynamic content creation and virtual staging. Users are concerned about data privacy, the bias inherent in training data influencing algorithmic decisions, and the necessary skill shift required for existing real estate professionals to leverage AI effectively rather than being replaced by it. The expectation is that AI will fundamentally transform the administrative and analytical workloads, freeing up human professionals to focus on high-value activities like negotiation and complex client relations.

AI's primary influence is moving PropTech away from reactive data recording towards proactive, predictive insights. In property management, AI-driven predictive maintenance systems analyze sensor data to forecast equipment failures before they occur, drastically reducing downtime and operational costs. For investment firms, AI accelerates due diligence by processing thousands of legal documents, market trends, and demographic shifts simultaneously, providing a superior analytical edge in acquisition strategies. The core consensus is that AI is not merely an augmentation tool but a foundational layer enabling Hyper-Personalization across the entire property transaction journey, from initial search using natural language processing (NLP) to automated underwriting processes in the financing phase.

Furthermore, the integration of AI is crucial for optimizing Smart Building operations. AI systems learn occupancy patterns, fine-tune HVAC and lighting systems in real-time to maximize energy efficiency, and enhance security protocols through advanced video analytics. This focus on optimization aligns perfectly with global sustainability targets and ESG mandates, making AI implementation a necessity, not just an option, for modern commercial real estate portfolio managers. The sophistication of AI tools, particularly deep learning models, is leading to highly specific solutions, such as fraud detection in digital transactions and dynamic pricing models for short-term rentals, solidifying AI as the foremost disruptive technology in PropTech.

- AI enhances Automated Valuation Models (AVMs), improving accuracy and speed of property appraisals.

- Predictive analytics optimize investment strategies by forecasting market shifts and identifying undervalued assets.

- AI-powered chatbots and NLP streamline customer service and initial lead qualification processes.

- Integration into Smart Buildings facilitates real-time energy management and proactive maintenance scheduling.

- Machine learning algorithms detect fraudulent activities and enhance cybersecurity in digital transaction platforms.

- Generative AI enables dynamic virtual staging and personalized marketing content creation.

DRO & Impact Forces Of Real Estate Technology Market

The PropTech market is propelled by significant drivers, notably the increasing accessibility and affordability of cloud computing, which lowers the barrier to entry for innovative software solutions, and the shift in consumer expectations favoring digital-first experiences for major life events like purchasing or leasing property. Restraints primarily involve the inherent resistance to change within the historically traditional real estate industry, concerns regarding data security and regulatory compliance across different jurisdictions, and the high initial integration costs associated with retrofitting existing legacy infrastructure with new smart technologies. However, these restraints are offset by substantial opportunities, including the vast potential in underserved markets like affordable housing management and specialized areas such as fractional ownership enabled by blockchain technology, alongside the mandatory requirement for commercial buildings to meet stringent global Environmental, Social, and Governance (ESG) standards, necessitating tech solutions for tracking and reporting.

Key impact forces shaping the market trajectory include the rapid advancement of 5G networks and IoT infrastructure, enabling real-time data collection and remote management of assets at an unprecedented scale, which strongly supports the Smart Building and facility management segments. Furthermore, the persistent demand for greater transparency in real estate transactions, accelerated by decentralized ledger technologies (DLT) like blockchain, is forcing the industry to adopt more standardized and verifiable digital processes. The shift towards remote work and the subsequent redesign of commercial office spaces post-pandemic has created a new demand category for flexible space management and occupancy tracking tools, acting as a powerful market driver.

The convergence of FinTech and PropTech, often termed FinPropTech, represents a significant force, simplifying capital access and investment vehicles globally. While the global economic volatility and interest rate fluctuations can restrain market enthusiasm for new capital investments, the fundamental need for efficient asset management remains constant, bolstering the SaaS segment. Successful market participants strategically manage the impact forces by prioritizing solutions that address both cost optimization (driver) and regulatory complexity (restraint), thus positioning technology as an essential operational expenditure rather than a discretionary capital investment, securing sustained growth regardless of short-term economic headwinds.

Segmentation Analysis

The Real Estate Technology market is comprehensively segmented based on technology type, deployment model, application, and end-user, providing a granular view of market dynamics and adoption patterns. The technology segmentation differentiates between platforms utilizing AI/ML, IoT, VR/AR, and Blockchain, reflecting the varying levels of technological maturity and application across different property lifecycle stages. The application segment, which includes Property Management, Sales and Marketing, and Investment and Financing, often dictates the specific technological requirements and the required level of data integration. The overarching trend indicates a movement towards cloud-based solutions across all segments, favored for their flexibility and scalability, particularly among Small and Medium Enterprises (SMEs) entering the digital transformation journey.

- By Component:

- Solution (Software and Platforms)

- Service (Managed Services, Professional Services, Consulting)

- By Technology:

- Artificial Intelligence (AI) and Machine Learning (ML)

- Internet of Things (IoT) and Sensors

- Blockchain

- Virtual Reality (VR) and Augmented Reality (AR)

- Big Data Analytics

- Cloud Computing

- By Deployment Model:

- Cloud-based

- On-premise

- By Application:

- Property Management (Leasing, Maintenance, Accounting, Tenant Screening)

- Sales and Marketing (CRM, Listing Platforms, Digital Staging)

- Asset and Investment Management (Valuation, Risk Assessment, Portfolio Optimization)

- Facility Management and Smart Building Operations

- Financing and Lending (Digital Mortgages, Crowdfunding)

- By End User:

- Residential

- Commercial (Office, Retail, Hospitality)

- Industrial

- Real Estate Investment Trusts (REITs)

Value Chain Analysis For Real Estate Technology Market

The value chain for the Real Estate Technology Market begins with the upstream analysis, dominated by core technology providers, including semiconductor manufacturers, cloud infrastructure services (AWS, Azure, Google Cloud), and specialized software development firms focusing on AI algorithms, IoT frameworks, and blockchain protocols. These foundational players supply the technological backbone and standardized APIs that PropTech firms integrate into their user-facing applications. The quality and reliability of the upstream components, particularly data security measures and platform interoperability, directly impact the success and adoption rates of downstream PropTech solutions. Strong partnerships between PropTech developers and cloud providers are crucial for ensuring scalability and data handling efficiency.

The downstream analysis involves the deployment, adoption, and integration of PropTech solutions by end-users, which include real estate agents, property managers, institutional investors, and individual landlords. This stage is highly service-intensive, requiring extensive professional services such as consulting, implementation, training, and ongoing technical support. The effectiveness of the value chain is measured by how seamlessly these solutions integrate into existing real estate workflows, improving efficiency, and generating tangible ROI. Key downstream processes include data migration, system customization tailored to specific regional regulatory requirements, and user onboarding to ensure maximum feature utilization.

Distribution channels in the PropTech market are primarily direct and indirect. Direct channels involve proprietary sales forces targeting large institutional clients and enterprise accounts, often using a Software-as-a-Service (SaaS) subscription model tailored for complex organizations like REITs or large property developers. Indirect distribution relies heavily on partnerships with system integrators, value-added resellers (VARs), and technology alliances that bundle PropTech solutions with other business services. The increasing reliance on online marketplaces and application stores is also simplifying the purchase journey for smaller real estate brokerages and individual investors, democratizing access to specialized tools. Both direct and indirect models are optimized for recurring revenue streams, reflecting the subscription nature of the underlying software solutions.

Real Estate Technology Market Potential Customers

The potential customers and end-users of Real Estate Technology solutions are highly diversified, ranging from individual consumers seeking efficient ways to buy or rent property to multinational corporations managing massive global real estate portfolios. Primary institutional buyers include large Real Estate Investment Trusts (REITs) and institutional fund managers who prioritize solutions related to asset management, portfolio risk assessment, and meeting ESG compliance reporting standards. These entities seek platforms that offer predictive analytics derived from big data to optimize returns and operational oversight across multiple geographies and asset classes, making them key consumers of high-end, AI-integrated solutions.

Another major category of buyers consists of property developers and builders who utilize PropTech for project management, Building Information Modeling (BIM), and Smart Building technology integration during the construction phase. Their demand focuses heavily on IoT sensors, construction management software, and pre-sales marketing tools like Virtual Reality (VR) walkthroughs to accelerate sales velocity and reduce construction delays. Furthermore, facility management companies represent a substantial customer base, acquiring technologies centered around energy efficiency, preventative maintenance scheduling, and tenant experience platforms to maintain commercial and residential properties cost-effectively.

The third significant customer group involves transactional intermediaries, including real estate brokerage firms and independent agents. These users heavily rely on Customer Relationship Management (CRM) systems tailored for lead generation, automated marketing tools, and transaction management platforms for digital closings and secure document handling. For smaller firms, the preference often leans towards scalable, cloud-based, and highly user-friendly SaaS solutions with integrated mobile functionality, allowing agents to manage their pipeline effectively while on the move, thus driving widespread adoption across the vast network of real estate professionals globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 30.0 Billion |

| Market Forecast in 2033 | USD 90.5 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce (Propertybase), MRI Software, RealPage, Yardi Systems, AppFolio, Zillow Group, CoStar Group, Redfin, OpenDoor, PlanGrid (Autodesk), VTS, Qualis Flow, Compass, Skyline AI, SmartRent, Procore Technologies, Knock, Guesty, Juniper Square, BoxBrownie. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Real Estate Technology Market Key Technology Landscape

The technological landscape of the Real Estate Technology market is defined by several converging technologies aimed at automation, decentralization, and optimization. Artificial Intelligence and Machine Learning are paramount, enabling predictive maintenance, precise automated valuation models (AVMs), and highly accurate lead scoring, moving beyond simple automation to genuine decision support. Concurrently, the Internet of Things (IoT), integrating sensors, smart devices, and connectivity across commercial and residential buildings, provides the crucial data streams necessary for AI algorithms to function effectively, fueling the Smart Building subset of PropTech. This synergy allows facility managers to monitor building health, optimize energy consumption, and personalize tenant environments in real time.

Blockchain technology is fundamentally altering transactional processes by introducing decentralized, immutable ledgers. This technology is gaining traction particularly in areas requiring high security and transparency, such as property titling, fractional ownership tokenization, and secure digital contract execution (smart contracts). While still in relatively early stages of mass adoption compared to AI or IoT, blockchain holds immense potential to reduce fraud, eliminate intermediaries, and drastically cut down the time required for property closings. The transition from traditional record-keeping to DLT-based systems represents a significant opportunity for market disruption in land administration and capital raising.

Furthermore, immersive technologies, including Virtual Reality (VR) and Augmented Reality (AR), are redefining the sales and marketing component of PropTech. VR tours allow potential buyers or tenants to remotely walk through properties globally, significantly broadening the market reach and reducing unnecessary physical viewings. AR applications, meanwhile, assist architects and designers in visualizing modifications to existing properties and aid maintenance staff by overlaying technical schematics onto physical structures. The combined application of these technologies creates a hyper-realistic, accessible, and data-rich experience, fundamentally improving the efficiency of the discovery and evaluation phases of the real estate lifecycle for all stakeholders.

Regional Highlights

- North America: This region maintains the largest market share, characterized by high investment in venture capital, sophisticated integration of AI and Big Data analytics, and mature adoption of SaaS platforms across commercial and residential sectors. The United States leads in the development of specialized FinPropTech solutions, particularly in digital lending and fractional investment platforms, driven by a large, transparent, and liquid housing market.

- Europe: Europe is a key growth region, highly focused on sustainable PropTech (Green PropTech). Adoption is mandated by strict governmental regulations regarding energy efficiency (e.g., EU Green Deal), driving rapid uptake of IoT and AI solutions for Smart Building management and ESG compliance reporting. The UK, Germany, and France are leaders in adopting Property Management Systems (PMS) and flexible workspace technology.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization, significant government investment in smart city projects (especially in China, Singapore, and South Korea), and a digitally native consumer base. The region sees massive adoption of transactional technologies like mobile listing services and digital payment integration in rental markets, though regulatory fragmentation across countries remains a challenge.

- Latin America (LATAM): The LATAM market is accelerating, focusing primarily on foundational PropTech such as online classifieds, digital mortgage applications, and basic property management software to address market inefficiencies and enhance transparency. Key markets like Brazil and Mexico are attracting international investment due to high urbanization rates and large populations seeking formal, digital real estate channels.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the GCC states (UAE, Saudi Arabia), driven by mega-projects and vision initiatives (e.g., Saudi Vision 2030) emphasizing smart infrastructure and luxurious residential development. Adoption is high for advanced solutions like digital twin technology and security-focused IoT systems, often starting with new construction rather than retrofitting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Real Estate Technology Market.- RealPage

- Yardi Systems

- MRI Software

- AppFolio

- CoStar Group

- Zillow Group

- Redfin

- Opendoor Technologies Inc.

- VTS

- Salesforce (Propertybase)

- Procore Technologies

- PlanGrid (Autodesk)

- SmartRent

- Juniper Square

- Compass

- Qualis Flow

- Knock

- Doma (formerly States Title)

- RentMoola

- Prologis Ventures

Frequently Asked Questions

Analyze common user questions about the Real Estate Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is PropTech and why is its adoption accelerating?

PropTech, or Property Technology, refers to digital solutions (software, hardware, platforms) optimizing the real estate lifecycle, including buying, selling, leasing, and management. Adoption is accelerating due to increased consumer demand for digital experiences, the necessity for operational efficiency, and the maturation of core technologies like cloud computing, AI, and IoT that reduce costs and improve data utilization.

How does blockchain technology impact real estate transactions and ownership?

Blockchain impacts real estate by enabling decentralized and immutable record-keeping, enhancing security and transparency in titling, deeds, and fractional ownership. It facilitates smart contracts for automated, secure closings, potentially eliminating intermediaries and significantly reducing transaction times and associated legal fees by providing a single source of verifiable truth.

Which segmentation of the PropTech market is growing the fastest?

The Investment and Financing application segment is projected to exhibit the fastest growth, primarily driven by FinPropTech solutions such as digital mortgage platforms, real estate crowdfunding, and tokenization services. This rapid expansion is linked to the democratization of real estate investment and the push for greater liquidity and accessibility to high-value assets globally.

What role do Smart Buildings play in the commercial Real Estate Technology sector?

Smart Buildings, powered by IoT sensors and AI/ML algorithms, are crucial for commercial real estate as they enable real-time operational optimization. They allow facility managers to implement predictive maintenance, maximize energy efficiency to meet stringent ESG targets, and significantly enhance tenant experience through personalized environment controls and improved building performance monitoring.

Which region currently leads the global Real Estate Technology Market?

North America currently holds the largest market share in the Real Estate Technology Market. This dominance is attributed to high levels of private and venture capital investment, advanced technological infrastructure, and the early, widespread adoption of enterprise-level software solutions across major residential and commercial property holders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager