Real-time Kinematic (RTK) Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437017 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Real-time Kinematic (RTK) Machine Market Size

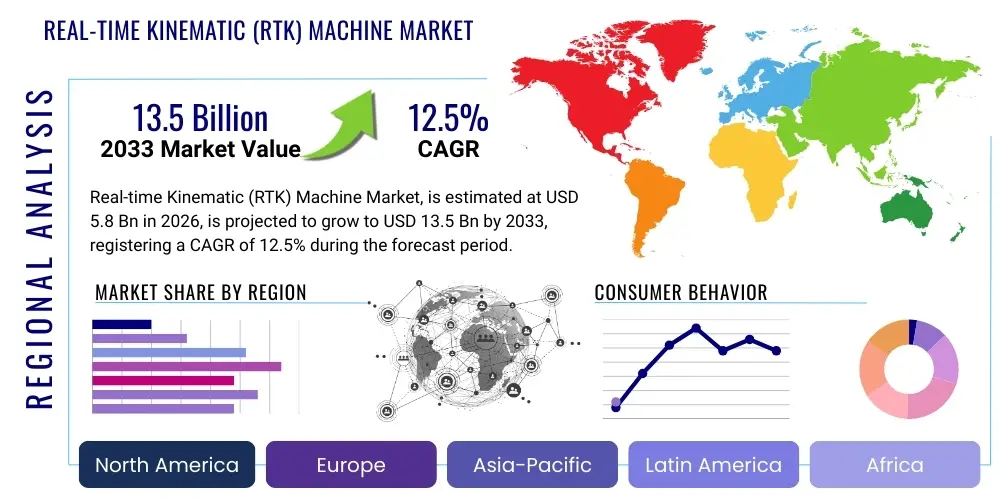

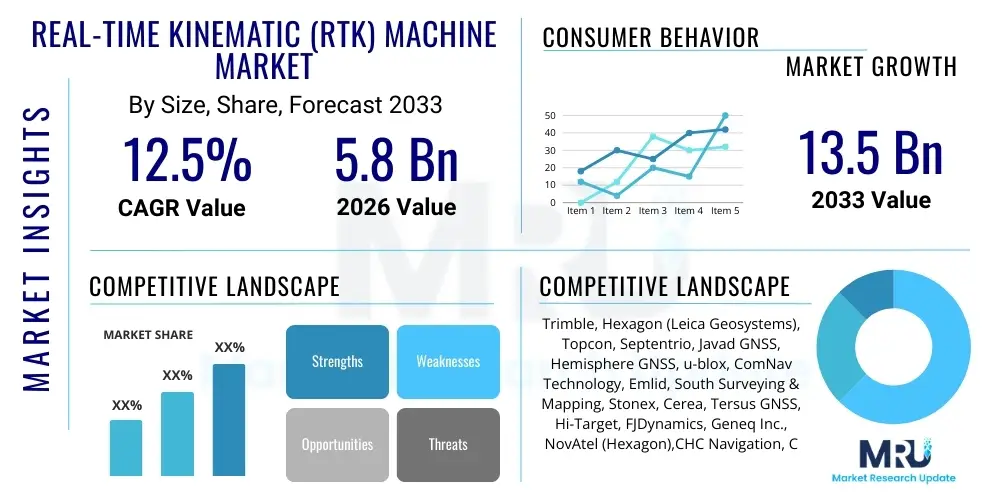

The Real-time Kinematic (RTK) Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $13.5 Billion by the end of the forecast period in 2033. This significant expansion is driven primarily by the escalating demand for high-precision positioning across critical industries, including precision agriculture, construction automation, and autonomous vehicle guidance systems, all of which rely fundamentally on centimeter-level accuracy for efficient operation and resource optimization.

Real-time Kinematic (RTK) Machine Market introduction

The Real-time Kinematic (RTK) Machine Market encompasses hardware and software solutions that utilize carrier phase measurements of Global Navigation Satellite Systems (GNSS) signals to deliver positioning accuracy down to the centimeter level, instantaneously or in real-time. RTK technology addresses the inherent inaccuracies of standard GPS systems by employing a fixed base station that transmits correction data to a mobile receiver, or rover. This system effectively mitigates atmospheric and orbital errors, making it indispensable for applications requiring tight tolerances and repeatable precision. Key hardware components include high-end GNSS receivers, specialized antennas, and robust communication links (radio, cellular, or internet protocols) to transmit the necessary correction vectors, forming the backbone of modern geospatial measurement systems.

Major applications of RTK machines span critical infrastructure development, land surveying, and advanced agricultural practices. In construction, RTK enables machine control systems for graders, dozers, and excavators, leading to significant reductions in material waste and operational time by ensuring designs are implemented to exact specifications. Within precision agriculture, RTK-guided tractors facilitate auto-steering, optimizing planting, spraying, and harvesting paths, thus maximizing yield potential and minimizing fuel consumption and input costs. Furthermore, the burgeoning sector of Unmanned Aerial Vehicles (UAVs) and robotics heavily relies on RTK modules to achieve autonomous navigation and highly precise data collection, particularly in complex or constrained environments where traditional methods are impractical or unsafe. The core benefit derived from RTK implementation is the enhanced operational efficiency and guaranteed repeatability of positioning tasks, offering a substantial return on investment for end-users committed to automation.

The market is predominantly driven by the global imperative for productivity improvement and digitalization across traditional industrial sectors. The increasing accessibility and falling costs of advanced GNSS chipsets, coupled with the rapid deployment of comprehensive Network RTK (NRTK) infrastructure, are lowering the barrier to entry for smaller enterprises. Moreover, the worldwide proliferation of 5G networks provides a stable, low-latency communication backbone crucial for reliable and continuous real-time data exchange between base stations and roving units, further solidifying RTK as the standard for high-accuracy positioning. Regulatory mandates in certain regions promoting safety standards and autonomous operations also compel industries like mining and logistics to integrate high-precision positioning solutions, thereby fueling sustained market growth throughout the forecast period.

Real-time Kinematic (RTK) Machine Market Executive Summary

The Real-time Kinematic (RTK) Machine Market is currently undergoing a transformative phase characterized by accelerated integration into mainstream industrial automation platforms, moving beyond its traditional stronghold in surveying and geodesy. Business trends indicate a strong move toward subscription-based services, specifically Network RTK (NRTK) services, where providers offer correction data streams over cellular networks, eliminating the need for users to manage their own physical base stations. This shift is highly appealing to end-users as it significantly reduces capital expenditure and maintenance burdens, fostering greater scalability and geographic coverage. Furthermore, strategic partnerships between GNSS hardware manufacturers and software developers specializing in specific industry solutions, such as farm management systems or Building Information Modeling (BIM) platforms, are becoming crucial for creating comprehensive, integrated offerings that meet complex project requirements.

Regionally, the market dynamics are heavily influenced by the pace of infrastructure modernization and regulatory frameworks favoring autonomous machinery adoption. North America and Europe maintain leading market shares due to established precision agriculture industries, high labor costs necessitating automation, and robust government investment in Continuous Operating Reference Station (CORS) networks. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, particularly driven by large-scale infrastructure projects in developing economies like China and India, coupled with rapid technological adoption in emerging agricultural markets across Southeast Asia. Investment in smart cities and massive urbanization efforts across APAC demand highly accurate positioning tools for quality control and construction logistics, making this region a focal point for future market expansion and investment opportunities.

Segment trends reveal that the component segment is witnessing strong demand for multi-constellation and multi-frequency receivers capable of processing signals from GPS, GLONASS, Galileo, and BeiDou simultaneously, enhancing reliability and availability even in obstructed environments. By application, the precision agriculture segment remains a major consumer, yet the construction and mining segment is experiencing rapid value growth fueled by the widespread deployment of machine control systems for automated heavy equipment. This shift is driven by the industry's need to improve safety records and achieve sustainability targets by minimizing rework and optimizing earthmoving volumes. The emergence of affordable and compact RTK modules designed for integration into mass-market devices, such as consumer drones and IoT applications, also signals a broadening of the market beyond traditional high-end industrial consumers, setting the stage for substantial volume growth in the near term.

AI Impact Analysis on Real-time Kinematic (RTK) Machine Market

User queries regarding the impact of Artificial Intelligence (AI) on the RTK Machine Market primarily revolve around how AI enhances the robustness and reliability of positioning data, particularly concerning mitigating signal vulnerabilities and automating complex navigation tasks. Users are highly interested in AI’s role in improving positional accuracy in challenging environments—such as urban canyons or under dense foliage—where traditional RTK signals often suffer interruptions or multipath errors. Key themes emerging from common questions center on the development of intelligent filtering algorithms that use machine learning to fuse imperfect GNSS data with other sensor inputs (like LiDAR, IMUs, and vision systems), ensuring continuous, centimeter-level accuracy even when correction links are temporarily lost. Furthermore, end-users frequently inquire about AI's potential to enable true autonomy, moving beyond simple RTK guidance to complex decision-making in real-time for robotic systems and heavy machinery.

The integration of AI transforms the raw high-accuracy data provided by RTK systems into actionable intelligence, significantly augmenting the capabilities of automated machinery. AI algorithms enable predictive maintenance of RTK hardware by analyzing performance patterns and environmental factors, reducing downtime and operational failure rates. More critically, AI facilitates the development of robust sensor fusion architectures. For instance, in an autonomous tractor, AI uses RTK data as the ground truth reference but employs machine learning models to predict the most likely path adjustments based on real-time field conditions, soil characteristics, and obstacles detected by on-board sensors, ensuring safe and highly efficient operation without constant human oversight. This sophisticated level of decision-making, driven by trained models processing massive datasets of positioning information, represents the cutting edge of adoption in construction and agriculture.

The long-term influence of AI is poised to standardize the adoption of sophisticated positioning solutions across previously underserved market niches. As AI streamlines the data processing workflow, it simplifies the user interface and reduces the need for specialized geospatial expertise to operate RTK-enabled equipment. This democratization of high-precision technology, facilitated by intelligent software that manages complex calibration and error modeling, is a major expected outcome. Concerns, however, often focus on data privacy, the computational intensity required for real-time AI processing on edge devices, and the need for standardized training datasets to ensure reliability across different geographic and atmospheric conditions. Addressing these concerns through standardized interfaces and certified, region-specific machine learning models will be crucial for the successful large-scale deployment of AI-enhanced RTK systems in the coming decade.

- AI optimizes sensor fusion, combining RTK data with IMU, LiDAR, and camera inputs for enhanced positional robustness.

- Machine Learning (ML) algorithms improve multipath error mitigation and noise filtering in signal processing, increasing accuracy in challenging urban environments.

- AI drives predictive maintenance for RTK hardware components, minimizing system failures and maximizing field operation uptime.

- Autonomous navigation systems leverage AI to translate high-precision RTK coordinates into complex, real-time operational decisions for heavy machinery and robotics.

- Generative AI models assist in synthetic data generation for testing and training autonomous navigation systems under varied simulated atmospheric and geographical conditions.

DRO & Impact Forces Of Real-time Kinematic (RTK) Machine Market

The market for Real-time Kinematic (RTK) machines is powerfully propelled by the increasing global emphasis on infrastructure development and the mandatory requirement for enhanced operational efficiencies across capital-intensive industries. The primary driver is the widespread deployment of automation and robotics in construction, mining, and agriculture, where centimeter-level accuracy is a non-negotiable prerequisite for cost reduction, quality assurance, and automated machinery operation. Supporting this acceleration is the continuous technological advancement in GNSS receiver chipsets, which have become smaller, more power-efficient, and capable of processing signals from multiple satellite constellations (multi-constellation support), significantly boosting reliability and time-to-fix (TTFF). Furthermore, governmental initiatives worldwide to establish dense networks of Continuous Operating Reference Stations (CORS) or NRTK services provide the necessary infrastructure, making the high-accuracy correction data readily accessible and affordable to a broader user base, thus transforming the value proposition of RTK solutions.

Conversely, the market faces significant restraints that temper its aggressive growth trajectory, most notably the high initial cost of investment associated with sophisticated RTK hardware and the infrastructure needed for consistent operation, particularly for setting up private base stations in remote areas. A major technical restraint involves the vulnerability of GNSS signals to interference, jamming, and spoofing, which can severely compromise positioning accuracy and reliability, necessitating the development of expensive anti-jamming technologies and comprehensive system redundancies. Furthermore, reliable operation is highly dependent on robust communication links (cellular or radio) for transmitting correction data; in regions with limited or unstable network coverage, the operational effectiveness of Network RTK services diminishes rapidly. The scarcity of specialized technical expertise required for the precise setup, calibration, and ongoing maintenance of these intricate systems also poses a significant bottleneck, particularly in emerging markets where trained personnel are limited.

Opportunities in the RTK market are abundant, driven primarily by the rising convergence with the Internet of Things (IoT) and the integration of RTK capabilities into mass-market applications like Advanced Driver Assistance Systems (ADAS) and consumer robotics, opening vast new revenue streams outside traditional industrial sectors. A key opportunity lies in the further development and commercialization of Precise Point Positioning Real-time Kinematic (PPP-RTK) services, which promise global, centimeter-level accuracy without requiring a local base station, relying instead on satellite-based correction streams, significantly improving flexibility and reach. Moreover, emerging applications in logistics and drone delivery systems, which require reliable, automated vertical and horizontal positioning for safe operation, present untapped potential. The market can also capitalize on the growing focus on environmental sustainability, utilizing RTK systems to minimize the environmental footprint of farming and construction activities through ultra-precise resource application and minimized ground disturbance.

- Drivers: Growing adoption of machine control in construction and mining; expanding global coverage of GNSS constellations; reduced cost and size of multi-frequency GNSS chipsets; increasing penetration of precision agriculture techniques globally.

- Restraints: High initial investment costs for professional-grade hardware; vulnerability of GNSS signals to interference (jamming/spoofing); dependency on stable, low-latency communication networks (cellular/radio); lack of standardized regional NRTK coverage in certain territories.

- Opportunities: Integration into autonomous vehicle platforms (L3/L4 ADAS); commercialization of satellite-based correction services (PPP-RTK) offering global coverage; expansion into drone fleet management and last-mile logistics; governmental support for modernizing public infrastructure.

- Impact Forces: Technological advancements significantly outpace infrastructure investment in developing regions; stringent safety and quality regulations drive compulsory adoption in heavy industries; market maturity in developed regions shifts competition toward service provision (NRTK subscriptions) rather than solely hardware sales.

Segmentation Analysis

The Real-time Kinematic (RTK) Machine Market is systematically segmented based on component, application, industry, and end-user, allowing for a precise understanding of market dynamics and tailored strategy development. The component segmentation differentiates between hardware (receivers, antennas, communication modules) and software/services (correction services, processing software, network subscriptions). The increasing complexity and sophistication of positioning software that integrates sensor fusion algorithms and error modeling are driving significant value in the software and services segment, particularly the recurring revenue generated by subscription models for NRTK correction data. Analyzing these segments helps stakeholders understand where technological investment is most critical and how service monetization strategies are reshaping traditional hardware sales cycles, moving toward integrated solution provision.

Segmentation by application is crucial, highlighting the dominant role of Surveying and Mapping, where high-precision localization is a foundational requirement, and Machine Control, which covers the automated guidance of heavy equipment across construction and agriculture. Within the application landscape, the emerging segment of Unmanned Systems (UAVs and Autonomous Ground Vehicles) is exhibiting the fastest growth due to the lightweight, small form factor, and low power requirements of modern RTK modules designed for aerial and mobile robotics. Understanding the specific performance benchmarks required by each application, such as latency requirements for drone delivery versus accuracy requirements for agricultural row-following, is key to developing targeted product specifications and marketing campaigns that resonate with distinct professional end-users.

Industry-based segmentation primarily focuses on Construction, Agriculture, Mining, Automotive, and Marine sectors, each with unique requirements regarding environmental robustness and operational scale. For instance, the Mining sector often requires extremely ruggedized, explosion-proof RTK solutions for reliable subterranean or heavy-duty surface operations, whereas the Automotive sector demands certified, functionally safe RTK components integrated into safety-critical ADAS architectures. This granular view enables manufacturers to specialize their offerings, optimize their distribution networks for sector-specific channels, and ensure regulatory compliance necessary for sustained engagement within high-barrier-to-entry industries. The interplay between industry scale and technological adoption rates dictates the short-term revenue potential and long-term stability of various segments within the global RTK market landscape.

- By Component:

- Hardware (GNSS Receivers, Antennas, Communication Modules)

- Software & Services (Correction Services, Data Processing Software, NRTK Subscriptions)

- By Application:

- Surveying and Mapping

- Machine Control and Guidance

- Unmanned Systems (UAVs/Drones and Autonomous Vehicles)

- Location-Based Services (LBS)

- By Industry:

- Construction and Infrastructure

- Precision Agriculture

- Mining and Quarrying

- Automotive (ADAS and Autonomous Driving)

- Oil and Gas

- Marine and Offshore

- By Frequency:

- Single Frequency

- Dual Frequency

- Multi-Frequency

- By Offering Type:

- Standard RTK

- Network RTK (NRTK)

- PPP-RTK

Value Chain Analysis For Real-time Kinematic (RTK) Machine Market

The value chain of the RTK Machine Market begins with upstream activities dominated by fundamental technology providers, primarily semiconductor manufacturers and satellite signal providers. This segment is characterized by high capital intensity and advanced R&D dedicated to developing multi-frequency, multi-constellation GNSS chipsets, such as those produced by specialized silicon design houses. These foundational components dictate the ultimate performance capabilities—accuracy, power consumption, and signal acquisition speed—of the downstream RTK devices. Strategic partnerships and long-term supply agreements between chipset developers and major RTK system manufacturers are critical at this stage to secure supply, leverage economies of scale, and incorporate cutting-edge features like anti-spoofing and robust interference mitigation directly into the hardware architecture. The competitiveness at the upstream level often centers on minimizing chip size and maximizing the number of simultaneous satellite tracking channels.

Midstream activities involve the design, manufacturing, and integration of the final RTK systems. This phase is handled by specialized system integrators and established geospatial equipment companies who purchase raw GNSS components and integrate them with proprietary firmware, communication modules (radio or cellular), and application-specific software. This segment adds substantial value through calibration, quality control, and ruggedization of the equipment to withstand harsh industrial environments, tailoring the final product for sectors like construction or mining. Moreover, the development of sophisticated correction service infrastructure—the network of physical base stations (CORS) or the server infrastructure for NRTK—falls within this midstream segment. Companies that successfully control both the hardware manufacturing and the provision of high-reliability correction services gain a significant competitive advantage by offering an end-to-end solution.

Downstream activities focus on distribution, customer support, and the provision of localized professional services. Distribution channels are typically segmented into direct sales for large enterprise clients (e.g., global construction companies or national government agencies) and indirect channels utilizing a network of authorized dealers, regional value-added resellers (VARs), and specialized integration partners. These resellers often provide crucial local support, training, and integration services, especially for complex machine control applications where the RTK system must interface seamlessly with proprietary heavy machinery systems. The success of the downstream segment is highly dependent on effective technical support and localized calibration services, ensuring that the high-precision technology performs optimally in specific geographic regions, often necessitating localized firmware and access to regional correction services, thereby completing the value delivery to the ultimate end-user/buyer.

Real-time Kinematic (RTK) Machine Market Potential Customers

The primary potential customers for Real-time Kinematic (RTK) machines are highly diversified across industries where geospatial accuracy directly translates into efficiency, quality, and cost savings. The largest cohort of buyers includes construction and heavy civil engineering companies. These organizations purchase RTK systems to implement machine control on graders, dozers, and pavers, ensuring that earthmoving operations adhere precisely to digital design models, minimizing material overages, and speeding up construction timelines. Additionally, surveying professionals, government mapping agencies, and utility companies are core consumers, relying on RTK for high-accuracy boundary definition, infrastructure asset mapping, and precise volume calculations necessary for large-scale planning and regulatory compliance. The demand from these sectors is characterized by a requirement for durable, highly reliable field equipment capable of operating continuously in demanding outdoor environments.

The precision agriculture sector represents a massive and rapidly expanding customer base. Farmers and large agribusinesses purchase RTK guidance systems (often integrated into auto-steer functionality) to optimize resource application. By achieving repeatable, sub-inch accuracy, they can maximize planting density, minimize overlap in spraying and seeding, and reduce consumption of expensive inputs like fertilizer and pesticides, leading directly to improved yields and operational sustainability. These customers are increasingly moving toward subscription-based NRTK services to avoid the maintenance complexities of base stations, prioritizing system ease-of-use and reliable, broad field coverage. The purchasing decision in this sector is heavily influenced by the demonstrable Return on Investment (ROI) derived from input savings and yield enhancement achieved through enhanced precision.

Emerging but high-value customer segments include developers and operators of autonomous systems, such as aerospace and defense contractors, specialized logistics firms utilizing drone fleets, and automotive manufacturers developing Level 3/Level 4 autonomous vehicles. For these customers, RTK is not merely a tool but a foundational safety-critical component essential for safe autonomous navigation and fleet management. For instance, drone delivery services rely on RTK for highly precise takeoff, landing, and navigation in complex urban airspace. These buyers require compact, lightweight, and robust modules with extremely low latency, often integrating these modules deeply with Inertial Measurement Units (IMUs) and AI vision systems to ensure positional integrity even during momentary signal loss, highlighting a focus on system integration complexity rather than just raw positional data.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $13.5 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble, Hexagon (Leica Geosystems), Topcon, Septentrio, Javad GNSS, Hemisphere GNSS, u-blox, ComNav Technology, Emlid, South Surveying & Mapping, Stonex, Cerea, Tersus GNSS, Hi-Target, FJDynamics, Geneq Inc., NovAtel (Hexagon),CHC Navigation, Carlson Software, Swift Navigation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Real-time Kinematic (RTK) Machine Market Key Technology Landscape

The technological landscape of the RTK Machine Market is rapidly evolving, driven by advancements in GNSS hardware and improved methods for delivering correction data. The foundation remains the highly sophisticated GNSS receiver, which has transitioned from supporting single constellations (GPS) and single frequencies to supporting multi-constellation and multi-frequency signals (L1/L2/L5/L6, etc.) from all major systems, including GPS, GLONASS, Galileo, and BeiDou. This technological shift is crucial as it significantly enhances the Time-to-First-Fix (TTFF) and improves positional availability and reliability, especially in environments where visibility to specific satellites is obstructed. Modern RTK receivers also incorporate advanced anti-jamming and anti-spoofing techniques, utilizing complex digital signal processing (DSP) to maintain signal lock and positional integrity even when facing intentional or unintentional radio frequency interference, a critical feature for high-value industrial operations.

A key disruptive technology is the evolution of correction services, particularly the rise of Network RTK (NRTK) and the emerging Precise Point Positioning Real-time Kinematic (PPP-RTK). NRTK utilizes a dense network of continuously operating reference stations (CORS) spread across a region, allowing the central server to model and broadcast atmospheric errors more accurately than a single base station could. This approach eliminates the user's need to establish a dedicated base station, offering superior coverage and operational flexibility via cellular or internet communication links, making it the preferred method for large-scale agricultural and infrastructure projects. Furthermore, PPP-RTK combines the global reach of Precise Point Positioning (PPP), which uses orbital and clock correction data streamed via satellite, with the rapid convergence time of RTK, promising global centimeter-level accuracy without local ground infrastructure, poised to transform the maritime and aviation sectors.

The market also benefits immensely from sensor fusion technologies, which are becoming standard in high-end RTK systems. While RTK provides highly accurate positional data, it is susceptible to outages when satellite signals are blocked. To mitigate this, RTK receivers are increasingly bundled with high-performance Inertial Measurement Units (IMUs). By integrating the positional accuracy of RTK with the dead reckoning capabilities of the IMU, the system can provide continuous, high-accuracy navigation (known as tightly-coupled integration) for short periods of GNSS signal deprivation (e.g., driving through a tunnel or under a bridge). This technological convergence is fundamental for safety-critical applications like machine control and autonomous driving, ensuring uninterrupted guidance and minimizing the risk of operational errors caused by transient positioning failures. The focus moving forward is on miniaturization and cost reduction of these integrated RTK-IMU modules for broader adoption in consumer electronics and small-scale robotics.

Regional Highlights

The global Real-time Kinematic (RTK) Machine Market exhibits diverse growth patterns across major geographical regions, influenced by infrastructure maturity, investment in technology, and regulatory environments.

- North America: North America holds a dominant share of the RTK market, driven by the high rate of adoption in precision agriculture, where farmers extensively use RTK for auto-steering and variable rate application technologies to optimize crop yields and manage soaring labor costs. The region benefits from robust infrastructure, including extensive government-supported CORS networks and widespread high-speed cellular coverage crucial for NRTK services. Additionally, massive investment in the construction and modernization of infrastructure, alongside leading research in autonomous vehicle technology, sustains high demand for advanced RTK solutions. The United States and Canada are pivotal markets, setting global standards for hardware and service reliability.

- Europe: Europe is a mature market characterized by stringent regulatory standards concerning environmental impact and worker safety, prompting industries like construction and surveying to integrate high-precision RTK systems for compliance and efficiency. Demand is strong across Western Europe, particularly Germany, the UK, and France, driven by public sector contracts for infrastructure renewal and smart city development. The European Union's Galileo GNSS provides enhanced signal redundancy and accuracy, benefiting local RTK providers. The focus here is increasingly on integrated solutions that link geospatial data directly into Building Information Modeling (BIM) workflows.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure development initiatives (such as China's Belt and Road Initiative), and technological modernization in agriculture, especially in India and Southeast Asian nations. While high-end industrial adoption is strong in developed economies like Japan and South Korea, the surging demand in developing nations for affordable, yet reliable, positioning solutions is creating significant market volume. Local manufacturers are gaining prominence by offering cost-competitive hardware, although infrastructure development, particularly CORS network density, remains uneven across the region, leading to reliance on diverse communication protocols.

- Latin America: This region presents significant opportunities, particularly in large-scale resource extraction industries (mining in Chile and Peru) and expansive agricultural sectors (Brazil and Argentina). Market penetration is accelerating as the cost of hardware decreases and regional providers invest in localized correction services. However, challenges include inconsistent governmental support for geospatial infrastructure and reliance on imported technology, making pricing a critical factor for wider commercial adoption. The growth is currently focused on optimizing existing industrial operations rather than extensive new infrastructure rollouts.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, propelled by vast capital projects related to future mega-cities (e.g., NEOM in Saudi Arabia) and oil and gas infrastructure expansion. These projects require state-of-the-art precision tools for engineering and quality control. In Africa, the RTK market growth is slower but significant in the mining and defense sectors, with increasing government interest in mapping and land registration projects driving demand for portable, robust RTK surveying equipment. Investment in private NRTK networks is beginning to emerge to support these high-value industrial operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Real-time Kinematic (RTK) Machine Market.- Trimble Inc.

- Hexagon AB (Leica Geosystems and NovAtel)

- Topcon Positioning Systems, Inc.

- Septentrio N.V.

- Javad GNSS, Inc.

- Hemisphere GNSS, Inc.

- u-blox Holding AG

- ComNav Technology Ltd.

- Emlid Ltd.

- South Surveying & Mapping Technology Co., Ltd.

- Stonex S.r.l.

- Cerea SAS

- Tersus GNSS Ltd.

- Hi-Target International Group Limited

- FJDynamics

- Geneq Inc.

- CHC Navigation

- Carlson Software Inc.

- Swift Navigation, Inc.

- Garmin Ltd.

Frequently Asked Questions

Analyze common user questions about the Real-time Kinematic (RTK) Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between standard GPS and RTK positioning accuracy?

Standard consumer-grade GPS typically offers accuracy ranging from several meters down to sub-meter level, often sufficient for general navigation but inadequate for precision industrial tasks. Real-time Kinematic (RTK) technology enhances this dramatically by utilizing carrier phase measurements and correctional data from a fixed base station or network. This methodology allows RTK systems to achieve consistent, highly reliable positioning accuracy down to the centimeter or sub-inch level (typically 1-3 cm), which is essential for machine control, surveying, and autonomous vehicle guidance applications.

How is the adoption of 5G technology influencing the viability and performance of Network RTK (NRTK) services?

5G technology is a crucial enabler for the widespread adoption and reliability of Network RTK (NRTK) services, which rely on cellular networks to transmit correction data. The key benefit of 5G is its significantly lower latency compared to 4G LTE. Low latency ensures that the correctional data reaches the rover receiver almost instantaneously, which is vital for maintaining high accuracy, especially when the receiver is in motion, such as in high-speed autonomous machinery. Furthermore, 5G’s enhanced capacity and reliability minimize connection drops, ensuring continuous, robust positioning data streams crucial for safety-critical operations.

What are the primary challenges limiting the widespread use of RTK technology in remote or developing regions?

The main limitations for RTK deployment in remote or developing regions center on infrastructure deficits and cost barriers. Challenges include the lack of dense, publicly maintained Continuous Operating Reference Station (CORS) networks necessary for NRTK coverage, requiring users to invest in and maintain expensive private base stations. Furthermore, unreliable or non-existent cellular/internet connectivity compromises the real-time data link. High initial hardware costs for industrial-grade, multi-frequency receivers also serve as a financial restraint for smaller enterprises and individual farm owners in these emerging markets, favoring simpler, lower-accuracy solutions.

In which industries are RTK systems expected to see the highest growth rate during the forecast period?

The highest growth rate for RTK systems is projected within the construction automation and automotive (autonomous vehicle) sectors. Construction projects worldwide are increasingly mandated to incorporate digital design execution and machine control to enhance efficiency and reduce material waste, making RTK fundamental. Concurrently, the automotive industry's push toward advanced Level 3 and Level 4 autonomous driving systems requires absolute positional confidence in dynamic environments, positioning RTK, often integrated with IMU and camera systems, as a mandatory technology for safe and reliable autonomous mobility solutions.

How does PPP-RTK differ from traditional terrestrial RTK, and what market needs does it address?

Precise Point Positioning Real-time Kinematic (PPP-RTK) represents an evolution of correction services. Traditional terrestrial RTK relies on localized ground base stations or a network of stations, limiting coverage to areas with established infrastructure. PPP-RTK, conversely, utilizes highly accurate satellite-based correction streams for satellite clock and orbit errors, combined with atmospheric correction modeling. This approach delivers global, centimeter-level accuracy without requiring any local base station, thus addressing the market need for highly mobile, globally deployable positioning solutions, particularly beneficial for offshore marine operations, aviation, and cross-continental logistics where ground infrastructure is impractical or nonexistent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager