Reaming Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433704 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Reaming Tools Market Size

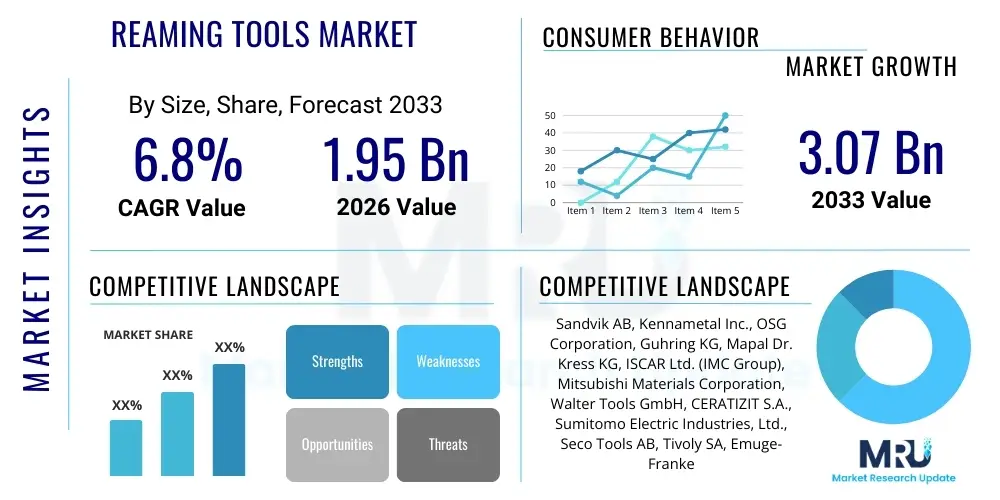

The Reaming Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The sustained expansion is largely attributed to the increasing global demand for high-precision components across critical manufacturing sectors, particularly aerospace, automotive engine production, and sophisticated mold making. These industries prioritize stringent tolerance requirements, driving the adoption of advanced reaming solutions that offer superior surface finish and dimensional accuracy compared to standard drilling techniques. Furthermore, the global trend towards lightweighting in transportation sectors necessitates specialized tooling capable of processing challenging materials like titanium alloys and composite materials with consistency and reliability.

The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.07 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by continuous technological advancements in cutting tool materials, such as the increasing utilization of solid carbide and polycrystalline diamond (PCD) reamers, which significantly enhance tool life and machining efficiency. The integration of smart manufacturing principles, including automated tool monitoring and adaptive reaming processes, further solidifies the market's positive outlook. Developing economies, especially those in the Asia Pacific region, are experiencing robust industrialization and infrastructural development, creating a large, expanding customer base for precision reaming applications.

Reaming Tools Market introduction

The Reaming Tools Market encompasses the global trade of cutting instruments specifically designed to enlarge and finish previously drilled or bored holes to precise dimensions and required surface finishes. Reaming tools are essential components in precision engineering workflows, offering critical improvements in concentricity and straightness that are unachievable with standard drilling operations alone. These tools come in various designs, including straight flute, spiral flute, expansion, and shell reamers, tailored for different materials and hole configurations. Major applications span high-volume and high-tolerance manufacturing environments, predominantly the automotive sector for engine blocks and transmission components, the aerospace industry for structural parts and turbine components, and general precision machinery manufacturing where exact fits are paramount for product performance and longevity.

The primary benefit derived from utilizing specialized reaming tools is the attainment of highly accurate finished bores, reducing operational friction and ensuring optimal fit between mated components, which is vital in complex mechanical assemblies. The driving factors behind market expansion include stringent quality control standards mandated by regulatory bodies in highly sensitive industries like medical devices and aerospace, coupled with the increasing adoption of automated CNC machining centers that demand highly reliable and repeatable tooling performance. The global push toward electric vehicles (EVs) also plays a role, requiring new reaming solutions tailored for specific components like battery casings and motor housings, often involving specialized non-ferrous materials or advanced composites, thereby sustaining high demand for innovative tooling solutions.

Market growth is also significantly influenced by the development of application-specific coatings, such as PVD and CVD coatings, which optimize reamer performance when working with abrasive or heat-resistant superalloys. The focus on reducing cycle times and minimizing scrap rates across manufacturing operations compels manufacturers to invest in premium reaming tools that maintain integrity and precision over extended runs. Furthermore, the shift towards modular and interchangeable tooling systems facilitates rapid production changeovers and reduces inventory costs, making advanced reaming solutions highly attractive to modern machine shops seeking efficiency gains and operational flexibility in a competitive global landscape.

Reaming Tools Market Executive Summary

The Reaming Tools Market is characterized by a strong convergence of mature precision engineering practices and rapid digitalization trends, necessitating continuous innovation in tool material science and geometry. Business trends emphasize the consolidation of supply chains, with major tool manufacturers focusing on offering integrated tooling solutions—including digital services for performance monitoring and predictive maintenance—rather than standalone physical products. There is a perceptible shift towards solid carbide and indexable reaming systems, moving away from conventional High-Speed Steel (HSS) tools, driven by the increasing need to machine hard metals at elevated speeds and feed rates. Strategic alliances between tool suppliers and machine tool builders are becoming crucial for co-developing optimized machining processes that maximize efficiency in specialized applications, ensuring that tooling is perfectly calibrated for the latest generation of CNC equipment.

Regionally, Asia Pacific maintains its dominance, spurred by massive investments in automotive manufacturing, particularly in China and India, and the burgeoning electronics and medical device industries. North America and Europe, while representing mature markets, exhibit strong demand for highly specialized, custom reaming solutions necessary for complex aerospace and energy sector components, particularly in high-mix, low-volume production environments. These regions are also leading the adoption of Industry 4.0 principles, integrating sensor-equipped reaming tools for real-time data collection and process optimization. Latin America and the Middle East & Africa are showing promising growth driven by localized industrialization efforts and expansion in oil and gas infrastructure, which requires durable and reliable tooling for heavy machinery repair and construction.

Segment-wise, the solid carbide segment is experiencing the fastest growth due to its superior rigidity, wear resistance, and ability to hold tighter tolerances, making it the preferred choice for high-precision, long-production-run environments. By application, the Automotive sector remains the largest consumer, but the Aerospace & Defense segment is projected to show the highest CAGR, fueled by massive backlogs in aircraft production and the increasing complexity of structural materials used. The shift towards modular reaming systems is also a critical segment trend, allowing manufacturers to quickly change cutting heads without removing the tool body from the spindle, thereby significantly enhancing machine uptime and contributing directly to overall equipment efficiency (OEE) improvements.

AI Impact Analysis on Reaming Tools Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Reaming Tools Market frequently center on predictive tool wear modeling, adaptive feed and speed optimization, and the role of machine learning in defect detection during high-precision boring processes. Users are concerned with how AI can minimize expensive scrapped parts, extend the effective operational lifespan of premium reamers, and automate the complex decision-making processes typically managed by highly experienced machinists. The expectation is that AI algorithms, utilizing historical and real-time sensor data from the cutting edge (vibration, torque, temperature), will move the industry beyond simple condition monitoring towards true prescriptive maintenance and automated process adjustment. There is significant interest in AI-driven tool path generation that inherently compensates for material inhomogeneity and machine tool deflection, thereby guaranteeing exceptional hole quality consistently, especially in demanding applications involving exotic alloys or deep holes where process stability is critical.

AI's influence is rapidly transforming the design, manufacturing, and deployment phases of reaming tools. In design, generative AI is accelerating the creation of novel reamer geometries optimized for specific material-removal characteristics, reducing the traditional iterative testing cycle. During manufacturing, AI-powered quality control systems use image recognition and acoustic analysis to ensure zero-defect production of the tools themselves, verifying microscopic edge integrity. In application, AI acts as a digital co-pilot, analyzing streaming data from machine spindles and tool holders to autonomously adjust cutting parameters, mitigating chatter, preventing catastrophic tool failure, and maintaining the surface finish within acceptable parameters. This capability is paramount in lights-out manufacturing environments where human intervention is minimal, thereby maximizing operational throughput and precision.

Furthermore, AI is instrumental in enhancing the aftermarket services offered by tool manufacturers. By analyzing aggregated performance data across thousands of end-user facilities globally, AI models can provide highly customized recommendations regarding optimal tool selection, regrinding schedules, and coating choices for specific production challenges. This data-driven consultative approach allows manufacturers to build stronger, value-added relationships with customers. The integration of AI also supports rapid prototyping of customized reamers by simulating performance under various stress conditions before physical production begins, significantly cutting down on development time and reducing the risk associated with introducing new specialized tooling into demanding high-tolerance applications.

- AI-Driven Predictive Maintenance: Forecasting reamer failure or degradation based on real-time acoustic, thermal, and vibration signatures to schedule proactive replacement.

- Generative Design Optimization: Using machine learning to rapidly develop and simulate complex, asymmetrical reamer geometries for improved chip evacuation and reduced cutting forces.

- Adaptive Machining Control: Implementing closed-loop AI systems that adjust spindle speed, feed rate, and depth of cut dynamically to maintain dimensional tolerance despite material inconsistencies.

- Automated Quality Inspection: Deploying computer vision and neural networks for micron-level surface finish and diameter verification, replacing manual inspection processes.

- Process Digital Twins: Creating AI-enhanced virtual models of the reaming process to simulate wear, temperature distribution, and material interaction, optimizing operational efficiency without physical trials.

- Supply Chain Forecasting: Utilizing AI to predict future demand for specific reamer types and materials based on macroeconomic trends and industry forecasts, optimizing inventory levels.

DRO & Impact Forces Of Reaming Tools Market

The Reaming Tools Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaped by powerful market impact forces originating from technology, economy, and regulation. Key drivers include the escalating global demand for precision components, particularly in the highly regulated and rapidly evolving automotive and aerospace sectors, which mandate extremely tight tolerances for safety-critical parts. Furthermore, the global expansion of CNC machining adoption, coupled with the necessity for highly efficient material removal processes, fuels the demand for premium carbide and PCD reaming solutions that offer extended operational life and superior surface integrity. These technological advancements are mandatory for competitive manufacturing, compelling investment despite high initial tooling costs, thereby acting as a continuous upward pressure on market valuation.

However, the market faces notable restraints. High initial capital investment required for specialized reaming tools, especially those incorporating advanced materials or modular designs, poses a challenge for smaller machine shops and those operating in developing markets. Moreover, the inherent vulnerability of highly specialized cutting edges to improper handling and operating conditions can lead to premature tool failure and costly scrap rates, generating reluctance among some users to shift away from more traditional, albeit less efficient, processes. The growing complexity of material science, with new alloys constantly being introduced, necessitates continuous research and development, which represents a substantial and ongoing financial burden for tool manufacturers, potentially constraining profitability for smaller market participants who lack extensive R&D budgets.

Opportunities for growth are concentrated in the rapid uptake of modular tooling systems that offer enhanced flexibility and reduced changeover times, catering to the trend of high-mix, low-volume production. The development of specialized reamers specifically designed for challenging materials like CFRP (Carbon Fiber Reinforced Polymers) and advanced ceramics, driven by electric vehicle and lightweight aircraft manufacturing, opens lucrative niche markets. Additionally, the proliferation of Industry 4.0 initiatives provides an opportunity for tool manufacturers to integrate sensor technology and digital services, moving the business model beyond simply selling a physical product to offering a comprehensive, data-driven productivity solution. The increasing focus on regrinding and recycling services also presents an avenue for revenue growth and enhanced sustainability alignment.

- Drivers: Intensification of precision engineering standards in automotive and aerospace; increasing global adoption of CNC machining technology; demand for improved surface finish and dimensional accuracy; rapid adoption of exotic and hard-to-machine materials requiring high-performance tools.

- Restraints: High initial investment cost for advanced solid carbide and modular reamers; volatility in raw material prices (Tungsten, Cobalt); technical expertise required for optimal reamer selection and application; risk of premature tool wear due to misalignment or incorrect cutting parameters.

- Opportunities: Expansion into developing markets with growing manufacturing bases; technological advancements in PVD/CVD coatings enhancing tool longevity; development of application-specific reamers for EV components and medical implants; implementation of smart tooling solutions integrated with IoT and AI for process optimization.

- Impact Forces: Technological substitution risk from advanced boring or grinding methods; regulatory pressure regarding manufacturing traceability and material sourcing; globalization leading to intense price competition; shift towards customized tooling solutions over standard off-the-shelf products.

Segmentation Analysis

The Reaming Tools Market is segmented based on critical factors including the tool's design (Product Type), the material used in its construction (Material), and the specific industry where it is deployed (Application). This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological specialization. The effectiveness of a reaming tool is fundamentally dependent on matching the appropriate tool type and material composition to the workpiece material and the desired tolerance level. For instance, solid carbide reamers dominate segments requiring extreme precision and high-volume consistency, while adjustable reamers cater to maintenance and repair operations (MRO) where flexibility is paramount. Understanding these segments is crucial for strategic planning and product portfolio development in the competitive cutting tool industry.

The segmentation by Product Type reveals that spiral flute reamers are highly popular due to their efficient chip evacuation capabilities, which is essential for deep hole reaming and soft materials, minimizing the risk of tool breakage or surface scratching. Conversely, the segmentation by Material clearly shows a rapid transition toward advanced tooling materials, particularly solid carbide and Cermet, which outperform High-Speed Steel (HSS) in terms of hardness, heat resistance, and maximum permissible cutting speed, directly translating to enhanced productivity in modern machining centers. The segmentation by Application underscores the automotive industry's massive scale as the dominant consumer, yet it points toward the aerospace sector as the primary driver of innovation due to its uncompromising requirements for material strength and performance verification across all stages of production.

- By Product Type:

- Straight Flute Reamers

- Spiral Flute Reamers (High prevalence in deep hole applications)

- Shell Reamers (Cost-effective for large diameters, used with reusable arbors)

- Expansion Reamers (Flexibility for slight size adjustments)

- Taper Pin Reamers (Crucial for achieving precise taper fits)

- Chucking Reamers (General purpose, highly common in basic machining)

- Modular Reamers (Advanced, quick-change systems)

- By Material:

- High-Speed Steel (HSS)

- Carbide (Solid Carbide and Carbide Tipped)

- Cermet

- Polycrystalline Diamond (PCD)

- CBN (Cubic Boron Nitride)

- Powder Metallurgy Steel

- By Application:

- Automotive (Engine blocks, transmission components, axle parts)

- Aerospace & Defense (Turbine blades, airframe structural components, landing gear)

- Precision Machinery Manufacturing

- Energy & Power Generation (Turbine components, valve bodies)

- Molds & Dies Manufacturing

- Medical Devices (Orthopedic implants, surgical instruments)

Value Chain Analysis For Reaming Tools Market

The value chain of the Reaming Tools Market is a multi-stage process beginning with the highly specialized extraction and processing of raw materials, primarily tungsten, cobalt, and diamond substrates, which form the basis for carbide and PCD tools. The upstream analysis is characterized by a relatively concentrated group of global material suppliers specializing in metal powders and hard materials, whose pricing and supply stability critically impact the manufacturing costs of the final tool. Tool manufacturers then engage in complex processes like powder pressing, sintering, grinding, and application-specific coating (e.g., AlTiN, TiCN) to produce the precision reamers. Intense R&D activities focused on optimizing tool geometry and coating technology occur at this manufacturing stage, establishing competitive differentiation.

The downstream analysis involves the distribution, sales, and end-user application phases. Distribution channels are bifurcated into direct sales, often utilized for highly customized or high-volume contracts with major OEM clients in aerospace and automotive, and indirect sales through specialized industrial distributors and integrated supply chain providers. These distributors play a crucial role in inventory management, technical support, and local market penetration, especially for smaller machine shops. A significant factor in the downstream market is the provision of essential aftermarket services, including precise regrinding, recoating, and technical consulting, which extend the value proposition and life cycle of the premium reaming tools, creating ongoing revenue streams for manufacturers and distributors.

The efficiency of the value chain is increasingly reliant on digitalization. E-commerce platforms and digital catalogs are streamlining the procurement process, particularly for standard tooling. Moreover, the feedback loop between the end-user (who generates performance data) and the manufacturer (who designs the tool) is being shortened through IoT integration. Direct channels allow for faster feedback and customization cycles, while indirect channels provide the necessary reach and localized expertise. Effective value chain management, encompassing sustainable sourcing of raw materials and optimizing the distribution network, is essential for maintaining cost competitiveness and responsiveness in this highly demanding precision tool market.

Reaming Tools Market Potential Customers

The potential customer base for the Reaming Tools Market is broad, comprising primarily industrial entities requiring high-precision bore finishing in various materials. These end-users typically include large-scale Original Equipment Manufacturers (OEMs) and their Tier 1 and Tier 2 suppliers operating within the transportation and heavy machinery sectors. The overriding need across all potential customer segments is the achievement of geometric accuracy and superior surface quality (low Ra values), often mandated by strict engineering specifications necessary for ensuring component integrity and functional longevity, such as precise fits for bearings and bushings.

Specific high-value customers are concentrated in sectors where component failure risk is high or replacement is excessively costly. This includes aerospace manufacturers producing complex engine and fuselage components, automotive powertrain suppliers crafting precision parts like connecting rod bores and valve guide holes, and power generation companies maintaining critical turbine components. These customers demand advanced, often custom-engineered reamers made from carbide or PCD, integrated with sophisticated cooling technologies (e.g., through-tool coolant) to manage heat dissipation during high-speed machining of challenging superalloys like Inconel or specialized hardened steels.

Furthermore, an expanding customer segment includes manufacturers of complex medical devices, particularly those involved in orthopedic implants (knee and hip replacements) and surgical tools, where dimensional exactitude is directly linked to patient safety and regulatory approval. The general precision machining job shop segment also remains a crucial customer, purchasing a diverse range of standard and adjustable reamers for general-purpose applications, emphasizing versatility and cost-efficiency. Addressing the diverse needs of these customers requires tool providers to offer tiered product portfolios ranging from premium, application-specific solutions to durable, cost-effective options for general engineering tasks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.07 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Kennametal Inc., OSG Corporation, Guhring KG, Mapal Dr. Kress KG, ISCAR Ltd. (IMC Group), Mitsubishi Materials Corporation, Walter Tools GmbH, CERATIZIT S.A., Sumitomo Electric Industries, Ltd., Seco Tools AB, Tivoly SA, Emuge-Franken GmbH, KYOCERA Corporation, DC Swiss SA, Allied Machine & Engineering Corp., Komet Group, Vargus Ltd., Greenfield Industries, Inc., Titex Plus (Dormer Pramet). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reaming Tools Market Key Technology Landscape

The technological landscape of the Reaming Tools Market is defined by continuous innovation aimed at increasing material removal rates while simultaneously improving surface integrity and dimensional consistency. A core technological area is the advancement in cutting tool material science, specifically the shift towards ultra-fine grain solid carbide grades and the increased utilization of Polycrystalline Diamond (PCD) inserts for machining highly abrasive non-ferrous materials like aluminum alloys used in lightweighting initiatives. These materials necessitate advanced grinding techniques and precise thermal management during production to ensure the structural integrity and sharp cutting geometry of the reamer teeth. Furthermore, the development of specialized micro-geometries, including optimized rake angles and non-uniform pitch designs, is critical for reducing cutting forces and minimizing chatter, especially when working with thin-walled components or materials prone to work hardening.

Another major technological driver is the deployment of sophisticated coating technologies. Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) techniques are employed to apply multi-layer ceramic coatings (such as AlCrN or TiAlN) that drastically enhance the tool's hardness, chemical stability, and heat resistance. These high-performance coatings are essential for dry machining or minimum quantity lubrication (MQL) applications, which are increasingly adopted for environmental and efficiency benefits. The latest generation of coatings are designed to be extremely smooth, reducing friction and preventing built-up edge formation, which is a major cause of poor surface finish in reaming operations. The success of premium reaming tools is intrinsically linked to the efficacy and longevity of these protective and performance-enhancing surface treatments.

Furthermore, the integration of smart manufacturing technologies is fundamentally altering reaming processes. Modern reaming systems incorporate sensor technology (e.g., strain gauges, acoustic emission sensors) embedded within the tool holder or directly into modular reamer bodies. This connectivity enables real-time monitoring of cutting forces, temperature, and vibration, facilitating adaptive control systems that automatically adjust machining parameters to maintain peak performance and preemptively detect issues like chip packing or impending tool failure. The development of modular quick-change systems, requiring high-precision coupling mechanisms, represents a mechanical innovation that supports rapid tooling exchange, dramatically reducing machine downtime and catering directly to the demands of flexible, automated production lines characteristic of Industry 4.0 environments.

Regional Highlights

Regional dynamics in the Reaming Tools Market are highly stratified, reflecting global manufacturing trends, regulatory environments, and the concentration of critical end-user industries. The Asia Pacific (APAC) region stands out as the primary market driver, characterized by unprecedented growth in industrial output, particularly in automotive and electronics manufacturing, led by key economies such as China, Japan, South Korea, and India. China, in particular, dominates consumption volume due to its position as the world's largest automotive producer and a massive hub for general machinery manufacturing. The region's sustained economic development and government emphasis on localizing high-tech manufacturing continue to attract substantial investment in modern precision machinery, ensuring strong demand for high-volume, cost-effective, and increasingly high-precision reaming solutions.

North America and Europe represent mature, high-value markets focused on technological sophistication and premium tooling. In North America, the demand is primarily fueled by the robust aerospace and defense industry (especially in the US), coupled with a strong resurgence in specialized automotive manufacturing (e.g., electric vehicle components) that requires highly customized solid carbide and PCD tooling for processing exotic materials. European consumption is concentrated in Germany, which leads in advanced manufacturing and machine tool production, and France, home to significant aerospace and energy sector activities. These regions prioritize tooling lifecycle management, integrated digital services, and sustainability, leading to higher adoption rates of modular, smart, and regrindable reaming systems, often compensating for lower volume growth with higher average selling prices (ASPs).

Latin America and the Middle East & Africa (MEA) are emerging regions offering significant future potential. Latin American growth is intrinsically tied to infrastructure projects and a recovering automotive manufacturing base in countries like Mexico and Brazil, driving demand for standard and high-speed steel reamers for routine maintenance and general engineering. The MEA region, heavily reliant on the oil, gas, and petrochemical sectors, requires robust, durable reaming tools for repair, maintenance, and facility upgrades. While these regions currently exhibit lower technology penetration compared to the West, rapid industrial investment and efforts to diversify economies away from resource extraction will progressively elevate the demand for higher precision and more advanced reaming technologies throughout the forecast period.

- Asia Pacific (APAC): Dominates the market in terms of volume; driven by high-volume automotive production, rapid industrialization in China and India, and rising demand in the electronics and general machinery sectors.

- North America: High-value market focused on highly specialized, customized carbide and PCD reamers; strong demand from the demanding aerospace, defense, and EV manufacturing segments.

- Europe: Key consumer of advanced tooling technology, emphasizing precision and automation (Industry 4.0); led by Germany's machine tool industry and substantial manufacturing in the UK and France (aerospace, medical).

- Latin America: Emerging market characterized by recovery in the automotive and mining sectors; growing demand for standard and intermediate precision tooling for general engineering and MRO activities.

- Middle East & Africa (MEA): Growth tied heavily to the expansion and maintenance of the energy (Oil & Gas) and infrastructure sectors, requiring durable tooling solutions for heavy industry applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reaming Tools Market.- Sandvik AB (Seco Tools AB)

- Kennametal Inc.

- OSG Corporation

- Guhring KG

- Mapal Dr. Kress KG

- ISCAR Ltd. (IMC Group)

- Mitsubishi Materials Corporation

- Walter Tools GmbH

- CERATIZIT S.A.

- Sumitomo Electric Industries, Ltd.

- Tivoly SA

- Emuge-Franken GmbH

- KYOCERA Corporation

- DC Swiss SA

- Allied Machine & Engineering Corp.

- Komet Group

- Vargus Ltd.

- Greenfield Industries, Inc.

- Titex Plus (Dormer Pramet)

- ASCO Tools Ltd.

Frequently Asked Questions

Analyze common user questions about the Reaming Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Reaming Tools Market?

The market growth is primarily driven by the increasing global demand for components requiring high dimensional accuracy and superior surface finish, particularly within the aerospace, automotive (especially EV components), and precision machinery sectors. Technological advancements in cutting materials like solid carbide and specialized coatings further accelerate market expansion.

How does the type of tool material impact reaming performance and cost?

Tool material significantly determines performance and total cost of ownership. High-Speed Steel (HSS) reamers are low-cost and versatile for softer materials. Solid Carbide and PCD reamers, while having a higher initial cost, offer superior hardness, heat resistance, and tool life, enabling faster cutting speeds and stricter tolerance adherence necessary for hard metals and high-volume production, ultimately lowering cost per hole.

Which region currently holds the largest share in the Reaming Tools Market?

The Asia Pacific (APAC) region currently holds the largest market share due to its vast and rapidly expanding manufacturing base, driven predominantly by high-volume production in the automotive industry and extensive industrialization across major economies like China and India.

What role does Industry 4.0 and AI play in modern reaming operations?

Industry 4.0 and AI enable smart reaming through the integration of sensors for real-time data collection on vibration and torque. This data feeds AI algorithms that perform predictive maintenance, optimize cutting parameters dynamically to maintain precision, and reduce scrap rates, significantly enhancing efficiency in automated machining environments.

What are the key differences between straight flute and spiral flute reamers?

Straight flute reamers are suitable for through-holes and ferrous materials, offering good accuracy but poor chip evacuation. Spiral flute reamers are preferred for blind holes or sticky materials because their helix angle efficiently pulls chips out of the hole, resulting in smoother finishes and reduced risk of chip packing and tool breakage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager