Rechargeable Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434244 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Rechargeable Battery Market Size

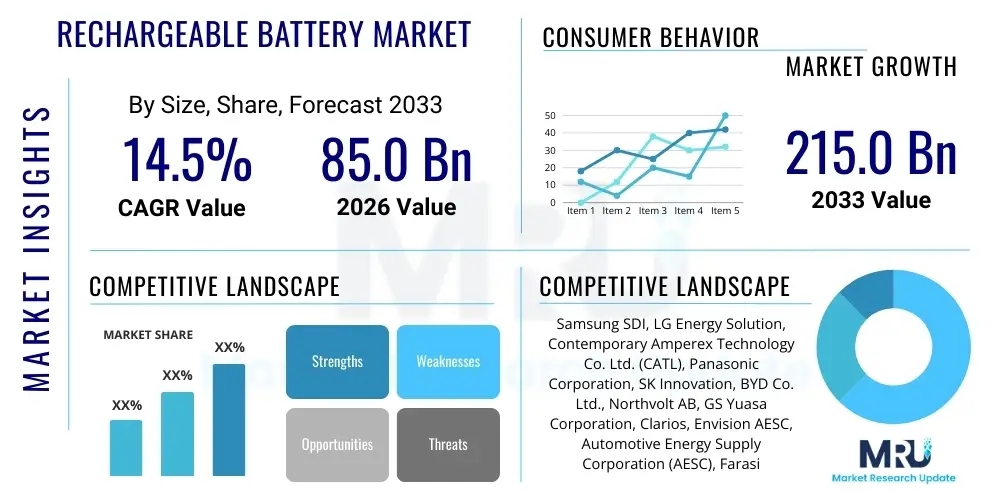

The Rechargeable Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 85.0 billion in 2026 and is projected to reach USD 215.0 billion by the end of the forecast period in 2033.

Rechargeable Battery Market introduction

The rechargeable battery market encompasses technologies that allow electrical energy storage devices to be repeatedly charged and discharged, offering significant advantages over primary, non-rechargeable cells. Key technologies dominating this sector include Lithium-ion (Li-ion), Nickel-Metal Hydride (NiMH), and Lead-Acid batteries, with Li-ion maintaining the primary growth trajectory due to its high energy density and suitability for portable and high-power applications. This market is fundamentally critical to the global energy transition, providing essential components for electrification across transportation, consumer electronics, and utility infrastructure. Product innovation is heavily focused on improving lifespan, safety, charging speed, and reducing reliance on critical raw materials like cobalt.

Major applications for rechargeable batteries span a broad spectrum, spearheaded by Electric Vehicles (EVs) and consumer electronics such as smartphones, laptops, and wearable devices. Beyond these, stationary energy storage systems (ESS) connected to renewable energy grids—including solar and wind farms—represent a rapidly expanding application area, addressing intermittency challenges inherent in clean power generation. Furthermore, industrial applications, including forklifts, uninterruptible power supplies (UPS), and medical devices, rely extensively on high-performance rechargeable systems. The inherent benefits of rechargeable batteries, such as cost-effectiveness over their lifecycle, reduced environmental waste compared to disposable alternatives, and their capacity to enable portable and decentralized power solutions, solidify their foundational role in modern society.

The market expansion is robustly driven by several macro-level factors. Global governmental mandates and subsidies promoting the adoption of Zero-Emission Vehicles (ZEVs) constitute the primary catalyst, particularly in North America, Europe, and Asia Pacific. Simultaneously, the drastic reduction in the manufacturing cost of battery cells over the last decade has made Li-ion technology more economically viable for large-scale energy storage projects. The burgeoning demand for sophisticated consumer electronics, coupled with advancements in fast-charging technology and safety protocols, further sustains market momentum. Additionally, the increasing deployment of smart grids and decentralized energy systems necessitates reliable, high-capacity storage solutions, ensuring continuous power availability and grid stability, thereby reinforcing market growth across all key segments.

Rechargeable Battery Market Executive Summary

The rechargeable battery market exhibits dynamic business trends characterized by intense competition, vertical integration, and aggressive capacity expansion by key players, particularly those based in Asia Pacific. Automotive OEMs are increasingly forming joint ventures with battery manufacturers (gigafactories) to secure stable supply chains and customize cell chemistry for specific vehicle platforms, moving away from purely external sourcing. A significant business trend involves the rapid commercialization of solid-state batteries, promising superior energy density and safety, although Li-ion remains the dominant commercial technology. Furthermore, recycling and second-life battery utilization are gaining traction, driven by sustainability goals and the need to mitigate the geopolitical risk associated with raw material sourcing.

Regional trends indicate that the Asia Pacific (APAC) region, led by China, South Korea, and Japan, commands the largest market share, attributable to established manufacturing ecosystems, high penetration of electric vehicles, and significant government backing for battery innovation and production scale-up. North America and Europe are demonstrating the highest growth rates, spurred by ambitious climate targets, localized battery production investments (driven by policies like the US Inflation Reduction Act and European Green Deal), and a mature uptake of utility-scale energy storage. Latin America, the Middle East, and Africa (MEA) are emerging regions, primarily focused on adopting batteries for off-grid and telecom tower applications, though EV penetration remains nascent compared to developed economies.

Segmentation trends highlight the dominance of the Lithium-ion battery type, which captured the highest revenue share and is expected to maintain its lead due to continuous performance improvements and cost reduction, despite emerging alternatives. The Electric Vehicles segment, encompassing Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), stands out as the primary application driver, consuming the largest volume of high-capacity batteries. The portable devices segment, while mature, continues to innovate around faster charging and slimmer form factors. Crucially, the segment focused on grid energy storage is anticipated to experience the most accelerated growth, reflecting global efforts to stabilize electricity grids increasingly powered by intermittent renewable sources.

AI Impact Analysis on Rechargeable Battery Market

User questions related to the impact of AI on the rechargeable battery market often center on whether AI can fundamentally accelerate the discovery of novel materials, improve battery manufacturing efficiency, and enhance the longevity and safety of existing products. Key concerns revolve around the practical integration of complex machine learning models into high-volume manufacturing lines and the data security implications of collecting vast amounts of real-time operational battery data. Users frequently express high expectations for AI’s role in optimizing battery management systems (BMS), specifically hoping for algorithms that can predict degradation patterns, optimize charging cycles based on usage profiles, and prevent thermal runaway events before they occur. This interest confirms that the market views AI not just as an analytical tool but as a critical enabler for achieving the next generation of performance and reliability benchmarks essential for mass EV and grid integration.

AI is already being integrated across the entire battery value chain, from materials science to end-of-life management. In research and development, machine learning algorithms are dramatically reducing the time required to screen potential cathode and anode materials, predicting optimal chemical compositions and identifying synthesis routes faster than traditional laboratory experimentation. This acceleration directly addresses the need for higher energy density and safer chemistries, such as those required for solid-state architectures. Furthermore, in the manufacturing phase, AI-powered computer vision and predictive maintenance systems are monitoring production lines for minute defects, reducing waste, improving yield rates, and ensuring stringent quality control necessary for high-volume, cost-effective cell production.

Operationally, Artificial Intelligence is transforming Battery Management Systems (BMS). Advanced AI models analyze real-time performance data from thousands of battery packs (in EVs or ESS), learning individual cell characteristics, temperature dependencies, and stress factors. This allows the BMS to execute sophisticated charge and discharge strategies that maximize the useful lifespan of the battery while maintaining optimal safety margins. For grid storage, AI optimizes charging schedules based on fluctuating energy prices and renewable energy availability forecasts, maximizing economic returns and grid stability. Consequently, AI integration ensures batteries operate closer to their theoretical maximum performance limits without compromising safety or durability, which is paramount for consumer confidence and warranty management.

- AI accelerates materials discovery and simulation for next-generation chemistries (e.g., solid-state, Li-S).

- Machine learning optimizes manufacturing yield and quality control through predictive anomaly detection.

- AI-enhanced Battery Management Systems (BMS) maximize battery lifespan and charging efficiency.

- Predictive analytics forecasts battery degradation and facilitates optimized second-life usage and recycling processes.

- AI models enhance safety protocols by predicting and mitigating thermal runaway risks in large battery packs.

DRO & Impact Forces Of Rechargeable Battery Market

The rechargeable battery market is shaped by a powerful interplay of drivers, restraints, and opportunities, culminating in significant impact forces. The primary driver is the global energy transition, specifically the rapid electrification of transportation and the necessary integration of grid-scale energy storage to support intermittent renewable sources like solar and wind power. Government mandates and favorable policies, coupled with substantial research and development investment aimed at improving energy density and safety standards, reinforce this momentum. However, the market faces significant restraints, chiefly concerning the volatility and geopolitical concentration of critical raw materials (lithium, cobalt, nickel, manganese). Concerns over supply chain resilience, coupled with the capital-intensive nature of establishing new gigafactories, constrain rapid expansion outside established hubs. Moreover, the technological challenge of achieving genuinely safe, high-density, and long-lasting solid-state batteries remains a key hurdle.

Opportunities in the market are abundant, particularly in innovation focused on sustainable solutions and new application areas. The development of sodium-ion, magnesium-ion, and zinc-air batteries represents an opportunity to decouple growth from existing constraints in the Li-ion supply chain. Furthermore, the burgeoning market for vertical integration—where battery manufacturers become involved in raw material processing and end-of-life recycling—offers a path towards circular economy models and reduced dependence on external suppliers. The expansion into untapped markets, such as micro-grids in developing economies, high-power applications in drones and aviation, and optimized residential storage solutions, provides diverse avenues for revenue growth and market diversification.

The resulting impact forces are structural shifts in global manufacturing dominance and regulatory pressure favoring localized production. The imperative for sustainability dictates that market participants must rapidly advance recycling technologies and design batteries for disassembly. Competition is intensifying not only on price and performance but increasingly on environmental credentials and ethical sourcing. This competitive dynamic is forcing rapid technological obsolescence, pushing manufacturers to continuously invest in Gen-4 battery technologies. Overall, the market impact leans heavily toward transformative growth, contingent upon the successful management of raw material supply risks and the sustained reduction of manufacturing costs through automation and scale.

Segmentation Analysis

The rechargeable battery market is broadly segmented based on technology, application, and capacity, providing a structured framework for understanding market dynamics and competitive positioning. Segmentation by technology is crucial, as performance characteristics—such as energy density, cycle life, and cost—vary significantly across different chemistries, dictating their suitability for specific end-use applications. Lithium-ion batteries maintain the highest market share due to their widespread use in EVs and portable devices, while legacy technologies like Lead-Acid still dominate specific sectors such as industrial UPS and backup power due to their robustness and low cost. The application segmentation clearly defines the primary revenue streams, with Electric Vehicles being the most influential segment driving technological investment and capacity expansion globally, followed by consumer electronics and grid storage.

Market analysts also focus on capacity segmentation, differentiating between high-capacity cells (typically used in grid storage and large commercial vehicles) and low-to-medium capacity cells (common in consumer devices and small electric mobility solutions). This distinction influences supply chain needs and manufacturing processes. The inherent differences between these segments necessitate specialized research and development efforts, optimizing cells for either high power output (critical for acceleration in EVs) or long cycle life (essential for stationary grid applications). Understanding these overlaps and distinct requirements is vital for manufacturers planning investment strategies and tailoring product portfolios to capitalize on the fastest-growing niches within the evolving energy ecosystem.

- By Technology:

- Lithium-ion (Li-ion)

- Lead-Acid

- Nickel-Metal Hydride (NiMH)

- Nickel-Cadmium (NiCd)

- Other Advanced Batteries (e.g., Solid-State, Sodium-ion, Flow Batteries)

- By Application:

- Electric Vehicles (EVs, including BEVs and PHEVs)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (ESS) / Grid Storage

- Industrial (UPS, Forklifts, Telecom Towers)

- Others (Medical Devices, Aerospace, Defense)

- By Capacity:

- Less than 3,000 mAh

- 3,000 mAh to 10,000 mAh

- More than 10,000 mAh

Value Chain Analysis For Rechargeable Battery Market

The rechargeable battery value chain is complex, highly globalized, and characterized by intensive capital expenditure at various stages, starting with upstream activities involving raw material extraction and refinement. Upstream analysis focuses heavily on securing critical minerals such as lithium, cobalt, nickel, and graphite. Mining and chemical processing companies, often concentrated in specific geopolitical regions (e.g., lithium in Australia/Chile, cobalt in DRC), are critical suppliers. The efficiency and environmental compliance of these upstream operations directly impact the overall cost structure and sustainability profile of the final battery cell. Strategic efforts are currently underway by major battery producers and governments to diversify these raw material sources and invest in domestic processing capabilities to mitigate supply chain disruptions.

Midstream activities involve the highly technical process of cell component manufacturing—producing cathodes, anodes, separators, and electrolytes—followed by the assembly of the finished battery cell. This phase is dominated by established players in Asia, requiring rigorous quality control and high-precision automation. Downstream analysis focuses on battery pack assembly (integrating cells with Battery Management Systems and thermal management), system integration into end-use products (EVs, ESS units), and the eventual distribution and sales channels. Distribution channels are highly varied, involving direct B2B sales to large automotive OEMs and utility providers, as well as complex indirect networks through specialized distributors and retailers for consumer electronics and smaller industrial applications. The tight coupling between cell manufacturers and automotive Tier 1 suppliers demonstrates the critical reliance on direct channels in the high-growth EV sector.

Rechargeable Battery Market Potential Customers

The potential customer base for the rechargeable battery market is highly diversified, categorized primarily into three major segments: automotive original equipment manufacturers (OEMs), stationary energy storage integrators (utilities and commercial installers), and consumer electronics manufacturers. Automotive OEMs represent the most valuable end-user segment, demanding high-performance, durable, and highly customized battery packs that adhere to stringent safety regulations and vehicle warranty periods. These customers are strategic partners rather than simple buyers, engaging in multi-year contracts and co-development efforts with cell manufacturers to ensure optimized performance for electric vehicle platforms.

Utilities and independent power producers (IPPs) focused on stationary Energy Storage Systems (ESS) constitute the fastest-growing segment of potential customers. These buyers require batteries optimized for longevity (deep cycle life) and capacity, often procured in large volumes for deployment in grid stabilization, peak shaving, and renewable energy integration projects. The purchasing decisions for this segment are driven heavily by levelized cost of storage (LCOS), reliability warranties, and compliance with grid interconnection standards. The third major segment, consumer electronics, comprises global manufacturers of smartphones, laptops, and wearables, who prioritize high energy density, miniaturization, and rapid charging capabilities, often placing high pressure on manufacturers for continuous technological advancement in form factor and efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.0 Billion |

| Market Forecast in 2033 | USD 215.0 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung SDI, LG Energy Solution, Contemporary Amperex Technology Co. Ltd. (CATL), Panasonic Corporation, SK Innovation, BYD Co. Ltd., Northvolt AB, GS Yuasa Corporation, Clarios, Envision AESC, Automotive Energy Supply Corporation (AESC), Farasis Energy, EVE Energy Co., Ltd., QuantumScape Corporation, Solid Power, StoreDot, Toshiba Corporation, Varta AG, Murata Manufacturing Co., Ltd., Saft (TotalEnergies) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rechargeable Battery Market Key Technology Landscape

The current technology landscape in the rechargeable battery market is dominated by Lithium-ion chemistry, which has evolved substantially since its commercialization. Within Li-ion, there is continuous diversification, with major commercial variants including Nickel Manganese Cobalt (NMC), Nickel Cobalt Aluminum (NCA), and Lithium Iron Phosphate (LFP). LFP has seen a strong resurgence, particularly in entry-level EVs and utility storage, due to its enhanced safety, longer cycle life, and lower cost, despite having a lower energy density compared to NMC/NCA. Technological advancements are focused on anode materials, moving towards silicon-based anodes to increase energy density beyond the limits of traditional graphite, and cathode coating innovations to improve high-voltage performance and thermal stability.

Looking ahead, the technological landscape is actively shifting towards next-generation chemistries aimed at addressing the key limitations of current liquid electrolyte Li-ion batteries—namely, fire risk and energy density ceilings. Solid-State Batteries (SSBs) represent the most significant area of research and development, utilizing solid electrolytes to offer superior safety, potentially doubling energy density, and improving cycle life. Several leading automotive and battery manufacturers are heavily investing in pilot production lines, although challenges related to interface resistance and manufacturing scalability remain. Furthermore, non-lithium alternatives, specifically Sodium-ion (Na-ion) batteries, are rapidly approaching commercial viability. Na-ion batteries utilize abundant materials, offer comparable performance to LFP, and are strategically positioned to serve large-scale stationary storage and two-wheeler EV markets, thereby diversifying the global battery technology portfolio and reducing reliance on high-cost lithium.

Regional Highlights

The geographical distribution of the rechargeable battery market is highly concentrated, reflecting the density of manufacturing capabilities, governmental support, and the pace of EV adoption. Asia Pacific (APAC) holds the largest market share globally, primarily driven by China, which is the world's leading producer and consumer of batteries for EVs and energy storage. China benefits from unparalleled capacity in cell manufacturing (gigafactories), a robust domestic supply chain for raw material processing, and aggressive government policies supporting domestic champions and EV purchasing. South Korea and Japan also remain crucial, focusing heavily on premium, high-energy-density chemistries (NMC/NCA) essential for high-end EVs and portable devices, leveraging decades of established electronics manufacturing expertise. This region dictates global pricing and technological trends.

North America is experiencing a rapid transformation, shifting from being a net importer of batteries to aggressively building domestic manufacturing capacity. This renaissance is fueled by substantial legislative support, notably the Inflation Reduction Act (IRA), which provides generous tax credits for batteries produced and assembled regionally, accelerating investment in gigafactories across the U.S. and Canada. The primary driver here is the mandated shift toward electric vehicles by major automotive OEMs, requiring localized supply chains to qualify for consumer subsidies. While manufacturing is still scaling up, the region leads in the deployment of large-scale stationary energy storage systems, driven by grid modernization efforts and renewable integration targets in states like California and Texas.

Europe is strategically positioned as a high-growth market, focusing on achieving 'battery sovereignty' to reduce reliance on Asian imports, aligning with the European Green Deal objectives. The European Battery Alliance (EBA) has galvanized significant public and private investment into establishing a continental battery value chain, from mining to recycling. Countries such as Germany, Sweden, and Hungary are becoming key manufacturing hubs, supported by incentives aimed at attracting gigafactory investment. Demand is exceptionally high, propelled by stringent EU emission standards and robust consumer subsidies for EVs. Europe is also pioneering advanced battery recycling legislation, positioning the region as a leader in sustainable circular economy models for energy storage.

The Latin America, Middle East, and Africa (LAMEA) region represents emerging opportunities, though currently smaller in market volume compared to the triad of APAC, North America, and Europe. In Latin America, countries rich in lithium resources, such as Chile and Argentina, are increasingly focusing on adding value through localized processing rather than merely exporting raw materials. EV adoption is nascent but growing, particularly in urban centers like Brazil. In the Middle East, substantial investment in utility-scale solar projects is driving demand for large ESS units to manage grid stability, often supported by government-led diversification programs. Africa’s market is characterized by a strong need for decentralized energy solutions; rechargeable batteries are vital for powering off-grid communities, telecom towers, and micro-grids, providing essential infrastructure where traditional grid access is limited or unreliable. Growth in LAMEA is expected to accelerate as infrastructure improves and battery costs continue to decline.

- Asia Pacific (APAC): Dominates manufacturing and consumption; led by China (production scale), South Korea, and Japan (technology leadership).

- North America: High growth rate fueled by supportive policies (IRA) and localized EV production mandates; significant investment in grid storage infrastructure.

- Europe: Focused on achieving battery supply chain autonomy; strong demand driven by stringent emission standards and pioneering recycling standards.

- LAMEA: Emerging market focused on resource processing (Lithium Triangle) and decentralized power solutions for telecommunications and off-grid electricity access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rechargeable Battery Market.- Samsung SDI

- LG Energy Solution

- Contemporary Amperex Technology Co. Ltd. (CATL)

- Panasonic Corporation

- SK Innovation

- BYD Co. Ltd.

- Northvolt AB

- GS Yuasa Corporation

- Clarios

- Envision AESC

- Automotive Energy Supply Corporation (AESC)

- Farasis Energy

- EVE Energy Co., Ltd.

- QuantumScape Corporation

- Solid Power

- StoreDot

- Toshiba Corporation

- Varta AG

- Murata Manufacturing Co., Ltd.

- Saft (TotalEnergies)

Frequently Asked Questions

Analyze common user questions about the Rechargeable Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the rechargeable battery market?

The market is primarily driven by the accelerated global transition to electric vehicles (EVs) and the increasing deployment of utility-scale energy storage systems (ESS) necessary for integrating intermittent renewable energy sources like solar and wind into the electrical grid infrastructure.

Which rechargeable battery technology is currently dominant and why?

Lithium-ion (Li-ion) batteries are dominant, accounting for the largest market share due to their superior energy density, light weight, and continuous cost reduction, making them ideal for high-performance applications in EVs and consumer electronics.

What major challenges does the rechargeable battery market face regarding raw materials?

Key challenges include the volatile pricing and concentrated geopolitical supply of critical raw materials such as lithium, cobalt, and nickel. Ensuring a sustainable and resilient supply chain requires aggressive investment in new mining, refining capacity, and advanced battery recycling technologies.

What is the significance of solid-state batteries (SSBs) to the market's future?

Solid-state batteries are considered the next major breakthrough, promising significant improvements in safety (eliminating flammable liquid electrolytes), potentially doubling energy density, and extending lifespan, which could revolutionize the EV and high-power portable device segments.

How is government policy impacting the regional landscape of battery manufacturing?

Government policies, such as the U.S. Inflation Reduction Act (IRA) and European Green Deal initiatives, are fundamentally shifting the manufacturing landscape by offering massive incentives and subsidies to encourage the localization of the entire battery value chain, leading to significant capacity expansion outside of Asia Pacific.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager