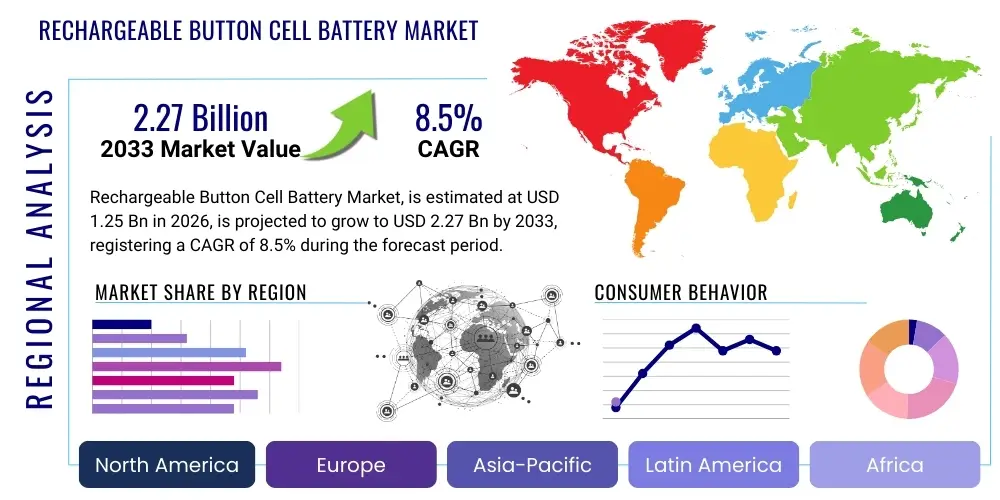

Rechargeable Button Cell Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436220 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Rechargeable Button Cell Battery Market Size

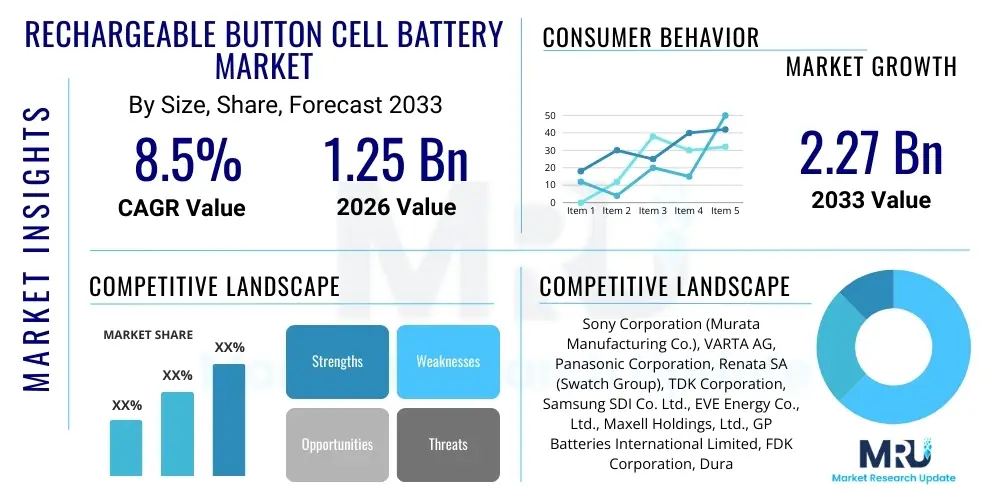

The Rechargeable Button Cell Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.27 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the accelerating miniaturization of electronic devices, particularly in the healthcare and wearable technology sectors, which demand high-energy-density, small-footprint power solutions capable of enduring numerous charge cycles.

Rechargeable Button Cell Battery Market introduction

The Rechargeable Button Cell Battery Market encompasses specialized, miniaturized energy storage solutions characterized by their coin-like, flat, and round physical configuration. These batteries utilize various chemistries, predominantly rechargeable Lithium-ion (Li-ion), Lithium Polymer (Li-Po), and increasingly, solid-state variants, offering superior cycle life and reduced environmental impact compared to their primary (non-rechargeable) counterparts. The fundamental product description involves a sealed unit designed to provide stable voltage output across numerous discharge-recharge cycles, crucial for maintaining long-term functionality in compact electronic ecosystems. Technological advancements focus heavily on improving volumetric energy density and safety profiles, particularly concerning thermal stability and swelling characteristics under high-stress usage conditions.

Major applications driving market demand include sophisticated medical devices, such as continuous glucose monitors (CGMs) and implantable sensors, where reliability and small size are non-negotiable prerequisites. Furthermore, the explosion in consumer electronics, specifically smartwatches, fitness trackers, hearables (wireless earbuds), and smart jewelry, constitutes a significant application segment. These devices require batteries that can be seamlessly integrated into ergonomic designs while offering sufficient power reserve for multi-day operation. The inherent benefit of rechargeability—reducing waste, lowering long-term operational costs for the consumer, and simplifying maintenance—positions these batteries as an indispensable component in the sustainable electronics lifecycle.

Key driving factors include global regulatory mandates promoting electronic waste reduction and the shift toward sustainable consumer products, compelling manufacturers to adopt rechargeable power sources. Furthermore, the continuous improvement in battery chemistry, allowing for higher energy density without compromising safety, enables the development of thinner, lighter, and more powerful wearable devices. Increased funding and research into solid-state electrolytes are poised to fundamentally reshape the market by offering enhanced safety and faster charging capabilities, ensuring sustained growth across diverse end-user industries.

- Product Description: Compact, coin-shaped electrochemical cells offering stable, reliable, and multi-cycle power delivery.

- Major Applications: Wearable electronics (smartwatches, hearables), medical devices (CGMs, hearing aids), industrial IoT sensors, and memory backup systems.

- Benefits: High cycle life, superior volumetric efficiency, reduced e-waste generation, and lower total cost of ownership.

- Driving Factors: Miniaturization trends, rise of IoT, stringent environmental regulations, and advancements in lithium-based chemistries.

Rechargeable Button Cell Battery Market Executive Summary

The rechargeable button cell battery market is characterized by robust business trends centered around strategic partnerships between battery manufacturers and Original Equipment Manufacturers (OEMs) in the wearable and medical technology sectors. Key business focus areas include scaling up production capacity for high-density Lithium-ion variants and accelerating the commercialization of proprietary solid-state technologies, which promise breakthrough performance metrics. Competition is intensifying, particularly among East Asian suppliers who dominate manufacturing volume, leading to continuous price pressure offset partially by innovation in proprietary anode and cathode materials designed for specific high-rate discharge applications. Sustainable supply chain management, focusing on ethically sourced raw materials like cobalt and nickel, is also becoming a critical differentiator for leading market players.

From a regional perspective, Asia Pacific (APAC) currently holds the largest market share, driven by the massive manufacturing base for consumer electronics in countries like China, South Korea, and Japan, coupled with high adoption rates of advanced wearables. North America and Europe are experiencing rapid growth, primarily fueled by the sophisticated medical device industry and the premium segment of the wearable market, where consumers prioritize device longevity and reliability. Regulatory landscapes, such as the European Union's Battery Regulation, are significantly influencing market dynamics by enforcing higher standards for recyclability and performance, thereby creating opportunities for specialized recycling and advanced material recovery segments.

Segmentation trends indicate that Lithium-ion (Li-ion) remains the dominant chemistry segment due to its established performance profile, but emerging segments like solid-state batteries are gaining traction due to superior safety characteristics essential for medical implants. Application-wise, the consumer wearable segment contributes the largest revenue share, though the medical segment commands a higher Average Selling Price (ASP) due to stringent quality control and certification requirements. Furthermore, capacity segmentation shows a strong shift toward ultra-high capacity batteries (above 80mAh) to support increasingly complex, always-on smart devices, necessitating continuous investment in specialized manufacturing lines capable of handling precise, small-form-factor assembly.

AI Impact Analysis on Rechargeable Button Cell Battery Market

User questions regarding AI's influence on the button cell battery market frequently center on how Artificial Intelligence can optimize battery life, improve manufacturing yields, and accelerate R&D for new chemistries. Consumers and industry stakeholders are keen to understand if AI-driven predictive maintenance can extend the operational life of devices reliant on these tiny batteries, thereby enhancing the overall value proposition. Key concerns also revolve around the use of machine learning algorithms in quality control during the delicate cell assembly process, mitigating the risks associated with thermal runaway and defective units. The underlying expectation is that AI integration will not only streamline production, addressing complex variables in material mixing and electrode coating, but also provide crucial predictive diagnostics for battery health management within end-user applications.

AI is already being deployed heavily in the upstream segment, particularly in materials informatics, where machine learning models analyze vast datasets of chemical compositions and crystallographic structures to predict superior electrode materials. This significantly reduces the experimental time needed for discovering high-performing, durable, and safe battery components suitable for button cell miniaturization. Furthermore, in battery management systems (BMS) embedded within wearables, AI algorithms analyze usage patterns, temperature fluctuations, and state-of-charge (SoC) in real-time. This dynamic management allows the device to optimize power usage, potentially extending battery life by 15-25% between charges, which is a major competitive advantage in the highly saturated consumer electronics market.

In the manufacturing phase, computer vision and deep learning models are crucial for ultra-precise quality inspection, identifying microscopic defects during the winding and sealing stages that could lead to premature failure or safety hazards. The ability of AI systems to process high-volume sensor data from production lines allows for immediate process adjustments, ensuring high yield rates and maintaining the tight tolerances required for button cell dimensions. This precision is paramount, as variations of just a few micrometers can compromise the overall performance and lifespan of the miniature power source, ensuring AI's role is critical for scalability and safety.

- AI optimizes electrode material discovery, accelerating the development of higher energy density chemistries.

- Machine Learning (ML) integration into Battery Management Systems (BMS) enables real-time, predictive charge optimization, significantly extending operational device runtime.

- Advanced AI-driven computer vision enhances manufacturing quality control, detecting minute defects in cell assembly to improve safety and yield rates.

- AI supports predictive maintenance for large fleets of IoT devices utilizing button cells, forecasting potential failure points before they occur.

- Simulation models powered by AI minimize costly and time-consuming physical prototyping, especially for new solid-state button cell designs.

DRO & Impact Forces Of Rechargeable Button Cell Battery Market

The market dynamics are defined by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces. The primary driver is the pervasive trend of device miniaturization across medical, consumer, and industrial sectors, necessitating compact and reliable rechargeable power sources. Simultaneously, stringent safety regulations and the inherent complexity of manufacturing ultra-small, high-energy-density cells act as significant restraints. The key opportunity lies in exploiting advancements in solid-state and micro-battery technologies, which offer breakthroughs in safety, form factor, and charging speed. These forces collectively shape the competitive landscape, creating an environment where technological superiority and robust quality control determine market leadership.

Drivers include the rapid adoption of true wireless stereo (TWS) earbuds and smart hearing aids, which rely exclusively on miniature rechargeable cells. The increasing focus on preventative and personalized healthcare, leading to a surge in disposable and continuous monitoring medical patches and sensors, further accelerates demand. Moreover, the need for sustainable energy solutions is pushing OEMs away from single-use batteries, making rechargeable options mandatory in many new product lines. Restraints primarily involve the critical challenge of thermal management within such a confined space; any overheating risks component damage or catastrophic failure, making safety certifications lengthy and costly. Furthermore, the reliance on constrained supply chains for raw materials like lithium and cobalt introduces geopolitical risks and price volatility.

Opportunities are vast, particularly in next-generation chemistries like silicon anodes or sulfur cathodes, promising higher capacities than traditional graphite-based cells. The development of customized, flexible button cell designs also presents a niche opportunity for specialized wearables and smart textiles. The overarching impact forces are high R&D intensity and consolidation. Companies must continually invest heavily in materials science and manufacturing precision to maintain a competitive edge. Market consolidation is inevitable as smaller players lacking the capital for safety compliance and large-scale, high-precision manufacturing exit, leaving the field to integrated giants capable of managing complex global supply chains and stringent regulatory requirements.

Segmentation Analysis

The Rechargeable Button Cell Battery Market is strategically segmented based on chemistry, capacity, application, and distribution channel, providing a comprehensive view of market dynamics and targeted growth areas. This detailed segmentation allows market participants to identify specific high-value niches, particularly in specialized medical and high-end consumer applications where performance metrics justify premium pricing. Chemistry type remains the foundational segmentation, influencing key performance indicators such as energy density, cycle life, and inherent safety profile, determining suitability for mission-critical applications.

The capacity segment is critical, reflecting the trend of increasing power demands in miniaturized electronics. Batteries categorized as high-capacity (above 80 mAh) are disproportionately demanded by feature-rich smartwatches and advanced medical implants requiring multi-day operation, driving premium revenue streams. Conversely, lower-capacity cells (below 40 mAh) remain essential for basic electronic accessories and memory backup functions where minimal footprint and low self-discharge rates are prioritized. Understanding the interplay between chemistry and capacity is vital for strategic product portfolio development.

Application segmentation reveals the market's primary revenue sources, with consumer electronics, particularly TWS and smartwatches, dominating volume. However, the medical segment, although smaller in volume, drives innovation due to the extreme reliability and biocompatibility standards required for devices like hearing aids and ingestible sensors. Analyzing these segments helps in forecasting investment distribution, directing R&D resources towards either mass-market scalability or high-specification, niche performance improvements.

- By Chemistry Type:

- Lithium-ion (Li-ion)

- Lithium Polymer (Li-Po)

- Nickel Metal Hydride (NiMH)

- Solid-State Batteries (Emerging)

- Zinc-Air (Rechargeable Variants)

- By Capacity:

- Less than 40 mAh

- 40 mAh – 80 mAh

- Above 80 mAh (High Capacity)

- By Application:

- Consumer Electronics (Smartwatches, Wearables, Hearables)

- Medical Devices (Hearing Aids, CGMs, Implantable Devices)

- Industrial IoT & Sensors

- Automotive (Key Fobs, Sensor Systems)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Rechargeable Button Cell Battery Market

The value chain for rechargeable button cell batteries is highly specialized and complex, beginning with the upstream sourcing and refinement of critical raw materials, primarily lithium, cobalt, nickel, and specific carbon compounds. This upstream stage is characterized by high capital expenditure and geopolitical sensitivity, as the quality and purity of these materials directly impact the final battery performance and safety profile. Key participants in this stage include major mining companies and specialized chemical processors who supply the precursor cathode and anode materials to the cell manufacturers. Supply chain transparency and material sustainability auditing are increasingly critical factors mandated by global OEMs.

Midstream activities involve the highly precise manufacturing and assembly of the button cells. This stage requires cleanroom environments, automated winding and stacking machinery, and rigorous quality testing. Cell manufacturers focus on proprietary designs, specialized electrolyte mixtures, and hermetic sealing techniques essential for ensuring long-term reliability in compact form factors. The competitive advantage here is derived from manufacturing efficiency, scale of operation, and proprietary technology in electrode processing. After manufacturing, the products enter the distribution channel, which can be direct or indirect.

Downstream analysis focuses on integration into final products and reaching end-users. Direct channels involve B2B sales where large battery manufacturers supply directly to major OEMs (like Apple, Samsung, or medical device companies) under long-term supply agreements, ensuring specification compliance and just-in-time delivery. Indirect channels involve authorized distributors and specialized industrial parts suppliers who cater to smaller electronic device manufacturers and aftermarket repair services. Potential customers, or end-users, vary widely, ranging from individual consumers purchasing smartwatches to regulated medical institutions acquiring advanced patient monitoring systems. The value added at the downstream stage includes integration services, warranty provision, and post-sale technical support for complex battery management systems.

Rechargeable Button Cell Battery Market Potential Customers

Potential customers for rechargeable button cell batteries span a diverse range of industries, driven primarily by the need for miniaturized, high-performance power sources. The most significant segment comprises manufacturers of high-volume consumer electronics, specifically global leaders in wearable technology and hearables. These buyers prioritize high volumetric energy density, rapid charge capability, and cost efficiency at massive scales. Their procurement decisions are heavily influenced by supplier capacity to meet volatile demand fluctuations and adherence to consumer safety standards, making long-term strategic partnerships with top-tier battery makers crucial.

Another high-value customer segment includes medical device manufacturers. These buyers operate under extremely stringent regulatory environments (e.g., FDA, CE mark) and prioritize reliability, ultra-low self-discharge rates, and guaranteed cycle life over cost. Applications here include sophisticated hearing aids, continuous glucose monitoring systems, and various non-invasive or minimally invasive sensors. For these customers, the supplier must demonstrate impeccable quality control, traceability, and the ability to provide customized chemistries optimized for specific operational temperature ranges and safety protocols, often demanding specialized certifications.

The emerging potential customer base resides in the Industrial Internet of Things (IIoT) sector and specialized industrial equipment. IIoT devices, such as environmental sensors deployed in remote locations or smart asset trackers, require button cells that offer extreme longevity and stability over wide temperature gradients. These customers seek batteries optimized for low-power, long-duration standby modes, where the ability to recharge sporadically significantly reduces maintenance costs associated with manual battery replacement across distributed networks. Automotive suppliers also constitute a smaller but growing niche for smart key fobs and embedded sensor systems within vehicle bodies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.27 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation (Murata Manufacturing Co.), VARTA AG, Panasonic Corporation, Renata SA (Swatch Group), TDK Corporation, Samsung SDI Co. Ltd., EVE Energy Co., Ltd., Maxell Holdings, Ltd., GP Batteries International Limited, FDK Corporation, Duracell Inc., ZeniPower (Zhuhai) Battery Co., Ltd., Power-One Inc. (Bel Fuse Inc.), Blue Spark Technologies, Enfucell Oy, Saft Groupe S.A., LG Energy Solution, APL Power Supply Co., Ltd., Huizhou Huideru Power Co., Ltd., Electrochem Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rechargeable Button Cell Battery Market Key Technology Landscape

The technology landscape of the rechargeable button cell battery market is rapidly evolving, driven by the intense demand for higher energy density and improved safety in miniature forms. The current dominant technology centers around advanced Lithium-ion chemistries, particularly those utilizing high-nickel cathodes (NMC or NCA) paired with silicon-enhanced anodes. These combinations are pushing the theoretical limits of volumetric energy density, crucial for extending the life of smartwatches and earbuds without increasing their physical size. Manufacturing techniques are equally critical, with highly automated micro-assembly lines and laser welding replacing traditional methods to ensure precise, contamination-free sealing necessary for long cycle life.

A major technological frontier is the transition towards solid-state button batteries. Unlike traditional Li-ion cells which use flammable liquid electrolytes, solid-state batteries employ solid ceramic or polymer electrolytes. This fundamentally eliminates the risk of thermal runaway and leakage, making them inherently safer, especially for sensitive medical implants and high-temperature industrial applications. While currently expensive to manufacture and offering relatively lower power density compared to their liquid-electrolyte counterparts, ongoing R&D focuses on developing solid electrolytes with high ionic conductivity that can operate efficiently at room temperature, signaling a disruptive shift within the next five to seven years.

Furthermore, technology development is focusing on specialized micro-structures and flexible battery designs. Flexible button cells, often employing lithium-polymer chemistry, can conform to curved surfaces, expanding design possibilities for ergonomic wearables and smart clothing. Another critical area is the enhancement of the Battery Management System (BMS) at the cell level. Integrating advanced microcontrollers and proprietary algorithms within the button cell packaging allows for more accurate state-of-charge calculation, cell balancing, and proactive thermal monitoring, which are essential for maximizing the longevity and safety performance of these miniature, high-performance power sources in their complex applications.

Regional Highlights

Regional dynamics play a crucial role in shaping the rechargeable button cell battery market, largely reflecting patterns of electronic manufacturing concentration, consumer adoption rates of smart devices, and the maturity of the local medical technology sector. The Asia Pacific (APAC) region stands as the dominant market, driven by its unparalleled scale in electronics manufacturing. Countries like China, South Korea, and Taiwan house the global production bases for most leading consumer electronics and possess robust supply chains for critical raw materials, ensuring competitive pricing and volume scalability. High consumer demand for affordable wearables further solidifies APAC's leading position, both as a producer and consumer.

North America and Europe represent high-growth, high-value markets, primarily dictated by strong demand from the medical device industry and the premium segment of consumer wearables. In North America, technological innovation, especially in specialized medical monitoring devices (CGMs, cardiac sensors), mandates the use of highest-quality, certified rechargeable button cells, driving high ASPs. Similarly, European markets benefit from progressive environmental regulations, such as the EU Battery Regulation, which favors rechargeable solutions and mandates stringent recycling targets, spurring local innovation in sustainable battery production and end-of-life management.

The Latin America (LATAM) and Middle East & Africa (MEA) regions are emerging markets characterized by increasing urbanization and rising disposable incomes leading to greater adoption of entry-level and mid-range consumer electronics. While these regions currently rely heavily on imported finished products, increasing local assembly of electronics, coupled with growing investments in IoT infrastructure and smart city projects, are expected to significantly boost localized demand for rechargeable button cells over the forecast period. Investment in manufacturing capacity in these regions remains low, but rising consumer expenditure is fostering import-driven market expansion.

- Asia Pacific (APAC): Dominates the market share due to the concentration of electronics manufacturing hubs (China, South Korea). Key relevance is driven by large-scale production volume and massive consumer adoption of TWS and smartwatches.

- North America: Significant growth driver, particularly strong in the high-ASP medical device segment (FDA-regulated devices) and advanced wearable technology. Focus on technological innovation and safety certifications.

- Europe: High-growth market influenced heavily by stringent environmental mandates and circular economy initiatives (EU Battery Regulation). Strong demand from the luxury watch industry and sophisticated industrial IoT applications.

- Latin America (LATAM): Emerging market characterized by increasing penetration of imported consumer electronics and growing regional demand for affordable wireless accessories.

- Middle East & Africa (MEA): Growth driven by expanding infrastructure investment, smart city developments, and rising consumer adoption of mobile and wearable devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rechargeable Button Cell Battery Market.- Sony Corporation (Murata Manufacturing Co.)

- VARTA AG

- Panasonic Corporation

- Renata SA (Swatch Group)

- TDK Corporation

- Samsung SDI Co. Ltd.

- EVE Energy Co., Ltd.

- Maxell Holdings, Ltd.

- GP Batteries International Limited

- FDK Corporation

- Duracell Inc.

- ZeniPower (Zhuhai) Battery Co., Ltd.

- Power-One Inc. (Bel Fuse Inc.)

- Blue Spark Technologies

- Enfucell Oy

- Saft Groupe S.A.

- LG Energy Solution

- APL Power Supply Co., Ltd.

- Huizhou Huideru Power Co., Ltd.

- Electrochem Automation

Frequently Asked Questions

Analyze common user questions about the Rechargeable Button Cell Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for rechargeable button cells in the healthcare sector?

The primary driver is the rapid shift toward miniaturized and disposable medical devices, such as continuous glucose monitors (CGMs), smart patches, and advanced hearing aids, which require stable, high-energy-density power sources in extremely compact form factors. Rechargeability ensures device longevity and cost-effectiveness for chronic patient monitoring.

How do solid-state button batteries compare to traditional Li-ion types in terms of safety and performance?

Solid-state button batteries offer superior safety due to the elimination of flammable liquid electrolytes, drastically reducing the risk of thermal runaway and leakage, making them ideal for implants. While current solid-state designs may have lower power density than optimized liquid Li-ion, they excel in cycle stability and temperature tolerance, representing a significant technological advantage for future-proof miniaturized electronics.

Which geographical region dominates the rechargeable button cell battery manufacturing and consumption market?

Asia Pacific (APAC), specifically nations with strong electronics manufacturing bases like China, South Korea, and Japan, dominates both the production capacity and consumption volume. This dominance is sustained by high consumer adoption of wearables and the localized supply chain for critical battery components.

What are the main technical challenges facing rechargeable button cell manufacturers today?

Key technical challenges include achieving consistent and precise thermal management within extremely constrained spaces, ensuring long-term cycle life stability without swelling or capacity fade, and managing the high costs and geopolitical risks associated with securing pure, high-quality raw materials (lithium, cobalt) for mass production.

How is the rechargeable button cell market impacted by evolving regulatory standards, such as those in the European Union?

Regulatory standards, particularly the EU Battery Regulation, significantly impact the market by enforcing higher standards for recyclability, durability, and mandatory reporting of critical material content. This drives manufacturers toward more sustainable chemistries and designs, favoring long-life rechargeable options and increasing investment in advanced battery recycling infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager