Reciprocating Engines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434892 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Reciprocating Engines Market Size

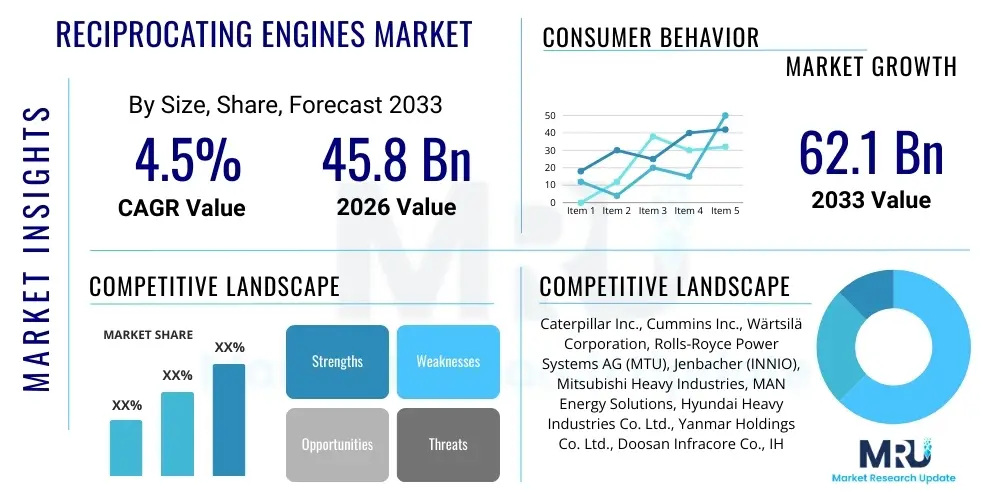

The Reciprocating Engines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 62.1 Billion by the end of the forecast period in 2033.

Reciprocating Engines Market introduction

The reciprocating engines market encompasses a vast array of mechanical devices that convert thermal energy derived from the combustion of fuel into mechanical motion, primarily rotation, through the linear action of pistons within cylinders. These engines are fundamental components across numerous heavy-duty sectors, forming the backbone of global transportation, decentralized power generation, and industrial operations. The product spectrum is diverse, ranging from high-speed, light-duty engines used in standard vehicles to massive, low-speed marine and stationary power generation engines. Key distinguishing factors include ignition type (spark ignition or compression ignition), fuel source (diesel, gasoline, natural gas, heavy fuel oil, or dual-fuel), and overall engine architecture (e.g., in-line, V-configuration, or opposed-piston). The longevity and continued relevance of reciprocating engines stem from their high power density, efficiency across variable loads, and proven reliability in challenging operational environments, making them indispensable despite the accelerating transition towards electrification and alternative power sources in specific niche applications.

Major applications for reciprocating engines are concentrated in three primary areas: transportation, stationary power generation, and industrial machinery. In the transportation sector, diesel and gasoline reciprocating engines dominate heavy-duty trucking, marine propulsion, and large construction equipment, where torque requirements and operational range are critical. For stationary power, large natural gas and diesel engines are widely utilized in combined heat and power (CHP) systems, peak-shaving plants, and essential prime power generation in remote or grid-unstable locations, capitalizing on their ability to switch fuels and operate continuously. The benefits derived from deploying these technologies include operational flexibility, relatively lower initial capital expenditure compared to some renewable solutions, and the maturity of the global supply chain for maintenance and fuel delivery. Furthermore, recent technological advancements focusing on reducing emissions through exhaust gas recirculation (EGR), selective catalytic reduction (SCR), and the integration of cleaner fuels like hydrogen and biogas are extending the lifecycle and improving the environmental footprint of modern reciprocating engine designs.

The market is currently driven by several critical factors, including the surging demand for reliable and decentralized power generation, particularly in developing economies experiencing rapid industrialization and urbanization. Increased activity in the marine shipping industry, necessitated by global trade volumes, drives demand for robust, high-efficiency marine diesel engines. Additionally, the constant regulatory pressure to reduce greenhouse gas emissions and improve fuel efficiency compels manufacturers to invest heavily in advanced engine management systems, sophisticated turbocharging technologies, and materials science improvements to optimize combustion processes. These innovations ensure that reciprocating engines remain competitive against emerging powertrain technologies, sustaining their market presence through enhanced performance metrics and compliance with increasingly strict global environmental standards, such as Tier IV and Euro VI equivalents.

Reciprocating Engines Market Executive Summary

The Reciprocating Engines Market exhibits robust growth trajectory, propelled primarily by sustained industrial expansion and the necessity for flexible, reliable power solutions worldwide. Current business trends indicate a significant shift towards natural gas and dual-fuel engines, driven by their lower operational costs and reduced carbon emissions compared to traditional diesel counterparts. Key manufacturers are focusing their strategic investments on modular engine designs that allow for easier integration into hybrid systems, optimizing performance for intermittent operational requirements typical in microgrids and smart city infrastructure. Furthermore, the aftermarket service segment is expanding rapidly, fueled by the vast installed base of engines requiring routine maintenance, overhauls, and modernization upgrades (retrofitting) to comply with new emission standards, thereby providing steady revenue streams and stabilizing the market against new engine procurement fluctuations. Consolidation activities, primarily through mergers and acquisitions, are observed among component suppliers and system integrators seeking to gain specialized technology access and expand their geographical footprint in high-growth regions like Asia Pacific.

Regionally, the market dynamics are highly differentiated. Asia Pacific remains the dominant and fastest-growing region, powered by colossal infrastructure projects, expanding manufacturing sectors, and rising energy demands in nations such as China and India, which heavily rely on reciprocating engines for both stationary and mobile applications. North America and Europe, while exhibiting slower growth in terms of unit sales due to strong legislative pushes towards electrification in light-duty sectors, showcase high demand for technologically advanced, high-efficiency engines, particularly in the oil and gas (e.g., compressor drive) and premium marine segments. The Middle East and Africa (MEA) region provides substantial opportunity, particularly in temporary and backup power generation solutions, owing to inadequate grid infrastructure and the prevalent use of diesel and gas engines to maintain critical operations in remote or volatile areas. Political stability and regulatory frameworks related to fuel availability and emissions significantly influence regional market penetration strategies and investment flows.

Segment trends highlight the enduring strength of the power generation application segment, which benefits from the global imperative for energy security and decentralized power distribution, especially leveraging engines capable of handling diverse gaseous fuels. Within the fuel type segmentation, dual-fuel engines are experiencing a particularly steep adoption curve, offering operators the flexibility to switch between cheaper, cleaner fuels (like LNG) and traditional liquid fuels (like diesel) based on price volatility and immediate availability. Regarding horsepower, the medium-speed and high-horsepower engine segments (above 1 MW) are critical to large-scale marine, locomotive, and utility power applications, necessitating sophisticated material science and advanced diagnostic capabilities. These engines represent a higher value per unit sale and drive innovation in thermal efficiency and reliability. The convergence of these trends suggests a market poised for evolutionary rather than revolutionary change, where technological refinement in efficiency and emissions control dictates competitive advantage across all operational segments.

AI Impact Analysis on Reciprocating Engines Market

Common user questions regarding AI’s influence on the reciprocating engines market frequently revolve around predictive maintenance capabilities, optimization of fuel consumption, and the automation of engine operation and diagnostics. Users are keen to understand how AI algorithms, specifically machine learning models, can process vast datasets generated by engine sensors (e.g., temperatures, pressures, vibration profiles) to forecast component failures long before they occur, thereby minimizing costly downtime and improving overall reliability. There is also strong interest in AI-driven real-time combustion optimization systems that can dynamically adjust parameters like air-fuel ratio and timing based on environmental conditions and load requirements, directly impacting efficiency and emissions compliance. Finally, stakeholders seek clarity on the integration challenges and the return on investment (ROI) associated with implementing sophisticated AI infrastructure in established engine fleets, particularly concerning data security and the necessary skills upgrade for maintenance personnel.

The integration of Artificial Intelligence and Machine Learning (ML) is rapidly transforming the operational landscape of reciprocating engines, moving them beyond purely mechanical devices towards intelligent, self-optimizing power systems. AI algorithms are instrumental in developing sophisticated digital twin models of engines, which simulate real-world performance under various load conditions. These digital twins allow engineers to optimize design parameters virtually before physical prototyping and provide operators with highly accurate predictive capabilities. This shift towards data-driven maintenance strategies represents a major value proposition, significantly reducing maintenance costs by replacing scheduled maintenance with condition-based maintenance. Furthermore, AI facilitates the development of automated diagnostics, enabling complex fault finding within minutes, a task that traditionally required specialized human expertise and considerable time, thereby increasing the effective operational uptime of high-capital-cost assets in demanding environments such as marine and oil and gas operations.

Beyond maintenance, AI is critically influencing the commercial and strategic decisions within the market. Generative AI tools are now being utilized in the rapid design and iteration of complex engine components, such as combustion chambers and turbochargers, optimizing fluid dynamics and thermal properties for enhanced efficiency and durability. On the business side, AI-powered demand forecasting and supply chain optimization help manufacturers manage inventory for high-value spare parts, addressing supply chain fragility and market volatility more effectively. However, the successful implementation of AI hinges on the quality and volume of sensor data collected. Therefore, the market is also seeing parallel growth in associated technologies like advanced IoT sensors, edge computing capabilities, and secure cloud platforms necessary to handle the enormous flow of operational data generated by a global fleet of monitored reciprocating engines, ensuring continuous performance improvement and regulatory compliance.

- AI Enables Predictive Maintenance: ML models analyze sensor data (vibration, temperature, oil quality) to predict component failure with high accuracy.

- Real-time Performance Optimization: Algorithms dynamically adjust combustion parameters (timing, fuel injection) for maximum fuel efficiency and lowest emissions.

- Digital Twin Development: Creation of high-fidelity virtual engine models for advanced simulation, testing, and operational monitoring.

- Automated Fault Diagnostics: AI systems identify and classify complex engine malfunctions autonomously, speeding up repair times.

- Supply Chain Optimization: ML algorithms improve forecasting of spare parts demand and optimize logistics for reduced operational lead times.

DRO & Impact Forces Of Reciprocating Engines Market

The reciprocating engines market is governed by a dynamic interplay of powerful drivers, significant restrictive factors, and evolving opportunities, all contributing to shaping its future trajectory and overall impact forces. The core drivers sustaining market growth include the unwavering demand for distributed power generation solutions, particularly in regions facing grid stability issues, and the continued necessity of high-torque, durable engines for heavy-duty industrial and commercial transport sectors (e.g., shipping and mining). Conversely, the market faces intense restraints, predominantly the aggressive global pivot towards electrification in the automotive sector, diminishing the long-term relevance of smaller internal combustion engines, and increasingly stringent global emission regulations (such as IMO Tier III and various national CO2 limits) which raise manufacturing and compliance costs significantly. These competing forces create complex scenarios for manufacturers, demanding constant investment in emission-reduction technologies and alternative fuel capabilities.

Key opportunities within the sector predominantly stem from technological innovation focused on sustainability and efficiency. The burgeoning interest in alternative fuels, specifically hydrogen, ammonia, and various forms of biogas (biomethane), presents a crucial long-term opportunity for engine manufacturers to diversify their product portfolio and reposition reciprocating engines as integral components of a cleaner energy future. Furthermore, the massive installed base of existing engines globally provides a substantial opportunity in the retrofit and modernization market, allowing operators to extend the life of their assets while meeting new emission standards through the integration of modern controls, fuel system upgrades, and exhaust after-treatment systems. Strategic market participants are capitalizing on the integration of digitalization, using telematics and sophisticated control systems to offer enhanced service contracts and performance guarantees, transforming the traditional engine supply model into a comprehensive power solutions service.

The impact forces within the reciprocating engine market are categorized by high regulatory pressure and technological disruption. The regulatory impact force is extremely high, compelling continuous redesigns and significant R&D spending, acting as both a restraint (due to compliance costs) and a driver (forcing market consolidation around entities capable of technological investment). Economic impact forces remain positive globally, driven by infrastructure growth and industrial output, although sensitive to global fuel price volatility. The competitive impact force is moderate but intensifying, characterized by established industry giants competing fiercely on efficiency, reliability, and lifecycle costs, while simultaneously facing disruption from non-engine related technologies like fuel cells and large-scale battery storage, particularly in the lower power segments. Successfully navigating these forces requires manufacturers to adopt a highly flexible manufacturing approach, enabling rapid transition between various fuel types and application requirements to maintain market relevance.

Segmentation Analysis

The Reciprocating Engines Market is meticulously segmented based on crucial attributes including fuel type, application, engine type, power output, and speed, providing granular insights into demand patterns across various industrial and commercial environments. This segmentation strategy is essential for stakeholders to accurately gauge market penetration opportunities and align product development with specific end-user requirements, especially concerning regulatory compliance and operational efficiency targets. The segmentation by fuel type, encompassing diesel, gasoline, and gaseous fuels, clearly illustrates the ongoing transition dictated by environmental policies and fuel economics, while application segmentation highlights the persistent strength in critical sectors such as marine propulsion and stationary power generation, areas where the intrinsic durability and power density of reciprocating engines are irreplaceable.

- By Fuel Type:

- Diesel

- Gasoline

- Natural Gas

- Dual Fuel/Bi-fuel

- Heavy Fuel Oil (HFO)

- By Application:

- Power Generation (Prime, Standby, Peaking)

- Marine (Propulsion, Auxiliary)

- Oil & Gas (Compressor Drive, Pumping)

- Automotive (Heavy-duty Vehicles)

- Industrial & Construction Machinery

- By Engine Type:

- Spark Ignition (SI)

- Compression Ignition (CI)

- By Speed:

- Low Speed (Under 500 rpm)

- Medium Speed (500 – 1500 rpm)

- High Speed (Above 1500 rpm)

- By Power Output:

- Below 1 MW

- 1 MW – 5 MW

- Above 5 MW

Value Chain Analysis For Reciprocating Engines Market

The value chain for the reciprocating engines market is complex and capital-intensive, starting with the upstream supply of critical raw materials, primarily specialized alloys (aluminum, steel, iron) and high-performance ceramics required for components like cylinder heads, pistons, and turbochargers. Upstream analysis highlights that the market is heavily reliant on global commodity markets and specialized foundries and forging operations capable of meeting the tight tolerances and material integrity required for high-pressure, high-temperature combustion environments. Suppliers of sophisticated components, such as electronic control units (ECUs), fuel injection systems, and exhaust after-treatment systems (e.g., SCR and DPF components), hold significant leverage, as these technologies are crucial for meeting modern efficiency and emission standards. Price volatility in base metals and the necessity for long-term sourcing contracts significantly impact the final manufacturing cost and delivery lead times for engine builders.

The core manufacturing and assembly stage involves the integration of thousands of components, utilizing advanced computer-numerical-control (CNC) machining and precise assembly robotics. Manufacturers operate globally distributed production facilities to mitigate trade tariffs and satisfy regional content requirements, optimizing logistics. Distribution channels are highly structured and typically bifurcated into direct and indirect routes. Direct sales are common for high-value, bespoke projects, such as large marine engines or utility-scale power plants, where direct engagement between the manufacturer and the original equipment manufacturer (OEM) or end-user is necessary for custom specification and integration support. This route often involves long contract negotiation cycles and integrated service agreements.

The downstream activities involve distribution, installation, and, most critically, the extensive aftermarket segment. Indirect channels rely heavily on authorized distributors, independent dealerships, and certified service centers that provide regional sales support, localized inventory of spare parts, and specialized technical expertise. This vast network is essential for the aftermarket, which includes routine maintenance, major overhauls (top-end and complete), and mandatory regulatory compliance upgrades (retrofits). The profitability and customer loyalty in this industry are heavily determined by the quality and responsiveness of the aftermarket support, emphasizing the importance of a robust global service network utilizing modern diagnostics (telematics) to ensure engine uptime and performance throughout its decades-long lifecycle. The high cost of specialized tools and training ensures high barriers to entry in the downstream service segment.

Reciprocating Engines Market Potential Customers

The primary potential customers and end-users of reciprocating engines span across highly capitalized industries where reliable and robust power sources are paramount, including original equipment manufacturers (OEMs) who integrate the engines into larger systems, and direct end-users who operate the machinery. Marine propulsion companies, including builders of container ships, tankers, and cruise liners, represent a cornerstone of demand, requiring highly durable, medium to low-speed diesel and dual-fuel engines tailored for continuous operation in harsh environments, demanding adherence to strict International Maritime Organization (IMO) regulations. Similarly, companies specializing in stationary power solutions, such as independent power producers (IPPs), utility companies, and major industrial facilities (e.g., petrochemical plants), constitute a significant buyer base, utilizing these engines for baseload, peak load, or combined heat and power (CHP) applications, often favoring natural gas engines for long-term operational efficiency and environmental compliance.

Another crucial segment consists of heavy-duty vehicular and off-highway equipment manufacturers. This includes builders of construction machinery (excavators, bulldozers), mining haul trucks, agricultural tractors, and locomotives. These buyers prioritize engines offering exceptional torque, reliability, and longevity under extreme loads and variable terrain conditions. The purchase decision in this sector is heavily influenced by the total cost of ownership (TCO), fuel efficiency, and the ease of obtaining replacement parts and field service. Governments and military organizations also function as significant potential customers, purchasing specialized reciprocating engines for defense vehicles, backup power systems, and specialized marine craft, where performance under non-standard fuels and ruggedization are key selection criteria.

Finally, the rapidly growing Oil & Gas sector, covering both upstream drilling and midstream pipeline operations, represents a specialized but high-value customer group. These companies require robust reciprocating engines for driving massive gas compressors, pumps, and generators in remote field locations where reliability and rapid deployment are essential. As these engines often run on field gas, customization and specialized fuel handling systems are often required. Furthermore, data center operators and telecommunications infrastructure providers are increasingly demanding high-speed diesel and natural gas engines for uninterruptible power supply (UPS) and critical backup generation, driven by the need for zero downtime in an increasingly digital global economy, making them critical high-growth potential customers focusing intensely on startup reliability and low emission profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 62.1 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Cummins Inc., Wärtsilä Corporation, Rolls-Royce Power Systems AG (MTU), Jenbacher (INNIO), Mitsubishi Heavy Industries, MAN Energy Solutions, Hyundai Heavy Industries Co. Ltd., Yanmar Holdings Co. Ltd., Doosan Infracore Co., IHI Power Systems Co. Ltd., Kawasaki Heavy Industries Ltd., Siemens Energy, Volvo Penta, Kohler Co., Fairbanks Morse Defense, Guangxi Yuchai Machinery Co. Ltd., Kubota Corporation, Deutz AG, John Deere. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reciprocating Engines Market Key Technology Landscape

The technological landscape of the reciprocating engines market is characterized by intense development aimed at maximizing thermal efficiency, minimizing pollutant emissions, and enhancing engine flexibility across multiple fuel types. A primary focus is placed on advanced combustion technologies, including high-pressure common rail (HPCR) fuel injection systems for precision fuel delivery, which significantly improves fuel atomization and reduces particulate matter. Furthermore, variable valve timing (VVT) and variable geometry turbochargers (VGT) are increasingly common, allowing engines to maintain optimal performance and responsiveness across a wider range of operating conditions and load changes, particularly critical for meeting transient emission limits in mobile applications. These mechanical and fluid dynamic enhancements work in conjunction with sophisticated engine control units (ECUs) that manage hundreds of operational parameters in real-time, often leveraging advanced diagnostics and predictive algorithms.

Exhaust after-treatment systems (EATS) represent another vital technological domain, necessitated by increasingly stringent global emission standards, especially regarding NOx and SOx. Selective Catalytic Reduction (SCR) technology remains the cornerstone for NOx reduction, utilizing urea injection (DEF/AdBlue) to convert nitrogen oxides into harmless nitrogen and water vapor. For particulate matter (PM), Diesel Particulate Filters (DPF) are mandatory, particularly in high-speed, light-duty engines, requiring continuous regeneration processes. Research is actively exploring more compact and efficient EATS solutions that can be integrated seamlessly without compromising engine packaging or reliability, especially for off-highway and marine applications where space constraints are significant. The shift towards cleaner fuels like Natural Gas and LPG also mandates the development of specialized ignition systems and materials capable of handling these high-octane, low-lubricity fuels.

Digitalization and connectivity are fundamentally reshaping the operational technology landscape. Modern reciprocating engines are equipped with extensive sensor arrays and telematics hardware, enabling continuous transmission of performance data to centralized monitoring systems. This integration of Industrial Internet of Things (IIoT) facilitates condition-based monitoring, predictive maintenance scheduling, and remote diagnostics, drastically reducing unscheduled downtime and optimizing long-term operational costs. Key players are also heavily investing in dual-fuel and multi-fuel technologies, allowing engines to seamlessly switch between conventional fuels and greener alternatives like LNG, bio-gas, or increasingly, hydrogen-blended natural gas. This fuel flexibility is essential for future-proofing engine assets and allowing operators to adapt swiftly to changing fuel availability and regulatory requirements across diverse global markets, maintaining the reciprocating engine as a versatile and resilient power solution.

Regional Highlights

- Asia Pacific (APAC): APAC represents the epicenter of market expansion, primarily driven by rapid industrialization, infrastructural development, and escalating energy demand across major economies like China, India, and Southeast Asian nations. The region relies heavily on reciprocating engines for both continuous power generation (due to often strained national grids) and heavy commercial transportation. The demand is particularly high for medium-speed natural gas engines in distributed power and high-horsepower diesel engines in the marine and construction sectors. Government initiatives promoting cleaner air quality are forcing a gradual transition from older, high-emission diesel engines toward modern, compliant gaseous-fuel engines, fueling the retrofit market and new procurement of advanced, compliant models.

- North America: This region is characterized by high demand for specialized, high-specification engines, particularly within the upstream Oil & Gas sector (driving compressors and pumps) and in the backup power segment for critical infrastructure like data centers and hospitals. While the automotive light-duty sector is rapidly electrifying, the heavy-duty trucking, rail, and marine sectors maintain strong demand for advanced diesel and emerging dual-fuel engines that meet stringent EPA Tier IV Final regulations. Innovation focus here is heavily skewed towards digitalization, telematics integration, and achieving ultra-low NOx standards in stationary applications.

- Europe: The European market is highly regulated and mature, placing the highest emphasis on fuel efficiency and achieving the lowest possible emissions (Euro VI standards). Growth is moderate but sustained by the marine sector (driven by IMO regulations) and the widespread adoption of Combined Heat and Power (CHP) and decentralized power solutions utilizing biogas and natural gas engines. European manufacturers are global leaders in developing hydrogen-ready and high-efficiency medium-speed engines, positioning the region at the forefront of sustainable reciprocating engine technology development and retrofit solutions for aging engine fleets.

- Latin America: Market growth in Latin America is uneven but strong in specific segments, particularly related to the expansion of mining operations in countries like Chile and Peru, and infrastructure projects across Brazil and Mexico. The need for reliable prime power generation in remote areas, coupled with significant agricultural activity, drives demand for durable diesel and HFO engines. Economic instability and fuel price volatility can influence purchasing decisions, favoring robust, lower-technology engines in some areas, contrasted by increasing adoption of natural gas engines near reliable pipeline infrastructure.

- Middle East and Africa (MEA): MEA exhibits significant potential, particularly in the Middle East due to substantial investments in oil and gas infrastructure, requiring large gas-powered compression and pumping engines. Africa’s rapidly expanding population and industrial base, coupled with extensive grid deficits, create massive demand for decentralized and backup power solutions, heavily reliant on diesel and gas engines. The market is highly price-sensitive but appreciates reliability and robust service support, making localized assembly and comprehensive service contracts key competitive differentiators in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reciprocating Engines Market.- Caterpillar Inc.

- Cummins Inc.

- Wärtsilä Corporation

- Rolls-Royce Power Systems AG (MTU)

- Jenbacher (INNIO)

- Mitsubishi Heavy Industries

- MAN Energy Solutions

- Hyundai Heavy Industries Co. Ltd.

- Yanmar Holdings Co. Ltd.

- Doosan Infracore Co.

- IHI Power Systems Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Siemens Energy

- Volvo Penta

- Kohler Co.

- Fairbanks Morse Defense

- Guangxi Yuchai Machinery Co. Ltd.

- Kubota Corporation

- Deutz AG

- John Deere

Frequently Asked Questions

Analyze common user questions about the Reciprocating Engines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards dual-fuel and natural gas reciprocating engines?

The primary driver is the stringent global emission legislation, particularly concerning sulfur and nitrogen oxide limits (NOx), coupled with the economic benefit of utilizing cheaper and cleaner natural gas (LNG/CNG). Dual-fuel capability offers essential operational flexibility, allowing operators in marine and power generation sectors to switch between fuels based on environmental zones or price volatility, ensuring compliance and optimizing running costs across variable global routes and markets.

How are strict environmental regulations, such as IMO Tier III and EPA Tier IV, impacting market technology?

These regulations necessitate significant technological investments in exhaust after-treatment systems (EATS), primarily Selective Catalytic Reduction (SCR) for NOx reduction and Diesel Particulate Filters (DPF). They also drive innovations in High-Pressure Common Rail (HPCR) injection and advanced turbocharging, increasing complexity and manufacturing costs, but ultimately delivering engines with significantly higher thermal efficiency and reduced pollutant output.

What role does the aftermarket service segment play in the overall reciprocating engines market?

The aftermarket service segment, encompassing maintenance, spare parts, retrofitting, and overhauls, is critical. Given the decades-long lifespan of large reciprocating engines, this segment provides stable, high-margin revenue streams. Demand is further fueled by the need to upgrade older engines with new emission control technologies and digital diagnostic capabilities to extend asset life and ensure compliance with evolving standards.

Which application segment offers the strongest growth opportunities for reciprocating engine manufacturers?

The stationary power generation segment, particularly distributed power and combined heat and power (CHP) installations, presents the strongest growth opportunities. This is driven by global demands for energy security, grid decentralization, and the increasing viability of renewable fuels like biogas and hydrogen being utilized in modular engine configurations for microgrids and industrial applications worldwide.

What impact is digitalization, such as the use of IIoT and AI, having on engine operation and maintenance?

Digitalization revolutionizes operation and maintenance by enabling continuous remote monitoring, detailed performance diagnostics, and highly accurate predictive maintenance. IIoT sensors feed data to AI/ML models, allowing operators to forecast failures, optimize fuel consumption in real-time, and shift from scheduled downtime to condition-based servicing, significantly boosting reliability and reducing the total cost of ownership (TCO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager