Reciprocating Saw Blades Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432281 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Reciprocating Saw Blades Market Size

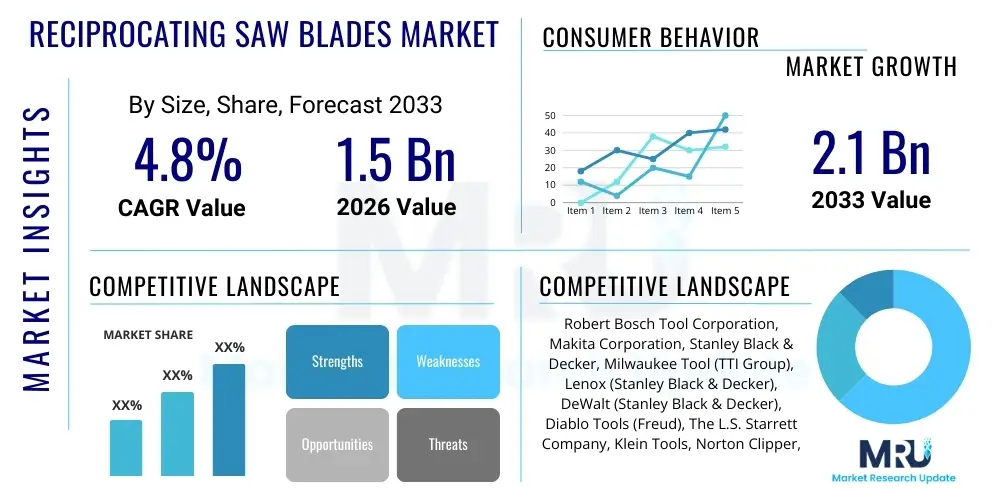

The Reciprocating Saw Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Reciprocating Saw Blades Market introduction

The Reciprocating Saw Blades Market encompasses the manufacturing, distribution, and sale of specialized cutting tools designed for use with reciprocating saws, commonly known as Sawzalls. These blades are crucial components in various demanding applications, ranging from routine maintenance and DIY projects to heavy-duty demolition and intricate industrial metalworking. The product definition centers on the blade's material composition—such as high carbon steel (HCS) for wood, high-speed steel (HSS) for general metal, bi-metal for versatility and enhanced durability, and carbide-tipped options for extreme longevity in abrasive materials—and its tooth geometry, which dictates the cutting speed and finish. The core function of these blades is to perform rapid linear cutting actions, making them indispensable for quick material removal, particularly in confined or awkward spaces where other cutting tools are impractical.

Major applications of reciprocating saw blades span critical sectors including residential and commercial construction, automotive repair and salvage, plumbing and HVAC installation, and industrial maintenance, repair, and overhaul (MRO). The benefit derived from using these specialized blades lies primarily in their superior demolition capabilities, versatility across diverse material types, and speed of execution. For instance, carbide-tipped blades offer immense benefits in cutting high-strength alloys or masonry, significantly reducing downtime and replacement costs compared to traditional bi-metal options. The versatility inherent in the blade design allows a single tool platform (the reciprocating saw) to handle tasks as disparate as cutting through wood studs embedded with nails and slicing thick steel pipes.

Market growth is predominantly driven by sustained activity in the global construction sector, especially in emerging economies undergoing rapid infrastructural development, which necessitates continuous demolition and renovation work. Furthermore, the increasing adoption of cordless power tools, which enhances portability and accessibility in challenging work environments, directly stimulates demand for high-performance, battery-optimized reciprocating saw blades. Technological advancements focusing on enhanced blade durability, anti-stick coatings, and specialized tooth pitches designed for precise application requirements, such as scroll cutting or flush cutting, are also key factors propelling the market forward.

Reciprocating Saw Blades Market Executive Summary

The global reciprocating saw blades market is characterized by robust demand stemming from the resilient construction and automotive repair sectors, positioning it for steady growth over the forecast period. Business trends indicate a pronounced shift towards premiumization, driven by end-users seeking carbide-tipped and specialized bi-metal blades that offer superior longevity and efficiency, thereby offsetting the higher initial cost through reduced replacement frequency and labor time. Key industry players are heavily investing in proprietary tooth geometry and coating technologies to secure competitive advantages. Mergers, acquisitions, and strategic partnerships focused on expanding distribution networks and integrating vertically within the materials supply chain are common strategies observed among market leaders, aiming to optimize production costs and improve market reach, particularly in high-growth APAC regions.

Regionally, North America and Europe maintain leading positions, primarily due to well-established construction industries, high adoption rates of advanced power tools, and stringent safety regulations that necessitate reliable, high-quality cutting equipment. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, fueled by massive infrastructure projects, burgeoning urbanization, and increasing DIY penetration among middle-class populations. Latin America and MEA are slower to adopt the highest-tier technologies but show consistent demand linked to oil and gas infrastructure maintenance and basic construction activities. Segment trends highlight the dominance of the Bi-Metal segment due to its versatility and favorable cost-performance ratio, although the Carbide-Tipped segment is rapidly gaining market share, reflecting the growing intensity of demolition and material hardness encountered in modern construction and industrial environments.

The primary constraint facing the market is the inherent wear and tear associated with abrasive cutting applications, necessitating frequent replacement and generating significant waste. However, this restraint also serves as a perpetual revenue driver for manufacturers operating on a consumable goods model. Opportunities abound in developing specialized blades optimized for sustainable materials, such as engineered wood and composite plastics, and integrating smart features or digital tracking into high-value blades to monitor usage and predict failure. Overall, the market remains highly competitive, driven by innovation in metallurgy and geometry, catering to the professional user who prioritizes performance and reliability above initial cost considerations.

AI Impact Analysis on Reciprocating Saw Blades Market

Common user questions regarding AI's impact on the Reciprocating Saw Blades Market revolve primarily around predictive maintenance for power tools, optimization of blade manufacturing processes, and inventory management automation based on real-time usage data. Users are keen to understand if AI can prolong blade life, reduce premature failures, or recommend the exact optimal blade type for highly specific materials (e.g., specific grades of stainless steel or treated lumber). Key themes emerging from these inquiries include expectations for AI-driven quality control during manufacturing, anticipating material defects in raw steel inputs, and using machine learning models to analyze vibration and temperature data collected from connected reciprocating saws to dynamically advise the operator on cutting speed and feed rate, thereby maximizing blade efficiency and safety. The overarching concern is how AI can transform a traditional consumable product into a data-optimized component, minimizing waste and maximizing profitability for professional users.

While AI does not directly interact with the physical cutting action of the blade itself, its influence is profound across the value chain, from material procurement to end-user feedback loops. In manufacturing, AI algorithms are being deployed to monitor CNC machining parameters and heat treatment processes, ensuring consistent metallurgical properties and precise tooth geometry, which are critical determinants of blade performance and longevity. This level of precision significantly reduces manufacturing variability and improves the average lifespan of the product. Furthermore, AI-powered computer vision systems are enhancing quality control inspections, identifying micro-fractures or geometry imperfections that human inspectors might miss, leading to higher product reliability and fewer warranty claims.

The most tangible impact of AI is seen in the ecosystem surrounding the tool. By integrating AI/ML models with data collected from smart, connected power tools (IoT sensors on reciprocating saws), manufacturers can analyze variables like cut duration, material type inferred from load profiles, and frequency of use. This data informs highly accurate predictive maintenance schedules for both the tool and the blade, automating re-ordering processes for large commercial users and allowing manufacturers to refine product design iteratively. For instance, if data shows a particular blade profile consistently fails prematurely when cutting certain composite materials, the AI analysis instantly highlights the requirement for an improved design iteration, thereby speeding up product development cycles and enhancing customer satisfaction significantly.

- AI optimizes blade manufacturing precision, reducing metallurgical defects through real-time process monitoring.

- Predictive analytics integrated into smart reciprocating saws forecasts blade wear, recommending optimal replacement times and minimizing unexpected downtime.

- Machine learning algorithms inform dynamic inventory management systems for construction firms based on usage patterns and material consumption rates.

- AI-driven computer vision enhances quality control inspection, ensuring superior tooth geometry and weld integrity, particularly for bi-metal construction.

- Consumption data analyzed by AI guides R&D toward developing specialized blades for high-demand, challenging materials, accelerating product innovation cycles.

DRO & Impact Forces Of Reciprocating Saw Blades Market

The market for reciprocating saw blades is propelled by robust drivers, primarily the global resurgence in construction and demolition activities, alongside continuous innovation in blade material science, offering users enhanced performance. However, growth is tempered by notable restraints, particularly the intense competition from alternative cutting technologies and the perpetual challenge of blade wear and high replacement rates, which affect end-user operational costs. Opportunities exist mainly in expanding the use of advanced materials like carbide and exploring specialized niche applications, while the impact forces shape the competitive landscape and technological investment priorities across the industry. Balancing performance requirements against cost pressures is the core challenge defining market evolution.

Drivers: The increasing complexity and density of modern building materials necessitate powerful, reliable cutting tools for renovation and demolition, boosting demand for high-performance blades. The widespread adoption of cordless reciprocating saws, offering unparalleled mobility and convenience on job sites, directly correlates with increased usage and, consequently, higher consumption of replacement blades. Furthermore, stringent safety standards in developed markets push contractors towards certified, high-quality blades that minimize the risk of breakage and associated injuries, favoring established premium brands over cheaper alternatives. This emphasis on efficiency and safety is a substantial, non-negotiable driver.

Restraints: A primary restraint is the inherently high frequency of blade replacement required in intense applications, leading to significant recurring costs for professional users. This constant expenditure sometimes pushes price-sensitive buyers toward lower-cost, lower-quality products, which can saturate the mid-to-low market tier. Competition from alternative cutting methods, such as abrasive wheels, diamond cutters, and specialized handheld plasma cutters, particularly in metal fabrication and pipe cutting, poses a constraint by offering comparable results in certain specific applications. Moreover, environmental concerns regarding the disposal of metal consumables are increasing, pushing manufacturers to explore recyclable or longer-lasting blade options.

Opportunities: Significant growth opportunities lie in the continuous development of Carbide-Tipped technology, offering 50 to 100 times the lifespan of standard Bi-Metal blades in harsh applications, commanding premium prices and strong brand loyalty. Targeting specialized applications, such as blades optimized for specific composite materials (e.g., carbon fiber, fiberglass, and dense ceramics) found in the aerospace and marine industries, provides lucrative niche markets. Additionally, expanding accessibility and user education in emerging markets about the long-term cost benefits of utilizing premium, application-specific blades presents a substantial growth opportunity, driving a shift from general-purpose to specialized consumption.

Segmentation Analysis

The reciprocating saw blades market is meticulously segmented based on key factors including the material composition of the blade, the primary application area, and the type of end-user utilizing the tool. This segmentation is crucial as performance requirements vary drastically; a blade designed for delicate wood cutting differs fundamentally from one engineered for high-speed metal demolition. Analyzing these segments helps manufacturers tailor product lines, optimize material science investments, and strategically target distinct professional and consumer demographics with specialized solutions that maximize efficiency and lifespan for the intended task. The segmentation reflects the market’s maturity and the need for precision tools in complex modern construction and maintenance tasks.

By focusing on material type, the segmentation highlights the core technological differences: Bi-Metal blades dominate due to their optimal balance of flexibility (from the HCS body) and hardness (from the HSS cutting edge), making them the industry workhorse. Conversely, the high-growth Carbide-Tipped segment addresses the most demanding industrial and demolition environments where wear resistance is paramount. Application segmentation directly influences tooth pitch (TPI) and geometry; fine-toothed blades are prioritized for clean metal cuts, while coarse, often aggressively set teeth are used for quick wood and demolition work. Finally, end-user segmentation separates the high-volume, cost-sensitive DIY sector from the performance-driven, longevity-focused professional construction and MRO segments, influencing pricing and distribution channel strategy.

- By Blade Material:

- Bi-Metal

- High Carbon Steel (HCS)

- High-Speed Steel (HSS)

- Carbide-Tipped

- By Application:

- Wood Cutting (including nail-embedded wood)

- Metal Cutting (ferrous and non-ferrous)

- Demolition and Multi-Material

- Plastic and Composites

- By End-User:

- Construction and Plumbing

- Automotive and HVAC

- Industrial Maintenance, Repair, and Overhaul (MRO)

- Do-It-Yourself (DIY) and Home Repair

Value Chain Analysis For Reciprocating Saw Blades Market

The value chain for reciprocating saw blades commences with upstream activities centered on the procurement and processing of specialized raw materials, primarily high-quality steel alloys (such as M2 or M7 HSS) and tungsten carbide powder, which are critical inputs defining the final product's performance. Upstream analysis involves rigorous quality control in material sourcing to ensure metallurgical consistency necessary for optimal heat treatment and subsequent blade hardness. Key activities at this stage include steel rolling, forging, and the highly specialized process of manufacturing carbide inserts, often outsourced to specialist firms. Efficient raw material procurement and inventory management are critical to controlling manufacturing costs, particularly given the volatility in global steel and commodity markets. Strong supplier relationships are essential for maintaining a steady supply of high-grade inputs required for bi-metal welding and carbide brazing techniques.

The mid-stream encompasses the manufacturing process, involving precision stamping, tooth setting (TPI and geometry), specialized welding techniques (like laser welding for bi-metal constructions), heat treatment for achieving the required hardness (HRC), and final grinding and coating (e.g., titanium nitride or anti-stick coatings). This stage is capital intensive, relying heavily on advanced CNC machinery and quality assurance checks to produce blades with consistent dimensions and performance characteristics. Optimization in manufacturing focuses on reducing scrap rates, increasing throughput, and minimizing the energy consumption associated with the heat treatment cycles, which can be significant. Vertical integration, where major manufacturers control their own steel processing or carbide tipping facilities, provides significant competitive advantages in cost and quality control.

Downstream analysis focuses on distribution and sales. The primary distribution channels are segmented into direct sales (to large industrial MRO clients or major construction groups) and indirect sales, which include retail hardware stores (such as Home Depot, Lowe's), specialized industrial supply distributors (e.g., Grainger, Fastenal), and rapidly growing e-commerce platforms. The choice of channel depends heavily on the end-user segment; DIY products are typically sold through large retail chains, requiring aggressive merchandising and consumer-friendly packaging, while professional-grade carbide blades are often routed through specialized industrial suppliers who provide technical expertise and bulk purchasing options. Effective channel management, including optimizing logistics for a high-volume, low-weight product, is essential for maximizing market penetration and maintaining shelf presence globally.

Reciprocating Saw Blades Market Potential Customers

Potential customers for reciprocating saw blades span a broad spectrum of industries, anchored predominantly by the professional tradesperson and supported by a robust segment of dedicated DIY enthusiasts. The primary end-users are those involved in activities requiring rapid material removal, cutting through disparate materials, and performing demolition or renovation tasks where precision saws or specialized cutters are impractical. The high-volume consumers are typically large construction contractors, specialized demolition firms, and maintenance teams within significant industrial facilities. These customers prioritize blade longevity, application-specific specialization, and bulk purchasing efficiency, often seeking direct supply relationships or agreements with major industrial distributors that guarantee consistent, high-quality stock.

Secondary yet vital customer groups include automotive repair and body shops, plumbing and HVAC installation specialists, and general electrical contractors. These professionals require specific blade types—such as fine-toothed HSS blades for clean metal conduit cuts or specialized plunge-cutting blades for delicate drywall work—emphasizing tool compatibility and reliable performance in confined spaces. The DIY market represents a growing customer base, driven by home renovation trends and increased access to professional-grade tools. While DIY customers may be more price-sensitive, they still drive significant volume, particularly for general-purpose bi-metal and HCS blades, distributed primarily through major retail hardware chains, making brand visibility and consumer education critical for market capture within this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch Tool Corporation, Makita Corporation, Stanley Black & Decker, Milwaukee Tool (TTI Group), Lenox (Stanley Black & Decker), DeWalt (Stanley Black & Decker), Diablo Tools (Freud), The L.S. Starrett Company, Klein Tools, Norton Clipper, Irwin Tools, Hilti Corporation, Knipex, Atlas Copco, Tyrolit, Snap-on Incorporated, Apex Tool Group, Dremel (Bosch), FEIN Power Tools, Vermont American. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reciprocating Saw Blades Market Key Technology Landscape

The technology landscape for reciprocating saw blades is dominated by advancements in material science, particularly concerning the composition and bonding techniques used to maximize blade durability and cutting speed. The core innovation remains the Bi-Metal construction, where a flexible, shatter-resistant high carbon steel backer is laser-welded to a strip of hardened high-speed steel (HSS) on the cutting edge. Recent technological efforts focus on optimizing the HSS alloy, introducing cobalt or specialized heat treatments (cryogenic processes) to enhance edge retention and heat resistance, crucial for minimizing wear when cutting tough metals like stainless steel or high-tensile alloys. Furthermore, the evolution of proprietary coatings, such as Titanium Nitride (TiN) or specialized anti-friction polymer coatings, aims to reduce heat build-up and material stickiness, thereby extending the effective life of the standard bi-metal blade and enabling faster, smoother cutting through materials like pressure-treated wood or adhesive-laden composites.

The most disruptive technological trend is the rapid adoption and refinement of Carbide-Tipped reciprocating saw blades. These blades utilize high-grade tungsten carbide tips, brazed onto a flexible steel body, offering exponentially greater resistance to abrasion compared to HSS or bi-metal counterparts. Technological developments in this segment focus on the geometry of the carbide tip—specifically, the size, grind, and rake angle—to ensure optimal chip evacuation and minimizing shock impact during aggressive cutting or demolition work. The advanced brazing process, often requiring specialized tri-metal fillers, is critical to ensuring the carbide tip remains securely bonded even under extreme vibration and heat loads. This carbide revolution is transforming the market, allowing contractors to cut previously challenging materials like cast iron pipe, masonry, and highly abrasive composites with tools that were traditionally limited to softer materials.

Beyond material composition, innovation extends to blade geometry and mounting systems. Manufacturers are introducing variable pitch teeth (VPT) designs, where the teeth per inch (TPI) changes along the cutting edge. This technological feature improves versatility by providing the benefits of quick cutting (low TPI) at the start of the stroke and smoother action (high TPI) during the cut, reducing vibration and noise. Furthermore, attention is paid to the universal shank design, ensuring secure locking mechanisms that accommodate the high torque and vibration generated by modern high-output cordless saws. The optimization of these features ensures that the consumables keep pace with the power delivery capabilities of the latest generation of power tools, maintaining performance under continuous high load conditions which are increasingly common in professional applications.

Regional Highlights

The market dynamics for reciprocating saw blades exhibit distinct characteristics across major global regions, influenced by varying levels of construction activity, labor costs, regulatory environments, and the adoption rate of cordless technology.

- North America: This region holds a leading market share, driven by a mature construction sector, high labor costs necessitating efficient and durable tools, and a strong culture of professional contracting. The market is defined by heavy penetration of premium brands and a high demand for specialized blades (especially carbide-tipped) used in large-scale residential and commercial demolition and renovation projects. The rapid growth of the cordless power tool segment is a key driver for replacement blade consumption.

- Europe: Characterized by stringent quality and safety standards (CE certification) and an emphasis on sustainability, the European market shows strong demand for high-quality bi-metal blades and specialized wood-cutting blades (due to a focus on sustainable building practices). Germany, the UK, and France are major consumption hubs, with innovation often focused on optimizing blade performance for energy efficiency in demolition and minimizing material waste.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC market expansion is directly linked to massive urbanization, infrastructural investment (roads, rails, utilities), and rapid industrialization, particularly in China, India, and Southeast Asian nations. While price sensitivity remains high, leading to a strong demand for cost-effective HCS and entry-level bi-metal blades, the adoption of premium carbide technology is accelerating in high-end construction and manufacturing centers.

- Latin America (LATAM): Market growth is steady but highly dependent on local economic stability and commodities pricing, especially in Brazil and Mexico. Demand is concentrated in general maintenance and mid-range construction, favoring robust, multi-purpose blades. Market penetration of advanced carbide blades is comparatively low, but steadily increasing in industrial MRO operations.

- Middle East and Africa (MEA): Growth is primarily centered around major construction projects in the Gulf Cooperation Council (GCC) states (Saudi Arabia, UAE), particularly those related to large-scale infrastructure and energy sectors. The extreme heat environments necessitate blades with superior heat resistance and durability. South Africa remains a key consumption point in the African sub-region, driven by mining and construction activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reciprocating Saw Blades Market.- Robert Bosch Tool Corporation

- Makita Corporation

- Stanley Black & Decker

- Milwaukee Tool (TTI Group)

- Lenox (Stanley Black & Decker)

- DeWalt (Stanley Black & Decker)

- Diablo Tools (Freud)

- The L.S. Starrett Company

- Klein Tools

- Norton Clipper

- Irwin Tools

- Hilti Corporation

- Knipex

- Atlas Copco

- Tyrolit

- Snap-on Incorporated

- Apex Tool Group

- Dremel (Bosch)

- FEIN Power Tools

- Vermont American

Frequently Asked Questions

Analyze common user questions about the Reciprocating Saw Blades market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Bi-Metal and Carbide-Tipped reciprocating saw blades?

Bi-Metal blades are flexible, versatile, and suitable for general-purpose cutting of wood and soft metals, offering a balance of performance and cost. Carbide-Tipped blades use extremely hard tungsten carbide tips for superior abrasion resistance, providing significantly longer life (often 50x or more) when cutting tough materials like cast iron, stainless steel, and masonry.

Which factors most significantly impact the longevity and performance of a reciprocating saw blade?

The key factors are the blade's material composition (e.g., carbide content), the tooth pitch (TPI) matched correctly to the material being cut, and the user's operational technique, specifically maintaining the correct speed and feed rate to avoid overheating and premature tooth wear.

How is the demand for reciprocating saw blades related to the growth of cordless power tools?

The increased efficiency and mobility provided by high-powered cordless reciprocating saws have led to higher overall usage rates on job sites. This directly accelerates the consumption of consumable blades, driving demand, especially for optimized, high-performance blades designed to maximize battery life.

Which geographical region is expected to show the highest growth rate for the market, and why?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by large-scale infrastructure development, rapid urbanization, and significant investments in industrial and residential construction projects across countries like China and India.

What technological advancements are currently defining the competitive landscape of the saw blade market?

The competitive landscape is defined by advancements in metallurgical coatings (like TiN for heat dissipation), specialized tooth geometry (such as variable pitch teeth for reduced vibration), and continuous innovation in carbide brazing techniques to enhance the durability and resilience of premium blades against extreme cutting conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager