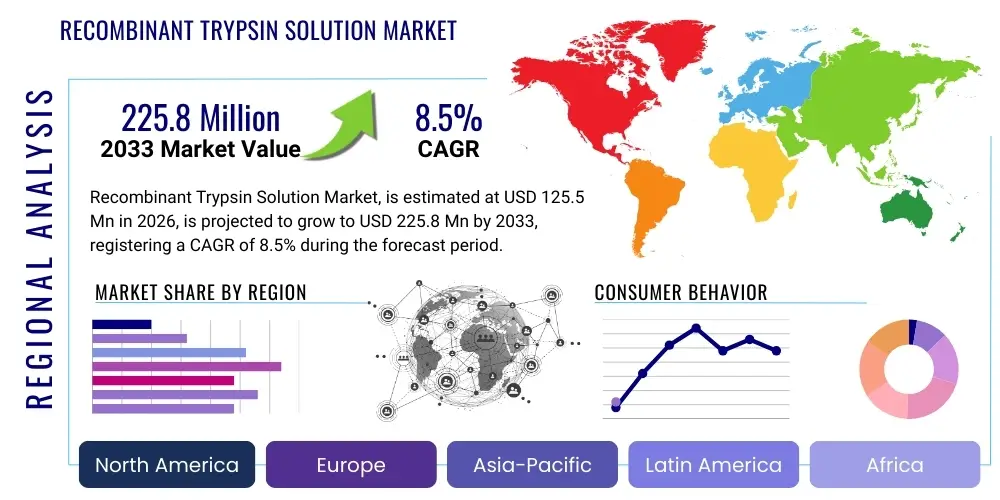

Recombinant Trypsin Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431894 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Recombinant Trypsin Solution Market Size

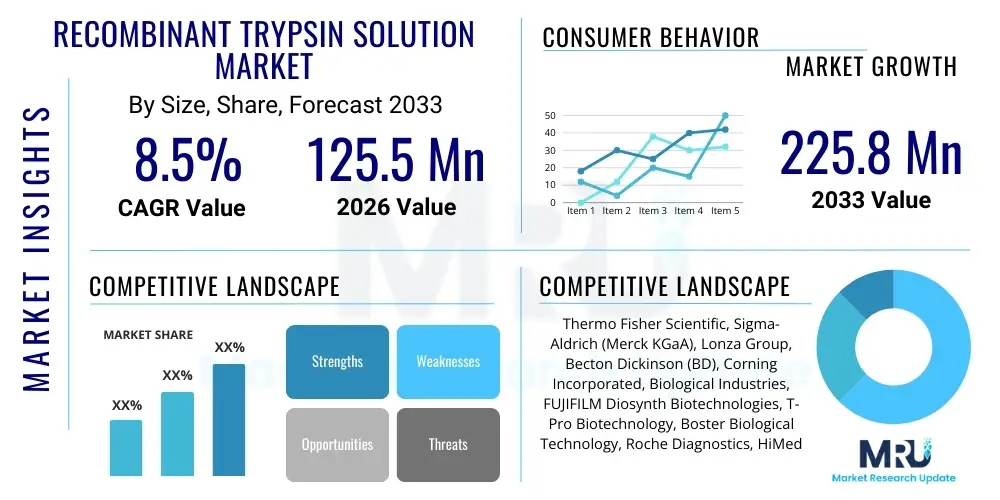

The Recombinant Trypsin Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 125.5 Million in 2026 and is projected to reach USD 225.8 Million by the end of the forecast period in 2033.

Recombinant Trypsin Solution Market introduction

The Recombinant Trypsin Solution Market encompasses the production and supply of highly purified, animal-origin-free (AOF) trypsin substitutes utilized primarily in biological research, biopharmaceutical manufacturing, and regenerative medicine. Recombinant trypsin is an essential protease used for cell dissociation during cell culture processes, particularly for human and animal cells intended for vaccine production, therapeutic protein synthesis, and stem cell therapy development. The product is valued for its consistency, high purity, and significantly reduced risk of viral or prion contamination compared to traditional porcine or bovine-derived trypsin, making it the preferred choice for Good Manufacturing Practice (GMP) compliant environments.

The core application driving market growth is the large-scale production of biologics, including monoclonal antibodies and gene therapies, which necessitate stringent regulatory requirements regarding raw material safety and purity. Recombinant trypsin offers superior lot-to-lot consistency, which is critical for maintaining robust and scalable cell culture protocols. Furthermore, its crucial role in stem cell research—where maintaining cell viability and avoiding cross-contamination risks are paramount—solidifies its positioning as a key enabling technology in the burgeoning fields of tissue engineering and personalized medicine. The market's expansion is intrinsically linked to the global rise in biotechnological investments and increased emphasis on safer, defined media components.

Major applications span basic life science research, drug discovery processes, and complex clinical manufacturing. The shift away from animal-derived components, driven by ethical considerations and regulatory pressures, provides a substantial tailwind for recombinant alternatives. Key benefits include enhanced safety profiles, consistent enzyme activity, and simplified regulatory approval pathways for therapeutic products utilizing AOF raw materials. The driving factors include the rapid growth of the biopharmaceutical industry, particularly in emerging Asian economies, and the increasing adoption of serum-free and chemically defined cell culture media formulations globally.

Recombinant Trypsin Solution Market Executive Summary

The Recombinant Trypsin Solution Market is characterized by robust growth fueled by strategic shifts in bioprocessing methodologies towards animal-origin-free components and the accelerating demand for high-quality biologics. Current business trends indicate a strong emphasis on establishing diversified supply chains and expanding manufacturing capacity to meet the demands of large-scale cell and gene therapy production. Key market participants are focusing on vertical integration and strategic partnerships with Contract Development and Manufacturing Organizations (CDMOs) to ensure seamless supply of GMP-grade reagents. Innovation centers around optimizing enzyme stability and activity profiles to suit diverse cell lines, including challenging suspension cultures and sensitive pluripotent stem cells.

Regionally, North America and Europe maintain dominance due to established biopharmaceutical infrastructures, substantial R&D investments, and stringent regulatory frameworks promoting AOF materials. However, the Asia Pacific (APAC) region, spearheaded by China, India, and South Korea, is emerging as the fastest-growing market, driven by governmental initiatives supporting local biotechnology industries and increasing foreign investment in biomanufacturing facilities. This regional dynamic suggests a future market structure characterized by decentralized production hubs focusing on regional regulatory compliance and local consumption of specialized media components.

Segmentation trends highlight the increasing preference for high-concentration and specialized formulations tailored for specific cell types, such as mesenchymal stem cells (MSCs) and induced pluripotent stem cells (iPSCs). The Application segment remains dominated by Biopharmaceutical Manufacturing due to the sheer volume requirements, but Cell and Gene Therapy applications are exhibiting the highest growth trajectory, reflecting the transition of pipeline therapies into commercial production. The market is consolidating around quality standards, making brand reputation and regulatory compliance paramount competitive differentiators across all identified segments.

AI Impact Analysis on Recombinant Trypsin Solution Market

User queries regarding the impact of Artificial Intelligence (AI) on the Recombinant Trypsin Solution Market frequently center on how AI can optimize fermentation and purification processes, predict enzyme activity consistency, and integrate into automated high-throughput screening workflows in drug discovery. A primary concern is whether AI can accelerate the development of next-generation recombinant proteases with tailored specificity and enhanced stability, potentially reducing reliance on traditional trypsin. Users are also interested in how AI-driven predictive maintenance and quality control systems can be deployed by manufacturers to maintain the high purity and lot-to-lot consistency demanded by GMP customers, thereby mitigating supply chain risks associated with batch variability. The overarching theme is the integration of machine learning for process optimization, quality assurance, and accelerated enzyme engineering within biomanufacturing environments.

- AI optimizes upstream fermentation processes for recombinant host organisms, maximizing trypsin yield and purity.

- Machine learning algorithms predict batch consistency, ensuring stringent quality control and reducing manufacturing deviations.

- AI-driven image analysis in cell culture monitoring utilizes recombinant trypsin solutions, assessing optimal cell detachment kinetics.

- Predictive analytics enhance supply chain management by forecasting demand fluctuation from biopharma clients, ensuring timely reagent availability.

- In silico enzyme design platforms utilize AI to engineer novel proteases with superior activity and thermal stability compared to current recombinant trypsin.

- Robotic process automation, often governed by AI systems, integrates recombinant trypsin dispensing for high-throughput automated cell processing and screening in drug discovery labs.

- AI aids in regulatory documentation and traceability by monitoring usage parameters of GMP-grade recombinant trypsin in closed manufacturing systems.

DRO & Impact Forces Of Recombinant Trypsin Solution Market

The market dynamics are significantly influenced by the escalating demand for biopharmaceutical products, stringent regulatory mandates favoring Animal Origin Free (AOF) components, and substantial investment in cell and gene therapies, which collectively act as primary drivers. Restraints largely involve the high production costs associated with recombinant technology, the technical complexities of scaling up GMP production, and the challenge of maintaining regulatory parity across different global jurisdictions. Opportunities arise from technological advancements leading to stabilized, ready-to-use formulations and untapped potential in emerging markets rapidly developing their biotech sectors. These forces create a dynamic environment where compliance and innovation are critical differentiators, impacting pricing strategies and competitive positioning within the global life science tools sector.

The primary driver is the necessity for safety and regulatory compliance. Regulatory bodies worldwide are increasingly favoring defined, traceable reagents to minimize biological risks in therapeutic manufacturing. Recombinant trypsin, due to its defined synthesis and lack of zoonotic contamination risk, aligns perfectly with these guidelines, thereby becoming an essential input material. Furthermore, the rapid expansion of research into complex cell therapies, which require gentle, highly consistent cell dissociation, heavily relies on the optimized performance characteristics inherent in recombinant solutions, driving continuous procurement and usage volumes in clinical production facilities.

Conversely, a major restraint is the significant initial capital expenditure required for establishing high-quality recombinant protein production facilities, often hindering smaller players from entering the GMP supply chain. The sensitivity of the market to pricing is another constraint, as manufacturers must balance the high cost of production with competitive pricing demands from large-volume biopharma buyers. The impact forces are characterized by high industry rivalry centered on product purity and specific activity, moderate bargaining power of large buyers demanding economies of scale, and high entry barriers due to complex intellectual property landscapes and strict quality certifications, solidifying the market position of established, specialized suppliers.

Segmentation Analysis

The Recombinant Trypsin Solution Market is structurally divided based on product type, application, and end-user, reflecting the diverse requirements of the biotechnology and biopharmaceutical sectors. Segmentation by product type often differentiates between liquid formulations (ready-to-use) and lyophilized powders, where liquid forms dominate due to ease of use and reduced preparation time in manufacturing settings, despite the challenge of maintaining long-term stability. The market landscape is increasingly refined by application, where cell culture and bioprocessing constitute the largest segment, but analytical applications like mass spectrometry sample preparation also represent a high-value niche requiring ultra-pure reagents.

The end-user segmentation clearly indicates Biopharmaceutical Companies and Contract Development and Manufacturing Organizations (CDMOs) as the dominant consumers, driven by large-scale commercial production needs. Academic and Research Institutions, while purchasing lower volumes, contribute significantly to demand through exploratory research, often necessitating customized or smaller-batch quantities. Understanding these segment dynamics is crucial for suppliers to tailor product specifications, packaging, and distribution strategies, focusing on the high-growth areas such as advanced therapy medicinal product (ATMP) manufacturing.

- By Product Type:

- Liquid Formulations (Ready-to-Use)

- Lyophilized Powders

- By Concentration:

- Standard Concentration (e.g., 0.25%)

- High Concentration/Specialized Formulations

- By Application:

- Cell Culture and Bioprocessing (including cell detachment)

- Vaccine Manufacturing

- Biopharmaceutical Manufacturing (Monoclonal Antibodies, Recombinant Proteins)

- Cell and Gene Therapy Production

- Analytical Applications (e.g., Peptide Mapping)

- Stem Cell Research and Regenerative Medicine

- By End-User:

- Biopharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic and Research Institutes

- Biotechnology Companies

Value Chain Analysis For Recombinant Trypsin Solution Market

The value chain for the Recombinant Trypsin Solution Market initiates with upstream activities centered on genetic engineering, microbial or yeast fermentation (host systems like E. coli or Pichia pastoris), and initial protein expression. This complex stage requires specialized infrastructure, high-purity raw materials (feedstock), and robust quality control systems to ensure the initial recombinant protein is synthesized efficiently and free from contaminants. The consistency of the host cell line and the optimization of the fermentation yield are critical determinants of the final cost and purity of the resulting trypsin.

Midstream activities involve sophisticated downstream processing, including multiple chromatography steps, ultrafiltration, and rigorous viral inactivation protocols to achieve the necessary GMP-grade purity (often >99%). Formulation and aseptic filling follow, where the purified recombinant trypsin is blended into proprietary buffered solutions (liquid formulation) or lyophilized (powder) for stability. Packaging, labeling, and lot-release testing, which adheres to strict regulatory standards (e.g., USP, Ph. Eur.), finalize the product before distribution. This intensive purification phase adds significant value and represents a major cost component.

The distribution channel is characterized by a mix of direct sales and specialized third-party distributors who possess expertise in handling sensitive biological reagents requiring cold chain logistics. Direct sales are common for large-volume CDMOs and major biopharmaceutical clients to ensure full traceability and dedicated technical support. Indirect distribution via specialized life science distributors ensures wider market penetration, particularly into research institutes and smaller biotech firms. The end of the chain involves the end-user application in cell culture laboratories and manufacturing suites, where performance, stability, and supporting documentation are paramount for customer satisfaction and repeat business.

Recombinant Trypsin Solution Market Potential Customers

Potential customers for recombinant trypsin solutions are concentrated within sectors requiring highly reliable, contamination-free proteases for dissociation and processing of high-value cell lines. The primary end-users are biopharmaceutical firms engaged in the commercial production of therapeutic proteins, vaccines, and advanced drug modalities where scalability and regulatory compliance are non-negotiable. These organizations require bulk supply of GMP-grade reagents with comprehensive documentation packages validating AOF status and lot consistency.

A rapidly expanding customer base consists of companies specializing in Cell and Gene Therapy (CGT) manufacturing. These entities rely heavily on recombinant trypsin for the gentle, efficient harvesting of delicate cells such as T-cells, NK cells, and various stem cell populations, requiring specialized formulations optimized for high viability. Furthermore, Contract Research Organizations (CROs) and academic institutions conducting foundational research in oncology, immunology, and regenerative medicine represent crucial, high-frequency buyers of smaller, research-grade quantities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Million |

| Market Forecast in 2033 | USD 225.8 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Sigma-Aldrich (Merck KGaA), Lonza Group, Becton Dickinson (BD), Corning Incorporated, Biological Industries, FUJIFILM Diosynth Biotechnologies, T-Pro Biotechnology, Boster Biological Technology, Roche Diagnostics, HiMedia Laboratories, A&E Scientific, Promega Corporation, Sartorius AG, Eppendorf AG, Irvine Scientific, Pan-Biotech GmbH, CESCO Bioengineering, R&D Systems (Bio-Techne), Atlanta Biologicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recombinant Trypsin Solution Market Key Technology Landscape

The key technology underpinning the Recombinant Trypsin Solution Market revolves around advanced microbial expression systems and purification techniques necessary to produce high-purity, active enzyme free from mammalian contaminants. The primary technological focus is on strain engineering, utilizing systems like Pichia pastoris or specific E. coli strains modified to express the porcine trypsin gene or synthetic analogues. Optimization of fermentation technology, including bioreactor design and precise media composition, is crucial for maximizing yield and maintaining consistent enzyme folding and activity, which directly impacts the product's performance in cell dissociation protocols.

Following expression, the technological landscape shifts to sophisticated protein purification. Modern manufacturers employ multi-stage chromatography systems, including ion-exchange, affinity, and hydrophobic interaction chromatography, often integrated with sterile filtration techniques, to eliminate host cell proteins (HCPs) and nucleic acids to achieve GMP compliance. Crucially, stabilization technologies—such as specialized buffering agents, cryoprotectants, and lyophilization techniques—are constantly being refined to enhance the shelf life and ambient stability of the final liquid or powdered trypsin solution, addressing logistical challenges related to cold chain requirements for global distribution.

Emerging technologies include the development of proprietary, chemically defined detachment solutions that integrate recombinant trypsin with other gentle enzymes or chelating agents to provide faster and safer cell dissociation specific to highly sensitive cell lines, such as induced pluripotent stem cells (iPSCs). Furthermore, advanced analytical methodologies, including high-performance liquid chromatography (HPLC) and mass spectrometry, are employed extensively throughout the production cycle to confirm structural integrity, measure specific activity units (U/mg), and ensure the complete absence of animal-derived components, thereby adhering to the strict regulatory demands of the clinical market.

Regional Highlights

Geographical market analysis reveals that North America, led by the United States, commands the largest market share, driven by a highly mature biotechnology industry, extensive government and private funding in life science research, and the presence of numerous global biopharmaceutical headquarters and leading academic institutions. The stringent regulatory environment in the U.S. and Canada heavily favors the adoption of high-quality, AOF reagents like recombinant trypsin for clinical trials and commercial manufacturing, ensuring sustained demand. Investment in cutting-edge cell and gene therapy manufacturing facilities further cements North America’s dominance.

Europe represents the second-largest market, characterized by strong governmental support for biomedical research in countries like Germany, the UK, and Switzerland. The European market exhibits high adoption rates due to the robust vaccine production sector and the proactive implementation of EU directives promoting the use of non-animal derived components in therapeutic production. Market growth in Europe is steady, supported by substantial public-private partnerships aimed at scaling up personalized medicine production and optimizing complex bioprocessing workflows utilizing advanced reagents.

The Asia Pacific (APAC) region is projected to experience the fastest growth during the forecast period. This acceleration is primarily attributed to rising healthcare expenditures, government initiatives promoting domestic biotech manufacturing capabilities (especially in China and India), and the increasing influx of foreign direct investment into regional biopharma centers. The establishment of localized GMP production hubs, driven by the need for cost-effective manufacturing and regional market access, translates into rapidly increasing demand for recombinant trypsin solutions as core raw materials.

- North America: Market leader due to high R&D spending, strong biopharma sector, dominance in cell and gene therapy development, and strict regulatory adherence to AOF standards.

- Europe: Significant market presence, driven by centralized regulatory bodies (EMA) endorsing AOF materials, substantial vaccine production capacity, and leading academic research focusing on tissue engineering.

- Asia Pacific (APAC): Fastest-growing market segment, fueled by rapid industrialization of biotechnology, supportive governmental policies in countries like China and South Korea, and expanding local CDMO infrastructure.

- Latin America (LATAM): Emerging market showing gradual growth, focused mainly on regional vaccine production and basic biological research, reliant largely on imports of specialized reagents.

- Middle East and Africa (MEA): Smallest but developing market, characterized by initial investments in localized pharmaceutical production and research facilities, creating niche demand for high-quality imported reagents.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recombinant Trypsin Solution Market.- Thermo Fisher Scientific

- Sigma-Aldrich (Merck KGaA)

- Lonza Group

- Becton Dickinson (BD)

- Corning Incorporated

- Biological Industries

- FUJIFILM Diosynth Biotechnologies

- T-Pro Biotechnology

- Boster Biological Technology

- Roche Diagnostics

- HiMedia Laboratories

- A&E Scientific

- Promega Corporation

- Sartorius AG

- Eppendorf AG

- Irvine Scientific

- Pan-Biotech GmbH

- CESCO Bioengineering

- R&D Systems (Bio-Techne)

- Atlanta Biologicals

Frequently Asked Questions

Analyze common user questions about the Recombinant Trypsin Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using recombinant trypsin over traditional porcine trypsin?

The primary advantage of recombinant trypsin is its Animal-Origin-Free (AOF) status, which eliminates the risk of introducing viral, prion, or other zoonotic contamination into cell cultures, ensuring higher product safety, superior batch-to-batch consistency, and simplified regulatory compliance, especially for therapeutic production (GMP grade).

In which applications is GMP-grade recombinant trypsin most critical for market growth?

GMP-grade recombinant trypsin is most critical in high-growth segments such as Cell and Gene Therapy (CGT) manufacturing, including CAR-T cell production and induced pluripotent stem cell (iPSC) harvesting, and large-scale biopharmaceutical manufacturing where regulatory traceability and product purity are paramount for patient safety and clinical success.

How does the liquid formulation of recombinant trypsin compare to the powdered (lyophilized) form?

Liquid formulations are highly favored in manufacturing settings for immediate use and ease of handling, reducing contamination risk during preparation. However, lyophilized (powdered) recombinant trypsin offers superior long-term stability and reduced cold chain dependence for storage and shipping, making it viable for long-distance transport and research labs with limited specialized storage.

What factors constrain the overall growth of the Recombinant Trypsin Solution Market?

Market growth is primarily constrained by the high initial capital investment required for establishing GMP-compliant recombinant protein production facilities, the high ongoing operational costs associated with sophisticated purification processes, and the logistical challenges of stabilizing and distributing temperature-sensitive liquid formulations globally.

Which geographical region is expected to demonstrate the highest CAGR for recombinant trypsin solutions?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive investment in domestic biotechnology sectors, the rapid expansion of localized biomanufacturing hubs in countries like China and South Korea, and increasing adoption of Western GMP standards in regional drug production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Recombinant Trypsin Solution Market Size Report By Type (Solid, Liquid), By Application (Insulin Manufacturing, Vaccines Manufacturing, Cell Culture, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Recombinant Trypsin Solution Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Solid, Liquid), By Application (Insulin Manufacturing, Vaccines Manufacturing, Cell Culture), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager