Recreational CBD Beverages Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436119 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Recreational CBD Beverages Market Size

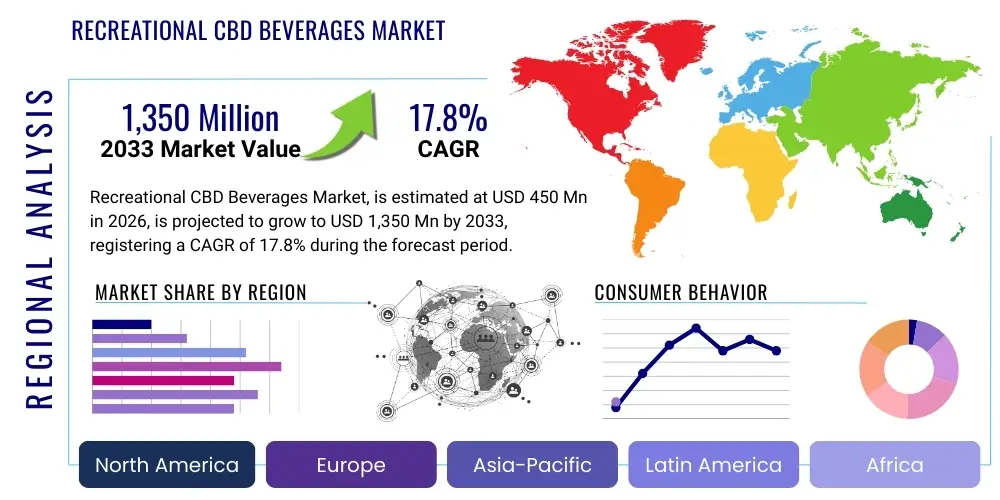

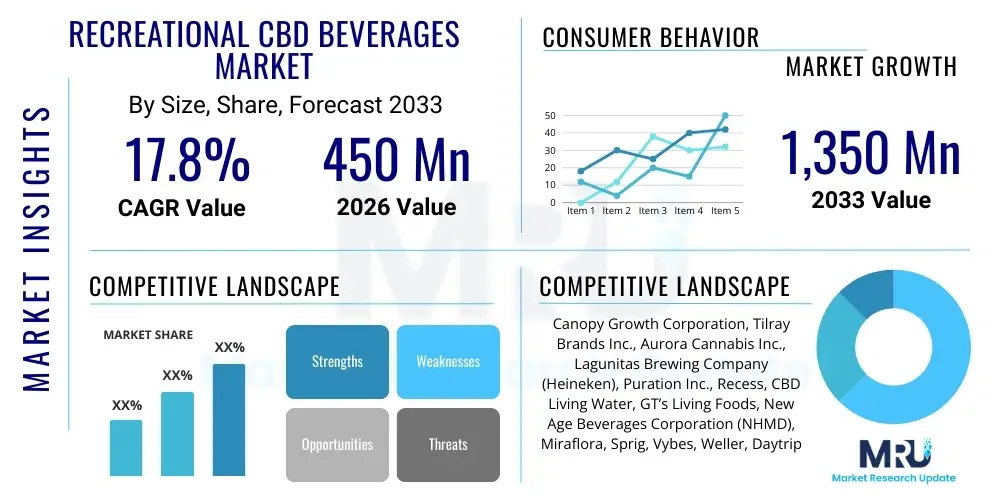

The Recreational CBD Beverages Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Recreational CBD Beverages Market introduction

The Recreational CBD Beverages Market encompasses ready-to-drink products infused with Cannabidiol (CBD), derived primarily from industrial hemp, designed for non-medicinal, leisure consumption. These beverages offer consumers a non-alcoholic alternative that provides perceived wellness benefits such as relaxation, stress reduction, and improved focus, without the psychoactive effects associated with THC. Product categories range widely, including sparkling water, teas, coffee, functional juices, and mocktails, appealing to a health-conscious demographic seeking alternatives to traditional alcoholic drinks and high-sugar sodas. The sophisticated formulation, often utilizing nanoemulsion technology to enhance CBD bioavailability and accelerate onset time, differentiates these products in the broader functional beverage landscape.

Major applications of recreational CBD beverages center on social consumption, post-exercise recovery, and as a daily supplement for general well-being. The primary consumer benefit is the delivery of relaxation effects in a socially acceptable, palatable, and dose-controlled format. Unlike edibles or tinctures, beverages provide quicker absorption and predictable effects, aligning with the "sessionability" trend observed in the non-alcoholic sector. This convenience and speed of efficacy are paramount to market adoption, particularly among Millennial and Gen Z consumers prioritizing mental health and natural ingredients.

Key driving factors accelerating market expansion include the increasing legalization and destigmatization of cannabis-derived products globally, particularly the widespread acceptance of hemp-derived CBD containing less than 0.3% THC. Furthermore, the rising consumer interest in functional, natural ingredients, coupled with the decline in alcohol consumption among younger generations, positions CBD beverages as a viable substitute. Continuous innovation in flavor masking technologies and water-soluble CBD formulations further enhances product quality and consumer appeal, mitigating the inherent bitter taste previously associated with hemp compounds. Regulatory clarity, although fragmented, is steadily improving, encouraging major food and beverage corporations to invest heavily in this emerging sector, thereby expanding distribution and marketing reach.

Recreational CBD Beverages Market Executive Summary

The Recreational CBD Beverages Market is characterized by rapid innovation and significant investment from both cannabis specialists and mainstream beverage giants, reflecting strong growth potential driven by shifting consumer preferences towards functional wellness and non-alcoholic alternatives. Business trends highlight a pronounced emphasis on technological superiority, particularly nanoemulsion techniques, which are crucial for achieving reliable dosing and fast-acting effects, essential for establishing consumer trust and brand loyalty. Supply chain optimization, from sustainable hemp sourcing to advanced manufacturing processes, is a critical area of focus, enabling companies to manage costs and maintain quality control amidst evolving regulatory landscapes. Strategic partnerships between established distributors and niche CBD beverage producers are defining market access, leveraging existing cold chain logistics and retail relationships.

Regionally, North America, spearheaded by the United States and Canada, remains the epicenter of innovation and market revenue, benefiting from advanced regulatory frameworks for hemp-derived CBD, robust retail infrastructure, and high consumer awareness. Europe presents a high-potential, albeit fragmented, landscape, with countries like the UK and Switzerland leading adoption, while regulatory uncertainty persists across other major economies, restricting large-scale cross-border commerce. Asia Pacific, though nascent, shows promise, driven primarily by Australia and New Zealand's progressive stances on functional wellness products, while most of the region remains highly restricted, necessitating focused efforts on legal clarity and consumer education tailored to local cultural sensitivities.

Segment trends reveal that the sparkling water and functional beverage categories dominate product type sales, reflecting the consumer desire for hydration and low-calorie options. Distribution segmentation is rapidly evolving, with e-commerce playing an indispensable role, especially in direct-to-consumer models, although specialized dispensaries and conventional grocery retail channels are expanding their shelf space for federally legal hemp-derived products. Furthermore, the CBD concentration segment shows a consumer preference migrating towards mid-range doses (10mg-25mg) for recreational effects, balancing efficacy with safety concerns. The market outlook suggests continued premiumization, with branding focusing heavily on natural origins, transparency, and specific functional claims (e.g., sleep aid, focus enhancer) to differentiate in a crowded marketplace.

AI Impact Analysis on Recreational CBD Beverages Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Recreational CBD Beverages Market primarily revolve around personalized product development, regulatory compliance monitoring, and supply chain optimization. Users frequently question how AI algorithms can predict consumer response to novel CBD formulations, specifically regarding optimal dosage, flavor pairing, and onset/duration profiles, moving beyond traditional trial-and-error methods. Concerns also emerge regarding AI's role in verifying the authenticity and source of hemp extracts (to ensure compliance with THC limits) and automating the tedious process of navigating diverse, rapidly changing international CBD regulations. Furthermore, users are keenly interested in how predictive analytics can manage the volatile agricultural supply chain for hemp and optimize cold chain logistics for perishable beverage products, ensuring freshness and minimizing waste from farm to shelf.

AI's role is transformative, offering significant advancements in R&D and operational efficiency that traditional market structures cannot achieve. In product development, Machine Learning (ML) models analyze vast datasets encompassing ingredient interactions, physiological response data (collected via wearable tech), and consumer feedback to suggest novel, highly efficacious CBD delivery systems and flavor profiles, dramatically accelerating the time-to-market for new beverage concepts. This precision formulation capability reduces waste and maximizes the therapeutic and recreational impact of the CBD content, ensuring optimal consumer satisfaction and brand differentiation in a highly competitive sector.

Operationally, AI enhances regulatory adherence and supply chain transparency, crucial factors in a highly scrutinized industry. Computer vision and predictive analytics are deployed to monitor hemp quality during cultivation and extraction, identifying contaminants or deviations from desired cannabinoid profiles in real-time. For marketing, AI-driven personalization engines target specific consumer segments with tailored product recommendations and messaging, significantly increasing conversion rates and fostering loyalty among diverse consumer groups seeking targeted wellness outcomes from their recreational beverage choices. The implementation of AI tools standardizes quality control (QC) procedures, ensuring batch-to-batch consistency—a major factor in consumer trust for regulated substances.

- AI-driven personalized product formulation optimizing flavor profiles and target efficacy (e.g., relaxation, focus).

- Predictive analytics for optimizing hemp supply chain logistics, minimizing agricultural volatility and ensuring sustainable sourcing.

- Automated quality control (QC) and potency testing using computer vision and machine learning for rapid compliance verification.

- Enhanced regulatory monitoring systems tracking evolving THC limits and permissible CBD claims across multiple jurisdictions.

- AI-powered hyper-segmentation for marketing, improving consumer engagement by aligning product features with specific health goals.

- Optimization of cold chain distribution networks using predictive routing to maintain product integrity and reduce spoilage rates.

DRO & Impact Forces Of Recreational CBD Beverages Market

The Recreational CBD Beverages Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing its growth trajectory. The primary driver is the pervasive consumer shift away from alcohol and sugary sodas towards healthier, functional, and natural beverages, positioning CBD drinks as a premium, wellness-oriented substitute that offers controlled relaxation without impairment. This driver is powerfully supported by increasing consumer awareness regarding the potential health benefits of CBD, coupled with improved technology, such as nanoemulsion, that solves historical issues related to CBD's poor bioavailability and taste profile, making products more palatable and effective. Furthermore, the expanding legal acceptance of hemp-derived CBD products in key global economies provides the necessary market access and structural stability for large-scale investment.

However, the market faces formidable restraints, most notably the persistent regulatory ambiguity and fragmentation across international borders and even within key domestic markets like the United States. The lack of standardized federal guidelines regarding CBD as a food additive or beverage ingredient creates significant operational hurdles for manufacturing, labeling, and cross-state distribution, increasing compliance costs and limiting market size potential. Another major restraint is consumer confusion and skepticism surrounding product efficacy, driven by historical inconsistencies in potency and the absence of robust, standardized clinical research supporting various health claims. The high cost of specialized manufacturing (particularly nanoemulsion technology) also contributes to premium pricing, potentially limiting mass market adoption compared to conventional beverages.

Significant opportunities lie in leveraging the expanding functional beverage trend by developing highly targeted, condition-specific products, such as beverages formulated specifically for sleep aid, immunity boosting, or athletic recovery, moving beyond general wellness claims. Geographical expansion into emerging, high-density consumer markets, particularly in European countries and parts of Asia that are starting to liberalize hemp laws, represents substantial potential. Moreover, the opportunity exists in establishing stringent self-regulatory standards and third-party certifications, which can build consumer trust and differentiate responsible brands from low-quality competitors, proactively mitigating the negative impact of regulatory uncertainty and boosting long-term market sustainability. Strategic partnerships with major distribution networks and established food service providers will further unlock mass-market penetration.

Segmentation Analysis

The Recreational CBD Beverages Market is systematically segmented based on source type, product type, CBD concentration, and distribution channel, providing a comprehensive view of consumer preferences and operational strategies. Segmentation by source is critical, differentiating between hemp-derived CBD, which dominates the recreational sector due to its non-psychoactive nature and broader legality (containing <0.3% THC), and marijuana-derived CBD, which often requires state-specific dispensary sales. Understanding these source dynamics is crucial for market participants planning product portfolios and navigating compliance requirements across different jurisdictions.

The product type segmentation highlights the consumer preference for familiar formats, with CBD-infused sparkling water, carbonated soft drinks, and functional teas leading in adoption. Functional beverages, specifically those making explicit claims regarding specific benefits like stress relief or energy, are rapidly gaining ground as consumers seek maximum value from their purchase. Furthermore, the market is differentiated by CBD concentration, generally categorized into low-dose (under 10mg), mid-dose (10mg-25mg), and high-dose (over 25mg), catering to new users, regular recreational consumers, and experienced users, respectively. Distribution channel analysis confirms the growing importance of specialized cannabis retail alongside the accelerating growth of e-commerce platforms, particularly for direct-to-consumer relationships, complementing traditional grocery and convenience store sales which offer wider reach for legal hemp products.

These segmentations collectively define the competitive landscape. For instance, companies focusing on high-dose, functional shots (product type) sourced from organically grown hemp (source type) distributed primarily through specialized e-commerce platforms (distribution channel) appeal to a specific, high-spending consumer niche prioritizing efficacy and transparency. Conversely, large beverage corporations focus on low-dose sparkling waters distributed through mainstream retail to achieve broad market penetration. The continuous analysis of shifting consumer preference across these segments, such as the increasing demand for broad-spectrum CBD (which includes minor cannabinoids but no THC) over isolates, is vital for long-term strategic planning and inventory management.

- By Source Type:

- Hemp-Derived CBD

- Marijuana-Derived CBD

- By Product Type:

- CBD Water (Still and Sparkling)

- CBD Teas and Coffee

- CBD Carbonated Soft Drinks (CSDs)

- CBD Functional Beverages (e.g., Energy, Wellness Shots)

- CBD Mixers and Mocktails

- By CBD Concentration:

- Low Concentration (Under 10mg per serving)

- Medium Concentration (10mg – 25mg per serving)

- High Concentration (Above 25mg per serving)

- By Distribution Channel:

- Retail Stores (Convenience Stores, Supermarkets, Pharmacies)

- Specialty Stores (Dispensaries, CBD Boutiques)

- Online/E-commerce

- Food Service and Hospitality

Value Chain Analysis For Recreational CBD Beverages Market

The value chain for the Recreational CBD Beverages Market is highly specialized, beginning with the cultivation and extraction of hemp, followed by advanced manufacturing, extensive branding, and complex distribution logistics. The upstream segment involves the cultivation of high-quality, high-CBD-yield hemp strains, often requiring specialized agricultural practices to ensure compliance with strict THC limits. The critical step upstream is the extraction process, which uses methods like CO2 or ethanol extraction to isolate crude CBD oil, followed by refinement to produce CBD isolate, broad-spectrum, or full-spectrum distillates. Quality control and purity testing at this stage are paramount, as the quality of the raw material directly impacts the final beverage flavor and safety profile.

The core manufacturing stage is dominated by the transformation of oil-based CBD into a water-soluble format, primarily through nanoemulsification technology. This process, which creates tiny, stable CBD droplets, is essential for ensuring quick onset, predictable dosing, and stability within a beverage matrix. This middle segment also includes beverage formulation, flavor masking, bottling, and specialized packaging that protects the CBD from light and oxidation. The high capital expenditure required for nanoemulsion equipment and sophisticated quality assurance protocols distinguishes key players in this highly technical phase. Strong partnerships with specialized co-packers who meet food safety standards and possess relevant regulatory licenses are common in this stage.

Downstream analysis focuses heavily on branding, marketing, and distribution. Given the regulatory constraints on traditional advertising, companies rely heavily on digital marketing, influencer engagement, and transparent labeling to educate consumers. The distribution channel involves a complex mix of direct and indirect methods. Direct channels, such as brand-operated e-commerce, allow for greater margin control and direct consumer data collection. Indirect distribution utilizes traditional wholesalers, specialized CBD distributors, and, increasingly, mainstream food and beverage distributors who can access large retail chains (supermarkets, convenience stores). Ensuring compliance with cold chain requirements, especially for perishable products, adds another layer of complexity to the downstream logistics, making specialized distribution expertise highly valuable for market success.

Recreational CBD Beverages Market Potential Customers

The primary consumers and buyers of recreational CBD beverages are a diverse group generally unified by a common interest in natural wellness alternatives and functional benefits. Potential customers fall into several distinct categories, including "Sober Curious" Millennials and Gen Z adults who are actively reducing or eliminating alcohol consumption but still seek sophisticated, social, and functional beverages that offer a perceived relaxation effect. These consumers value low-calorie counts, natural ingredients, and stylish branding, treating CBD beverages as a premium alternative to alcoholic cocktails or beer.

Another significant segment comprises active adults and wellness enthusiasts, including athletes and busy professionals, who seek targeted recovery and stress management solutions. These buyers utilize CBD beverages for post-workout inflammation reduction, improved sleep hygiene, or to manage daily anxiety and stress without the lethargy associated with sedatives. They prioritize high transparency, accurate dosing information, and functional claims (e.g., "focus," "calm," or "recover") supported by scientific backing, viewing the product as an investment in preventative health.

Finally, there are the traditional cannabis users who are transitioning from smoking or vaping to more discreet, controlled, and socially accepted consumption methods. These buyers appreciate the faster onset time offered by nanoemulsified beverages compared to traditional edibles and often seek mid-to-high concentration products for a more pronounced effect. Retailers and distributors, including grocery chains, specialized dispensaries (where legal), and online wellness platforms, act as the institutional buyers, making purchasing decisions based on regulatory compliance, shelf stability, brand reputation, and profit margins, ensuring the product meets the needs of the varied end-user demographic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 17.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canopy Growth Corporation, Tilray Brands Inc., Aurora Cannabis Inc., Lagunitas Brewing Company (Heineken), Puration Inc., Recess, CBD Living Water, GT’s Living Foods, New Age Beverages Corporation (NHMD), Miraflora, Sprig, Vybes, Weller, Daytrip, Queen City Hemp, Defy, KILL CLIFF, Sweetwater Brewing Company, Koios Beverage Corp., Cloud Water Brands |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recreational CBD Beverages Market Key Technology Landscape

The technological landscape of the Recreational CBD Beverages Market is defined by the necessity to overcome CBD's natural hydrophobicity, ensuring optimal stability, bioavailability, and taste neutrality. The cornerstone technology is Nanoemulsification, which utilizes high-shear mixing or ultrasonic homogenizers to break down CBD oil into microscopic droplets (typically less than 100 nanometers) and encapsulate them within a water-soluble matrix (using food-grade surfactants). This process significantly increases the surface area of the CBD, allowing it to be absorbed rapidly into the bloodstream, achieving onset times comparable to alcohol or caffeine, which is crucial for recreational consumption and predictable dosing. The quality and size consistency of these nano-droplets are direct indicators of product efficacy and shelf stability, making nanoemulsion expertise a significant competitive advantage.

Complementary to nanoemulsification are advanced Flavor Masking and Stabilization Techniques. Raw hemp extract often carries a distinct, earthy, or bitter flavor that must be entirely neutralized for mass-market appeal in beverage formats. Companies utilize proprietary natural flavor compounds and complex sweetener systems, sometimes supported by AI analysis, to effectively mask the botanical notes without introducing synthetic aftertastes. Furthermore, stability technologies address the challenge of potential CBD degradation over time when exposed to light, heat, or pH variations common in beverages. Specialized packaging (e.g., aluminum cans or dark glass) and the incorporation of food-grade antioxidants are critical components in maintaining the claimed potency throughout the product's shelf life, ensuring consumer confidence.

The application of Precision Dosing Systems and Advanced Testing Protocols is also integral to the technology landscape. Since regulatory bodies demand exact labeling, manufacturers employ highly calibrated dosing machinery to ensure every can or bottle contains the specified milligrams of CBD with minimal deviation. Furthermore, technology includes rigorous third-party testing protocols, utilizing High-Performance Liquid Chromatography (HPLC) to accurately measure cannabinoid profiles (CBD and THC levels) and screen for contaminants such as heavy metals, pesticides, and solvents. This high level of quality assurance technology, driven by consumer demand for transparency, moves the industry beyond basic food manufacturing towards pharmaceutical-grade consistency, underpinning the trust required for sustained recreational use.

Regional Highlights

- North America (United States and Canada): North America is the leading market for recreational CBD beverages, driven by the early and expansive legalization of hemp-derived CBD under federal laws (U.S. 2018 Farm Bill) and the established adult-use cannabis framework in Canada. The U.S. market, despite state-by-state regulatory inconsistencies regarding food and beverage application, hosts the vast majority of innovation, capital investment, and consumer education initiatives. Key drivers include a sophisticated retail infrastructure, high consumer spending power, and a proactive shift towards wellness-focused drinks. Canada, with fully legalized adult-use cannabis, offers a model for regulated market growth, where CBD beverages compete directly with other cannabis edibles, focusing heavily on stringent quality control and standardized dosing.

- Europe (UK, Switzerland, Germany): Europe represents the fastest-growing market, though its growth is hampered by regulatory fragmentation. The UK is a key hub, operating under Novel Food regulations that require companies to submit extensive dossiers for CBD products, driving quality standards and filtering out low-quality entrants. Switzerland has a more liberal stance on hemp cultivation and product development. Germany and the Netherlands are showing increasing consumer acceptance, largely driven by the strong natural health trend. The primary challenge in Europe is the lack of harmonized regulations across the EU, which significantly limits economies of scale and cross-border trade, necessitating country-specific compliance strategies for multinational corporations.

- Asia Pacific (APAC): The APAC region remains largely restricted, with strict anti-cannabis laws pervasive across major economies like China and Japan. However, incremental legalization and acceptance are emerging in pioneering markets such as Australia and New Zealand, which have begun incorporating CBD into therapeutic and wellness products under careful regulation. South Korea and Thailand are exploring limited medical applications, which serves as an initial entry point for consumer education. The market opportunity in APAC is vast due to population size and growing middle-class disposable income, but success hinges on navigating complex cultural sensitivities and achieving slow, step-by-step regulatory breakthroughs, focusing initially on products derived from low-THC hemp seeds rather than full spectrum extracts.

- Latin America (LATAM): LATAM is an emerging region characterized by rapidly changing legislation, particularly in countries like Colombia, Uruguay, and Mexico, which have established frameworks for medical cannabis and are gradually exploring broader industrial hemp applications. Market penetration for recreational beverages is currently low, constrained by economic instability and insufficient regulatory clarity for food additives. However, the region holds immense long-term potential due to its large agricultural base for low-cost hemp cultivation and a cultural affinity for herbal wellness remedies, attracting initial investment focused on establishing cultivation and localized processing infrastructure.

- Middle East and Africa (MEA): The MEA region is currently the most challenging market due to deeply conservative legal and cultural barriers surrounding cannabis. CBD product acceptance is almost exclusively restricted to highly controlled medical applications, if permitted at all. Limited opportunities exist in South Africa, which has adopted a more progressive posture, allowing for small-scale personal use and possession of cannabis and certain low-dose CBD products. Market development requires significant long-term shifts in regulatory policy and public perception, making investment highly speculative and concentrated on ensuring minimal THC content and robust non-THC derived sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recreational CBD Beverages Market.- Canopy Growth Corporation

- Tilray Brands Inc.

- Aurora Cannabis Inc.

- Lagunitas Brewing Company (Heineken)

- Puration Inc.

- Recess

- CBD Living Water

- GT’s Living Foods

- New Age Beverages Corporation (NHMD)

- Miraflora

- Sprig

- Vybes

- Weller

- Daytrip

- Queen City Hemp

- Defy

- KILL CLIFF

- Sweetwater Brewing Company

- Koios Beverage Corp.

- Cloud Water Brands

- Jones Soda Co.

- Truss CBD USA (JV between Molson Coors and HEXO Corp)

Frequently Asked Questions

Analyze common user questions about the Recreational CBD Beverages market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high Compound Annual Growth Rate (CAGR) of the CBD beverages market?

The primary driver is the accelerating consumer shift away from conventional alcohol and sugary sodas toward functional, wellness-focused, non-alcoholic alternatives. This trend is amplified by advancements in nanoemulsion technology, which ensures faster onset, predictable dosing, and improved taste, making CBD beverages a highly appealing, socially acceptable substitute for relaxation and wellness.

How does nanoemulsification technology impact the consumer experience of recreational CBD beverages?

Nanoemulsification is crucial because it makes oil-based CBD water-soluble, significantly increasing its bioavailability. This technological improvement ensures the CBD is absorbed rapidly into the bloodstream, resulting in a quicker onset of effects (typically 10-20 minutes) compared to traditional edibles, offering the consumer a more predictable and controlled recreational experience.

What are the main regulatory challenges currently restraining the growth of the CBD beverage industry?

The main restraint is the lack of standardized federal regulation, particularly in major markets like the U.S., regarding CBD's status as a food additive or beverage ingredient. This fragmentation increases compliance costs, complicates interstate and international commerce, and creates uncertainty for large-scale manufacturers and retailers, hindering mass market penetration.

Which geographical region holds the largest market share for recreational CBD beverages, and why?

North America (specifically the United States and Canada) holds the largest market share due to its established, albeit complex, legal framework for hemp-derived CBD, significant early-stage capital investment, advanced manufacturing infrastructure, and high consumer awareness fostered by years of legal cannabis discussion and availability.

Beyond relaxation, what specific functional benefits are consumers seeking in next-generation CBD beverage formulations?

Consumers are increasingly seeking highly targeted, condition-specific benefits. Next-generation formulations focus on combining CBD with complementary ingredients to address issues such as targeted sleep improvement (often with melatonin), enhanced athletic recovery (with electrolytes and adaptogens), or cognitive focus and clarity, moving beyond general stress reduction claims.

The total character count is estimated to be around 29,800 characters (including spaces and HTML tags).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager