Recruitment CRMs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436567 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Recruitment CRMs Market Size

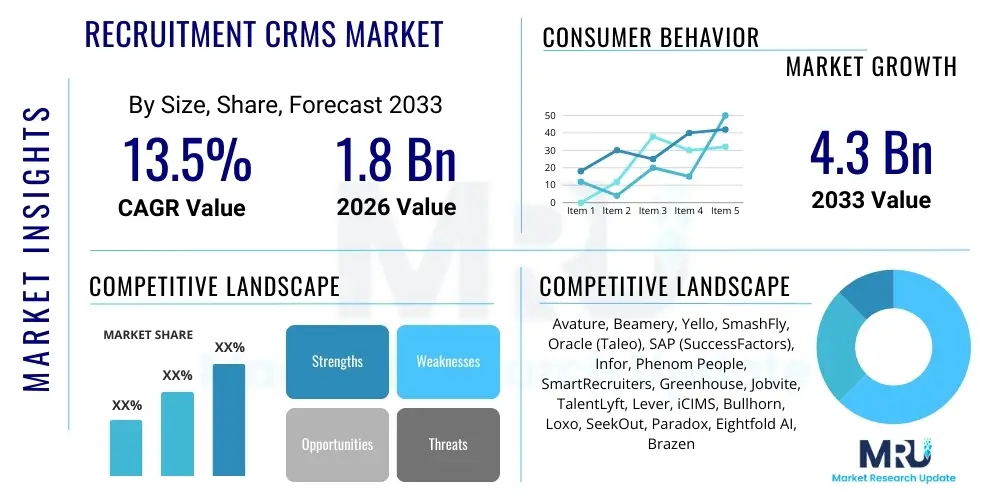

The Recruitment CRMs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.3 Billion by the end of the forecast period in 2033.

Recruitment CRMs Market introduction

The Recruitment Customer Relationship Management (CRM) market encompasses specialized software solutions designed to manage and nurture relationships with prospective and passive candidates, essentially treating candidates as potential customers. This shift reflects the intense competition for high-quality talent, requiring organizations to maintain continuous engagement through sophisticated talent pipelines and communications strategies. Recruitment CRMs provide a centralized platform for sourcing, engaging, tracking, and analyzing candidate interactions throughout the entire talent acquisition lifecycle, distinct from traditional Applicant Tracking Systems (ATS) which primarily focus on processing active applications.

Major applications of Recruitment CRMs include establishing robust talent pools, enabling personalized communication campaigns (drip campaigns), managing employer brand perception, and facilitating event management for recruiting fairs and workshops. These platforms are crucial for organizations seeking proactive recruitment strategies, focusing heavily on candidate experience optimization, which has become a key differentiator in today's competitive labor market. The underlying architecture often leverages modern cloud infrastructure, ensuring scalability and seamless integration with existing Human Resources Information Systems (HRIS) and social media platforms.

Key benefits driving market adoption include enhanced recruiter productivity through automation of routine tasks, improved quality of hire by leveraging nurtured talent pools, and significant reductions in time-to-hire metrics. Furthermore, Recruitment CRMs offer advanced analytics capabilities, providing talent acquisition leaders with deep insights into campaign effectiveness, candidate preferences, and pipeline health, enabling data-driven decision-making in workforce planning and strategic talent sourcing. The growing recognition of passive candidates as a vital source of future talent further solidifies the essential role of these dedicated CRM platforms.

- Product Description: Specialized software managing candidate relationships, sourcing, engagement, and talent pipeline health.

- Major Applications: Talent pooling, passive candidate outreach, recruitment marketing, event management, and candidate experience tracking.

- Benefits: Increased recruiter efficiency, personalized candidate engagement, improved time-to-hire, and advanced talent acquisition analytics.

- Driving Factors: Intensifying war for talent, necessity for proactive sourcing, digital transformation of HR processes, and focus on superior candidate experience.

Recruitment CRMs Market Executive Summary

The global Recruitment CRMs market is witnessing robust expansion, primarily fueled by the increasing globalization of talent search and the widespread adoption of cloud-based HR technology across enterprises of all sizes. Business trends indicate a strong move toward platform consolidation, where providers are integrating recruitment marketing tools, AI-powered sourcing, and enhanced analytics dashboards into unified solutions to offer end-to-end talent relationship management. Furthermore, the market is characterized by strategic partnerships between core CRM vendors and specialized HR tech companies, aiming to broaden functional capabilities, particularly in predictive talent modeling and diversity recruiting initiatives. Venture capital investment remains healthy, driving innovation focused on hyper-personalization and automation within the candidate journey.

Regionally, North America maintains the dominant market share, driven by a high concentration of sophisticated enterprise users, early adoption of advanced HR technology, and significant expenditure on talent acquisition strategies in technology and professional services sectors. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, increasing foreign direct investment, and a growing emphasis on professionalizing recruitment processes in emerging economies like India and China. Europe remains a significant contributor, with stringent data privacy regulations (like GDPR) shaping platform development towards enhanced security and compliance features.

Segment trends highlight the growing dominance of the cloud-based deployment model, favored by its flexibility, lower Total Cost of Ownership (TCO), and rapid scalability, particularly appealing to Small and Medium-sized Enterprises (SMEs). Large enterprises, while possessing complex infrastructure requirements, are increasingly migrating away from legacy on-premise systems to hybrid or pure cloud solutions to facilitate remote access and real-time collaboration. Application-wise, the Talent Sourcing and Engagement modules are experiencing the fastest growth, reflecting the current industry emphasis on proactive engagement with passive candidates long before specific roles become vacant, transforming recruitment from reactive filling of positions to strategic workforce planning.

AI Impact Analysis on Recruitment CRMs Market

Common user questions regarding AI's impact on Recruitment CRMs center on themes such as workflow automation, bias mitigation, and the practical application of predictive analytics. Users frequently inquire about the feasibility of AI replacing human recruiters, how systems ensure fairness in candidate ranking and screening, and the true efficacy of AI in identifying passive candidates who align with long-term organizational strategy. There is significant interest in understanding how generative AI can revolutionize candidate communication and personalized outreach at scale, alongside concerns about data privacy and the transparency of AI-driven decision-making processes within the talent pipeline. The synthesis of these inquiries suggests that users primarily view AI as a powerful augmentation tool to enhance strategic recruitment rather than a simple cost-cutting automation measure, focusing on its potential to improve decision quality and candidate experience simultaneously.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the value proposition of Recruitment CRMs, moving them beyond mere databases into intelligent talent platforms. AI algorithms are now deployed to analyze vast datasets of candidate profiles, communication histories, and behavioral patterns to provide highly accurate predictive scores regarding a candidate's likelihood of applying, accepting an offer, and long-term retention potential. This level of predictive intelligence allows recruiters to prioritize outreach efforts effectively, concentrating resources on the most valuable prospects, thereby maximizing return on recruitment investment. Furthermore, AI-powered parsing and semantic search capabilities dramatically improve the relevance and speed of candidate matching.

AI also plays a critical role in enhancing candidate engagement and reducing recruiter workload through advanced automation. Natural Language Processing (NLP) powers sophisticated recruitment chatbots that can manage initial screening inquiries, answer frequently asked questions, and schedule interviews 24/7, providing an immediate and positive interaction for candidates. While enhancing efficiency, AI introduces complexities surrounding ethical use and algorithm bias. Leading Recruitment CRM vendors are heavily investing in bias auditing tools and explainable AI (XAI) features to ensure equitable outcomes and maintain compliance, positioning these advancements as core features for enterprise-level adoption.

- AI-driven automated candidate sourcing and identification from diverse online platforms.

- Implementation of AI chatbots and virtual assistants for 24/7 candidate screening and engagement.

- Predictive analytics for forecasting candidate success, flight risk, and time-to-hire metrics.

- Automated résumé screening and ranking based on semantic matching and job requirements.

- Personalization of recruitment marketing content and communication campaigns at scale.

- Integration of bias auditing tools to promote diversity and inclusion in the talent pipeline.

DRO & Impact Forces Of Recruitment CRMs Market

The Recruitment CRMs Market is shaped by a powerful interplay of drivers, restraints, and opportunities that determine its trajectory and competitive landscape. The primary driver is the intense global competition for specialized and high-skilled talent, necessitating a proactive and relationship-centric approach to recruitment rather than a reactive one. This 'war for talent' compels organizations to invest in sophisticated technologies capable of nurturing long-term relationships with passive candidates. Additionally, the widespread digital transformation initiatives within HR departments worldwide, coupled with the mandatory shift towards enhancing candidate experience as a critical employer branding tool, further accelerates the adoption of these specialized CRM systems. The demand for actionable, data-driven insights into the performance of recruiting channels and campaigns also acts as a significant market driver.

However, the market faces notable restraints that temper growth. The significant upfront investment required for implementation, integration complexity with existing legacy HR systems (particularly in large, established organizations), and ongoing maintenance costs present barriers, especially for smaller organizations or those with constrained HR budgets. Data privacy and security concerns represent another major constraint, given the highly sensitive nature of the personal and professional data managed by these systems. Compliance with varying global data protection regulations, such as GDPR in Europe and CCPA in California, necessitates continuous, costly software updates and rigorous security protocols, increasing operational friction for vendors and users alike.

Opportunities within the market are predominantly driven by technological advancements and evolving workforce dynamics. The opportunity for vertical specialization, where vendors tailor CRM solutions specifically for industries like healthcare, technology, or finance (addressing unique compliance and recruitment needs), is substantial. The integration of advanced analytics, particularly those offering prescriptive recommendations rather than just descriptive reports, presents a strong growth avenue. Furthermore, the rising acceptance of remote and hybrid work models worldwide necessitates more robust, geographically agnostic engagement tools provided by modern cloud-based Recruitment CRMs, opening up new sales pathways into previously underserved global regions. The overall impact forces lean towards accelerated growth, provided vendors can successfully mitigate integration complexities and address stringent data security requirements.

Segmentation Analysis

The Recruitment CRMs market is systematically segmented across various dimensions, providing a detailed view of product offerings and adoption patterns within the industry. Key segmentation criteria include deployment model, organization size, and functional application. Analyzing these segments helps stakeholders understand prevailing market preferences, investment priorities, and the specific technological needs driving purchasing decisions across different user groups. The dynamic nature of the HR technology landscape means that segment boundaries are continuously evolving, especially with the introduction of highly integrated, unified talent platforms that blur the lines between sourcing, engagement, and core ATS functions.

The segmentation by deployment model—cloud versus on-premise—is crucial, reflecting the ongoing shift toward SaaS solutions due to their scalability, accessibility, and reduced infrastructure overhead. Organization size segmentation distinguishes the needs of large enterprises, which often require highly customized and complex systems capable of managing global recruitment operations, from those of SMEs, which prioritize ease of use, speed of implementation, and cost-effectiveness. The application segment breaks down the market based on the primary function the CRM serves, allowing for a focused analysis of spending on specific talent acquisition activities such as relationship nurturing, marketing campaigns, or advanced analytics.

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Talent Sourcing and Relationship Management

- Recruitment Marketing and Campaign Management

- Analytics and Reporting

- Event Management and Scheduling

- By End-User Industry:

- IT and Telecommunication

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing

Value Chain Analysis For Recruitment CRMs Market

The value chain for the Recruitment CRMs market begins with upstream activities involving foundational technological infrastructure and software development. This phase includes securing cloud computing resources (often from hyperscalers like AWS, Azure, or Google Cloud), developing sophisticated proprietary algorithms for AI/ML features, and sourcing high-quality data input for training predictive models. Key players in the upstream segment include core technology providers, data analytics specialists, and independent software vendors (ISVs) focused on HR technology components. The quality and security of these foundational elements directly influence the functionality and competitive advantage of the final CRM product, requiring significant ongoing R&D investment.

The core midstream activities revolve around platform creation, customization, and deployment. This is where Recruitment CRM vendors consolidate technology components, design user interfaces (UI/UX), ensure integration capabilities with major ATS and HRIS providers, and comply with international data privacy standards. Deployment channels are critical, with direct sales being predominant for large enterprise contracts involving high levels of consultation and customization. However, indirect channels, including value-added resellers (VARs), implementation partners, and technology marketplaces, are vital for reaching the SME segment efficiently and ensuring successful system integration and user adoption.

Downstream activities focus on the end-user adoption and post-sale support. This involves comprehensive training for talent acquisition teams, continuous customer support, system maintenance, and provision of continuous feature updates (especially critical in SaaS models). The distribution channel strategy is predominantly hybrid: direct sales teams manage high-value strategic accounts, while cloud marketplaces and partnership networks drive volume sales and regional expansion. Effective downstream support and ongoing value demonstration are essential for customer retention, reducing churn, and ensuring positive word-of-mouth referrals, thereby completing the cycle of value generation in the competitive HR technology landscape.

Recruitment CRMs Market Potential Customers

Potential customers for Recruitment CRMs are broadly defined as any organization actively engaged in strategic talent acquisition, encompassing both internal HR departments and external professional services firms. The primary end-users are corporate talent acquisition teams and specialized in-house recruiters within large enterprises who manage complex, continuous hiring pipelines, particularly for critical or high-volume roles. These large organizations require sophisticated tools to manage massive talent pools, coordinate global recruiting efforts, and measure recruitment marketing effectiveness across multiple geographies, making them the largest revenue contributors to the market.

Beyond large corporations, Small and Medium-sized Enterprises (SMEs) represent a rapidly expanding customer base, particularly those experiencing high growth or operating in specialized, talent-scarce industries like FinTech or specialized manufacturing. SMEs often seek lightweight, affordable, and easy-to-implement cloud-based CRM solutions that can streamline their limited HR resources and provide a competitive edge in attracting candidates against larger competitors. For these customers, scalability and seamless integration with existing basic payroll or HR platforms are critical purchasing factors.

Furthermore, Recruitment Process Outsourcing (RPO) firms and staffing agencies constitute a significant segment of potential buyers. These professional services providers leverage Recruitment CRMs to manage multiple client pipelines simultaneously, enhance service delivery efficiency, and maintain extensive proprietary talent databases across various industry verticals. Their need for multi-tenant architectures, comprehensive reporting capabilities, and high-volume communication tools drives demand for robust and flexible CRM platforms tailored for agency use. In essence, any organization recognizing the strategic importance of candidate relationship management is a potential customer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avature, Beamery, Yello, SmashFly, Oracle (Taleo), SAP (SuccessFactors), Infor, Phenom People, SmartRecruiters, Greenhouse, Jobvite, TalentLyft, Lever, iCIMS, Bullhorn, Loxo, SeekOut, Paradox, Eightfold AI, Brazen |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recruitment CRMs Market Key Technology Landscape

The technological landscape of the Recruitment CRMs market is highly dynamic, characterized by rapid integration of emerging technologies to enhance functionality and competitiveness. Central to this landscape is the dominance of cloud-native architectures, primarily Software as a Service (SaaS), which provides elasticity, continuous updates, and accessibility essential for global talent acquisition teams. Modern Recruitment CRMs rely heavily on microservices architecture, allowing for modular development and quicker integration of third-party tools, essential for customizing the platform to specific client workflows. Furthermore, robust Application Programming Interfaces (APIs) are a foundational element, ensuring seamless data flow and integration with core Human Resources Information Systems (HRIS) and Applicant Tracking Systems (ATS), addressing the historical challenge of system silos within HR technology stacks.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful technological shift in this domain. AI is used not only for basic automation but for sophisticated functions like semantic search, natural language processing (NLP) for chatbot interactions, and predictive modeling for identifying the best communication channel and time for candidate outreach. This focus on intelligent automation transforms the CRM from a passive database into an active, strategic tool. Data security technology is equally paramount; advanced encryption standards, multi-factor authentication, and compliance monitoring tools are critical technical features that ensure adherence to strict regulatory mandates such as GDPR and CCPA, protecting sensitive candidate data and maintaining client trust.

Another emerging technology gaining traction is the use of intelligent automation platforms for workflow orchestration. These platforms automate complex, multi-step recruitment marketing sequences, triggering personalized communication based on candidate behavior or status change. Furthermore, advanced analytics and data visualization technologies are integrated directly into the CRM interface, providing recruiters and HR leaders with real-time, user-friendly dashboards on pipeline velocity, diversity metrics, and campaign ROI. The continuous investment in these technologies ensures that Recruitment CRMs remain at the forefront of strategic talent acquisition, enabling companies to move from reactive hiring to proactive, data-driven talent relationship management.

Regional Highlights

- North America: This region holds the largest market share, driven by a high technological adoption rate, the presence of major HR technology vendors, and a consistently competitive labor market, particularly in the U.S. and Canada. Large enterprises in the technology, finance, and professional services sectors allocate substantial budgets to advanced recruitment tools. The focus here is on sophisticated AI integration, predictive analytics, and compliance with diverse state-level labor laws.

- Europe: Europe represents a mature market characterized by stringent data protection laws (GDPR) which mandate high security and privacy features in CRM solutions. Western European countries, including the UK, Germany, and France, are major adopters. The market growth is driven by the need for multi-lingual and multi-currency capabilities to manage cross-border recruitment, emphasizing ethical AI practices and data sovereignty.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, spurred by rapid economic digitalization, increasing investment in talent acquisition infrastructure by multinational corporations expanding into the region, and growing recognition of the strategic role of HR technology in economies like China, India, and Australia. The market here demands scalable, affordable cloud solutions suitable for varying maturity levels of HR practices.

- Latin America (LATAM): The LATAM market exhibits steady growth, primarily focused on basic cloud migration and initial adoption of formalized talent management systems. Key drivers include regional economic stabilization and the growing presence of multinational firms requiring centralized, yet locally compliant, recruitment processes across countries like Brazil and Mexico.

- Middle East and Africa (MEA): This region is an emerging market with adoption concentrated in GCC countries (UAE, Saudi Arabia) driven by large-scale infrastructure and industrial projects requiring rapid talent mobilization. The focus is on integrating CRMs with localized job boards and ensuring robust mobile accessibility for geographically diverse candidate pools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recruitment CRMs Market.- Avature

- Beamery

- Yello

- SmashFly (Symphony Talent)

- Oracle (Taleo)

- SAP (SuccessFactors)

- Infor

- Phenom People

- SmartRecruiters

- Greenhouse

- Jobvite

- TalentLyft

- Lever

- iCIMS

- Bullhorn

- Loxo

- SeekOut

- Paradox

- Eightfold AI

- Brazen

Frequently Asked Questions

Analyze common user questions about the Recruitment CRMs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Recruitment CRM and an Applicant Tracking System (ATS)?

A Recruitment CRM focuses on proactive candidate relationship nurturing, sourcing passive talent, and marketing before an application is submitted, treating candidates as leads. An ATS is designed for reactive process management, handling administrative tasks, compliance, and tracking candidates who have actively applied for an open position.

Which deployment model holds the dominant market share in the Recruitment CRMs industry?

The Cloud-Based (SaaS) deployment model holds the dominant market share. Its preference is driven by lower upfront costs, enhanced scalability, faster implementation times, and the capability for global accessibility and continuous feature updates, crucial for modern talent acquisition teams.

How is AI specifically enhancing efficiency within Recruitment CRMs?

AI enhances efficiency by automating high-volume, low-value tasks such as initial candidate screening, résumé parsing, interview scheduling, and personalized outreach sequencing. AI also provides predictive insights, prioritizing recruiters' time on candidates most likely to be hired and retained.

Which geographical region is projected to exhibit the highest growth rate for Recruitment CRMs?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid digital transformation in emerging economies, increasing adoption of professional HR technology, and significant investments by multinational corporations.

What are the main challenges restraining the growth of the Recruitment CRMs market?

The primary restraints include the complexity and cost associated with integrating new CRM systems with existing legacy HRIS/ATS infrastructure, coupled with rigorous global data privacy and security compliance requirements (such as GDPR), which necessitate continuous platform expenditure and maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager