Recruitment Staffing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437020 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Recruitment Staffing Market Size

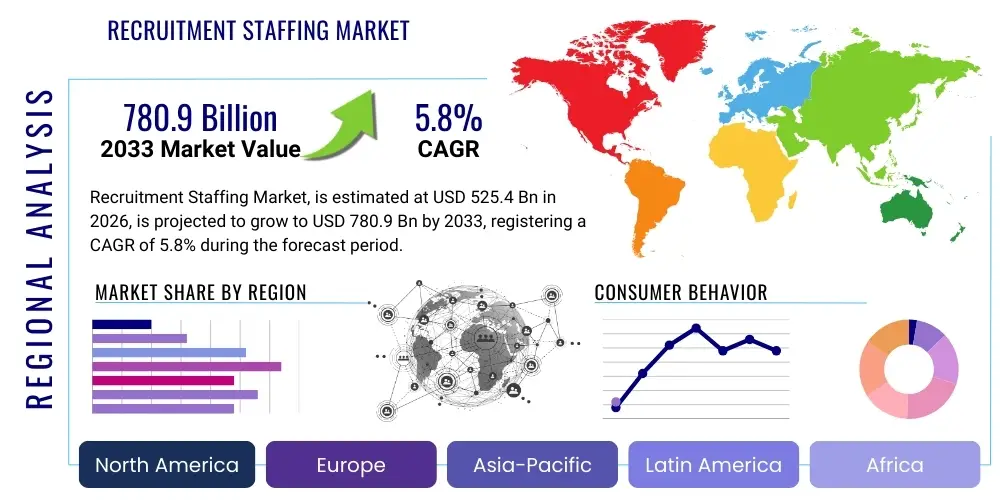

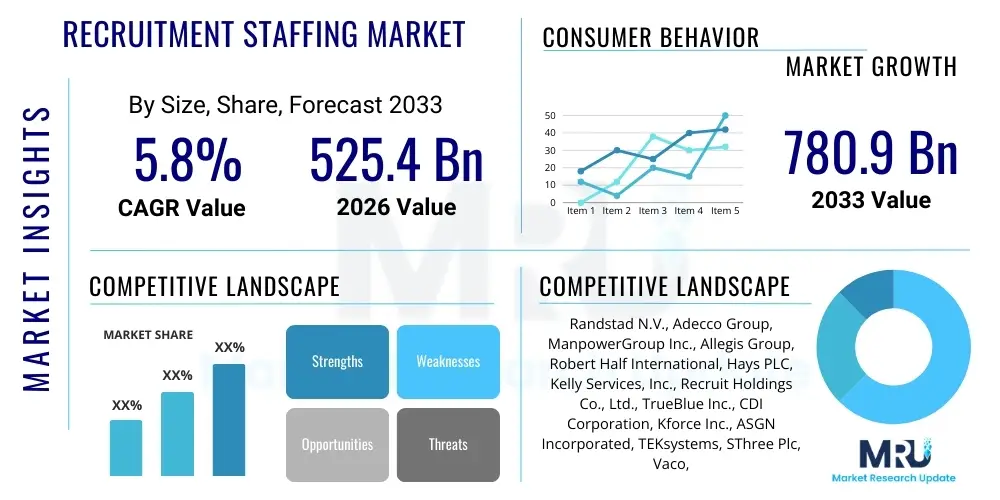

The Recruitment Staffing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 525.4 Billion in 2026 and is projected to reach USD 780.9 Billion by the end of the forecast period in 2033.

Recruitment Staffing Market introduction

The Recruitment Staffing Market encompasses a wide array of services designed to connect employers with suitable candidates for temporary, permanent, and specialized contract positions. This industry acts as a crucial intermediary, addressing complex human capital needs across diverse sectors such as Information Technology, Healthcare, Engineering, and Finance. The primary offering involves sourcing, screening, background checks, and placement, effectively mitigating the hiring burden on client organizations. Product descriptions within this market include specialized offerings like temporary staffing (flexible workforce solutions), permanent placement (headhunting and executive search), and specialized consulting services related to talent acquisition strategy and workforce planning. These services are increasingly vital as businesses seek agility and require specialized skills quickly in a dynamic economic environment, driving sustained demand for sophisticated staffing solutions globally. The structural shift towards project-based work and the gig economy further solidify the importance of external staffing agencies in optimizing organizational flexibility.

Major applications of recruitment staffing solutions span every segment of the modern economy. In the IT sector, staffing agencies provide highly sought-after expertise in cybersecurity, cloud computing, and software development on a project basis, which often exceeds the in-house capabilities of many firms. Similarly, the healthcare industry relies heavily on agency staffing to fill critical shortages in nursing and specialized medical roles, ensuring continuity of care amidst fluctuating demands. The benefits derived by client companies are substantial, primarily centering on reduced time-to-hire, lower overhead costs associated with internal recruiting departments, and access to a wider, pre-vetted talent pool. Staffing firms also bear the compliance and administrative burden related to temporary employees, offering clients a streamlined and low-risk approach to workforce management. This efficiency and specialized focus are key reasons why organizations across all verticals continue to allocate significant portions of their HR budget to external staffing services.

The market is primarily driven by global economic recovery, increasing digitalization across industries, and the perpetual shortage of specialized skills in advanced technological fields. Demographic shifts, including an aging workforce in developed nations and high turnover rates in certain service sectors, compel organizations to rely on external recruitment partners. Furthermore, stringent labor laws and regulatory complexity in different jurisdictions make professional staffing firms attractive, as they possess the expertise to navigate compliance requirements seamlessly. The evolving nature of work, characterized by hybrid models and remote positions, expands the geographical reach and opportunities for staffing providers, positioning them as essential partners in talent acquisition and retention strategies in the highly competitive post-pandemic labor landscape. These driving factors ensure robust growth and continuous innovation within the market structure.

Recruitment Staffing Market Executive Summary

The global Recruitment Staffing Market is witnessing transformative business trends centered around technological integration and service specialization. Key market players are heavily investing in proprietary AI-driven sourcing platforms and data analytics tools to enhance candidate matching accuracy and expedite the hiring cycle. There is a strong business trend towards managed service programs (MSPs) and recruitment process outsourcing (RPO), where staffing firms take over entire or significant portions of a company's recruitment function, offering strategic long-term workforce solutions rather than transactional placements. Furthermore, the increasing prevalence of remote work has broadened talent pools, requiring staffing agencies to adopt globalized recruitment strategies and comply with international labor regulations. This technological and service evolution ensures competitive differentiation and addresses the growing complexity of talent acquisition in a globally connected economy.

Regionally, North America remains the dominant market, characterized by mature staffing infrastructure, high adoption rates of contingent workers, and robust demand from the technology and healthcare sectors. Europe, particularly the Western European economies like the UK, Germany, and France, exhibits steady growth, driven by stringent labor flexibility demands and increasing regulatory clarity around temporary work. Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid industrialization, expanding middle-class populations, and significant foreign direct investment, leading to substantial hiring needs, particularly in emerging economies like India and China. While regulatory challenges exist, the sheer scale of workforce needs in APAC presents lucrative growth opportunities, making regional expansion a core strategy for global staffing leaders.

Segment trends highlight the significant growth of the IT staffing segment, driven by persistent digital transformation initiatives across all industries. Healthcare staffing is also experiencing unparalleled demand, exacerbated by global health crises and ongoing labor shortages for specialized roles. Contingent staffing (temporary and contract placements) continues to dominate the market share due to its flexibility, but the permanent placement segment is gaining traction as companies seek high-level executive and specialized talent retention. Small and Medium Enterprises (SMEs) represent an underserved segment with high growth potential, increasingly leveraging flexible staffing solutions to manage their workforce budget constraints and sudden skill gaps, thereby contributing to the diversification of the market landscape.

AI Impact Analysis on Recruitment Staffing Market

Common user inquiries regarding AI's influence on the Recruitment Staffing Market revolve heavily around automation, job displacement, and ethical bias. Users frequently question whether AI-powered tools will completely replace human recruiters, focusing on the potential loss of personalized interaction and nuanced decision-making crucial in complex hiring scenarios. Concerns also center on the fairness and transparency of AI algorithms, particularly regarding the risk of perpetuating or amplifying existing biases in candidate screening and selection processes. Additionally, users seek clarity on how AI enhances productivity—specifically, which tasks (like initial sourcing, candidate matching, or administrative scheduling) are most susceptible to automation, and what new roles (like AI platform management or ethical oversight) will emerge for human recruiters. This collective interest underscores a perception of AI as a disruptive, yet necessary, force that requires careful ethical and strategic implementation within the staffing industry.

AI is fundamentally reshaping the operational workflow of staffing agencies, moving them from reactive placement services to proactive talent strategists. AI tools are utilized extensively for parsing resumes, analyzing millions of data points to predict candidate success, and automating communication sequences with applicants, significantly reducing the administrative load on recruiters. This shift allows human recruiters to focus on high-value interactions, such as negotiating offers, building client relationships, and assessing soft skills that machines cannot effectively evaluate. The integration of Natural Language Processing (NLP) in job description generation and candidate outreach ensures better linguistic matching and improved search engine optimization for job postings, leading to higher quality candidate pools.

Furthermore, the strategic implementation of AI extends into demand forecasting and risk management. Predictive analytics, powered by machine learning, helps staffing firms anticipate future client needs based on economic indicators and industry trends, allowing them to pipeline talent proactively. This foresight is critical in highly competitive niche markets, ensuring that staffing agencies can deliver specialized talent on short notice, enhancing their competitive edge. While AI automates routine tasks, it simultaneously creates new avenues for data-driven strategic consultation, positioning sophisticated staffing firms as technological leaders in the broader Human Resources ecosystem, ensuring the market's continued professionalization and efficiency gains.

- Automated Sourcing and Screening: AI tools efficiently scan vast databases, ranking candidates based on required skills and cultural fit, drastically accelerating the initial screening phase.

- Bias Mitigation Efforts: Algorithms are increasingly designed to identify and reduce unconscious bias in language and criteria, promoting more equitable hiring outcomes, though challenges remain.

- Enhanced Candidate Experience: AI-powered chatbots provide 24/7 support and instant feedback to candidates, improving engagement and reducing drop-off rates during the application process.

- Predictive Workforce Planning: Machine learning models analyze market data to forecast talent demand and supply shortages, enabling proactive recruitment strategies for specialized roles.

- Recruiter Role Transformation: Automation frees human recruiters from transactional tasks, shifting their focus towards relationship management, negotiation, and complex problem-solving.

DRO & Impact Forces Of Recruitment Staffing Market

The Recruitment Staffing Market is propelled by powerful drivers, particularly the accelerating demand for workforce flexibility and specialized expertise in highly technical domains like AI, data science, and renewable energy. The global trend towards project-based work models and the rapid expansion of the gig economy necessitate reliable external staffing partners to manage contingent labor forces efficiently. However, the market faces significant restraints, including strict and often inconsistent global labor regulations regarding temporary employment, which can complicate cross-border placements and increase compliance costs. The persistent challenge of talent scarcity in critical sectors also limits growth, as agencies struggle to find qualified candidates quickly enough to meet overwhelming client demand, leading to pricing pressure and extended fulfillment times. These dynamics create a complex environment where opportunity is tightly coupled with substantial regulatory and talent limitations.

Significant opportunities abound in the outsourcing of high-volume, low-margin recruitment tasks through RPO models, allowing staffing firms to secure stable, long-term revenue streams. The expansion into emerging geographic markets, particularly Southeast Asia and Latin America, presents untapped potential as these economies rapidly formalize their labor structures. Furthermore, specializing in niche high-growth sectors, such as cybersecurity staffing or environmental, social, and governance (ESG) related roles, offers higher profitability and less competition. Technology adoption is another core opportunity, with firms that successfully integrate sophisticated platforms for personalized outreach and skill validation gaining a decisive advantage over traditional competitors. The ability to offer integrated HR technology solutions alongside placement services constitutes a major growth avenue.

The impact forces within the market are predominantly technological and socioeconomic. Digitization is the primary impact force, lowering barriers to entry for new competitors (e.g., specialized tech platforms) while simultaneously forcing established firms to innovate or face obsolescence. Socioeconomic factors, such as shifting employee expectations regarding work-life balance, flexibility, and remote opportunities, directly influence the type of services clients demand from staffing agencies. Geopolitical instability and trade wars introduce volatility, affecting client investment decisions and subsequent hiring volumes. Effectively managing these technological advancements, adapting to evolving worker preferences, and demonstrating robust resilience against external economic shocks are critical capabilities defining market leadership and future revenue growth within the staffing sector.

Segmentation Analysis

The Recruitment Staffing Market is segmented based on Type, Service, End-user, and Region, allowing for a detailed examination of sector-specific dynamics and growth potential. Segmentation by Type, primarily distinguishing between temporary and permanent staffing, reveals the market's reliance on contingent labor for operational elasticity, contrasting with the growing demand for strategic permanent placements in leadership roles. Service segmentation highlights the increasing specialization, including IT staffing, engineering staffing, and healthcare staffing, each driven by unique industry demands and skill gaps. Analyzing the market by End-user—spanning IT & Telecom, Healthcare, Manufacturing, and BFSI—helps pinpoint where the most robust recruitment expenditure occurs and identifies niche areas ripe for expansion and specialized service development globally.

- By Type:

- Temporary Staffing (Contract and Contingent)

- Permanent Staffing (Direct Hire and Executive Search)

- By Service:

- IT Staffing

- Healthcare Staffing

- Engineering Staffing

- Finance and Accounting Staffing

- Industrial/Manual Labor Staffing

- Other Professional Staffing Services (Legal, Marketing, HR)

- By End-user:

- Information Technology & Telecommunication

- Healthcare and Life Sciences

- Manufacturing and Industrial

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Goods

- Government and Public Sector

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For Recruitment Staffing Market

The value chain of the Recruitment Staffing Market begins with upstream activities focused heavily on talent pooling and infrastructure development. Upstream analysis involves establishing and maintaining extensive databases of potential candidates, investing in proprietary Applicant Tracking Systems (ATS), and developing sophisticated sourcing methodologies, often leveraging AI and big data. Key upstream partners include technology providers (for CRM and ATS), job board platforms, and professional networking sites, which supply the raw talent data and outreach capabilities essential for market operations. Efficiency at this stage is measured by the speed and quality of candidate identification, minimizing the time-to-source and maximizing the depth of specialized talent within the agency's accessible network.

The core midstream activities involve the crucial stages of screening, assessment, and matching. This is where staffing agencies add significant value through expert screening processes, which include behavioral interviews, technical testing, and verifying credentials. The rigorous process ensures that only the most qualified and culturally aligned candidates proceed to the client. This stage demands highly skilled human recruiters who use technology to augment their qualitative judgments. Downstream activities involve the placement, contract negotiation, and post-placement support, ensuring both the client and the placed candidate are satisfied. This ongoing relationship management, including performance monitoring and compliance handling, sustains long-term partnerships and drives repeat business, which is a key metric for market success.

The distribution channel within the Recruitment Staffing Market is primarily characterized by direct and indirect models. Direct channels involve in-house recruitment teams of staffing agencies engaging directly with client organizations, often through dedicated account managers for large enterprise accounts or MSP/RPO contracts. This direct approach ensures customized service delivery and deep integration into the client's HR strategy. Indirect channels involve using third-party software vendors or referral networks to find candidates or clients, though this is less common for high-volume contract staffing. The industry is rapidly migrating toward digital distribution via branded online portals and mobile applications, which act as self-service platforms for both clients and candidates, streamlining the transactional aspects of the business and enhancing service accessibility globally.

Recruitment Staffing Market Potential Customers

The potential customers and primary buyers of recruitment staffing services are organizations across virtually every industry vertical that experience fluctuating labor needs, specialized skill gaps, or high employee turnover. These customers range from Fortune 500 multinational corporations requiring thousands of temporary staff for seasonal peaks or large RPO contracts, down to small and medium enterprises (SMEs) needing just one specialized engineer or executive. The key determinant for customer potential is the strategic value they place on external expertise to solve immediate talent shortages, manage workforce flexibility, and ensure regulatory compliance, particularly when rapid scaling or downsizing is necessary. Industries facing aggressive digital transformation or stringent regulatory oversight, such as BFSI and Healthcare, are consistently the largest consumers of specialized staffing solutions.

Within the largest customer segments, the IT & Telecom sector represents a substantial end-user base, constantly seeking highly skilled contractors for projects in software development, cloud infrastructure management, and data analytics. These companies often utilize staffing services to gain temporary access to rare, high-cost skills without incurring the long-term overhead of permanent employment. Similarly, the Healthcare sector, including hospitals, clinics, and pharmaceutical companies, relies heavily on staffing agencies to maintain optimal patient care levels by quickly sourcing registered nurses, physicians, and clinical researchers, especially during peak demand periods or public health crises. The critical nature of these services makes healthcare providers perennial, high-value clients.

Furthermore, manufacturing and industrial segments are significant end-users, requiring large-scale industrial staffing for production lines, logistics, and supply chain management, often utilizing flexible labor to match production schedules. The shift towards automation and Industry 4.0 also necessitates technical staffing support for maintenance engineers and specialized robotics technicians. Potential buyers in the Government and Public Sector also represent a robust, though highly regulated, customer base, requiring support for administrative roles, specialized IT projects, and public works infrastructure. The primary motivation for all these end-users is maximizing organizational efficiency, minimizing labor risks, and accessing premium talent faster than their competition, making professional staffing an indispensable operational expense rather than a mere transactional cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 525.4 Billion |

| Market Forecast in 2033 | USD 780.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Randstad N.V., Adecco Group, ManpowerGroup Inc., Allegis Group, Robert Half International, Hays PLC, Kelly Services, Inc., Recruit Holdings Co., Ltd., TrueBlue Inc., CDI Corporation, Kforce Inc., ASGN Incorporated, TEKsystems, SThree Plc, Vaco, Insight Global, Beacon Hill Staffing Group, Corestaff, Apex Systems, Aerotek |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recruitment Staffing Market Key Technology Landscape

The technological landscape of the Recruitment Staffing Market is dominated by sophisticated software solutions aimed at automating high-volume administrative tasks and enhancing data-driven decision-making. Applicant Tracking Systems (ATS) remain foundational, evolving from simple database managers to highly integrated platforms utilizing machine learning for predictive matching and workflow optimization. Integration capabilities are crucial, allowing ATS to seamlessly communicate with Customer Relationship Management (CRM) tools, payroll systems, and external job boards, creating a unified talent acquisition ecosystem. Furthermore, specialized proprietary algorithms for skill assessment and cultural fit are becoming central competitive differentiators, allowing top agencies to deliver higher quality placements with greater efficiency than those relying solely on manual screening.

Advanced technologies, particularly Artificial Intelligence (AI) and Machine Learning (ML), are moving beyond basic keyword matching to perform complex tasks such as sentiment analysis of candidate interactions and predicting flight risk or long-term retention potential. AI-powered chatbots and conversational interfaces are deployed heavily for initial candidate qualification and scheduling, providing instant responses and significantly improving the overall candidate experience, which is a critical factor in the current competitive market. Moreover, the adoption of specialized talent marketplaces and platform models is democratizing access to contingent workers, forcing traditional staffing firms to enhance their digital offerings to compete with pure-play technology platforms that often bypass traditional intermediary roles.

The necessity for secure, compliant, and globally scalable solutions drives the demand for cloud-based deployment models across the entire technology stack. Data security and privacy technologies, particularly related to GDPR, CCPA, and other global regulations, are paramount, requiring robust encryption and compliance features within all staffing software. Blockchain technology is emerging as a potential disruptor for securely verifying credentials, educational history, and work experience, minimizing fraud and reducing time spent on background checks. Successful staffing agencies are those that treat technology not merely as a supportive tool but as a core product offering, providing clients with transparency, speed, and analytical insight into their workforce planning and talent acquisition lifecycle, driving the sustained need for technological investment.

Regional Highlights

- North America: North America, led by the United States, represents the largest and most technologically advanced market for recruitment staffing services. The region benefits from a highly flexible labor market, strong economic fundamentals, and massive corporate investment in technology (especially cloud computing and cybersecurity), fueling exceptional demand for specialized IT contractors. Market penetration of RPO and MSP services is high, reflecting a sophisticated approach to workforce management among large enterprises. Regulatory standardization, though complex, is generally navigable, contributing to predictable market growth. The region's focus on high-margin professional staffing segments drives overall high revenue realization, establishing North America as the global benchmark for service innovation and efficiency.

- Europe: The European market is characterized by high fragmentation and significant regulatory variations between member states, particularly concerning temporary worker rights and social security contributions. Western European nations (Germany, UK, France) dominate the revenue, with Germany showing robust demand in the manufacturing and engineering sectors, while the UK leverages its strong financial services sector. The implementation of strict labor laws encourages companies to utilize temporary staffing for risk mitigation. The ongoing need for digitalization across Central and Eastern Europe provides substantial growth avenues, especially for IT and engineering staffing services, although economic volatility in some peripheral regions can occasionally restrain growth momentum.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate due to rapid industrial expansion, urbanization, and a growing influx of multinational corporations establishing regional hubs. Countries like India and China are witnessing explosive demand for staffing services driven by massive populations and a maturing professional services sector. While pricing competition is fierce, the scale of hiring needs in manufacturing, construction, and entry-level IT roles provides volume growth. Challenges include navigating diverse cultural norms and local employment regulations, necessitating highly localized operational strategies for global players seeking market entry and sustainable long-term success in the diverse sub-regions of APAC.

- Latin America (LATAM): The LATAM region presents a developing landscape for formal staffing services, often hampered by economic volatility and high inflation rates in major markets like Brazil and Argentina. However, the region shows increasing professionalism in staffing, driven by foreign investment and the need for greater transparency in hiring practices. Demand is concentrated in shared services centers, basic manufacturing, and rapidly expanding service industries. Staffing solutions here often focus on addressing workforce compliance challenges and providing reliable, stable talent pools where local labor market information can be opaque, fostering growth in administrative and light industrial segments.

- Middle East and Africa (MEA): The MEA region is segmented, with the GCC countries (UAE, Saudi Arabia) being key drivers, propelled by massive government initiatives (e.g., Saudi Vision 2030) focused on diversification, infrastructure development, and technology. This drives high demand for expat specialized talent in engineering, construction, and finance. Africa remains complex, with South Africa being the most developed market. Staffing firms often play a critical role in navigating complex visa processes and localized labor laws, making expertise in cross-border talent mobility a key value proposition for clients in this high-potential yet operationally challenging region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recruitment Staffing Market.- Randstad N.V.

- Adecco Group

- ManpowerGroup Inc.

- Allegis Group

- Robert Half International

- Hays PLC

- Kelly Services, Inc.

- Recruit Holdings Co., Ltd.

- TrueBlue Inc.

- CDI Corporation

- Kforce Inc.

- ASGN Incorporated

- TEKsystems

- SThree Plc

- Vaco

- Insight Global

- Beacon Hill Staffing Group

- Corestaff

- Apex Systems

- Aerotek

Frequently Asked Questions

Analyze common user questions about the Recruitment Staffing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What key factors are driving the growth of the Recruitment Staffing Market globally?

The primary drivers are the increasing necessity for workforce flexibility across industries, the acute global shortage of specialized IT and technical skills, and the rising corporate adoption of managed service programs (MSPs) and recruitment process outsourcing (RPO) to achieve scalable talent solutions and operational efficiencies.

How is technological integration, such as AI, affecting the operational strategies of staffing agencies?

AI significantly impacts staffing by automating administrative tasks like candidate sourcing, initial screening, and scheduling, enhancing matching accuracy using predictive analytics, and allowing human recruiters to pivot their focus toward high-value activities like relationship building and complex negotiation, thereby accelerating time-to-hire metrics.

Which geographical region is expected to demonstrate the fastest growth rate in the Recruitment Staffing Market during the forecast period?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by rapid economic development, industrialization, massive investments in infrastructure, and the subsequent high demand for professional and industrial staffing services in major economies like China and India.

What are the main challenges or restraints facing the sustained expansion of the Recruitment Staffing sector?

Key challenges include navigating the complexity of inconsistent and stringent global labor regulations regarding contingent work, mitigating the persistent global scarcity of highly specialized talent, and managing the intense price competition stemming from the proliferation of digital recruitment platforms and marketplaces.

What is the difference between temporary staffing and permanent staffing in terms of market dynamics and revenue generation?

Temporary staffing dominates in volume and provides operational flexibility, yielding consistent, lower-margin transactional revenue, critical for meeting immediate labor demands. Permanent staffing, while lower in volume, focuses on specialized, executive, and direct-hire roles, generating high-margin revenue through placement fees and focusing on long-term client human capital strategy.

Appendix: Deep Dive into Market Dynamics and Future Outlook

The strategic future of the Recruitment Staffing Market hinges on adaptability and deep specialization within niche sectors. As economic cycles fluctuate, the reliance on flexible workforce solutions intensifies, solidifying temporary staffing as an essential risk mitigation strategy for corporate clients. Furthermore, the persistent evolution of job roles due to automation means staffing firms must continuously update their skill taxonomies and assessment methods to remain relevant. A critical area of focus for market leaders involves integrating ethical AI practices, ensuring that technological efficiency does not compromise diversity goals or introduce systemic bias into the hiring pipeline. Compliance with emerging global ESG (Environmental, Social, and Governance) mandates is also becoming a requirement, with clients increasingly favoring staffing partners who can demonstrate sustainable and equitable talent sourcing practices, thereby embedding these non-financial metrics into the core competitive fabric of the industry.

The market outlook suggests a sustained consolidation trend, where large multinational firms acquire smaller, highly specialized agencies to expand their geographical footprint and deepen their expertise in high-demand technical areas, such as renewable energy staffing or biopharmaceutical roles. This consolidation is driven by the need for integrated, cross-border workforce solutions demanded by global enterprises. Simultaneously, niche technology startups are challenging incumbents by offering hyper-specialized talent marketplaces that focus solely on specific skill sets (e.g., Python developers in FinTech), compelling traditional agencies to invest heavily in their digital front-ends and personalized user experiences. The ability of an agency to offer a robust blended model—combining personalized human interaction with scalable technological infrastructure—will define market success over the next decade. Client loyalty will increasingly depend not just on placement speed, but on the strategic insights provided regarding future labor trends.

In analyzing the socioeconomic impact, the shift towards remote and hybrid work models has fundamentally altered the sourcing strategies within the staffing sector. Staffing agencies are no longer limited by geographical proximity, allowing them to tap into previously inaccessible global talent pools. However, this also introduces significant complexity in managing global payroll, tax compliance, and labor law adherence across multiple jurisdictions. Successful agencies are developing sophisticated global employment platforms capable of managing this complexity seamlessly. The rise of "internal mobility" as a staffing service is also noteworthy, where agencies partner with large corporations to identify, train, and place existing employees into new roles within the same organization, transforming the staffing firm's role into a comprehensive workforce development consultant rather than just an external recruiter. This expansion of service scope guarantees continued revenue diversification and market resilience against economic downturns.

IT Staffing Segment Analysis

The IT Staffing segment remains the powerhouse of the recruitment market, characterized by intense demand and premium pricing driven by the continuous global surge in digital transformation projects. Core requirements center around highly specialized roles in software development, cloud engineering (AWS, Azure, Google Cloud), data science, and crucial cybersecurity expertise. Companies across all sectors, from retail to manufacturing, require these skills to maintain competitive advantage, leading to a structural skills deficit that internal HR departments cannot fill alone. IT staffing agencies differentiate themselves through robust technical screening processes, often involving proprietary coding assessments and practical project evaluations, ensuring that candidates possess verified, practical competencies rather than just certification listings. The rapid obsolescence of technical skills means agencies must also invest heavily in continuous upskilling programs for their contractor base.

A major trend in IT staffing is the transition towards project-based, Statement of Work (SOW) engagements, moving beyond simple hourly contracts. Under SOW, the staffing agency assumes responsibility for delivering a specific project outcome, requiring a blend of technical talent provision and project management oversight. This shift elevates the staffing firm's role from a resource provider to a strategic technology partner, increasing the value proposition and potentially enhancing margins. The demand for flexible IT talent is amplified by the widespread adoption of DevOps methodologies, requiring cross-functional teams to be assembled rapidly. Consequently, agencies with established pipelines of full-stack developers and agile project managers are best positioned for robust market penetration and growth.

Furthermore, cybersecurity staffing is experiencing exponential growth, driven by escalating cyber threats and increasingly strict data privacy regulations. Organizations view cybersecurity as a mission-critical function, necessitating access to top-tier security analysts, penetration testers, and compliance officers, roles that are notoriously difficult to fill internally. IT staffing firms specializing in this vertical command significant leverage due to the limited supply of certified professionals. As technological needs become more esoteric—such as expertise in quantum computing or edge AI—the role of the specialized IT staffing firm as the gatekeeper to rare talent will only intensify, solidifying its dominant position within the overall recruitment market structure.

Healthcare Staffing Dynamics

Healthcare staffing is currently undergoing a period of intense pressure and critical expansion globally, primarily driven by demographic shifts, including aging populations that require complex, long-term care, and ongoing labor shortages exacerbated by high burnout rates among clinical professionals. This segment encompasses the placement of registered nurses, allied health professionals, physicians, and non-clinical support staff within hospitals, long-term care facilities, and specialized clinics. Agencies play a vital role in ensuring patient care continuity, especially in rural areas or during seasonal peak demands (like flu season or global health emergencies). The demand is highly inelastic, meaning clients prioritize speed and quality of placement over cost, giving agencies substantial pricing power in emergency and critical care placements. Regulatory compliance, including rigorous credentialing and state licensing verification, is a non-negotiable requirement for success in this segment.

The sub-segment of travel nursing and temporary physician coverage has witnessed massive revenue growth, particularly in North America, as facilities leverage flexible contracts to stabilize their fluctuating staffing needs without committing to permanent headcount increases. Specialized healthcare staffing in pharmaceuticals and life sciences is also flourishing, driven by increased R&D expenditure and the accelerated pace of drug development and clinical trials. Agencies in this area require deep domain expertise to source professionals like clinical research associates, biostatisticians, and regulatory affairs specialists. The successful navigation of stringent healthcare privacy laws, such as HIPAA, is crucial for maintaining client trust and regulatory standing within the complex ecosystem.

Future trends in healthcare staffing are moving toward technology integration to streamline administrative burdens. Telehealth and remote patient monitoring innovations necessitate staffing agencies to source professionals with unique skills combining clinical knowledge with technical proficiency in digital health platforms. Furthermore, agencies are increasingly offering workforce optimization consulting services to clients, moving beyond simple placements to advise on retention strategies and efficient staff scheduling protocols, utilizing predictive analytics to minimize costly vacancies. The ethical considerations around fair compensation and working conditions for agency staff remain paramount, influencing public perception and regulatory scrutiny across key operational territories.

Evolving Regulatory and Compliance Landscape

The global regulatory environment presents both a barrier and a competitive differentiator for staffing agencies. Variations in national and regional labor laws regarding contract duration, worker classification (e.g., distinguishing between independent contractors and employees), social security contributions, and minimum wage requirements necessitate sophisticated compliance infrastructure. For multinational staffing firms, maintaining compliance across dozens of jurisdictions requires continuous legal monitoring and investment in flexible payroll and HR systems. Failure to properly classify workers can result in substantial fines and legal challenges, making expert compliance services a key value addition offered by top-tier agencies to their clients, especially for those operating within the intricate European Union framework.

The rise of the "gig economy" has triggered significant regulatory scrutiny worldwide. Governments are grappling with how to provide appropriate protections and benefits to non-traditional workers without stifling the flexibility that drives this segment. Staffing firms that proactively adopt mechanisms to ensure their contingent workers receive competitive wages, health benefits, and secure work environments are better positioned to attract top talent and mitigate future regulatory risks. Legislative changes, such as those related to "co-employment" or "joint employer liability," directly impact the operational model of staffing agencies, forcing them to refine their contractual agreements and client relationship management strategies to allocate risk appropriately.

Moreover, the focus on diversity, equity, and inclusion (DE&I) is increasingly mandated by regulatory bodies and client expectations. Staffing agencies are required not only to avoid discriminatory practices but often to actively demonstrate efforts toward building diverse candidate pipelines. Technological tools are being deployed to monitor and report on diversity metrics throughout the recruitment funnel. This shift places compliance at the intersection of legal mandates and strategic ethical sourcing, requiring agencies to possess comprehensive knowledge beyond basic transactional labor law, ensuring their practices align with evolving corporate social responsibility standards across global markets.

Key Competitive Strategies and Innovation

Competitive strategy within the Recruitment Staffing Market is rapidly shifting from mere volume placement to specialized value creation. Leading firms are focusing on developing proprietary technology platforms that integrate AI for superior candidate matching and provide clients with real-time analytics on labor market supply and demand. This technological investment enables a significant improvement in the quality of service delivery and establishes a moat against smaller competitors. Furthermore, strategic mergers and acquisitions (M&A) are common, allowing large firms to quickly absorb specialized talent bases and expand into high-growth vertical niches, such as cybersecurity or AI/ML engineering, where organic growth is slow due to talent scarcity.

Service innovation is a critical competitive lever, particularly the expansion into RPO and MSP models. By offering full-scale outsourcing of recruitment functions, agencies transition into strategic partners, securing long-term, predictable revenue streams and embedding themselves deeper within the client's operational structure. This move increases client stickiness and raises the barriers to entry for competitors. Moreover, brand reputation, built through reliable placement quality and strong candidate relationships, remains an indispensable, non-replicable asset. Staffing firms that prioritize candidate experience—offering transparent communication, professional development, and robust support systems for contractors—gain a competitive edge in securing high-demand talent.

Pricing strategy is also evolving, moving away from simple mark-up percentages towards value-based pricing, particularly in highly skilled professional segments. Agencies charge premium rates for access to rare expertise, proven quality assurance, and expedited fulfillment times. Geographic expansion, particularly into the high-growth APAC and emerging LATAM markets, allows firms to tap into new client bases and diversify revenue streams, mitigating dependency on mature, slower-growing Western markets. Ultimately, successful firms integrate robust technological capabilities, deep domain expertise, global compliance frameworks, and a commitment to candidate welfare to sustain their competitive advantage in the complex and rapidly evolving global staffing landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager