Rectangular Enameled Wire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438891 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Rectangular Enameled Wire Market Size

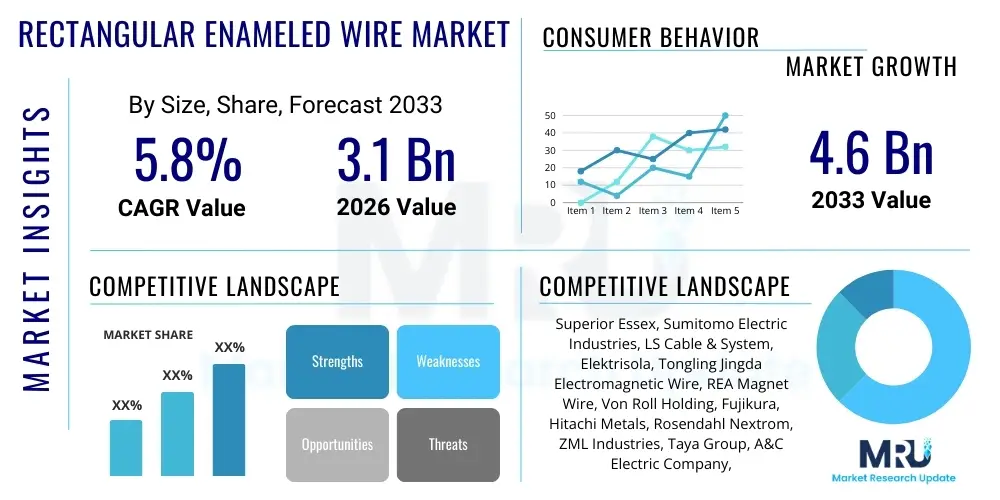

The Rectangular Enameled Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.6 Billion by the end of the forecast period in 2033.

Rectangular Enameled Wire Market introduction

Rectangular enameled wire, often referred to as magnet wire, represents a specialized class of electrical conductors essential for constructing high-efficiency electrical equipment. This product features a solid, rectangular or square cross-section of copper or aluminum, insulated with a thin layer of enamel coating, typically based on polyester, polyimide, or polyurethane resins. The shape of the wire offers a superior fill factor compared to traditional round wire, enabling manufacturers to design more compact, powerful, and thermally stable components. This unique characteristic is particularly critical in applications where space minimization and enhanced thermal management are paramount, driving its adoption across sophisticated industrial and consumer electronics sectors.

The primary function of rectangular enameled wire is to create windings in electromagnetic devices, facilitating the efficient conversion of electrical energy into magnetic force, and vice versa. Its major applications span high-voltage transformers, large industrial motors, power generation equipment, and increasingly, components within electric vehicle (EV) powertrains, including traction motors and on-board chargers. Key benefits include excellent dielectric strength, high thermal resistance (especially in the NEMA 200 and higher temperature classes), mechanical robustness against winding stresses, and superior resistance to chemical agents and refrigerants. These qualities ensure reliable operation under demanding thermal and mechanical conditions prevalent in modern high-performance machinery, thereby reducing maintenance needs and extending equipment lifespan.

Market expansion is strongly driven by the global push toward electrification and energy efficiency standards. The surge in demand for electric vehicles, which utilize high-density windings for efficient traction motors, is a primary catalyst. Furthermore, continuous investment in smart grids and renewable energy infrastructure, such as wind turbines and solar inverters, necessitates high-performance magnet wires capable of handling fluctuating loads and operating at elevated temperatures. Technological advancements in insulation materials, focusing on ultra-thin coatings with superior thermal stability and breakdown voltage, are further enhancing the competitive advantages of rectangular enameled wire over conventional alternatives, solidifying its essential role in the future of electrical engineering.

Rectangular Enameled Wire Market Executive Summary

The Rectangular Enameled Wire Market is currently undergoing significant transformation, primarily characterized by shifts towards higher thermal class insulation materials and increasing integration into electric mobility applications. Business trends highlight a consolidation of manufacturing capabilities among major global players, focusing on vertical integration to secure raw material supply, particularly high-purity copper and specialized enamel resins. Manufacturers are prioritizing innovation in insulation technology to meet stringent thermal shock and partial discharge requirements imposed by high-frequency power electronics. Furthermore, the market structure is seeing heightened competitive pressure from Asia Pacific manufacturers, who are leveraging cost efficiencies and scaling production volumes to capture substantial market share in the industrial machinery and consumer appliance segments.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing region, driven by massive investments in infrastructure development, rapid industrialization in countries like China and India, and the establishment of global electric vehicle manufacturing hubs. North America and Europe, while representing mature markets, exhibit robust demand for premium, high-specification rectangular wires, particularly those compliant with stringent environmental regulations and high-efficiency standards mandated by governmental bodies. European market growth is particularly tied to industrial automation and the overhaul of legacy grid infrastructure, necessitating specialized wires for efficient transformers and high-efficiency motors (IE3 and IE4 standards). Manufacturers are increasingly establishing localized production facilities to mitigate supply chain risks and cater to region-specific quality standards.

Segment trends reveal that copper remains the dominant conductor material due to its superior conductivity, although aluminum rectangular wire is gaining traction in large-scale transformer and high-voltage transmission applications where weight reduction is a critical design parameter. Based on insulation type, polyester-imide and polyimide wires are experiencing rapid uptake, driven by their ability to withstand the extreme temperatures and rapid switching cycles characteristic of inverter-driven systems found in EVs and renewable energy systems. The application segmentation confirms that the automotive sector, especially the EV segment, will be the primary driver of future market valuation, overshadowing traditional demand from the power and industrial sectors, prompting strategic reallocation of R&D resources towards specialized EV wire products.

AI Impact Analysis on Rectangular Enameled Wire Market

User inquiries regarding AI's impact on the Rectangular Enameled Wire Market primarily center on three themes: optimizing manufacturing processes, predicting raw material fluctuations, and enhancing product quality control. Users are keen to understand how AI can reduce scrap rates, optimize the complex enameling process—which involves precise temperature control and coating thickness—and potentially streamline supply chain logistics for essential inputs like copper and specialized resins. There is significant interest in using predictive maintenance algorithms, driven by sensor data (IoT integration), to monitor winding equipment and insulation quality in real time, moving away from traditional batch testing towards continuous quality verification. Furthermore, questions arise about AI's potential role in simulating electrical performance and thermal management of new wire geometries before costly physical prototyping.

The primary expectations revolve around achieving ultra-high precision and consistency in wire manufacturing, crucial for high-density, high-frequency applications like those in electric vehicle motors. Manufacturers anticipate leveraging machine learning for defect detection during the drawing and enameling stages, minimizing inconsistencies that lead to dielectric failure under stress. Concerns, however, often relate to the high initial investment required for retrofitting existing production lines with advanced sensors and data processing infrastructure. Users also question the availability of specialized AI models capable of interpreting the complex physical and chemical parameters unique to the wire coating process, which requires expert domain knowledge combined with data science expertise.

Overall, AI is viewed less as a disruptive force transforming the product itself and more as an enabling technology that optimizes the production value chain, enhances product reliability, and improves time-to-market for specialized wire products. The integration of AI/ML models is expected to provide manufacturers with a competitive edge by lowering operational costs (OpEx) through reduced energy consumption and minimizing material waste, thereby ensuring that the final rectangular enameled wire adheres to the increasingly stringent quality benchmarks required by high-tech end-users, especially in the aerospace and advanced automotive industries.

- AI-driven optimization of coating thickness and curing temperature in the enameling process, reducing material consumption and improving uniformity.

- Implementation of machine vision systems powered by AI for real-time, high-speed defect detection on the wire surface and insulation integrity check.

- Predictive maintenance schedules for wire drawing and winding machinery, minimizing downtime and extending equipment lifespan.

- Enhanced simulation capabilities using ML to model thermal run-off and stress tolerance in various coil designs, accelerating R&D cycles.

- Optimization of copper and resin procurement strategies based on predictive market analytics and inventory management supported by AI algorithms.

DRO & Impact Forces Of Rectangular Enameled Wire Market

The dynamics of the Rectangular Enameled Wire Market are influenced by a complex interplay of growth drivers, structural restraints, and emerging opportunities, all mediated by several impactful market forces. A major driver is the accelerating electrification of the automotive sector; the sheer volumetric demand for high-performance magnet wires used in EV traction motors and charging infrastructure provides a sustained impetus for market growth globally. Simultaneously, the global mandate for improved energy efficiency in industrial machinery and consumer appliances drives the preference for rectangular wires, which inherently allow for better coil designs and higher motor efficiencies compared to round wires. Continuous innovation in insulation materials, specifically the development of higher thermal class (Class 220 and above) enamels, further supports applications in severe operating environments, thereby broadening the market scope.

Conversely, the market faces significant restraints, primarily stemming from the volatile pricing and supply chain instability of key raw materials, namely copper and specialized petroleum-based enamel resins. Copper price fluctuations directly impact production costs and profit margins, making long-term strategic pricing difficult for manufacturers. Furthermore, the manufacturing process for high-quality rectangular enameled wire is capital intensive and highly specialized, posing significant barriers to entry for new players, limiting competition and potentially slowing innovation in certain segments. The complex technical requirements for winding specialized rectangular wire in automated processes also present operational challenges for end-users transitioning from traditional round wire configurations, requiring significant investment in new winding machinery.

Opportunities for market players lie chiefly in penetrating emerging markets, particularly Southeast Asia and Latin America, which are rapidly industrializing and investing in new power infrastructure. The expansion of high-speed rail networks and urban transit systems, which require specialized traction systems, offers niche growth avenues. Impact forces such as rapid technological change, regulatory mandates related to energy consumption (e.g., EU Ecodesign directives), and environmental concerns are reshaping product requirements, favoring wires with increased longevity and thermal performance. The consolidation trend among major global electrical equipment manufacturers also exerts pressure on wire suppliers to meet highly specific, large-volume contracts, prioritizing suppliers with robust quality certifications and global supply chain resilience.

Segmentation Analysis

The Rectangular Enameled Wire Market is meticulously segmented based on key criteria, including the conductor material used, the type of insulation applied, the thermal class rating, and the end-use application. This segmentation provides a granular view of market dynamics, revealing varying growth rates and competitive landscapes across specialized niches. The distinction between copper and aluminum conductors remains fundamental, dictated by application requirements relating to conductivity, weight, and cost tolerance. Insulation technology, the differentiating factor for wire performance, is categorized by chemical composition and thermal endurance, reflecting the industry's continuous drive toward higher operating temperatures and voltage resistance capabilities required for advanced power systems and microelectronics.

Detailed segmentation analysis allows stakeholders to target high-growth areas, such as high-temperature polyimide-insulated copper wires (for EV traction motors) or the use of large-gauge aluminum wires with robust insulation (for utility-scale power transformers). Thermal classes delineate the maximum continuous operating temperature the wire can withstand, with Class 200 (Polyesterimide) and Class 220 (Polyimide/Aromatic Polyimide) dominating demand in high-reliability industrial and transportation sectors. Geographically, segmentation highlights the regional disparities in technology adoption and regulatory influence, with Asia Pacific leading in volume consumption across general industrial applications, while North America and Europe focus on high-specification, niche requirements.

Understanding these segments is crucial for strategic planning, allowing wire manufacturers to align R&D efforts with specific end-user demands, such as developing wires resistant to high-pressure refrigerants for HVAC systems or wires with exceptional resistance to varnish solvents for submersible pump motors. The dominance of the power generation and distribution sector, alongside the rapid emergence of the automotive sector, necessitates tailored product portfolios that address the unique thermal, mechanical, and electrical stresses inherent to each application environment, ensuring optimal performance and longevity.

- By Conductor Material:

- Copper Rectangular Enameled Wire

- Aluminum Rectangular Enameled Wire

- By Insulation Type:

- Polyester Enameled Wire

- Polyurethane Enameled Wire

- Polyesterimide Enameled Wire

- Polyimide Enameled Wire

- Polyvinyl Formal Enameled Wire

- By Thermal Class:

- Class 130

- Class 155

- Class 180

- Class 200

- Class 220

- Class 240 and Above

- By Application/End-Use Industry:

- Automotive (Electric Vehicles, Hybrid Vehicles)

- Power Generation and Distribution (Transformers, Generators)

- Industrial Motors and Generators

- Consumer Electronics and Appliances

- Aerospace and Defense

- Medical Devices

Value Chain Analysis For Rectangular Enameled Wire Market

The value chain for the Rectangular Enameled Wire Market is characterized by highly specialized processes, starting from the procurement of upstream raw materials and extending through complex manufacturing steps to the final delivery to Original Equipment Manufacturers (OEMs). Upstream analysis focuses predominantly on securing high-quality, high-purity conductor materials, primarily electrolytic tough pitch (ETP) copper rods and electrical grade aluminum. The cost and quality of these base metals, subject to global commodity markets, significantly influence the final product price and market competitiveness. The other critical upstream component is the procurement of highly specialized polymer resins and chemical solvents used for the enamel coating, requiring strong partnerships with chemical suppliers specializing in high thermal stability coatings like polyimide precursors.

The core manufacturing stage involves drawing the conductor material to the precise rectangular gauge, followed by the meticulous enameling process. This process requires specialized machinery for continuous drawing, annealing, and multiple-layer application and baking of the insulating enamel. Operational efficiency and adherence to stringent quality control standards—monitoring dielectric strength and abrasion resistance—are paramount at this stage. Direct distribution channels involve large wire manufacturers supplying high volumes directly to major OEMs in the automotive or power sectors, often under long-term supply agreements that require customized wire specifications (e.g., specific dimensions, enhanced partial discharge resistance). This direct model ensures quality control and facilitates technical collaboration.

Downstream analysis centers on the utilization of the finished wire by end-users. The wire is typically integrated into components like transformer coils, motor stators, and electromagnets. Indirect distribution channels are utilized for smaller industrial users or repair shops, involving distributors or agents who manage inventory, cut-to-length services, and provide localized technical support. The effectiveness of the distribution channel is crucial in ensuring timely supply, especially for the high-volume EV industry, where just-in-time inventory management is critical. Efficiency throughout the value chain, from minimizing copper waste during drawing to optimizing coating process energy use, determines the overall profitability and sustainability of market participants.

Rectangular Enameled Wire Market Potential Customers

The primary customers for Rectangular Enameled Wire are large-scale Original Equipment Manufacturers (OEMs) and specialized component manufacturers operating within key electrical sectors. The most significant potential buyers include manufacturers of electric vehicles and hybrid vehicles, particularly those producing high-efficiency traction motors, which require compact, high-performance winding materials to maximize power density and minimize overall weight. These automotive tier-one suppliers and OEMs demand wires capable of operating reliably at high temperatures (Class 200 and 220) and often require specialized resistance to harsh chemical environments, such as battery coolants and transmission fluids.

Another major customer segment encompasses power generation and distribution companies, particularly those involved in producing high-voltage transformers, switchgear, and utility-scale generators. For these customers, the emphasis is on wires that offer exceptional long-term reliability, high dielectric breakdown voltage, and superior thermal performance to ensure grid stability and minimize energy losses over decades of service. Large industrial equipment manufacturers, producing heavy-duty motors (e.g., for mining, maritime, and large HVAC systems) and industrial automation components, also constitute a stable customer base, valuing the high fill factor and thermal endurance offered by rectangular conductors to achieve stringent IE efficiency ratings.

Additionally, specialized niche buyers include manufacturers in the aerospace and defense sector, requiring ultra-lightweight and radiation-resistant enameled wires for avionics and specialized radar systems. Producers of high-end consumer electronics and renewable energy systems, such as solar micro-inverters and wind turbine generators, represent a growing cohort. These buyers are continuously seeking smaller gauge, highly reliable rectangular wires that can sustain high-frequency switching cycles and operate efficiently in compact power delivery systems, underscoring the shift towards demanding, high-specification applications across the industrial landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Superior Essex, Sumitomo Electric Industries, LS Cable & System, Elektrisola, Tongling Jingda Electromagnetic Wire, REA Magnet Wire, Von Roll Holding, Fujikura, Hitachi Metals, Rosendahl Nextrom, ZML Industries, Taya Group, A&C Electric Company, LWW Group, Samdong Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rectangular Enameled Wire Market Key Technology Landscape

The technology landscape for the Rectangular Enameled Wire Market is heavily focused on materials science, advanced insulation application techniques, and geometric optimization. A crucial area of innovation involves the continuous development of high-performance enamel coatings that offer superior thermal endurance, chemical resistance, and dielectric properties while maintaining thin film consistency. Specifically, the development of aromatic polyimide and polyetherimide enamels is essential for meeting the Class 220 and Class 240+ requirements of modern EV traction motors and aerospace applications, where wires must withstand continuous operation at extreme temperatures and high voltage spikes characteristic of pulse width modulation (PWM) drives.

Furthermore, precision manufacturing technologies related to conductor preparation are becoming increasingly critical. These include specialized wire drawing dies and annealing processes that ensure the rectangular cross-section maintains dimensional stability and minimizes sharp edges, which could compromise the insulation integrity under mechanical stress during winding. The application technology involves highly sophisticated vertical or horizontal enameling ovens that utilize precise atmospheric control and infrared heating to ensure uniform curing and adherence of multi-layer insulation films. Advances in quality control, such as continuous non-destructive testing (NDT) using eddy current systems or laser micrometers, are integrated into the production line to ensure minimal defects and consistent film build before shipment.

A significant technological shift impacting the market is the rise of wires specifically designed for partial discharge (PD) resistance. As power systems, particularly in electric vehicles, operate at higher DC bus voltages and utilize rapid-switching insulated gate bipolar transistors (IGBTs) or silicon carbide (SiC) devices, the risk of partial discharge leading to premature insulation degradation increases significantly. Manufacturers are addressing this through nano-composite insulation systems, incorporating inorganic fillers like alumina or silica into the polymer matrix. This technological adoption enhances the material’s resistance to erosive discharges, extending the operational life of the equipment and validating the premium pricing associated with these specialized, high-reliability rectangular magnet wires.

Regional Highlights

The global demand and production ecosystem for Rectangular Enameled Wire are highly regionalized, driven by industrial concentration, energy policy, and the density of the electric vehicle manufacturing base.

- Asia Pacific (APAC): APAC is the global hub for manufacturing and consumption of rectangular enameled wire, accounting for the largest market share. This dominance is underpinned by robust infrastructure investment, massive electronics manufacturing output (Korea, Taiwan), and the undisputed leadership in global EV production (China). Countries like China, Japan, and South Korea are key consumers due to their large transformer manufacturing base and expansive industrial motor production. The region benefits from lower manufacturing costs and scalable production capacity, driving competitive pricing across the market.

- North America: North America represents a mature, high-value market focused on quality and high-specification products. Demand is strongly correlated with the rapidly expanding domestic EV production (including new gigafactories and motor assembly plants) and the extensive need for grid modernization and replacement of aging power transformers. Regulatory mandates encouraging energy-efficient motors (IE3/IE4) necessitate the adoption of premium rectangular wires, which enhances the market’s revenue per unit, despite lower volume growth compared to APAC.

- Europe: The European market is characterized by stringent regulatory environments and a strong emphasis on industrial automation and renewable energy integration. Germany, Italy, and France are primary manufacturing centers for high-quality industrial machinery and components. The push towards sustainable energy solutions, particularly offshore wind turbines and high-efficiency railway traction systems, drives the demand for Class 200+ polyimide-insulated rectangular wires. Manufacturers here focus heavily on traceability, environmental compliance, and technical collaboration with sophisticated end-users.

- Latin America (LATAM): LATAM is an emerging market with potential driven by significant urbanization, expanding local manufacturing bases, and investment in modernizing electrical grids, particularly in Brazil and Mexico. The market currently relies heavily on imported high-specification wires but shows increasing capacity for local production of standard industrial wires. Growth is tied closely to commodity cycles and localized infrastructure projects.

- Middle East and Africa (MEA): The MEA market is smaller but expanding, primarily driven by massive government investments in power generation (especially in the GCC region) and large-scale industrial projects. Demand is focused on robust rectangular wires capable of withstanding high ambient temperatures, essential for desert environments. The increasing adoption of renewable energy technologies, particularly solar power farms, provides niche demand for reliable magnet wires in inverter systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rectangular Enameled Wire Market.- Superior Essex

- Sumitomo Electric Industries

- LS Cable & System

- Elektrisola

- Tongling Jingda Electromagnetic Wire

- REA Magnet Wire

- Von Roll Holding

- Fujikura

- Hitachi Metals

- Rosendahl Nextrom

- ZML Industries

- Taya Group

- A&C Electric Company

- LWW Group

- Samdong Co., Ltd.

- Shandong Wanda Cable

- Jiangsu Fuchuan Electrical Materials

- MWS Wire Industries

- Precision Wire & Cable

- Phelps Dodge International

Frequently Asked Questions

Analyze common user questions about the Rectangular Enameled Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What differentiates rectangular enameled wire from traditional round wire in motor applications?

Rectangular enameled wire offers a significantly superior space factor (fill factor), allowing windings to be packed more densely within a defined space. This results in motors and transformers that are more compact, lighter, and crucially, exhibit higher energy efficiency and superior thermal dissipation capabilities compared to components wound with round wire.

Which thermal classes of rectangular enameled wire are most critical for the electric vehicle (EV) sector?

The EV sector predominantly demands wires rated Class 200 (Polyesterimide) and especially Class 220 (Polyimide). These high thermal classes are necessary because EV traction motors operate under severe thermal stress due to high power density, rapid switching frequencies, and limited cooling capacity, requiring insulation capable of maintaining integrity under continuous high-temperature exposure.

How does copper price volatility impact manufacturers in the rectangular enameled wire market?

Since the conductor material (copper) constitutes a major portion of the final product cost, copper price volatility directly and significantly impacts manufacturers' cost of goods sold and profit margins. Manufacturers often mitigate this risk through hedging strategies, adopting pass-through clauses (Comex pricing mechanisms) in long-term contracts, and exploring aluminum substitutes where technically feasible.

What are the primary technological challenges currently faced in rectangular enameled wire manufacturing?

Key challenges include achieving ultra-thin, highly uniform enamel coatings to maximize space factor while ensuring zero-defect dielectric strength, managing the mechanical stresses involved in drawing and annealing large rectangular conductors, and developing insulation systems with enhanced resistance to partial discharge (PD) at high operating voltages (above 1000V) prevalent in modern power electronics.

Is aluminum rectangular enameled wire a viable alternative to copper, and for which applications?

Yes, aluminum rectangular enameled wire is a viable and cost-effective alternative, particularly in large-scale power transformer windings and high-voltage transmission equipment where weight reduction is critical and slight compromises in conductivity are acceptable. Copper maintains dominance in high-performance applications like EV motors where maximum conductivity and minimum size are non-negotiable requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager