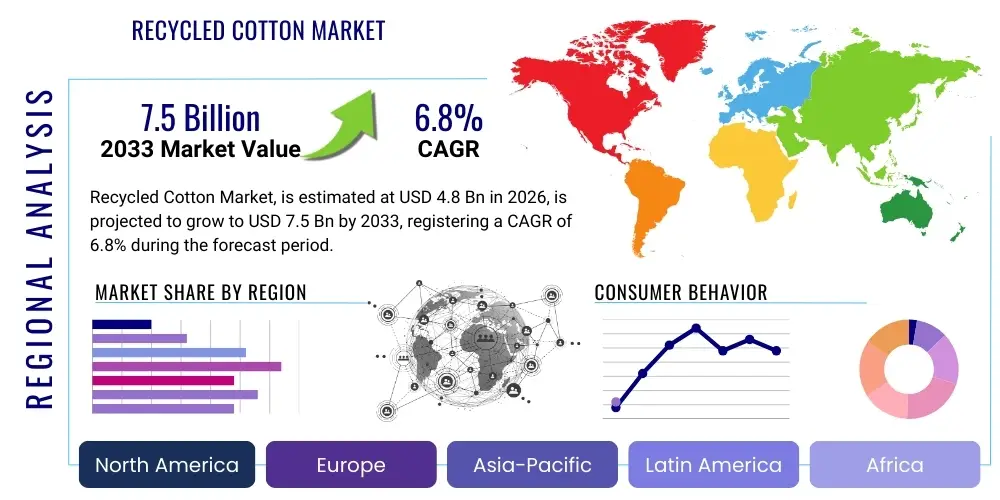

Recycled Cotton Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434581 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Recycled Cotton Market Size

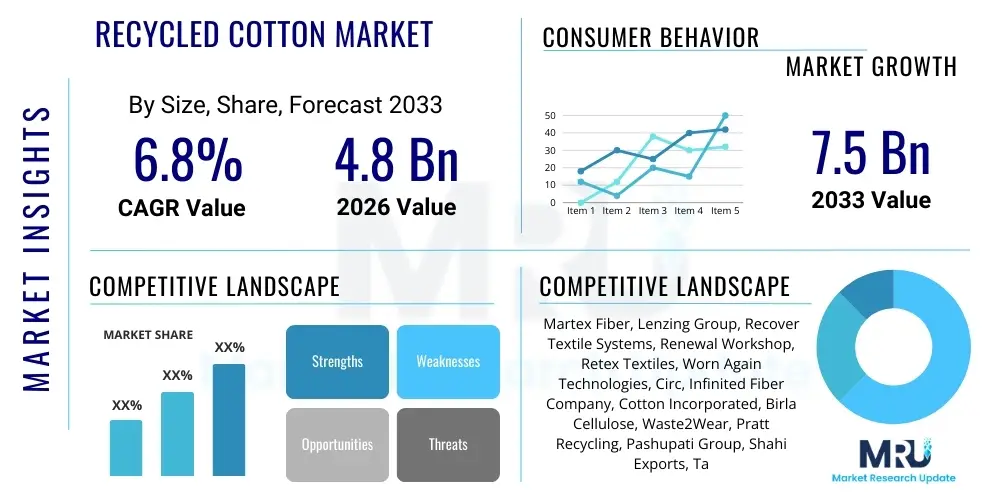

The Recycled Cotton Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Recycled Cotton Market introduction

The Recycled Cotton Market encompasses the production, processing, and application of cotton fibers derived from pre-consumer (manufacturing waste) and post-consumer (used garments and textiles) sources. This circular economy segment addresses the severe environmental footprint associated with conventional cotton cultivation, which includes extensive water usage, pesticide application, and land degradation. Recycled cotton, often processed through mechanical or chemical means, provides a sustainable alternative for textile manufacturing, enabling brands to meet increasing consumer demand for eco-friendly products and comply with stringent global environmental regulations. The core benefit lies in significantly reducing textile waste destined for landfills while conserving natural resources crucial for virgin fiber production.

Major applications of recycled cotton span the entire textile value chain, dominating sectors such as apparel manufacturing, home furnishings, and non-woven industrial textiles. In apparel, it is extensively used in denim, knitwear, and casual wear, often blended with virgin cotton or other recycled fibers like polyester to maintain desired strength and durability characteristics, especially when derived from mechanical recycling processes which typically shorten fiber length. The versatility of the material and its low environmental impact position it as a critical component in achieving circularity goals established by international fashion and textile industry bodies, making it indispensable for brands targeting net-zero emissions.

Key driving factors accelerating market expansion include the implementation of Extended Producer Responsibility (EPR) schemes globally, which mandate manufacturers to manage the lifecycle of their products, alongside robust governmental initiatives promoting waste reduction and circular textile sourcing. Furthermore, technological advancements in automated sorting (e.g., using near-infrared spectroscopy) and chemical recycling (dissolving cellulose back into usable pulp) are overcoming traditional limitations associated with fiber quality degradation and dye contamination in recycled materials. These innovations enhance the efficiency, consistency, and applicability of recycled cotton, ensuring its suitability for high-quality, high-fashion applications, thereby continuously expanding the overall market potential.

Recycled Cotton Market Executive Summary

The Recycled Cotton Market is defined by a rapid transition towards circularity, driven primarily by shifts in corporate sustainability strategies and heightened consumer awareness regarding textile waste. Current business trends indicate significant investment in vertical integration across the supply chain, particularly focused on establishing efficient textile collection and sorting infrastructure in high-consumption regions like North America and Europe. Brands are increasingly setting aggressive targets for incorporating certified recycled content, fueling innovation in both mechanical defabrication processes for pre-consumer waste and advanced chemical dissolution methods necessary for complex post-consumer textile mixtures. Mergers and partnerships between waste management firms, fiber processors, and major textile manufacturers are commonplace, aiming to secure consistent, high-quality feedstock supply and streamline the transformation process from waste stream to textile input.

Regionally, Asia Pacific maintains its dominance as the primary processing hub due to established manufacturing infrastructure, particularly in countries like China, India, and Vietnam, which handle both large volumes of imported textile waste and substantial domestic manufacturing scrap. However, Europe and North America are leading in demand generation and regulatory enforcement. European Union policies, such as the Waste Framework Directive and the upcoming Ecodesign for Sustainable Products Regulation (ESPR), are compelling market transformation, focusing on design for disassembly and mandated recycled content percentages. This regulatory impetus ensures that while processing remains global, the innovation and demand drivers are centered in developed Western economies where consumers are willing to pay a premium for certified sustainable products.

Segmentation trends highlight the increasing importance of post-consumer waste as a source material, necessitating greater sophistication in sorting technologies to handle blended fabrics and different dyeing treatments effectively. While pre-consumer waste remains the most straightforward and highest quality input, the future scalability of the market hinges on efficiently utilizing the vast volumes of post-consumer garments. Application-wise, the apparel sector continues to hold the largest market share, but the industrial sector, including materials for automotive interiors and specialized filters, is exhibiting the highest growth rate, driven by corporate requirements for sustainable materials across all manufacturing inputs. Chemically recycled cotton, though currently a smaller segment, is projected to experience exponential growth as technology matures, offering a potential breakthrough for achieving fiber quality comparable to virgin cotton.

AI Impact Analysis on Recycled Cotton Market

User inquiries regarding AI's influence on the Recycled Cotton Market primarily revolve around optimizing the complex upstream supply chain, specifically addressing how technology can enhance the notoriously labor-intensive and inaccurate process of textile sorting and grading. Key themes include the use of AI-driven vision systems for rapid fiber identification, predicting the quality and composition of incoming textile waste streams, and optimizing inventory management for varied feedstock types. Users are concerned about AI's role in scaling up chemical recycling efficiency and improving the logistical precision required to match specific textile waste inputs with appropriate recycling methods, thereby minimizing operational costs and maximizing fiber yields while ensuring consistent quality for downstream applications.

- AI-powered vision systems and robotics enhance automatic sorting of blended textiles by composition (cotton, polyester, elastane) and color, drastically improving feedstock purity for recycling processes.

- Predictive analytics driven by machine learning algorithms optimize textile collection routes and inventory management, ensuring a steady, categorized supply chain tailored to specific recycling plant needs.

- AI models are used in chemical recycling to monitor reaction conditions (temperature, pressure, catalyst concentration) in real-time, maximizing cellulose dissolution efficiency and minimizing energy consumption.

- Demand forecasting models utilize AI to predict future recycled fiber requirements based on fashion cycles, regulatory changes, and brand commitments, enabling producers to align capacity planning accurately.

- AI assists in traceability and certification management by analyzing and verifying data points across the supply chain, ensuring compliance with global standards like the Global Recycled Standard (GRS) and accelerating transparency efforts.

DRO & Impact Forces Of Recycled Cotton Market

The dynamics of the Recycled Cotton Market are shaped by powerful forces encompassing technological innovation, regulatory mandates, and shifting consumer expectations towards sustainability. Key Drivers (D) include widespread brand commitments to circularity, where major global retailers are setting quantifiable targets for incorporating recycled fibers, thereby creating stable, long-term demand. Simultaneously, the inherent environmental benefits—drastically reduced water consumption and minimized reliance on pesticides compared to conventional cotton—provide a compelling economic and ethical justification for adoption. These drivers are heavily supported by evolving global waste management regulations that increasingly restrict landfilling of textiles and encourage resource recovery, forcing industry participants to adopt circular models.

Restraints (R) primarily center on the technical challenges associated with processing post-consumer waste. Mechanically recycled cotton typically yields shorter fibers, which limits its application in high-performance or high-quality textiles unless significant blending with virgin fibers occurs. Furthermore, sorting mixed textile waste is complex and expensive; the presence of synthetic fibers and diverse dyes often contaminates batches, hindering the efficiency of both mechanical and chemical recycling infrastructure. The inconsistency of feedstock supply and the high upfront capital investment required for advanced recycling facilities also act as significant barriers to entry and scalability, particularly for small and medium-sized enterprises (SMEs) operating within the value chain.

Opportunities (O) are abundant, driven primarily by maturing chemical recycling technologies that promise high-quality fiber outputs from complex blended waste, potentially unlocking the market for previously unusable textile streams. Furthermore, the development of robust, digitally enabled traceability systems (often leveraging blockchain and IoT) creates opportunities for enhanced supply chain transparency, building greater trust among consumers and stakeholders regarding the authenticity of recycled content claims. Impact forces are currently dominated by regulatory pressure, particularly in the EU, which has the power to drastically accelerate market adoption through mandatory recycled content quotas, making sustainable sourcing a compliance necessity rather than a voluntary initiative.

Segmentation Analysis

The Recycled Cotton Market is primarily segmented based on the source of the material (pre-consumer versus post-consumer), the type of recycling process utilized (mechanical versus chemical), and the final application of the fiber. Analyzing these segments provides crucial insights into the current market dynamics, technological bottlenecks, and future growth trajectories. While pre-consumer waste offers higher quality and easier processing, the massive, untapped potential lies within the post-consumer segment, which requires significant technological innovation, especially in automated sorting and chemical processing, to convert heterogeneous waste into viable textile inputs. The dominance of mechanical recycling is being challenged by the increasing need for high-quality fibers that chemical processes can deliver, particularly for the expanding high-end apparel market.

- Source

- Pre-consumer (Industrial Waste, Manufacturing Scrap)

- Post-consumer (Used Garments, Household Textiles)

- Type of Recycling

- Mechanically Recycled Cotton

- Chemically Recycled Cotton

- Application

- Apparel (Denim, Knitwear, Casual Wear)

- Home Furnishings (Towels, Bedding, Upholstery)

- Industrial and Non-woven (Wipes, Insulation, Automotive Textiles)

Value Chain Analysis For Recycled Cotton Market

The value chain for the Recycled Cotton Market begins with the collection and sorting of textile waste, which is the most critical and often the most challenging upstream activity. Upstream analysis involves sourcing raw materials, which are categorized as pre-consumer clips (from cutting rooms and yarn spinning) or post-consumer garments (collected via municipal programs or retail take-back schemes). The efficiency of this initial sorting stage directly determines the quality and cost of the final recycled fiber. Investment in automated sorting facilities utilizing advanced sensor technology is essential to classify heterogeneous post-consumer waste accurately by fiber composition and color, ensuring a consistent feedstock for subsequent recycling processes. Inconsistent sourcing or inefficient preliminary processing can significantly increase operational costs downstream and reduce the quality of the end product.

Midstream activities encompass the actual recycling processes, primarily mechanical (shredding and carding) and chemical (dissolution). Mechanical recycling is cost-effective but reduces fiber length, often necessitating blending with virgin fibers. Chemical recycling, while capital-intensive, offers the advantage of producing pulp or fibers chemically identical to virgin cotton, suitable for high-end applications, thereby addressing the quality constraint of mechanical recycling. This stage involves significant technological expertise and high energy consumption. The processed fibers or pulp are then spun into yarn or converted into non-woven fabrics, often requiring specialized machinery designed to handle the slightly shorter or less uniform characteristics of recycled materials.

Downstream activities involve distribution channels leading to the end-use applications, predominantly apparel, home textiles, and industrial use. Direct distribution often occurs through specialized recycled yarn producers selling directly to major textile mills and large apparel manufacturers (B2B). Indirect channels involve distributors, agents, and fabric suppliers who cater to smaller brands and niche markets. The marketing emphasis downstream is placed heavily on transparency and certification (e.g., GRS, Recycled Claim Standard), as end-users prioritize verifiable sustainability claims. Successful penetration in the downstream market relies not only on competitive pricing but crucially on demonstrating consistent quality and robust environmental credentials, which ultimately influence consumer purchasing decisions.

Recycled Cotton Market Potential Customers

Potential customers for recycled cotton are predominantly large-scale textile manufacturers, vertically integrated apparel brands, and major retailers committed to sustainable sourcing. Global fast-fashion and high-street retailers represent a substantial portion of the market, driven by the need to meet regulatory compliance, enhance corporate social responsibility (CSR) profiles, and respond to heightened environmental scrutiny from Gen Z and Millennial consumers. These customers utilize recycled cotton primarily for high-volume products such as denim, t-shirts, hoodies, and basic apparel items, where cost-effectiveness and visible sustainability attributes are critical purchasing criteria. Their demand drives economies of scale in the recycling sector and necessitates massive, consistent supply chains.

The second major customer segment includes premium and luxury fashion houses and high-end home furnishing brands. While their volume requirement might be lower than fast fashion, they prioritize quality and purity, often seeking chemically recycled cotton or high-grade pre-consumer mechanically recycled fibers that can maintain the aesthetic and tactile properties associated with luxury textiles. For these customers, recycled cotton serves as a premium input that validates their commitment to exclusive and environmentally responsible production models. Partnerships between luxury brands and pioneering chemical recycling firms are emerging as a trend, aiming to co-develop exclusive, high-performance recycled materials.

A third, rapidly growing customer group is the industrial textile sector, encompassing automotive manufacturers, construction firms, and healthcare providers who use non-woven materials, insulation, filtration media, and specialized wipes. These customers are driven by industrial standards, internal mandates for supply chain sustainability, and the cost-effectiveness of using recycled fibers for technical applications where strict aesthetic requirements are less critical than performance attributes like insulation capacity, absorbency, or acoustic dampening. As industries external to fashion increasingly prioritize circular sourcing for their operational inputs, the demand for non-apparel applications of recycled cotton is set for significant expansion throughout the forecast period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Martex Fiber, Lenzing Group, Recover Textile Systems, Renewal Workshop, Retex Textiles, Worn Again Technologies, Circ, Infinited Fiber Company, Cotton Incorporated, Birla Cellulose, Waste2Wear, Pratt Recycling, Pashupati Group, Shahi Exports, Tavex Corporation, Unifi Inc., Sateri, Evrnu, C&A, Patagonia |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Cotton Market Key Technology Landscape

The technological landscape of the Recycled Cotton Market is bifurcated into mechanical and chemical recycling pathways, with significant ongoing innovation focused on overcoming the limitations of both. Mechanical recycling technology, the traditional method, involves defiberizing waste textiles through shredding and carding. Recent advancements in this area focus on optimizing machinery to minimize fiber length reduction and remove contaminants more effectively, often incorporating metal detectors and advanced dust filtration systems. However, the core limitation remains: this method inherently degrades the fiber quality, requiring sophisticated blending strategies to ensure yarn viability. The current technology is highly mature for processing pure, pre-consumer cotton scrap, but struggles significantly with mixed fiber post-consumer garments.

Chemical recycling represents the cutting edge of market innovation and is crucial for future scalability, particularly in utilizing complex post-consumer textile waste containing blends of cotton and synthetic fibers. Technologies such as solvent-based dissolution (e.g., using ionic liquids) and carbamate chemistry aim to break down cellulose fibers into a high-quality dissolved pulp or liquid form, which can then be extruded back into new, high-tenacity cellulosic fibers (often referred to as 'man-made cellulosic fibers' derived from cotton waste). Leading companies in this space are focusing intensely on developing closed-loop systems that recover and reuse the processing chemicals efficiently, thereby reducing environmental impact and improving economic viability, positioning this technology as the long-term solution for high-volume, high-quality recycled cotton substitutes.

Crucial enabling technologies underpinning the entire value chain include Automated Fiber Sorting (AFS) systems. These systems employ spectroscopic technologies, predominantly Near-Infrared (NIR) sensors and specialized cameras combined with machine learning algorithms, to rapidly and accurately distinguish between different fiber types (cotton, wool, polyester, nylon) and colors, even in complex blended garments. AFS drastically improves the purity of feedstock, which is vital for the efficiency of both mechanical and chemical recycling plants. Furthermore, advanced dye removal and purification processes, often utilizing non-toxic or biological agents, are being developed to ensure recycled fibers can be colored consistently without compromising quality, thereby broadening their acceptance across the fashion industry.

Regional Highlights

Geographical market dynamics are highly differentiated, with Asia Pacific dominating production capacity and Europe leading innovation and regulatory demand. Asia Pacific, particularly China, India, and Bangladesh, serves as the global textile manufacturing hub, processing massive volumes of raw textile waste (both imported and domestic) into recycled yarn and fabric due to lower operational costs and established industrial infrastructure. India, specifically, benefits from a long-standing decentralized cottage industry focused on textile waste recycling, providing significant capacity for mechanically recycled cotton, although the focus is increasingly shifting toward modern, certified facilities to meet global brand standards. The regional emphasis is on supply chain efficiency and cost leadership in producing mass-market recycled textiles.

Europe and North America are the primary centers of demand and regulatory impetus. In Europe, the ambitious Circular Economy Action Plan, coupled with forthcoming regulations mandating separate textile waste collection by 2025 and product ecodesign requirements, acts as a powerful catalyst for market growth. European nations are heavily investing in localized sorting and chemical recycling technologies to reduce reliance on exporting waste and to secure high-quality recycled input closer to regional markets. This regional focus on innovation and compliance means European players are driving the development of high-value, high-performance recycled cotton solutions suitable for premium markets, ensuring the highest standards of traceability and environmental verification.

Latin America and the Middle East & Africa (MEA) currently represent nascent but rapidly expanding markets. In MEA, particularly in South Africa and key Middle Eastern manufacturing hubs, there is a growing realization of the economic potential associated with capitalizing on textile waste generated locally, thereby reducing dependence on volatile global supply chains. However, investment in specialized recycling infrastructure remains limited compared to established regions. Latin America is seeing demand driven primarily by multinational brands operating within the region, implementing global sustainability mandates at the local level, pushing domestic textile suppliers to adopt certified recycled materials to maintain international competitiveness and access foreign markets.

- Asia Pacific: Dominates manufacturing and processing volume; key players include India and China; focus on mechanical recycling of pre-consumer waste and cost-efficient production.

- Europe: Leading region for regulatory-driven demand (EPR, Ecodesign); significant investment in advanced chemical recycling and automated sorting infrastructure; focus on high-quality, traceable output.

- North America: Strong consumer awareness and brand sustainability mandates (especially in the US); emphasis on scaling collection and integrating recycled content across major retail supply chains.

- Latin America: Emerging market driven by multinational brand adherence to global sustainability targets; gradual infrastructure development for local waste management.

- Middle East and Africa (MEA): Nascent market development focused on establishing domestic circular economies and leveraging textile waste for local manufacturing inputs; high potential for non-woven industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Cotton Market.- Martex Fiber

- Lenzing Group

- Recover Textile Systems

- Renewal Workshop

- Retex Textiles

- Worn Again Technologies

- Circ

- Infinited Fiber Company

- Cotton Incorporated

- Birla Cellulose

- Waste2Wear

- Pratt Recycling

- Pashupati Group

- Shahi Exports

- Tavex Corporation

- Unifi Inc.

- Sateri

- Evrnu

- C&A

- Patagonia

Frequently Asked Questions

Analyze common user questions about the Recycled Cotton market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary sources of recycled cotton fiber?

The two main sources are pre-consumer waste, consisting of textile scraps and clips generated during manufacturing, and post-consumer waste, which includes discarded used garments and household textiles collected through recycling programs. Post-consumer waste represents the greater challenge and highest growth opportunity.

How does chemical recycling differ from mechanical recycling in cotton processing?

Mechanical recycling physically shreds textiles into fibers, shortening their length, often requiring blending with virgin material. Chemical recycling uses solvents to dissolve the cellulose content, resulting in a purified pulp that can be spun into new fibers with quality and strength comparable to virgin cotton, suitable for high-end applications.

What regulatory frameworks are driving the demand for recycled cotton?

Demand is primarily driven by global regulatory shifts, including the European Union’s Circular Economy Action Plan, national Extended Producer Responsibility (EPR) schemes for textiles, and upcoming Ecodesign regulations which mandate higher sustainability standards and eventual recycled content quotas for products sold in major markets.

What are the main quality challenges associated with recycled cotton?

The primary challenges include reduced fiber length and strength in mechanically recycled cotton, which limits its application, and the difficulty of processing complex blended fabrics and removing diverse dyes and contaminants efficiently, particularly with post-consumer waste streams.

Which application segment holds the largest share in the Recycled Cotton Market?

The apparel sector holds the largest market share, driven by high-volume usage in items like denim, casual wear, and knitwear, owing to strong consumer demand for sustainable clothing and the ability of many mechanically recycled fibers to meet the standards required for these products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Post Consumer Yarns/Recycled Yarns Market Statistics 2025 Analysis By Application (Textiles, Packaging, Building Products, Industrial Use, Other), By Type (Recycled PET Yarns, Recycled Cotton Yarns, Recycled Nylon Fiber Yarns, Recycled Wool Yarns), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Post Consumer Yarns (Recycled Yarns) Market Statistics 2025 Analysis By Application (Clothing, Carpet, Car, Building), By Type (Recycled PET Yarns, Recycled Cotton Yarns, Recycled Nylon Yarn, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Recycle Yarn Market Statistics 2025 Analysis By Application (Carpet, Clothing, Car, Building), By Type (Recycled PET Yarn, Recycled Cotton Yarn, Recycled Nylon Yarn), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager