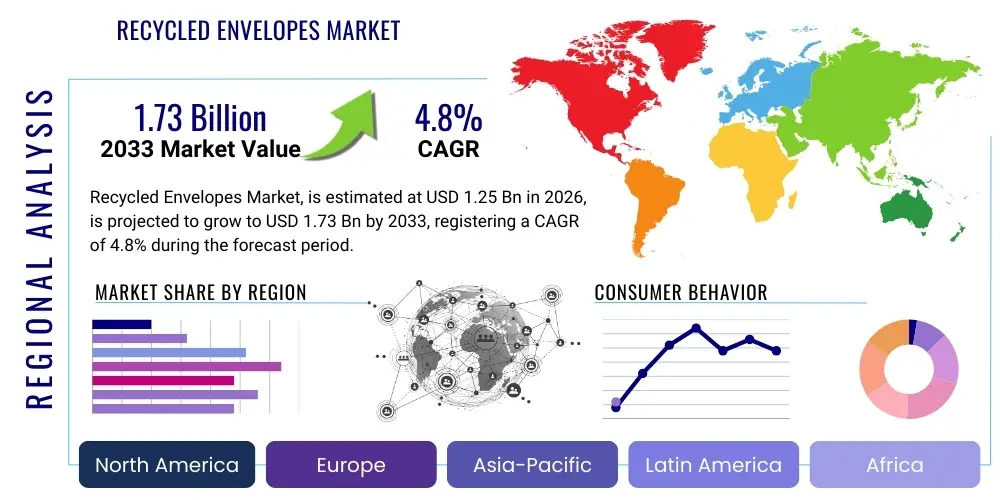

Recycled Envelopes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438901 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Recycled Envelopes Market Size

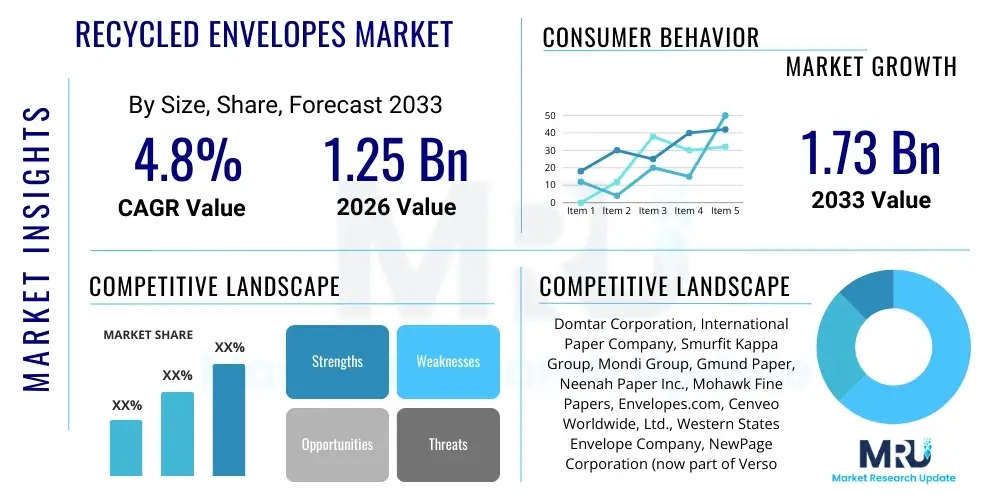

The Recycled Envelopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by stringent global environmental regulations, evolving corporate sustainability mandates, and increasing consumer awareness regarding the carbon footprint associated with paper products. The shift towards circular economy principles necessitates the adoption of recycled content in stationery and packaging, positioning recycled envelopes as a vital component in minimizing waste and conserving natural resources within the paper goods supply chain. Market expansion is further supported by innovations in pulping and de-inking technologies, improving the quality and aesthetic appeal of recycled paper stock, thus addressing previous industry concerns regarding durability and print quality, making these products viable alternatives to virgin fiber envelopes across various commercial and governmental applications.

Recycled Envelopes Market introduction

The Recycled Envelopes Market encompasses the production, distribution, and sale of envelopes manufactured entirely or partially from post-consumer waste (PCW) or post-industrial waste (PIW) paper fibers. These products serve diverse mailing, packaging, and archival applications across commercial, governmental, and personal sectors. The core product description centers on envelopes meeting specific environmental certifications, such as FSC Recycled or Blue Angel, distinguishing them from standard envelopes. Major applications span corporate correspondence, direct mail marketing, secure document transmission in the BFSI (Banking, Financial Services, and Insurance) sector, and sustainable packaging components for e-commerce shipments. A key benefit derived from using recycled envelopes is the significant reduction in demand for virgin wood pulp, leading to decreased deforestation, lower water consumption, and notably lower energy requirements during the manufacturing process compared to producing paper from scratch. This intrinsic environmental benefit positions recycled envelopes as a preferred choice for organizations aiming to adhere to rigorous ESG (Environmental, Social, and Governance) reporting standards and demonstrate corporate responsibility.

The operational landscape of the Recycled Envelopes Market is heavily influenced by the availability and stability of recovered paper feedstock, the efficiency of recycling infrastructure, and governmental procurement policies favoring sustainable goods. Driving factors include mandatory recycling targets implemented by major economies, the cost competitiveness achieved through mature recycling processes, and the rising consumer preference for sustainable brands, which pushes companies to adopt eco-friendly packaging across their operations. Furthermore, the increasing sophistication of recycled paper technology has allowed manufacturers to produce envelopes that match the performance characteristics—such as strength, opacity, and adhesive quality—of traditional envelopes, thereby removing functional barriers to adoption. This convergence of environmental pressure and technological advancement is accelerating market penetration across traditionally conservative sectors like healthcare and legal services, where document integrity is paramount.

While the fundamental purpose of an envelope remains constant—secure conveyance of contents—the recycled segment focuses intensely on maximizing resource efficiency and minimizing environmental impact. Manufacturers are continuously investing in research and development to enhance the percentage of PCW content without compromising quality, with many premium products now featuring 100% PCW material. The market introduction phase has long passed, transitioning into a growth and maturation phase characterized by product diversification, including various sizes, sealing mechanisms (gummed, self-seal, peel-and-seal), and specialized functionalities like padded or security-tinted recycled envelopes. The increasing regulatory emphasis on reducing single-use plastics also indirectly supports this market, as paper-based recycled envelopes offer a highly renewable and easily recyclable alternative for light-duty packaging and fulfillment, solidifying their long-term relevance in the global supply chain focused on sustainability metrics.

Recycled Envelopes Market Executive Summary

The Recycled Envelopes Market is experiencing robust acceleration driven primarily by global governmental mandates promoting sustainability and powerful shifts in corporate purchasing policies aligned with environmental stewardship. Business trends indicate a strong move toward supply chain transparency, with large corporations specifically demanding documented certifications regarding the recycled content source and manufacturing process of their stationery and packaging supplies. This trend is fostering innovation in high-percentage PCW utilization and pushing smaller market players to adopt standardized environmental reporting. Furthermore, cost efficiencies derived from economies of scale in paper recovery and processing, coupled with fluctuating virgin pulp prices, often make recycled options highly competitive, thereby lowering the barrier to entry for widespread corporate adoption. The executive outlook highlights that strategic partnerships between paper recycling mills and envelope converters will be crucial for maintaining quality consistency and meeting escalating demand, particularly within high-volume sectors like financial services and retail.

Regionally, the market is highly segmented, with North America and Europe leading in adoption rates due to mature recycling infrastructures and established regulatory frameworks such as the EU’s Circular Economy Action Plan and various state-level green procurement policies in the US. The Asia Pacific (APAC) region is forecasted to exhibit the highest growth CAGR, fueled by rapid urbanization, increasing industrial output, and growing environmental awareness in major economies like China and India, prompting government initiatives to curb pollution and promote resource efficiency. In contrast, emerging markets in Latin America and the Middle East and Africa (MEA) are characterized by nascent recycling infrastructure but represent substantial long-term opportunity as economic development drives higher paper consumption and simultaneous pressure for sustainable resource management increases. Successful penetration in these developing regions requires localized investment in paper collection and processing capabilities to ensure reliable feedstock supply.

Segment trends underscore the dominance of 100% Post-Consumer Waste (PCW) recycled content envelopes as the premium, high-growth category, driven by maximum environmental commitment from large institutional buyers. The application segment sees strong growth in e-commerce packaging, where lightweight, recyclable paper envelopes are replacing plastic mailers for non-fragile goods, directly leveraging consumer preference for sustainable delivery methods. Technology-wise, the self-seal and peel-and-seal product types, offering enhanced convenience and efficiency in high-speed mailing operations, continue to capture market share over traditional gummed envelopes, regardless of the recycled material used. The long-term executive summary conclusion is that the Recycled Envelopes Market is not a niche environmental market but a mandatory, integrated component of the global paper industry’s transformation towards verifiable circularity, offering both ethical and economic incentives for widespread participation.

AI Impact Analysis on Recycled Envelopes Market

User queries regarding AI's impact on the Recycled Envelopes Market frequently center on automation in manufacturing, predictive analytics for supply chain stability, and the indirect influence of digital transformation on paper usage volume. The primary concern is whether AI-driven digitization—such as automated invoicing, digital correspondence platforms, and advanced electronic document management—will ultimately reduce the overall volume of physical mail and, consequently, the demand for envelopes. Conversely, users are also keen on understanding how AI can optimize the recycling process itself, specifically in sorting recovered paper, predicting feedstock quality fluctuations, and managing logistics within complex, geographically dispersed recycling networks. The key theme summarized is a balanced view: AI presents a dual influence, potentially reducing overall paper demand through digitalization while simultaneously offering powerful tools to enhance the efficiency, cost-effectiveness, and quality control crucial for the sustainable manufacturing processes required in the recycled paper sector, thereby bolstering the long-term viability of high-quality recycled products against virgin alternatives.

- AI-driven optimization of paper sorting mechanisms enhances the quality and purity of recovered paper feedstock, crucial for high-grade recycled envelope production.

- Predictive maintenance analytics applied to envelope manufacturing machinery minimizes downtime and increases production efficiency, lowering the unit cost of recycled products.

- Advanced logistic modeling and route optimization minimize the carbon footprint associated with sourcing post-consumer waste and distributing finished envelopes.

- Natural Language Processing (NLP) tools assist large corporate clients in analyzing internal document flow, potentially reducing unnecessary physical mailings but focusing remaining envelope usage on critical, certified, and premium sustainable needs.

- AI-enabled demand forecasting improves inventory management for envelope converters, reducing waste and minimizing the risk of holding obsolete recycled stock.

- Computer vision systems are used for real-time quality control on high-speed envelope folding lines, ensuring superior consistency in recycled paper products compared to manual inspection.

DRO & Impact Forces Of Recycled Envelopes Market

The core dynamics of the Recycled Envelopes Market are shaped by a complex interplay of environmental regulatory drivers, supply chain constraints, and competitive forces. Drivers (D) are overwhelmingly linked to sustainability mandates, including governmental green procurement policies that often require a minimum percentage of recycled content in public sector stationary. Restraints (R) primarily revolve around the fluctuating quality and price volatility of recovered paper fiber, which can sometimes challenge the production consistency required for high-volume commercial contracts. Opportunities (O) emerge from technological advancements in de-inking and fiber restoration, enabling the utilization of lower-grade recycled inputs to produce high-quality envelopes, alongside untapped potential in emerging economies building out their recycling infrastructure. These three forces converge to dictate market potential and operational strategies, pushing manufacturers toward vertical integration or strong, long-term sourcing agreements to mitigate supply risks while maximizing the favorable demand environment created by ecological pressures.

Impact Forces, which include competitive intensity, buyer power, supplier power, threat of substitutes, and threat of new entrants (aligned with Porter's analysis), heavily influence the market structure. Supplier power, stemming from paper collection and recycling companies, is moderate to high, as the availability of consistent, certified high-quality PCW input is critical and sometimes scarce, particularly during periods of high demand. Buyer power is also significant, especially from large institutional buyers (BFSI, government) who leverage their volume to demand specific environmental certifications and price concessions. The threat of substitutes, largely coming from digital communication methods, remains a constant external pressure, although physical mail retains necessary utility for secure, legal, and formal communications. Competitive intensity within the manufacturing segment is moderate, focused primarily on efficiency, certification levels, and pricing, rather than radical product differentiation, given the commodity nature of envelopes.

The ongoing commitment to global decarbonization targets acts as a sustained macro-driver, fundamentally reshaping the procurement landscape across all sectors. This environmental imperative transforms the recycled envelope from an optional, premium product into a strategic necessity for organizations focused on achieving net-zero goals. However, the operational complexity associated with adhering to varied international standards for recycled content verification (e.g., European vs. North American definitions of PCW) introduces a bureaucratic restraint. Strategic opportunity lies in expanding product portfolios into specialized sustainable packaging where recycled paper is superior to plastic, such as internal cushioning or protective sleeves, broadening the application scope beyond traditional mailing. Ultimately, the market trajectory is dictated by the ongoing ability of the recycling infrastructure to scale reliably and cost-effectively to meet the rapidly expanding ethical demand for verified sustainable stationary, minimizing the impact of short-term price volatility associated with raw recovered fiber.

Segmentation Analysis

The Recycled Envelopes Market segmentation provides a granular view of consumer preferences, operational requirements, and strategic growth pockets across various dimensions. Key segmentation criteria include the percentage and source of recycled material used, the physical product format and features, the application sector, and the geographic distribution of demand. Understanding these segments is critical for manufacturers to tailor their production capabilities and marketing efforts, focusing, for instance, on high-margin 100% PCW security envelopes required by the healthcare sector or focusing on cost-effective mixed recycled content standard commercial envelopes for general corporate use. The analysis highlights that market maturity varies significantly across segments, with North American and European markets demonstrating high penetration in specialized, high-recycled-content segments, while developing regions still prioritize mixed-content or lower PCW percentage products based on immediate cost considerations and available local fiber supply. Furthermore, the segmentation by product type reveals a continuous evolution towards convenience, with peel-and-seal and window envelopes maintaining strong growth within the recycled category due to their high adoption in automated mailing processes.

- By Material Type:

- 100% Post-Consumer Waste (PCW)

- Mixed Recycled Content (e.g., 30% PCW, 50% PCW, 80% PCW)

- Post-Industrial Waste (PIW)

- By Product Type:

- Standard Commercial Envelopes (e.g., #10, #9)

- Window Envelopes

- Booklet and Catalog Envelopes (Larger Formats)

- Specialty Envelopes (Security Tinted, Padded Mailers)

- Self-Seal and Peel-and-Seal Envelopes

- Gummed Envelopes

- By Application:

- Corporate Correspondence and Office Use

- Direct Mail Marketing (DMM)

- Transactional Mail (Invoices, Statements)

- E-commerce and Fulfillment Packaging

- Archival and Storage

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Healthcare and Pharmaceuticals

- Retail and E-commerce

- Education and Non-Profit Organizations

- Corporate Offices and Services

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Recycled Envelopes Market

The Value Chain for the Recycled Envelopes Market begins with the upstream processes centered on raw material acquisition and preparation, which is significantly more complex than that for virgin fiber products. Upstream analysis focuses on the procurement of recovered paper (PCW and PIW), including collection, sorting, baling, and transportation to recycling mills. Key challenges upstream include managing contamination levels in recovered fiber, ensuring the consistent volume required for large-scale production, and the significant energy and water resources needed for the de-inking and repulping processes. The midstream involves the core manufacturing process: conversion of recycled paper pulp into paper stock, followed by high-speed converting (die-cutting, folding, gumming/sealing application) to form the finished envelopes. Efficiency in this stage—minimizing trim waste and maximizing converting speed—is paramount to maintaining competitive pricing against non-recycled alternatives. Technology integration, particularly in adhesive formulation and paper handling, determines the final product quality and durability, which are critical differentiators in the commercial market.

The downstream analysis focuses on the distribution and end-use application segments. Distribution channels are varied, encompassing direct sales to large corporate and governmental clients (high-volume, highly specified contracts), sales through office supply wholesalers and distributors (broad market reach), and increasingly, direct-to-consumer sales via e-commerce platforms for small businesses and personal use. Direct channels typically offer higher margins and tighter control over product specification and quality assurance, which is vital for maintaining environmental certifications. Indirect channels maximize volume reach and rely heavily on the promotional efforts of the retail and wholesale partners. The end-use segment involves integration into customer mailing systems, ranging from sophisticated, automated inserting machines used by BFSI companies to manual office handling, emphasizing the need for envelopes to perform reliably across diverse operational settings.

The distribution channel dynamics are rapidly evolving, characterized by a preference for efficient, traceable logistics, which aligns with the sustainability mandate of the product itself. Major e-commerce retailers, acting as end-users, increasingly demand customized fulfillment solutions, pushing envelope manufacturers to integrate recycled paper products into packaging supply chains. This blurring of lines between traditional stationary and packaging is a critical trend. Direct and indirect sales balance is shifting: while large governmental tender contracts remain highly lucrative direct sales opportunities, the proliferation of centralized corporate purchasing portals often funnels orders through large indirect office supply distributors. Successful market penetration therefore requires robust channel management, supporting both direct contract negotiation capabilities and seamless integration into major global office supply chains, ensuring product availability and adherence to localized environmental labeling requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.73 Billion |

| Growth Rate | CAGR 4.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Domtar Corporation, International Paper Company, Smurfit Kappa Group, Mondi Group, Gmund Paper, Neenah Paper Inc., Mohawk Fine Papers, Envelopes.com, Cenveo Worldwide, Ltd., Western States Envelope Company, NewPage Corporation (now part of Verso), Southworth Company, Wausau Paper (now part of Domtar), Tension Corporation, Environmental Paper Company, Paper Mart, Supreme Envelopes Pvt. Ltd., Guangzhou Siyuan Paper Co., Ltd., Asia Pulp & Paper (APP), Sonoco Products Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Envelopes Market Potential Customers

The potential customer base for recycled envelopes is expansive, encompassing any entity with significant outgoing physical correspondence or light packaging needs, but is increasingly focused on large organizations with rigorous sustainability mandates and high volumes. Primary end-users fall into distinct categories, including institutional buyers like government agencies and educational institutions, which are often legally bound by green procurement policies to favor recycled content. A second major segment is the Banking, Financial Services, and Insurance (BFSI) sector, which relies heavily on transactional mail (statements, notices) requiring high security and integrity, yet simultaneously needs to demonstrate commitment to ESG criteria to satisfy investors and regulators. These high-volume customers demand robust, security-tinted, 100% PCW envelopes that can withstand high-speed automated mailing equipment, prioritizing quality and reliability alongside environmental benefits.

A rapidly growing customer segment is the Retail and E-commerce industry. As online fulfillment expands, there is increasing pressure to replace plastic poly mailers and conventional packaging with sustainable, easily recyclable alternatives. Recycled paper envelopes, particularly larger catalog and padded mailer formats, address this need directly, aligning the brand’s sustainability message with the delivery experience. These buyers prioritize cost-effectiveness for mass-volume shipments, lightweight design to minimize postage, and strong resistance to tearing during transit. Furthermore, Corporate Offices and Professional Services (legal, consulting, accounting) represent reliable mid-volume customers who integrate recycled stationery as a fundamental component of their internal sustainability policies and client-facing branding, signaling environmental responsibility through every piece of correspondence.

Targeting these diverse customer groups necessitates tailored sales strategies. For government and large BFSI institutions, the focus is on long-term contract negotiation, demonstrating verifiable third-party certification (e.g., FSC Recycled, post-consumer content verification) and guaranteeing stable supply volumes. For the e-commerce sector, the value proposition centers on performance, customized branding opportunities on the recycled surface, and seamless integration into existing packaging lines. The increasing market transparency regarding product carbon footprints and lifecycle assessment scores means that potential buyers are no longer merely looking for the word "recycled," but are actively seeking high-percentage PCW content verified by stringent audit trails, positioning manufacturers who can provide this detailed documentation at a significant competitive advantage in winning large tenders and securing long-term customer loyalty across all major purchasing segments.

Recycled Envelopes Market Key Technology Landscape

The technology landscape for the Recycled Envelopes Market is primarily focused on two critical areas: optimizing the conversion of recovered fiber into high-quality paper stock, and enhancing the efficiency and features of the envelope manufacturing process itself. In fiber conversion, advanced de-inking technologies, including flotation and washing systems coupled with enzymatic treatments, are essential to remove contaminants and residual inks from recovered paper, enabling the production of bright, clean paper from lower-grade or highly-printed feedstock. Furthermore, sophisticated fiber fractionation and strength additives (e.g., starch, synthetic polymers) are utilized to compensate for the shorter, weaker fibers inherent in recycled pulp, ensuring the finished envelope exhibits high tensile strength and burst resistance required for automated mailing machinery and secure content delivery. These technological improvements are crucial for overcoming the historical perception that recycled paper is inferior in quality or performance to virgin paper stock, directly supporting market expansion into demanding applications.

In the envelope manufacturing stage (converting), the key technologies center on high-speed automation and precise application of functional features. Modern envelope converting machines incorporate sensor technology and AI-driven quality control systems to handle recycled paper, which can sometimes have greater variability than virgin stock, ensuring consistent folding, window patching, and adhesive application at speeds exceeding 1,000 envelopes per minute. Significant technological advancements have been made in adhesive formulation, particularly for the self-seal and peel-and-seal strips. Manufacturers are developing environmentally friendly, water-based, or fully recyclable adhesives that maintain strong sealing integrity without compromising the recyclability of the entire envelope after use. This focus on "design for recycling" is a critical technological pivot, ensuring the product aligns perfectly with circular economy objectives and remains compatible with standard municipal recycling systems.

The overarching technological trend involves the integration of monitoring and tracing systems throughout the value chain to provide verifiable sustainability metrics. Digital platforms leveraging blockchain or advanced data logging are being introduced to track the origin of the PCW fiber and document the energy and water consumption involved in the conversion process. This technological transparency is becoming mandatory, allowing manufacturers to furnish the detailed environmental data required by major governmental and corporate buyers for ESG reporting and compliance purposes. Consequently, investment in robust data infrastructure and certified process technologies, rather than just incremental increases in production speed, defines the competitive edge in the current Recycled Envelopes Market landscape, ensuring both high performance and validated sustainability claims.

Regional Highlights

- North America: This region is characterized by high market maturity, strong corporate adoption driven by brand image and internal sustainability goals, and robust, localized recycled fiber sourcing networks, particularly in the US and Canada. Government mandates, like specific requirements for PCW content in federal purchases, solidify stable demand. The market here leads in the adoption of specialized, high-security recycled envelopes for the BFSI and Healthcare sectors, necessitating investments in advanced security tinting and robust seal technologies. Continuous innovation focuses on achieving 100% PCW content while maintaining the brightest white paper options, targeting premium market segments willing to pay a premium for verified sustainability.

- Europe: Europe is the global leader in regulatory influence, driven by the EU’s ambitious Circular Economy Action Plan, which imposes stringent targets for material recovery and waste reduction. The market exhibits high fragmentation, with strong regional specialization; for example, Nordic countries excel in sustainable forestry and pulp recovery, while Central Europe dominates in advanced envelope converting technologies. Consumer awareness is exceptionally high, pushing retail and packaging applications (e-commerce mailers) towards rapid adoption of recycled materials. Key regional drivers include schemes like the Blue Angel certification, which sets a high benchmark for environmental performance and recycled content verification, significantly influencing purchasing decisions across the continent.

- Asia Pacific (APAC): APAC represents the fastest-growing region, fueled by rapid industrial expansion, increasing disposable incomes, and improving governmental commitments to environmental protection, particularly in rapidly urbanizing nations like China, India, and Southeast Asia. While the recycling infrastructure remains inconsistent across the vast region, significant governmental and private investment is targeting large-scale paper collection and processing facilities. Demand growth is concentrated in the transactional mail sector (driven by banking and burgeoning e-commerce), where cost-competitive, slightly lower-percentage recycled content envelopes are gaining traction, creating massive volume opportunities for multinational manufacturers establishing local production hubs.

- Latin America (LATAM): The LATAM market is currently characterized by emerging infrastructure and a reliance on imported recycled paper stock in some areas, though local initiatives are gaining momentum, particularly in countries like Brazil and Mexico, which possess significant natural resource bases. Market adoption is primarily driven by large international corporations operating regional headquarters that adhere to global sustainability policies. The primary challenge is the inconsistent quality and price volatility of locally sourced recovered paper, which necessitates strategic partnerships or vertical integration to ensure stable supply and product quality compliance for high-volume customers.

- Middle East & Africa (MEA): MEA is the smallest but highly prospective market, driven by infrastructural investments and large governmental projects (e.g., Vision 2030 initiatives in Saudi Arabia) prioritizing sustainability and localization of supply chains. While paper consumption per capita is lower compared to developed regions, the rapid growth in commercial sectors, particularly retail, banking, and real estate, is creating new demand for certified recycled stationery. Market development requires significant initial investment in paper collection and recycling infrastructure, often necessitating technology transfer and joint ventures with experienced international paper manufacturers to establish viable, high-quality recycled envelope production capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Envelopes Market.- Domtar Corporation

- International Paper Company

- Smurfit Kappa Group

- Mondi Group

- Gmund Paper

- Neenah Paper Inc.

- Mohawk Fine Papers

- Envelopes.com

- Cenveo Worldwide, Ltd.

- Western States Envelope Company

- NewPage Corporation (now part of Verso)

- Southworth Company

- Wausau Paper (now part of Domtar)

- Tension Corporation

- Environmental Paper Company

- Paper Mart

- Supreme Envelopes Pvt. Ltd.

- Guangzhou Siyuan Paper Co., Ltd.

- Asia Pulp & Paper (APP)

- Sonoco Products Company

Frequently Asked Questions

Analyze common user questions about the Recycled Envelopes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Recycled Envelopes Market?

The primary market driver is stringent global governmental regulation and the increasing implementation of corporate Environmental, Social, and Governance (ESG) policies. These factors mandate the use of products with lower environmental footprints, pushing procurement departments towards high Post-Consumer Waste (PCW) recycled content stationery to meet sustainability targets and comply with public procurement guidelines favoring eco-friendly goods.

How does the quality of recycled envelopes compare to virgin fiber envelopes?

Modern recycled envelopes, especially those utilizing advanced de-inking and fiber strengthening technologies, meet or exceed the performance specifications (opacity, durability, printability) of standard virgin fiber envelopes. Premium 100% PCW products are engineered for use in high-speed automated mailing equipment, ensuring reliable operation without compromising on the aesthetics or integrity required for professional correspondence.

What role do certifications play in purchasing decisions for recycled envelopes?

Certifications are paramount, acting as verifiable proof of sustainability claims. Buyers, particularly large institutions and governments, prioritize products carrying certifications such as FSC Recycled, Blue Angel, or third-party verified PCW content percentages. These certifications minimize the risk of greenwashing and ensure the product contributes demonstrably to resource conservation and circular economy objectives.

Which end-use industry is projected to be the largest consumer of recycled envelopes?

The Banking, Financial Services, and Insurance (BFSI) sector, along with Government and Public Sector entities, consistently represent the largest consumption segments. Their high volume of transactional and official mail, combined with strict regulatory compliance requirements regarding sustainability and security, drives sustained high demand for large volumes of security-tinted, reliably high-PCW content envelopes.

What is the main challenge facing the stable supply chain of recycled envelopes?

The primary challenge is the fluctuating quality and price volatility of recovered paper feedstock (PCW). Variations in the global supply and the contamination levels of collected waste paper directly impact the consistency and cost of manufacturing high-grade recycled pulp, requiring manufacturers to invest heavily in advanced sorting and purification technologies to stabilize their input supply chain and maintain quality output.

The overall market trajectory remains highly positive, underpinned by an irreversible global trend toward circular economy models and verified corporate sustainability, ensuring the Recycled Envelopes Market continues its evolution from a niche category to a mainstream industry standard.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager