Recycled Glass Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431437 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Recycled Glass Fiber Market Size

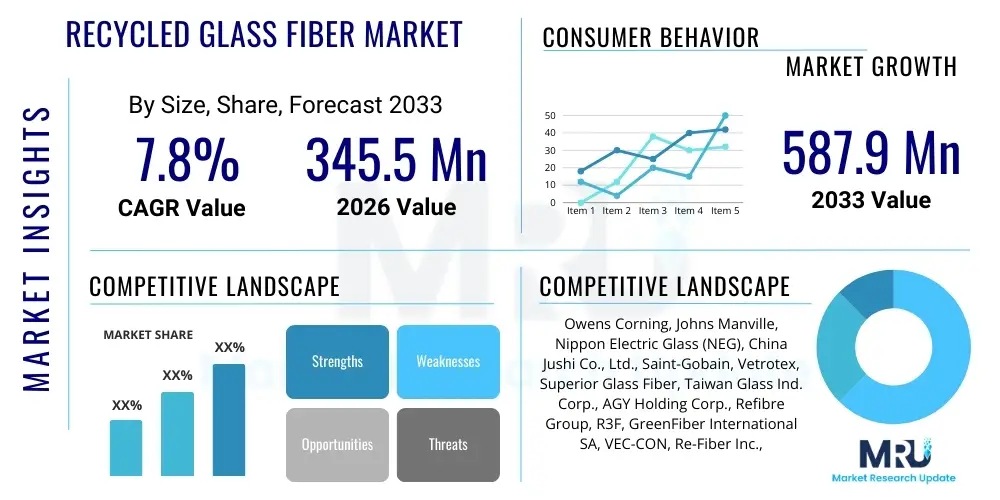

The Recycled Glass Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 345.5 million in 2026 and is projected to reach USD 587.9 million by the end of the forecast period in 2033.

Recycled Glass Fiber Market introduction

The Recycled Glass Fiber market encompasses the production, processing, and application of glass fibers derived from post-consumer or post-industrial waste glass. This market is fundamentally driven by the global imperative toward circular economy practices and sustainable material sourcing, offering an environmentally conscious alternative to virgin glass fibers. Recycled glass fibers maintain excellent mechanical properties, thermal stability, and chemical resistance, making them suitable for demanding industrial applications. The primary raw material sources include construction and demolition waste, end-of-life vehicles, and rejected glass production scraps, which are meticulously cleaned and processed through specialized melting or milling techniques to create new fibers. The utilization of these fibers significantly reduces the energy intensity associated with traditional glass manufacturing and minimizes landfill waste, positioning the market as a crucial component of green manufacturing strategies across developed and emerging economies.

Recycled Glass Fiber Market Executive Summary

The Recycled Glass Fiber Market is undergoing robust expansion, largely fueled by widespread industrial adoption of circular economy models and heightened regulatory pressures concerning waste management. Business trends indicate a strong move towards vertical integration among key players, focusing on securing consistent waste glass supply chains and investing heavily in advanced pyrolysis and milling technologies to improve fiber characteristics. Strategic collaborations between waste management firms and composite manufacturers are becoming common, aiming to optimize processing efficiency and tailor recycled fibers for specific performance requirements in specialized markets like aerospace and high-performance automotive components. Technological innovation centered around creating high-modulus and high-strength recycled fibers that can directly replace premium virgin fibers is a defining trend, alongside the development of bio-based resins compatible with these sustainable reinforcements. This integration drives down embodied energy and positions the industry favorably within stringent ESG reporting frameworks.

Regionally, Europe stands as the dominant market, driven by the implementation of ambitious recycling targets set by the European Union and strong consumer awareness regarding sustainability. Germany, France, and the Netherlands lead in terms of both processing capacity and end-use application development, especially within the construction and wind power industries. Asia Pacific, particularly China and India, is emerging as the fastest-growing region, stimulated by rapid urbanization, massive infrastructure projects, and increasing domestic governmental investment in resource efficiency and pollution control. North America exhibits mature adoption, particularly in automotive and insulation sectors, underpinned by robust governmental research grants and tax incentives promoting the use of sustainable composites in manufacturing, with a focus on closed-loop systems for large waste generators.

Segment trends reveal that the Short Cut Fibers segment holds the largest volume share, primarily due to their extensive use in plastics reinforcement, concrete additives, and non-woven mats across various consumer and industrial goods. However, the continuous strand segment is anticipated to register the highest growth rate, driven by escalating demand for advanced, high-performance composites in structural applications where long fibers provide superior strength and stiffness, such as in the expanding offshore wind energy sector and specialized piping. By application, the Construction segment maintains market dominance, given the scale of material consumption, while the Automotive and Transportation segment is experiencing accelerated growth due to stringent emissions standards requiring lighter, more sustainable component materials. Furthermore, the increasing complexity of recycled materials mandates specialized processing, leading to significant growth in the niche processing and consulting services segment focused on quality assurance, material traceability, and optimizing material-specific recycling routes.

AI Impact Analysis on Recycled Glass Fiber Market

User queries regarding the impact of Artificial Intelligence (AI) on the Recycled Glass Fiber Market often center on optimizing the complex recycling supply chain, improving material purity, and predictive quality control. Key themes include: How can AI enhance sorting efficiency to guarantee high-quality glass feedstock for fiber production? What role does Machine Learning (ML) play in modeling the properties of recycled glass fibers to ensure performance consistency across diverse applications? And can AI-driven predictive maintenance reduce downtime and optimize energy expenditure in energy-intensive melting and milling processes? Users are keenly concerned about bridging the historical performance gap between recycled and virgin fibers; they expect AI to provide the technological leap necessary to standardize recycled product quality, making it reliably interchangeable with primary resources. The overarching expectation is that AI will introduce unprecedented precision, transforming recycled glass fiber manufacturing from a variable batch process into a consistent, high-yield operation capable of meeting rigorous industrial specifications, thus dramatically accelerating market acceptance and growth.

The implementation of AI and ML is revolutionizing the upstream segment of the Recycled Glass Fiber market by significantly improving the accuracy and speed of glass waste segregation. Advanced computer vision systems, powered by deep learning algorithms trained on massive datasets of glass compositions, are capable of instantly identifying minute differences in glass types (e.g., soda-lime, borosilicate, leaded glass) and highly problematic contaminants (ceramics, metals, plastics) on high-speed conveyor belts. This meticulous sorting process is crucial because impurities severely degrade the quality of the resulting glass fiber, leading to fiber breakages, inconsistent melt viscosity, and failure in the drawing process. By automating and perfecting contamination removal with precision previously unattainable by human or mechanical sorting methods, AI ensures a highly refined cullet suitable for high-temperature fiberization. This technological leap enhances the overall feedstock yield and purity, directly contributing to the mechanical performance and thermal properties of the final recycled product, thereby enabling its use as a viable substitute for virgin materials in more critical structural applications.

Downstream, AI is instrumental in process optimization during the energy-intensive fiber manufacturing stage itself. Machine learning models utilize real-time sensor data—measuring critical parameters such as furnace temperature, melt viscosity, drawing speed, fiber diameter variation, and cooling rates—to continuously and dynamically adjust manufacturing variables. This capability not only minimizes defects and material waste but also significantly reduces the energy consumption per unit of fiber produced, aligning the recycled product with core sustainability goals. Furthermore, AI-driven digital twin simulations allow manufacturers to predict the structural and fatigue performance of new composite formulations reinforced with recycled fibers under various long-term stress conditions, accelerating product development cycles and reducing the need for extensive physical prototyping and destructive testing. This seamless integration of digital modeling and predictive analytics significantly lowers operational costs, enhances market responsiveness, and strengthens the competitive positioning of recycled glass fiber manufacturers relative to their traditional counterparts.

- AI-enhanced optical sorting algorithms increase cullet purity and feedstock consistency by identifying contaminants at high speeds, critical for producing high-grade fiber.

- Machine Learning models optimize the energy-intensive melting and drawing processes in real-time, reducing variable production costs and energy consumption.

- Predictive quality control systems utilize sensor data to ensure batch-to-batch consistency in fiber dimensional and mechanical property specifications, improving end-user confidence.

- Computer vision systems automate the early detection and removal of detrimental ceramic, porcelain, and stone (CPS) contaminants, improving overall recycling yield and furnace lifespan.

- Digital twin simulations accelerate the development of new recycled composite materials by accurately predicting long-term performance characteristics and optimal fiber sizing compatibility.

- AI-driven supply chain logistics enhance the traceability, transparency, and reliable sourcing of complex post-consumer and post-industrial glass waste streams.

- Predictive maintenance schedules, informed by ML analysis of equipment performance, minimize unscheduled downtime on high-cost fiber drawing and milling equipment, improving production reliability and efficiency.

DRO & Impact Forces Of Recycled Glass Fiber Market

The market dynamics of recycled glass fiber are shaped by a complex interplay of environmental regulatory drivers, technological limitations, economic incentives, and evolving industrial standards. The primary drivers are rooted in the global push for sustainability, specifically mandating higher recycling rates and favoring materials with lower carbon footprints, making recycled fibers highly desirable in the construction and automotive sectors. This regulatory push is particularly evident in the European Union, where directives focused on waste reduction and resource efficiency create a guaranteed market for recycled content, forcing industries to restructure their supply chains. Furthermore, the inherent economic benefit derived from utilizing cost-effective waste glass cullet instead of expensive, energy-intensive virgin raw materials provides a compelling financial incentive, especially in periods of high global energy price volatility. The convergence of environmental necessity and economic advantage forms the foundational support structure for the market's sustained expansion over the forecast period, encouraging long-term investment in recycling infrastructure and processing technology advancements.

The market faces significant restraints, chiefly related to the challenge of consistently sourcing high-purity waste glass. Mixed-stream recycling often introduces contaminants—such as ceramics, porcelain, stones (CPS), and metallic inclusions—that dramatically affect the melting process and negatively compromise the mechanical and thermal performance of the resulting fiber. Addressing these impurity concerns necessitates high initial capital expenditure in advanced sorting and cleaning equipment, which can be prohibitive for smaller market entrants. Another critical restraint is the perception of performance variability; despite technological improvements, some high-specification end-users, particularly in aerospace and high-stress structural engineering, remain cautious about adopting recycled fibers in critical applications where guaranteed, uniform consistency, traditionally offered by virgin fibers, is non-negotiable. Overcoming this perception requires robust quality control protocols and standardized certification processes across the entire supply chain, which adds complexity and cost.

Opportunities lie in developing proprietary processing technologies that can handle lower-grade cullet while still achieving acceptable fiber specifications, effectively broadening the usable feedstock base. This includes innovations in low-temperature chemical recycling or advanced mechanical processes that require less energy, thus improving the overall environmental profile. Furthermore, the market can significantly expand its addressable space by strategically penetrating specialized, high-value fields like additive manufacturing (3D printing filaments) and high-performance aerospace composites, where sustainability metrics are increasingly impacting procurement decisions. The global trend towards electric vehicle manufacturing presents a massive opportunity, as recycled glass fibers offer lightweight, sustainable solutions for composite battery enclosures and thermal management systems, aligning perfectly with the industry's need for efficiency and environmental compliance. Successful firms will leverage these opportunities by establishing strong technical partnerships with downstream innovators and aggressively certifying the full life-cycle benefits of their products.

- Drivers:

- Stricter governmental regulations promoting circular economy models, particularly in developed regions like Europe.

- Growing industrial demand for materials with low embodied energy and verifiable reduced carbon footprint across all composite sectors.

- Cost advantage derived from utilizing waste cullet, offering insulation from high and volatile energy costs associated with virgin production.

- Increasing corporate focus on stringent Environmental, Social, and Governance (ESG) reporting and sustainable sourcing commitments.

- Strong consumer preference for products incorporating recycled and sustainable content, influencing brand reputation.

- Restraints:

- Challenges in consistently sourcing large volumes of high-quality, contaminant-free glass cullet feedstock suitable for fiberization.

- Potential variability in the mechanical properties and batch-to-batch consistency of recycled fibers compared to premium virgin fibers.

- High capital expenditure required for establishing advanced glass sorting, refining, and specialized fiberization infrastructure.

- Competition from alternative natural fibers (e.g., basalt, hemp, flax) and advanced carbon fiber recycling technologies.

- Logistical complexities and costs associated with collecting, transporting, and centrally processing scattered glass waste.

- Opportunities:

- Technological breakthroughs allowing the efficient utilization of lower-grade or mixed glass waste streams through innovative processing.

- Expansion into high-value applications such as 3D printing filaments, specialized acoustic barriers, and next-generation battery components.

- Development of customized recycled fiber grades tailored for specific performance attributes (e.g., enhanced thermal performance or specialized chemical resistance).

- Untapped growth potential in developing economies prioritizing rapid, sustainable infrastructure development and waste reduction mandates.

- Formation of closed-loop recycling systems with major industrial glass users (e.g., beverage and automotive manufacturers).

Segmentation Analysis

The Recycled Glass Fiber market is primarily segmented based on the type of fiber (short cut, continuous, milled), the source of the waste glass (post-consumer, post-industrial, C&D waste), the recycling technology employed (melting and drawing, mechanical grinding), and the final application industry (construction, automotive, wind energy, marine). Understanding these segmentations is critical for market participants to tailor their processing capabilities and product offerings to specific end-user demands, especially concerning fiber length, surface treatment requirements, and purity certifications. The complexity of recycled feedstock necessitates specialized segmentation to ensure performance parity with virgin materials; for instance, high-performance applications usually require fibers derived from strictly controlled, high-purity post-industrial waste streams processed via high-temperature melting, whereas insulation and filler applications often utilize lower-grade post-consumer cullet processed via high-volume grinding or milling.

The segmentation by application reveals the dominant role of the Construction and Infrastructure sector, driven by the massive volume of materials required for insulation, non-structural reinforcement, fireproofing, and specialized concrete additives. This sector demands cost-effective, high-volume materials, making short cut and milled fibers the primary products consumed. However, the fastest-growing segment is the high-value Automotive and Transportation industry, where recycled glass fibers provide a lightweight, sustainable option for composite panels, interiors, and critical battery enclosures in electric vehicles (EVs). The demand in this segment is shifting towards continuous strand and customized chopped fibers that offer high strength-to-weight ratios, ensuring performance while meeting stringent environmental targets set by global OEMs, indicating a significant premiumization trend within the recycled market.

The importance of segmentation by fiber type cannot be overstated, as it dictates suitability for specific manufacturing processes and final product performance. Short cut fibers, typically ranging from 3mm to 12mm, are favored in high-speed manufacturing processes such as injection molding and extrusion, offering ease of incorporation and excellent reinforcement in thermoplastic and thermoset polymers for mass-market goods. Continuous strand fibers (rovings), used primarily for weaving, pultrusion, or filament winding, provide maximum structural integrity and are crucial for applications such as composite pipes, pressure vessels, and large wind turbine blades, representing the premium, high-growth end of the recycled market. Strategic positioning within these distinct segments allows manufacturers to capture specific market niches, focusing either on high-volume, cost-sensitive markets requiring mechanical grinding output or on low-volume, high-performance structural applications where material traceability and certified sustainability are paramount selling points.

- By Fiber Type:

- Short Cut Fibers (Chopped Strands): Dominant volume, used in plastics, concrete, and non-woven mats.

- Continuous Strand Fibers (Rovings): Highest growth, crucial for structural composites like wind turbine blades and pressure vessels.

- Milled Fibers (Powder/Filler): Used extensively in coatings, sealants, and low-stress polymer compounding applications.

- By Source:

- Post-Consumer Waste: Large volume source, but higher impurity levels require advanced sorting.

- Post-Industrial Waste: Lower volume but higher purity, preferred for high-performance continuous fibers.

- Construction & Demolition (C&D) Waste: Significant source, mainly utilized for lower-grade insulation products and milled fiber applications.

- By Application:

- Construction & Infrastructure: Largest consumer base (insulation, concrete additives, fireproofing).

- Automotive & Transportation: High-growth segment (lightweight composite parts, EV battery enclosures).

- Wind Energy: Structural applications requiring high-modulus continuous fibers for turbine blades.

- Marine Composites: Used in boat hulls, decks, and structural components requiring durability and corrosion resistance.

- Aerospace & Defense: Niche application focusing on certified, high-ppurity fibers for non-critical structures.

- Pipes & Tanks: Used for corrosion-resistant filament-wound composite structures in chemical processing.

- By Recycling Technology:

- Melting and Drawing: Yields high-quality fibers suitable for structural composites, but energy-intensive.

- Mechanical Grinding/Milling: Low energy consumption, produces filler materials and powders.

- Advanced Chemical Pre-treatment/Depolymerization: Emerging specialized techniques for contaminant removal and material separation.

Value Chain Analysis For Recycled Glass Fiber Market

The value chain for the Recycled Glass Fiber Market begins decisively with the upstream sourcing and meticulous processing of waste glass cullet. This initial stage involves the complex logistics of collection (from municipal recycling centers, industrial scrap yards, or C&D sites), followed by advanced sorting, cleaning, and crushing to produce high-purity feedstock ready for the furnace. Challenges in the upstream segment revolve critically around guaranteeing chemical purity and particle consistency, as residual impurities like ceramics, stones, or refractories severely disrupt the fiberization process. Key players in this segment are waste management conglomerates and specialized glass processing firms who utilize sophisticated magnetic separators, eddy current systems, and increasingly, AI-driven optical sorting technologies. The economic feasibility of the entire chain relies heavily on minimizing the energy and transportation costs associated with handling the bulky raw material, driving a geographical co-location strategy where fiber producers establish facilities close to major waste generation hubs and large industrial consumers.

The midstream stage represents the core manufacturing process, involving the transformation of the refined cullet into high-performance glass fibers, either through energy-intensive melting and high-speed drawing processes (yielding continuous strands) or through high-precision mechanical milling for filler applications. This stage adds the highest value, necessitating substantial capital investment in specialized furnaces, precision bushings, and proprietary expertise in fiber sizing chemistry—the surface treatment required to ensure optimal adhesion between the fiber and diverse composite matrix materials (e.g., epoxy, polyester, vinyl ester, thermoplastics). Manufacturers often tailor their process parameters based on the specific end-use application, such as optimizing fiber diameter for structural integrity or altering sizing for chemical resistance, which requires highly technical staff and stringent quality controls to manage recycled input variability.

The downstream segment consists of the diverse end-user industries utilizing the manufactured recycled glass fibers for creating final products, spanning sectors such as automotive components, high-performance insulation boards, specialized concrete mixtures, and composite wind turbine blades. Distribution channels are hybridized: large, integrated composite manufacturers often procure directly through long-term supply agreements (direct channel) to ensure material traceability and specifications. Conversely, smaller fabricators, compounders, and construction firms rely on specialized material distributors (indirect channel) who provide inventory management and smaller, tailored product batches. Major customers now prioritize suppliers who can demonstrate full environmental traceability, consistent mechanical performance, and compliance with increasingly demanding corporate sustainability targets, making technical support and transparent life-cycle analysis a required part of the product offering, thereby influencing the entire upstream operation.

Recycled Glass Fiber Market Potential Customers

The potential customers for recycled glass fibers are extensive and strategically aligned with industries where lightweighting, structural integrity, thermal efficiency, and environmental sustainability are paramount operational requirements. The largest volume consumers remain infrastructure and construction companies, encompassing major contractors, insulation manufacturers, and concrete admixture producers. These buyers purchase recycled fibers for applications such as fiberglass insulation manufacturing (thermal and acoustic), specialized fire-resistant panels, and non-structural reinforcement in cementitious products. These customers are highly sensitive to cost-effectiveness and require strict adherence to regulatory standards (e.g., LEED certification compliance, building codes) related to recycled content. The pervasive global demand for energy-efficient buildings and sustainable civil engineering projects ensures that this sector remains the foundational and primary buyer, demanding mostly short-cut and milled fibers, often procured through large, predictable tenders.

Another rapidly growing and increasingly influential customer base lies within the Automotive and Transportation industry, including global Original Equipment Manufacturers (OEMs) and their Tier 1 and Tier 2 suppliers. These sophisticated buyers utilize continuous and high-performance short-cut recycled glass fibers in advanced composite materials for applications such as instrument panels, structural components (e.g., bumper beams), lightweight underbodies, and, critically, robust battery housing components in the burgeoning electric vehicle (EV) market. Their primary motivations are dual: reducing overall vehicle weight to meet stringent fuel economy and emissions standards, alongside aggressively meeting internal corporate sustainability goals. This customer segment demands performance parity with virgin materials and superior life-cycle assessment (LCA) data, making quality-certified, high-modulus recycled fibers highly attractive alternatives to traditional or high-carbon footprint materials.

Furthermore, specialized industrial sectors such as wind energy generation and high-performance marine composites represent substantial, high-growth potential customers. Wind turbine manufacturers require extremely high-strength, low-density materials for blade production, and the use of recycled glass fibers significantly enhances the sustainability profile of their products, which is a major deciding factor in government procurement contracts and public energy projects. Similarly, manufacturers of industrial chemical storage tanks, high-pressure pipes, and leisure boats require exceptional corrosion resistance and durability, making them reliable, high-specification buyers of recycled glass fiber rovings, mats, and woven fabrics. These customers impose the most stringent quality control requirements and long-term performance guarantees, favoring suppliers who can provide detailed material traceability and certified environmental documentation for critical structural applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345.5 Million |

| Market Forecast in 2033 | USD 587.9 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Owens Corning, Johns Manville, Nippon Electric Glass (NEG), China Jushi Co., Ltd., Saint-Gobain, Vetrotex, Superior Glass Fiber, Taiwan Glass Ind. Corp., AGY Holding Corp., Refibre Group, R3F, GreenFiber International SA, VEC-CON, Re-Fiber Inc., Glass Fiber Technologies LLC, PPG Industries, Jiangsu Changhai Composite Materials Co., Ltd., Taishan Fiberglass Inc., Ahlstrom-Munksjö, BGF Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Glass Fiber Market Key Technology Landscape

The technological landscape of the Recycled Glass Fiber market is undergoing rapid evolution, characterized by innovations focused on achieving performance parity with virgin materials while maximizing resource efficiency and minimizing energy consumption. One of the most critical foundational technologies is advanced optical sorting, often integrated with hyperspectral imaging and AI-driven recognition algorithms. These systems are essential for precisely identifying and ensuring the removal of minute contaminants such as metals, ceramics, porcelain (CPS), and high-temperature resistant glass types (HRG) that can catastrophically compromise the fiberization process. These rigorous sorting facilities are crucial for producing furnace-ready cullet that meets the highly specific chemical composition requirements necessary for drawing high-quality continuous filaments. Continuous improvements in sensor technology, coupled with high-throughput robotic handling, are significantly lowering the operational cost of feedstock preparation and dramatically enhancing the chemical purity, thereby boosting the competitiveness of recycled fibers in structural applications.

Another crucial area of technological advancement involves the refinement and optimization of the core melting and drawing process itself. While traditional furnaces require cullet with near-virgin levels of purity, manufacturers are heavily investing in specialized furnace designs, advanced filtration systems, and proprietary melt conditioning techniques designed to efficiently handle slightly more heterogeneous recycled streams without degrading fiber properties or furnace life. Energy efficiency improvements are being driven by techniques like oxygen-fuel combustion and electric boosting within the melting tanks, directly addressing the environmental argument sometimes levied against recycled glass fiber production due to its high thermal requirements. Furthermore, the customized development of new fiber sizing agents (surface treatments) is paramount. These chemistries are specifically optimized for the slightly altered surface reactivity of recycled glass, ensuring robust chemical bonding and optimal stress transfer between the fiber and various high-performance polymer matrices, which is key to guaranteeing that recycled fibers perform effectively in demanding structural composite applications requiring high interfacial strength and fatigue resistance.

Mechanical recycling, specifically high-precision milling and grinding, represents a complementary and highly efficient technology path, though it typically yields products used as fillers rather than primary structural reinforcement. This process is significantly less energy-intensive than thermal melting. Recent innovations in ultra-fine milling, often utilizing cryogenic or high-energy jet milling techniques, now allow for the creation of exceptionally fine, spherical, and consistent particle sizing. This expansion of mechanical processing quality is broadening the application of milled recycled glass fibers into higher-specification markets, including specialized coatings, advanced friction materials, high-end paints, and precision polymer compounds where tight particle geometry control is paramount. Overall, the long-term technology roadmap is trending towards a comprehensive hybrid approach, combining highly precise mechanical and AI-driven pre-treatment (sorting, cleaning) with optimized thermal processing (melting, drawing), all rigorously managed by digital monitoring and data analytics to maximize yield, quality consistency, and documented sustainability metrics across the entire complex production chain.

Regional Highlights

The global market for Recycled Glass Fiber exhibits pronounced regional variations driven by differing regulatory climates, industrial maturity, and pervasive commitment to circular economy initiatives. Europe currently leads the market, primarily due to ambitious, decades-old EU directives (such as the Waste Framework Directive and policies targeting construction waste) that mandate high recycling rates for packaging and demolition waste. This is coupled with robust financial incentives and public procurement requirements favoring the use of certified recycled content. Germany, France, and the UK are key players, characterized by high technological sophistication in both industrial glass recycling infrastructure and advanced composite manufacturing (especially for the expansive wind energy sector). European manufacturers benefit significantly from well-established, integrated reverse logistics networks and mature end-user demand across insulation, construction, and high-end automotive sectors, which collectively create a stable and high-value market demanding verifiable sustainability credentials.

Asia Pacific (APAC) is projected to be the fastest-growing region globally, fueled by massive, unprecedented infrastructural growth, rapid urbanization, and a growing governmental imperative to address chronic waste management issues and resource scarcity. Governments in key economic centers like China, India, South Korea, and Japan are rapidly formalizing stringent recycling mandates and implementing policies that encourage the domestic utilization of recycled materials in construction and manufacturing. While challenges related to the quality and consistency of collected feedstock persist in some developing regions, massive industrial investments are being channeled into establishing large-scale, modern recycling facilities incorporating global best practices and AI sorting technology. China, in particular, is a dominant force, being both a massive producer and consumer of recycled glass fibers, particularly in high-volume construction materials, domestic automotive production, and export-oriented goods. The sheer scale of industrial output combined with rapidly improving quality standards is accelerating the region’s contribution to global market volume and innovation.

North America holds a substantial and highly mature market share, driven primarily by the strong and diversified presence of the automotive, aerospace, and insulation industries, particularly within the United States and Canada. The region benefits significantly from world-class technological expertise and substantial private sector investment, often spurred by ambitious corporate sustainability commitments (Net Zero targets). Market dynamics here are often influenced by state-level environmental policies, robust incentives (like tax credits for sustainable manufacturing), and mandatory voluntary industry standards (such as LEED certification requirements for commercial buildings), which strongly favor materials with documented and traceable recycled content. Although feedstock collection is often highly decentralized compared to the structured European model, robust private sector innovation in advanced processing technologies ensures a steady supply of high-quality recycled glass fibers specifically tailored for high-performance applications, positioning the region as a global leader in utilizing recycled content for technically demanding structural components.

- Europe: Dominant market leader due to strict, long-standing EU circular economy directives, comprehensive waste management infrastructure, and high adoption rates in the construction and advanced wind energy sectors. Characterized by high investment in LCA compliance and product certification.

- Asia Pacific (APAC): Expected to be the fastest-growing market, propelled by rapid urbanization, massive public and private infrastructure projects, and increasing governmental initiatives in countries like China and India focused on domestic resource efficiency and tackling severe industrial waste issues.

- North America: Mature market with high penetration in the automotive (especially EV components), aerospace, and fiberglass insulation industries. Growth is supported by strong corporate Environmental, Social, and Governance (ESG) mandates and high-tech private investment in closed-loop recycling systems.

- Latin America (LATAM): Emerging market undergoing regulatory transitions; growth is accelerating, primarily centered around urban infrastructure development and localized manufacturing expansion requiring basic insulation and construction materials.

- Middle East & Africa (MEA): Growth is primarily tied to large-scale, diversification-driven infrastructure projects (e.g., NEOM in Saudi Arabia) and the increasing need for high-performance thermal insulation in GCC countries; market penetration reliant on improving localized waste management systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Glass Fiber Market.- Owens Corning

- Johns Manville

- Nippon Electric Glass (NEG)

- China Jushi Co., Ltd.

- Saint-Gobain

- Vetrotex

- Superior Glass Fiber

- Taiwan Glass Ind. Corp.

- AGY Holding Corp.

- Refibre Group

- R3F

- GreenFiber International SA

- VEC-CON

- Re-Fiber Inc.

- Glass Fiber Technologies LLC

- PPG Industries

- Jiangsu Changhai Composite Materials Co., Ltd.

- Taishan Fiberglass Inc.

- Ahlstrom-Munksjö

- BGF Industries

Frequently Asked Questions

Analyze common user questions about the Recycled Glass Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Recycled Glass Fiber Market?

The primary driver is the accelerating global adoption of circular economy principles, strongly supported by stringent governmental waste reduction mandates and escalating corporate demand for sustainable, low-carbon footprint construction and manufacturing materials, particularly due to high energy costs associated with virgin glass production.

How do the properties of recycled glass fibers compare to those of virgin glass fibers?

High-quality recycled glass fibers, especially those derived from carefully sorted post-industrial waste using advanced melting techniques, exhibit comparable mechanical properties (tensile strength and modulus) to standard virgin fibers, making them suitable for many composite reinforcement applications, while offering verifiable superior environmental metrics and a lower embodied energy score.

Which application segment holds the largest share in the Recycled Glass Fiber Market?

The Construction and Infrastructure segment holds the largest market share by volume. Recycled glass fibers are extensively used for essential functions such as thermal and acoustic insulation, fire dampening, and non-structural reinforcement in concrete and specialized building panels due to their cost-effectiveness and volume demand.

What are the key technological challenges currently facing the recycled glass fiber industry?

The main technological challenge is ensuring consistent, cost-effective feedstock purity. Impurities in waste glass cullet (such as ceramics and metal) can compromise the chemical stability and performance of the resultant fibers during high-temperature drawing. This is being mitigated through heavy investment in AI-driven optical sorting and advanced melt filtration systems.

Which region is expected to demonstrate the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid and large-scale industrialization, massive infrastructure development, and increasing governmental initiatives in populous economies like China and India to enhance domestic recycling capacities and improve overall resource efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager