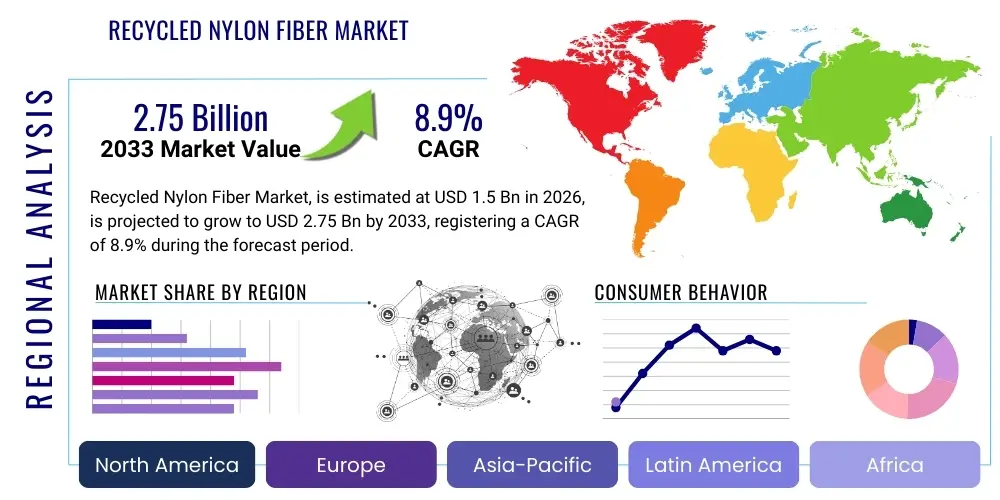

Recycled Nylon Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437237 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Recycled Nylon Fiber Market Size

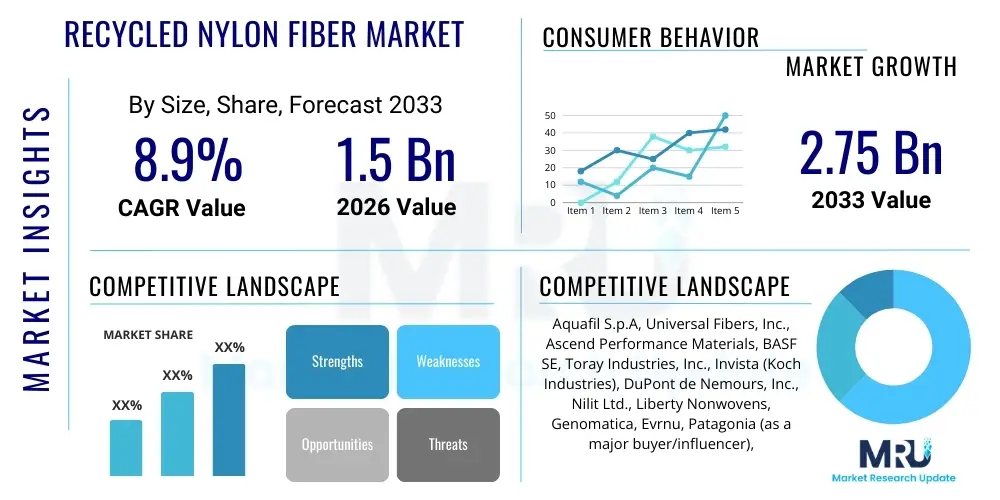

The Recycled Nylon Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

Recycled Nylon Fiber Market introduction

The Recycled Nylon Fiber market encompasses the production and utilization of nylon fibers derived from post-consumer or pre-consumer waste materials, primarily carpets, fishing nets (known as ghost gear), and industrial plastics. This process, often involving depolymerization or mechanical recycling, creates sustainable alternatives to virgin nylon (Polyamide 6 and Polyamide 6,6). The core appeal of recycled nylon lies in its significant reduction of environmental impact, including lower energy consumption, minimized greenhouse gas emissions, and decreased reliance on petroleum-based raw materials. Major applications span the textile industry, particularly high-performance athletic wear, luxury fashion, automotive interiors, and specialized technical fabrics, positioning it as a critical component in the circular economy movement. The demand is heavily influenced by corporate sustainability mandates and increasing consumer awareness regarding eco-friendly products, compelling brands to integrate certified recycled content into their product lines to meet stringent environmental, social, and governance (ESG) standards.

The primary product description involves two main types of recycled nylon: chemically recycled and mechanically recycled. Chemical recycling, often used for materials like discarded carpets (Nylon 6), breaks down the polymer structure back into monomers (caprolactam), which are then repolymerized into new high-quality nylon indistinguishable from virgin material, maintaining exceptional durability and performance characteristics. Mechanical recycling, while less expensive, typically results in fibers with slightly reduced performance, making them suitable for less demanding applications. Benefits of using recycled nylon fiber include resource conservation, waste diversion from landfills and oceans, and the branding advantage associated with sustainability. Furthermore, the material offers identical structural integrity, strength, elasticity, and comfort properties required for premium textile applications, eliminating the trade-off traditionally associated with sustainable material substitution. Key driving factors include rigorous government regulations on plastic waste management, corporate commitments to net-zero targets, and technological advancements enhancing the cost-efficiency and scalability of chemical recycling processes.

The market’s expansion is deeply tied to the fashion and apparel sector's rapid pivot toward sustainability, where certifications like the Global Recycled Standard (GRS) play a pivotal role in ensuring transparency and traceability of the source material. High-end brands are increasingly sourcing recycled nylon for swimwear, outerwear, and accessories, benefiting from its lightweight nature, quick-drying capabilities, and resistance to abrasion. Beyond apparel, the automotive sector utilizes recycled nylon in components such as engine covers, air intake manifolds, and interior trim, driven by regulatory pressures to increase the average recycled content per vehicle. This diversification across high-value industrial and consumer segments ensures robust, sustained growth, provided the supply chain for post-consumer nylon waste remains efficient and economically viable. The challenge of sourcing and processing complex nylon blends, however, necessitates continuous innovation in sorting and depolymerization technologies to maintain the quality and purity required by end-use manufacturers.

Recycled Nylon Fiber Market Executive Summary

The Recycled Nylon Fiber Market is experiencing rapid expansion, fueled predominantly by global legislative actions targeting ocean plastics and the increasing corporate focus on establishing transparent, circular supply chains, particularly within the textile and automotive industries. Key business trends indicate a vertical integration strategy among leading fiber producers, who are securing stable input streams of nylon waste through strategic partnerships with waste collection agencies and specialized material recovery facilities. Technological advancements, notably in depolymerization techniques for Polyamide 6, are enabling the production of high-grade recycled fibers at competitive costs, mitigating historical quality concerns and accelerating market acceptance. The shift from mechanical to chemical recycling represents a significant business trend, allowing manufacturers to capture premium markets requiring performance parity with virgin materials.

Regionally, Europe and North America lead the market adoption curve, driven by stringent Extended Producer Responsibility (EPR) regulations, high consumer willingness to pay for eco-friendly products, and the presence of major fast-fashion and luxury brand headquarters committed to aggressive sustainability targets. Asia Pacific (APAC), however, is emerging as the fastest-growing region, primarily due to expanding textile manufacturing bases in countries like China and India adopting circular production methods, alongside increasing governmental focus on domestic waste recycling infrastructure development. Latin America and the Middle East and Africa (MEA) are characterized by nascent but rapidly developing markets, often focusing on infrastructure projects and automotive applications. Segmentation trends highlight the dominance of the textile segment, especially in sportswear and outdoor gear, while the carpet and flooring segment is showing steady growth as commercial installations prioritize green building certifications. Nylon 6 dominates the product type segment due to the maturity and efficiency of its chemical recycling process (caprolactam regeneration).

The executive outlook confirms that sustainability is no longer a niche requirement but a fundamental competitive differentiator, driving massive investment into recycling infrastructure. The market structure remains fragmented but is consolidating around providers who can offer certified, traceable, high-volume supply. The primary challenge remains the consistent sourcing of clean, mono-material nylon waste streams, particularly for Nylon 6,6, which is harder to depolymerize chemically. Overall, strong policy support, combined with high brand commitment and technological viability, ensures a favorable long-term growth trajectory for the recycled nylon fiber industry, positioning it as a vital component in achieving sustainable material consumption globally.

AI Impact Analysis on Recycled Nylon Fiber Market

User inquiries regarding AI's influence on the Recycled Nylon Fiber market center around optimizing complex waste logistics, improving material sorting accuracy, and enhancing the efficiency of chemical depolymerization processes. Key themes identified include the integration of Machine Learning (ML) for predictive supply chain management, using computer vision systems to identify and segregate high-purity nylon waste (especially from mixed textiles or complex post-consumer waste streams), and leveraging AI to optimize energy usage and yield rates in energy-intensive recycling plants. Users are keen to understand how AI can solve the fundamental constraint of inconsistent feedstock quality and how automation driven by intelligent systems can lower operational costs, thereby making recycled nylon more price-competitive against virgin polymer alternatives. Expectations are high that AI will transform the traditionally manual and resource-intensive sorting process into an automated, high-throughput operation essential for meeting surging industrial demand for traceable recycled content.

- AI-driven sensor fusion and machine vision systems drastically improve the sorting accuracy of mixed plastic and textile waste, ensuring higher purity Nylon 6 or Nylon 6,6 feedstock for recycling.

- Machine Learning algorithms optimize the operational parameters (temperature, pressure, catalyst concentration) of chemical depolymerization reactors, maximizing monomer yield and minimizing energy consumption.

- Predictive supply chain analytics enabled by AI forecasts the availability and geographical distribution of post-consumer nylon waste (e.g., discarded fishing nets and carpets), stabilizing raw material sourcing.

- Natural Language Processing (NLP) tools enhance the traceability documentation and certification processes, ensuring transparent and immutable records for ESG reporting and compliance verification.

- AI modeling assists in designing new fiber structures or blends that maximize the performance of recycled polymers, overcoming slight quality degradation sometimes observed in mechanically recycled fibers.

DRO & Impact Forces Of Recycled Nylon Fiber Market

The Recycled Nylon Fiber Market is driven primarily by escalating regulatory pressures concerning plastic waste, particularly single-use plastics and marine debris, coupled with aggressive corporate sustainability mandates requiring high levels of certified recycled content in end products. Restraints include the high initial capital expenditure required for sophisticated chemical recycling facilities, the inherent complexity and high cost associated with sourcing, collecting, and cleaning consistent, high-purity waste streams, and the relative volatility of virgin nylon prices which can occasionally undercut the cost advantage of recycled alternatives. Opportunities emerge from untapped waste streams, such as end-of-life automotive components and durable goods, alongside the development of advanced recycling technologies like pyrolysis or supercritical fluid methods capable of processing complex nylon blends that current technologies struggle with. The major impact forces are the regulatory push (mandating recycling targets) and consumer pull (demand for sustainable brands), which collectively necessitate market compliance and innovation.

Key drivers center around brand commitment and consumer preference. Major global apparel and carpet manufacturers have publicly committed to phasing out virgin materials, creating substantial, guaranteed demand for recycled nylon feedstock. This commitment de-risks investment in recycling infrastructure. Furthermore, global initiatives aimed at cleaning the oceans, such as those targeting ghost fishing gear (e.g., the ECONYL initiative), not only provide a valuable raw material source but also generate positive public relations capital, further accelerating market growth. These drivers create a compelling economic case that outweighs the initial setup costs, especially for chemical recycling technologies that yield premium-grade output.

Conversely, the high capital cost of building new depolymerization plants and the operational expenses associated with managing complex reverse logistics pose significant restraints, particularly for smaller market players. Additionally, while Nylon 6 recycling is relatively mature, the commercial viability and scalability of recycling Polyamide 6,6 (used extensively in industrial textiles and carpets) remain a technological and economic hurdle. The impact forces are defined by the intersection of policy and innovation; mandatory recycling rates enforce market expansion (push), while breakthroughs in technology lower processing costs and expand feedstock availability (pull), solidifying the market's long-term sustainability and competitiveness.

Segmentation Analysis

The Recycled Nylon Fiber Market segmentation is crucial for understanding specific growth pockets, primarily categorized by Product Type (Nylon 6 and Nylon 6,6), Source (Pre-consumer and Post-consumer waste), and Application (Apparel, Automotive, Home Furnishings, and Industrial/Technical Textiles). The analysis indicates that Nylon 6 derived from chemical recycling (depolymerization) dominates the product type segment due to its established infrastructure and ability to achieve closed-loop recycling, yielding high-performance fibers. Application-wise, the apparel sector, particularly sportswear and premium activewear, generates the highest revenue, driven by consumer interest in visible sustainability and high material turnover rates. Geographical segmentation highlights Europe and North America as maturity markets, while APAC represents the core manufacturing growth engine. Each segment exhibits distinct material requirements, processing costs, and end-market competitive landscapes, necessitating customized sourcing and manufacturing strategies by market participants.

- By Product Type:

- Nylon 6 (Dominant due to established chemical recycling efficiency)

- Nylon 6,6 (Emerging segment facing chemical recycling complexities)

- By Source:

- Pre-consumer Waste (Industrial scraps, yarn waste)

- Post-consumer Waste (Fishing nets, carpets, textiles)

- By Application:

- Apparel (Activewear, Swimwear, Outerwear)

- Automotive (Interior fabrics, molded components)

- Home Furnishings (Carpets, Upholstery)

- Industrial & Technical Textiles (Ropes, nets, specialized gear)

Value Chain Analysis For Recycled Nylon Fiber Market

The value chain for the Recycled Nylon Fiber market is complex and highly interdependent, beginning with the critical Upstream Analysis which involves the sourcing and collection of diverse nylon waste streams. This upstream phase includes specialized waste recovery organizations that collect materials like discarded fishing nets (aquaculture and marine waste) and post-consumer carpets (urban waste streams). Effective sorting, cleaning, and preliminary processing (shredding/pelletizing) of this waste are vital prerequisites for the recycling process. The middle tier encompasses the core manufacturing stage: mechanical recycling (melting and spinning) and chemical recycling (depolymerization into monomers followed by polymerization). Chemical recycling is crucial for high-quality, closed-loop systems, ensuring the resulting polymer is suitable for premium applications. The efficiency of waste collection and pre-processing directly impacts the cost and quality of the final recycled fiber, representing a key vulnerability and opportunity within the value chain.

The downstream analysis focuses on the transformation of recycled nylon chips or fibers into finished products. This involves textile manufacturers, yarn producers, and compounders who utilize the recycled nylon in applications such as weaving, knitting, injection molding, and extrusion. Direct channels often involve major recycled fiber producers selling directly to large, integrated textile mills or automotive Tier 1 suppliers who demand traceable, certified material in bulk. Indirect distribution channels utilize specialized distributors and regional agents, particularly for smaller volume orders or geographically dispersed end-users. The close collaboration between fiber producers and downstream brands is essential, as the brands often dictate specific material specifications and demand robust traceability platforms to support their sustainability marketing claims. The value chain is characterized by a high degree of transparency requirements at every stage, driven by AEO demands for origin verification.

The most critical aspect of the distribution channel revolves around securing certified supply chains. Leading brands prioritize long-term contracts with suppliers who offer certifications like GRS or OEKO-TEX Standard 100, ensuring the final product meets environmental and safety standards. This preference favors large, established recycling companies with proprietary depolymerization technology and robust global collection networks. Direct engagement between suppliers and large fashion houses is common, bypassing traditional intermediaries to maintain control over supply and pricing. Conversely, the market for recycled nylon used in durable goods or industrial applications often relies more heavily on specialized industrial plastics distributors who can handle complex logistics and varied technical specifications, reflecting the divergent needs across the market’s application base.

Recycled Nylon Fiber Market Potential Customers

The potential customer base for Recycled Nylon Fiber is extensive and highly diverse, spanning sectors driven by high material performance and strong corporate sustainability commitments. Primary end-users/buyers are large multinational apparel companies, particularly those specializing in performance wear (e.g., outdoor, fitness, swimwear) and luxury fashion houses seeking premium, traceable, eco-friendly textiles for their collections. These buyers prioritize quality and brand image, making them willing to pay a premium for certified chemically recycled Nylon 6, which offers performance parity with virgin material. A second crucial customer segment resides in the automotive industry, specifically Tier 1 and Tier 2 suppliers involved in manufacturing interior fabrics, carpeting, and under-the-hood structural components, driven by regulatory mandates (such as EU requirements for end-of-life vehicle materials) and internal corporate goals to reduce vehicle weight and improve material circularity. The consistent need for high strength-to-weight ratio and durability makes recycled nylon an attractive option.

Another significant group includes major flooring and home furnishings companies. Commercial carpet manufacturers, in particular, are substantial consumers of recycled Nylon 6 (derived from old carpets through chemical recycling), often utilizing closed-loop systems where their own products are recovered and reprocessed. This segment is highly influenced by green building certifications (e.g., LEED and BREEAM) that favor materials with high recycled content, making these specifications mandatory for accessing institutional and commercial contracts. Finally, industrial textile buyers, including those in fisheries, agriculture, and construction, represent a consistent customer base for robust recycled nylon, particularly for items like specialized netting, ropes, and filtration fabrics where mechanical strength and environmental resilience are paramount. These customers often seek cost-effective, durable solutions, which mechanically recycled nylon can provide, balancing sustainability with functional requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aquafil S.p.A, Universal Fibers, Inc., Ascend Performance Materials, BASF SE, Toray Industries, Inc., Invista (Koch Industries), DuPont de Nemours, Inc., Nilit Ltd., Liberty Nonwovens, Genomatica, Evrnu, Patagonia (as a major buyer/influencer), Unifi, Inc., Li Peng Enterprise Co., Ltd., Formosa Taffeta Co., Ltd., Nylstar, Ltd., Far Eastern New Century Corporation (FENC), RadiciGroup. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Nylon Fiber Market Key Technology Landscape

The technology landscape governing the Recycled Nylon Fiber market is primarily bifurcated into mechanical and chemical recycling methods, with advanced chemical processes driving premium market growth and addressing the material quality constraints of traditional mechanical routes. Mechanical recycling involves shredding, washing, melting, and compounding nylon waste, which is the most cost-effective method but often results in downcycling due to polymer chain degradation and contamination, limiting its use to non-critical applications. In contrast, chemical recycling is the transformative technology, predominantly centered around depolymerization for Polyamide 6 (Nylon 6). Techniques such as the depolymerization of caprolactam allow waste nylon to be broken down into its original monomer, which is then purified and repolymerized. This yields virgin-equivalent fiber quality (e.g., ECONYL), making it suitable for high-end applications like luxury apparel and high-performance automotive parts, thereby eliminating the quality gap between virgin and recycled polymers.

Recent innovations have concentrated heavily on overcoming the challenge posed by Polyamide 6,6 (PA66) recycling, which historically resists cost-effective chemical depolymerization due to its chemical structure and higher melting point. Researchers are exploring novel chemical methods, including pyrolysis and specific catalytic processes, designed to handle complex blends and contaminants prevalent in end-of-life carpets and industrial textiles containing PA66. Furthermore, advanced sorting technologies utilizing Near-Infrared (NIR) spectroscopy and AI-driven machine vision are critical to the upstream preparation, ensuring that the feedstock entering the chemical recycling plants maintains the necessary purity. These sorting innovations are crucial for maximizing the yield and economic viability of the entire process, as contaminated input severely compromises the quality and efficiency of depolymerization.

The future technology outlook involves the scaling up of solvent-based purification and dissolution methods, which offer another path to regenerating high-quality polymers from mixed or contaminated nylon waste without high-temperature chemical breakdown. These purification technologies enhance the utilization of lower-grade post-consumer waste that would otherwise be landfilled. Investment is also flowing into developing closed-loop textile-to-textile recycling processes, minimizing the reliance on waste streams outside the traditional fiber industry (like fishing nets). The successful deployment of these technologies is contingent upon robust patent portfolios and collaboration between chemical companies and textile manufacturers, aiming to establish resilient, cost-competitive, and scalable recycling ecosystems globally, pushing the industry towards true circularity.

Regional Highlights

- Europe: Europe holds the dominant market share, driven by the strong commitment of the European Union to circular economy mandates, stringent waste reduction targets (especially the EU Waste Framework Directive), and high consumer environmental consciousness. Countries like Italy, Germany, and the Netherlands lead in technological deployment, particularly in sophisticated chemical recycling (depolymerization) of Nylon 6, supported by high regulatory pressure on textile and automotive manufacturers to utilize recycled content. The region benefits from large fashion brand headquarters, which are primary buyers of premium recycled nylon, influencing global sourcing standards.

- North America: North America represents a mature and rapidly expanding market, characterized by significant governmental investment in infrastructure recycling and corporate voluntary commitments. The presence of major carpet manufacturers and a robust automotive sector (driven by California and federal standards for recycled materials) ensures consistent demand. Initiatives focusing on the recycling of used carpets (CRI’s Carpet America Recovery Effort) provide reliable feedstock, although the market structure remains heavily influenced by the relative cost differential between recycled and virgin polymer pricing.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This growth is primarily fueled by the region's massive manufacturing base (China, India, Vietnam), rapidly increasing domestic consumption, and improving regional waste management infrastructure. While historically focused on cost-effective mechanical recycling, increased foreign investment and technological transfers are accelerating the adoption of advanced chemical recycling facilities to meet the export demands of European and North American brand partners, making it the most critical future manufacturing hub.

- Latin America (LATAM): The LATAM market is emerging, driven by localized waste collection initiatives, particularly related to marine plastics and fishing gear (ocean plastics being a key regional problem). Market penetration is currently concentrated in Brazil and Mexico, focusing mainly on textile and footwear applications. Growth is dependent on the development of reliable reverse logistics systems and investment in processing capacity, often supported by public-private partnerships focused on environmental clean-up.

- Middle East and Africa (MEA): The MEA region is currently a smaller market but shows potential in industrial and construction applications, especially in specialized technical textiles. Development is strongly tied to major infrastructure projects and the implementation of sophisticated waste management policies in Gulf Cooperation Council (GCC) countries. The focus is increasingly shifting towards establishing localized production capacities rather than relying solely on imported recycled materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Nylon Fiber Market.- Aquafil S.p.A

- Universal Fibers, Inc.

- Ascend Performance Materials

- BASF SE

- Toray Industries, Inc.

- Invista (Koch Industries)

- DuPont de Nemours, Inc.

- Nilit Ltd.

- Liberty Nonwovens

- Genomatica

- Evrnu

- Unifi, Inc.

- Li Peng Enterprise Co., Ltd.

- Formosa Taffeta Co., Ltd.

- Nylstar, Ltd.

- Far Eastern New Century Corporation (FENC)

- RadiciGroup

- M. & J.G. Karr

- Shaw Industries Group, Inc.

- EPR (European Plastic Recycling) Group

Frequently Asked Questions

Analyze common user questions about the Recycled Nylon Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material source for chemically recycled nylon fiber?

The primary source for chemically recycled nylon fiber, particularly Nylon 6, is post-consumer waste such as discarded fishing nets (ghost gear) and end-of-life Nylon 6 carpets. Chemical recycling breaks these materials down into caprolactam monomers, ensuring the resulting fiber is equivalent to virgin nylon in performance and purity.

How does the performance of recycled nylon fiber compare to virgin nylon?

Chemically recycled nylon fiber (e.g., ECONYL) offers performance parity with virgin nylon, maintaining identical tensile strength, elasticity, durability, and dye uptake. Mechanically recycled nylon may experience slight performance degradation, making chemically recycled material the preferred choice for high-specification applications like technical apparel and automotive components.

Which application segment holds the largest share in the Recycled Nylon Fiber Market?

The Apparel segment holds the largest market share, driven primarily by the high demand for sustainable textiles in activewear, performance sports gear, and luxury fashion. Brands are aggressively adopting recycled nylon to meet ESG reporting standards and increasing consumer demand for eco-friendly clothing options.

What are the main technological hurdles in recycling Nylon 6,6?

The main technological hurdle for Nylon 6,6 (Polyamide 6,6) is the difficulty and high energy requirement of chemical depolymerization compared to Nylon 6. Its chemical structure makes it less susceptible to existing caprolactam-based recycling methods, necessitating the development of novel pyrolysis or specific solvent-based solutions for cost-effective recycling.

Which region is anticipated to demonstrate the fastest growth rate in this market?

Asia Pacific (APAC) is anticipated to demonstrate the fastest Compound Annual Growth Rate (CAGR), driven by the region’s expanding textile manufacturing capacity, increasing focus on domestic waste infrastructure improvement, and rising adoption of circular economy principles across major industrial economies like China and India to support export-oriented production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Post Consumer Yarns/Recycled Yarns Market Statistics 2025 Analysis By Application (Textiles, Packaging, Building Products, Industrial Use, Other), By Type (Recycled PET Yarns, Recycled Cotton Yarns, Recycled Nylon Fiber Yarns, Recycled Wool Yarns), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Recycled Nylon Fiber Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (BCF(Bulk Continuous Filaments), NTF(Nylon Textile Filaments)), By Application (Clothing, Fishing, Automotive, Construction, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager