Recycled Polyester (RPET) Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438296 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Recycled Polyester (RPET) Fiber Market Size

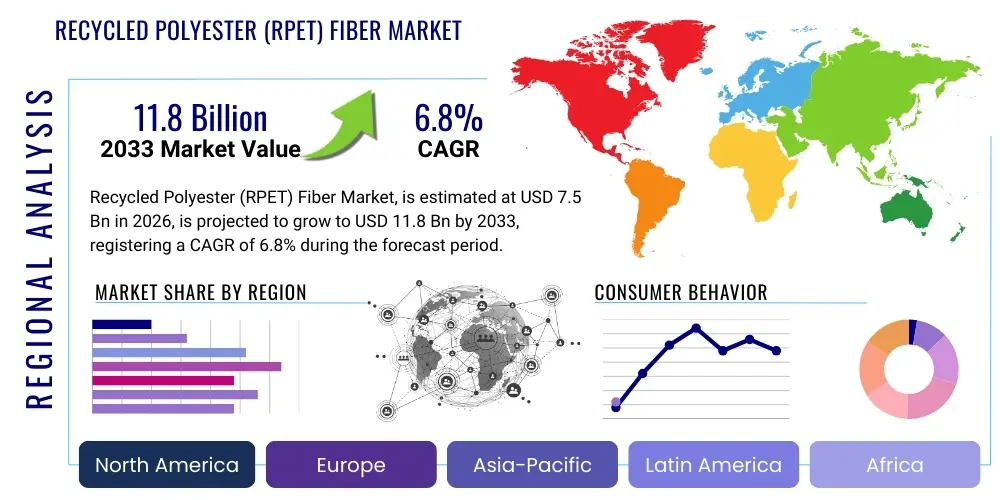

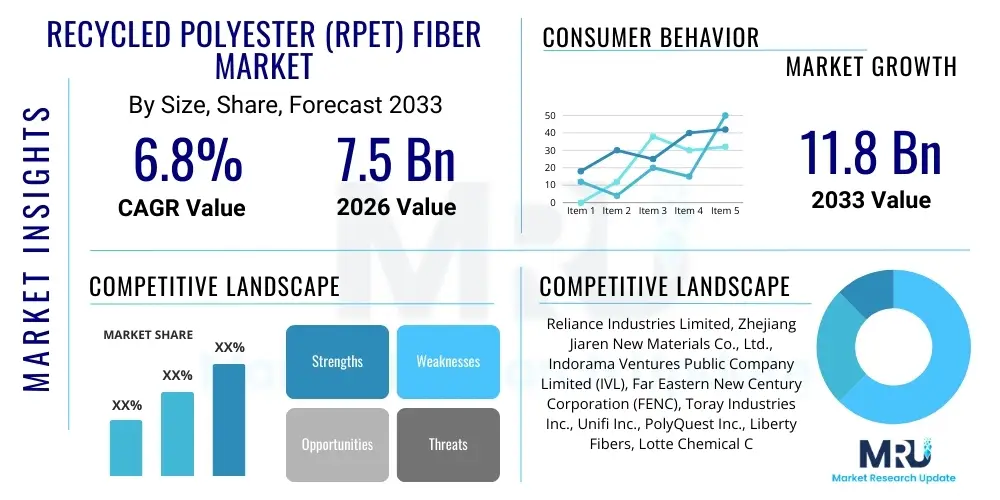

The Recycled Polyester (RPET) Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.8 Billion by the end of the forecast period in 2033.

Recycled Polyester (RPET) Fiber Market introduction

The Recycled Polyester (RPET) Fiber Market encompasses the production and utilization of fibers derived primarily from post-consumer polyethylene terephthalate (PET) plastic waste, most commonly beverage bottles. This product offers a critical sustainable alternative to virgin polyester, significantly reducing reliance on fossil fuels, lowering energy consumption, and decreasing landfill waste volumes. RPET fiber is chemically identical to virgin polyester, maintaining excellent properties such as strength, durability, wrinkle resistance, and colorfastness, making it highly versatile. The increasing global focus on circular economy models, coupled with stringent environmental regulations and mounting consumer demand for sustainable apparel and textiles, positions RPET fiber as a foundational material for future sustainable manufacturing across multiple industrial sectors. Manufacturers are investing heavily in improving mechanical and chemical recycling processes to enhance the quality and scalability of RPET production, driving market expansion, particularly in the Asia Pacific region where textile manufacturing is concentrated.

Major applications of RPET fibers span across various industries, led prominently by the apparel and fashion sector, where it is used to manufacture everything from high-performance activewear and technical garments to casual clothing and luxury textiles. Beyond clothing, the automotive industry utilizes RPET for car interior fabrics, headliners, floor mats, and non-woven components, contributing to vehicle lightweighting and compliance with sustainability mandates set by global automotive manufacturers. The home furnishings and textile sector represents another significant application area, employing RPET in carpeting, upholstery, bedding, and curtains, capitalizing on the fiber's durability and easy maintenance. The versatility of RPET allows its integration into sophisticated composite materials and non-woven products, expanding its reach into industrial and construction applications, further diversifying the market landscape.

The market is primarily driven by powerful macroeconomic and legislative forces. Government incentives and mandatory recycling targets implemented across major economies, particularly in the European Union and parts of North America, compel businesses to adopt recycled content. Furthermore, the immense brand reputation pressure faced by multinational corporations to meet ambitious Environmental, Social, and Governance (ESG) targets fuels the demand for high-quality, traceable RPET fibers. The reduced carbon footprint associated with RPET production—which generally requires 30-50% less energy than virgin polyester synthesis—serves as a compelling benefit, appealing directly to environmentally conscious consumers and supply chain partners. Ongoing innovation in chemical recycling technologies, which allow for the decomposition of polyester back into its basic monomers, promises to overcome current limitations related to material degradation and enable true closed-loop recycling, acting as a crucial long-term growth driver.

Recycled Polyester (RPET) Fiber Market Executive Summary

The Recycled Polyester (RPET) Fiber market is currently characterized by robust expansion driven by institutional commitments to sustainability and significant technological advancements in depolymerization processes. Key business trends indicate a strong move toward vertical integration among major textile producers and recyclers seeking to secure stable feedstock supplies (post-consumer PET bottles and textile waste). Mergers and acquisitions focusing on securing high-volume recycling infrastructure, particularly in high-waste generating regions, are prevalent. Furthermore, transparency and traceability in the supply chain are paramount; companies are deploying blockchain and advanced digital tracking systems to authenticate the recycled content of fibers, addressing increasing scrutiny from regulatory bodies and end-consumers regarding greenwashing claims. The market is witnessing a polarization of product offerings, with specialized high-performance RPET fibers commanding premium prices, contrasting with standard RPET staple fibers used in mass-market applications.

Geographically, Asia Pacific, specifically China, India, and Southeast Asian nations, dominates the global RPET production capacity due to established textile manufacturing hubs and readily available low-cost PET waste feedstock. However, Europe and North America are leading in terms of demand generation and regulatory enforcement, driving innovation toward closed-loop chemical recycling methods. European mandates on single-use plastics and packaging recycling are forcing rapid shifts in the supply chain, increasing the demand for mechanically and chemically recycled PET in both fiber and packaging formats. Regional trends show heavy investment in infrastructure in regions like Western Europe to process locally collected waste, reducing reliance on volatile international waste trade markets and increasing supply chain resilience, which is a major strategic priority following recent global supply chain disruptions.

Segment trends reveal that the Staple Fiber segment maintains the largest market share by volume due to its widespread use in non-woven fabrics, stuffing, and standardized apparel. However, the Filament Fiber segment is projected to exhibit the highest growth rate, driven by its necessity in high-end technical textiles, performance wear, and specialized automotive applications where superior strength and uniformity are required. In terms of end-use, the Apparel segment remains the primary consumer, but the Automotive and Construction sectors are expanding rapidly, supported by corporate decarbonization strategies. Within the source segmentation, Clear Bottles (Post-Consumer PET) remain the predominant feedstock, yet the market is heavily investing in technologies to utilize Mixed and Colored Waste and, increasingly, Post-Industrial and Post-Consumer Textile Waste (PCTT), aiming to close the loop within the textile industry itself, moving beyond bottle-to-fiber processes.

AI Impact Analysis on Recycled Polyester (RPET) Fiber Market

Users commonly inquire about how Artificial Intelligence (AI) can enhance the efficiency and sustainability of the RPET supply chain, particularly regarding waste sorting, material quality control, and prediction of feedstock availability. Key concerns center on whether AI can solve the long-standing challenge of separating mixed textile waste, which currently impedes high-quality chemical recycling processes. Users also seek information on AI's role in optimizing energy consumption during fiber production and ensuring verifiable traceability of recycled content to meet consumer transparency demands. The synthesis of these queries indicates a market expectation that AI will transition the RPET industry from high-volume, potentially inefficient mechanical recycling to data-driven, quality-assured, and resource-optimized advanced recycling methods, thereby stabilizing the supply chain and enhancing product integrity.

AI's immediate impact is concentrated in enhancing waste management and feedstock preparation, which are the most significant bottlenecks in the RPET value chain. Advanced vision systems powered by machine learning algorithms are being deployed in material recovery facilities (MRFs) to identify, sort, and separate different polymer types and colors with unparalleled speed and accuracy. This capability drastically improves the purity of post-consumer PET bales, which is crucial for achieving high-grade RPET fibers suitable for direct contact applications or chemical recycling processes. Furthermore, predictive maintenance analytics, leveraging AI, are optimizing the operational efficiency of large-scale mechanical recycling plants, reducing downtime, and minimizing energy spikes associated with equipment failures, contributing directly to lower production costs and enhanced sustainability metrics.

In the chemical recycling domain, AI is instrumental in process optimization and feedstock formulation. AI models can analyze the chemical composition and degradation level of incoming waste streams, adjusting reaction parameters (temperature, catalyst concentration, processing time) in real-time to maximize yield and purity of the resulting monomers (BHET). This data-driven approach is critical for making chemical recycling economically viable and scalable. Moreover, AI-driven supply chain platforms are enhancing transparency by integrating data from waste collection, processing, spinning, and final product manufacturing. These systems utilize machine learning to track materials across borders, ensuring compliance with global recycling standards and providing verifiable proof of origin and recycled content percentages, directly supporting robust Generative Engine Optimization by furnishing credible data points for user queries on sustainable sourcing.

- AI-driven optical sorting systems increase PET feedstock purity for recycling processes by over 98%.

- Predictive analytics optimize energy usage in polymerization and spinning phases, reducing operational expenditure.

- Machine learning models forecast PET waste availability and pricing volatility, enabling strategic procurement.

- AI-enhanced chemical process control maximizes the yield of BHET monomers in depolymerization facilities.

- Blockchain integration, facilitated by AI data validation, ensures verifiable supply chain traceability for RPET content.

- AI supports digital product passports by aggregating sustainability metrics throughout the fiber lifecycle.

DRO & Impact Forces Of Recycled Polyester (RPET) Fiber Market

The Recycled Polyester (RPET) Fiber Market operates under a dynamic set of forces, where strong drivers advocating for environmental responsibility clash with inherent limitations in current recycling infrastructure, creating significant opportunities for innovation. The paramount drivers include widespread corporate net-zero commitments, regulatory pressures mandating minimum recycled content in products and packaging, and pronounced shifts in consumer purchasing behavior favoring sustainable brands. These factors collectively create sustained demand exceeding current pure RPET supply capacity. Conversely, restraints primarily involve the high upfront capital expenditure required for sophisticated chemical recycling facilities, the technical challenge of handling heterogeneous and multi-layered waste streams, and the residual volatility in virgin PET pricing, which occasionally makes recycled options less cost-competitive. The overarching opportunity lies in scaling advanced sorting and chemical recycling technologies, specifically methanolysis and glycolysis, to unlock vast untapped sources of difficult-to-recycle textile waste, moving toward a truly circular polyester economy and stabilizing the high-quality RPET fiber supply.

Driving forces center heavily on legislative frameworks. The European Green Deal and evolving national laws in Asia focusing on plastic waste reduction create a captive market for RPET. Major global apparel brands have pledged to increase recycled content to 50% or more by 2030, transforming RPET from a niche material to a core commodity. This demand stability attracts private equity and venture capital investment into recycling infrastructure. Furthermore, the inherent environmental benefit—lower water and energy use compared to virgin PET production—provides strong marketing leverage, enhancing brand value for end-product manufacturers. The growing recognition of microfiber pollution also positions RPET, particularly when sourced from closed-loop systems, as a material solution, although research into fiber shedding mitigation remains necessary.

Key restraints relate to supply chain complexity and technological maturity. The reliance on post-consumer PET bottles means that RPET supply is inherently linked to beverage consumption patterns and global waste collection efficiency, leading to regional supply imbalances. Moreover, mechanical recycling, while mature, results in downcycling, limiting the RPET fiber to lower-quality applications after several cycles. Chemical recycling is emerging but requires significant standardization and large-scale investment to achieve cost parity with virgin materials. Impact forces manifest as fluctuating oil prices (which influence virgin PET costs), consumer willingness to pay a premium for sustainability, and the geopolitical stability of major textile production centers. These forces dictate the overall pace and direction of market growth, requiring manufacturers to maintain operational flexibility and robust dual-sourcing strategies.

Segmentation Analysis

The Recycled Polyester (RPET) Fiber market is comprehensively segmented based on its source material, the type of fiber produced, the end-use application, and the primary geographic region. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological focus. The analysis reveals that while post-consumer bottle recycling currently dominates the feedstock, the future growth potential is concentrated in advanced recycling solutions capable of processing complex waste streams, such as end-of-life garments and industrial textile remnants. The critical determinant for segment growth remains the balance between cost-effectiveness, mandated regulatory compliance, and the technical suitability of the RPET product for high-performance applications like automotive or high-fashion textiles.

- By Source:

- Clear Bottles (Post-Consumer PET)

- Mixed & Colored Waste

- Post-Industrial Waste

- Post-Consumer Textile Waste (PCTT)

- By Product Type:

- Solid/Staple Fiber

- Filament Fiber (Draw Textured Yarn, Fully Drawn Yarn, Partially Oriented Yarn)

- Non-Woven Fabrics

- By Application:

- Apparel (Sportswear, Casual Wear, Technical Garments)

- Home Furnishings (Carpets, Upholstery, Bedding)

- Automotive (Interior Fabrics, Headliners, Floor Mats)

- Filtration & Non-Wovens

- Construction & Industrial Textiles

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Recycled Polyester (RPET) Fiber Market

The RPET fiber value chain begins with the critical upstream analysis, focusing on waste collection, sorting, and preparation. This stage is highly dependent on efficient municipal recycling programs, private waste management firms, and robust regulatory frameworks. Upstream success hinges on the purity and volume of collected PET bottles or textile waste. Once collected, materials undergo rigorous sorting, washing, and flaking processes to prepare clean PET flakes suitable for melting. The primary challenge upstream is overcoming contamination, as impurities significantly degrade the quality of mechanically recycled fiber. Strategic partnerships between RPET producers and advanced sorting technology providers are essential to secure high-quality feedstock and reduce reliance on expensive imported waste materials.

The core production phase involves converting purified PET flakes into fibers, utilizing two main methods: mechanical recycling (melting and spinning flakes directly) or chemical recycling (depolymerization into monomers followed by repolymerization). Mechanical recycling is mature and cost-effective, yielding solid or staple fibers, but the product suffers from some material degradation. Chemical recycling, though capital-intensive, yields virgin-quality monomers, enabling the production of high-specification filament fibers and closing the textile loop entirely. Distribution channels for RPET fibers are complex, involving direct sales to large textile mills and indirect channels through global fiber brokers and agents. The need for precise technical specifications means many large RPET manufacturers prefer direct B2B relationships with major apparel brands or automotive suppliers to ensure material requirements and sustainability claims are met efficiently.

Downstream analysis focuses on the large end-use markets, primarily the textile and non-woven industries. Apparel manufacturers integrate RPET fibers into yarns and fabrics, leveraging its performance characteristics for sustainable product lines. Direct sales are common when RPET suppliers provide proprietary or certified sustainable fibers to flagship brands (e.g., Patagonia, Nike). Indirect distribution often occurs through yarn converters who purchase RPET staple fiber and then sell finished yarns to smaller, diverse textile manufacturers. Given the emphasis on sustainability, transparent logistics and warehousing certified by bodies like the Global Recycled Standard (GRS) are critical components of the modern RPET value chain, ensuring that the integrity of the recycled material is maintained until it reaches the final consumer product.

Recycled Polyester (RPET) Fiber Market Potential Customers

The primary customers for Recycled Polyester (RPET) Fiber are large, globally recognized companies operating in sectors characterized by high material consumption and intense public scrutiny regarding environmental impact. The most significant customer base resides within the Apparel and Textile Industry, specifically fast-fashion retailers, outdoor performance wear brands, and luxury fashion houses. These customers demand high-quality, traceable RPET to meet ambitious internal ESG targets and satisfy a consumer base that increasingly values sustainable and circular products. Brands that produce activewear, in particular, rely on RPET filament fibers for moisture-wicking properties, durability, and lightweight performance, making them pivotal high-volume buyers seeking long-term supply agreements with certified RPET producers.

The Automotive Industry represents a rapidly growing segment of potential customers, driven by the need to meet strict vehicle emission standards and circular economy directives. Major original equipment manufacturers (OEMs) such as BMW, Ford, and Toyota are integrating RPET into vehicle interiors—for seating, floor coverings, insulation, and acoustic damping materials. These buyers prioritize consistent supply, stringent quality control, and specific technical approvals (like flammability ratings) tailored for automotive applications. RPET usage in automotive components supports the industry's shift toward lighter-weight materials and enhances the perception of corporate environmental stewardship, positioning these manufacturers as lucrative customers for specialized, high-specification RPET compounders and fiber producers.

Furthermore, the Home Furnishings and Non-Woven sectors constitute a vast customer base, utilizing RPET staple fibers for applications ranging from carpeting, bedding, and upholstery filling to filtration media and geo-textiles in construction. Carpet manufacturers are crucial buyers, as RPET offers durability, stain resistance, and a cost-effective alternative to virgin nylon or polyester. These customers value RPET’s bulk and resilience, often engaging in indirect purchasing through regional fiber distributors. The increasing adoption of circular design principles in residential and commercial architecture further solidifies these industrial customers as essential long-term buyers, driving demand for RPET in large-scale infrastructure and construction projects that require verifiable sustainable material inputs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.8 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reliance Industries Limited, Zhejiang Jiaren New Materials Co., Ltd., Indorama Ventures Public Company Limited (IVL), Far Eastern New Century Corporation (FENC), Toray Industries Inc., Unifi Inc., PolyQuest Inc., Liberty Fibers, Lotte Chemical Corporation, Nanya Plastics Corporation, Green Fiber International Inc., SUEZ Group, Thai Taffeta Industry Co., Ltd., Teijin Limited, Jiangsu Sanfangxiang Group Co., Ltd., Shangdong Longda Special-Purpose Fibre Co., Ltd., Ganesha Ecosphere Ltd., Evergreen Plastics Inc., Eastman Chemical Company, Alpek S.A.B. de C.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Polyester (RPET) Fiber Market Key Technology Landscape

The Recycled Polyester (RPET) fiber market is driven by two distinct technological paths: mechanical recycling and chemical recycling, with significant innovation focusing on enhancing the efficiency and output quality of both processes. Mechanical recycling involves shredding, washing, melting, and extrusion of PET flakes into new fibers, representing the mature, low-cost technology that accounts for the bulk of current RPET production. Recent advances in mechanical recycling focus primarily on solid-state polymerization (SSP) processes to increase the intrinsic viscosity (IV) of the recycled polymer, making the resulting fiber stronger and suitable for higher-grade applications, effectively slowing down the inevitable downcycling that historically limits mechanically recycled PET. Furthermore, advanced melt filtration systems are being employed to remove minuscule non-PET contaminants, greatly improving the aesthetics and performance of the final fiber products.

Chemical recycling, often referred to as advanced recycling, represents the cutting edge of technological development, promising true textile-to-textile circularity. This technology breaks down the PET polymer back into its original monomers (glycolysis, methanolysis, or hydrolysis), which can then be purified and repolymerized into virgin-quality polyester fiber without any loss of performance. Methanolysis, which uses methanol to break down PET, is particularly favored for its high-purity output, while glycolysis utilizes ethylene glycol and is gaining traction for processing lower-quality or mixed PET waste streams. The successful commercialization and scaling of these chemical recycling technologies are crucial for the market's long-term sustainability, as they can process colored, contaminated, and mixed textile waste that mechanical processes cannot handle, thereby expanding the available feedstock pool exponentially.

Beyond the core recycling methods, ancillary technologies are vital for market maturation. This includes high-speed sensor-based sorting (using near-infrared spectroscopy and AI vision systems) to prepare pure feedstock streams, essential for high-quality RPET production. Furthermore, innovative techniques for textile pretreatment, such as automated de-trimming and zipper removal, are being developed to facilitate the processing of end-of-life garments. The integration of digital technologies, specifically blockchain, is becoming standard practice to ensure verifiable transparency of the recycled content journey from waste bin to final garment. These technological investments are critical for RPET fiber manufacturers to secure premium pricing and satisfy the strict traceability requirements imposed by major global brands committed to certified sustainable supply chains.

Regional Highlights

The market dynamics for Recycled Polyester (RPET) Fiber exhibit substantial regional variation, driven by differing regulatory frameworks, manufacturing capacities, and consumer demands.

- Asia Pacific (APAC): APAC holds the dominant position in terms of production volume, primarily centered in China, India, and Vietnam. This dominance is due to established textile manufacturing infrastructure, low operational costs, and access to the world’s largest pool of PET waste feedstock. While production is high, the region is rapidly moving up the value chain, investing in chemical recycling to meet stringent quality requirements for exporting RPET textiles to European and North American markets. China’s "14th Five-Year Plan" focuses heavily on enhancing recycling infrastructure and promoting resource utilization, further solidifying its manufacturing leadership.

- Europe: Europe represents a leading demand market characterized by strong regulatory enforcement and high consumer awareness. The European Union’s Circular Economy Action Plan and mandates on plastic packaging and minimum recycled content drive significant demand. The region focuses heavily on closing the loop internally, emphasizing textile-to-textile recycling and chemical depolymerization projects to reduce reliance on imported waste and enhance supply chain security. Germany, Italy, and Spain are key demand centers, especially for high-end fashion and automotive RPET applications.

- North America: North America is defined by high consumer demand for sustainable products and strong corporate commitments from major apparel and sports brands (e.g., Unifi, PolyQuest). While the region has substantial recycling capacity, it often relies on international markets for feedstock. Investment is concentrated in developing domestic collection infrastructure and commercializing advanced chemical recycling facilities to process mixed plastics and textile waste, moving toward greater self-sufficiency in high-quality RPET fiber supply.

- Latin America (LATAM): LATAM is an emerging market for RPET production, leveraging local PET bottle collection programs, particularly in Mexico and Brazil. Growth is propelled by domestic legislative efforts to tackle plastic pollution and increasing export opportunities to the US. The market is primarily focused on mechanical recycling for staple fiber applications but shows rising interest in establishing partnerships for advanced recycling technologies.

- Middle East & Africa (MEA): This region is characterized by varying levels of recycling maturity. The Middle East, particularly the UAE and Saudi Arabia, is investing in large-scale infrastructure projects to diversify economies and enhance waste management, driving potential future demand for RPET in construction and industrial applications. Africa, though facing structural challenges, holds vast potential as sustainable waste management practices develop, supported by international textile sourcing initiatives focused on ethical supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Polyester (RPET) Fiber Market.- Reliance Industries Limited

- Zhejiang Jiaren New Materials Co., Ltd.

- Indorama Ventures Public Company Limited (IVL)

- Far Eastern New Century Corporation (FENC)

- Toray Industries Inc.

- Unifi Inc.

- PolyQuest Inc.

- Liberty Fibers

- Lotte Chemical Corporation

- Nanya Plastics Corporation

- Green Fiber International Inc.

- SUEZ Group

- Thai Taffeta Industry Co., Ltd.

- Teijin Limited

- Jiangsu Sanfangxiang Group Co., Ltd.

- Shangdong Longda Special-Purpose Fibre Co., Ltd.

- Ganesha Ecosphere Ltd.

- Evergreen Plastics Inc.

- Eastman Chemical Company

- Alpek S.A.B. de C.V.

Frequently Asked Questions

Analyze common user questions about the Recycled Polyester (RPET) Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary feedstock source for Recycled Polyester (RPET) Fiber?

The primary feedstock source is post-consumer polyethylene terephthalate (PET) plastic bottles, which are mechanically or chemically recycled into flakes or monomers used to produce new RPET fibers. However, post-consumer textile waste (PCTT) is rapidly emerging as a critical secondary source for advanced chemical recycling processes.

How do mechanical recycling and chemical recycling differ for RPET production?

Mechanical recycling involves physical processing (melting and spinning) of plastic flakes, resulting in fibers with slight quality degradation (downcycling). Chemical recycling involves depolymerization, breaking the plastic back into pure monomers, allowing for the creation of virgin-quality RPET fiber, facilitating true closed-loop textile recycling.

Which application segment drives the highest demand for RPET fiber globally?

The Apparel and Textile segment drives the highest demand globally, particularly in activewear, casual clothing, and high-performance garments, due to strong brand commitments to sustainability and high consumer adoption of eco-friendly fashion lines.

What are the main challenges hindering the mass adoption of RPET fiber?

The main challenges include the high capital investment required for establishing advanced chemical recycling facilities, the technical difficulty of achieving consistent quality when using mixed or colored waste, and supply chain constraints related to efficient global PET and textile waste collection and sorting infrastructure.

How is the pricing of RPET fiber affected by crude oil prices?

RPET fiber pricing is indirectly influenced by crude oil prices because virgin polyester, which is oil-derived, serves as the primary competitor. When oil prices fall significantly, virgin polyester becomes cheaper, putting downward pressure on the price premium that RPET typically commands, requiring RPET producers to focus on cost efficiency or premium sustainable certification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager