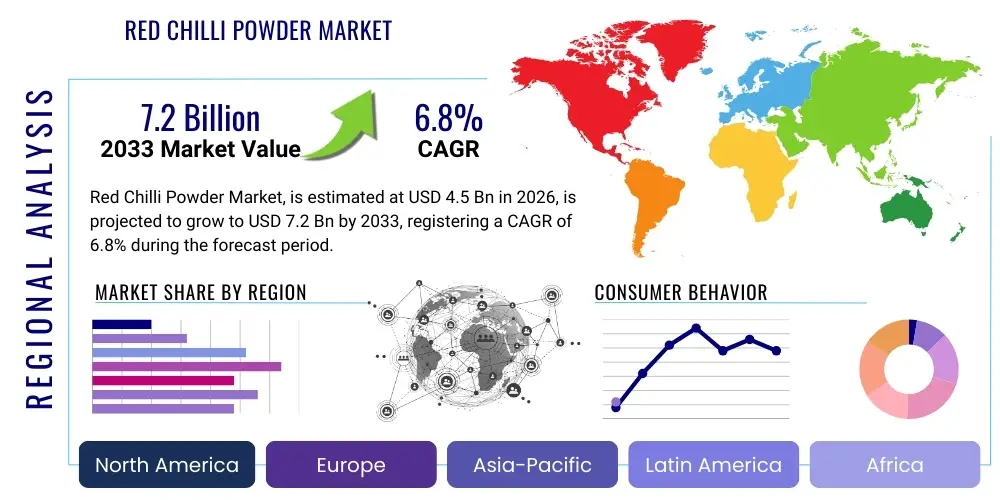

Red Chilli Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436178 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Red Chilli Powder Market Size

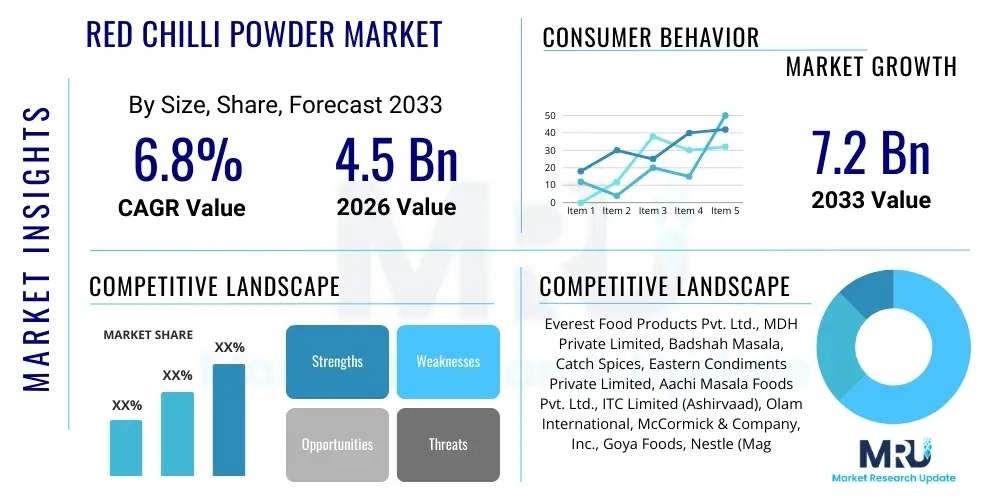

The Red Chilli Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the expanding global food processing industry, coupled with the increasing consumer demand for authentic and standardized spice products. The high consumption of chili powder, particularly in Asia Pacific and parts of Latin America, underpins the robust market valuation.

Red Chilli Powder Market introduction

The Red Chilli Powder Market encompasses the global trade and consumption of ground chili peppers, a staple seasoning derived from dried fruits of plants belonging to the genus Capsicum. The product serves as a crucial ingredient, imparting color, pungency, and flavor to diverse cuisines worldwide. Its preparation involves selecting, drying, and grinding various species of chili peppers, ensuring consistent quality in terms of heat units (measured in Scoville Heat Units, SHU) and color intensity. Major applications span across household cooking, industrial food processing (ready-to-eat meals, snacks, sauces, and marinades), and the foodservice sector (HORECA).

The primary benefits associated with red chili powder consumption extend beyond its culinary attributes; it is rich in capsaicin, which offers potential health benefits such as improved metabolism and analgesic properties. Furthermore, standardized and hygienically packaged red chili powder addresses consumer concerns regarding food safety and consistency. Key driving factors propelling market expansion include rapid urbanization, shifting consumer preferences towards exotic and spicy flavors, the proliferation of globalized food chains, and technological advancements in grinding and packaging that preserve product freshness and shelf life.

Red Chilli Powder Market Executive Summary

The Red Chilli Powder Market is witnessing dynamic shifts driven by standardization efforts and the burgeoning demand from the processed food sector. Business trends indicate a strong focus on traceability, with major manufacturers investing in backward integration to ensure raw material quality and combat issues related to adulteration and contamination. Furthermore, there is a growing market for premium, single-origin, and organic chili powders, catering to health-conscious consumers in developed economies. Innovation in packaging technology, particularly oxygen barrier and moisture-proof materials, is extending product shelf life and maintaining flavor integrity, positioning quality brands favorably in competitive retail environments. E-commerce platforms are increasingly critical, particularly for niche and specialty chili varieties, driving direct-to-consumer sales and expanding market penetration in non-traditional geographic areas.

Regionally, Asia Pacific maintains its dominance in both production and consumption, spearheaded by large markets like India, China, and Southeast Asian nations where chili powder is fundamental to daily cooking. North America and Europe are experiencing accelerated growth, fueled primarily by the increasing popularity of global cuisines, ethnic food penetration, and the high demand from industrial food manufacturers looking for bulk supply of various heat profiles. Segment trends highlight that the B2B segment, specifically the food processing industry, remains the largest consumer, valuing consistent quality and bulk availability. Within the B2C sector, online retail channels are showing the highest growth rate, offering consumers unparalleled access to diverse product types, from high-heat variants like Teja to milder, color-rich options like Kashmiri chili.

AI Impact Analysis on Red Chilli Powder Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Red Chilli Powder Market frequently revolve around how technology can enhance food safety, optimize supply chain resilience, and ensure product authenticity, given the historical issues of adulteration and quality variance in the spice trade. Users are keen to understand if AI-driven sorting and grading systems can improve the uniformity of raw material input (dried chillies) and whether predictive analytics can stabilize highly volatile raw material prices. Furthermore, questions emerge about AI's role in sophisticated consumer engagement, such as personalized recipe recommendations based on preferred heat levels and flavor profiles, thus driving higher consumption rates and brand loyalty. The core concerns address traceability and transparency, seeking assurance that AI solutions provide verifiable data from farm to fork, ultimately safeguarding consumer trust.

AI is beginning to revolutionize the Red Chilli Powder sector by introducing precision agriculture and smart quality control. Machine learning algorithms analyze satellite imagery and drone data to optimize irrigation, pest control, and harvesting times for chili crops, maximizing yield and improving capsaicin content consistency. In the processing phase, computer vision systems are employed to rapidly inspect dried chilies for defects, discoloration, or foreign materials before grinding, significantly improving the safety and purity of the final powder. This automated quality assessment is far more reliable and faster than traditional manual sorting, meeting stringent international food safety standards (e.g., HACCP, ISO 22000). AI-driven demand forecasting also plays a vital role in optimizing inventory management and reducing waste across the supply chain, ensuring manufacturers can respond dynamically to fluctuating seasonal and regional consumption patterns.

- AI-powered computer vision systems enhance raw material sorting, detecting foreign matter and non-standard chilies with high accuracy.

- Machine Learning (ML) models optimize supply chain logistics and routing, reducing transport costs and time-to-market.

- Predictive analytics aid in demand forecasting, inventory management, and mitigating risks associated with commodity price volatility.

- Blockchain technology, often integrated with AI, provides immutable traceability records, combating food fraud and ensuring origin transparency.

- AI-driven sensors monitor processing parameters (temperature, humidity) during drying and grinding to maintain optimal flavor and color retention.

DRO & Impact Forces Of Red Chilli Powder Market

The Red Chilli Powder Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory, generating significant impact forces. Key drivers include the massive growth of the ethnic food segment globally, requiring substantial imports of high-quality chili powder, particularly in Western markets. Additionally, the proliferation of packaged foods, snacks, and ready-to-cook meal kits necessitates large, stable supplies of industrial-grade chili powder, favoring large-scale processing units. Technological improvements in grinding, sterilization (such as steam sterilization), and packaging have also bolstered consumer confidence regarding hygiene and product freshness, acting as a major growth catalyst, especially for branded products.

Conversely, the market faces significant restraints, notably the high price volatility of raw chilies, which are heavily dependent on climatic conditions and geopolitical stability in major producing regions. A critical restraint is the persistent issue of adulteration, where unscrupulous practices involving mixing chili powder with cheaper alternatives or synthetic colorants erode consumer trust and pose health hazards. Strict food safety regulations imposed by importing nations (e.g., Maximum Residue Limits for pesticides and aflatoxins) also restrict market entry for producers lacking robust quality control systems, imposing substantial compliance costs. These restraints mandate substantial investment in quality assurance and certification, particularly for exports.

Opportunities for market expansion are abundant, particularly in the premium and specialty segments. The rising consumer demand for organic, non-GMO, and ethically sourced spices presents a lucrative avenue for specialized producers. Furthermore, product innovation focusing on specific heat profiles, customized blends for industrial clients, and convenient packaging formats (e.g., single-serving sachets) can capture new consumer groups. The development of advanced processing techniques that enhance color stability and extend shelf life without chemical additives also provides a competitive edge. The impact forces are generally high, driven by urbanization and rising disposable incomes in emerging markets, making this a high-growth, albeit regulated and volatile, commodity sector.

Segmentation Analysis

The Red Chilli Powder Market is comprehensively segmented based on Type, Application, Form, Packaging, and Distribution Channel, allowing for granular analysis of consumer preferences and industry demand dynamics. Segmentation by Type is crucial as it reflects the sensory attributes of the final product, ranging from low-heat, high-color variants essential for aesthetics (e.g., Kashmiri chili) to extreme-heat variants required for specific spice blends (e.g., Guntur or Teja varieties). The Application segment differentiates between household consumption, which prioritizes small, branded packaging, and industrial/commercial use, which demands bulk supply and stringent specification adherence.

The market analysis reveals that the industrial application segment holds the largest market share due to the explosive growth in the processed food and snack industry globally. However, the B2C segment, particularly through modern retail and online channels, is exhibiting the highest growth CAGR, reflecting increased consumer reliance on packaged, branded staples over unbranded loose powder. Understanding these segments is vital for stakeholders to tailor their product offerings, marketing strategies, and distribution networks to effectively capitalize on specialized market niches and generalized consumer requirements. The shift toward convenience and certified quality drives the premiumization trend across several segment dimensions.

- By Type:

- Kashmiri Chili Powder (Low Heat, High Color)

- Byadagi Chili Powder (Medium Heat, Rich Red Color)

- Guntur/Teja/S-17 Chili Powder (High Heat, Pungent)

- Standard Mixes/Blends

- By Application:

- Household/Retail

- Industrial (Food Processing, Beverage Manufacturing)

- Foodservice (HORECA)

- By Form:

- Powder

- Flakes/Crushed

- By Packaging Type:

- Sachets and Pouches (50g – 500g)

- Bottles and Jars

- Bulk Packaging (Bags, Drums, Industrial Boxes)

- By Distribution Channel:

- B2C (Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

- B2B (Direct Sales to Food Manufacturers, Wholesalers)

Value Chain Analysis For Red Chilli Powder Market

The value chain of the Red Chilli Powder Market begins with upstream activities involving agricultural cultivation, focusing on hybrid seed development, farming, and meticulous harvesting of raw chilies. Key upstream stakeholders include contract farmers, seed suppliers, and agricultural technology providers. Critical challenges at this stage involve ensuring the standardization of chili varieties, minimizing pesticide residues, and efficient drying practices to prevent mold and quality degradation, which heavily influence the final powder quality and pricing. Investment in post-harvest technology, especially solar or mechanical dryers, is crucial for preserving the color and capsaicin content before the raw material moves to aggregation centers.

Midstream activities involve processing, which includes cleaning, grinding, and packaging. Large-scale processors employ sophisticated machinery for sorting (often using AI-enhanced vision systems), cryogenic grinding to minimize heat generation and maintain volatile oils, and steam sterilization to comply with microbial safety standards without compromising flavor. Downstream activities focus on distribution, reaching consumers via complex networks. Distribution channels encompass direct sales to industrial clients (B2B), wholesalers, and modern retail chains (B2C) like supermarkets. Direct and indirect distribution routes are both essential; direct distribution ensures prompt delivery and adherence to customized industrial specifications, while indirect routes leverage the expansive reach of third-party logistics and major retail partnerships to penetrate mass markets.

The high complexity of the spice trade means that efficient logistics and reliable quality control at every stage are paramount. Value addition occurs through branding, quality assurance (certifications like ISO, FSSAI, FDA), and specialized processing techniques. The dominance of indirect channels for household consumption highlights the importance of strong relationships with major retailers and e-commerce platforms. For B2B sales, the relationship is often direct and contractual, emphasizing consistency, bulk delivery, and customized product specifications (e.g., particle size, SHU level). The ability to manage logistics across international borders, ensuring compliance with diverse import regulations, further adds significant value.

Red Chilli Powder Market Potential Customers

Potential customers for red chili powder span a diverse spectrum, categorized primarily into industrial users, foodservice providers, and end-consumers. The largest volume consumers are industrial food manufacturers, including companies specializing in ready-to-eat meals, snacks (chips, extruded products), sauces, condiments, and meat processing. These B2B clients require guaranteed consistency in flavor, color, and pungency, along with bulk, standardized packaging. They often demand specific particle sizes for optimal blending in their formulations and rely heavily on supplier certifications to ensure safety and regulatory compliance, making long-term supply contracts common.

The Foodservice (HORECA) segment represents another significant customer base, encompassing hotels, restaurants, and catering services. These customers prioritize high-quality, mid-sized packaging that offers convenience and preserves freshness, often opting for branded professional-grade products. Their purchasing decisions are driven by the need for consistency in their culinary output, maintaining specific heat and flavor profiles for their signature dishes. Finally, the massive consumer market constitutes end-users purchasing red chili powder for household cooking. This segment is highly fragmented, purchasing through diverse channels, including local markets, supermarkets, and online platforms, prioritizing factors like brand trust, perceived purity, and competitive pricing for their daily culinary needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Everest Food Products Pvt. Ltd., MDH Private Limited, Badshah Masala, Catch Spices, Eastern Condiments Private Limited, Aachi Masala Foods Pvt. Ltd., ITC Limited (Ashirvaad), Olam International, McCormick & Company, Inc., Goya Foods, Nestle (Maggi), Ajinomoto Co., Inc., Synthite Industries, VKL Seasoning Pvt. Ltd., Agro Products & Services, Emami Agrotech, R. K. Spices, Vasant Masala, DS Group (Rajhans), Sakthi Masala. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Red Chilli Powder Market Key Technology Landscape

The Red Chilli Powder Market is increasingly adopting advanced processing technologies to ensure product safety, preserve nutritional and sensory qualities, and meet stringent global export standards. A critical technology is Cryogenic Grinding, which utilizes liquid nitrogen or carbon dioxide to freeze the raw material before grinding. This low-temperature process prevents the loss of volatile essential oils and capsaicin—the compounds responsible for flavor and pungency—that often occurs due to frictional heat generated during conventional grinding. Cryogenic grinding results in finer powder particle size, superior color retention, and enhanced shelf stability, justifying the premium cost associated with the technology.

Another essential technological advancement is Steam Sterilization (or Vapour Sterilization). Given that raw spices often carry high microbial loads (bacteria, mold, and yeast), especially when sun-dried, steam sterilization subjects the chili powder to high-temperature saturated steam for a precise, short duration. This process effectively reduces microbial contamination, meeting stringent safety criteria (e.g., reduction of Salmonella and E. coli) without significantly degrading the color or flavor compounds, unlike chemical fumigation methods like ethylene oxide (ETO), which are banned in many jurisdictions. Furthermore, advanced packaging technologies, including Modified Atmosphere Packaging (MAP) and the use of multilayer barrier films incorporating metallized polyester or aluminum foil, are crucial for protecting the powder from oxygen, light, and moisture, thereby extending freshness and preventing clumping.

Digitalization also forms a key part of the technology landscape, particularly in traceability and quality control. Near-Infrared (NIR) spectroscopy and Hyperspectral Imaging are increasingly utilized for non-destructive, rapid analysis of chili powder to assess quality parameters such as moisture content, capsaicin levels (SHU), and detect adulteration or contamination in real-time. Integrating these sensing technologies with Enterprise Resource Planning (ERP) systems and Blockchain provides end-to-end visibility, ensuring compliance and enhancing consumer trust by guaranteeing the product's origin and purity across the entire value chain.

Regional Highlights

The global Red Chilli Powder Market exhibits distinct consumption patterns and growth dynamics across major geographical regions. Asia Pacific (APAC) stands as the dominant market, both in terms of production volume and consumption value. Countries like India, China, and Thailand are not only major producers of various chili varieties but also have deep-rooted culinary traditions where chili powder is an essential staple. The dense population, rapid economic growth, and the thriving packaged food sector in this region drive continuous high demand. India, in particular, is a global epicenter for chili production and trade, influencing global commodity prices and quality standards.

North America and Europe represent high-growth markets, primarily fueled by the increasing multicultural populations, leading to significant demand for authentic international flavors. The popularity of Mexican, Indian, Thai, and other spicy cuisines has prompted food manufacturers and foodservice operators in these regions to source large volumes of specialized chili powders. Consumers in these regions prioritize safety, organic certification, and detailed sourcing transparency, creating a premium market niche. Strict regulatory frameworks, such as those governed by the FDA in the US and EFSA in Europe, necessitate suppliers to adopt advanced sterilization and quality testing technologies to access these lucrative markets.

Latin America, especially Mexico, is a significant consumer and producer, characterized by high per capita consumption of chili products. The market here is largely traditional, though modern retail channels are expanding, increasing the demand for branded and packaged chili powders over loose varieties. The Middle East and Africa (MEA) region shows steady growth, driven by growing population, urbanization, and a strong preference for flavor-intensive cooking. Gulf Cooperation Council (GCC) countries, heavily reliant on food imports, present substantial opportunities for international exporters of high-quality, pre-packaged chili powder.

- Asia Pacific (APAC): Dominates the market due to massive domestic consumption, extensive cultivation, and the presence of major global processors; high growth in processed foods.

- North America: High-value market characterized by demand for specialty, organic, and ethically sourced chili products; growth driven by ethnic food trends and rigorous food safety standards.

- Europe: Driven by strict regulatory compliance; focused on import of standardized, sterilized powder for food manufacturing and specialty retail segments; increasing popularity of high-heat varieties.

- Latin America: Stable consumer base with high traditional consumption; modernization of retail infrastructure driving demand for packaged, branded goods.

- Middle East and Africa (MEA): Growth bolstered by high reliance on food imports, increasing disposable incomes, and urbanization across Gulf nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Red Chilli Powder Market.- Everest Food Products Pvt. Ltd.

- MDH Private Limited

- Badshah Masala

- Catch Spices

- Eastern Condiments Private Limited

- Aachi Masala Foods Pvt. Ltd.

- ITC Limited (Ashirvaad)

- Olam International

- McCormick & Company, Inc.

- Goya Foods

- Nestle (Maggi)

- Ajinomoto Co., Inc.

- Synthite Industries

- VKL Seasoning Pvt. Ltd.

- Agro Products & Services

- Emami Agrotech

- R. K. Spices

- Vasant Masala

- DS Group (Rajhans)

- Sakthi Masala

Frequently Asked Questions

Analyze common user questions about the Red Chilli Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Red Chilli Powder Market?

The Red Chilli Powder Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven primarily by globalization of cuisines and increased consumption of processed foods.

Which factors are driving the growth of the industrial segment in the Red Chilli Powder Market?

The industrial segment's growth is largely driven by the rapid expansion of the ready-to-eat and processed food manufacturing sectors, which require consistent, bulk supply of chili powder with standardized heat and color specifications for mass production.

What are the primary challenges related to quality and safety in the global chili powder trade?

The primary challenges include high price volatility, concerns over adulteration (mixing with cheaper ingredients or artificial colorants), and the need to meet strict international regulations regarding pesticide residues and microbial contamination, necessitating advanced sterilization techniques.

How does technological advancement like cryogenic grinding benefit the quality of chili powder?

Cryogenic grinding, by freezing the chilies before processing, prevents the loss of volatile essential oils and capsaicin due to heat, resulting in a finer powder with superior retention of flavor, aroma, color, and pungency compared to conventional methods.

Which geographical region holds the largest market share for Red Chilli Powder?

Asia Pacific (APAC) holds the largest market share due to its significant production volumes, large consumer base, and deep cultural integration of chili powder in daily cooking and local food processing industries, with India and China being key contributors.

The global Red Chilli Powder Market is fundamentally influenced by shifting demographic trends and evolving consumer health consciousness. As urbanization continues globally, consumers increasingly rely on branded, packaged spices, moving away from traditional, unbranded loose powder purchased through informal markets. This shift is primarily motivated by heightened awareness regarding food safety, consistency, and the need for convenience in busy urban lifestyles. Major brands capitalize on this trend by emphasizing their stringent quality control processes, including sourcing transparency, steam sterilization, and advanced packaging to guarantee product purity and extended freshness. The demand for specific regional varieties, such as high-pigment Kashmiri chili powder or high-pungency Guntur chili, is also being meticulously addressed through targeted branding strategies and specialized supply chains, ensuring global availability of these niche products.

Furthermore, the market structure is becoming increasingly competitive, pressuring mid-sized players to either invest heavily in technology and certification or risk being marginalized by large multinational corporations (MNCs) that command superior supply chain efficiencies and marketing reach. Strategic partnerships between raw material suppliers, processors, and major food manufacturers (B2B) are becoming critical to ensure a stable supply of high-quality, standardized ingredients necessary for large-scale industrial use. In the B2C sector, product differentiation often hinges on factors such as organic certification, single-origin sourcing claims, and sustainable farming practices, appealing directly to the environmentally and socially conscious consumer demographic, particularly in North America and Europe. These factors collectively drive innovation in both product formulation and distribution methodology, setting the stage for steady, quality-focused market expansion.

In terms of regulatory impact, the establishment and enforcement of strict food safety standards by global bodies and national governments have fundamentally altered market dynamics. Producers exporting to the European Union or the United States must strictly comply with limits on contaminants like aflatoxins and synthetic dyes. This regulatory pressure acts as a barrier to entry for smaller, non-compliant producers but simultaneously offers a significant advantage to technologically equipped firms capable of performing rigorous testing and maintaining HACCP certification. Consequently, the market is gradually consolidating toward players who can demonstrate verifiable commitment to international quality benchmarks, further professionalizing the traditionally informal spice trade sector. This focus on verifiable quality is expected to remain a primary determinant of market leadership over the forecast period.

The application of Red Chilli Powder within the Food Processing industry is expansive and complex, representing the single largest consumption segment. It is integral to numerous products, including savory snacks (e.g., potato chips, extruded snacks), instant noodles, canned and frozen foods, and ready-to-cook meal kits. Manufacturers prioritize chili powder that offers consistent color, specific heat profiles (measured in SHU), and excellent dispersibility within complex food matrices. The demand here is highly technical; for example, a manufacturer of chili-flavored chips requires a fine powder that adheres well to the surface, while a sauce producer needs a powder that dissolves uniformly without clumping. Suppliers often work directly with industrial clients to develop custom blends and specifications that meet precise textural and sensory requirements, forging deep, specialized business relationships. This specialized B2B requirement drives investment in precision grinding and blending equipment.

The household consumption segment, while volume-wise smaller than the industrial segment, is crucial for brand development and profitability. Consumers are increasingly discerning, often opting for premium packaging that ensures flavor preservation and hygiene. The market is segmented further by heat preference, with consumers choosing between milder, color-enhancing chili powders and intensely hot varieties. In traditional cooking regions, brand trust is paramount, often built through decades of consistent quality delivery. The rise of cooking shows, global food media, and social media influencers also plays a role in driving trial and adoption of specialty chili types, encouraging consumers to experiment with diverse spice blends and regional culinary techniques. This segment's growth is strongly correlated with increased disposable incomes and global exposure to diverse food cultures.

Distribution channels for red chili powder are evolving rapidly. While traditional grocery stores and wholesale markets remain vital in emerging economies, modern retail channels—hypermarkets, supermarkets, and convenience stores—are gaining dominance due to their superior infrastructure, centralized purchasing power, and ability to enforce quality standards on their vendors. Crucially, the online retail segment is experiencing exponential growth, especially in developed markets, offering convenience and access to a wider variety of specialty and imported chili powders that might not be stocked locally. E-commerce facilitates direct-to-consumer models for niche brands, reducing dependence on traditional retail middlemen. This digital transformation requires manufacturers to invest in robust supply chain tracking and aesthetically appealing, e-commerce-friendly packaging designs that withstand shipping stresses while maintaining product integrity.

The market for organically certified red chili powder is poised for significant expansion, particularly in Europe and North America. Organic production prohibits the use of synthetic pesticides and fertilizers, addressing key consumer concerns related to chemical residues. Although organic chili powder currently constitutes a small fraction of the total market, its high growth rate reflects a broader trend toward clean label ingredients and sustainable consumption. Achieving organic certification, however, demands stringent farming practices, segregated processing facilities, and high auditing costs, leading to premium pricing compared to conventional alternatives. Manufacturers pursuing this opportunity often highlight ethical sourcing and environmental sustainability in their marketing, appealing to a demographic willing to pay a premium for verified ecological integrity.

In the context of technology adoption, traceability solutions utilizing Blockchain technology are gaining traction. Given the fragmented and complex nature of the chili supply chain, where raw materials may pass through multiple aggregators and processors, guaranteeing the origin and purity of the powder is challenging. Blockchain provides an immutable, transparent ledger recording every transaction and quality check from the farm gate to the retail shelf. This enhanced traceability not only builds consumer trust but also helps manufacturers swiftly isolate and recall contaminated batches, minimizing liability and damage to brand reputation. Such sophisticated digital solutions are becoming a necessity for global traders operating in highly regulated environments and interacting with large industrial clients who require verifiable supply chain security.

Competitive dynamics in the Red Chilli Powder Market are characterized by a mix of highly localized regional powerhouses and internationally dominant commodity traders. Companies like Everest and MDH in India hold enormous brand equity within their home markets and diaspora communities globally. Conversely, multinational commodity giants like Olam and McCormick leverage their global procurement networks and advanced processing capabilities to serve the large industrial food sector worldwide. The key competitive differentiator often lies not only in price but also in the ability to consistently deliver standardized quality, manage price hedging strategies against raw material volatility, and rapidly adapt to evolving consumer preferences for specific heat levels and ethical sourcing claims. Merger and acquisition activities are frequent, as larger players seek to acquire regional brands with strong local market penetration or specialized processing technologies.

The demand for chili powder varieties, segmented by their Scoville Heat Units (SHU), is becoming more sophisticated. Consumers are moving beyond generic "chili powder" to seek out specific varieties based on their intended culinary use. For instance, low-SHU, high-color varieties (like Paprika or specific Kashmiri types) are used where visual appeal and color saturation are prioritized, such as in seasoning blends or meat rubs. High-SHU varieties (like Teja or Bhut Jolokia derivatives, often sold in concentrated or specialty forms) cater to the growing demand for extreme heat challenges and niche culinary experimentation. Manufacturers must manage inventories of multiple chili strains and possess the blending expertise necessary to create standardized finished products that consistently meet the required SHU target, reflecting a transition from basic commodity trading to specialized ingredient manufacturing.

The influence of socio-economic factors, particularly in Asia Pacific and Latin America, dictates consumption patterns. Rising middle-class populations in India and Southeast Asia are shifting from unorganized, loose spice purchases to branded, packaged goods, contributing significantly to the formal market growth. This transition provides companies with opportunities for branding, packaging innovation, and utilizing targeted advertising. Conversely, economic instability in certain regions can constrain consumer purchasing power, leading to temporary down-trading to cheaper, unbranded alternatives. Therefore, maintaining competitive pricing while assuring superior quality remains a delicate balance for market players targeting mass consumer segments in rapidly developing economies.

Finally, sustainability and environmental concerns are increasingly shaping the upstream segment of the value chain. Climate change poses a direct threat to chili cultivation, leading to unpredictable harvests and increased vulnerability to pests and diseases, which in turn drives up commodity prices. In response, market leaders are investing in climate-resilient farming techniques, supporting farmers in adopting sustainable irrigation practices, and promoting diversification of sourcing locations to mitigate supply risk. These efforts not only contribute to corporate social responsibility goals but also ensure the long-term viability of the raw material supply, reinforcing the stability and resilience of the entire Red Chilli Powder Market against future environmental shocks. The future of the market hinges on balancing mass production efficiency with ethical sourcing and technological precision.

The utilization of Red Chilli Flakes (or crushed chilies) as a separate form segment is gaining significant traction globally, distinct from the traditional fine powder. Chili flakes are widely popular in the foodservice industry, particularly in Italian, Mediterranean, and fast-casual dining, where they are used as a condiment or topping. The demand for flakes is driven by aesthetic preference and the textural contribution they provide to dishes. This segment requires different processing techniques, primarily focusing on maintaining the structural integrity of the chili pieces and minimizing dust, often involving specialized crushing and sieving equipment. Manufacturers are increasingly offering pre-packaged spice kits or specific blends that include both powder and flakes, catering to the versatile needs of modern consumers and professional kitchens, thereby diversifying their product portfolio and maximizing market coverage across various culinary applications.

In the context of the Middle East and Africa (MEA), market growth is strongly correlated with increased trade liberalization and foreign investment. As these regions develop modern infrastructure and embrace global food trends, the import of high-quality, reliable packaged chili powder grows. The expatriate population, coupled with a general increase in dining out, fuels the demand in the HORECA sector. However, local production capacity in parts of Africa, while existent, often struggles with inconsistent quality and processing limitations, creating a dependency on external suppliers, particularly those from Asia and South America who can offer standardized products compliant with Islamic dietary laws (Halal certification). This dependence highlights the strong B2B opportunities for certified international exporters within the GCC and surrounding African nations.

To optimize for Answer Engine Optimization (AEO), content must directly address user intent and provide definitive, factual summaries. The high-level market data, segment breakdowns, and technological summaries provided throughout the report serve this function by offering clear, structured answers to commercial and technical queries. For Generative Engine Optimization (GEO), the use of strong semantic headers (H2, H3), detailed descriptive paragraphs integrated with long-tail keywords (e.g., "cryogenic grinding benefits," "impact of AI on spice safety," "global consumer preferences for organic chili powder"), and well-structured lists ensures that the generated text is easily indexed and used by generative models to form accurate, context-rich responses, solidifying the report’s authority in the domain of spice market analysis.

The regulatory environment in different regions poses a multifaceted impact on market strategy. In Europe, the regulation of synthetic colorants (such as Sudan dyes) is extremely strict, often resulting in large-scale product recalls if contamination is detected. This necessitates intensive pre-export testing and high-level quality assurance systems. Conversely, in many developing economies, while regulations exist, enforcement may be sporadic, allowing unbranded, lower-quality products to compete aggressively on price. International players must maintain dual standards—one for highly regulated export markets and another for domestic markets—which adds complexity and cost to operations. Harmonization of global standards, though slow, remains an industry goal that would streamline processing and reduce trade barriers, promoting fairer competition based on genuine quality metrics.

In conclusion, the Red Chilli Powder Market is positioned for robust growth, underpinned by fundamental demand drivers related to global food habits and the necessity of convenient, safe ingredients. The market's future will be defined by its ability to navigate technological integration (AI, Blockchain), manage commodity volatility through efficient supply chain management, and continually reassure consumers through enhanced transparency and certified quality, ensuring that this staple ingredient retains its central role in kitchens and food manufacturing worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager