Reducer Housing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431658 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Reducer Housing Market Size

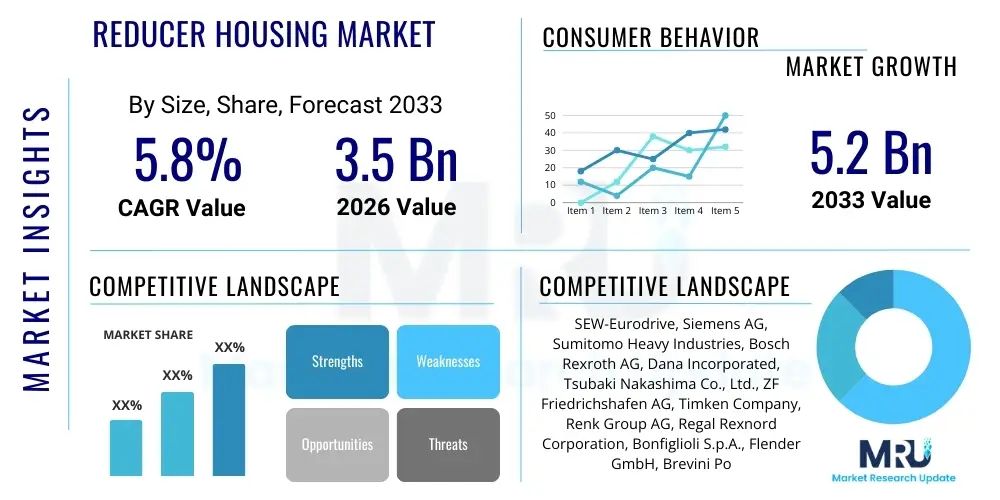

The Reducer Housing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for industrial automation across diverse manufacturing sectors, coupled with significant investments in renewable energy infrastructure, particularly wind power, where robust and durable reducer housings are critical components for gearbox longevity and performance. The continuous modernization of existing industrial machinery, necessitating the replacement and upgrade of gearbox components, further solidifies the market expansion outlook.

Reducer Housing Market introduction

The Reducer Housing Market encompasses the design, manufacturing, and distribution of protective casings essential for enclosing gear trains, shafts, and bearings within speed reduction mechanisms. These housings, typically engineered from high-strength materials such such as cast iron, aluminum alloys, or specialized composite materials, serve the vital function of maintaining precise alignment, dissipating operational heat, containing lubricants, and shielding internal components from environmental contaminants like dust, moisture, and abrasive particles. The primary purpose of a reducer housing is to ensure the efficient, reliable, and extended operation of gearboxes used ubiquitously across heavy and light industrial applications, guaranteeing structural integrity under immense mechanical stress and varied operational temperatures.

Major applications for high-performance reducer housings span critical sectors including heavy machinery and mining equipment, industrial robotics and automation systems, specialized transportation infrastructure, and highly demanding renewable energy installations, notably wind turbine drivetrains. The benefits derived from advanced reducer housing solutions include enhanced operational stability, reduced vibration and noise levels, improved thermal management capabilities which are crucial for high-speed or high-torque applications, and significantly lower maintenance costs over the equipment lifecycle. Furthermore, modern housing designs often incorporate modularity and lightweight characteristics, addressing contemporary industry demands for energy efficiency and ease of installation.

Driving factors propelling market growth include the accelerating pace of global industrialization, particularly in emerging economies, alongside the persistent trend toward smart manufacturing processes requiring precision motion control. The stringent operational requirements in sectors such as oil and gas, aerospace manufacturing, and precision engineering demand housings with superior material specifications and tighter manufacturing tolerances. Additionally, the increasing global focus on maximizing energy efficiency and minimizing machine downtime translates directly into a higher demand for premium-quality, defect-free reducer housings capable of withstanding continuous, high-duty cycles without compromise.

Reducer Housing Market Executive Summary

The global Reducer Housing Market is experiencing robust expansion, characterized by a fundamental shift toward lightweight material utilization and adoption of advanced manufacturing techniques, specifically high-precision CNC machining and increasing experimentation with specialized additive manufacturing for complex geometries. Business trends indicate strong consolidation among key players, focusing on vertical integration to control the quality of raw material supply, particularly high-grade iron and specialized aluminum. Furthermore, there is an escalating emphasis on developing modular gearbox designs that allow for flexible component exchange and easier integration into diverse industrial machinery, catering directly to the bespoke requirements of major original equipment manufacturers (OEMs) in automation and power generation sectors. This pursuit of greater manufacturing flexibility and customized component solutions is redefining competitive landscapes.

Regionally, the Asia Pacific (APAC) continues to dominate the production and consumption landscape, fueled by rapid industrialization in China, India, and Southeast Asian nations, alongside the region’s established position as a global manufacturing hub for automotive and electronics components. North America and Europe, however, exhibit higher demand for technologically advanced and specialized reducer housings, driven by the maturity of their aerospace, medical device, and high-end robotics industries, demanding superior thermal performance and stringent tolerance specifications. Segment trends highlight the growing prominence of aluminum alloys, favored for their excellent strength-to-weight ratio in applications like robotics and electric vehicles, significantly outpacing the growth of traditional cast iron in specific high-growth segments. The helical and planetary gearbox housing types are witnessing particularly strong adoption due to their compactness and high efficiency in heavy-duty industrial and precision motion applications.

Overall, the market trajectory is strongly linked to global capital expenditure in factory automation and infrastructure projects, ensuring sustained demand for durable power transmission components. The key market challenge remains mitigating raw material price volatility and achieving zero-defect production in high-volume environments. Strategic alliances focusing on material research and development of anti-corrosion coatings are becoming vital for competitive differentiation, especially for housings exposed to harsh environments such as marine or chemical processing facilities. The incorporation of sensor technology directly into the housing structure for condition monitoring is emerging as a critical evolutionary trend, transitioning the product from a passive component to an active enabler of predictive maintenance strategies.

AI Impact Analysis on Reducer Housing Market

Common user questions regarding AI's influence on the Reducer Housing Market frequently center on how these technologies can enhance production efficiency, predict component failure, and optimize material use during the design and machining phases. Users are particularly interested in understanding the practical implementation of AI-driven defect detection systems in high-volume casting and forging operations, minimizing costly scrap rates associated with internal material flaws. Furthermore, inquiries focus heavily on how AI algorithms analyze vibration and temperature data transmitted from sensors integrated into the housing structure, enabling precise, predictive maintenance scheduling, thereby extending mean time between failures (MTBF) and dramatically reducing unplanned operational downtime across demanding industrial setups. The consensus expectation is that AI will transform the reducer housing from a simple mechanical component into a critical node within the Industrial Internet of Things (IIoT) framework, fundamentally altering the service and maintenance models deployed by manufacturers and end-users.

- AI-driven optimization of casting and forging parameters to minimize internal defects and material waste, resulting in superior mechanical properties.

- Integration of machine learning models for real-time quality control during complex CNC machining processes, ensuring tighter tolerance adherence and reducing human error.

- Implementation of predictive maintenance algorithms utilizing vibration and acoustic data collected by sensors mounted directly onto the reducer housing to forecast component degradation.

- AI-enhanced supply chain management, optimizing inventory levels of raw materials (e.g., specific iron grades, aluminum alloys) and finished housings based on real-time global demand forecasts.

- Generative design tools, powered by AI, assisting engineers in creating novel, lightweight, and thermally efficient housing geometries that were previously too complex or computationally intensive to design manually.

- Automated visual inspection systems using deep learning for precise surface finish and dimensional verification, ensuring compliance with rigorous automotive and aerospace standards.

DRO & Impact Forces Of Reducer Housing Market

The market dynamics of reducer housings are currently driven by the global surge in industrial automation and capital expenditure in renewable energy sectors, particularly offshore wind power, which demands extremely robust and high-torque gearbox components. These drivers are compelling manufacturers to invest heavily in advanced casting and machining capabilities. Conversely, the market faces significant restraints from the inherent volatility of raw material costs, specifically steel, aluminum, and specialized alloys, which frequently compress profit margins, alongside the increasing complexity of modern gearbox designs requiring multi-material integration and intricate internal geometries. Opportunities are abundant in the development and market penetration of lightweight, corrosion-resistant composite materials and the advancement of smart housings that integrate embedded sensors for real-time condition monitoring, offering value-added services beyond the core mechanical function. These factors collectively exert substantial pressure on pricing and innovation cycles.

Impact forces dictate that suppliers must prioritize precision manufacturing and material quality to meet demanding application specifications, particularly in aerospace and high-speed rail. The competitive intensity is moderate to high, with differentiation primarily achieved through material science expertise, manufacturing scale, and the ability to deliver customized, complex designs rapidly. Regulatory requirements related to noise reduction and energy efficiency (e.g., efficiency classes for gearboxes) also serve as significant external forces, compelling a continuous refinement in housing design, focusing on optimized lubricant channels and heat dissipation mechanisms to minimize energy losses. The long-term success in this market is intrinsically tied to a manufacturer's capacity to integrate digital technologies, specifically AI and IIoT, into both the production lifecycle and the final product offering, thereby addressing the crucial industry need for enhanced reliability and operational transparency.

The rapid adoption of electric vehicles (EVs) and associated high-power density drive units presents a unique set of impact forces. EV powertrains require reducer housings capable of managing extremely high rotational speeds and sudden torque loads while maintaining strict acoustic performance standards. This application pushes the boundaries of traditional metallurgy and necessitates specialized heat treatment and surface finishing technologies to ensure long-term durability and silent operation. Furthermore, the global emphasis on sustainability pressures manufacturers toward utilizing recycled materials and adopting energy-efficient manufacturing processes, thereby reshaping material sourcing and process engineering practices within the market.

Segmentation Analysis

The Reducer Housing Market is comprehensively segmented based on material type, the specific gearbox type it houses, the manufacturing process employed, and the primary end-use application. Understanding these segmentations is critical for manufacturers to tailor their production capabilities and marketing strategies, addressing the specific performance criteria demanded by various industrial clients. Material segmentation differentiates performance characteristics significantly, with cast iron dominating heavy industrial sectors due to its vibration damping properties and cost-effectiveness, while specialized aluminum alloys and increasingly high-performance plastics are gaining traction in automotive, robotics, and consumer electronics due to their low weight and superior thermal conductivity. Process segmentation highlights the technical evolution from conventional sand casting to high-pressure die casting and precision forging, each offering trade-offs between unit cost, structural integrity, and achievable dimensional accuracy.

Segmentation by gearbox type reflects the mechanical complexity and specific functional demands of the application; for example, planetary gear housings require exceptional radial stiffness due to the internal load distribution, whereas worm gear housings must manage significant sliding friction heat generation, necessitating optimized thermal interfaces. The end-use application segment is perhaps the most defining, partitioning demand based on the harshness of the operational environment, required duty cycle, and regulatory compliance standards. Segments such as wind energy and offshore oil and gas require maximum corrosion resistance and structural redundancy, driving demand for specialized coatings and robust material specifications, distinct from the requirements of general manufacturing automation where cost optimization and volume production are paramount.

- By Material:

- Cast Iron (Grey Iron, Ductile Iron)

- Aluminum Alloys (Die-cast Aluminum, Gravity Cast Aluminum)

- Steel (Cast Steel, Forged Steel)

- Specialized Plastics and Composites

- By Gearbox Type:

- Worm Gear Reducer Housing

- Helical Gear Reducer Housing

- Bevel Gear Reducer Housing

- Planetary Gear Reducer Housing

- Cylindrical Gear Reducer Housing

- By Manufacturing Process:

- Casting (Sand Casting, Die Casting, Investment Casting)

- Forging

- Fabrication/Welding

- Additive Manufacturing (for prototyping and specialized parts)

- By End-Use Application:

- Industrial Machinery (Conveyors, Pumps, Mixers)

- Wind Energy (Turbine Drivetrains)

- Automotive and Transportation (Heavy trucks, Electric Vehicles)

- Mining and Construction Equipment

- Robotics and Automation

- Aerospace and Defense

Value Chain Analysis For Reducer Housing Market

The value chain for the Reducer Housing Market begins with the highly specialized upstream procurement of raw materials, primarily high-grade ferrous metals (ductile and gray iron) and non-ferrous alloys (aluminum, specifically grades 380 and A356). The quality and consistency of these materials are paramount, directly influencing the final component's structural integrity and machinability. Suppliers of these raw materials must meet rigorous metallurgical standards, often requiring custom formulations to achieve specific vibration damping and tensile strength properties demanded by high-performance applications. Price negotiation and stable sourcing agreements at this stage significantly determine the final cost structure of the reducer housing. Following material acquisition, the process moves to conversion—either specialized casting (sand, gravity, or high-pressure die) or precision forging, which sets the foundational geometry and initial structural characteristics of the component.

Midstream activities involve intensive and highly accurate machining operations, including multi-axis CNC milling, boring, and turning, designed to achieve the micron-level tolerances required for bearing seats, shaft bores, and mounting surfaces. This precision is non-negotiable as it directly impacts the alignment of the internal gear set, which is critical for minimizing friction, noise, and premature wear. Quality control, including non-destructive testing (NDT) such as ultrasonic inspection and radiographic analysis to detect internal voids, is integrated throughout this stage. Surface finishing, painting, and application of specialized protective coatings (e.g., epoxy, anti-corrosion, or thermal barrier coatings) are the final steps before the housing is prepared for distribution. The efficiency of this midstream process, heavily reliant on capital-intensive machinery and skilled labor, is a key determinant of competitive advantage.

Downstream distribution channels are bifurcated, serving both direct and indirect routes. Direct sales are predominant for large-volume orders to major OEMs in the wind energy, automotive, and heavy machinery sectors, where long-term supply contracts and highly customized design specifications necessitate close manufacturer-client interaction. Indirect distribution involves a network of authorized distributors, industrial supply houses, and specialized gear repair shops that cater to the aftermarket segment, smaller machinery manufacturers, and MRO (Maintenance, Repair, and Overhaul) service providers. Effective inventory management and geographic proximity to key industrial clusters are crucial for indirect channel success, ensuring rapid supply of standard housing types. E-commerce platforms are increasingly utilized for smaller, standard components, streamlining procurement for the MRO segment.

Reducer Housing Market Potential Customers

Potential customers for high-quality reducer housings are diverse, extending across any industry reliant on mechanical power transmission and speed or torque modification. The primary consumer base consists of large Original Equipment Manufacturers (OEMs) specializing in capital goods and industrial machinery, which incorporate gearboxes as core components. These OEMs demand high-volume supply, adherence to stringent quality control standards (such as ISO or industry-specific certifications like API for oil and gas), and collaborative design partnerships to ensure seamless integration into complex mechanical systems. Key sectors include manufacturers of conveying systems, agitators, pumps, compressors, and specialized material handling equipment used in logistics and processing plants. A strong focus is placed on the total cost of ownership (TCO) and certified longevity, driving demand for materials and designs that promise long operational lives in demanding conditions.

Beyond traditional industrial OEMs, the renewable energy sector, particularly wind turbine manufacturers, represents a high-value customer segment. Gearbox housings in multi-megawatt wind turbines are subject to extreme, variable loads and harsh environmental exposure, necessitating specialized metallurgy, sophisticated anti-corrosion treatments, and proven fatigue resistance. Similarly, the rapidly expanding automotive sector, especially electric vehicle manufacturers and Tier 1 suppliers developing e-axles and reduction gearboxes, are major consumers. This segment prioritizes lightweight materials (aluminum/composites) for efficiency gains and advanced noise, vibration, and harshness (NVH) performance, demanding ultra-precise machining to achieve silent operation. The growing adoption of industrial robotics and advanced manufacturing automation further expands the customer base, requiring compact, high-precision housings for articulated robot joints and linear motion systems.

Finally, the Maintenance, Repair, and Overhaul (MRO) segment, comprising service companies, industrial repair shops, and end-users operating legacy machinery, constitutes a consistent stream of demand for replacement and upgrade housings. These customers often seek compatible, readily available standard parts or rapid customized solutions for repairing older equipment, prioritizing quick turnaround times and dimensional interchangeability. Establishing strong relationships with these MRO providers is crucial for sustaining aftermarket revenue and ensuring brand visibility long after the initial equipment sale. The trend toward customized gearbox solutions for specific industrial challenges further encourages direct engagement with large end-users seeking performance improvements through component upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SEW-Eurodrive, Siemens AG, Sumitomo Heavy Industries, Bosch Rexroth AG, Dana Incorporated, Tsubaki Nakashima Co., Ltd., ZF Friedrichshafen AG, Timken Company, Renk Group AG, Regal Rexnord Corporation, Bonfiglioli S.p.A., Flender GmbH, Brevini Power Transmission (now Dana), Nidec Corporation, Comer Industries S.p.A., China High Speed Transmission Equipment Group Co., Ltd., Eickhoff Antriebstechnik GmbH, Winergy AG, NGC Group, Elecon Engineering Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reducer Housing Market Key Technology Landscape

The technological landscape of the Reducer Housing Market is undergoing rapid evolution, primarily driven by the need for superior precision, reduced component weight, and enhanced thermal performance. A foundational technology remains advanced machining, specifically 5-axis Computer Numerical Control (CNC) milling centers. These sophisticated machines are essential for accurately manufacturing complex internal geometries, particularly the highly critical bearing bores and internal features that dictate the overall efficiency and noise profile of the assembled gearbox. Modern CNC strategies focus on minimizing tooling deflection and achieving nanometer-level surface finishes on critical mating surfaces, thereby improving lubricant retention and reducing vibrational energy transfer. Furthermore, the implementation of automated measurement systems, such as in-line Coordinate Measuring Machines (CMMs) and laser scanners, provides closed-loop feedback to the CNC process, ensuring consistent quality in high-volume production runs and maintaining compliance with extremely tight geometrical tolerances required by aerospace and high-speed applications.

Material science innovation is another critical technology area. The shift toward lightweight solutions has intensified the reliance on specialized aluminum alloys (e.g., Al-Si-Mg alloys) and high-strength, low-density materials. Die casting, particularly high-pressure die casting (HPDC), is frequently used for aluminum housings in automotive and small robotics due to its ability to produce components near net shape, minimizing subsequent machining requirements. Concurrently, specialized surface engineering techniques, including plasma-nitriding, thermal spraying, and advanced ceramic or polymer coatings, are being deployed to enhance resistance to corrosion, abrasion, and cavitation in extremely harsh operational environments, extending the housing's functional life significantly without adding substantial weight or complexity to the underlying casting process. Research into composite materials, though currently niche, holds future potential for extremely demanding, weight-sensitive applications.

Additive Manufacturing (AM), or 3D printing, is gaining relevance, primarily in prototyping, small-batch production of highly customized housings, and the creation of internal features that are impossible to achieve via traditional casting, such as intricate cooling channels or integrated structural lattices for weight reduction. While AM faces cost and material property limitations for mass production of large, load-bearing housings, its ability to rapidly iterate on complex thermal management designs is invaluable in the product development cycle, especially for next-generation electric vehicle and aerospace gearboxes where maximizing power density is key. Finally, the integration of smart technologies, encompassing micro-sensors (accelerometers, thermocouples, acoustic emission sensors) directly embedded into the housing material during the casting or molding process, transforms the component into an intelligent data collection point, fundamentally enabling sophisticated condition monitoring and predictive maintenance strategies central to Industry 4.0 paradigms.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market, dominating both manufacturing capacity and regional consumption. This dominance is attributed to rapid, large-scale industrialization, particularly in China and India, coupled with massive infrastructure development projects and a substantial manufacturing base for electronics, automotive, and heavy industry. Countries like South Korea and Japan maintain high demand for technologically advanced housings used in high-precision robotics and machine tools. The proliferation of renewable energy projects, especially solar and onshore wind farms, further sustains demand for medium-to-large sized cast iron and ductile iron housings for reliable power transmission components.

- North America (NA): The North American market is characterized by a strong demand for high-performance and customized reducer housings, driven by mature industries such as aerospace, oil and gas, and the accelerating adoption of industrial automation and sophisticated robotics in the United States and Canada. Demand is shifting toward lightweight aluminum housings for the rapidly expanding electric vehicle manufacturing sector and specialized housings equipped with sensor integration for predictive maintenance applications. High environmental and safety standards necessitate premium-quality materials and stringent quality control, driving the average selling price higher compared to other regions.

- Europe: Europe represents a crucial market focused heavily on innovation, particularly driven by German and Italian engineering excellence in high-precision machinery, machine tools, and advanced robotics. The region has strict energy efficiency regulations and a mature offshore wind energy market, fueling demand for extremely durable, large-scale housings capable of withstanding corrosive marine environments. The emphasis on sustainability also fosters technological adoption of lightweight composite materials and processes that minimize material waste. Central and Eastern European countries contribute significantly through their growing automotive supplier base and general industrial expansion.

- Latin America (LA): The Latin American market exhibits moderate growth, tied closely to fluctuating commodity prices and investment cycles in the mining, agriculture, and raw material processing industries, especially in Brazil and Mexico. Demand is concentrated in robust, heavy-duty cast iron housings designed for high-torque applications in demanding operational conditions. Infrastructure investment, though volatile, remains a consistent driver. The region relies heavily on imported technology and components from European and North American suppliers, focusing primarily on cost-effective and reliable solutions for operational stability in challenging environments.

- Middle East and Africa (MEA): Growth in the MEA market is largely influenced by large-scale capital projects in the oil and gas sector (requiring highly certified, explosion-proof housings), coupled with significant government investments in diversification, construction, and localized manufacturing hubs. Countries in the Gulf Cooperation Council (GCC) are heavily investing in logistics and port infrastructure, demanding industrial gearboxes. The market requires components with superior thermal management and corrosion resistance due to the region's high temperatures and often corrosive coastal environments. South Africa remains a key consumer due to its robust mining and industrial heritage, driving demand for heavy-duty components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reducer Housing Market.- SEW-Eurodrive GmbH & Co KG

- Siemens AG (Flender GmbH)

- Sumitomo Heavy Industries, Ltd.

- Bonfiglioli S.p.A.

- Bosch Rexroth AG

- Dana Incorporated (Brevini Power Transmission)

- ZF Friedrichshafen AG

- The Timken Company

- Regal Rexnord Corporation

- Renk Group AG

- Tsubaki Nakashima Co., Ltd.

- Nidec Corporation

- Comer Industries S.p.A.

- China High Speed Transmission Equipment Group Co., Ltd. (NGC)

- Elecon Engineering Co. Ltd.

- Winergy AG (A part of Siemens Gamesa Renewable Energy)

- Eickhoff Antriebstechnik GmbH

- Emerson Electric Co. (through various subsidiaries)

- Santasalo Gears Oy

- Falk Corporation (A brand of Regal Rexnord)

Frequently Asked Questions

Analyze common user questions about the Reducer Housing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are predominantly used for manufacturing high-performance reducer housings?

The predominant materials are Ductile Iron and Grey Cast Iron, favored for their excellent vibration damping properties and cost-efficiency in heavy industrial applications. High-strength Aluminum Alloys are increasingly used in automotive and robotics for weight reduction and superior thermal dissipation, while specialized composites are emerging for highly corrosive or extremely weight-sensitive sectors.

How does the integration of IIoT affect the design and function of modern reducer housings?

IIoT integration transforms the housing into a smart component by embedding sensors (e.g., vibration, temperature, acoustic) directly into the structure. This enables real-time condition monitoring, predictive maintenance capabilities, optimized lubrication schedules, and immediate fault detection, significantly reducing unplanned downtime and enhancing operational efficiency.

Which manufacturing process ensures the highest precision for reducer housing bearing seats?

Precision is primarily achieved through highly automated, multi-axis CNC machining, specifically boring and milling operations, following the initial casting or forging. These processes ensure bearing seats and shaft bores meet the strict micron-level tolerances necessary for maintaining perfect gear alignment, which is critical for minimizing noise, friction, and ensuring the gearbox’s longevity.

What is the primary factor driving demand for aluminum alloy reducer housings?

The primary factor driving demand for aluminum alloy housings is the global imperative for lightweighting, particularly in the electric vehicle (EV) sector and industrial robotics. Aluminum offers an excellent strength-to-weight ratio and superior thermal conductivity compared to cast iron, crucial for managing the intense heat generated by high-speed e-axle gearboxes while maximizing efficiency.

What are the key differences between housings used in wind energy and general industrial machinery?

Wind energy housings are significantly larger and require specialized materials (often highly certified ductile iron or cast steel) with advanced corrosion and fatigue-resistant coatings due to continuous exposure to extreme loads and harsh, often marine, environments. General industrial machinery housings are typically smaller, prioritizing high-volume manufacturing cost optimization and standard material specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager