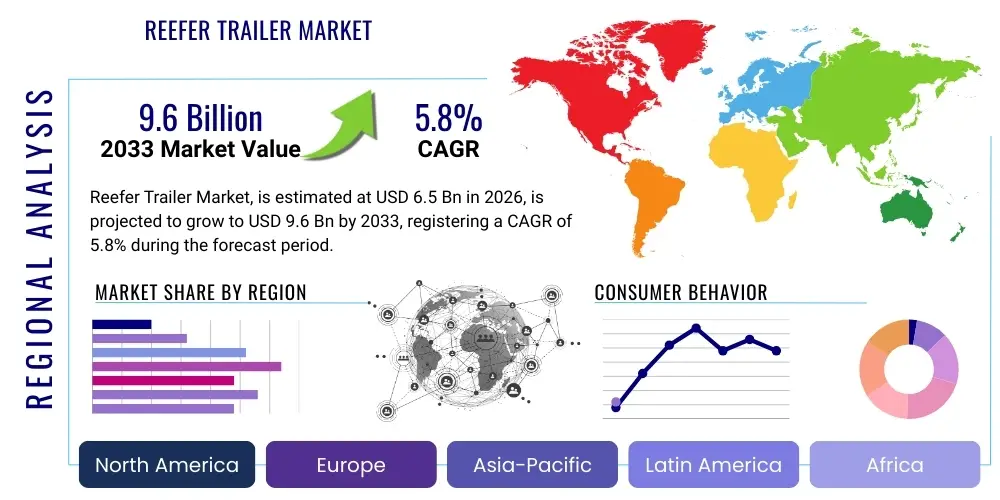

Reefer Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435931 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Reefer Trailer Market Size

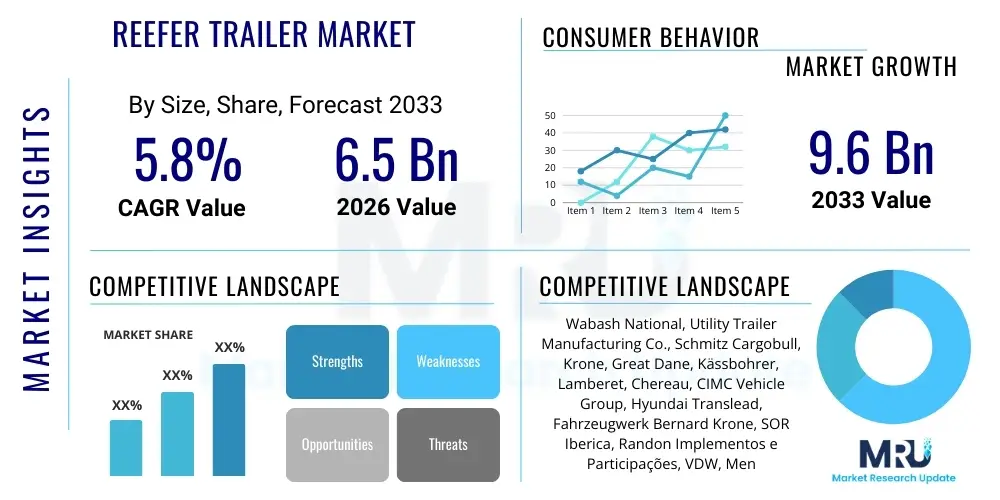

The Reefer Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Reefer Trailer Market introduction

The Reefer Trailer Market encompasses the specialized segment of the commercial vehicle industry dedicated to the transportation of temperature-sensitive goods. A reefer trailer, short for refrigerated trailer, is equipped with an integrated cooling system, high-grade insulation, and typically a diesel-powered refrigeration unit (TRU) to maintain precise temperature ranges, crucial for preserving perishable cargo over long distances. These units are essential components of the cold chain logistics infrastructure, ensuring the quality, safety, and efficacy of products ranging from fresh produce and frozen foods to delicate pharmaceuticals and specialized chemicals. The primary function of these trailers is not to cool the cargo, but rather to maintain the required temperature once the cargo has been pre-cooled, emphasizing the need for robust thermal management capabilities and consistent operational reliability across diverse climatic conditions.

Major applications for reefer trailers span high-growth sectors, predominantly food and beverages, which necessitate stringent temperature control for preservation and shelf-life extension. Pharmaceuticals represent another critical application area, particularly with the increasing global distribution of biologics, vaccines, and highly sensitive medications that require ultracold or specific chilled environments to remain viable. Furthermore, certain chemical products, floriculture, and specialized electronics also rely heavily on controlled temperature transport. The foundational benefits provided by reefer trailers include minimized spoilage rates, compliance with increasingly strict global food safety regulations, and the expansion of market reach for perishable goods, allowing producers to access distant consumer bases with confidence in product quality upon delivery.

Driving factors for sustained market expansion are intrinsically linked to demographic and logistical shifts. Rapid globalization of food supply chains, coupled with rising consumer demand for fresh and frozen products year-round, places immense pressure on the cold chain infrastructure. Regulatory mandates, particularly those related to pharmaceutical traceability and temperature monitoring (such as GDP guidelines), further accelerate the adoption of advanced reefer technologies, including telematics and precise temperature data logging capabilities. Moreover, technological advancements focusing on fuel efficiency, reducing emissions from TRUs, and utilizing hybrid or electric refrigeration systems are driving modernization and replacement cycles within established fleets, contributing significantly to overall market growth.

Reefer Trailer Market Executive Summary

The global Reefer Trailer market is experiencing robust growth driven primarily by escalating demand for cold chain logistics solutions across food, beverage, and pharmaceutical industries. Key business trends include the strong preference for multi-temperature trailers, allowing logistics providers to consolidate diverse perishable shipments requiring different temperature zones within a single unit, thereby enhancing operational efficiency and optimizing delivery routes. Furthermore, there is a distinct shift toward advanced fleet management solutions, integrating IoT sensors, sophisticated telematics, and predictive maintenance protocols into modern reefer units. This technological integration is not merely about tracking location; it focuses heavily on real-time monitoring of refrigeration unit performance, fuel consumption, and thermal integrity, enabling proactive intervention and ensuring cargo safety throughout transit, ultimately reducing insurance claims related to temperature excursions.

Regionally, the market dynamics are characterized by high maturity and replacement demand in North America and Europe, juxtaposed against accelerated infrastructure development and new fleet acquisition in emerging economies, notably the Asia Pacific (APAC) region. North America, driven by demanding retail and pharmaceutical distribution networks, emphasizes larger 53-foot trailers and regulatory compliance related to emissions standards for transport refrigeration units (TRUs). Conversely, APAC nations, particularly China and India, are rapidly investing in establishing modern cold storage and transport infrastructure to cope with urbanization and the shift towards organized retail, resulting in significant growth in demand for both medium and long-haul refrigerated capacity. Government incentives promoting cold chain development and foreign direct investment in logistics infrastructure are pivotal regional trends impacting the market trajectory.

In terms of segment trends, the trailer type segment shows increasing dominance of cryogenic and electric refrigeration units, moving away from conventional diesel power, driven by sustainability goals and tightening emission regulations. The length segment is standardized, but the adoption of customized and smaller urban delivery reefer trailers is surging to support e-commerce fulfillment and last-mile cold chain delivery networks. End-use segmentation reveals pharmaceuticals as the fastest-growing sector, demanding highly reliable and verifiable temperature control solutions, often requiring dual-redundancy cooling systems. This push towards high-specification trailers is creating a bifurcated market: large-volume, cost-efficient food transport trailers and high-precision, premium pharmaceutical transport trailers, each requiring specialized technological features and verification protocols.

AI Impact Analysis on Reefer Trailer Market

User queries regarding AI's influence in the Reefer Trailer market frequently center on maximizing operational longevity, minimizing fuel expenditure, and preempting mechanical failures that could compromise temperature-sensitive cargo. Common themes include the efficacy of AI in dynamic route planning, considering real-time traffic and weather conditions alongside refrigeration unit load requirements, and the deployment of machine learning algorithms for predictive maintenance of Transport Refrigeration Units (TRUs). Users express significant interest in how AI can facilitate energy optimization by intelligently modulating cooling cycles based on ambient temperature fluctuations and cargo thermal mass. The core expectation is that AI will transition fleet management from reactive troubleshooting to proactive, data-driven decision-making, significantly enhancing reliability and overall supply chain resilience in cold logistics.

The integration of artificial intelligence and machine learning is fundamentally transforming reefer trailer operations by processing vast datasets generated by telematics systems, internal sensors, and external environmental factors. AI algorithms analyze historical performance data of refrigeration components—such as compressors, condensers, and fans—to calculate Mean Time To Failure (MTTF) for specific parts, providing maintenance alerts weeks or months in advance. This predictive capability drastically reduces unexpected breakdowns on the road, which are highly detrimental in cold chain logistics. Furthermore, AI-driven load management optimizes energy consumption by dynamically adjusting set points and optimizing defrost cycles, ensuring minimal temperature variance while achieving substantial fuel savings, crucial for reducing the operational Total Cost of Ownership (TCO) for large fleets.

- AI-driven Predictive Maintenance: Analyzing TRU sensor data to forecast component failures (compressors, motors) before critical breaches occur, maximizing uptime.

- Dynamic Route Optimization: Integrating real-time traffic, weather, and delivery schedules with TRU energy demands to select the most efficient cold chain route.

- Automated Temperature Compliance: Utilizing machine learning to monitor, log, and alert deviations in temperature control, ensuring adherence to strict regulatory guidelines (e.g., GDP).

- Energy Consumption Optimization: Intelligent modulation of cooling unit cycles based on cargo type, thermal inertia, and ambient conditions to minimize fuel consumption.

- Fraud Detection and Security: Analyzing patterns in door openings, setpoint changes, and driving behavior to detect and prevent unauthorized access or tampering with sensitive cargo.

DRO & Impact Forces Of Reefer Trailer Market

The Reefer Trailer Market is significantly shaped by robust driving forces, predominantly the global surge in demand for perishable goods, fueled by population growth, urbanization, and the expansion of international trade, necessitating reliable cross-border cold chain infrastructure. Restraints primarily involve the high initial acquisition cost of refrigerated trailers compared to standard dry vans, coupled with the substantial operational expenses associated with fuel consumption and specialized maintenance required for refrigeration units. Opportunities emerge from the transition toward sustainable and energy-efficient technologies, specifically the commercial viability of electric and cryogenic refrigeration systems, alongside the untapped potential in developing markets seeking to upgrade outdated cold storage and transport capabilities. The overall impact force analysis indicates that the strong market drivers related to pharmaceutical and food safety regulations currently outweigh the cost-related restraints, sustaining positive momentum in technology adoption and fleet expansion globally.

Detailed analysis of impact forces reveals that regulatory compliance acts as a powerful external driver. Strict global standards, such as those imposed by the Food Safety Modernization Act (FSMA) in the US and comparable directives in the EU, mandate verifiable temperature control during transport, compelling shippers and carriers to invest in technologically advanced, telematics-equipped reefer trailers. This regulatory push elevates the quality floor for market entry and accelerates the obsolescence of older, less reliable units. Conversely, the volatility of diesel prices and increasing stringency of emission standards (e.g., California’s zero-emission TRU requirement) serve as strong restraining forces that pressure manufacturers and fleet operators to absorb higher capital expenditure for compliance, which can temporarily dampen investment velocity, particularly among smaller fleet operators.

Strategic opportunities lie in vertical integration and specialization within the cold chain. As pharmaceutical logistics become more demanding, offering specialized, ultra-low temperature (ULT) reefer trailers equipped with redundant systems and validated data logging capabilities presents a high-margin growth avenue. Furthermore, the development of lightweight trailer materials (e.g., advanced composites for insulation and structure) offers an opportunity to increase payload capacity and fuel efficiency, directly mitigating the impact of high operational costs. The continuous evolution of telematics and IoT integration provides a distinct competitive advantage, enabling carriers to offer superior visibility and verifiable integrity to clients, positioning reliable cold chain service providers for preferential contracts in high-value sectors.

Segmentation Analysis

The Reefer Trailer Market segmentation provides a granular view of demand distribution across various dimensions, including the type of refrigeration technology, the physical dimensions of the trailers, and the primary end-use industries served. This structured analysis is essential for manufacturers and logistics providers to tailor product offerings and strategic investments toward the most lucrative and rapidly evolving segments. The underlying driver for segment differentiation is the diverse requirement profiles of temperature-sensitive goods, necessitating specialized solutions ranging from basic chill maintenance for mass-market produce to highly accurate, verifiable temperature profiles for sophisticated medical supplies. Understanding these segment dynamics is critical for navigating the competitive landscape and forecasting demand shifts influenced by regulatory changes or supply chain innovations.

- By Trailer Type: Single-Temperature Reefer Trailer, Multi-Temperature Reefer Trailer, Cryogenic Reefer Trailer, Specialized Container/Chassis Systems.

- By Trailer Length: 28 Feet, 40-48 Feet, 53 Feet and Above, Custom Lengths.

- By Refrigeration Unit Power Source: Diesel-Powered TRUs, Electric/Hybrid TRUs, Cryogenic Systems, Eutectic Systems.

- By End-Use Industry: Food & Beverages (Frozen Foods, Chilled Foods, Meat & Seafood, Dairy, Produce), Pharmaceuticals & Healthcare, Chemicals & Fertilizers, Floriculture & Horticulture, Others.

Value Chain Analysis For Reefer Trailer Market

The value chain for the Reefer Trailer Market begins with the upstream sourcing of specialized raw materials, notably high-quality insulating foams (polyurethane or polystyrene) and durable, lightweight structural metals (aluminum or composite materials). This stage is characterized by intense focus on optimizing insulation thickness and material density to achieve superior thermal performance while minimizing overall trailer weight to enhance fuel efficiency and payload capacity. Following material sourcing, the manufacturing stage involves the specialized assembly of the trailer chassis, body construction (incorporating seamless insulation panels), and the crucial integration of the Transport Refrigeration Unit (TRU) sourced from leading specialists like Carrier Transicold or Thermo King. Quality control, particularly leak testing and thermal validation, is paramount during this phase to ensure the trailer can maintain stringent temperature specifications.

Midstream activities primarily focus on distribution and financing. Trailer sales often occur through a mix of direct sales channels to large fleet operators and through authorized dealerships providing regional maintenance and support services. Financing is a critical component, given the high capital cost of reefer units, involving specialized leasing options and asset-backed lending provided by financial institutions or OEM captive finance arms. Downstream analysis reveals the dominant role of logistics service providers (LSPs) and dedicated cold chain carriers, who constitute the primary immediate customers. These entities utilize the reefer trailers to provide specialized transport services to the ultimate end-users—large food processors, pharmaceutical distributors, and major retailers—effectively forming the final link in the cold chain distribution network.

The distribution channel is predominantly hybrid. Direct channels are favored for large-volume transactions involving major refrigerated carriers seeking customization and long-term service agreements directly with the trailer or TRU OEM. Indirect channels, involving dealers and distributors, manage regional sales, offer smaller fleet solutions, and provide essential aftermarket services, including parts supply, scheduled maintenance, and emergency repair services. The efficiency of this downstream segment relies heavily on maintaining a robust service network, as the continuous operation of the TRU is non-negotiable for cargo integrity, emphasizing the strategic importance of reliable service support across key transport corridors globally.

Reefer Trailer Market Potential Customers

The primary customers and end-users of reefer trailers are large, integrated logistics providers and specialized refrigerated trucking companies who invest heavily in fleet assets to offer comprehensive cold chain transport services. These customers require high-reliability equipment, often customized for specific route profiles (e.g., long-haul 53-footers for cross-country food distribution) and demanding robust telematics integration for compliance and operational efficiency reporting. Beyond logistics specialists, major retail chains and food processors frequently own and operate captive fleets of reefer trailers to maintain direct control over their supply chain integrity, minimizing reliance on third-party carriers during peak demand periods or for highly sensitive product lines.

A rapidly growing segment of potential customers includes pharmaceutical distributors and wholesalers, especially those dealing with cold-sensitive vaccines, insulin, and advanced therapies, which often require highly specialized validation documentation and temperature mapping services. These customers prioritize thermal accuracy, system redundancy, and data security over basic acquisition cost, driving demand for premium, high-specification multi-temperature trailers. Furthermore, the expansion of e-commerce platforms and quick-commerce companies is fostering a new customer base requiring smaller, agile reefer trailers and refrigerated vans designed specifically for urban last-mile delivery, necessitating integration with non-traditional power sources like electric batteries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wabash National, Utility Trailer Manufacturing Co., Schmitz Cargobull, Krone, Great Dane, Kässbohrer, Lamberet, Chereau, CIMC Vehicle Group, Hyundai Translead, Fahrzeugwerk Bernard Krone, SOR Iberica, Randon Implementos e Participações, VDW, Menci Group, Kögel Trailer GmbH, Stoughton Trailers, Reitenauer, Cold Chain Technologies, Thermo King (Trane Technologies), Carrier Transicold (Carrier Global). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reefer Trailer Market Key Technology Landscape

The technology landscape of the Reefer Trailer Market is rapidly advancing, moving beyond traditional diesel-powered mechanical cooling toward smarter, cleaner, and more efficient solutions centered on real-time data and energy optimization. The paramount technological shift involves the integration of advanced telematics and IoT sensors, which provide granular, continuous monitoring of internal cargo temperatures, humidity levels, refrigeration unit performance metrics, door security status, and trailer location. These systems utilize cellular and satellite connectivity to transmit data instantly, allowing fleet managers to receive proactive alerts regarding potential temperature excursions or mechanical malfunctions, thus enabling immediate corrective action, a vital capability for high-value pharmaceutical loads governed by stringent quality protocols.

Another major technological trend is the transition towards sustainable refrigeration unit power sources. Tightening environmental regulations, particularly in urban zones and specific US states, are driving significant investment in electric, hybrid, and cryogenic refrigeration systems. Electric TRUs, powered either by independent battery packs, solar panels, or directly via the truck’s auxiliary power during transit, offer zero-emission cooling, minimizing noise and air pollution. Cryogenic systems, utilizing liquid nitrogen or carbon dioxide for ultra-cold transport, provide exceptional temperature precision and rapid pulldown capabilities, although they present higher operational costs due to refrigerant consumption. Hybrid models offer flexibility, leveraging diesel power for long hauls and transitioning to electric power for quiet, low-emission operations in urban delivery areas.

Furthermore, innovations in trailer construction materials are enhancing thermal efficiency and durability. Manufacturers are utilizing advanced composite materials, lighter chassis designs, and Vacuum Insulated Panel (VIP) technology to improve insulation performance substantially, reducing the load on the refrigeration unit and decreasing fuel burn. Improved aerodynamics, including trailer skirts and gap reducers, are also standardizing across fleets to achieve marginal gains in fuel efficiency. The convergence of these technologies—smart monitoring, sustainable power, and lightweight construction—is collectively lowering the Total Cost of Ownership (TCO) while meeting the escalating demands for transparency and environmental responsibility within the cold chain sector.

Regional Highlights

North America currently holds a dominant share of the Reefer Trailer market, primarily driven by the massive scale of its food production and distribution networks, which necessitate extensive long-haul refrigerated capacity. The region’s market is characterized by a strong demand for 53-foot trailers and a high rate of technological adoption, particularly telematics for compliance with regulatory standards such as FSMA. Fleet operators in the U.S. and Canada are increasingly focused on replacing older diesel TRUs with hybrid or fully electric units due to strict state-level emissions mandates, such as those originating from the California Air Resources Board (CARB). The maturity of the logistics infrastructure and the established presence of leading manufacturers and specialized financing options contribute to the region’s sustained market value, focusing heavily on operational efficiency gains through digitalization and predictive maintenance protocols.

Europe represents another mature yet highly dynamic market, propelled by stringent food safety standards, cross-border trade fluidity facilitated by the European Union, and robust environmental consciousness. European demand leans heavily towards multi-temperature trailers, often smaller or specialized for navigating dense urban centers and adhering to stricter axle load and overall length regulations imposed by various member states. The rapid expansion of e-commerce cold delivery services across the continent is driving innovation in last-mile refrigerated transport solutions. Furthermore, European manufacturers, particularly in Germany and the Nordics, lead the adoption curve for highly efficient aerodynamic designs and innovative insulation technologies to comply with the region’s ambitious climate targets, making sustainability a core competitive advantage in this geography.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, undergoing a transformative phase in cold chain infrastructure development. Rapid urbanization, rising disposable incomes, and the shift from traditional wet markets to organized retail and modern food distribution channels (including significant frozen food consumption) are fueling explosive demand for new reefer capacity. Countries like China, India, and Southeast Asian nations are witnessing massive government and private sector investments in cold storage and refrigerated logistics networks to reduce post-harvest losses, which historically have been substantial. While initial adoption favors cost-effective diesel units, regulatory pressures in major metropolitan areas are gradually shifting investment toward reliable, traceable, and eventually, electric-powered solutions, creating immense opportunity for international TRU and trailer manufacturers seeking market penetration.

Latin America and the Middle East & Africa (MEA) regions offer significant growth potential, albeit from a smaller base, due to ongoing infrastructure improvements and increasing international trade of perishables. In Latin America, agricultural exports (fruits, vegetables, meat) are a major market driver, necessitating cross-border refrigerated transport, particularly between South American nations and the U.S. and European markets. The MEA region, characterized by extreme climatic conditions, requires high-performance insulation and highly reliable TRUs capable of maintaining integrity despite intense ambient heat. Investments in cold chain logistics are essential for supporting growing tourism, large-scale construction projects, and securing reliable food and vaccine distribution, often relying on international partnerships to deploy sophisticated refrigerated transport solutions that can withstand severe operating environments.

- North America: Dominant market share; driven by long-haul logistics and early adoption of electric/hybrid TRUs due to stringent CARB regulations.

- Europe: High adoption of multi-temperature units and aerodynamic designs; strong focus on emissions reduction and cross-border regulatory compliance.

- Asia Pacific (APAC): Fastest growing; fueled by urbanization, retail modernization, and massive government investment in cold chain infrastructure (China, India).

- Latin America: Growth tied to agricultural exports and increasing pharmaceutical distribution complexity.

- Middle East & Africa (MEA): High demand for specialized, robust cooling systems due to harsh environmental conditions and expanding food security initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reefer Trailer Market.- Wabash National Corporation

- Utility Trailer Manufacturing Co.

- Schmitz Cargobull AG

- Krone Commercial Vehicle Group

- Great Dane LLC

- Kässbohrer Trailer Group

- Lamberet Refrigerated Trailers

- Chereau SAS

- CIMC Vehicle Group Co., Ltd.

- Hyundai Translead

- Fahrzeugwerk Bernard Krone GmbH

- SOR Iberica S.A.

- Randon Implementos e Participações S.A.

- VDW Composites

- Menci Group SpA

- Kögel Trailer GmbH & Co. KG

- Stoughton Trailers LLC

- Reitenauer, Inc.

- Cold Chain Technologies, Inc. (Specialized Reefer)

- Thermo King (A brand of Trane Technologies)

- Carrier Transicold (A brand of Carrier Global Corporation)

- ZANOTTI S.p.A. (A division of Daikin Industries)

Frequently Asked Questions

Analyze common user questions about the Reefer Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for multi-temperature reefer trailers?

Demand for multi-temperature reefer trailers is primarily driven by the need for logistics efficiency and consolidation of diverse perishable goods (e.g., frozen foods and chilled produce) in a single shipment. This capability reduces logistics costs, minimizes empty backhauls, and enhances delivery route optimization, making them essential for complex retail distribution networks.

How are environmental regulations impacting the adoption of new refrigeration units?

Stringent environmental regulations, particularly regarding diesel emissions (e.g., California’s zero-emission requirements), are forcing fleet operators to transition towards electric, hybrid, and cryogenic Transport Refrigeration Units (TRUs). This shift increases compliance costs but promotes long-term operational sustainability and reduces operational noise and urban pollution.

What role does telematics play in modern reefer trailer operations?

Telematics provides real-time data on temperature logging, unit performance, fuel consumption, and geographical location. This technology is critical for ensuring regulatory compliance (like FSMA and GDP), enabling predictive maintenance to prevent costly breakdowns, and offering complete cargo integrity traceability to shippers.

Which geographical region exhibits the fastest growth potential in the reefer trailer market?

The Asia Pacific (APAC) region, specifically emerging economies such as China and India, is projected to show the fastest market growth. This acceleration is fueled by massive investments in modernizing underdeveloped cold chain infrastructure, rapid urbanization, and rising consumer demand for high-quality imported and domestically produced perishable goods.

What is the primary restraint affecting the wider adoption of reefer trailers?

The primary restraint is the significantly higher total cost of ownership (TCO) compared to standard dry vans. This includes the high initial capital expenditure for the specialized trailer and TRU, coupled with higher operational costs related to fuel consumption for refrigeration and the complexity of specialized maintenance requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager