Refined Anthracite Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431814 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Refined Anthracite Filters Market Size

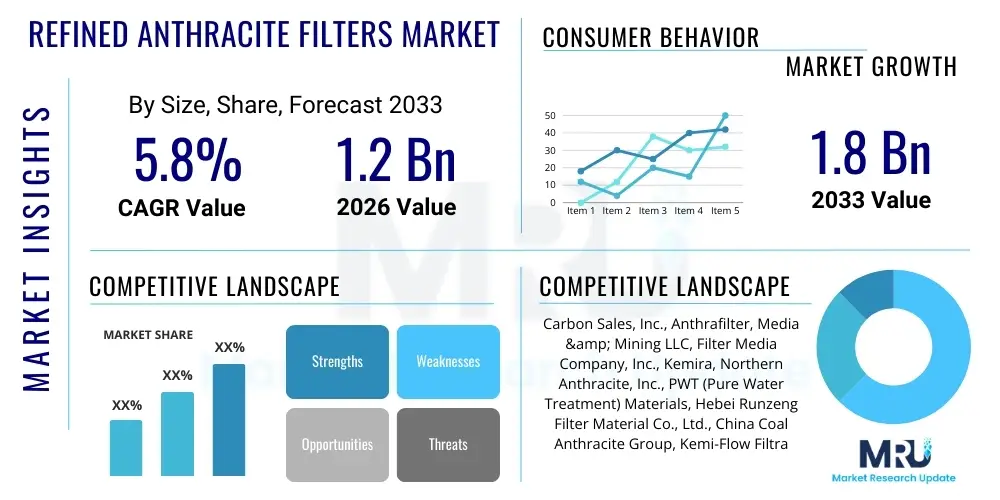

The Refined Anthracite Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Refined Anthracite Filters Market introduction

The Refined Anthracite Filters Market encompasses the production, distribution, and utilization of high-grade, meticulously processed anthracite coal media specifically designed for water and wastewater treatment applications. This specialized filtering media is characterized by its high carbon content, exceptional hardness, chemical inertness, and superior void space, which collectively enable high flow rates and efficient removal of suspended solids and turbidity. Refined anthracite filters are essential components in multi-media filtration systems, frequently layered above sand or garnet, leveraging their low specific gravity to prevent intermixing during backwashing and to enhance the overall filtration depth and efficiency, making them indispensable in large-scale municipal and industrial water purification infrastructure.

Product description highlights include stringent quality control over particle size uniformity, minimizing fines, and ensuring angularity to maximize surface area for particle capture. Major applications span municipal drinking water treatment plants, where clarity and safety are paramount, and industrial sectors such as power generation, petrochemicals, and food and beverage processing, which require consistent, high-quality process water. The primary benefit of using refined anthracite over conventional sand filters alone is its ability to operate effectively at higher loading rates and longer filtration runs, significantly reducing downtime and operational costs while maintaining stringent effluent quality standards required by regulatory bodies globally. Furthermore, its robust nature allows for effective regeneration and prolonged service life, offering a favorable return on investment for water utilities.

Key driving factors accelerating market growth include the escalating global demand for potable water due to rapid urbanization and population expansion, coupled with increasingly strict environmental regulations regarding industrial wastewater discharge. Government initiatives promoting water reuse and recycling, particularly in water-stressed regions, necessitate advanced and reliable filtration technologies like refined anthracite. The ongoing modernization and expansion of municipal water infrastructure, especially in developing economies, further contribute substantially to the demand, cementing refined anthracite’s role as a foundational media in reliable water purification chains worldwide.

Refined Anthracite Filters Market Executive Summary

The Refined Anthracite Filters Market demonstrates robust growth driven by environmental mandates and critical infrastructure spending, particularly in the Asia Pacific region. Business trends indicate a strong move toward high-specification, standardized products and an increased focus on supply chain resilience, necessitated by geopolitical instability affecting global coal sourcing. Leading manufacturers are investing in advanced refining techniques, such as thermal treatment and acid washing, to produce ultra-pure media optimized for advanced industrial processes, including membrane pre-treatment. Regional trends show APAC leading both consumption and production growth, attributed to massive municipal water projects and rapid industrialization in countries like China and India, while North America and Europe emphasize replacement cycles and stringent regulatory compliance, driving demand for premium-grade, certified materials. Segment trends confirm that the municipal water treatment application segment holds the largest market share, though the power generation and chemical processing sectors are expected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the increasing need for high-purity feed water for boilers and critical systems.

Strategic movements within the competitive landscape point toward consolidation among specialized processing companies, focusing on enhancing logistical efficiencies and securing long-term supply agreements with key end-users. Technological advancements are centered on optimizing media blends (e.g., combining anthracite with activated carbon or garnet) to create dual-purpose or multi-layer filters that address evolving contaminants, such as micropollutants and complex organic matter, without significant capital expenditure for infrastructure overhaul. The market faces constraints primarily related to the fluctuating price of raw anthracite coal and the environmental scrutiny associated with mining operations; however, the functional superiority and cost-effectiveness of refined anthracite as a filtration medium continue to outweigh these challenges for many critical applications.

The outlook remains highly positive, underpinned by the indispensable nature of water filtration in public health and industrial output. Regulatory bodies, such as the EPA and WHO, continually raise the bar for water quality, forcing industries and municipalities to upgrade filtration capabilities. This sustained regulatory push, combined with global recognition of water scarcity issues, ensures consistent demand for reliable, high-performing media like refined anthracite. Successful market players are those who demonstrate transparency in sourcing, consistency in product grading, and adaptability in logistics, effectively mitigating supply risks associated with specialized mineral commodities.

AI Impact Analysis on Refined Anthracite Filters Market

Users frequently inquire whether Artificial Intelligence (AI) can replace traditional filtration media like anthracite or if it primarily serves to optimize existing processes. Common concerns revolve around AI's role in predicting media lifespan, optimizing backwash cycles, and improving overall plant efficiency in facilities utilizing refined anthracite filters. The prevailing theme suggests that AI will not replace the physical media but will fundamentally transform the operational management and maintenance of filtration systems. Users expect AI tools to reduce manual monitoring, prevent system failures by detecting subtle anomalies in filtration performance (such as slight pressure drops or flow rate inconsistencies), and precisely schedule maintenance and media replacement, thereby maximizing the economic life of the anthracite filters and reducing chemical usage during cleaning cycles. The consensus among technical users is that AI integration translates directly into reduced operational expenditure (OPEX) and enhanced water quality consistency.

- AI-driven Predictive Maintenance: AI algorithms analyze historical filtration data (turbidity, head loss, flow rate) to predict the optimal time for backwashing or media replenishment, minimizing operational disruption and maximizing filter run lengths for anthracite beds.

- Real-time Process Optimization: Machine learning models continuously adjust operational parameters, such as coagulation dosage or filtration velocity, based on real-time raw water quality fluctuations, ensuring peak performance of the refined anthracite layer.

- Enhanced Water Quality Monitoring: AI-powered sensor networks monitor effluent quality and rapidly identify deviations, allowing operators to preemptively address issues related to anthracite bed integrity or breakthrough of suspended solids.

- Supply Chain and Sourcing Optimization: AI tools analyze global anthracite supply chain risks, predicting price volatility and optimizing sourcing strategies for bulk refined media procurement, leading to better cost control.

- Automated Reporting and Compliance: AI automates the generation of detailed regulatory compliance reports based on filtration performance logs, reducing administrative burden and ensuring adherence to national and international water quality standards related to total suspended solids (TSS) removal by anthracite filters.

DRO & Impact Forces Of Refined Anthracite Filters Market

The Refined Anthracite Filters Market is shaped by significant Drivers (D) such as increasingly stringent global water quality regulations and rapid infrastructure development; Restraints (R) including volatility in raw material (coal) pricing and environmental opposition to mining activities; and Opportunities (O) represented by the growing adoption of multi-media filtration systems for water reuse projects and the technological development of ultra-high-purity anthracite grades. These forces exert substantial pressure, defining market profitability and strategic direction. The continuous global push for access to safe drinking water and effective sanitation acts as a primary market stabilizer, ensuring sustained foundational demand regardless of short-term economic fluctuations. Concurrently, the necessity for robust water treatment solutions in high-purity industrial applications, particularly microelectronics and pharmaceutical manufacturing, elevates the importance of high-specification anthracite media.

Impact forces are heavily weighted toward environmental and regulatory pressures. The necessity for water treatment plants to handle emerging contaminants and complex industrial effluents requires filtration media that can perform consistently under variable loading conditions. Refined anthracite, due to its low uniformity coefficient and high efficiency in combination with denser media, fulfills this requirement, driving its continued integration into complex filtration trains. However, the market remains sensitive to external factors like energy costs (affecting processing and transport) and international trade dynamics that influence the sourcing of specific high-quality anthracite reserves. Manufacturers are therefore compelled to prioritize transparency, quality assurance, and sustainable sourcing to maintain competitiveness and meet the high expectations of municipal and industrial buyers.

The long-term opportunity lies in specialized applications and geographic expansion. Developing economies, undergoing rapid industrial and urban expansion, represent untapped potential for large-scale municipal projects. Furthermore, technological innovation focused on reducing the reliance on chemical flocculants through optimized filtration media structure provides a green pathway for growth. The core challenge for the industry remains balancing cost-efficiency, which is crucial for municipal contracts, with the necessity of maintaining premium quality and addressing the environmental footprint associated with raw material extraction. Successful penetration in the future will depend on effective supply chain management and the ability to demonstrate superior life-cycle value compared to alternative filtration solutions.

Segmentation Analysis

The Refined Anthracite Filters Market is structurally segmented based on crucial dimensions including the grade of anthracite, the specific application area, and the end-user industry. Grading is essential as it dictates the filtering performance and is categorized typically by size and purity (e.g., standard filter grade, high-purity filter grade). Application segmentation differentiates the use in general suspended solids removal versus highly specialized turbidity control or pre-filtration for reverse osmosis systems. The end-user segment clearly delineates the market share held by capital-intensive municipal infrastructure versus the diverse needs of industrial consumers, offering nuanced insights into purchasing power, regulatory drivers, and volume requirements across the market.

Detailed analysis of these segments reveals that while the Standard Filter Grade remains the largest by volume due to widespread use in municipal water systems, the High-Purity Grade segment is experiencing faster revenue growth. This acceleration is attributed to the expansion of industries requiring ultra-pure water, such as semiconductor manufacturing, which demands extremely low levels of trace elements and contaminants from their filter media. Geographically, the segmentation confirms the dominance of Asia Pacific in both municipal and industrial consumption, driven by massive population density and regulatory catch-up in environmental standards. Understanding these segment dynamics is critical for market players to tailor product specifications, optimize distribution channels, and focus research and development efforts on high-margin, high-growth niche applications within industrial sectors.

The effectiveness of refined anthracite filters is also dependent on the specific regulatory environment of the end-user sector. For instance, the food and beverage industry requires media that comply with strict food contact standards, driving demand for specially processed, acid-washed materials to minimize leaching. Conversely, power generation utilities focus primarily on mechanical robustness and consistent performance under high-flow, high-temperature conditions. This necessitates manufacturers to adopt flexible production lines capable of producing media that meet varied certification and performance profiles tailored to the precise requirements of each segmented end-user category, thereby maximizing market penetration.

- By Grade:

- Standard Filter Grade Anthracite (Size 0.6mm - 1.6mm)

- High-Purity Filter Grade Anthracite (Acid-Washed/Thermal Treated)

- Fine Grade Anthracite (Specific Media Blends)

- By Application:

- Drinking Water Treatment (Turbidity Control)

- Wastewater Treatment (Tertiary Filtration)

- Industrial Process Water Pre-treatment

- Desalination Plant Pre-filtration

- By End-User Industry:

- Municipal Water Works

- Power Generation (Boiler Feed Water)

- Chemical and Petrochemical Processing

- Food and Beverage Industry

- Pharmaceutical and Life Sciences

- Electronics and Semiconductor Manufacturing

Value Chain Analysis For Refined Anthracite Filters Market

The value chain for the Refined Anthracite Filters Market begins with upstream activities focused on the extraction and initial processing of raw anthracite coal, which is highly resource-intensive and geographically concentrated in specific regions globally. This stage involves meticulous selection of high-carbon, low-ash raw materials, often sourced from deep-mine operations, ensuring the fundamental quality necessary for high-performance filtration. Middle-stream activities, which constitute the core value addition, involve specialized refining processes such as crushing, screening, washing (including optional acid washing for high-purity grades), thermal treatment, and rigorous quality classification to achieve specific uniformity coefficients and particle size distributions mandated by ANSI/AWWA standards. Efficiency in this stage significantly determines the final product cost and performance, with market leaders investing heavily in automated sizing and cleaning technologies.

The downstream segment centers on distribution, sales, and end-user installation. Distribution channels are typically dual: direct sales to large municipal water authorities or EPC (Engineering, Procurement, and Construction) firms handling massive infrastructure projects, and indirect sales through specialized chemical and water treatment distributors serving smaller industrial end-users or maintenance contractors. Direct distribution channels emphasize technical support, bulk logistics, and customized product specifications. Indirect channels rely on distributor networks for regional reach and inventory management. Effective logistics, given the high bulk density and volume requirements of filter media, are paramount to minimizing transportation costs, which can form a significant portion of the final product price, particularly across international borders.

Critical linkages in the chain include the relationship between raw material suppliers and refiners, where long-term contracts are essential for price stability and consistent quality feedstock. The final link, market access, is heavily influenced by certifications (e.g., NSF 61 certification for drinking water components) and demonstrated compliance with regional environmental regulations. Overall, the value chain is characterized by low product differentiation at the basic level, but high technical expertise required for high-purity grades, making technical performance and compliance the key competitive differentiators, rather than simple commodity pricing, especially in highly regulated North American and European markets.

Refined Anthracite Filters Market Potential Customers

The primary customers for refined anthracite filters are large-scale operators of water treatment facilities, driven by mandatory public health requirements and industrial operational necessity. Municipal Water Works departments represent the largest purchasing block, routinely procuring tens or hundreds of thousands of tons of media for new filtration beds or periodic replacement (typically every 5 to 10 years). These buyers are highly sensitive to price, logistical reliability, and strict compliance with public health standards (like those set by EPA and national health organizations), making volume discounts and assured quality paramount in purchasing decisions. Engineering consulting firms and EPC contractors, often serving as intermediaries for large municipal projects, also function as crucial decision-makers and high-volume buyers.

The secondary, high-value customer group comprises industrial entities that rely on consistent, high-purity process water to protect their critical assets and production processes. This includes power generation facilities, particularly nuclear and coal-fired plants requiring ultra-pure boiler feed water to prevent scaling and corrosion, and the chemical/petrochemical industry, where water quality directly impacts product quality and catalytic processes. These industrial buyers often demand specialized, pre-treated (e.g., acid-washed) anthracite media that minimizes the leaching of minerals, ensuring the final water quality meets extremely tight specifications required for sensitive manufacturing applications.

Emerging potential customers include operators of water recycling and reuse facilities, especially those mandated to implement advanced tertiary treatment processes in water-scarce regions. As regulations tighten on the discharge of treated wastewater, these facilities are increasingly adopting multi-media filtration systems, positioning them as a rapidly growing customer segment. Furthermore, the global expansion of desalination plants, which utilize large-scale filtration systems for robust pre-treatment to protect expensive reverse osmosis membranes, solidifies their position as essential consumers of high-quality refined anthracite media, focusing on media with exceptional uniformity and durability under aggressive operating conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carbon Sales, Inc., Anthrafilter, Media & Mining LLC, Filter Media Company, Inc., Kemira, Northern Anthracite, Inc., PWT (Pure Water Treatment) Materials, Hebei Runzeng Filter Material Co., Ltd., China Coal Anthracite Group, Kemi-Flow Filtration Systems, Inc., Red Flint Group, Sibelco, Calgon Carbon Corporation (Kuraray), Jacobi Carbons (Orora Group), USFilter Media, Inc., Lehigh Anthracite, CarboTech AC GmbH, Universal Refiner, WaterFiltr, LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refined Anthracite Filters Market Key Technology Landscape

The technology landscape in the Refined Anthracite Filters Market is primarily centered on enhancing the purification, grading, and layering application of the media rather than disruptive changes to the material itself. Key technological advancements focus heavily on achieving exceptionally high uniformity coefficients (U.C.), which is crucial for minimizing the intermixing of anthracite with underlying layers (like filter sand or garnet) during backwash operations, thereby sustaining high filtration efficiency and extending the service life of the filter bed. Advanced crushing and sieving techniques, often utilizing laser or automated visual inspection systems, ensure precise adherence to specified particle sizes, significantly reducing the presence of undersized or oversized particles that could compromise filter performance. Furthermore, high-purity applications increasingly utilize specialized acid washing or calcining processes—thermal treatment at high temperatures—to remove trace metal oxides and impurities, making the anthracite highly inert and suitable for use in sensitive applications such as boiler feed water pre-treatment where metallic leaching must be avoided entirely.

Technological innovation is also driving the optimization of filter bed design, moving beyond simple single-layer systems to highly engineered multi-media and deep-bed filtration approaches. Refined anthracite is critical in these systems due to its low density, allowing it to remain on top of denser media layers. Current research focuses on determining the ideal ratios and layer depths through computational fluid dynamics (CFD) modeling, simulating flow patterns and particulate capture rates to maximize throughput and efficiency. This analytical approach, coupled with the introduction of proprietary media blends that might integrate anthracite with activated carbon for simultaneous filtration and adsorption, represents the cutting edge of application technology, allowing water treatment facilities to address a broader range of contaminants, including tastes, odors, and certain organic micropollutants, within the same physical footprint.

Automation and control technology are transforming the operational use of these filters. Modern water treatment plants are implementing sophisticated sensor technology (e.g., streaming current detectors, laser turbidimeters) and utilizing Supervisory Control and Data Acquisition (SCADA) systems to continuously monitor parameters such as head loss, effluent turbidity, and filter run length. These systems leverage the consistent performance characteristics of refined anthracite to autonomously initiate precise backwash cycles only when necessary, minimizing water waste and energy consumption. The integration of such smart controls with high-quality media ensures that the filters operate close to their theoretical maximum efficiency, reinforcing the long-term viability and cost-effectiveness of refined anthracite compared to high-maintenance or chemical-intensive alternatives, thus securing its position as a benchmark media in conventional water purification infrastructure globally.

Regional Highlights

Regional dynamics play a significant role in defining the demand and consumption patterns for Refined Anthracite Filters, largely mirroring global trends in population growth, industrial activity, and regulatory enforcement of water quality standards. The Asia Pacific (APAC) region stands out as the primary engine of market growth, characterized by rapid urbanization and massive government investment in new and upgraded municipal water infrastructure, particularly in populous nations like China and India. The sheer scale of ongoing construction projects aimed at providing safe drinking water and managing industrial effluents ensures that APAC maintains the largest market share by volume. Moreover, the simultaneous growth of high-tech manufacturing in countries such as South Korea and Taiwan drives specialized demand for high-purity, acid-washed anthracite media for semiconductor and electronics fabrication water systems.

North America and Europe represent mature markets, distinguished by stringent quality regulations (e.g., US EPA, EU Water Framework Directive) and a focus on replacing aging infrastructure and ensuring compliance with emerging contaminant standards. Demand in these regions is less driven by new construction and more by scheduled media replacements and upgrades aimed at improving existing filter performance. North American market participants prioritize certification (e.g., NSF/ANSI Standard 61) and robust supply chain reliability, often sourcing from regional mines or highly vetted international suppliers. European demand shows a strong preference for sustainable sourcing and low-environmental-impact processing methods, aligning with broader regional policy goals centered on circular economy principles and resource efficiency.

The Latin America (LATAM) and Middle East & Africa (MEA) regions present substantial untapped potential. LATAM markets are progressing in water infrastructure development, driven by internal regulatory pressures and international development aid, particularly in urban centers where water scarcity and quality issues are prominent. The MEA region, heavily reliant on desalination technology due to extreme water stress, represents a niche but high-value segment, as desalination plants require continuous, high-volume pre-filtration using durable media like refined anthracite to protect costly membrane systems from silt and suspended solids, ensuring efficient operation under challenging environmental conditions. The growth trajectory in these regions is closely tied to energy costs, infrastructure financing, and geopolitical stability impacting project execution.

- Asia Pacific (APAC): Leading market share and highest growth rate; driven by massive municipal projects, rapid industrialization, and high-tech manufacturing demanding ultra-pure process water. Key markets: China, India, Southeast Asia.

- North America: Mature market characterized by strict regulatory compliance, infrastructure replacement cycles, and high demand for NSF/ANSI certified media. Key focus on reliable supply chains. Key markets: United States, Canada.

- Europe: Stable growth fueled by stringent environmental directives, replacement of old filters, and high preference for technologically optimized, sustainably sourced media blends. Key markets: Germany, UK, France.

- Latin America (LATAM): Emerging market with increasing infrastructural investment in large urban areas, addressing urbanization challenges and water quality deficiencies.

- Middle East and Africa (MEA): High demand primarily from desalination plants and industrial facilities requiring robust pre-filtration to handle high levels of turbidity and protect sensitive downstream technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refined Anthracite Filters Market.- Carbon Sales, Inc.

- Anthrafilter

- Filter Media Company, Inc.

- Red Flint Group

- Sibelco

- Lehigh Anthracite

- PWT (Pure Water Treatment) Materials

- Hebei Runzeng Filter Material Co., Ltd.

- China Coal Anthracite Group

- Kemi-Flow Filtration Systems, Inc.

- Northern Anthracite, Inc.

- WaterFiltr, LLC.

- USFilter Media, Inc.

- Universal Refiner

- The Anthracite Filter Media Company

- CarboTech AC GmbH

- Kemira

- Kuraray Co., Ltd. (Calgon Carbon)

- Jacobi Carbons (Orora Group)

- Diatomite Filter Aids, LLC

Frequently Asked Questions

Analyze common user questions about the Refined Anthracite Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using refined anthracite over conventional sand filters?

Refined anthracite possesses lower specific gravity, allowing it to sit atop denser filter media in multi-media systems. This stratification enables true deep-bed filtration, facilitating higher flow rates, longer filter runs, and superior capacity for removing lighter, flocculent solids, optimizing overall water treatment efficiency.

How often does refined anthracite filter media need to be replaced in a municipal setting?

The replacement cycle for refined anthracite typically ranges from 5 to 10 years, depending heavily on the raw water quality, frequency and effectiveness of backwashing, and specific filter loading rates. Proper maintenance and quality control can help maximize this lifespan and minimize system downtime.

What regulatory standards must refined anthracite filters comply with for use in drinking water?

For potable water applications, refined anthracite media must comply strictly with international and national standards, most notably NSF/ANSI Standard 61 in North America, which certifies that the material will not leach contaminants into the drinking water supply above acceptable health limits.

Which geographical region exhibits the highest growth potential for refined anthracite filters?

The Asia Pacific (APAC) region displays the highest growth potential, driven by significant government investments in municipal water infrastructure expansion, rapid industrialization, and the increasing adoption of multi-media filtration systems to manage complex water challenges across dense populations.

Are there different grades of refined anthracite, and how do they differ in application?

Yes, grades differ primarily by particle size (Uniformity Coefficient) and purity. Standard grades are used for general turbidity removal, while High-Purity (often acid-washed or thermal-treated) grades are essential for sensitive industrial applications like power generation or semiconductor manufacturing, where minimizing trace metal leaching is critical.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager