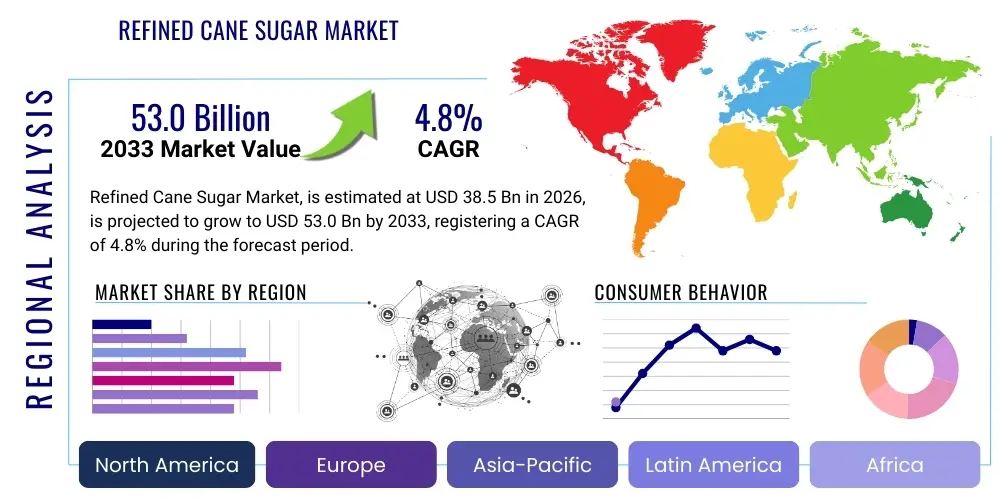

Refined Cane Sugar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436048 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Refined Cane Sugar Market Size

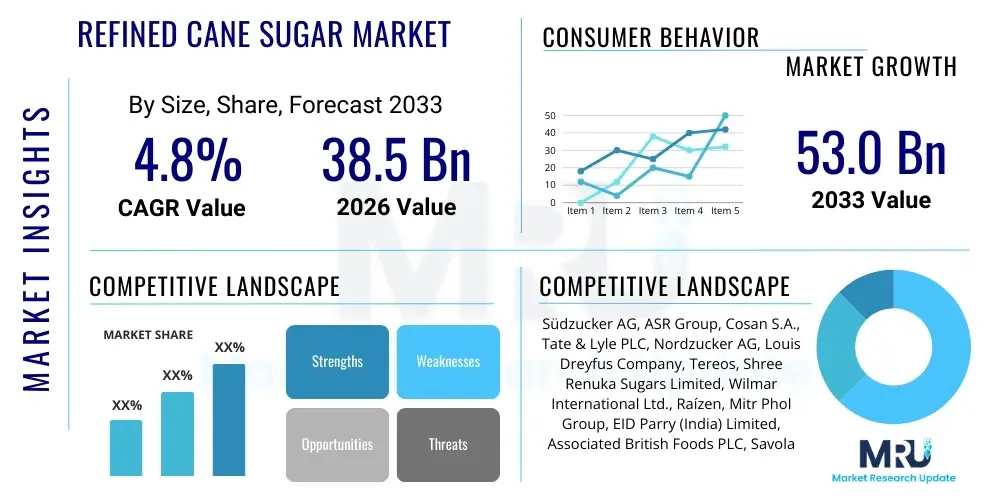

The Refined Cane Sugar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $53.0 Billion by the end of the forecast period in 2033.

Refined Cane Sugar Market introduction

The Refined Cane Sugar Market encompasses the industrial production, processing, and distribution of high-purity sucrose derived from sugarcane, differentiated by its high polarization value and minimal non-sucrose solids. Refined cane sugar, typically available in granulated, powdered, or liquid forms, serves as a fundamental ingredient across the global food system. The refinement process, which involves clarification, filtration, evaporation, crystallization, and drying, removes molasses and impurities inherent in raw sugar, resulting in a white, crystalline product favored for its consistent quality and neutral flavor profile essential for standardized food and beverage manufacturing. This stringent processing ensures the final product meets the demanding quality specifications required by industrial users, ensuring shelf stability and purity.

Major applications of refined cane sugar span numerous industries, primarily driven by the massive demand from the beverage and confectionery sectors. It acts as a bulking agent, preservative, fermentation substrate, texture modifier, and flavor enhancer. Beyond traditional uses in baking, soft drinks, and candies, refined cane sugar is increasingly utilized in the pharmaceutical industry as an excipient and in the production of high-grade industrial chemicals. Its functional versatility and relatively low cost compared to synthetic sweeteners maintain its central role in the global ingredient market, despite growing consumer scrutiny regarding sugar intake. The market dynamics are intricately linked to global sugarcane harvests, trade policies, and energy costs associated with the intensive refining process.

The primary driving factors propelling the refined cane sugar market include robust population growth, particularly in emerging economies where per capita consumption of processed foods and beverages is rapidly increasing, and the subsequent expansion of the organized retail and quick-service restaurant (QSR) sectors globally. Furthermore, the inherent stability and consistent functionality of cane sugar make it difficult to completely substitute in many complex food formulations, ensuring sustained industrial demand. While health and wellness trends pose restraints, the foundational role of sugar in maintaining the palatability and structure of many mass-produced food items guarantees continuous, high-volume procurement by global food giants, solidifying its market position throughout the forecast period.

Refined Cane Sugar Market Executive Summary

The Refined Cane Sugar Market is characterized by intense price volatility driven by complex global supply chains, geopolitical influences impacting trade agreements, and environmental variability affecting cane harvests in key producing regions such as Brazil, India, and Thailand. Business trends highlight a significant push towards supply chain transparency and traceability, necessitated by increasing consumer demand for ethically sourced ingredients and stricter regulatory compliance regarding origin verification. Large industrial buyers are increasingly negotiating long-term contracts to mitigate risk associated with fluctuating raw sugar prices, leading to consolidation among major refiners who can leverage scale for cost efficiency and inventory management. Innovation is centered around enhancing efficiency in the refining process, particularly reducing energy and water consumption, which are major operating costs for manufacturers.

Regional trends indicate that the Asia Pacific (APAC) region remains the epicenter of consumption and growth, propelled by the rising middle class, urbanization, and the associated growth in demand for packaged foods and sugary beverages across China, India, and Southeast Asia. Latin America, particularly Brazil, dominates the supply side, holding significant influence over global pricing and export volumes. In developed regions like North America and Europe, consumption is stabilizing or slightly declining due to health awareness and regulatory pressures such as sugar taxes, but high-value niche segments like organic and fair-trade certified cane sugar are witnessing above-average growth, providing premiumization opportunities for specialized refiners.

Segmentation trends reveal that the Food & Beverage industry continues to be the dominant end-user, accounting for the vast majority of market revenue, with beverages and confectionery leading the consumption profile. From a product form perspective, granulated white sugar remains the largest segment due to its ubiquity and cost-effectiveness in industrial applications. However, the powdered sugar and liquid sucrose segments are expanding rapidly, particularly for specific industrial processes where ease of dispersion or precise concentration control is critical, such as in high-speed bottling operations. Distribution channels are shifting slightly, with direct B2B sales to multinational corporations remaining crucial, while B2C channels are adapting to e-commerce growth, allowing specialized sugar variants to reach niche consumer markets more effectively.

AI Impact Analysis on Refined Cane Sugar Market

Common user questions regarding AI's influence on the refined cane sugar market primarily revolve around operational efficiency, sustainability, and market predictability. Users are frequently inquiring about how Artificial Intelligence can optimize sugarcane farming practices—specifically yield forecasting, irrigation scheduling, and pest detection—to stabilize the volatile raw material supply. Furthermore, there is significant interest in AI's role in refining plant operations, focusing on energy optimization, predictive maintenance of complex machinery like centrifuges and crystallizers, and ensuring consistent product quality (purity levels) through real-time process monitoring. A key concern centers on whether AI-driven analytics can provide superior foresight into global supply-demand imbalances, thereby stabilizing commodity pricing and reducing financial risk for refiners and large buyers. This collective focus highlights the industry’s desire to leverage AI to address persistent challenges related to climate volatility, operational complexity, and market uncertainty.

AI is beginning to integrate into the sugar supply chain, offering transformational capabilities that enhance efficiency and sustainability from field to factory. In agricultural operations, machine learning models analyze satellite imagery, weather data, and soil metrics to provide prescriptive insights, maximizing cane yield per hectare and minimizing resource waste. Within the refining facility, AI-powered systems monitor critical parameters, such as crystal size distribution and liquid sugar concentration, automatically adjusting inputs to maintain stringent quality specifications while significantly reducing energy expenditure during the crystallization phase. The long-term impact involves creating a more resilient and transparent supply chain, capable of responding dynamically to both market fluctuations and environmental stressors.

- AI optimizes sugarcane yield prediction by integrating weather, satellite, and historical harvest data.

- Predictive maintenance using AI minimizes downtime of large-scale refining equipment, such as boilers and evaporators, improving throughput.

- Machine learning algorithms enhance energy efficiency in refining processes by optimizing steam consumption and crystallization cycles.

- AI-driven supply chain platforms improve logistics planning and inventory management, reducing storage costs and spoilage risk.

- Advanced analytics aid in market price forecasting, providing refiners and traders with better hedging strategies against commodity volatility.

- Quality control is automated using computer vision and sensors, ensuring consistent purity and reducing human error in grading.

DRO & Impact Forces Of Refined Cane Sugar Market

The dynamics of the refined cane sugar market are shaped by a powerful interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate long-term strategic planning for market participants. The primary drivers revolve around the continuous expansion of the global population and the concomitant growth in food processing industries, particularly in emerging economies where Westernized diets are becoming prevalent. The functional superiority of sucrose, offering unique browning, texturing, and preservation qualities, ensures its irreplaceable status in many complex formulations, sustaining high demand from major industrial consumers. This consistent industrial requirement forms a robust bedrock for market stability, counteracting consumer-driven health anxieties to some extent.

Key restraints significantly challenging market growth include heightened consumer awareness regarding the health risks associated with excessive sugar consumption, leading to regulatory interventions such as national sugar taxes and mandated nutritional labeling, particularly in North America and Europe. Furthermore, the market faces intense competition from high-intensity and artificial sweeteners, along with natural alternatives like stevia and monk fruit, which are gaining traction as manufacturers reformulate products to meet ‘low sugar’ or ‘sugar-free’ consumer demand. Supply side constraints, such as the inherent volatility of raw sugar commodity prices linked to unpredictable weather patterns (El Niño/La Niña cycles) and geopolitical instability in major producing nations, also pose substantial financial risks for refiners and processors.

Opportunities for growth are concentrated in the development and marketing of specialty sugar products, including certified organic cane sugar, non-GMO verified sugar, and specialized liquid sucrose blends tailored for the beverage industry. These premium segments command higher margins and cater to affluent consumers and multinational corporations prioritizing sustainability and clean-label ingredients. Furthermore, technological innovation in refining processes focused on reducing environmental footprint, such as advanced water recycling and co-generation of energy from bagasse, presents opportunities for refiners to achieve operational excellence and comply with stringent environmental regulations, thereby enhancing competitive advantage and appeal to environmentally conscious industrial buyers. These mitigating factors and strategic pivots are essential for maintaining viability against the backdrop of health-related market pressures.

Segmentation Analysis

The Refined Cane Sugar Market is highly diversified, segmented primarily based on Form, End-User Industry, and Distribution Channel, reflecting the diverse requirements of industrial, commercial, and retail applications globally. Understanding these segments is crucial as they reveal distinct growth trajectories and pricing sensitivities. The industrial segmentation is particularly critical, as the purity and physical characteristics required for beverage manufacturing differ significantly from those needed for pharmaceutical applications, driving specialization among refiners. The interplay between these segments determines overall market profitability and the strategic focus of major refiners.

Market segmentation provides a detailed map of consumption patterns. The Form segmentation, encompassing granulated, powdered, and liquid forms, highlights operational preferences; for instance, liquid sucrose is preferred by high-volume beverage manufacturers due to ease of handling and integration into automated lines. Conversely, the End-User segmentation demonstrates that while Food & Beverage dominates, the stable, high-value demand from the pharmaceutical sector for high-grade sucrose for syrups and excipients offers resilient growth pockets. The continuous refinement and specialization within these segments allow producers to target specific high-margin niches, offsetting volume declines in mainstream, highly commoditized segments.

- By Form:

- Granulated Sugar (Standard White)

- Powdered Sugar (Confectioners' Sugar)

- Liquid Sucrose/Invert Syrup

- Cube/Cast Sugar

- By End-User Industry:

- Food and Beverage (Bakery, Confectionery, Dairy, Beverages)

- Pharmaceuticals (Excipients, Syrups)

- Industrial (Chemical Manufacturing)

- Cosmetics and Personal Care

- By Distribution Channel:

- Business-to-Business (B2B) Sales (Direct Industrial Supply)

- Business-to-Consumer (B2C) Sales (Retail, Supermarkets, E-commerce)

- By Grade:

- Standard Refined (Plantation White)

- High Purity Refined (HP)

- Organic Certified

- Non-GMO Certified

Value Chain Analysis For Refined Cane Sugar Market

The Refined Cane Sugar value chain is an intricate, capital-intensive process that spans from agricultural cultivation to final consumer delivery, marked by significant value addition at the refining stage. The upstream analysis focuses on sugarcane cultivation and harvesting, which is highly dependent on agricultural inputs, climate, and labor intensity. Following harvest, the raw sugar mill operation (crushing and milling) extracts the juice and produces raw sugar. This raw sugar, often characterized by a polarization below 99.5 degrees, is the primary input commodity for refiners. Efficiency at this initial stage is critical, as the quality and cost of raw sugar directly influence the refiner's profit margins, making favorable raw sugar procurement a significant competitive advantage.

The core value addition occurs during the refining process itself, where raw sugar is transformed into high-purity refined sucrose. This stage involves complex physical and chemical purification steps, including affination, carbonation or sulfitation, decolorization using carbon or ion-exchange resins, evaporation, crystallization, and final drying. Refining is energy and water intensive, meaning technological advancements that improve energy efficiency or utilize bagasse for co-generation are paramount for cost control. The successful operation of the refining stage determines the final product's grade, marketability, and ability to meet stringent industrial specifications, particularly for beverage and pharmaceutical applications requiring maximum purity.

Downstream analysis involves the complex web of distribution channels. Direct distribution (B2B) dominates, where refined sugar is sold in large volumes (bulk sacks, rail cars, liquid tankers) directly to major food, beverage, and confectionery manufacturers globally. This channel demands robust logistical capabilities, adherence to strict quality protocols, and reliable supply contracts. The indirect distribution channel targets smaller industrial users, catering services (HORECA), and retail consumers, typically moving through wholesalers, distributors, and modern retail chains (supermarkets). The effectiveness of the distribution network, particularly the ability to manage complex cross-border logistics and meet Just-In-Time (JIT) inventory demands, significantly impacts market reach and customer satisfaction in this highly commoditized environment.

Refined Cane Sugar Market Potential Customers

Potential customers for refined cane sugar represent a vast array of global industries, fundamentally categorized by their scale of operation and specific purity requirements. The largest volume consumers are multinational corporations within the Food and Beverage sector. This includes global soft drink manufacturers, whose proprietary formulations rely on high-purity sucrose for consistent taste and stability, and large-scale confectioneries and bakeries that utilize granulated and powdered sugar as key structural and sweetening components in mass production. These customers require reliable, high-volume, continuous supply, often secured through long-term contracts and stringent quality audits, making refiner reliability and scale critical purchasing factors.

A second major category includes niche, high-value end-users such as the Pharmaceutical and Biotechnology industries. These sectors demand specialized, ultra-high-purity (USP/EP grade) sucrose for use as inert carriers, binding agents (excipients), or in pediatric syrups and fermentation media. This customer base is highly quality-conscious and less price-sensitive than commodity users, driving demand for specialized refining processes and meticulous quality assurance documentation. Furthermore, smaller, regional food producers, specialized organic food companies, and the rapidly growing network of catering and food service establishments also constitute substantial customer segments, often purchasing through distributor networks rather than directly from the refiners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $53.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Südzucker AG, ASR Group, Cosan S.A., Tate & Lyle PLC, Nordzucker AG, Louis Dreyfus Company, Tereos, Shree Renuka Sugars Limited, Wilmar International Ltd., Raízen, Mitr Phol Group, EID Parry (India) Limited, Associated British Foods PLC, Savola Group, Tongaat Hulett Sugar, Bunge Limited, Cargill, Incorporated, Czarnikow Group, Al Khaleej Sugar Co., Cristal Union. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refined Cane Sugar Market Key Technology Landscape

The refined cane sugar market relies on sophisticated, continuously evolving processing technologies aimed at maximizing sucrose recovery, enhancing purity, and minimizing operational costs, particularly concerning energy consumption. One core technological area involves advanced clarification processes, such as carbonation and sulfitation, which utilize lime and carbon dioxide or sulfur dioxide, respectively, to precipitate non-sugar impurities, ensuring effective removal of suspended solids and colorants prior to crystallization. Modern refineries are adopting highly efficient membrane filtration techniques as an enhancement or alternative to traditional processes, improving the effluent quality and reducing chemical usage, thereby aligning operations with stricter environmental compliance standards.

Furthermore, automation and digitalization are becoming increasingly integral to the modern refining landscape. Key technologies include Continuous Vacuum Pans (CVPs) for efficient, continuous crystallization, replacing older batch processes and ensuring uniform crystal size distribution critical for industrial applications. Advanced process control systems (APCS) integrate real-time sensor data—measuring parameters like Brix (sugar concentration), conductivity, and turbidity—to regulate evaporators and crystallizers precisely, optimizing recovery yields and minimizing energy input. The integration of advanced boiler technology, often using bagasse (a sugarcane byproduct) for co-generation of heat and electricity, significantly reduces reliance on external energy sources, substantially lowering the overall carbon footprint and operating expenditure of the refining facility.

The emphasis on high-purity sugar for sensitive applications drives the adoption of advanced decolorization technologies. While bone char was historically used, modern facilities predominantly rely on granular activated carbon (GAC) systems and specialized ion exchange resins, which offer superior color removal capabilities and consistency while allowing for regeneration and reuse. Beyond processing, supply chain visibility technologies, including blockchain-enabled traceability platforms, are gaining traction. These systems provide end-to-end transparency concerning sugar origin, processing metrics, and sustainability credentials, meeting the stringent audit requirements of large global buyers and addressing growing consumer demand for ethical sourcing.

Regional Highlights

Regional dynamics heavily influence the refined cane sugar market due to localized production capabilities, consumption habits, and regulatory frameworks, creating diverse operational environments for market participants.

- Asia Pacific (APAC): This region is the primary engine of demand growth globally, driven by massive urbanization, a swelling middle-class population, and rapid expansion of the packaged food and beverage sector across countries like India, China, and Indonesia. APAC is characterized by a mix of domestic production and significant imports, resulting in highly competitive market pricing and intense focus on large-scale industrial distribution.

- Latin America (LATAM): Dominated by Brazil, which is the world’s largest producer and exporter of sugarcane products, LATAM is crucial for global supply stability. The region benefits from highly mechanized, cost-efficient agricultural practices and significant infrastructure geared towards bulk sugar export. Market dynamics here are intrinsically linked to global commodity pricing and exchange rate fluctuations (particularly the Brazilian Real).

- North America: Characterized by high per capita consumption, the market is mature but faces significant headwinds from health trends and sugar taxation. Demand remains steady, primarily met through a combination of domestic refining (often supplemented by imported raw sugar) and quota-based imports. Focus is shifting towards high-quality, specialty sugars (e.g., organic, liquid sucrose) for premium applications.

- Europe: Facing strong competition from the domestic beet sugar industry, the refined cane sugar market in Europe is heavily influenced by EU agricultural policies and import tariffs. The market prioritizes sustainability certifications, ethical sourcing (Fair Trade), and non-GMO status. Consumption is increasingly regulated by public health initiatives aimed at reducing sugar intake, driving substitution efforts in formulations.

- Middle East and Africa (MEA): This region is a major import hub, especially the Gulf Cooperation Council (GCC) countries, which operate some of the world’s largest standalone sugar refineries utilizing imported raw cane sugar. Demand is strong due to rapid population growth and high consumption of sugary beverages, with strategic investments focused on establishing regional processing capabilities to ensure food security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refined Cane Sugar Market.- Südzucker AG

- ASR Group

- Cosan S.A.

- Tate & Lyle PLC

- Nordzucker AG

- Louis Dreyfus Company

- Tereos

- Shree Renuka Sugars Limited

- Wilmar International Ltd.

- Raízen

- Mitr Phol Group

- EID Parry (India) Limited

- Associated British Foods PLC

- Savola Group

- Tongaat Hulett Sugar

- Bunge Limited

- Cargill, Incorporated

- Czarnikow Group

- Al Khaleej Sugar Co.

- Cristal Union

Frequently Asked Questions

Analyze common user questions about the Refined Cane Sugar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Refined Cane Sugar Market?

The Refined Cane Sugar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033, driven primarily by industrial demand in emerging economies and stable consumption in high-value segments.

How do rising health concerns impact the industrial demand for refined cane sugar?

While health trends reduce per capita consumption in retail segments, industrial demand remains resilient because cane sugar provides superior functionality (bulking, texture, preservation) that alternative sweeteners struggle to replicate cost-effectively in complex food and beverage formulations.

Which geographical region dominates the supply side of the Refined Cane Sugar Market?

Latin America, specifically Brazil, dominates the global supply side. Brazil is the largest producer of sugarcane and plays a critical role in determining global raw sugar pricing and export volumes, significantly influencing the refining sector worldwide.

What are the key technological advancements transforming the cane sugar refining process?

Key technological advancements include the deployment of Continuous Vacuum Pans (CVPs) for crystallization, advanced membrane filtration for clarification, and the implementation of AI-driven process control systems to optimize energy usage and ensure ultra-high purity grades for industrial buyers.

What are the main segments driving profitability in the refined cane sugar market?

The most profitable segments are high-purity refined sugar used in Pharmaceuticals and specialty products like certified Organic and Fair Trade cane sugar, which command significant price premiums over standard granulated sugar due to stricter quality control and niche market demand.

Detailed Market Dynamics and Competitive Landscape

The refined cane sugar industry operates within a complex ecosystem where global commodity trading, agricultural policy, and consumer preferences intersect, resulting in constant market volatility and strategic shifts among major players. The price of refined sugar is fundamentally dependent on the London (No. 5) and New York (No. 11) futures markets for raw sugar, creating a highly commoditized trading environment where refining margins are often narrow. Successful refiners leverage sophisticated hedging instruments and vertical integration, controlling both raw material sourcing (via cane cultivation or long-term raw sugar purchase agreements) and distribution logistics to secure stable profit margins amidst these fluctuations. Furthermore, the competitive landscape is concentrated, with a few multinational refiners controlling significant market share, allowing them to benefit from economies of scale in capital-intensive processing operations.

Competitive strategy increasingly focuses on non-price factors, particularly sustainability and traceability, reflecting pressure from corporate clients who have committed to ethical sourcing mandates. Leading refiners are investing heavily in certifications, such as Bonsucro and Fair Trade, and implementing advanced tracking technologies to provide verifiable data on labor practices, environmental impact, and product origin. This focus on ethical supply chain management is emerging as a critical differentiator, especially when serving large, socially conscious corporations in North America and Europe. The shift towards product customization, offering specialized liquid sugar solutions and customized granulation sizes for specific industrial client machinery, also provides a competitive edge beyond mere bulk sales.

The long-term resilience of the market is heavily tied to infrastructure investment, especially in major exporting nations like Brazil and India. Investments in improved port facilities, advanced transportation networks (rail and internal waterways), and large, efficient storage capacity are essential for maintaining competitiveness and minimizing logistical costs, which can constitute a significant portion of the final product price. Moreover, regulatory arbitrage—navigating differences in import tariffs, domestic subsidies, and export quotas across major economic blocs like the EU, NAFTA, and ASEAN—requires expert trade management and geopolitical awareness, forming another layer of strategic complexity for global market leaders.

Sustainability and ESG Focus in Refined Cane Sugar Production

Sustainability is rapidly transitioning from a voluntary initiative to a mandatory competitive requirement within the refined cane sugar market, driven by stakeholder pressure from investors, consumers, and major corporate buyers. Environmental, Social, and Governance (ESG) criteria are scrutinizing cane sugar production across the entire value chain, particularly focusing on land use, water consumption, and greenhouse gas emissions associated with both agriculture and the high-heat refining process. Refiners are increasingly adopting practices that prioritize the responsible management of natural resources, often exceeding statutory minimums to enhance their brand reputation and secure premium pricing for certified sustainable products.

In the agricultural phase, sustainable practices emphasize improved farming techniques such as precision agriculture, which minimizes fertilizer and pesticide use, coupled with water conservation methods like drip irrigation, particularly critical in water-stressed cane-growing regions. A major environmental advancement in refining is the widespread adoption of co-generation power plants, where bagasse—the fibrous residue left after crushing the cane—is burned to generate steam and electricity, often providing enough power to run the entire refinery and sometimes exporting excess power back to the grid. This circular economy approach significantly reduces reliance on fossil fuels and minimizes waste output, representing a substantial improvement in the industry's environmental performance metrics.

Social sustainability is also a core focus, addressing historical concerns related to labor conditions and land rights. Compliance with international labor standards, ensuring fair wages, safe working conditions, and adherence to anti-child labor policies are now prerequisites for major certification schemes. Companies are actively engaging with local communities, investing in infrastructure, and ensuring equitable distribution of the economic benefits derived from sugar production. This holistic approach to ESG is crucial for mitigating operational risks, such as reputational damage or supply chain disruptions resulting from labor disputes, and for attracting environmentally conscious capital investment.

Regulatory and Policy Environment Analysis

The refined cane sugar market is heavily influenced by a dynamic and often restrictive global regulatory landscape involving trade agreements, health policies, and agricultural subsidies. Trade policies, particularly tariff rate quotas (TRQs) and bilateral trade agreements, dictate which countries can export raw and refined sugar and at what volume and price point. For instance, the sugar regime in the European Union and the US sugar program significantly impact global trade flows, creating protected domestic markets and influencing investment decisions regarding refinery capacity outside these regions. Changes in these protectionist policies can instantaneously shift global supply dynamics and commodity pricing.

Health-focused regulations represent the most significant long-term restraint, primarily through the introduction of excise taxes on sugar-sweetened beverages (SSBs), commonly referred to as "sugar taxes." Implemented in various forms across dozens of jurisdictions globally, these taxes aim to reduce consumption and fund public health initiatives. For refiners and industrial users, sugar taxes necessitate product reformulation towards low- or zero-sugar alternatives, thereby reducing the volume demand for standard refined cane sugar in the beverage segment—historically a high-volume consumer. Successful market players are those that diversify their product portfolio to include specialty functional ingredients or develop low-sugar custom blends.

Furthermore, stringent food safety and quality regulations impose significant operational overheads on refiners. Regulations governing maximum residue limits (MRLs) for pesticides, heavy metal contamination, and microbial control demand continuous investment in sophisticated quality assurance systems and laboratory testing. Refiners must also comply with evolving labeling requirements, including mandates for nutritional panels, allergen warnings, and origin tracing, especially for products sold in consumer markets. Failure to comply with these meticulous standards can result in costly product recalls, market exclusion, and severe financial penalties, underscoring the critical importance of robust regulatory compliance management.

Product Innovation and Formulation Trends

Innovation in the refined cane sugar sector is less about inventing a new molecule and more about enhancing functional characteristics, purity levels, and specialized physical forms to meet niche industrial demands. While sucrose remains chemically constant, refiners are optimizing crystal structure and particle size distribution to improve performance in specific applications. For instance, ultra-fine powdered sugar is optimized for solubility in cold liquids and dusting applications, while specific liquid invert syrups are developed for enhanced stability and microbial resistance, essential for premium beverage concentrates and ice cream manufacturing.

A key trend involves the proliferation of specialty sugar grades tailored for the clean-label movement. Demand for certified Organic Cane Sugar, which requires adherence to strict cultivation and processing standards without synthetic chemicals, is growing rapidly in developed markets. Similarly, Non-GMO Project verified sugar is increasingly sought after, even though sugarcane is not typically a genetically modified crop globally, the certification provides critical marketing differentiation and assurance to highly selective corporate buyers focused on consumer trust. These premium offerings allow refiners to distance themselves from the volatility of the commoditized standard white sugar segment.

Innovation also focuses on functional blends and co-processed ingredients. This includes creating specialized blends of cane sugar with high-intensity natural sweeteners (like stevia or monk fruit) to achieve significant sugar reduction while maintaining acceptable taste and mouthfeel, often aimed at helping food manufacturers meet reduction targets without drastic reformulation costs. Furthermore, the development of highly sterile, pharmaceutical-grade sucrose is a continuous area of technological refinement, involving meticulous control over crystal morphology and minimizing particulate contamination to ensure compliance with pharmacopoeia standards for use in injectable solutions and high-end medications.

Market Entry and Growth Strategies

Market entry into the refined cane sugar industry, characterized by high capital expenditure requirements and established supply chains, typically relies on strategic partnerships and focused geographic targeting. New entrants often seek collaboration or joint ventures with existing raw sugar mill operators in key growing regions (LATAM, APAC) to secure a stable and cost-effective raw material supply, bypassing the necessity of building an entirely new upstream infrastructure. This integration minimizes exposure to raw sugar price volatility and facilitates control over the input quality destined for refining.

For growth, leading players predominantly pursue vertical and horizontal integration strategies. Vertical integration involves expanding backward into sugarcane cultivation or forward into specialized distribution and logistics capabilities, increasing control over the entire value chain and enhancing margin capture. Horizontal integration, typically through mergers and acquisitions (M&A) of regional competitors, allows established refiners to rapidly expand geographic reach, acquire specialized assets (like liquid sugar terminals), and consolidate market share, leveraging greater economies of scale to drive down operating costs per unit.

A successful growth strategy also hinges on product diversification and market segmentation. Rather than competing solely on price in the bulk standard white sugar segment, companies focus resources on high-margin, high-value specialty segments, such as organic, liquid, or pharmaceutical grades. This involves targeted marketing to specific industrial buyers who prioritize quality, consistency, and certification over basic cost. Furthermore, aggressive investment in enhancing operational efficiency through digital transformation, predictive analytics, and automated material handling systems is crucial for sustaining a competitive cost structure globally.

Operational and Financial Risk Management

Risk management in the refined cane sugar market is multifaceted, primarily focusing on managing raw material price volatility, logistical disruptions, and regulatory shifts. Financial risk is mitigated through sophisticated hedging programs utilizing sugar futures and options contracts to lock in prices for raw sugar inputs and refined sugar outputs, thereby protecting refining margins from unexpected market swings caused by weather events or political decisions in major producing countries. Access to diverse sources of raw sugar, sourced from multiple geographical regions, is also a critical strategy to mitigate supply failure risk associated with single-region crop failures or export bans.

Operational risks stem largely from the capital intensity and complex technical nature of the refining process. Refiners must employ rigorous maintenance schedules, often leveraging AI and IoT sensors for predictive maintenance, to prevent catastrophic failures of large, specialized equipment like evaporators and centrifuges, which can halt production and lead to massive financial losses. Furthermore, ensuring consistent energy and water supply is a perpetual operational challenge, necessitating investment in backup power generation and advanced water treatment and recycling facilities, especially in areas with unstable utility infrastructure.

Logistical risk, particularly the movement of bulk raw sugar across oceans and the subsequent refined product to industrial consumers, requires robust risk planning. This involves securing reliable shipping contracts, managing currency exposure related to international transactions, and ensuring compliance with stringent customs and biosecurity regulations globally. Effective inventory management, balancing the cost of holding buffer stocks against the risk of supply shortages, is also central to maintaining operational stability and ensuring just-in-time delivery capabilities demanded by major food and beverage manufacturers.

Future Outlook and Emerging Trends

The future outlook for the Refined Cane Sugar Market is characterized by divergent forces: stabilizing volume demand driven by persistent industrial use, contrasted with increasing pressure for sustainability and alternative formulations. While global consumption volumes are expected to maintain steady growth, primarily in APAC and MEA, the nature of the product demanded will continue to evolve, shifting towards specialized, certified, and functionally optimized sugar products. The primary strategic imperative for market participants will be adapting their business models to effectively navigate these polarized demands—maintaining low costs for bulk commodity sugar while simultaneously developing high-margin specialty offerings.

Emerging trends indicate a greater reliance on advanced technology for resource efficiency. The implementation of Smart Factory concepts, utilizing Industrial IoT and machine learning across refining operations, will become standard practice, leading to significant reductions in steam, electricity, and water consumption—crucial factors in improving profitability and achieving sustainability targets. Furthermore, the development of enhanced coproduct utilization, moving beyond simple bagasse-based co-generation to producing advanced biochemicals or sustainable materials from cane derivatives, represents a potential new revenue stream that could enhance the overall economic viability of cane processing operations.

The regulatory environment, particularly concerning public health, is expected to intensify, requiring continuous proactive reformulation efforts from industrial buyers. This sustained pressure will likely accelerate the adoption of hybrid sweetening solutions where cane sugar works synergistically with low-calorie alternatives. Successfully securing market leadership in the coming decade will depend on a refiner's ability to demonstrate transparent, resilient, and environmentally responsible supply chains, capitalizing on the growing consumer willingness to pay a premium for verified sustainable ingredients.

Data Analysis Techniques and Methodology

The compilation of this comprehensive market insights report utilized a rigorous, mixed-methodology approach combining both primary and secondary market research data collection and analysis. Secondary research involved the exhaustive review of industry publications, annual reports of key market players, trade association statistics, governmental databases (e.g., USDA, FAO), investor presentations, and academic journals focusing on sugarcane agriculture, commodity trading, and food processing trends. This provided a foundational quantitative baseline for historical market sizing and trend identification.

Primary research supplemented this baseline through structured interviews and surveys with key opinion leaders, including refining company executives, commodity traders, supply chain managers for multinational food and beverage corporations, and technical specialists in refining technology. This qualitative data provided deep insights into current operational challenges, strategic priorities, anticipated regulatory impacts, and future investment plans, validating and enriching the quantitative models derived from secondary sources. The triangulation of data sources ensured high reliability and validity of the market forecasts and competitive analysis.

Advanced econometric modeling techniques were employed to forecast market size and growth trajectory, using regression analysis to correlate market demand drivers (e.g., GDP growth, population increase, disposable income) with historical refined sugar consumption patterns. Scenario planning was applied to assess the impact of major risks, such as climate change effects on harvests and the implementation of widespread sugar taxation, providing a range of plausible market outcomes for the forecast period (2026-2033). Sensitivity analysis was performed to evaluate the responsiveness of market valuation to fluctuations in key input variables, such as crude oil prices (influencing logistics and energy costs) and raw sugar commodity prices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager