Refined Copper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432169 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Refined Copper Market Size

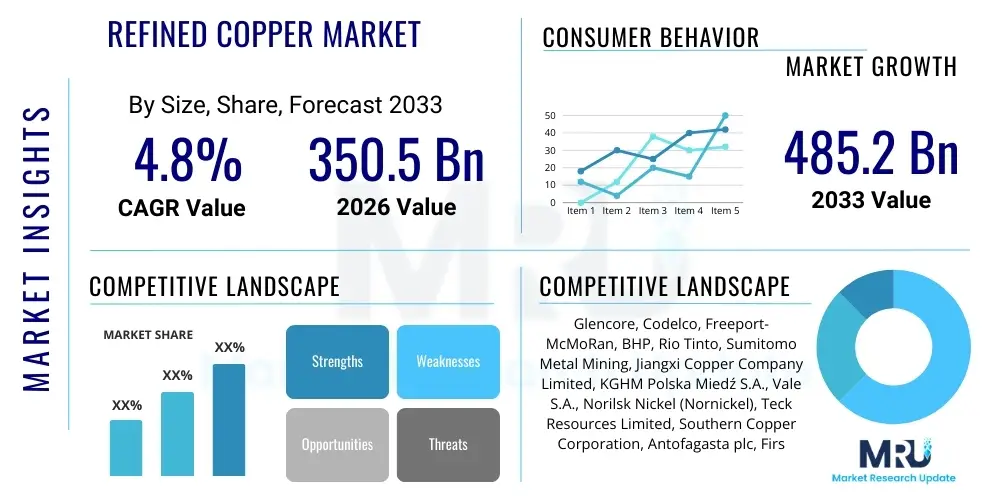

The Refined Copper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 350.5 billion in 2026 and is projected to reach USD 485.2 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by global commitments to decarbonization, massive investments in renewable energy infrastructure, and the accelerating adoption of electric vehicles (EVs), all of which necessitate vast quantities of high-purity copper.

Refined Copper Market introduction

The Refined Copper Market encompasses the supply and demand dynamics of high-purity copper products, typically achieving 99.99% purity, which is essential for electrical conductivity applications. Refined copper, primarily produced through electrolytic refining (electrowinning or electro-refining) or, less commonly, pyrometallurgical processes, serves as a fundamental material across industrial and technological sectors. The final product forms include wire rod, cathodes, billets, and cakes, tailored for immediate manufacturing into end-use components.

Major applications of refined copper span the electrical and electronic industries, including power generation, transmission, and distribution, given its exceptional thermal and electrical conductivity. Furthermore, it is integral to the construction sector for piping and wiring, and increasingly crucial in modern transportation systems, particularly in electric and hybrid vehicles where it is utilized extensively in batteries, motors, and charging infrastructure. The inherent durability, corrosion resistance, and recyclability of copper further solidify its position as a strategically vital metal.

Key driving factors fueling market expansion include rapid urbanization in developing economies, leading to increased construction and infrastructure demands, and government mandates promoting renewable energy integration, such as solar and wind power, which are highly copper-intensive. The transition to advanced smart grid technologies and the widespread deployment of 5G networks also contribute significantly to the increased demand for high-quality refined copper products globally. These macro trends ensure sustained demand that often outpaces short-term supply fluctuations.

Refined Copper Market Executive Summary

The global Refined Copper Market exhibits strong momentum, characterized by significant business trends focusing on sustainable sourcing, enhanced recycling infrastructure, and vertical integration across the supply chain. Business trends highlight strategic mergers and acquisitions aimed at securing raw material access, especially high-grade concentrates, and improving operational efficiencies in energy-intensive refining processes. Furthermore, there is a distinct push toward refining processes that minimize environmental footprint, such as advanced hydrometallurgy techniques, attracting substantial institutional investment across major producing regions.

Regional trends indicate a continued dominance of the Asia Pacific (APAC) region, spearheaded by China, which acts as both the largest consumer and a major refiner, driven by massive investments in domestic infrastructure, consumer electronics manufacturing, and clean energy deployment. While North America and Europe are mature markets, their growth is revitalized by national electrification initiatives, including grid modernization and EV manufacturing targets, supported by favorable regulatory frameworks designed to promote material circularity and domestic supply security. Latin America remains the powerhouse for raw copper production, influencing global supply stability.

Segment trends reveal that the Electrical & Electronics application segment, particularly wire rod utilized in power transmission and EV components, is expected to maintain the highest growth rate due to global electrification efforts. Product segmentation indicates that copper cathodes, the base form for most refined products, will retain the largest market share. The increasing focus on circular economy principles is boosting the secondary refining segment (recycling), positioning it as a critical growth vector that mitigates reliance on primary mining and refining activities.

AI Impact Analysis on Refined Copper Market

User queries regarding AI's influence on the Refined Copper Market often center around two main areas: optimizing production efficiency and enhancing demand-supply equilibrium amid volatile pricing. Users frequently ask how machine learning algorithms can improve ore sorting and extraction yields in primary copper mining, a direct input to refining operations. There is also significant interest in the application of predictive analytics for managing energy consumption within the highly energy-intensive electrolytic refining process, which is critical for reducing operational expenditure and environmental impact. Furthermore, stakeholders seek clarification on how AI-driven market intelligence can stabilize price forecasting, crucial for long-term contract negotiations and hedging strategies in a commodity subject to intense geopolitical and economic volatility.

The implementation of Artificial Intelligence and Machine Learning (ML) solutions is rapidly transforming the operational landscape of copper refining. These technologies enable real-time monitoring and optimization of complex chemical and thermal processes involved in pyrometallurgy and hydrometallurgy. By analyzing vast datasets related to input material quality, temperature gradients, and energy flows, AI systems can automatically adjust process parameters, leading to measurable increases in copper recovery rates, reduced processing time, and significant savings in electrical power consumption, which is a major cost component in electro-refining.

Beyond the production floor, AI is pivotal in optimizing the sophisticated global supply chain for refined copper. Predictive algorithms are now used to model future demand based on macroeconomic indicators, infrastructure project timelines, and regional EV sales forecasts, allowing refiners and distributors to manage inventory levels more effectively and mitigate stockout risks. This capability is crucial for ensuring that the supply of high-purity copper, which is essential for time-sensitive manufacturing, meets fluctuating industrial requirements without causing disruptive price spikes or dips. The integration of AI also enhances safety protocols within hazardous refinery environments through predictive maintenance and autonomous monitoring systems.

- AI-driven optimization of flotation and leaching processes in upstream mining increases copper concentrate quality entering the refinery.

- Predictive maintenance schedules reduce unplanned downtime in high-capital refining equipment, enhancing overall utilization rates.

- Machine Learning algorithms minimize energy consumption in electro-refining cells by fine-tuning voltage and current inputs based on real-time material analysis.

- AI-enhanced demand forecasting models improve inventory management and logistical planning for distributors and end-users, stabilizing supply chains.

- Autonomous robotic systems in refineries improve worker safety and precision in handling intermediate products like anodes and cathodes.

DRO & Impact Forces Of Refined Copper Market

The dynamics of the Refined Copper Market are shaped by a powerful combination of supportive drivers, significant structural restraints, and emerging technological opportunities, collectively referred to as the Impact Forces. Major drivers include the global push for electric vehicle adoption, which requires several times more copper per unit than conventional vehicles, and widespread government-led infrastructure investment focusing on smart grids and high-capacity data transmission networks. Restraints primarily involve the environmental complexities and high capital expenditure associated with new mining and refining projects, coupled with stringent environmental regulations, particularly regarding sulfur dioxide emissions from smelters. Opportunities lie in the technological advancements in hydrometallurgy for treating complex or low-grade ores, and the increasing viability of secondary copper production (recycling) to meet sustainability targets and reduce supply vulnerability, summarized as the primary forces dictating market evolution.

Drivers: Global initiatives targeting net-zero emissions mandate a massive increase in renewable energy generation capacity (wind, solar), which requires substantial copper wiring and components for connectivity and storage. Furthermore, the rapid expansion of data centers and the 5G rollout necessitate high-speed, high-conductivity copper cabling. The consistent growth of urbanization in Asia and Africa also creates persistent baseline demand for construction-related wiring and plumbing. This fundamental reliance on copper for energy transition technologies ensures its status as a critical mineral, pushing demand ahead of current production capacities.

Restraints: Significant geographical concentration of copper mining in politically sensitive regions poses substantial supply chain risks, exacerbated by resource nationalism and labor disputes. Environmentally, the refining process, especially primary smelting, generates substantial greenhouse gas emissions and chemical waste, leading to escalating regulatory pressure and operational costs. Furthermore, the decline in ore grades globally means higher energy expenditure and increased waste generation per ton of copper produced, pushing up both capital and operational costs for new projects, making investment difficult without significant sustained price buoyancy.

Opportunities: Technological breakthroughs in solvent extraction and electrowinning (SX-EW) allow for the economical processing of formerly unviable oxidized or low-grade copper reserves, expanding the resource base. The development of advanced sensing and automation technologies in refineries promises significant efficiency gains and waste reduction. Most critically, the transition toward a circular economy significantly elevates the opportunity in secondary copper refining, utilizing end-of-life products like discarded electronics and cables as a stable, often cleaner, feedstock source, thereby diversifying supply and meeting stringent environmental criteria.

Segmentation Analysis

The Refined Copper Market is systematically segmented based on product type, application, and end-use industry, reflecting the diverse requirements of downstream manufacturing sectors. Product segmentation is crucial as it defines the form factor and specific purity levels required for subsequent processing. The dominant product type remains the copper cathode, serving as the foundational raw material that is then melted and cast into various other forms, such as wire rod, used predominantly in electrical applications. Understanding these segments is key for supply chain efficiency, enabling refiners to align production capacities with specific industrial demands across different geographical markets.

Application segmentation highlights the immense dependence of modern infrastructure and technology on refined copper. The electrical and electronics sector consistently consumes the largest volume, driven by high conductivity requirements in power transmission and telecommunications. However, the construction sector, encompassing architectural, plumbing, and HVAC systems, also represents a massive and stable demand base, particularly in emerging economies undergoing rapid infrastructural development. Furthermore, the transportation sector, particularly due to the exponential growth of Electric Vehicle (EV) manufacturing, is rapidly increasing its proportional share of refined copper consumption, creating a new high-growth demand pocket.

Segmentation by end-use allows market participants to tailor their marketing and distribution strategies, acknowledging the distinct procurement cycles and specification requirements of industries like telecommunications, automotive manufacturing, and specialized machinery production. The market resilience is often linked to the balanced demand across these diverse end-use segments; while one sector might experience a downturn, others, such as renewable energy installations, often provide counter-cyclical growth, ensuring overall market stability and justifying continued investment in refinery capacity expansion and modernization projects.

- By Product Type:

- Copper Cathodes (Dominant initial product)

- Wire Rod (Primary use in electrical transmission)

- Copper Billets and Billet Derivatives

- Copper Ingots and Cakes (Used for specialized alloys)

- By Form:

- Primary Refined Copper (From mining/smelting)

- Secondary Refined Copper (From recycling/scrap)

- By Application:

- Electrical and Electronics (Wiring, PCBs, Motors)

- Construction (Piping, Roofing, General Wiring)

- Transportation (EV components, Railway Infrastructure)

- Industrial Machinery and Equipment

- Consumer Products

- By End-Use Industry:

- Power Generation and Transmission

- Automotive (EV and traditional vehicles)

- Telecommunications

- Building & Infrastructure

- HVAC and Refrigeration

Value Chain Analysis For Refined Copper Market

The Refined Copper value chain is complex and capital-intensive, starting with the highly concentrated upstream segment of mining and concentration. This stage involves the extraction of copper ore, primarily sulfides, which is then processed through flotation to produce copper concentrate. Upstream analysis focuses on geopolitical stability, access to water and energy resources, and the fluctuating global ore grade quality, which directly impacts the costs and feasibility of subsequent processing stages. The efficiency and scale of upstream operations, dominated by a few major multinational miners, dictate the feedstock supply reliability for the entire global refining industry.

The midstream segment involves smelting and refining—the conversion of concentrates into high-purity copper cathodes. Smelting transforms concentrates into blister copper, which is then sent to electro-refineries. The refining stage is highly technical and energy-intensive, requiring massive electrical power infrastructure. Distribution channels, both direct and indirect, then move the cathodes to downstream fabricators. Direct channels often involve long-term off-take agreements between large refiners and major wire rod manufacturers or industrial conglomerates. Indirect channels utilize global metal exchanges (like the LME and COMEX) and specialized metal traders to facilitate spot market transactions and hedging activities, providing necessary liquidity and price discovery.

The downstream analysis focuses on fabrication and end-use application. Fabricators convert cathodes into customized products like wire rod, sheets, tubes, and specialized alloys, aligning with specific industry standards (e.g., conductivity requirements for automotive wiring harnesses). These fabricated products are then integrated into final goods across key end-use industries such as construction, power transmission, and automotive manufacturing. The profitability of the downstream segment is highly dependent on the stability of copper pricing and the technological demands of end-users, increasingly favoring advanced, smaller gauge wiring for electronic and EV applications.

Refined Copper Market Potential Customers

The primary customers for refined copper are large industrial manufacturers and vertically integrated corporations that rely on high-purity metal as a fundamental input for their production processes. The largest segments of end-users include high-volume wire and cable manufacturers, essential for energy transmission infrastructure and telecommunications networks. These buyers demand certified purity levels (Grade A copper) and often engage in long-term supply contracts with refiners to secure pricing stability and guaranteed tonnage, mitigating the risks associated with volatile commodity markets. The quality assurance protocols required by these customers are extremely stringent, particularly for applications like underground power cables and high-precision electronic components.

Another major category of potential customers encompasses the global automotive sector, specifically manufacturers focused on Electric Vehicles (EVs) and charging infrastructure developers. An EV requires significantly more copper than a conventional vehicle, utilized in the battery pack, wiring, motor, and inverters. These buyers prioritize lightweight, high-performance copper alloys and seek suppliers capable of meeting the stringent volume and delivery timelines necessary for mass production. As EV adoption scales globally, the automotive industry's demand for refined copper, especially in the form of specialized magnet wire and busbars, is becoming a primary consumption driver, leading to increased specialization among copper fabricators.

Furthermore, major infrastructure and construction companies represent consistent, long-term buyers. Copper is indispensable for plumbing (due to its corrosion resistance and anti-microbial properties), roofing, and internal building wiring systems. In the context of large-scale urbanization projects and smart city development, these customers require reliable volumes of copper tubing and standard wiring. Government-backed utilities and energy generation companies, involved in solar farms and wind turbine construction, are also massive procurement entities, requiring substantial refined copper for connectivity and grounding applications across vast energy generation sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 485.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glencore, Codelco, Freeport-McMoRan, BHP, Rio Tinto, Sumitomo Metal Mining, Jiangxi Copper Company Limited, KGHM Polska Miedź S.A., Vale S.A., Norilsk Nickel (Nornickel), Teck Resources Limited, Southern Copper Corporation, Antofagasta plc, First Quantum Minerals, Aurubis AG, JX Nippon Mining & Metals Corporation, Vedanta Resources Limited, Zijin Mining Group Co., Ltd., Sterlite Copper, Trafigura Group Pte. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refined Copper Market Key Technology Landscape

The technology landscape governing the Refined Copper Market is characterized by a continuous drive for efficiency, sustainability, and the capacity to process increasingly complex raw materials. Pyrometallurgy, involving smelting and converting, remains the dominant technology globally for processing sulfide concentrates, leading to blister copper. However, significant technological innovation is focused on improving environmental compliance in this area, specifically through enhanced off-gas capture systems, such as utilizing modern flash smelting or IsaSmelt processes, to minimize sulfur dioxide emissions and optimize energy recovery, which is essential for meeting rigorous global air quality standards.

Hydrometallurgy, specifically Solvent Extraction and Electrowinning (SX-EW), represents the major technological shift in the sector, enabling the economic recovery of copper from low-grade oxide ores and increasingly, from sulfide ores through bioleaching or heap leaching techniques. This process bypasses the high-energy and high-emissions stage of smelting, producing refined copper cathodes directly. Advances in SX-EW are focused on developing more selective and robust extraction reagents and optimizing cell house operations through automation and advanced process control systems, dramatically lowering the processing costs associated with otherwise uneconomical reserves and improving the overall sustainability profile of copper production.

Furthermore, technology related to secondary refining (recycling) is becoming paramount. Modern recycling facilities utilize advanced sorting, shredding, and separation technologies to efficiently recover copper from complex scrap sources, particularly end-of-life electronics (e-waste) and cabling. The use of advanced furnaces and processes like the Kaldo technology for scrap melting allows for higher recovery rates and the co-recovery of valuable byproducts (like gold, silver, and other strategic metals), making secondary copper refining a technologically sophisticated and economically vital component of the future copper supply chain, supporting the industry’s commitment to resource circularity.

Regional Highlights

The Refined Copper Market exhibits distinct consumption and production characteristics across major global regions, heavily influenced by urbanization rates, industrial policy, and resource availability.

- Asia Pacific (APAC): APAC is the epicenter of global refined copper demand and consumption, primarily driven by China, which accounts for over half of global consumption due to its enormous manufacturing base, massive infrastructure investments (e.g., Belt and Road Initiative), and rapid growth in electric vehicle production. India and Southeast Asian nations are emerging as secondary growth poles, fueled by urbanization, expanding power grids, and burgeoning consumer electronics industries. This region’s growth is characterized by high demand for wire rod and copper tubes.

- North America: This region is a mature market focusing on high-value applications and smart infrastructure modernization. Demand is steadily increasing, driven heavily by government-led initiatives supporting domestic EV battery supply chains, grid hardening against climate events, and substantial investments in renewable energy integration. The emphasis here is on securing sustainable and transparently sourced copper, prioritizing secondary refining capabilities and efficient consumption.

- Europe: European market growth is tightly linked to the European Green Deal, emphasizing decarbonization, energy efficiency, and material circularity. While production capabilities are limited compared to Asia, consumption is strong in high-tech manufacturing, offshore wind energy, and sophisticated automotive components. Regulations promoting recycling and penalizing carbon-intensive production methods are significant market determinants, boosting demand for low-carbon refined copper.

- Latin America (LATAM): LATAM remains the world's largest supplier of primary copper concentrate, particularly Chile and Peru, which heavily influence global pricing and supply stability. Although refined production occurs, most raw material is exported. The region's market dynamics are focused on maximizing resource extraction efficiency and mitigating operational risks from water scarcity and geopolitical instability.

- Middle East and Africa (MEA): Demand growth in the Middle East is primarily driven by large-scale construction projects and energy infrastructure development, including ambitious smart city initiatives (e.g., NEOM). Africa possesses substantial untapped copper reserves (e.g., the Copperbelt), offering future growth potential for both mining and, eventually, localized refining capacity to serve continental development needs, though infrastructure limitations currently constrain immediate refined output.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refined Copper Market.- Glencore

- Codelco

- Freeport-McMoRan

- BHP

- Rio Tinto

- Sumitomo Metal Mining

- Jiangxi Copper Company Limited

- KGHM Polska Miedź S.A.

- Vale S.A.

- Norilsk Nickel (Nornickel)

- Teck Resources Limited

- Southern Copper Corporation

- Antofagasta plc

- First Quantum Minerals

- Aurubis AG

- JX Nippon Mining & Metals Corporation

- Vedanta Resources Limited

- Zijin Mining Group Co., Ltd.

- Sterlite Copper

- Trafigura Group Pte. Ltd.

Frequently Asked Questions

Analyze common user questions about the Refined Copper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the demand for refined copper?

Demand is fundamentally driven by global electrification mandates, the exponential adoption of Electric Vehicles (EVs), massive renewable energy infrastructure projects (solar and wind power), and continued urbanization, requiring high volumes of copper wiring and components for power transmission and modern electronics.

How is the volatility of copper prices managed in long-term procurement contracts?

Volatility is typically managed through hedging strategies utilizing the London Metal Exchange (LME) or COMEX futures contracts, coupled with long-term procurement agreements that often include agreed-upon pricing formulas, such as fixed premiums over the prevailing spot market price (or benchmark price) to ensure cost predictability for both buyers and refiners.

What role does copper recycling (secondary refining) play in the overall market supply?

Copper recycling is playing an increasingly vital role, currently contributing a significant portion of the total supply. It provides a more sustainable and less energy-intensive source of refined copper, mitigating reliance on primary mining and addressing environmental concerns related to mineral extraction and processing waste.

Which geographical region holds the largest market share for refined copper consumption?

The Asia Pacific (APAC) region, dominated by the industrial and manufacturing output of China, holds the largest market share for refined copper consumption globally. This is due to massive infrastructure development, extensive power grid expansion, and high-volume electronics manufacturing.

What are the primary technological challenges facing copper refiners today?

Key technological challenges include managing the high energy intensity of electrolytic refining, processing lower-grade and increasingly complex sulfide ores economically, and meeting stringent environmental regulations regarding sulfur dioxide emissions from traditional smelting processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager