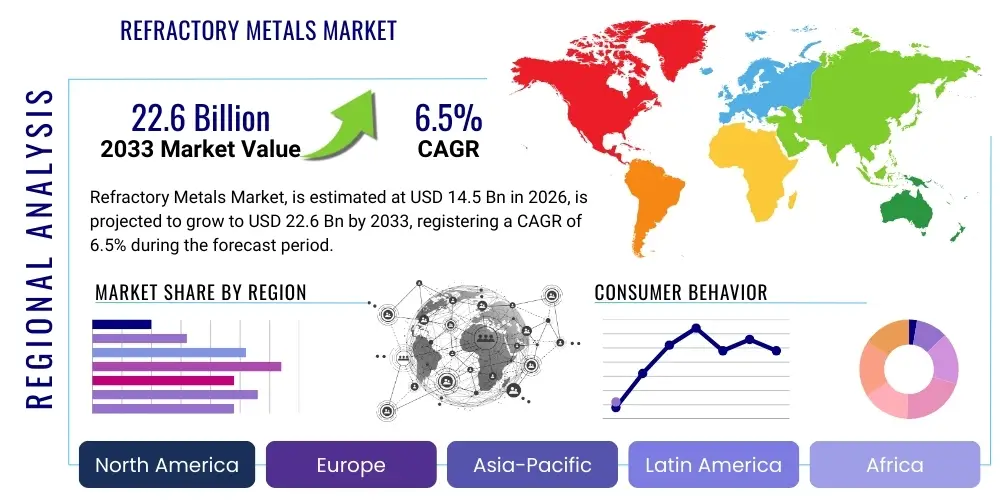

Refractory Metals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436152 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Refractory Metals Market Size

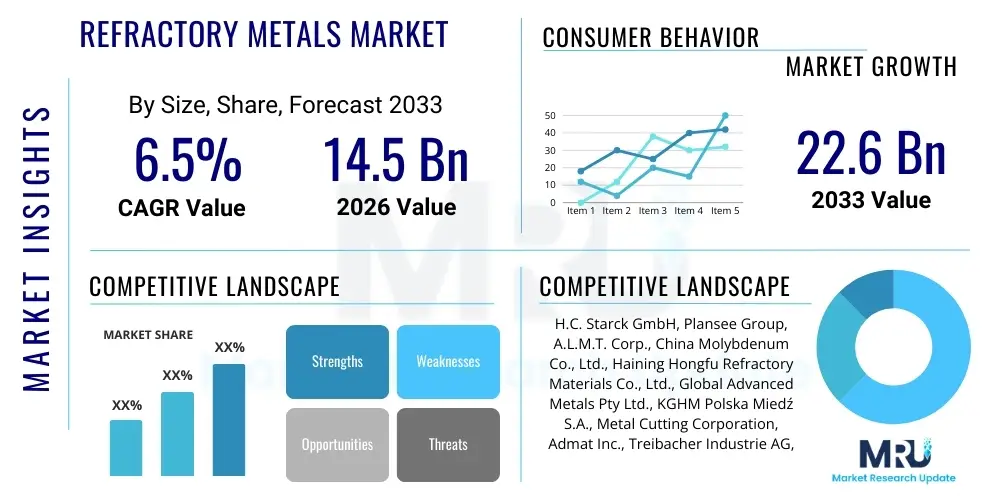

The Refractory Metals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $22.6 Billion by the end of the forecast period in 2033.

Refractory Metals Market introduction

Refractory metals are a class of metallic elements highly resistant to heat, wear, and corrosion. Characterized by incredibly high melting points—all exceeding 2000 °C—the most commercially significant metals in this group include Tungsten (W), Molybdenum (Mo), Niobium (Nb), Tantalum (Ta), and Rhenium (Re). These exceptional thermal and mechanical properties make them indispensable in demanding industrial environments where standard engineering materials would fail, particularly in high-temperature reactors, vacuum furnaces, and specialized electronic components.

The core application sectors driving the demand for refractory metals are electronics, aerospace, chemical processing, and energy generation. For instance, Tungsten is vital for high-speed cutting tools and lighting filaments, while Tantalum capacitors are foundational components in modern consumer electronics and telecommunications infrastructure due to their high capacitance density. Molybdenum is critical in the production of high-strength alloys and crucial catalysts used in the petrochemical industry. The benefits derived from utilizing these metals—such as extended equipment lifespan, improved process efficiency at extreme temperatures, and superior electrical performance—substantially outweigh their relatively higher production costs, solidifying their status as strategic materials.

Market expansion is primarily fueled by the accelerating global demand for advanced electronics, including 5G infrastructure and high-performance computing, which rely heavily on tantalum and niobium. Furthermore, the resurgence in nuclear energy projects and the continuous evolution of the aerospace and defense industries, requiring materials capable of handling extreme stress and heat loads, provide significant momentum. Geopolitical stability concerning raw material sourcing and the development of cost-effective recycling technologies remain crucial factors influencing long-term market growth and supply chain resilience for these critical materials.

- Product Description: Metals with melting points above 2000 °C, including Tungsten, Molybdenum, Niobium, and Tantalum, prized for heat resistance, hardness, and chemical inertness.

- Major Applications: High-temperature components (furnace parts, aerospace engine components), electronics (capacitors, sputtering targets), cutting tools, and chemical processing equipment.

- Key Benefits: Superior thermal stability, excellent mechanical strength at elevated temperatures, high corrosion resistance, and specific electrical properties essential for miniaturization.

- Driving Factors: Growth in 5G and IoT device manufacturing, increasing investment in defense and aerospace, and expanding utilization in specialized medical devices and renewable energy systems.

Refractory Metals Market Executive Summary

The Refractory Metals Market is experiencing robust growth, underpinned by fundamental shifts in global manufacturing toward high-performance materials necessary for advanced technological deployment. Key business trends indicate a strategic focus on vertical integration among major players, aiming to secure control over the complex mining, refining, and fabrication processes required for refractory metals. Innovation is concentrated on powder metallurgy and additive manufacturing techniques, enabling the production of highly intricate components with reduced waste and enhanced performance specifications. Furthermore, sustainability is becoming a key business driver, pushing for greater implementation of recycling programs, especially for expensive materials like Tantalum and Rhenium, to mitigate supply risks and environmental impact.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by its unparalleled capacity for electronics manufacturing and industrial expansion, particularly in China and South Korea. However, North America and Europe are demonstrating accelerated growth, primarily fueled by strategic defense spending, stringent aerospace quality standards, and significant governmental investment in semiconductor production capabilities. Geopolitical tensions concerning supply chains, particularly those linked to tungsten and rare earth elements, are prompting companies in Western nations to diversify their sourcing and invest in domestic processing facilities to ensure strategic autonomy and mitigate commodity price volatility.

In terms of segmentation, the Tungsten and Molybdenum segments collectively account for the largest market share due to their widespread use in steel alloying and industrial tooling. Nevertheless, the Niobium and Tantalum segments are exhibiting the fastest growth rates, directly correlating with the proliferation of sophisticated electronic devices and specialized high-reliability applications (e.g., medical implants, space technology). The market for primary material processing remains robust, but the downstream fabrication and finished components segment offers the highest value addition, prompting companies to shift focus towards providing complex, ready-to-use parts like high-performance sputtering targets and intricate furnace heat shields.

AI Impact Analysis on Refractory Metals Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Refractory Metals market predominantly center on how AI can optimize extraction and processing, predict material performance under extreme conditions, and streamline supply chain logistics. Users are concerned with leveraging machine learning (ML) algorithms to improve the efficiency of powder metallurgy, a key fabrication method for these materials, by minimizing defects and controlling microstructural characteristics. A significant theme revolves around AI's potential to accelerate material discovery and simulation, reducing the typically lengthy and costly R&D cycles required to qualify new refractory alloys for high-stress applications like hypersonic flight or next-generation fusion reactors. Expectations are high that AI will lead to predictive maintenance models for high-temperature equipment, thus reducing downtime and optimizing the life cycle of components made from these expensive materials.

The application of AI in mining and refining operations offers substantial opportunities for cost reduction. ML models can analyze geological data to pinpoint optimal extraction sites for Tantalum and Niobium, while predictive maintenance on heavy machinery in tungsten mines ensures maximum operational efficiency. Furthermore, AI algorithms are being deployed in smelting and purification processes to maintain tighter quality control, analyzing spectroscopic data in real-time to adjust furnace parameters, resulting in higher yield rates of ultra-high purity refractory metals required for semiconductor fabrication.

In the downstream sector, AI facilitates advanced material engineering. Computational modeling powered by AI is drastically accelerating the design and testing of new refractory metal matrices and composites. By simulating atomic interactions and thermal stress responses, researchers can quickly identify promising compositions, essential for developing materials that meet the rigorous demands of emerging technologies such as solid-state battery components or advanced nuclear cladding. This predictive capability significantly lowers the barrier for entry into high-specification markets and secures a competitive advantage for early adopters.

- AI optimizes extraction and mining operations by predicting mineral concentration and equipment failure rates.

- Machine Learning (ML) enhances quality control in powder metallurgy, minimizing defects in complex Tantalum and Tungsten components.

- Predictive modeling shortens R&D cycles for new refractory alloys suitable for aerospace and nuclear applications.

- AI-driven supply chain transparency improves traceability and mitigates risks associated with geopolitical material sourcing.

- Automated spectroscopic analysis systems maintain ultra-high purity levels required for semiconductor-grade Molybdenum and Niobium targets.

DRO & Impact Forces Of Refractory Metals Market

The Refractory Metals market is driven primarily by escalating demand from high-tech sectors, particularly aerospace, defense, and advanced electronics, where these materials are irreplaceable due to their performance characteristics. Restraints include the highly complex and energy-intensive extraction and processing methods, which lead to high production costs and environmental scrutiny. Opportunities arise from technological advancements, such as additive manufacturing (3D printing) of refractory metals, which opens up new design possibilities and reduces material waste. The impact forces acting on the market are multifaceted, combining robust industrial demand with significant supply chain vulnerabilities concentrated in a few key geographic regions, creating inherent price volatility and strategic supply security concerns for end-users globally.

A key driver is the continuous miniaturization and performance enhancement in the semiconductor industry, requiring high-purity Tantalum capacitors and Tungsten interconnects for complex chips. Furthermore, government initiatives in major economies focusing on bolstering technological independence and strategic material reserves substantially boost market stability and investment. Conversely, the market faces strong constraints from regulatory barriers concerning mining practices and the often-volatile nature of raw material pricing, which can significantly impact profitability for downstream manufacturers. The high capital expenditure required for establishing processing facilities acts as a substantial barrier to entry, maintaining an oligopolistic market structure.

Opportunities are emerging through the development of advanced recycling infrastructures, particularly for highly valuable scraps and spent industrial components containing Rhenium and Tantalum. This not only addresses supply security but also improves the environmental footprint of the industry. The impact forces are also shaped by competing material substitutions, though few materials can genuinely replicate the combined thermal and mechanical performance of refractory metals under extreme conditions. Geopolitical trade policies, tariffs, and export controls further exert a powerful, fluctuating force on global pricing and sourcing strategies, necessitating constant risk assessment by major market participants.

Segmentation Analysis

The Refractory Metals market segmentation provides a granular view of the diverse material types, end-use industries, and forms utilized globally. The market is fundamentally segmented by Metal Type (Tungsten, Molybdenum, Tantalum, Niobium, Rhenium, etc.), which dictates specific application profiles based on unique physical properties. Further segmentation occurs by Form, including Metal Powder, Mill Products (sheets, rods, wires), and Fabricated Components, reflecting different stages of the value chain. Finally, the End-Use Industry segmentation highlights critical demand areas such as Electronics, Aerospace & Defense, Industrial, Medical, and Energy, demonstrating the strategic importance of these materials across the industrial landscape.

The Metal Powder segment is crucial as it serves as the foundational feedstock for both traditional powder metallurgy and the rapidly expanding additive manufacturing processes. Mill products, especially those related to Molybdenum and Tungsten, dominate volume due to their heavy usage in steel alloying and high-temperature furnace construction. The segmentation by end-use confirms that the Electronics sector is the most significant revenue generator, predominantly utilizing Tantalum and Niobium for advanced passive components, while the Industrial sector leverages Tungsten and Molybdenum for tooling and high-wear parts.

- By Metal Type:

- Tungsten (W)

- Molybdenum (Mo)

- Niobium (Nb)

- Tantalum (Ta)

- Rhenium (Re)

- Others (e.g., Hafnium, Vanadium)

- By Form:

- Metal Powder

- Mill Products (Sheets, Plates, Foils, Rods, Wires)

- Fabricated Components

- By End-Use Industry:

- Electronics and Semiconductors

- Aerospace and Defense

- Industrial Furnaces and Heat Shields

- Chemical Processing and Catalysts

- Energy (Nuclear, Solar, High-Temperature Batteries)

- Medical Devices

Value Chain Analysis For Refractory Metals Market

The value chain for refractory metals is characterized by high complexity and capital intensity, beginning with the upstream segment involving mining and primary extraction of ores (e.g., tantalite, columbite, scheelite). This phase is highly centralized geographically, leading to inherent supply chain risks. The midstream processing involves highly technical chemical separation, refinement, and conversion into high-purity metal powders. This refinement stage is critical for meeting the stringent purity requirements of the electronics and aerospace industries, often requiring specialized techniques like vacuum arc melting or electron beam melting.

The downstream segment encompasses the production of mill products and specialized fabricated components. Manufacturers use techniques such as powder metallurgy, rolling, drawing, and forging to convert metal powders into forms like sheets, rods, or sputtering targets. This fabrication stage adds significant value and often requires highly specialized machinery and technical expertise. Distribution channels are typically segmented into direct sales for large, custom orders (e.g., aerospace manufacturers purchasing turbine components) and indirect channels through global distributors specializing in chemical and metallic raw materials for smaller-volume users like electronics component manufacturers or research laboratories.

Direct distribution ensures tighter quality control and specifications alignment for strategic military or aerospace applications. Indirect distribution through specialized metal trading houses and regional stocking distributors facilitates market access for small and medium enterprises (SMEs) and ensures timely delivery of standard mill products. The integration of digital tracking systems throughout the distribution channel is improving transparency and accountability, crucial for demonstrating ethical sourcing, particularly for conflict minerals like Tantalum, thereby enhancing the overall resilience of the supply network.

Refractory Metals Market Potential Customers

Potential customers for refractory metals span highly technical and performance-driven industries that necessitate materials capable of enduring extreme operational conditions. The primary buyers include multinational electronics giants requiring ultra-high purity Tantalum and Niobium for high-density capacitors and critical semiconductor deposition targets. Aerospace and defense prime contractors are major purchasers of Tungsten and Molybdenum alloys for rocket nozzles, engine components, and heat shielding systems, where thermal stability is paramount.

In the industrial sector, large engineering and fabrication firms serving the high-temperature furnace and chemical processing industries rely heavily on Molybdenum and its alloys for internal furnace components, crucibles, and reaction vessels. Energy producers, particularly those involved in nuclear fusion research or advanced fission reactor design, constitute a growing customer base, requiring Niobium and specific Tungsten alloys for cladding and structural integrity under neutron bombardment and extreme heat flux.

The medical device industry represents a niche but highly demanding customer segment, utilizing Tantalum for biocompatible implants and surgical instruments due to its inertness and compatibility with human tissue. Additionally, specialist material suppliers that produce hard metal tools and wear-resistant coatings constitute a perpetual customer base, primarily consuming Tungsten carbide powder for applications ranging from mining drill bits to precision cutting tools used in machining centers across the globe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $22.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | H.C. Starck GmbH, Plansee Group, A.L.M.T. Corp., China Molybdenum Co., Ltd., Haining Hongfu Refractory Materials Co., Ltd., Global Advanced Metals Pty Ltd., KGHM Polska Miedź S.A., Metal Cutting Corporation, Admat Inc., Treibacher Industrie AG, Molymet (Sociedad Química y Minera de Chile S.A.), Alkane Resources Ltd., IperionX Limited, Kennametal Inc., ELG Metals, Inc., Advanced Metallurgical Group N.V. (AMG), Materion Corporation, Vascotube GmbH, Mitsui Mining & Smelting Co., Ltd., Teledyne Technologies Incorporated. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refractory Metals Market Key Technology Landscape

The technological landscape for refractory metals is dominated by advancements in powder metallurgy and high-precision fabrication techniques essential for optimizing material performance. Powder metallurgy, encompassing pressing, sintering, and often specialized Hot Isostatic Pressing (HIP), remains the primary method for producing dense, complex shapes from tungsten and molybdenum powders. Recent innovations focus on ultra-fine powder preparation and specialized sintering atmospheres to achieve materials with exceptionally controlled grain structures, necessary for high-wear resistance and thermal shock stability in industrial tooling and furnace applications.

Additive Manufacturing (AM), particularly Electron Beam Melting (EBM) and Laser Powder Bed Fusion (L-PBF), represents the most disruptive technological shift. While challenging due to the high melting points and inherent brittleness of many refractory metals, progress in AM allows for the creation of previously impossible geometries, such as optimized heat exchangers and custom aerospace components, with significantly reduced material waste. This capability is particularly relevant for expensive metals like Rhenium and Tantalum, offering economic efficiency and enhanced design freedom critical for next-generation applications.

Furthermore, the focus on surface engineering and protective coatings is increasing. Due to the susceptibility of some refractory metals (like Molybdenum and Tungsten) to catastrophic oxidation at moderate temperatures, sophisticated silicide and aluminide coatings are being developed. Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD) processes are being refined to apply these protective layers, extending the operational life of components exposed to harsh oxidative environments, thereby expanding the potential application envelope of refractory materials in high-temperature industrial environments and combustion systems.

Regional Highlights

The global refractory metals market exhibits strong regional disparities driven by industrial capacity, technological specialization, and raw material access. Asia Pacific (APAC) stands as the undisputed market leader, primarily owing to massive semiconductor and consumer electronics manufacturing hubs located in China, South Korea, Taiwan, and Japan. China not only dominates the supply side, holding significant global reserves and processing capacity for Tungsten and Molybdenum, but also drives demand through its rapidly expanding aerospace and electric vehicle (EV) battery industries. The region’s focus on 5G deployment and data center infrastructure ensures sustained high demand for Tantalum capacitors and Niobium alloys.

North America maintains a robust position, characterized by high-value applications in the aerospace, defense, and specialized medical fields. The United States, in particular, emphasizes domestic production and strategic sourcing of refractory metals crucial for national security applications, leading to significant investment in advanced material processing technologies and recycling infrastructure. Demand is concentrated among high-tier fabrication firms serving NASA, the Department of Defense (DoD), and leading semiconductor manufacturers, prioritizing quality, reliability, and guaranteed domestic supply chains over marginal cost reductions.

Europe demonstrates significant consumption, particularly in Germany, France, and the UK, driven by its advanced automotive sector (using Molybdenum for high-strength steel) and sophisticated industrial manufacturing base. Europe excels in powder metallurgy and hard metal tooling production, utilizing large volumes of Tungsten carbide. Furthermore, the region’s commitment to nuclear energy and scientific research (suchably Cern) maintains steady demand for specialized Niobium and Tantalum alloys for high-vacuum and superconducting components. Strict environmental regulations, however, necessitate complex processing adherence and drive innovation towards circular economy principles for metal utilization.

The Middle East and Africa (MEA) region presents untapped potential, primarily driven by expanding oil and gas refining operations, requiring Molybdenum-containing catalysts and high-temperature processing equipment. Investment in large-scale infrastructure projects and emerging renewable energy sectors also contributes to demand. Latin America, particularly Brazil, is a significant source of Niobium, controlling a majority of the world's supply, making the region crucial for the upstream segment of the global value chain, though downstream consumption remains comparatively smaller than in industrialized regions.

- Asia Pacific (APAC): Market leader due to concentration of electronics manufacturing (semiconductors, capacitors) and heavy industrial output; major hub for Tungsten and Molybdenum processing.

- North America: High-value market focused on defense, aerospace, and advanced medical devices; emphasis on strategic material autonomy and domestic high-specification fabrication.

- Europe: Strong demand from the automotive, industrial tooling (Tungsten carbide), and nuclear research sectors; technological focus on powder metallurgy and recycling infrastructure.

- Latin America (LATAM): Strategically important for upstream Niobium mining and supply; growing industrial demand for steel alloying materials.

- Middle East & Africa (MEA): Emerging consumer driven by oil & gas infrastructure development and investment in high-temperature chemical processing units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refractory Metals Market.- H.C. Starck GmbH

- Plansee Group

- Global Advanced Metals Pty Ltd.

- China Molybdenum Co., Ltd. (CMOC)

- A.L.M.T. Corp.

- Treibacher Industrie AG

- Molymet (Sociedad Química y Minera de Chile S.A.)

- Vascotube GmbH

- Kennametal Inc.

- Advanced Metallurgical Group N.V. (AMG)

- IperionX Limited

- Metal Cutting Corporation

- Admat Inc.

- KGHM Polska Miedź S.A.

- Mitsui Mining & Smelting Co., Ltd.

- Teledyne Technologies Incorporated

- Haining Hongfu Refractory Materials Co., Ltd.

- ELG Metals, Inc.

- Materion Corporation

- Alkane Resources Ltd.

Frequently Asked Questions

Analyze common user questions about the Refractory Metals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Refractory Metals Market?

Growth is significantly driven by the accelerating demand for high-performance materials in advanced electronics (5G, IoT, high-density capacitors using Tantalum), increasing defense and aerospace investment requiring high-temperature alloys (Tungsten, Molybdenum), and global expansion of specialized industrial furnace technology.

Which refractory metal segment holds the largest market share by volume?

The Tungsten segment, primarily due to its widespread use in cemented carbides for cutting tools, high-density armaments, and steel alloying, traditionally holds the largest volume share, followed closely by Molybdenum used extensively in high-strength alloys and chemical catalysts.

How is the volatility of the supply chain affecting refractory metal pricing?

Supply chain volatility, largely stemming from the concentrated geographical distribution of key mineral reserves (e.g., China for Tungsten, Brazil for Niobium) and geopolitical trade tensions, leads directly to price instability. This forces end-users to secure long-term contracts and invest in diversification and recycling strategies to mitigate risk.

What role does additive manufacturing (3D printing) play in the Refractory Metals sector?

Additive Manufacturing (AM) is a growing opportunity that enables the production of complex, customized parts from refractory metal powders (especially Tantalum and Molybdenum) with reduced material waste. AM is critical for prototyping and producing intricate, high-value components for aerospace and medical applications that cannot be easily achieved via conventional methods.

What is the most rapidly growing application sector for Tantalum and Niobium?

The Electronics and Semiconductor sector represents the fastest-growing application for Tantalum, primarily for high-capacitance solid electrolytic capacitors essential for modern portable and 5G electronic devices. Niobium is seeing rapid growth in superconducting alloys and specialized steel production for infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager