Refrigerant Leak Detectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432367 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Refrigerant Leak Detectors Market Size

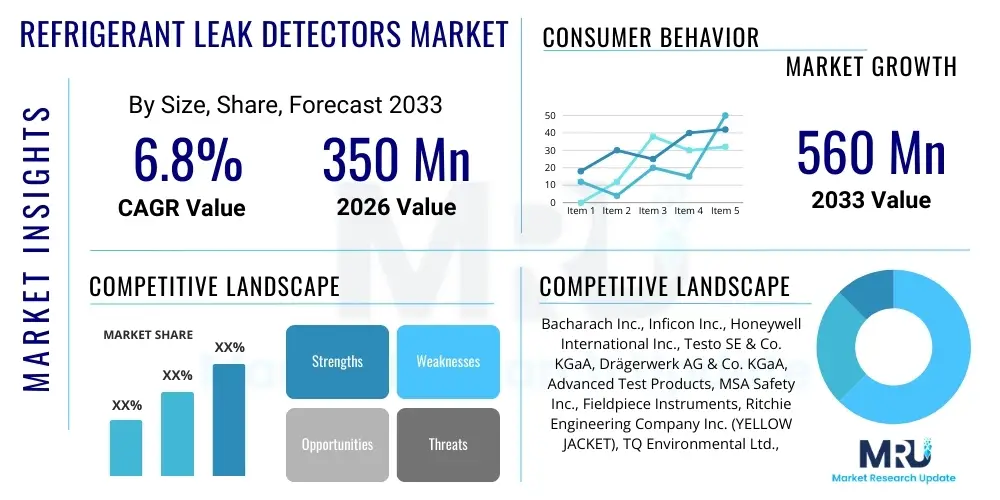

The Refrigerant Leak Detectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 560 Million by the end of the forecast period in 2033.

Refrigerant Leak Detectors Market introduction

Refrigerant leak detectors are specialized instruments designed to identify the presence and concentration of refrigerant gases escaping from HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) systems. The proliferation of these devices is fundamentally driven by stringent global environmental regulations, such as the F-Gas regulation in Europe and similar mandates worldwide, aimed at phasing down high Global Warming Potential (GWP) refrigerants like HFCs. As refrigerants are potent greenhouse gases, minimizing leakage is paramount for environmental stewardship and regulatory compliance. Furthermore, ensuring system integrity prevents catastrophic failure, maintains optimal energy efficiency, and protects user health, especially concerning mildly flammable (A2L) or toxic refrigerants.

The core function of these devices spans continuous monitoring in large industrial cold storage facilities, precise diagnostic repair work by field technicians, and routine safety checks in commercial buildings. Key applications include automotive air conditioning repair, large-scale supermarket refrigeration racks, data center cooling systems, and residential HVAC unit maintenance. The market features a diverse product portfolio, ranging from highly sensitive infrared and heated diode sensor technologies for pinpoint accuracy to robust, fixed-mounted systems integrated with building management systems (BMS) for continuous area monitoring and automatic shutdown protocols. This technological evolution enhances operational efficiency and safety across all end-user segments.

The primary benefits derived from the adoption of high-quality refrigerant leak detectors include significant cost savings through reduced refrigerant recharge requirements, avoidance of regulatory fines associated with mandatory leak checks, and improved energy efficiency as leaky systems operate sub-optimally. Driving factors encompass the rising global demand for cooling solutions, particularly in developing economies, coupled with the mandatory shift towards complex, newer-generation refrigerants (HFOs, natural refrigerants like CO2 and ammonia) which often necessitate highly selective and sensitive detection equipment due to their varying properties and safety profiles. The necessity of maintaining uptime in critical infrastructure, such as pharmaceutical cold chains and food processing plants, further accelerates the demand for reliable and continuous leak detection solutions.

Refrigerant Leak Detectors Market Executive Summary

The global Refrigerant Leak Detectors Market is characterized by robust growth, primarily spurred by the accelerating enforcement of environmental protocols globally, which necessitates meticulous management and reporting of refrigerant emissions. Business trends indicate a pronounced shift towards advanced sensor technologies, specifically Non-Dispersive Infrared (NDIR) sensors, due to their superior accuracy, longevity, and reduced susceptibility to cross-contamination compared to traditional heated diode and corona discharge sensors. Key industry players are focusing heavily on developing devices with enhanced connectivity features, integrating Bluetooth, Wi-Fi, and sophisticated data logging capabilities to facilitate seamless compliance reporting and predictive maintenance strategies across enterprise systems, appealing strongly to commercial and industrial end-users seeking centralized monitoring solutions.

Regionally, North America and Europe currently dominate the market share, driven by mature regulatory frameworks (e.g., U.S. EPA regulations and the EU F-Gas Regulation) demanding regular leak inspection schedules and mandatory record-keeping. However, the Asia Pacific region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid expansion is attributed to fast urbanization, massive infrastructure development, increasing installation base of HVACR systems in countries like China and India, and the gradual adoption of international environmental standards leading to a higher demand for compliant monitoring equipment. Latin America and MEA are also showing steady growth, motivated by investments in cold chain logistics and increasing regulatory alignment with global standards regarding refrigerant management practices.

In terms of segmentation, the market for stationary or fixed leak detectors is experiencing substantial momentum, especially in large facilities where continuous, unattended monitoring is required for safety and regulatory reasons. Sensor technology trends highlight the increasing preference for infrared technology in high-end, professional devices due to its reliability and specificity. The application segment remains dominated by the commercial refrigeration sector, including supermarkets and cold storage warehouses, which utilize vast amounts of refrigerant and are subject to the strictest leak rate regulations. Furthermore, the rising awareness about the dangers of flammable refrigerants (e.g., R-290, R-600a) is driving demand for detectors specifically certified for hazardous environments, thereby boosting the safety-focused segment.

AI Impact Analysis on Refrigerant Leak Detectors Market

Common user inquiries regarding AI’s influence center on whether artificial intelligence can transform reactive leak detection into predictive failure prevention, how data generated by smart detectors integrates into Building Management Systems (BMS), and the feasibility of using machine learning (ML) to differentiate between background environmental contamination and genuine refrigerant leakage signals. Users are keenly interested in optimizing maintenance schedules, reducing false positives, and ensuring rapid identification of minor leaks before they escalate into major regulatory and environmental liabilities. The consensus expectations involve AI enabling smarter, self-calibrating detectors that can learn operational patterns, thus offering highly accurate diagnostics and minimizing unnecessary technician dispatches, fundamentally improving the efficiency of compliance and service operations.

- AI-driven predictive maintenance modeling analyzes historical leak data, equipment performance metrics, and ambient conditions to forecast potential failure points in HVACR systems before a substantial leak occurs.

- Integration of ML algorithms minimizes false alarms by analyzing sensor readings, factoring in environmental noise (e.g., humidity, temperature fluctuations), and improving the signal-to-noise ratio specific to refrigerant signatures.

- Automated compliance reporting systems utilize AI to process continuous monitoring data, instantly flag regulatory thresholds breaches, and generate mandated reports, drastically simplifying environmental accountability.

- AI enhances sensor fusion capabilities, allowing detectors to utilize input from multiple sensor types (NDIR, catalytic bead, electrochemical) simultaneously, leading to higher confidence in detection and classification of gas type.

- Optimization of service routes and technician deployment is facilitated by AI platforms that prioritize leak alerts based on severity, location, and potential environmental impact, improving overall service efficiency.

- Development of self-calibrating detectors using continuous AI feedback loops ensures prolonged accuracy and reduces the requirement for frequent, costly manual calibration processes in fixed installations.

DRO & Impact Forces Of Refrigerant Leak Detectors Market

The Refrigerant Leak Detectors Market is primarily driven by rigorous international and regional environmental legislation mandating the phase-down of high-GWP refrigerants and requiring mandatory leak checks, significantly increasing the compliance burden on equipment owners. This legislative pressure is augmented by the growing adoption of flammable and mildly flammable refrigerants (A2L category), such as R-32 and various HFOs, which necessitate specialized, safety-certified detection equipment to mitigate explosion risks, thereby driving technological demand. Restraints include the high initial capital expenditure associated with advanced infrared and laser-based detection systems compared to traditional, lower-cost methods, potentially hindering adoption in price-sensitive emerging markets. Furthermore, a persistent challenge is the lack of standardized training for technicians regarding the proper use and calibration of highly sophisticated detection equipment, often leading to performance inefficiencies.

Opportunities for market expansion are abundant, particularly in the integration of leak detection systems with comprehensive Internet of Things (IoT) platforms and cloud-based data analytics services, allowing for remote monitoring and centralized fleet management for large enterprises. The burgeoning cold chain logistics sector, essential for pharmaceuticals and perishable food transport, presents a vast untapped market for robust, portable, and fixed detectors compliant with stringent quality and safety standards. Moreover, developing hyper-selective sensors capable of differentiating between similar-GWP refrigerants quickly and accurately offers a competitive advantage, especially as the refrigerant mix diversifies under various phase-down schedules globally.

Impact forces within the market are predominantly centered on technological innovation and regulatory impact. Regulatory forces exert the strongest influence, making compliance a non-negotiable factor for procurement. Technological advancement, particularly miniaturization and enhanced sensor specificity, acts as a secondary but powerful force, determining market leadership and pricing dynamics. Substitution threats are relatively low as certified detection is legally required, although competition exists between different sensor technologies (e.g., infrared vs. heated diode). Buyer power remains moderate, driven by large commercial customers seeking integrated solutions and long-term service contracts, thus influencing manufacturers to offer comprehensive packages rather than standalone devices.

Segmentation Analysis

The Refrigerant Leak Detectors Market is extensively segmented based on portability, sensor technology, application, and end-use industry, reflecting the diverse requirements across residential, commercial, and industrial settings. Segmentation provides clarity on specialized product demands, such as the preference for highly accurate, fixed NDIR detectors in industrial environments contrasted with the need for cost-effective, durable portable units for residential field service technicians. The increasing complexity of refrigerant blends and the mandatory shift towards natural and low-GWP refrigerants necessitate the development of specialized detection capabilities tailored to each segment's unique regulatory and safety mandates, driving segmentation granularity and focused product development strategies.

- By Product Type:

- Portable Leak Detectors

- Fixed/Stationary Leak Detectors

- By Sensor Technology:

- Infrared (NDIR) Detectors

- Heated Diode Detectors

- Corona Discharge Detectors

- Semiconductor/Electrochemical Detectors

- Halogen Detectors

- By Refrigerant Type:

- Halogenated Refrigerants (HFC, HCFC, CFC, HFO)

- Natural Refrigerants (Ammonia, CO2, Hydrocarbons)

- By Application:

- Commercial Refrigeration

- Industrial Refrigeration

- Automotive AC

- Residential & Light Commercial HVAC

- Chillers and Process Cooling

- By End-Use Industry:

- Supermarkets and Retail

- Food & Beverage Processing

- Pharmaceuticals and Healthcare

- Data Centers and IT

- Transportation and Logistics (Cold Chain)

- Oil & Gas

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Refrigerant Leak Detectors Market

The value chain for the Refrigerant Leak Detectors Market starts with upstream activities, primarily involving the sourcing of specialized components, crucially high-purity sensor materials (e.g., optics for NDIR, semiconductors, noble metals for catalytic sensors), microprocessors, and sophisticated calibration gases. Component manufacturers, particularly those specializing in optical assemblies and advanced semiconductor technology, hold significant bargaining power as the precision and reliability of the final product hinge on these specialized inputs. The core manufacturing stage involves complex integration, firmware development, and rigorous quality assurance and calibration procedures, which require high levels of technical expertise and often patented manufacturing processes to ensure compliance with international standards like SAE J2791 and J2913.

Midstream activities encompass the critical stages of distribution and logistics. Direct distribution channels are often favored for large industrial and fixed monitoring systems, particularly when installation and post-sale calibration services are required, fostering a direct relationship between the manufacturer and the end-user (e.g., large commercial building operators or industrial process facilities). Conversely, portable and handheld detectors are typically routed through indirect channels, relying heavily on a network of authorized distributors, HVACR wholesale supply houses, and specialized online retailers. These indirect channels are essential for reaching the fragmented market of individual HVAC service technicians and smaller contractors, requiring efficient inventory management and geographically dispersed support centers.

Downstream activities focus on installation, calibration, maintenance, and end-user support. The market is heavily reliant on certified HVACR technicians who act as critical gatekeepers, influencing product adoption based on ease of use, durability, and perceived accuracy. Ongoing service contracts, especially for fixed leak detection systems, represent a significant revenue stream and necessitate continuous manufacturer support, including remote diagnostics and mandatory annual calibration to maintain regulatory compliance. The effective management of this downstream service layer is crucial for maintaining brand reputation and ensuring long-term customer satisfaction and repeat business, especially given the regulatory requirement for device functionality.

Refrigerant Leak Detectors Market Potential Customers

Potential customers for refrigerant leak detection equipment span a vast spectrum of industries that utilize cooling or heating processes, making them indispensable components of mandatory safety and compliance infrastructure. End-users are segmented by the scale and criticality of their refrigeration needs, ranging from small, independent HVAC service companies purchasing portable handheld units to multinational pharmaceutical giants investing in sophisticated, integrated fixed systems for temperature-sensitive storage. The purchasing decisions are primarily driven by the mandate for operational safety, cost avoidance associated with refrigerant loss, and strict adherence to environmental protection agency mandates concerning GWP emissions and mandated leak repair timelines.

A significant customer group resides within the commercial refrigeration sector, notably supermarkets, grocery chains, and large retail outlets. These entities manage extensive refrigeration racks that house hundreds or even thousands of pounds of refrigerant, making them high-priority targets for regulators and requiring continuous monitoring solutions to detect leaks early and minimize massive financial and environmental penalties. These customers typically favor fixed monitoring systems with centralized alarm interfaces and data logging capabilities integrated into existing building management and energy optimization systems, preferring reliable vendors who offer comprehensive installation and service packages that ensure long-term compliance.

Other crucial segments include the industrial sector, particularly chemical manufacturing, food and beverage processing, and cold storage logistics providers. The pharmaceutical cold chain, critical for vaccine and medicine integrity, demands the highest standard of continuous monitoring, favoring NDIR or advanced laser-based detectors known for their exceptional sensitivity and specificity across a range of regulated refrigerants. Procurement in these high-stakes environments often involves stringent vendor qualification processes, focusing not just on the detector unit cost but also on calibration certification, service availability, and proven reliability in highly specialized, sometimes hazardous, operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 560 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bacharach Inc., Inficon Inc., Honeywell International Inc., Testo SE & Co. KGaA, Drägerwerk AG & Co. KGaA, Advanced Test Products, MSA Safety Inc., Fieldpiece Instruments, Ritchie Engineering Company Inc. (YELLOW JACKET), TQ Environmental Ltd., Senseair AB, Emerson Electric Co., Danfoss A/S, Yokogawa Electric Corporation, Sensata Technologies, Spectroline, AGU-Detection. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigerant Leak Detectors Market Key Technology Landscape

The technological landscape of the Refrigerant Leak Detectors Market is rapidly evolving, moving away from older, less reliable technologies like heated diodes and embracing highly selective, durable sensing methods. Non-Dispersive Infrared (NDIR) technology currently dominates the high-end professional and fixed system segments. NDIR sensors operate by detecting the specific infrared wavelength absorbed by refrigerant molecules, offering unparalleled accuracy, long sensor life (often exceeding 10 years), and crucially, immunity to contamination from common environmental gases like cleaning solvents, cigarette smoke, or high humidity, which traditionally caused false alarms in older technologies. The ability of NDIR to detect ultra-low concentrations (down to 1 ppm or less) is essential for meeting increasingly strict leak reporting thresholds mandated by environmental agencies globally, cementing its position as the technology standard for professional use.

Alongside NDIR, other advanced technologies are gaining traction. Laser Diode Spectroscopy (LDS), particularly used in highly selective fixed monitoring systems, offers even faster response times and better discrimination between gas types, although often at a higher cost. Furthermore, manufacturers are heavily investing in integrating IoT capabilities into both portable and fixed units. This includes embedded data logging, Bluetooth connectivity for instant reporting to mobile applications, and cloud-based analytics dashboards. These smart detectors enable technicians and facility managers to document leak tests automatically, generate required compliance reports, track historical leak rates, and schedule preventive maintenance, drastically streamlining regulatory accountability and improving operational transparency.

A crucial technological advancement is the focus on detector specificity for natural refrigerants, such as propane (R-290), ammonia (R-717), and carbon dioxide (R-744). Ammonia detection requires specific electrochemical or catalytic bead sensors tailored to its toxic properties, while CO2 systems demand specialized infrared sensors that can handle high concentrations typical of transcritical systems. The market is also seeing miniaturization efforts, making highly sensitive sensors available in compact, robust portable units that can withstand the harsh environments of field service work. The convergence of superior sensing technology with robust digital connectivity is fundamentally redefining best practices in leak detection and refrigerant management across all major end-user industries.

Regional Highlights

- North America: This region holds a significant market share, primarily driven by stringent enforcement of the U.S. EPA Section 608 regulations, which mandate leak repair and record-keeping for systems containing 50 or more pounds of regulated refrigerant. The market here is mature, characterized by high adoption rates of advanced NDIR and heated diode portable detectors among HVACR technicians. Demand is strong in the commercial sector, especially due to the vast cold chain logistics network and the push toward reducing HFC consumption. Canada also contributes significantly, aligning closely with U.S. and global phase-down efforts.

- Europe: Europe is a market leader in regulatory strictness due to the comprehensive EU F-Gas Regulation (517/2014). This regulation imposes severe obligations on operators for continuous leak checking and mandating fixed leak detection systems for installations above specific CO2-equivalent thresholds. The strong regulatory environment necessitates the widespread use of highly reliable, certified fixed systems, particularly in supermarkets, food processing plants, and industrial chilling facilities. Germany, the UK, and France are key contributors, favoring continuous monitoring and automated reporting capabilities to ensure compliance and avoid hefty financial penalties.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure investment, and burgeoning cold chain development, particularly in China and India. While regulatory adoption is geographically uneven, increasing environmental awareness and the phased implementation of the Kigali Amendment are pushing large corporations toward adopting global standards. The region currently features a high demand for cost-effective, durable portable units, but fixed system installation is quickly escalating, especially in new large commercial buildings and manufacturing hubs seeking energy efficiency certifications.

- Latin America (LATAM): This region exhibits moderate but consistent growth, mainly driven by foreign investment in the industrial and food processing sectors, leading to upgrades in refrigeration equipment and subsequent demand for compliance tools. Brazil and Mexico are leading markets, influenced by local regulatory bodies adopting elements of international refrigerant phase-down agreements. The primary focus remains on reducing operating costs through minimized refrigerant loss, often favoring essential portable detection technology for maintenance purposes.

- Middle East and Africa (MEA): Growth in MEA is spurred by substantial investment in mega-projects (e.g., in UAE and Saudi Arabia), demanding advanced cooling infrastructure in high-ambient temperature environments. The increasing necessity for sophisticated cooling in data centers and pharmaceuticals drives the adoption of high-quality, fixed leak detection systems. Regulatory alignment, particularly in the UAE and surrounding Gulf Cooperation Council (GCC) states, with global environmental standards is gradually accelerating market penetration, prioritizing robust equipment designed to withstand extreme climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerant Leak Detectors Market.- Bacharach Inc.

- Inficon Inc.

- Honeywell International Inc.

- Testo SE & Co. KGaA

- Drägerwerk AG & Co. KGaA

- Advanced Test Products

- MSA Safety Inc.

- Fieldpiece Instruments

- Ritchie Engineering Company Inc. (YELLOW JACKET)

- TQ Environmental Ltd.

- Senseair AB

- Emerson Electric Co.

- Danfoss A/S

- Yokogawa Electric Corporation

- Sensata Technologies

- Spectroline

- AGU-Detection

- Teledyne Technologies Incorporated

- Amprobe (Fluke Corporation)

- Robinair (Bosch)

Frequently Asked Questions

Analyze common user questions about the Refrigerant Leak Detectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most accurate sensor technology for detecting HFO refrigerants?

The Non-Dispersive Infrared (NDIR) sensor technology is widely considered the most accurate and reliable method for detecting HFO (Hydrofluoroolefin) refrigerants, such as R-1234yf and R-1234ze, because it offers high specificity and is not prone to saturation or cross-contamination from non-refrigerant gases, ensuring precise leak identification vital for compliance.

How do global regulations, such as the F-Gas rule, influence the demand for fixed leak detectors?

Regulations like the EU F-Gas rule mandate the use of fixed, continuous leak detection systems for refrigeration equipment containing large charges (above certain CO2 equivalent thresholds). This regulatory requirement directly drives high demand for stationary detectors that automatically monitor, alert, and log data for mandatory compliance reporting and rapid environmental mitigation.

What are the primary differences between portable and fixed refrigerant leak detectors?

Portable detectors are handheld tools used by technicians for pinpointing the exact source of a known or suspected leak during maintenance. Fixed detectors are permanently installed area monitors, typically NDIR-based, used for continuous, automated surveillance of equipment rooms and large commercial spaces to ensure safety and provide immediate alerts upon initial leak occurrence.

Why is calibration essential for maintaining the performance of refrigerant leak detectors?

Calibration is essential because it maintains the sensitivity and accuracy of the detection sensors over time. Environmental contaminants, sensor drift, and age degrade performance; regular calibration against certified reference gases ensures the detector meets the mandated sensitivity standards required for accurate leak detection and regulatory compliance.

Which end-use industry is the largest consumer of refrigerant leak detection systems?

The Commercial Refrigeration sector, specifically supermarkets, large retail food stores, and cold storage warehouses, represents the largest consumer segment. This is due to the massive volumes of refrigerant used in their extensive rack systems and the stringent regulatory pressure they face regarding mandatory periodic leak checks and minimizing environmental emissions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager