Refrigerated Compressed Air Dryers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434901 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Refrigerated Compressed Air Dryers Market Size

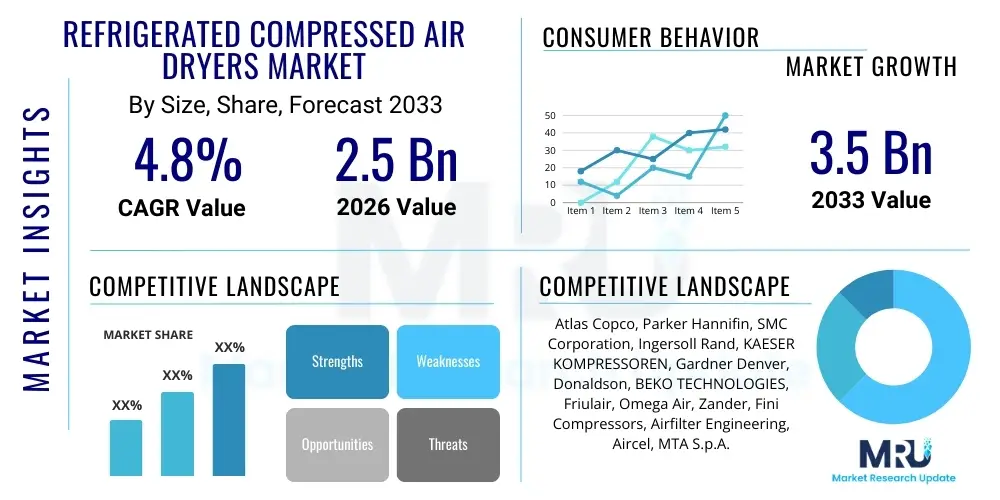

The Refrigerated Compressed Air Dryers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033.

Refrigerated Compressed Air Dryers Market introduction

The Refrigerated Compressed Air Dryers Market is fundamentally driven by the industrial requirement for moisture-free compressed air, essential for maintaining the operational integrity and longevity of pneumatic tools, machinery, and production processes. Compressed air, while indispensable across manufacturing, inherently contains significant moisture content. If this moisture is not adequately removed, it leads to corrosion in distribution systems, contamination of end products, operational failure of sensitive instruments, and increased maintenance costs. Refrigerated air dryers address this critical need by cooling the compressed air stream to a near-freezing point, causing water vapor to condense into liquid water, which is then separated and drained, typically achieving pressure dew points ranging from 35°F to 40°F (3°C to 5°C).

These dryers are vital components within the larger compressed air treatment infrastructure, serving diverse applications across nearly every industrial sector. Key applications include general manufacturing, automotive paint shops, textile production, chemical processing, and small-scale operations requiring clean, dry air. The primary benefit of employing refrigerated dryers is the prevention of product spoilage and equipment downtime caused by condensate. Furthermore, they offer a highly cost-effective and energy-efficient method of drying air compared to desiccant dryers, particularly when the required pressure dew point (PDP) is moderate and does not necessitate extremely dry air below freezing. This balance of performance and operational economy positions refrigerated dryers as the standard choice for the vast majority of industrial air treatment tasks.

Major driving factors fueling the market expansion include the stringent quality standards adopted across high-value manufacturing sectors, the ongoing global push toward optimizing energy efficiency in industrial utilities, and the rapid expansion of automated production facilities, particularly in emerging economies. As industrialization intensifies, the installed base of compressed air systems grows, simultaneously increasing the demand for reliable and effective air drying solutions. Continuous technological advancements focusing on reducing refrigerant charges, integrating smart control systems, and enhancing heat exchanger efficiency further solidify the market’s positive growth trajectory, promoting higher uptime and lower operating expenses for end-users.

Refrigerated Compressed Air Dryers Market Executive Summary

The Refrigerated Compressed Air Dryers Market is undergoing steady growth, characterized by strong business trends centered on energy efficiency, digitalization, and compliance with environmental regulations governing refrigerants. Key business strategies deployed by market leaders include the integration of IoT and predictive maintenance capabilities, transforming traditional dryers into smart connected assets that optimize performance based on real-time operational data. This shift towards smart technology minimizes energy consumption—a significant operating cost for compressed air systems—and maximizes reliability. Furthermore, the necessity for manufacturers to comply with evolving F-Gas regulations, particularly in Europe, is prompting a rapid transition toward environmentally friendly refrigerants with low Global Warming Potential (GWP), driving innovation in heat exchanger design and compressor technology to maintain efficiency under new operating constraints.

Regionally, the market exhibits varied dynamics. Asia Pacific (APAC) stands out as the primary growth engine due to robust industrial expansion, particularly within China, India, and Southeast Asian nations, where massive infrastructure and manufacturing projects necessitate new compressed air installations. North America and Europe, while being mature markets, focus heavily on replacement demand, modernization, and the adoption of high-efficiency cycling dryer technologies to adhere to strict energy performance standards. These developed regions lead in the implementation of advanced control algorithms and preventative maintenance contracts, sustaining demand for premium, technologically sophisticated equipment that offers superior total cost of ownership (TCO).

In terms of segmentation, the Non-Cycling dryer segment currently maintains a larger market share, especially in applications requiring consistent, high flow rates, but the Cycling dryer segment is exhibiting faster growth due to its superior energy-saving characteristics, particularly in systems with fluctuating air demand. The market is also heavily influenced by the end-user application; the automotive and general manufacturing sectors remain the largest consumers, demanding high-quality, reliable air to prevent defects in processes like painting and precision machining. The increasing sophistication of the electronics and pharmaceutical industries requires specialized dryers capable of maintaining extremely stable dew points, further diversifying product requirements and driving demand for advanced dryer configurations and material compatibility.

AI Impact Analysis on Refrigerated Compressed Air Dryers Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Refrigerated Compressed Air Dryers Market primarily revolve around predictive maintenance capabilities, optimizing energy usage, and enhancing operational reliability. Users frequently question how AI algorithms can anticipate component failures—such as refrigerant leaks or heat exchanger degradation—before they occur, thereby reducing costly unplanned downtime. There is also significant interest in AI's role in fine-tuning dryer cycles, especially in cycling dryers, to match fluctuating compressed air demand perfectly, ensuring maximum energy savings without compromising air quality. Key expectations center on AI providing real-time diagnostic insights, automating fault resolution suggestions, and establishing benchmarks for optimal performance across varied environmental conditions, leading to truly autonomous and self-optimizing compressed air treatment systems.

AI’s primary role in this market is transforming reactive maintenance into highly precise predictive maintenance. By analyzing vast streams of operational data—including inlet temperature, pressure drop, ambient conditions, and refrigerant circuit performance—AI algorithms can detect subtle anomalies indicative of impending failure. This predictive capability allows plant managers to schedule maintenance precisely when necessary, maximizing the lifespan of components, minimizing inventory holding costs for spare parts, and drastically reducing the risk of catastrophic system failure, which is critical in continuous operation environments like automotive or food processing facilities.

Furthermore, AI significantly enhances the energy efficiency of refrigerated dryers, which consume substantial electrical power. Traditional cycling dryers operate based on simple pressure or temperature thresholds. However, AI-powered control systems can leverage machine learning to understand complex usage patterns over time. This enables the dryer to dynamically adjust its refrigeration cycle timing, fan speed, and heat exchanger bypass settings in real-time, optimizing the trade-off between energy consumption and maintaining the target dew point under varying load profiles. This level of granular control is unattainable through conventional logic controllers, ensuring the dryer only operates at the required capacity, thus achieving substantial operational cost reductions and improving the dryer's overall sustainability profile.

- AI enables predictive failure analysis based on acoustic signatures and vibration data.

- Optimizes refrigerant compressor run-time using machine learning algorithms based on load forecasting.

- Facilitates remote diagnostics and automated reporting through connected smart platforms.

- Enhances energy efficiency by dynamically controlling fan speed and heat exchanger operation.

- Improves equipment lifespan by maintaining operation within tight, optimized parameters.

- Automates troubleshooting and generates prioritized maintenance recommendations.

DRO & Impact Forces Of Refrigerated Compressed Air Dryers Market

The market for refrigerated compressed air dryers is fundamentally shaped by a confluence of accelerating drivers, structural restraints, and compelling opportunities, all contributing to influential impact forces on pricing, innovation, and market penetration. A major driver is the escalating global focus on energy efficiency in industrial operations, mandating the adoption of modern, energy-saving dryer technologies such as variable speed drives (VSD) and high-efficiency cycling units. Alongside this, the continuous expansion of manufacturing sectors in emerging economies requires vast numbers of new air treatment installations. However, market growth is restrained by the high initial capital expenditure associated with high-quality, sophisticated drying equipment, particularly for smaller enterprises, alongside the technical challenge posed by the need to manage environmentally sensitive refrigerants and comply with complex international environmental regulations, which often drives up manufacturing complexity and cost.

Opportunities for market growth are strongly tied to the development and implementation of IoT-enabled smart dryers. These devices offer enhanced monitoring and remote control, enabling manufacturers to offer value-added services like subscription-based predictive maintenance and guaranteed uptime performance contracts. Furthermore, the specialized demand from high-purity sectors like pharmaceuticals, food and beverage, and electronics manufacturing represents a niche opportunity for premium, contaminant-free dryer solutions. The industry is also witnessing significant opportunity through retrofitting older, inefficient non-cycling units with modern, low-GWP refrigerant-based systems, especially in Europe and North America, driven by regulatory pressure and the desire for reduced operational costs and carbon footprints.

The primary impact forces shaping competitive intensity include raw material price volatility, particularly for copper and steel used in heat exchangers, which directly affects pricing models. Regulatory impact is high, forcing rapid R&D into next-generation refrigerants, creating a technology race among key players. The pressure for reduced total cost of ownership (TCO) pushes manufacturers towards integrating higher efficiency components and smart controls, making initial purchase price less critical than long-term energy savings. These interwoven dynamics necessitate a strategic focus on sustainable product design, robust supply chain management, and the leveraging of digital connectivity to maintain competitive advantage and capture both replacement and expansion market segments effectively.

Segmentation Analysis

Segmentation analysis for the Refrigerated Compressed Air Dryers Market provides a structured view of market dynamics based on technology, application, and end-user requirements, enabling manufacturers to tailor product development and marketing strategies effectively. The market is primarily segmented based on the operational mechanism: Non-Cycling, Cycling, and Variable Speed Drive (VSD) controlled dryers. Non-cycling models offer simplicity and stability but consume power continuously, while cycling models use thermal storage or mass to cycle the refrigeration compressor on and off, offering significant energy savings under partial load conditions. The VSD segment represents the technological apex, seamlessly matching refrigeration capacity to air flow demand, driving adoption in highly regulated and energy-conscious industries, and accelerating its market share growth.

Further granularity is achieved through segmentation by application flow rate (e.g., low, medium, and high flow), which dictates the physical size, heat exchanger design, and compressor capacity of the unit. This structural differentiation is crucial as large industrial facilities require high-flow, heavy-duty units, while small workshops utilize compact, low-flow dryers. The choice of dryer is also profoundly influenced by the necessary pressure dew point (PDP); while refrigerated dryers typically achieve a standard 3°C to 5°C PDP, specialized high-efficiency models or integrated systems might aim for tighter tolerances, positioning them for sensitive industrial applications where standard dew points are insufficient to prevent condensation during severe temperature fluctuations.

End-user industry segmentation, including Automotive, Chemical, Food & Beverage, and General Manufacturing, defines product specification requirements, such as materials of construction, sanitation standards, and certification needs. For instance, the Food & Beverage sector requires high hygiene standards and oil-free air compatibility, often necessitating stainless steel components and specialized filtration preceding the dryer. This precise segmentation allows market participants to develop targeted product portfolios that directly address the pain points and regulatory mandates specific to each industrial vertical, ensuring optimal air quality delivery and compliance, thereby enhancing customer satisfaction and reinforcing market leadership.

- By Technology:

- Non-Cycling Dryers

- Cycling Dryers (Thermal Mass/Direct Expansion)

- Variable Speed Drive (VSD) Dryers

- By Application Flow Rate:

- Low Flow (up to 200 CFM)

- Medium Flow (201 to 1000 CFM)

- High Flow (Above 1000 CFM)

- By End-User Industry:

- Automotive

- General Manufacturing & Assembly

- Food & Beverage Processing

- Chemical & Petrochemical

- Textiles

- Electronics & Semiconductors

- Pharmaceutical & Healthcare

- Others (Mining, Aerospace)

Value Chain Analysis For Refrigerated Compressed Air Dryers Market

The value chain for refrigerated compressed air dryers starts with upstream activities focused on securing high-quality raw materials and critical components, including high-efficiency refrigeration compressors, heat exchangers (typically copper or aluminum), specialized refrigerants, and advanced electronic control systems. Upstream analysis highlights the dependency on global suppliers for energy-efficient scroll and piston compressors, which are crucial for the dryer's performance and energy rating. Sourcing of new, low-GWP refrigerants (e.g., R-513A, R-1234ze) also places reliance on chemical manufacturers, who must scale production to meet the stringent environmental compliance needs of dryer manufacturers. Effective negotiation and robust inventory management at this stage are critical to mitigating supply chain volatility and maintaining competitive manufacturing costs, particularly given the global shortage dynamics often seen in specialized electronic components and high-pgrade metals.

Midstream activities involve core manufacturing, assembly, quality control, and testing. Manufacturers focus on optimizing production layouts for lean assembly of complex systems involving refrigerant charging, piping, insulation, and the integration of sophisticated control panels. Key strategic elements include standardization of components across different model ranges to simplify inventory and increase production scalability. The downstream analysis focuses on the efficient movement of finished goods to the end-user. Distribution channels are varied, involving a significant role for specialized distributors and technical dealers who possess the expertise to size, install, and commission these systems correctly. Direct sales channels are often utilized for large, bespoke industrial projects or key accounts, ensuring direct technical consultation and service provision from the OEM.

The distribution ecosystem relies heavily on both direct and indirect routes. Indirect distribution, leveraging a network of authorized dealers and third-party maintenance providers, is essential for reaching small to medium-sized enterprises (SMEs) and providing localized technical support and spare parts availability. These dealers act as the primary interface for post-sales support, influencing customer satisfaction and brand loyalty. Direct channels, conversely, ensure tighter control over the relationship with large industrial clients, facilitating customized solutions and bundling the dryer with other compressed air system components (compressors, filters, storage tanks). The effectiveness of the value chain is ultimately measured by the speed of delivery, quality of localized support, and the ability to minimize the total cost of ownership (TCO) for the final user through optimal product design and efficient servicing models.

Refrigerated Compressed Air Dryers Market Potential Customers

The primary potential customers and buyers of refrigerated compressed air dryers span across nearly all industrial sectors that utilize pneumatic equipment or require clean, dry air for their processes. End-users are generally categorized by the criticality of moisture control and the required air purity standards. General manufacturing and fabrication facilities form the largest customer base, using dry air for powering machinery, controlling pneumatic cylinders, and performing basic surface treatments like sandblasting. Their motivation centers on ensuring machinery longevity and avoiding basic operational shutdowns due to rust or sludge formation in air lines. Purchasing decisions in this segment often prioritize robust reliability, ease of maintenance, and competitive pricing, favoring standardized, dependable non-cycling or basic cycling dryer models.

High-value manufacturing sectors represent the most lucrative customer segments, particularly Automotive, Electronics, and Pharmaceutical industries. In automotive manufacturing, dry air is non-negotiable for high-quality paint application, where even minimal moisture can cause defects and massive rework costs. Electronics and semiconductor manufacturers require exceptionally high-purity air, though refrigerated dryers often serve as the first stage of drying before highly specialized desiccant or membrane dryers are employed to achieve ultra-low dew points. These customers are motivated by strict process control, compliance with ISO 8573 standards for air quality, and the necessity of zero downtime, leading them to invest heavily in advanced VSD and smart cycling dryers that offer superior energy efficiency and built-in predictive diagnostics.

Furthermore, smaller workshops and service-oriented businesses, such as tire repair shops, localized garages, and carpentry workshops, also constitute a vast pool of potential buyers. While they operate smaller compressors, the requirement to protect sensitive tools and maintain operational flow means they still need cost-effective drying solutions. For these buyers, compact, integrated dryer solutions are popular, often bundled with the compressor unit itself. The overarching motivation for all potential customers remains the minimization of indirect costs associated with moisture contamination—including maintenance, energy waste, and product spoilage—making the refrigerated dryer an essential investment in operational efficiency rather than merely an optional component.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Parker Hannifin, SMC Corporation, Ingersoll Rand, KAESER KOMPRESSOREN, Gardner Denver, Donaldson, BEKO TECHNOLOGIES, Friulair, Omega Air, Zander, Fini Compressors, Airfilter Engineering, Aircel, MTA S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigerated Compressed Air Dryers Market Key Technology Landscape

The technological landscape of the refrigerated compressed air dryers market is predominantly characterized by continuous innovation aimed at improving energy efficiency, enhancing reliability, and achieving environmental compliance related to refrigerants. The most significant technological shift involves the transition from traditional Non-Cycling dryers, which have continuous power draw, to sophisticated Cycling and Variable Speed Drive (VSD) controlled units. Cycling dryers incorporate advanced thermal storage materials, such as aluminum mass or specialized fluids, to store "cold" energy, allowing the refrigeration compressor to shut down during periods of low air demand, resulting in substantial energy savings, particularly in industrial settings with fluctuating production schedules. VSD technology further refines this by modulating the compressor speed precisely to match the real-time thermal load, offering the highest level of energy optimization and stable dew point control across the entire load spectrum.

Material science and component design also play a pivotal role. The efficiency of the refrigeration circuit is heavily dependent on advanced heat exchanger designs, moving toward highly efficient plate-and-shell or micro-channel heat exchangers that maximize thermal transfer while minimizing pressure drop within the air stream. A low pressure drop is critical as it translates directly into energy savings for the upstream air compressor. Furthermore, the stringent enforcement of environmental regulations, notably the European F-Gas Regulation, is accelerating the adoption of refrigerants with low Global Warming Potential (GWP), such as R-513A or R-1234ze. This shift requires redesigns of the refrigerant circuit components to handle the different thermodynamic properties of these new fluids, maintaining or even improving the system’s performance and adherence to mandated energy efficiency indexes.

Digitalization and smart control systems represent the fastest-growing technological segment. Modern dryers are equipped with advanced microprocessors and connectivity modules (IoT capabilities) that enable continuous monitoring of performance metrics, remote diagnostics, and integration into centralized plant management systems (SCADA/DCS). These smart systems utilize algorithms for optimized auto-drain operation, preventing unnecessary air loss, and provide predictive maintenance alerts that improve overall operational uptime. The move towards connectivity facilitates the offering of performance guarantees and remote optimization services by OEMs, embedding the dryer deeper into the overall industrial ecosystem and providing invaluable operational intelligence to plant operators focused on maximizing resource utilization and maintaining ISO 8573 air quality standards consistently.

Regional Highlights

Regional dynamics significantly influence the Refrigerated Compressed Air Dryers Market, reflecting variations in industrial maturity, regulatory frameworks, and energy cost structures across the globe. Asia Pacific (APAC) currently dominates in terms of volume growth, driven by massive investments in infrastructure development, rapid industrialization, and the relocation of global manufacturing facilities to countries like China, India, Vietnam, and Indonesia. This region generates high demand for new installations across automotive, general manufacturing, and textile sectors. While pricing is highly competitive, the growing awareness of air quality standards and energy consumption is beginning to shift demand toward higher efficiency cycling and VSD models, moving beyond basic non-cycling units.

North America and Europe represent mature markets characterized by stringent energy efficiency mandates and a high rate of replacement demand. In Europe, adherence to the Pressure Equipment Directive (PED) and aggressive targets for reducing greenhouse gas emissions (F-Gas regulations) compel end-users to upgrade to state-of-the-art dryers utilizing low-GWP refrigerants and achieving superior Seasonal Energy Efficiency Ratios (SEER). North America, driven by high labor and energy costs, focuses heavily on reliability, low Total Cost of Ownership (TCO), and advanced predictive maintenance systems enabled by IoT integration. Both regions prioritize premium, high-efficiency products that minimize lifecycle costs and ensure long-term regulatory compliance.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions experiencing moderate growth. In the MEA, demand is spurred by investments in oil and gas, petrochemicals, and manufacturing diversification efforts, particularly in the Gulf Cooperation Council (GCC) countries. High ambient temperatures in these regions pose unique challenges, requiring specialized dryer designs with robust cooling systems and high thermal tolerance to maintain the required low pressure dew point reliably. LATAM exhibits strong demand in Brazil and Mexico, linked to automotive and general industrial sectors, with purchasing decisions often balancing initial cost with recognized brand reliability, creating opportunities for both global market leaders and localized competitive manufacturers.

- Asia Pacific (APAC): Highest growth trajectory fueled by industrial expansion; focus on new capacity addition in China and India; increasing adoption of energy-saving technology.

- North America: Mature market with strong emphasis on IoT integration, predictive maintenance, and VSD technology for reduced TCO; driven primarily by replacement and modernization cycles.

- Europe: Driven by strict environmental regulations (F-Gas) and energy efficiency mandates (Ecodesign); high demand for low-GWP refrigerant-based and cycling dryers.

- Middle East & Africa (MEA): Growing demand from petrochemical and industrial diversification projects; requires robust solutions due to high ambient temperature operating conditions.

- Latin America (LATAM): Steady growth linked to automotive and mining sectors; preference for cost-effective, reliable standard solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerated Compressed Air Dryers Market.- Atlas Copco

- Parker Hannifin

- SMC Corporation

- Ingersoll Rand

- KAESER KOMPRESSOREN

- Gardner Denver (A brand of Ingersoll Rand)

- Donaldson Company, Inc.

- BEKO TECHNOLOGIES

- Friulair

- Omega Air

- Zander GmbH

- Fini Compressors

- Airfilter Engineering

- Aircel, LLC

- MTA S.p.A.

Frequently Asked Questions

Analyze common user questions about the Refrigerated Compressed Air Dryers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical operational dew point achieved by refrigerated compressed air dryers?

Refrigerated air dryers typically lower the pressure dew point (PDP) of compressed air to between 35°F and 40°F (3°C and 5°C). This range is sufficient for most general industrial applications to prevent condensation and corrosion within the air distribution system during standard operating temperatures.

What is the difference between Non-Cycling and Cycling refrigerated dryers regarding energy consumption?

Non-Cycling dryers operate their refrigeration compressor continuously, regardless of the air flow demand, leading to higher energy consumption. Cycling dryers (including VSD models) utilize thermal mass or variable speed technology to turn the compressor off or modulate its speed during low-demand periods, resulting in significant energy savings and a lower operational cost.

How are environmental regulations impacting the design and selection of refrigerated dryers?

Environmental regulations, particularly those concerning fluorinated gases (like the F-Gas Regulation), are driving manufacturers to phase out high Global Warming Potential (GWP) refrigerants. This necessitates redesigns to utilize low-GWP alternatives such as R-513A or R-1234ze, focusing technological advancements on maintaining or improving efficiency with these new, regulated substances.

Which end-user industries are the largest consumers of refrigerated compressed air dryers?

The largest consuming industries are General Manufacturing, due to sheer volume, and the Automotive sector, where dry air is crucial for paint quality and precision machinery operation. The Food & Beverage and Pharmaceutical sectors also represent critical, high-value segments requiring specialized, high-purity drying solutions.

What role does IoT integration play in modern refrigerated air dryer performance?

IoT integration enables real-time monitoring, remote diagnostics, and advanced predictive maintenance. By analyzing operational data, smart dryers can optimize energy consumption dynamically, anticipate component failures (like fan or compressor issues), and minimize unscheduled downtime, thereby maximizing reliability and reducing the Total Cost of Ownership (TCO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager