Refrigerated Trailer Gaskets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433418 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Refrigerated Trailer Gaskets Market Size

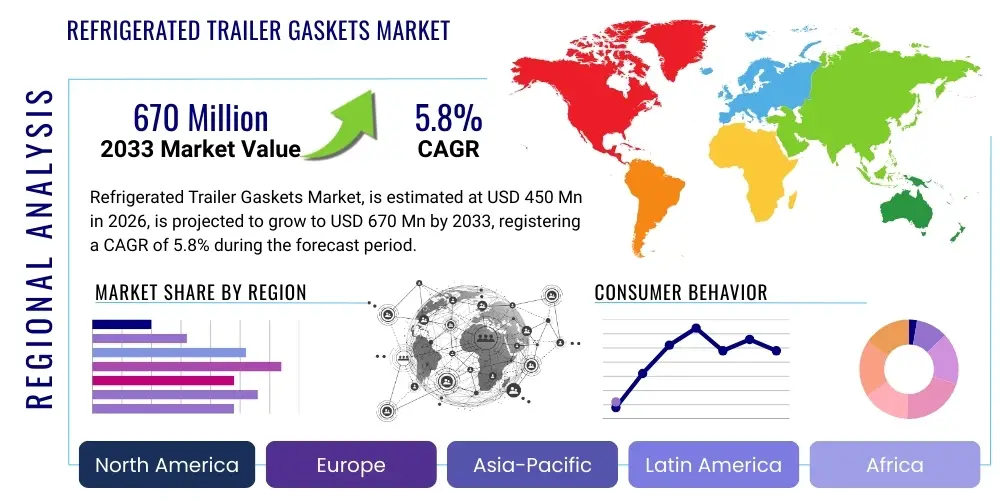

The Refrigerated Trailer Gaskets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033. This growth trajectory reflects the critical role gaskets play in maintaining the integrity of the global cold chain, a necessity underscored by increasing volumes of international trade in temperature-sensitive commodities such as fresh produce, frozen foods, and life-saving pharmaceuticals. The consistent expansion of refrigerated vehicle fleets globally, driven by urbanization and changing consumer habits, provides a robust foundation for continuous market expansion, both in the original equipment manufacturer (OEM) segment and the essential aftermarket replacement sector.

Refrigerated Trailer Gaskets Market introduction

The Refrigerated Trailer Gaskets Market is defined by the demand for highly specialized sealing solutions crucial for refrigerated (reefer) transport units. These products, typically manufactured from advanced elastomeric materials like EPDM, TPE, or PVC, form a critical barrier against thermal exchange and moisture ingress, preserving the quality and safety of transported goods. Major applications span across sealing large rear doors, smaller access hatches, and body panel joints in both long-haul refrigerated trailers and intermodal shipping containers. The primary benefits derived from high-quality gaskets include significant reductions in energy consumption by the refrigeration unit, prolonged equipment lifespan, and most importantly, compliance with stringent international food safety and pharmaceutical transportation standards, collectively minimizing the risk of costly cargo spoilage during transit. The market expansion is fundamentally driven by the accelerating global cold chain logistics ecosystem, characterized by increasing regulatory scrutiny on temperature control and continuous innovation in material science focused on improving sealing efficiency and durability in extreme operating conditions.

Refrigerated Trailer Gaskets Market Executive Summary

The Refrigerated Trailer Gaskets Market is undergoing a significant evolution, propelled by transformative business trends focusing on material innovation, digitalization, and sustainability. Key trends include the pivot towards custom-engineered gasket profiles that optimize aerodynamic performance alongside thermal insulation, catering to manufacturers seeking to improve overall fleet efficiency. There is a discernible movement away from simple single-compound seals to sophisticated, multi-material systems, such as dual-durometer extrusions, which offer superior sealing integrity and ease of installation. Furthermore, leading market participants are investing heavily in establishing global supply chain resilience and expanding local manufacturing capabilities, particularly in the fast-developing Asian Pacific region, to efficiently serve burgeoning OEM demand and stabilize aftermarket supply across fragmented fleets.

Regionally, the market exhibits a clear bifurcation: mature regions like North America and Europe emphasize compliance, high performance, and environmental responsibility, driving the adoption of premium TPE and EPDM solutions and fueling a substantial replacement market. Conversely, the Asia Pacific region, led by China and India, represents the engine of future growth, spurred by aggressive infrastructure development, growing consumer wealth, and the subsequent need for modernizing vast logistics networks. This regional disparity dictates market segmentation strategies, with Western markets demanding technologically superior, high-cost solutions, while APAC often seeks robust, volume-driven products that balance durability and affordability in initial fleet setup.

Segment trends highlight the persistent dominance of EPDM as the material of choice due to its exceptional performance envelope, particularly its cold-weather resilience, essential for deep-freeze applications. However, Thermoplastic Elastomers (TPEs) are rapidly gaining traction, favored for their recyclability, lighter weight, and manufacturing versatility, positioning them as a sustainable alternative in European and North American markets. The aftermarket distribution channel remains the largest revenue generator, reflecting the cyclical need for replacement to maintain thermal performance, reinforcing the necessity for efficient, broad distribution networks capable of supplying hundreds of distinct profile geometries globally. This segmentation overview confirms the market’s reliance on both innovative new material adoption and high-volume replacement cycles for sustained financial growth.

AI Impact Analysis on Refrigerated Trailer Gaskets Market

Common user inquiries regarding the intersection of Artificial Intelligence (AI) and the Refrigerated Trailer Gaskets Market primarily center on how AI can optimize manufacturing processes, predict gasket failure rates, and improve cold chain performance monitoring. Users are keenly interested in predictive maintenance systems leveraging machine learning to analyze sensor data (temperature logs, door usage frequency, atmospheric data) to determine the optimal replacement cycle for specific gasket types, thereby minimizing trailer downtime and maximizing thermal efficiency. This transition from time-based maintenance to condition-based maintenance is viewed as a critical economic lever. Furthermore, there is significant interest in how AI can be integrated into quality control during the high-speed extrusion manufacturing phase, potentially automating inspection for microscopic flaws or inconsistent material density and cross-sectional geometry, areas traditionally prone to human error.

The core expectation is that AI integration will fundamentally enhance product reliability and operational sustainability. By processing massive datasets related to road vibration, environmental humidity, and door usage patterns over time, AI can generate highly accurate degradation models for various gasket profiles operating in different geographical locations. This level of granular data analysis allows manufacturers to refine material formulations and design specifications more rapidly, leading to the production of inherently more durable and fit-for-purpose sealing solutions. Fleet operators are also exploring AI tools to correlate fuel consumption directly with the detected degradation level of the gasket, thereby providing quantifiable justification for proactive seal replacement before significant energy losses accumulate.

Beyond maintenance, AI algorithms are proving valuable in strategic inventory management for the aftermarket, forecasting regional demand peaks for specific, often customized, gasket profiles. This sophisticated demand planning mitigates supply chain bottlenecks and reduces the carrying costs associated with stocking large and diverse inventories of specialized replacement parts. The adoption of AI is not solely an optimization effort but a strategic imperative that transforms the gasket from a passive component into an integrated part of a digitally monitored cold chain asset, enhancing the overall value proposition delivered by manufacturers to large fleet owners and logistics providers.

- AI-driven Predictive Maintenance: Utilizing sensor data from trailer doors and thermal zones to forecast gasket wear and schedule replacements proactively, minimizing thermal leakage and associated energy costs.

- Optimized Manufacturing Quality Control: Implementing machine vision and deep learning algorithms to automate the detection of dimensional defects and material inconsistencies during the high-volume extrusion and molding processes.

- Supply Chain and Inventory Management: AI algorithms forecasting highly localized and seasonal demand for specific gasket profiles based on regional fleet deployment, historical usage, and environmental conditions, thereby optimizing distribution efficiency.

- Enhanced Material Testing and Simulation: Employing AI models to simulate the long-term performance and durability of novel elastomeric compounds under accelerated testing protocols, significantly speeding up material development cycles.

- Energy Efficiency Monitoring: Using AI to correlate gasket seal integrity with the real-time performance metrics and cooling load of the HVAC unit, providing quantifiable data on the return on investment (ROI) of timely gasket replacement.

DRO & Impact Forces Of Refrigerated Trailer Gaskets Market

The dynamics of the Refrigerated Trailer Gaskets Market are fundamentally shaped by the escalating global demand for specialized cold chain logistics, which acts as the primary driver. This demand is further amplified by stringent governmental regulations, particularly concerning the safe transport of perishables, bio-pharmaceuticals, and vaccines, necessitating the adoption of certified, high-performance sealing solutions. However, the market faces significant restraints, chiefly stemming from the high and often volatile initial manufacturing costs associated with acquiring advanced, specialized elastomeric raw materials, coupled with the systemic challenge of standardizing replacement parts across a highly fragmented global fleet base composed of numerous OEM designs. Opportunities lie predominantly in the realm of sustainable development, including the creation of recyclable materials, and the increasing market acceptance of 'smart' technologies (IoT sensors) integrated directly into gaskets for real-time performance monitoring. The interplay of these factors creates powerful impact forces that emphasize the absolute critical role of sealing reliability in achieving regulatory compliance, reducing carbon footprint, and maintaining operational efficiency within the highly scrutinized cold chain ecosystem.

Drivers: The sustained increase in the volume of cross-border and international trade involving perishable goods, directly correlated with the rapid expansion of global organized retail and e-commerce platforms requiring robust, seamless cold chain networks, significantly fuels the underlying demand for durable and thermally efficient refrigerated trailer gaskets. Concurrently, the burgeoning pharmaceutical industry’s requirements for transporting sensitive biologics, advanced therapies, and temperature-controlled vaccines necessitates sealing components that can guarantee ultra-low temperature maintenance with verifiable consistency, accelerating innovation in precision sealing technology. Furthermore, legislative mandates implemented by major economic blocs, such as the EU and North America, enforcing minimum insulation standards, thermal leakage limits, and energy efficiency criteria for all transport refrigeration units (TRUs), actively compel fleet operators and trailer manufacturers to exclusively adopt superior quality, certified sealing systems over cheaper, less effective alternatives, thus driving market value.

Restraints: A paramount challenge facing market stability is the inherent fluctuation and often sudden increase in the cost of crucial raw materials, notably specialized polymers and synthetic rubbers such as EPDM, PVC resins, and advanced TPE compounds, directly impacting the profitability margins of manufacturers and driving up end-product prices. Additionally, the aftermarket segment faces immense operational complexity due to the sheer multitude of highly specific trailer designs and dimensional specifications utilized globally by various Original Equipment Manufacturers (OEMs). This fragmentation mandates that aftermarket suppliers must stock and manage an excessively wide array of custom profile geometries and sizes, leading to inefficient inventory cycles, higher warehousing costs, and sometimes, delayed availability of replacement parts in local service markets. The necessary short lifespan of standard gaskets, typically requiring replacement every three to five years depending on usage intensity, also imposes a continuous high maintenance expenditure burden on fleet operators, occasionally incentivizing smaller enterprises to risk postponing critical gasket replacement, thereby compromising thermal performance across the supply chain.

Opportunities: Major growth opportunities are centered on breakthrough innovation in specialized material science, specifically focusing on the creation of high-performance, lightweight, and environmentally friendly gaskets. This includes the development and scaling of solutions derived from recycled content, bio-based polymers, or halogen-free compounds, aligning with stringent global sustainability and ESG reporting initiatives. A significant technological advancement lies in the mass production and acceptance of 'smart gaskets,' embedded with low-power temperature, humidity, or compression sensors that allow for immediate, digital feedback regarding seal breaches or gradual material degradation. This real-time data integration facilitates truly predictive maintenance models. Moreover, the extensive and rapid expansion of modern cold chain infrastructure across rapidly developing economies in Asia Pacific and Latin America offers vast, untapped potential for providers specializing in scalable, robust, and cost-effective sealing solutions that that are specifically tailored to withstand highly diverse and often extreme operational environments, creating substantial long-term market entry opportunities.

- Drivers

- Expansion of Global Cold Chain Logistics and Increased Volume of Perishable Trade.

- Implementation of Strict Government Regulations Regarding Food Safety and Pharmaceutical Integrity (e.g., GDP Guidelines).

- Sustained Growth in Demand for Frozen and Chilled Foods Distributed via E-commerce and Organized Retail.

- Continuous Technological Advancements in Elastomeric Material Science Offering Enhanced Thermal Performance and Durability.

- Rising Global Energy Costs Mandating the Use of Highly Efficient Thermal Sealing Systems.

- Restraints

- High Volatility and Unpredictable Fluctuations in Key Raw Material Prices (Synthetic Polymers and Rubber).

- Operational Complexity and Fragmentation of Global Trailer Design Specifications Leading to Inventory Management Challenges.

- Significant Initial Manufacturing Costs Associated with Advanced, Customized Gasket Profiles.

- The Pervasive Threat of Low-Quality, Uncertified Aftermarket Products Undermining Thermal Performance Standards.

- Opportunities

- Development and Widespread Adoption of Sustainable and Recyclable Gasket Materials (Bio-polymers, TPE).

- Successful Integration of Smart/IoT Sensors into Gaskets for Real-Time Performance Monitoring and Predictive Maintenance.

- Strategic Penetration into Emerging Markets (APAC, LATAM) with Rapidly Expanding Cold Chain Infrastructure.

- Customization of Gaskets for Highly Specialized Ultra-Low Temperature (Deep Freeze) and High-Temperature (Desert Environment) Applications.

- Impact Forces

- Compliance Requirements: Gaskets are mission-critical for meeting mandatory safety, temperature, and hygiene regulations.

- Operational Efficiency: Direct correlation between seal integrity and the reduction of fuel consumption and refrigeration unit wear.

- Thermal Integrity: Gasket quality is the primary determinant of cargo preservation and spoilage reduction across the cold chain.

- Lifecycle Cost Management: High-durability gaskets reduce overall total cost of ownership (TCO) for fleet operators.

Segmentation Analysis

The Refrigerated Trailer Gaskets Market is rigorously segmented across various dimensions, primarily focusing on the material composition, specific application within the trailer structure, the method of distribution, and the ultimate end-user industry served. Material segmentation is fundamentally important, distinguishing between established options like flexible PVC, the high-performance benchmark EPDM, and modern, sustainable thermoplastic elastomers (TPEs). This material choice dictates crucial product characteristics, including operational temperature range, UV resistance, compression set, and overall economic viability for manufacturers. Analyzing the distribution channel segmentation, specifically the contrast between Original Equipment Manufacturer (OEM) supply and the high-volume Aftermarket sector, reveals the dual-pronged sales strategy required to capture market share, catering both to new production lines and ongoing global maintenance requirements.

Further detailed analysis segments the market by application, distinguishing between large-format door seals, which are critical for preventing thermal bridging at the main access point, and panel/frame gaskets, which provide insulation integrity across the trailer body structure. Segmentation by trailer type is also crucial, differentiating between the needs of over-the-road truck trailers, which require gaskets optimized for high vibration and dynamic flexing, and static refrigerated shipping containers (reefers), which demand superior resistance to salt spray and continuous exposure to harsh marine environments. The evolving complexity of modern transport requires specialized gasket profiles tailored to the specific dynamic stress and material demands imposed by each transport modality, driving innovation in custom profile design and material selection across these application segments.

Finally, the segmentation based on the End-use Industry highlights the diverse regulatory and performance demands placed upon gaskets. The Food and Beverages segment, while driving the largest volume, requires gaskets optimized for hygiene and anti-microbial resistance. In contrast, the Pharmaceuticals and Healthcare segment, particularly for vaccine transport, demands gaskets capable of maintaining ultra-tight seals for severe temperature control (e.g., -80°C), where failure is non-negotiable. This high-stakes environment in the pharmaceutical cold chain compels suppliers to provide certified, traceable, and highly reliable sealing solutions, often necessitating the use of premium, validated materials like specific silicone formulations or medical-grade EPDM. Understanding these segmented demands allows manufacturers to tailor marketing, certification efforts, and R&D investment to maximize penetration into high-value sectors.

- By Material Type

- Ethylene Propylene Diene Monomer (EPDM): Dominant due to excellent temperature stability and weather resistance.

- Polyvinyl Chloride (PVC): Cost-effective option, often used in less critical or warmer cold chain applications.

- Thermoplastic Elastomers (TPE): Growing segment favored for recyclability, lightweight properties, and customization ease.

- Silicone: Utilized for specialized, ultra-low temperature, or high-purity pharmaceutical applications.

- Others (Neoprene, Nitrile Rubber): Niche uses based on specific oil resistance or chemical compatibility needs.

- By Application

- Door Gaskets (Primary Seals): High-wear components, critical for main thermal barrier maintenance.

- Panel Gaskets (Frame Seals): Used for sealing modular joints and interior/exterior panel connections.

- Window and Vent Seals: Smaller, specialized seals for access ports, observation windows, and air vents.

- By Trailer Type

- Truck Refrigerated Trailers: Requires resilience against frequent movement and road vibration.

- Shipping Refrigerated Containers (Reefer Containers): Demands high corrosion resistance and maritime durability.

- Rail Refrigerated Wagons: Focus on heavy-duty construction and long-term sealing integrity.

- By Distribution Channel

- Original Equipment Manufacturers (OEMs): Direct sales channel for new trailer production.

- Aftermarket (Replacement Sales): High-volume indirect sales through distributors and service centers for maintenance.

- By End-use Industry

- Food and Beverages: Largest segment (Fresh Produce, Dairy, Meat, Frozen Goods); high volume, focus on hygiene.

- Pharmaceuticals and Healthcare: High-value segment (Vaccines, Biologics); focus on extreme temperature precision and validation.

- Chemicals and Other Temperature-Sensitive Goods: Niche industrial applications requiring chemical resistance.

Value Chain Analysis For Refrigerated Trailer Gaskets Market

The value chain for refrigerated trailer gaskets is initiated upstream with the intricate processes of raw material sourcing and specialized compounding. This involves the procurement of high-grade synthetic rubbers, specific polymer resins (such as EPDM and TPE), plasticizers, vulcanizing agents, and UV stabilizers. A critical upstream activity is the proprietary compounding and formulation phase, where materials are mixed under highly controlled conditions to ensure the final elastomeric product exhibits the necessary resilience, low compression set, and temperature flexibility required for demanding cold chain environments. The stability and predictability of prices for these commodity chemicals directly influence the profitability and operational continuity of the entire value chain, making supplier relationship management and hedging strategies crucial for gasket manufacturers.

Midstream, the focus shifts entirely to precision manufacturing. This phase encompasses high-tolerance processes such as dual-durometer extrusion, continuous vulcanization, and advanced injection molding techniques used for corners and end caps. The investment in automated machinery is substantial, as quality control must be meticulous—gasket profiles are often highly complex, requiring exact dimensional accuracy (tolerances often measured in hundredths of a millimeter) to ensure a perfect fit with OEM trailer specifications and prevent potential air leaks. Midstream efficiency is optimized by lean manufacturing principles and vertical integration by larger players who manage compounding internally to maintain strict quality control over material properties, thereby reducing reliance on third-party compounders and mitigating intellectual property risks associated with specialized formulations.

The downstream segment handles the crucial element of market access and delivery, segmented into direct and indirect channels. The direct channel involves sales and dedicated technical support provided directly to major global trailer OEMs (e.g., Schmitz Cargobull, Utility Trailer Manufacturing, Wabash National) for integration into new vehicle production lines. This requires long-term contractual agreements and adherence to stringent supplier quality assurance (SQA) protocols. The indirect channel, representing the lucrative aftermarket, relies heavily on a global network of authorized distributors, wholesale parts providers, and specialized repair service centers. This channel’s success hinges on maintaining vast, distributed inventories of replacement profiles and ensuring rapid fulfillment capabilities, recognizing that a malfunctioning gasket often requires immediate, local replacement to prevent significant cargo loss. Effective value chain management, therefore, demands synchronization across specialized material suppliers, precision manufacturers, and a globally agile distribution network.

- Upstream Analysis: Sourcing of specialty chemical polymers (EPDM, TPE), rubber compounding, R&D in thermal insulation and aging resistance materials, dominated by large chemical and polymer producers.

- Midstream Analysis (Manufacturing): Precision extrusion, complex profile molding, continuous vulcanization, cutting, and critical quality assurance checks (dimensional, hardness, compression set testing).

- Downstream Analysis (Distribution and Sales):

- Direct Channel: Strategic, long-term supply agreements with global refrigerated trailer Original Equipment Manufacturers (OEMs).

- Indirect Channel: Sales via specialized authorized distributors, regional wholesale parts suppliers, and independent cold chain maintenance workshops (driving the significant Aftermarket revenue).

- End-User Application: Installation, cyclical maintenance, performance diagnostics, and eventual replacement executed by large fleet owners (3PLs, food processors) and independent transport operators.

Refrigerated Trailer Gaskets Market Potential Customers

The core potential customer base for refrigerated trailer gaskets is structurally divided into three primary categories: original equipment manufacturers (OEMs), massive third-party logistics (3PL) providers and vertically integrated fleet owners, and the extensive network of independent repair and maintenance shops supporting the aftermarket. OEMs of refrigerated trailers, trucks, and intermodal containers represent the primary buyer for new equipment installation, prioritizing suppliers who can meet high-volume demands, offer custom design integration, and adhere to strict quality and technical specifications required for mass production. These buyers are acutely focused on maximizing the lifespan of the initial component, thereby minimizing warranty claims and enhancing the reputation of their finished product in the fiercely competitive transport manufacturing market.

The largest and most consistent demand, however, originates from the operational phase, driven by large-scale 3PL companies (such as Kuehne + Nagel, DHL, and C.H. Robinson) and major food/beverage distributors (e.g., Nestle, Tyson Foods) who own and operate extensive fleets of refrigerated assets. These customers are the key drivers of the aftermarket, purchasing gaskets as essential replacement parts to ensure regulatory compliance and operational efficiency. Their purchasing decisions are primarily influenced by the guaranteed durability, proven performance in extreme climates, and the availability of certified products through established, readily accessible distribution channels. They view the gasket not merely as a component but as a critical determinant of fuel expenditure and cargo loss prevention, thus making procurement highly risk-averse.

Finally, smaller, independent trucking companies and local vehicle maintenance and repair facilities constitute a significant purchasing influence within the localized aftermarket segment. These buyers often prioritize cost-effectiveness and rapid availability, but are increasingly educated about the long-term cost benefits of higher quality, premium EPDM or TPE solutions over cheaper, short-lived PVC alternatives. For these customers, accessibility through local parts wholesalers and ease of installation are paramount, pushing manufacturers to design gaskets with user-friendly installation features (e.g., clip-on profiles, pre-mitered corners) to reduce repair downtime and labor costs, further expanding the market opportunity for streamlined replacement parts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trelleborg AB, Rehau AG, Cooper Standard, Lauren Manufacturing, Standard Industrial Manufacturing Corporation, Metflex Precision Mouldings Ltd., Trim-Lok Inc., Hutchinson Sealing Systems, Toyoda Gosei Co. Ltd., Parker Hannifin Corporation, CRH Custom Rubber Products, Mantaline Corporation, Rubber Shape, Custom Rubber Corp., Gaska Tape Inc., Quanxing, Techniparts B.V., Flexaust, DSG-Canusa (TE Connectivity), Zhejiang Sanxing Rubber Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigerated Trailer Gaskets Market Key Technology Landscape

The technological landscape of the Refrigerated Trailer Gaskets Market is undergoing significant innovation, primarily driven by the imperative to achieve superior thermal performance and enhanced sustainability standards across the global cold chain. Key technologies deployed include advanced cellular rubber structures and precision dual-durometer extrusion techniques. Dual-durometer processes are particularly crucial, as they allow manufacturers to strategically combine a rigid elastomer base for secure mounting to the trailer frame with a softer, highly flexible sealing lip, optimizing both mechanical stability and thermal sealing capabilities in a single, complex profile. Furthermore, significant technological effort is directed toward incorporating anti-microbial technologies and surface treatments into gasket materials, which is vital for minimizing bacterial and fungal growth, thereby ensuring compliance with increasingly stringent hygiene regulations, particularly within the sensitive food and pharmaceutical transport sectors.

Innovation extends significantly into material science, with the development and rapid adoption of lightweight, high-performance TPE (Thermoplastic Elastomers) formulations. These TPEs offer comparable sealing efficacy to traditional EPDM but with the added benefits of being fully recyclable and significantly lighter. This material shift directly aids trailer manufacturers in reducing the overall vehicle tare weight, contributing substantially to improved fuel economy and adherence to global CO2 reduction and emission standards. Additionally, manufacturing technologies such as continuous vulcanization (CV) lines and sophisticated injection molding for seamless, vulcanized corner joints are now industry standards. These processes are essential for eliminating thermal weak spots that traditionally occur at gasket corners, ensuring that the sealing integrity is perfectly maintained across the entire perimeter of the trailer door or panel, a critical factor for deep-freeze operations.

The future trajectory is undeniably digital, marked by the nascent but critical integration of low-power IoT sensor technology directly into the gasket structure, leading to the creation of 'smart gaskets.' These embedded micro-sensors are designed to continuously monitor critical operational parameters, such as the degree of compression or localized temperature and humidity differentials. The data collected is wirelessly transmitted to fleet management systems, enabling a true paradigm shift toward predictive maintenance models. The ability to receive real-time alerts regarding seal degradation or compression loss allows fleet operators to schedule replacements precisely when performance begins to decline, maximizing the operational lifespan of the component while proactively preventing catastrophic thermal failure and associated cargo loss, representing the most impactful technological advancement in the market today.

- Dual-Durometer Extrusion: Combining rigid mounting components and flexible sealing elements in one co-extruded profile to maximize both mechanical and thermal performance.

- Advanced Cellular Rubber Structures: Utilizing closed-cell or foamed EPDM/TPE cores to significantly enhance thermal insulation and reduce heat transfer across the seal line.

- Anti-Microbial/Hygiene Technology: Incorporation of specific additives or coatings to inhibit mold, mildew, and bacterial growth, crucial for food safety compliance.

- Thermoplastic Elastomer (TPE) Formulations: Development of highly engineered, lightweight, recyclable, and environmentally preferable alternatives to traditional rubber compounds.

- IoT Integration (Smart Gaskets): Embedding micro-sensors for real-time monitoring of seal compression, environmental conditions, and door status to facilitate predictive diagnostics.

- Precision Corner Molding: Utilizing injection molding or vulcanization to create seamlessly joined, leak-proof corner sections, eliminating common points of failure in the sealing system.

- Computational Fluid Dynamics (CFD) Modeling: Use of simulation tools to optimize gasket profile geometry for maximum aerodynamic efficiency and minimum thermal leakage during trailer operation.

Regional Highlights

The global refrigerated trailer gaskets market exhibits distinct growth patterns and technological preferences across major geographical regions, dictated by varying regulatory landscapes, climate conditions, and levels of cold chain maturity.

North America represents the largest and most established market in terms of value, characterized by exceptionally high standards for thermal performance and product longevity. The dominance here is driven by the vast distances involved in logistics, necessitating the highest quality EPDM and sophisticated TPE solutions capable of maintaining seal integrity across severe temperature fluctuations (from Canadian winters to Texan summers). Regulatory pressure, particularly relating to minimizing thermal leakage and maximizing energy efficiency, ensures a constant demand for premium gaskets and fuels a highly active aftermarket replacement cycle. Key players are highly focused on offering specialized solutions catering to the demanding specifications of the pharmaceutical cold chain, requiring rigorous validation and certification of sealing components.

Europe maintains a strong market presence, highly influenced by the European Union’s commitment to sustainability and circular economy principles. This region is a leader in the adoption of advanced, recyclable Thermoplastic Elastomers (TPEs) and halogen-free rubber compounds, driven by regulatory frameworks emphasizing the environmental impact of transport equipment. Countries like Germany, France, and the Netherlands are pivotal, leveraging advanced road and intermodal rail infrastructure which creates a substantial market for high-performance sealing solutions for both standard trailers and specialized refrigerated rail wagons. The focus on reducing food waste and adhering to stringent cross-border transport standards maintains consistently high demand for certified, long-lasting gasket solutions designed for durability and ease of recycling at end-of-life.

Asia Pacific (APAC) is undeniably the fastest-growing region globally, projected to expand rapidly due to massive governmental and private sector investments pouring into modernizing cold storage and logistics infrastructure across developing economies. Urbanization, coupled with increasing consumer disposable income in China, India, and Southeast Asia, dramatically increases the demand for chilled, fresh, and frozen commodities, directly translating into exponential growth in the refrigerated fleet size. While initial purchasing decisions might be more cost-sensitive than in Western markets, the sheer volume of new trailer manufacturing and container mobilization ensures that APAC offers the most significant long-term market opportunity for both regional and international gasket suppliers looking to establish high-volume manufacturing hubs.

Latin America (LATAM) and the Middle East & Africa (MEA) represent critical emerging opportunities. In LATAM, growth is fundamentally tied to the large-scale export of agricultural products (fruits, meat) requiring guaranteed temperature control from farm to port, necessitating robust gaskets capable of handling diverse humidity and temperature zones. The MEA market, specifically the Gulf Cooperation Council (GCC) nations, faces the unique challenge of maintaining refrigeration integrity against extreme ambient desert heat, driving a specialized requirement for ultra-heat-resistant polymer formulations and durable, heavy-duty sealing systems. These regions often require rugged, easily replaceable gaskets that can withstand harsh operational environments and frequent maintenance cycles, making them a target for suppliers offering durability-focused product lines.

- North America: Market leader in value; driven by long-haul transport needs, stringent federal and state regulations (e.g., thermal performance standards), and specialized demand from high-value pharmaceutical cold chain logistics.

- Europe: Strong focus on sustainability and recyclability, leading the adoption of TPEs; high market value due to advanced cold chain networks and cross-border regulatory compliance (ATP Agreement).

- Asia Pacific (APAC): Highest CAGR; expansion fueled by immense investment in new cold chain infrastructure, urbanization, rising consumption of perishable goods, and rapid fleet acquisition in China and India.

- Latin America (LATAM): Growth underpinned by agricultural export mandates; requires sealing solutions robust enough to manage high humidity and significant climate variations across transport routes.

- Middle East & Africa (MEA): Specialized market focusing on extreme temperature resilience (anti-heat deformation) due to harsh desert climates; increasing demand linked to food security initiatives and urbanization in GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerated Trailer Gaskets Market.- Trelleborg AB

- Rehau AG

- Cooper Standard

- Lauren Manufacturing

- Standard Industrial Manufacturing Corporation

- Metflex Precision Mouldings Ltd.

- Trim-Lok Inc.

- Hutchinson Sealing Systems

- Toyoda Gosei Co. Ltd.

- Parker Hannifin Corporation

- CRH Custom Rubber Products

- Mantaline Corporation

- Rubber Shape

- Custom Rubber Corp.

- Gaska Tape Inc.

- Quanxing

- Techniparts B.V.

- Flexaust

- DSG-Canusa (A member of the TE Connectivity family)

- Zhejiang Sanxing Rubber Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Refrigerated Trailer Gaskets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of refrigerated trailer gaskets?

The primary function is maintaining thermal integrity and energy efficiency by creating an airtight and insulated seal around doors and panels, preventing heat transfer and moisture infiltration. This guarantees the stable temperature required for preserving perishable goods (food and pharmaceuticals) during transit, ensuring crucial cold chain compliance and minimizing cargo spoilage risk.

Which material type dominates the refrigerated trailer gaskets market?

Ethylene Propylene Diene Monomer (EPDM) rubber currently dominates the market. It is highly favored due to its exceptional resilience to temperature extremes, superior resistance to ozone, UV exposure, and its critical ability to retain flexibility and sealing efficiency even in deep-freeze, sub-zero conditions, making it the industry standard for durability.

How often should refrigerated trailer gaskets typically be replaced?

Standard replacement cycles typically fall between three to five years, though intensive usage environments (high door cycling, abrasive cleaning) may necessitate earlier replacement. Regular, preventative maintenance inspections are mandatory, as delayed replacement directly causes significant refrigeration energy loss, increased operational costs, and elevated risk of cargo spoilage.

What are 'smart gaskets' and their importance to logistics efficiency?

Smart gaskets are innovative components embedded with micro-sensors that continuously monitor critical performance parameters, such as compression status or localized temperature leakage, in real-time. Their importance lies in enabling advanced predictive maintenance capabilities, alerting fleet managers immediately to potential seal degradation, optimizing maintenance schedules, and significantly boosting overall logistics efficiency.

What technological advancements are driving material shifts in the market?

The market is shifting towards advanced Thermoplastic Elastomers (TPEs) due to technological advancements that have improved their durability and temperature range. This shift is primarily driven by the demand for lighter, fully recyclable materials that help trailer manufacturers meet increasingly strict environmental mandates and reduce vehicle tare weight for better fuel economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager