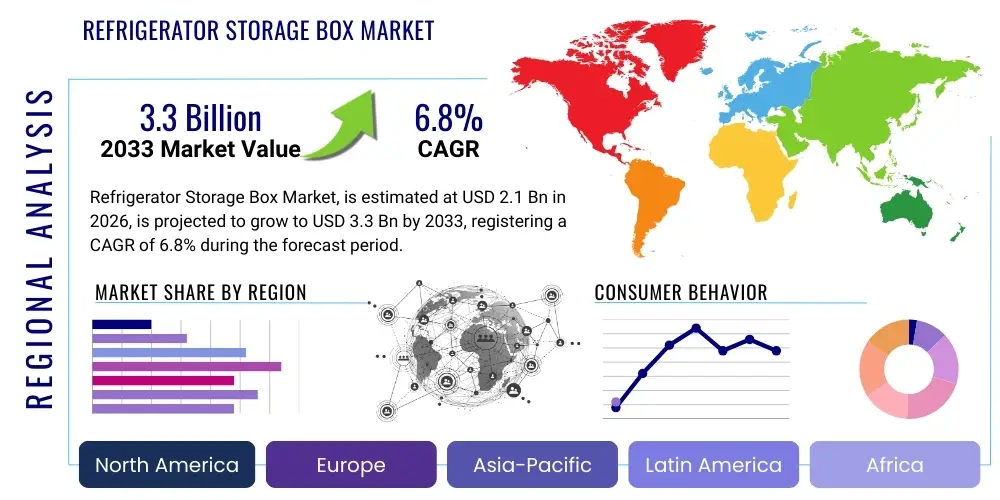

Refrigerator Storage Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438645 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Refrigerator Storage Box Market Size

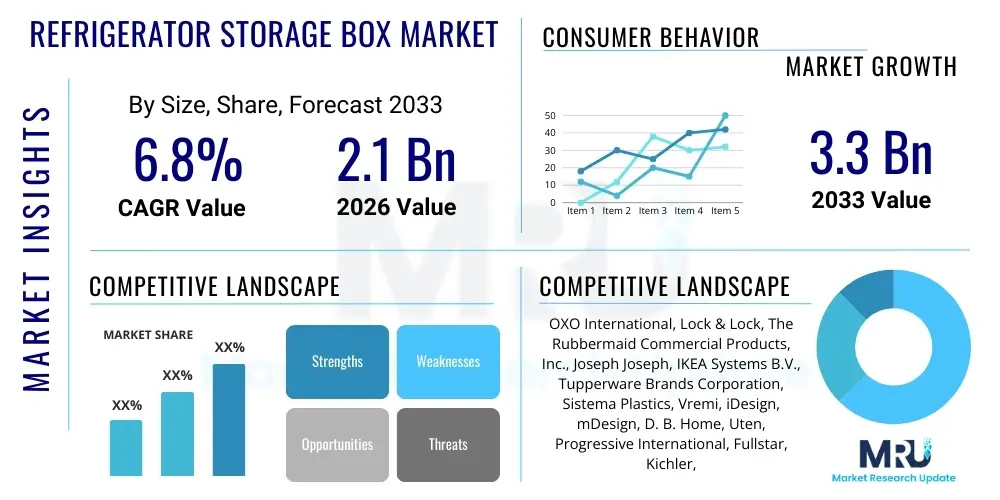

The Refrigerator Storage Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.3 Billion by the end of the forecast period in 2033.

Refrigerator Storage Box Market introduction

The Refrigerator Storage Box Market encompasses the sales and distribution of specialized containers designed to optimize space utilization, enhance food preservation, and improve organizational efficiency within household and commercial refrigerators. These products range widely in material composition, including durable plastics (BPA-free PP, PET), tempered glass, and sometimes silicone, catering to various consumer needs from vegetable crisper inserts to modular stackable bins for beverages and leftovers. The foundational purpose of these storage solutions is to compartmentalize the refrigerator space, preventing cross-contamination and maximizing visibility, thereby reducing food waste—a critical factor driving contemporary consumer adoption globally.

Major applications of refrigerator storage boxes extend beyond basic household use to include commercial settings such as catering services, small restaurants, and specialized food prep businesses where stringent organization and rapid inventory assessment are mandatory. The increasing trend of batch cooking and meal prepping among urban populations further solidifies the market's demand, as these containers are essential for efficiently storing prepared ingredients and portioned meals. Furthermore, product innovation focusing on specialized features, such as ventilation control for specific produce types (e.g., ethylene-sensitive fruits) and integrated date markers, transforms these simple boxes into vital tools for modern kitchen management.

Key driving factors propelling the market include rapid urbanization leading to smaller living spaces requiring highly efficient storage solutions, the pervasive influence of home organization aesthetics popularized through digital media, and a heightened global awareness concerning food safety and reducing household food waste. These drivers collectively incentivize consumers to invest in sophisticated, durable, and aesthetically pleasing storage systems, moving beyond simple makeshift containers to dedicated, purpose-built refrigerator organizers designed for long-term utility and seamless integration into high-efficiency smart kitchen environments. The shift towards healthier eating and fresh produce consumption also mandates superior preservation methods, directly benefiting the uptake of high-quality refrigerator storage boxes.

Refrigerator Storage Box Market Executive Summary

The Refrigerator Storage Box market is characterized by robust growth, propelled primarily by shifting consumer behavior toward organized living, sustainable material preferences, and the expansion of direct-to-consumer (DTC) e-commerce channels which simplify product access. Key business trends indicate a strong move towards modular, interlocking designs that offer maximum customization and stackability, appealing especially to millennial and Gen Z consumers residing in urban apartments where space efficiency is paramount. Furthermore, material innovation is central to competitive differentiation, with manufacturers increasingly adopting certified BPA-free plastics, high-grade borosilicate glass, and even bio-degradable polymers in response to growing consumer concern regarding chemical leaching and environmental impact, thereby driving premiumization within specific market segments.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, largely due to rapid modernization of households, rising disposable incomes, and the adoption of Western-style kitchen organization techniques in rapidly developing economies like China and India. North America and Europe, representing mature markets, exhibit trends focused heavily on premium aesthetics, smart features integration (e.g., sensor compatibility), and rigorous testing standards for durability and food contact safety. Retail trends show that while mass merchandisers and supermarkets remain important for volume sales, online platforms, particularly those specializing in home goods and organization, are instrumental in launching innovative products and reaching niche consumer groups interested in specialized, high-design storage solutions.

Segmentation trends confirm that the Plastic segment dominates volume sales due to cost-effectiveness and versatility, but the Glass segment is rapidly gaining market share in terms of value, driven by perceived benefits regarding hygiene, durability, and stain resistance. The demand for specific application-based products, such as egg holders, produce separators with adjustable vents, and specific freezer-safe containers, is increasing, signaling a maturation in consumer purchasing habits from general storage to specialized tools. This segmentation shift necessitates that manufacturers continuously iterate on product design, focusing on ergonomics, ease of cleaning, and standardized sizing to ensure compatibility across different refrigerator brands and models globally.

AI Impact Analysis on Refrigerator Storage Box Market

User inquiries regarding AI's influence on the Refrigerator Storage Box market often center on the practical integration of organization tools within the broader "smart kitchen" ecosystem. Consumers commonly ask how storage boxes can communicate inventory levels to a central smart refrigerator unit, how AI can track expiration dates of items stored within the box, and whether future designs will incorporate embedded smart sensors. The key themes revolve around automation, predictive inventory management, and maximizing the shelf life of perishable goods. While the storage box itself is a passive physical product, its future relevance is intrinsically linked to its ability to seamlessly interact with AI-driven inventory systems, moving beyond static organization to becoming an active component of food lifecycle management.

The direct impact of AI on the physical design or material composition of a storage box is currently minimal, yet its indirect influence on market opportunities is significant. AI-powered smart refrigerators or companion apps can use optical recognition or weight sensors (often placed underneath specialized storage boxes or drawers) to determine what items are stored, how long they have been there, and when they are likely to spoil based on pre-programmed material properties and storage conditions. This ecosystem view transforms the storage box from a containment unit into a data point, enabling personalized shopping lists, automatic recipe generation based on available ingredients, and proactive alerts to minimize waste. This convergence necessitates standardization of box dimensions and the integration of features compatible with sensor technology.

Consequently, manufacturers of refrigerator storage solutions must now consider "smart readiness" as a core design criterion. This involves designing boxes that optimize visibility for internal cameras (e.g., transparent materials, specific lid designs), ensuring dimensional consistency for optimal use in sensor-equipped drawers, and potentially developing collaborations with appliance manufacturers to create branded, optimized storage systems. The ultimate goal of AI integration is to provide consumers with effortless, real-time control over their fresh produce and pantry items, thus making organized storage not just about aesthetics, but about fundamental utility and cost savings through waste reduction.

- AI drives demand for standardized, dimensionally consistent storage boxes compatible with smart refrigerator sensor platforms.

- Predictive analytics fueled by AI can track item freshness, increasing the perceived value of specialized produce storage boxes with optimized ventilation features.

- Integration possibilities include RFID tags or QR codes on boxes to facilitate automated inventory tracking via companion mobile applications.

- AI contributes to design optimization by analyzing real-world usage patterns, informing manufacturers on ideal sizing, stacking heights, and compartmental needs.

- Future product development will focus on storage box materials optimized for machine vision algorithms used in smart refrigerators for visual inventory checks.

DRO & Impact Forces Of Refrigerator Storage Box Market

The dynamics of the Refrigerator Storage Box Market are shaped by a complex interplay of positive market drivers (D), persistent constraints (R), emerging opportunities (O), and overarching competitive impact forces. The primary drivers revolve around the global trend toward home organization and decluttering, significantly amplified by social media influence and lifestyle content promoting efficient home management. Coupled with this is the crucial imperative of food waste reduction; consumers are increasingly aware that proper, temperature-controlled, and organized storage significantly prolongs the freshness of perishable items, leading to higher willingness to invest in quality solutions. Restraints largely center on the environmental concerns associated with high-volume plastic production, pressuring manufacturers to transition to more costly, yet sustainable, material alternatives. Furthermore, the market faces competition from existing, often free, repurposed containers, requiring premium products to constantly justify their higher price point through superior functionality and longevity.

Opportunities for expansion lie predominantly in material science innovation, specifically the commercialization of bio-based or recycled plastics that maintain the desired transparency and durability characteristics, addressing consumer sustainability demands without sacrificing performance. There is also a substantial opportunity in catering to the growing niche of personalized and modular solutions, offering consumers the ability to custom-fit their entire refrigerator space, leveraging 3D-modeling and digital consultation services. Key impact forces include intensified competition from Asian manufacturers who offer cost-effective, high-volume products, necessitating that Western and premium brands focus heavily on branding, material certification, and unique ergonomic design features to maintain market relevance. The rapid evolution of e-commerce logistics also serves as an impact force, allowing smaller, specialized brands to bypass traditional retail barriers and achieve global distribution.

The balance between functionality and sustainability is currently the dominant impact force shaping strategic decisions within the market. Brands that successfully navigate the transition to sustainable materials (e.g., ocean-bound plastic, certified recycled content) while maintaining competitive pricing and superior performance will likely secure long-term consumer loyalty. The trend of smaller, more frequent grocery runs necessitates flexible, dynamic storage solutions that can adapt to varying volumes, pushing product innovation away from large, static boxes towards smaller, modular, and easy-to-handle components. Furthermore, stringent regulations related to food contact materials (e.g., FDA and EU standards) act as a continuous barrier to entry for lower-quality manufacturers, reinforcing the market position of established brands compliant with global safety standards.

Segmentation Analysis

The Refrigerator Storage Box Market is fundamentally segmented across material type, product application, design type, and distribution channel, reflecting the diverse needs of both residential and commercial end-users. This granular segmentation allows manufacturers to target specific consumer pain points, such as the need for long-term freezer storage versus short-term produce preservation. Material segmentation is particularly critical, dividing the market into segments based on consumer priorities concerning longevity, transparency, microwave/dishwasher compatibility, and sustainability credentials. The trend toward specialization means that general-purpose containers are gradually being supplanted by purpose-built organizers optimized for specific food items, enhancing preservation efficacy and overall organizational flow within the cooling unit.

By Design Type, the market is categorized into stackable organizers, fixed drawer inserts, adjustable dividers, and specialized containers (e.g., egg trays, beverage dispensers). Stackable solutions dominate due to their spatial efficiency and adaptability to different refrigerator dimensions. Distribution channel analysis confirms the increasing prominence of online retail, which provides consumers with wider access to niche, imported, or bulk-purchase options typically unavailable in physical stores. Understanding these segmentation nuances is crucial for strategic market positioning, enabling brands to tailor marketing efforts and product development pipelines to capture high-growth subsets, such as the premium segment favoring aesthetic glass organizers or the mass market relying on cost-efficient plastic sets.

- By Material:

- Plastic (Polypropylene (PP), Polyethylene Terephthalate (PET), Acrylonitrile Butadiene Styrene (ABS))

- Glass (Borosilicate, Tempered Glass)

- Ceramic/Earthenware (Niche use for specific temperature stability)

- Silicone (Lids and collapsible sections)

- By Design Type:

- Stackable Bins and Drawers

- Adjustable Dividers and Trays

- Specialty Containers (Egg Holders, Beverage Dispensers, Deli Containers)

- By Application:

- Produce/Vegetable Preservation

- Meat and Seafood Storage

- Leftover/Prepared Meal Storage

- Beverage and Condiment Organization

- By Distribution Channel:

- Offline (Supermarkets, Hypermarkets, Department Stores, Specialty Home Stores)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Refrigerator Storage Box Market

The value chain for the Refrigerator Storage Box Market begins with upstream activities focused on securing high-quality raw materials, primarily various grades of polymer resins (such as BPA-free PP and PET) and specialized silica sand for tempered glass production. Stability of raw material prices, particularly for petrochemical derivatives, significantly impacts the final cost structure and profitability. Suppliers must maintain rigorous quality control and provide material certifications (e.g., FDA food-grade approval) to ensure compliance. Manufacturing processes involve high-precision injection molding for plastic components and complex thermal processing for glass products. Efficiency in manufacturing, driven by automation and minimizing waste from defective molds, is a key determinant of competitive advantage, especially for high-volume producers in APAC.

Downstream activities center on distribution, sales, and aftermarket support. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves sales through the brand's proprietary e-commerce portal, offering high margin control and direct consumer feedback. Indirect distribution, which accounts for the majority of volume, utilizes large-scale retailers, home organization specialty stores, and major online marketplaces (e.g., Amazon, Walmart Marketplace). Logistics optimization is crucial here, as these products, while relatively low in individual value, require significant volume shipping and robust packaging to prevent transit damage, especially for glass variants.

The most significant shift in the value chain is the increasing reliance on e-commerce, which shortens the distance between the manufacturer and the end-consumer. This acceleration necessitates sophisticated digital marketing and high-quality content creation (professional photography, videography, and detailed product specifications) to influence purchasing decisions, as consumers cannot physically inspect the product beforehand. Furthermore, the rise of private label brands by major retailers and e-commerce giants introduces vertical integration pressures, forcing traditional manufacturers to continuously innovate on design and material composition to maintain differentiation and avoid price wars based solely on manufacturing cost.

Refrigerator Storage Box Market Potential Customers

The primary customer base for the Refrigerator Storage Box Market consists overwhelmingly of households, ranging from single urban dwellers living in small apartments to large suburban families seeking maximal efficiency from their refrigeration appliances. Within the household segment, significant demographic targets include young professionals focused on meal prepping and health-conscious consumers who prioritize the extended freshness and visible organization of their produce. These buyers often seek mid-to-high-range products made from certified, durable materials like borosilicate glass or high-quality BPA-free plastics, prioritizing aesthetics and stackability above all else, often influenced by organizational trends seen on social media platforms.

Beyond residential use, the commercial sector represents a growing segment of potential customers, particularly within the HoReCa (Hotel, Restaurant, Catering) industry. Commercial kitchens require standardized, high-volume, and exceptionally durable storage boxes that comply with strict food safety regulations (e.g., NSF standards) and are designed to withstand industrial-level washing and temperature fluctuations. These buyers prioritize operational efficiency, rapid inventory identification (often requiring clear labeling systems), and the ability to integrate seamlessly into complex cold storage logistics. The institutional segment, including schools, hospitals, and corporate cafeterias, similarly demands rugged, easy-to-clean, and standardized containers for bulk food storage and management.

A crucial emerging group includes environmentally conscious consumers who actively seek products made from sustainable, recycled, or bio-degradable materials, even if the cost is higher than conventional plastic options. These customers are driving innovation in the materials segment and require strong assurances regarding product lifecycle and end-of-life disposal. Ultimately, the market caters to anyone who owns a refrigerator and prioritizes minimizing food waste, extending freshness, and improving the functional aesthetics of their kitchen environment, making the addressable market exceptionally broad, though varying significantly in price elasticity across different segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.3 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OXO International, Lock & Lock, The Rubbermaid Commercial Products, Inc., Joseph Joseph, IKEA Systems B.V., Tupperware Brands Corporation, Sistema Plastics, Vremi, iDesign, mDesign, D. B. Home, Uten, Progressive International, Fullstar, Kichler, Pura, Prep & Savour, W&P Design, Ziploc (SC Johnson), Blueair |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigerator Storage Box Market Key Technology Landscape

The technology landscape in the Refrigerator Storage Box market is predominantly driven by advancements in material science and high-precision manufacturing processes. For plastic storage solutions, the primary technological focus is on injection molding techniques that ensure zero flash, minimal shrinkage, and maximum consistency, which is critical for airtight seals and interlocking modularity. Key material technology involves the use of Tritan plastics (for enhanced durability and glass-like clarity), BPA-free polyethylene (PE) and polypropylene (PP) formulations that guarantee food safety compliance, and antimicrobial coatings or additives embedded directly into the polymer matrix to inhibit bacterial growth and prolong the cleanliness of the containers, particularly crucial for fresh produce storage.

For glass storage boxes, the technology revolves around thermal tempering and borosilicate glass formulations that offer superior resistance to thermal shock, allowing safe transitions directly from freezer to microwave or oven, a significant consumer utility feature. Manufacturing techniques ensure consistent wall thickness and precise lid-fitting interfaces, which are necessary for creating hermetic seals without resorting to complex latching mechanisms. Furthermore, design technologies, particularly Computer-Aided Design (CAD) and simulation software, are essential for developing space-efficient, ergonomic, and aesthetic designs that maximize refrigerator capacity and enhance consumer usability, allowing for rapid prototyping and testing of stackable configurations.

A crucial emerging technological area is the integration of "smart" elements, though these are external to the box itself. This includes developing optimized materials and designs for integration with refrigerator smart sensors (e.g., highly transparent material clarity for internal cameras, specific structural features to trigger weight sensors). Another area is the use of vacuum seal technology integrated into lids, which employs small pumps (manual or electric) to actively remove air, offering preservation benefits far beyond standard airtight seals. This continuous drive for better sealing, superior durability (e.g., shatter-resistance testing protocols), and compliance with increasing food contact regulatory standards defines the technological competitive edge in this otherwise mature product category.

Regional Highlights

The regional market landscape for Refrigerator Storage Boxes exhibits diverse growth rates and consumer preferences driven by lifestyle, economic development, and cultural factors related to food management.

- North America: This region is characterized by high demand for premium, large-capacity, and technologically integrated storage solutions. Consumer behavior is heavily influenced by the organizational media trend and a high propensity for meal prepping, driving the adoption of specialized, highly aesthetic, and high-durability products (especially glass and high-grade Tritan plastic). The market here is mature but experiences steady value growth through premiumization and innovative features like vacuum sealing and smart inventory compatibility.

- Europe: European consumers prioritize sustainability and minimalist design. The market shows strong preference for products made from recycled or sustainable materials, often favoring high-quality glass for perceived hygiene benefits and longevity. Stringent EU regulations regarding food contact materials shape the competitive environment, ensuring high standards for all products sold. Germany, the UK, and France are key markets, focusing on functional, aesthetically pleasing, and highly durable solutions designed for long-term use and waste reduction.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and the modernization of kitchen spaces. The demand is massive, often favoring cost-effective, high-volume plastic containers (PP and PET). However, there is a rapidly emerging middle class in China and India driving demand for branded, quality products. Japan and South Korea lead the innovation curve in compact, hyper-efficient, and modular designs tailored for smaller refrigerator units common in high-density urban housing.

- Latin America (LATAM): This market is price-sensitive but shows increasing awareness regarding food safety and organization. Growth is steady, primarily driven by the expansion of organized retail and improving access to imported or locally manufactured mid-range products. The focus remains largely on functional, durable plastic options.

- Middle East and Africa (MEA): Growth in MEA is concentrated in urban centers and high-income Gulf Cooperation Council (GCC) countries, where modern kitchens and large refrigeration units are common. The demand is split between basic, inexpensive solutions and high-end, imported designer sets, reflecting significant economic disparities across the region. Logistics and distribution challenges remain key market considerations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerator Storage Box Market.- OXO International

- Lock & Lock

- The Rubbermaid Commercial Products, Inc.

- Joseph Joseph

- IKEA Systems B.V.

- Tupperware Brands Corporation

- Sistema Plastics

- Vremi

- iDesign

- mDesign

- D. B. Home

- Uten

- Progressive International

- Fullstar

- Kichler

- Pura

- Prep & Savour

- W&P Design

- Ziploc (SC Johnson)

- Blueair

Frequently Asked Questions

Analyze common user questions about the Refrigerator Storage Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are considered safest for refrigerator storage boxes?

The safest materials are certified food-grade, specifically BPA-free plastics such as Polypropylene (PP) and high-quality Polyethylene Terephthalate (PET), along with borosilicate or tempered glass. Consumers should look for clear labeling confirming compliance with FDA or EU food contact standards to ensure no chemical leaching occurs.

How do specialized refrigerator storage boxes help in reducing food waste?

Specialized boxes reduce food waste by providing optimal conditions for preservation, such as airtight seals to minimize oxidation, specific containers for deli meats that prevent drying, and produce organizers with adjustable ventilation to regulate humidity, thereby extending the shelf life of perishables significantly.

Are glass refrigerator storage boxes better than plastic ones?

Glass boxes are generally preferred for hygiene, stain resistance, and durability, as they do not absorb odors or colors and are oven/freezer safe. Plastic boxes, however, are favored for their light weight, affordability, and shatter resistance, making them ideal for high-volume use or households with children.

What role does modular design play in maximizing refrigerator space?

Modular design features, such as standardized widths, stackability, and interlocking bases, allow consumers to create a fully customized, seamless storage grid. This maximization eliminates wasted vertical and horizontal space, ensuring every inch of the refrigerator cavity is utilized efficiently, a crucial feature for modern, compact living.

How is the e-commerce distribution channel impacting the refrigerator storage box market?

E-commerce has significantly broadened market access, enabling niche brands focused on innovative or sustainable designs to reach a global audience. It supports comparative shopping, facilitates bulk purchasing, and provides detailed product specifications, driving consumer preference towards high-value, specialized organizational systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager