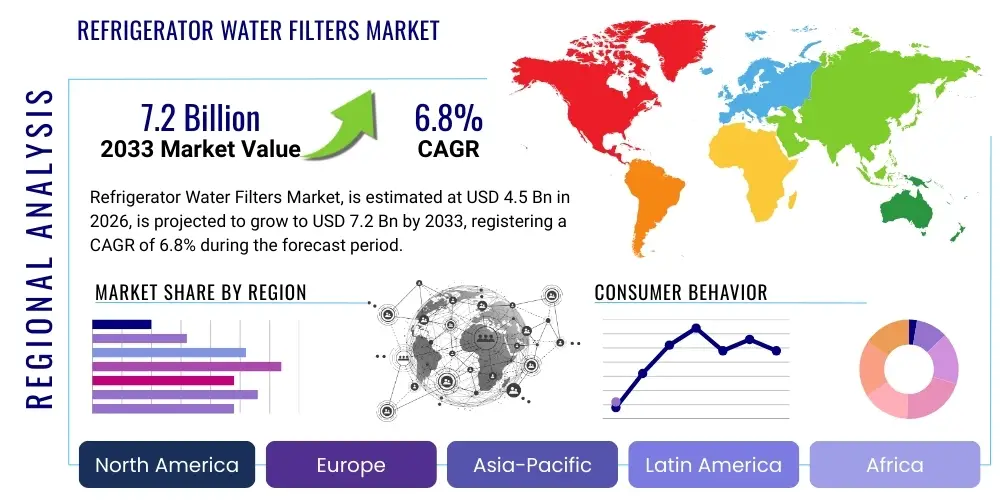

Refrigerator Water Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436015 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Refrigerator Water Filters Market Size

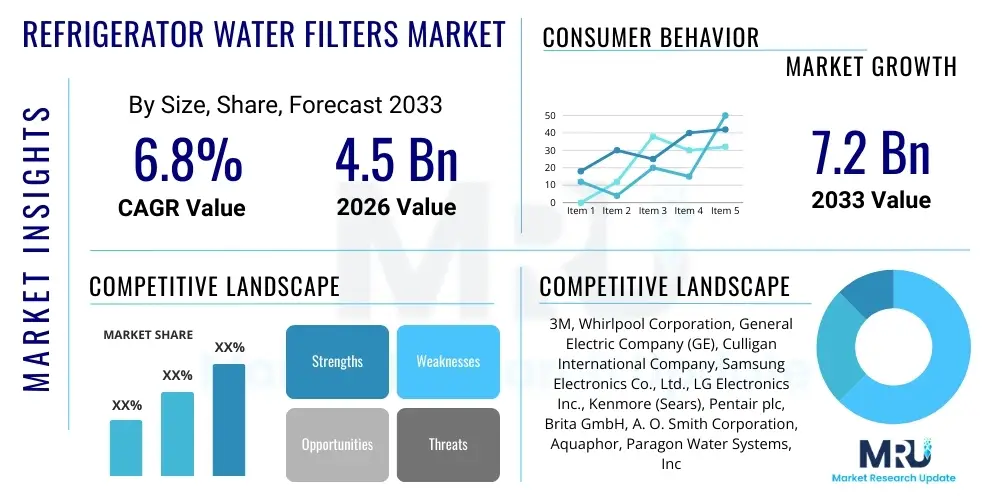

The Refrigerator Water Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033.

Refrigerator Water Filters Market introduction

The Refrigerator Water Filters Market encompasses the industry dedicated to manufacturing and distributing filtration mechanisms designed to remove impurities, contaminants, and undesirable tastes and odors from water dispensed through household and commercial refrigerators. These filtration systems are essential components of modern appliances, ensuring safe and aesthetically pleasing drinking water and ice. The product description involves various media types, including activated carbon blocks, granulated activated carbon (GAC), and specialized ion exchange resins, often housed in proprietary casings designed for specific refrigerator models.

Major applications of refrigerator water filters span both the residential and commercial sectors. In residential settings, they are integral to providing instant, filtered water for drinking and cooking, directly impacting household health and convenience. Commercially, they are utilized in offices, hotels, and food service establishments that rely on integrated refrigerator units for high-quality water dispense. The fundamental benefits include significant reduction of chlorine, sediment, cysts, lead, and various volatile organic compounds (VOCs), thereby improving overall water quality and extending the lifespan of the refrigerator's internal components.

Driving factors for this market are intrinsically linked to rising consumer health awareness concerning potable water quality, particularly in urban and densely populated areas where municipal water infrastructure may face challenges. Furthermore, the increasing adoption of premium refrigerator models (such as French door and side-by-side units) equipped with mandatory filtration systems, coupled with stringent regulatory standards regarding drinking water safety, continue to propel market expansion across global regions.

Refrigerator Water Filters Market Executive Summary

The Refrigerator Water Filters Market is characterized by robust business trends focusing on innovation in filtration media, driven by consumer demand for contaminant-specific removal capabilities, such as PFOA/PFOS and pharmaceutical residues. Key industry players are increasingly investing in proprietary technologies that offer longer filter life, faster flow rates, and enhanced certification compliance, translating into higher perceived value for the consumer. The competitive landscape is also witnessing consolidation and strategic partnerships aimed at optimizing supply chains and combating the growing influx of aftermarket and counterfeit products, which pose both safety and revenue challenges to original equipment manufacturers (OEMs).

Regionally, North America and Europe maintain dominance, primarily due to high household penetration of high-end refrigerators and established consumer willingness to invest in water quality solutions. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid urbanization, increasing disposable incomes, and widespread concerns over local water quality standards in emerging economies like China and India. This regional shift mandates that global manufacturers adapt their distribution strategies to cater to diverse regulatory environments and consumer purchasing power variations.

Segment trends indicate a strong preference for activated carbon block filters due to their efficacy and cost-effectiveness. Furthermore, the segmentation by application shows that French Door and Side-by-Side refrigerators represent the largest and fastest-growing application segments, correlating directly with the premiumization of the appliance market. The rise of e-commerce platforms has significantly impacted the Distribution Channel segment, offering consumers unprecedented access to a wide variety of replacement filters, thereby accelerating the replacement cycle and driving overall market volume.

AI Impact Analysis on Refrigerator Water Filters Market

Analysis of common user questions reveals significant interest in how artificial intelligence (AI) can enhance the longevity, efficacy, and maintenance of refrigerator water filters. Users frequently inquire about personalized filter replacement schedules, the integration of smart sensors for real-time contaminant detection, and how AI can optimize the supply chain to ensure genuine product availability. Key concerns center on data privacy related to water usage patterns and the reliability of AI-driven diagnostics in detecting subtle changes in water quality. The overarching user expectation is that AI will transform the traditionally reactive filter replacement process into a proactive, preventative system, thereby maximizing consumer confidence and minimizing exposure to contaminants through timely alerts and automated ordering.

AI's influence is transforming product design and consumer interaction. Through machine learning algorithms processing usage data, manufacturers can accurately predict the remaining effective life of a filter based on specific household water chemistry and consumption rates, moving beyond simple volumetric measurements. This capability not only improves consumer satisfaction by preventing premature water quality degradation but also allows manufacturers to refine product design by understanding real-world performance characteristics. Furthermore, AI-powered diagnostic tools embedded within smart refrigerators can analyze sensor data to detect flow anomalies or sudden decreases in filtration efficiency, triggering maintenance notifications instantaneously and contributing significantly to the integrity of the dispensed water.

In the supply chain, AI is pivotal for optimizing inventory management, forecasting demand for specific filter models across different regions, and identifying potential bottlenecks. This optimization ensures that replacement filters are readily available through both OEM and retail channels, thereby supporting market growth by reducing friction in the replacement process. Moreover, AI-driven platforms can enhance customer service by providing sophisticated troubleshooting guides and personalized recommendations, ultimately reinforcing brand loyalty and streamlining the consumer experience in a highly fragmented aftermarket.

- AI enables predictive maintenance, calculating filter expiration based on actual water usage and quality data.

- Machine learning algorithms optimize supply chain logistics, ensuring genuine filter availability and reducing counterfeiting risks through tracking.

- Smart refrigerators utilizing AI integrate real-time sensors to monitor filtration performance and instantly alert users to contaminant breaches.

- AI-powered customer service chatbots provide specialized troubleshooting and filter compatibility guidance, enhancing post-sale support.

- Demand forecasting models, driven by AI, allow manufacturers to manage production cycles efficiently for various proprietary filter types globally.

- AI facilitates personalized filtration solutions, recommending specific filter types based on local municipal water reports and detected impurities.

- Automated replenishment systems using AI trigger filter orders when consumption metrics indicate near-end-of-life status.

DRO & Impact Forces Of Refrigerator Water Filters Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate growth trajectory and competitive intensity. Primary Drivers include the global proliferation of chronic waterborne diseases, heightened awareness regarding microplastics and pharmaceutical contaminants in drinking water, and the trend towards adopting higher-capacity, feature-rich refrigerators that mandate complex filtration systems. These factors create consistent, non-discretionary demand for replacement filters, sustaining the market volume.

Significant Restraints facing the market involve the high cost associated with certified, genuine OEM replacement filters, often leading consumers to seek cheaper, potentially unauthorized alternatives, which negatively impacts brand reputation and intellectual property. Furthermore, the complexity arising from numerous proprietary filter designs, which lack universal standardization, creates confusion for consumers and hinders market efficiency. The environmental impact associated with the disposal of plastic filter cartridges also acts as a restraint, prompting regulatory scrutiny and pushing manufacturers towards sustainable material development.

Opportunities for expansion are abundant, particularly in the realm of smart filtration technologies, including IoT-enabled filters that communicate usage data and performance metrics to consumers via mobile applications. The burgeoning adoption of reverse osmosis and advanced ultrafiltration technologies within refrigerator systems presents a high-value opportunity. Geographically, untapped potential lies in developing regions where increasing urbanization drives the need for reliable in-home water treatment solutions. Managing these forces effectively is crucial for sustained profitability and market leadership in the coming decade, prioritizing both innovation and supply chain integrity.

- Drivers: Growing consumer focus on health and wellness; deteriorating quality of municipal water supplies; increased sales of premium refrigerators (French door, side-by-side); effective marketing and awareness campaigns by filter manufacturers; ease of use and installation compared to external filtration systems.

- Restraints: High recurring cost of certified OEM replacement filters; prevalent circulation of uncertified counterfeit products affecting consumer trust and brand image; lack of industry standardization leading to proprietary complexity; environmental concerns related to non-biodegradable filter components.

- Opportunities: Integration of IoT and smart features for predictive maintenance and automated ordering; development of sustainable and biodegradable filter materials; expansion into fast-growing APAC and Latin American markets; technological advancements in filtration media for emerging contaminants (e.g., arsenic, PFOA/PFOS).

- Impact Forces: Consumer awareness acts as a strong positive influence, pushing demand; stringent governmental certifications (like NSF standards) elevate barriers to entry but assure quality; supply chain vulnerabilities stemming from geopolitical tensions can disrupt manufacturing and distribution schedules.

Segmentation Analysis

The Refrigerator Water Filters Market is comprehensively segmented based on several critical dimensions, including the type of filtration media used, the specific refrigerator application, the distribution channel utilized for sales, and the end-use sector. This segmentation is vital for manufacturers and distributors to tailor their product offerings, marketing strategies, and pricing models to address distinct consumer needs and market requirements. Understanding these granular segments allows for precise targeting of niche growth areas, such as high-performance filtration for specific contaminants or specialized filters designed for commercial-grade dispensing units.

The segmentation by Product Type, encompassing Activated Carbon, Sediment, and specialized Reverse Osmosis systems, directly influences product performance and pricing tiers. Activated carbon filters dominate due to their balanced efficacy against chlorine and VOCs coupled with reasonable cost. Application-based segmentation highlights the necessity of producing model-specific filters, reflecting the proprietary nature of modern refrigerator designs, making replacement compatibility a key determinant of consumer choice.

Furthermore, the Distribution Channel analysis reveals the ongoing shift towards online retail, which offers convenience and price transparency, contrasting with the traditional reliance on brick-and-mortar appliance stores and supermarkets. The End-Use segmentation confirms that the residential sector remains the largest consumer base, although the commercial segment, driven by food service and institutional applications, presents a steady demand for high-capacity, durable filtration solutions. Detailed analysis of these segments is crucial for strategic market positioning and achieving competitive advantage.

- Product Type: Activated Carbon Filters, Sediment Filters, Reverse Osmosis Filters, Others (e.g., Ultrafiltration, Ceramic).

- Application: Side-by-Side Refrigerators, French Door Refrigerators, Top/Bottom Freezer Refrigerators, Specialty Refrigeration Units.

- Distribution Channel: Online Retail (E-commerce platforms, Direct-to-Consumer), Offline Retail (Supermarkets & Hypermarkets, Appliance Specialty Stores, Home Improvement Stores).

- End-Use: Residential, Commercial (Offices, Restaurants, Hotels).

Value Chain Analysis For Refrigerator Water Filters Market

The value chain for the Refrigerator Water Filters Market begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized filtration media like coconut shell-based activated carbon, synthetic polymers for filter casings, and specialized resins. Key upstream players focus on achieving high porosity, adsorption capacity, and material purity. Efficient sourcing and quality control at this stage are paramount, as the performance of the final product is directly dependent on the quality of the raw filtration components. Strong relationships with material suppliers ensure cost optimization and consistency in production quality.

Midstream activities involve the design, molding, assembly, and rigorous testing of the filter cartridges. Manufacturers must adhere to strict regulatory standards (such as NSF/ANSI) through internal testing protocols. This stage also includes significant investment in proprietary molding techniques to ensure perfect compatibility with specific refrigerator models—a critical differentiation factor for OEMs. Efficient manufacturing processes, minimizing waste, and maximizing assembly automation contribute significantly to cost competitiveness and scalability across diverse product lines.

Downstream analysis focuses on distribution and sales channels, which are bifurcated into original equipment manufacturing (OEM) sales and the aftermarket segment. Direct and indirect distribution channels play crucial roles. Direct distribution includes sales through manufacturers' own websites and service networks, providing greater control over pricing and customer experience. Indirect channels, encompassing major retailers, e-commerce giants, and specialized plumbing distributors, rely on strong logistics and optimized inventory management. The downstream phase is heavily impacted by digital marketing, consumer education regarding replacement schedules, and efforts to combat the entry of counterfeit products, ensuring consumers purchase certified, genuine replacements.

Refrigerator Water Filters Market Potential Customers

The primary customer base for refrigerator water filters is segmented into residential end-users, who constitute the vast majority of the market, and commercial entities requiring consistent access to filtered water. Residential customers are typically homeowners possessing modern refrigerators with built-in dispensers, ranging from mid-tier to high-end models. These buyers are highly motivated by health concerns, the desire for improved taste, and the convenience of in-refrigerator dispensing, often prioritizing NSF certification and brand trust when selecting replacement filters.

Commercial end-users, while smaller in volume, represent a crucial high-capacity segment. This includes businesses such as hotels, corporate offices, healthcare facilities, and food service establishments (e.g., cafes, catering companies). For commercial applications, filter requirements often emphasize durability, high flow rates, and the ability to handle larger volumes of water processing, ensuring compliance with health regulations while supporting operational efficiency. Purchasing decisions in this segment are often centralized and based on long-term cost of ownership and reliability.

Furthermore, a growing segment of potential customers includes renters and apartment dwellers who purchase replacement filters for appliances provided in their residences, often seeking affordable yet certified alternatives. The market also sees indirect buyers, such as home improvement contractors, appliance repair services, and property management companies, who purchase filters in bulk for installation and maintenance purposes. Targeted marketing campaigns focusing on filter compatibility, cost-effectiveness, and health benefits are essential to capturing the spending power of these diverse customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 7.2 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Whirlpool Corporation, General Electric Company (GE), Culligan International Company, Samsung Electronics Co., Ltd., LG Electronics Inc., Kenmore (Sears), Pentair plc, Brita GmbH, A. O. Smith Corporation, Aquaphor, Paragon Water Systems, Inc., Waterdrop, FilterLogic, EveryDrop, IcePure, Tier1, K&J, Purity Pro, Glacier Fresh |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigerator Water Filters Market Key Technology Landscape

The technological landscape of the Refrigerator Water Filters Market is centered on enhancing media efficiency, ensuring safety compliance, and integrating smart connectivity features. Activated carbon technology remains the foundational element, with ongoing research focused on developing superior adsorption capabilities through ultra-fine carbon media and advanced binder materials. Innovations include incorporating catalytic carbon to remove specific chemical contaminants like chloramines, which are often resistant to standard carbon filtration. There is also a continuous drive toward miniaturization without compromising filtration capacity, allowing for sleeker, less intrusive filter designs within modern appliances.

A key technological shift involves the integration of advanced polymers and composite materials in the filter structure. Manufacturers are exploring layered filtration architectures combining sediment removal pre-filters with specialized media like ion exchange resins to target hardness and specific heavy metals such as lead and mercury more effectively. Furthermore, significant investment is being directed into testing and validation methodologies to comply with evolving global standards, ensuring filters meet requirements for the removal of emerging contaminants, including endocrine disruptors and microplastics, reflecting a preventative approach to water safety.

The most transformative technology involves smart filtration systems enabled by the Internet of Things (IoT). These systems utilize embedded sensors to monitor flow rates, pressure differentials, and, in advanced prototypes, even subtle chemical changes. This data is transmitted via Wi-Fi to proprietary applications, allowing refrigerators to manage their own maintenance schedules, alert users to impending filter replacement, and potentially communicate directly with retail platforms for automated replenishment. This connectivity not only maximizes filter performance but also significantly improves the consumer experience, reducing the likelihood of using an expired filter and improving water safety compliance.

- Activated Carbon Block Technology: Dominant technology utilizing compressed carbon powder for high contaminant removal efficiency and improved flow rates compared to Granular Activated Carbon (GAC).

- IoT Integration and Smart Sensors: Embedding electronic sensors and Wi-Fi modules within cartridges to track real-time usage, predict end-of-life accurately, and communicate maintenance alerts.

- Proprietary Media Blends: Utilization of specialized composite media combining activated carbon, ion exchange resins, and kinetic degradation fluxion (KDF) media for multi-stage filtration targeting a wider array of contaminants.

- Ultrafiltration (UF) and Reverse Osmosis (RO) Membranes: Increasing application of fine membranes within the refrigerator unit, offering superior removal of microbiological contaminants and total dissolved solids (TDS), particularly in high-end appliances.

- Sustainable Materials: Development of biodegradable plastics and recyclable casing materials to address environmental concerns associated with disposable cartridges.

- RFID and Authentication Chips: Integration of Radio Frequency Identification (RFID) or similar chips to verify the authenticity of OEM filters and prevent the use of unauthorized aftermarket substitutes, ensuring system integrity.

Regional Highlights

The global Refrigerator Water Filters Market exhibits distinct regional characteristics influenced by appliance penetration rates, consumer awareness regarding water quality, and local regulatory frameworks.

- North America: This region holds the largest market share, driven by high disposable incomes, widespread adoption of large, feature-rich refrigerators (particularly French door and side-by-side models), and stringent health standards necessitating certified filtration products. The U.S. market is highly mature and replacement cycles are generally consistent, supported by strong OEM and aftermarket distribution networks. Innovation in smart filtration and advanced contaminant removal (e.g., pharmaceuticals) often originates here.

- Europe: The market is characterized by diverse consumption patterns, with Western European countries exhibiting high adoption of filtration technology, largely due to taste preferences and concerns over chlorine and limescale. Germany, France, and the UK are key markets. The region is seeing a push towards sustainable filter materials, driven by rigorous EU environmental regulations and a strong consumer preference for eco-friendly products.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, significant infrastructure investment, and rising middle-class disposable income, leading to increased purchase of modern appliances. Countries like China and India face severe water quality challenges, making in-home filtration a necessity rather than a luxury. This market is highly sensitive to pricing, favoring cost-effective replacement options, and presents immense opportunities for both established global players and local manufacturers.

- Latin America: Growth is steady, primarily driven by increasing penetration of modern refrigerators and a general lack of confidence in municipal water quality across several major economies. Brazil and Mexico are pivotal markets. The focus here is often on robust filtration solutions capable of handling higher levels of sediment and bacteria.

- Middle East and Africa (MEA): The MEA market growth is concentrated in the Gulf Cooperation Council (GCC) countries, supported by high per capita spending and luxury appliance imports. Water scarcity and reliance on desalinated water often necessitate specialized filtration that can manage total dissolved solids (TDS) effectively. The African segment is nascent but offers long-term growth potential as economic development continues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerator Water Filters Market.- 3M

- Whirlpool Corporation

- General Electric Company (GE)

- Culligan International Company

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Kenmore (Sears)

- Pentair plc

- Brita GmbH

- A. O. Smith Corporation

- Aquaphor

- Paragon Water Systems, Inc.

- Waterdrop

- FilterLogic

- EveryDrop

- IcePure

- Tier1

- K&J

- Purity Pro

- Glacier Fresh

- Purwater Filtration

- EcoAqua

- CleverFilter

- iFilters

- Crystal Quest

- KleenWater

- Water Sentinel

- FreshFlow

- Universal Filters, Inc.

- Aquacrest

Frequently Asked Questions

Analyze common user questions about the Refrigerator Water Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for refrigerator water filters globally?

The primary driver is the rising consumer health consciousness, coupled with increasing concerns over the quality and safety of municipal tap water, leading to heightened demand for in-home water purification solutions integrated into modern refrigerators.

How often should a refrigerator water filter typically be replaced?

Most manufacturers recommend replacing refrigerator water filters every six months or after filtering approximately 300 gallons of water. However, replacement frequency can be influenced by local water quality and actual household water consumption rates.

What is the significance of NSF certification for these filters?

NSF International certification confirms that a water filter meets strict public health standards for contaminant reduction claims and material safety. Certification, such as NSF 42 (Aesthetic Effects) and NSF 53 (Health Effects), provides consumers with crucial assurance regarding the filter's performance and integrity.

Are universal replacement filters compatible with all refrigerator models?

No, most modern refrigerators use proprietary filter designs, often featuring specific locking mechanisms or unique connections. While aftermarket alternatives exist, compatibility must be strictly verified against the refrigerator's model number, as true universal compatibility is uncommon in this market segment.

What impact does the growth of e-commerce have on the water filter market?

E-commerce platforms significantly boost market accessibility, enabling consumers to easily compare prices, read reviews, and find replacements for a diverse range of models. This distribution shift accelerates the replacement cycle and fosters competitive pricing among third-party manufacturers.

How are manufacturers addressing the issue of counterfeit water filters?

Manufacturers combat counterfeiting primarily through consumer education campaigns, emphasizing the risks of uncertified products, and technologically, by integrating authentication measures such as RFID chips, unique serial numbers, and tamper-evident packaging on genuine OEM filters.

Which geographical region is experiencing the highest growth rate in this market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, substantial investment in modern appliance infrastructure, and escalating concerns over water purity in densely populated areas.

What role does activated carbon play in refrigerator water filtration?

Activated carbon is the primary medium used to adsorb contaminants. Its large surface area effectively captures and removes impurities, including chlorine, sediment, pesticides, and various volatile organic compounds (VOCs), significantly improving water taste and odor.

What are the key restraint factors limiting market growth?

Key constraints include the relatively high replacement cost of certified OEM filters, which drives consumers toward cheaper, unverified alternatives, and the complex challenge posed by proprietary design fragmentation across various refrigerator brands.

How is IoT technology being applied to refrigerator water filters?

IoT enables smart filtration systems that monitor water usage, track performance metrics via embedded sensors, and communicate this data to mobile apps, facilitating proactive maintenance alerts and automated filter replenishment services.

What segment dominates the market based on refrigerator application?

The Side-by-Side and French Door refrigerator segments collectively dominate the market share, corresponding to the strong global preference and high penetration rate of these premium appliance types equipped with built-in water and ice dispensing capabilities.

Are there any sustainable trends emerging in filter material development?

Yes, manufacturers are actively investing in sustainable practices, focusing on the development of biodegradable filter casings and utilizing higher percentages of renewable, coconut shell-based activated carbon to reduce the environmental footprint of disposable cartridges.

Why is standardization difficult in the refrigerator water filter industry?

Standardization is challenging because major refrigerator OEMs strategically utilize proprietary filter designs to ensure compatibility only with their models, creating a strong revenue stream in the aftermarket through exclusive filter sales.

What is the difference between NSF 42 and NSF 53 certifications?

NSF 42 certification addresses aesthetic properties, such as improving taste and odor and reducing chlorine. NSF 53 is a health effects certification, verifying the filter's ability to reduce contaminants with documented health risks, like lead, cysts, and certain chemicals.

How do smart filters help optimize water filter performance?

Smart filters leverage AI and real-time data from sensors to accurately measure contaminant load and flow rate, allowing the filter's remaining effective life to be calculated based on actual usage, ensuring maximum efficiency before replacement.

What type of filters are most effective against lead contamination?

Filters certified under NSF 53 are specifically tested for lead reduction. These usually involve highly effective activated carbon blocks combined with specialized ion exchange media designed to capture heavy metal ions like lead.

Is the commercial segment an important part of the filter market?

Yes, the commercial segment, including hospitality and food service, is crucial as it requires high-capacity, durable filtration units necessary for reliable operation and compliance with stringent public health regulations regarding dispensed water and ice quality.

What is the typical lifespan extension provided by a refrigerator water filter to the appliance?

While the primary function is water purification, the filter also removes sediment and mineral deposits that can clog the refrigerator's internal ice maker and water lines, thereby helping to protect components and potentially extending the appliance's functional lifespan.

How do manufacturers ensure filter compatibility with older refrigerator models?

Manufacturers often maintain production lines for legacy filter models for a defined period, and third-party aftermarket companies specialize in reverse-engineering and producing compatible replacements for a wide range of discontinued or older refrigerator brands and models.

What emerging contaminants are driving new filtration technology development?

New filtration technologies are being developed specifically to target emerging contaminants such as PFOA and PFOS (per- and polyfluoroalkyl substances), microplastics, and trace levels of pharmaceuticals and hormones found in municipal water sources globally.

Why is the supply chain particularly vulnerable in this market?

The supply chain is vulnerable due to reliance on specific raw material sourcing (like coconut shells for activated carbon) and the high global logistics costs associated with distributing proprietary plastic cartridges, often exacerbated by geopolitical trade tensions.

What is the main advantage of Reverse Osmosis (RO) filters in refrigerators?

RO filters offer the most comprehensive reduction of Total Dissolved Solids (TDS) and contaminants, providing water purity levels superior to standard carbon filters, though they are typically slower and require a separate holding tank within the appliance.

How does the quality of the raw carbon material affect filter performance?

The quality of the raw carbon, especially its surface area and uniformity of pore size, directly determines the filter's adsorption capacity and efficiency in removing trace contaminants, fundamentally impacting the overall efficacy and lifespan of the cartridge.

What role do retailers play in the market's distribution channel?

Offline retailers, including hypermarkets and specialty appliance stores, provide immediate access and allow consumers to visually verify the product before purchase, serving as essential channels for established brands and catering to immediate replacement needs.

How do filter replacement indicators typically function on refrigerators?

Most basic indicators operate based on volumetric flow, tracking the amount of water dispensed since the last replacement. More advanced, smart indicators utilize time-based tracking or, increasingly, sensor data to provide more accurate estimates of remaining filter life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager