Regional Low CTE Ceramic Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434572 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Regional Low CTE Ceramic Material Market Size

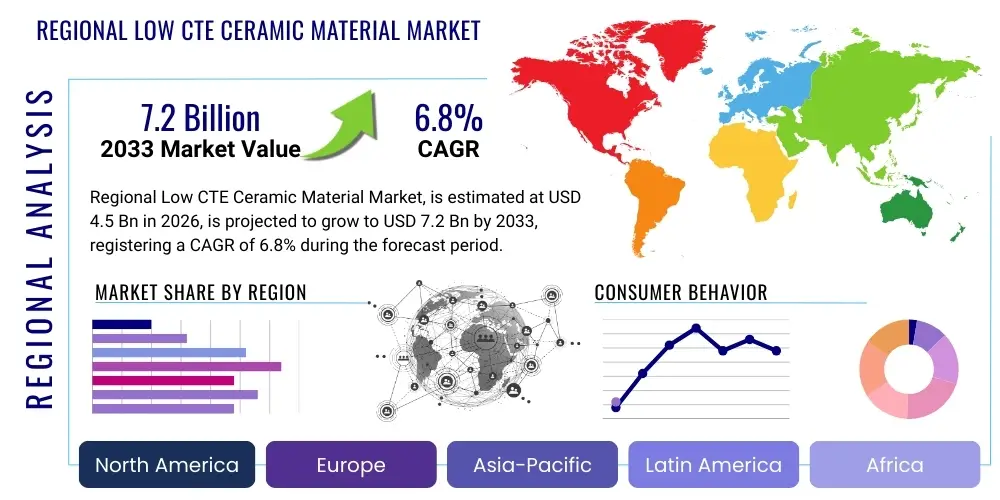

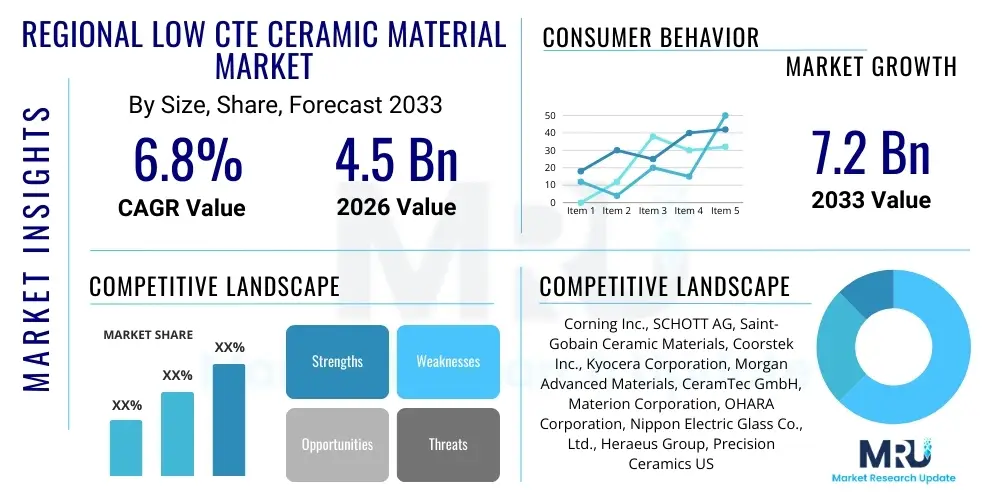

The Regional Low CTE Ceramic Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033.

Regional Low CTE Ceramic Material Market introduction

Low Coefficient of Thermal Expansion (CTE) ceramic materials represent a specialized, high-performance segment of advanced ceramics, essential for applications demanding extreme dimensional stability across significant temperature fluctuations. These materials are characterized by their ability to maintain near-constant dimensions when subjected to thermal cycling, preventing mechanical stress, distortion, and failure in sensitive systems. Key examples include materials based on lithium aluminum silicate (LAS), cordierite, and zirconium phosphate compounds, which are engineered specifically to minimize volume changes caused by temperature variations. The primary advantages of utilizing low CTE ceramics stem from their superior thermal shock resistance, excellent mechanical properties at high temperatures, and chemical inertness, making them irreplaceable components in high-precision and harsh operating environments.

The core applications driving the demand for Low CTE ceramic materials span several critical high-tech sectors. In the semiconductor industry, they are vital for components like wafer chucks, optical bench tooling, and precision alignment fixtures where nanometer-level accuracy is mandatory, even during intense thermal processing. Furthermore, the aerospace and defense sectors utilize these ceramics extensively for infrared domes, mirror substrates for advanced telescopes, and structural elements in propulsion systems where lightweight, high-temperature resistance and thermal stability are prerequisites for mission success. The proliferation of electric vehicles (EVs) and advanced battery systems also opens new avenues, particularly for thermal management substrates and insulating components requiring tight tolerances and high operational reliability.

The market is primarily driven by relentless technological advancements in high-performance electronics and the increasing complexity of optical systems that demand unprecedented levels of precision. As integrated circuits continue to shrink and laser systems become more powerful, the need for substrates and fixtures that do not expand or contract under load becomes paramount. Additionally, the tightening regulatory standards regarding energy efficiency and reduced emissions in industries like automotive and industrial machinery further promote the use of lightweight, durable, and thermally stable ceramic components, thereby sustaining robust growth for Low CTE materials regionally and globally. Continuous innovation in synthesis techniques, such as sol-gel processing and reaction bonding, is also expanding the accessibility and performance envelope of these specialized ceramics.

Regional Low CTE Ceramic Material Market Executive Summary

The Regional Low CTE Ceramic Material Market demonstrates strong resilience and significant growth potential, underpinned by structural shifts towards advanced manufacturing, miniaturization in electronics, and the rapid expansion of the space and defense industries. Key business trends indicate a strong focus on strategic mergers and acquisitions among major players aiming to consolidate proprietary material science patents and expand production capacities for high-purity compositions, such as Zerodur-like glasses and specialized silicon carbides. Furthermore, there is an observable trend toward customized material solutions, moving away from standardized products, as end-users in the optics and semiconductor industries require tailored CTE values and mechanical performance characteristics specific to their unique operational constraints. Supply chain optimization, particularly securing stable sources of high-purity raw materials (like alumina and silica), remains a critical operational challenge and a competitive differentiator.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, primarily fueled by massive investments in semiconductor fabrication plants (fabs) and the rapid scaling of indigenous aerospace programs in countries like China, South Korea, and Taiwan. North America and Europe, while representing mature markets, continue to lead in terms of technological innovation and high-value applications, particularly in advanced research optics, military hardware, and the development of next-generation satellite technology. These regions are characterized by stringent quality standards and a higher willingness to adopt premium, highly engineered low CTE ceramics. The shifting geopolitical landscape and subsequent emphasis on technological independence further accelerate regionalized manufacturing efforts, ensuring stable, localized supply chains for critical defense and semiconductor components.

Segment trends reveal that the cordierite segment maintains high volume consumption due to its cost-effectiveness in catalytic converters and industrial furnace furniture, while the specialized glass-ceramics and composites segments are experiencing the fastest value growth. This rapid growth is directly linked to their unparalleled performance in ultra-precision applications, particularly high-power lasers and lithography systems. Application-wise, the semiconductor and electronics segment dominates revenue generation, driven by the indispensable nature of low CTE materials in minimizing registration errors and maximizing throughput in complex fabrication processes. Material suppliers are increasingly investing in proprietary composite formulations that combine the thermal stability of ceramics with enhanced fracture toughness, addressing the historical brittleness constraints associated with traditional ceramic systems.

AI Impact Analysis on Regional Low CTE Ceramic Material Market

User queries regarding the impact of Artificial Intelligence (AI) on the Low CTE Ceramic Material Market predominantly revolve around three key themes: how AI enhances material discovery and optimization, how it improves manufacturing efficiency and quality control, and its role in increasing the demand for high-performance electronic substrates necessary for advanced AI hardware (e.g., specialized chips and accelerators). Users are concerned with the speed at which AI can simulate and predict optimal compositions to achieve specific, tailored low CTE targets, potentially disrupting traditional, time-consuming R&D cycles. Furthermore, significant interest lies in AI-driven process control within complex sintering and firing stages, where maintaining precise temperature gradients is crucial for achieving the desired microstructure and minimal thermal expansion coefficients, ensuring high yield rates for expensive, high-purity ceramic components.

- AI accelerates the discovery of novel Low CTE material compositions through predictive modeling and simulation, reducing R&D timelines.

- Machine learning algorithms optimize complex sintering profiles and thermal processing parameters, ensuring minimal internal stresses and achieving target CTE values consistently.

- AI-enhanced visual inspection systems provide superior quality control, detecting micro-cracks and structural defects in ceramic components with unprecedented accuracy.

- Increased global deployment of AI infrastructure (data centers, edge computing) drives demand for thermally stable ceramic substrates used in high-power semiconductor packaging.

- Predictive maintenance schedules for ceramic manufacturing equipment, powered by AI, minimize downtime and maximize the operational efficiency of kilns and processing machinery.

DRO & Impact Forces Of Regional Low CTE Ceramic Material Market

The Low CTE Ceramic Material Market is fundamentally shaped by a complex interplay of strong technological drivers, significant inherent material limitations, and burgeoning application opportunities. Key market drivers include the irreversible trend towards miniaturization in microelectronics, which demands dimensional stability at increasingly smaller scales, and escalating defense budgets globally, fueling demand for high-performance thermal management and optical components in surveillance and weapon systems. Conversely, the market is severely restrained by the high manufacturing costs associated with achieving ultra-purity and precise microstructure control during synthesis, coupled with the intrinsic brittleness and difficulty in machining these ultra-hard materials, often resulting in high scrap rates. Opportunities are vast, particularly in leveraging the transition to 5G/6G communication infrastructure and the exponential growth in space-based technology, both requiring lightweight, radiation-resistant, and thermally inert structural elements.

The primary driving force is the imperative for precision across high-tech industries. Whether in deep-space telescopes or advanced semiconductor lithography equipment, performance hinges on maintaining nanoscale tolerances, a requirement that conventional metals or polymers cannot meet. This necessity for absolute dimensional stability elevates low CTE ceramics from a choice to a requirement, effectively insulating the market from substitution threats in high-end applications. The continuous innovation cycle within the semiconductor industry, specifically the adoption of Extreme Ultraviolet (EUV) lithography, relies heavily on specialized low CTE glass-ceramics (like Zerodur) for massive mirror structures, securing a long-term demand curve.

Impact forces on this market are characterized by technological intensity and regulatory pressures. The high barrier to entry for new competitors is maintained by the necessity for specialized intellectual property and capital-intensive manufacturing facilities. Furthermore, stringent quality and certification requirements in aerospace and medical device applications act as a significant stabilizing force, ensuring that only established, highly reliable suppliers can participate. The volatility of raw material prices (such as Li, Al, and high-purity SiC powders) occasionally influences production margins, although end-users are often willing to absorb these costs due to the critical nature of the final component's performance.

Segmentation Analysis

The Regional Low CTE Ceramic Material Market is segmented based on Material Type, Application, and End-User Industry, reflecting the diverse and specialized requirements across its consuming sectors. This structural breakdown helps in understanding the varying growth trajectories and value pools within the market. Material classification is crucial, distinguishing high-volume, cost-effective options like Cordierite from ultra-high-performance, low-volume materials such as Glass-Ceramics (e.g., Zerodur and ULE) and specialized Composites (e.g., Silicon Carbide matrices). The distinction between these material classes directly correlates with their target applications, impacting pricing and technological complexity. Understanding the distribution across these segments provides strategic insights into where technological investment and market penetration efforts should be focused to maximize return on investment.

Application segmentation reveals the dominance of precision engineering requirements. Semiconductor processing equipment requires materials with the tightest CTE control for alignment fixtures and chucks, representing the highest value segment. Optical systems, ranging from terrestrial observatories to space-based telescopes, rely heavily on low CTE ceramics for mirror substrates to maintain wavefront accuracy regardless of temperature changes. Conversely, the automotive segment primarily utilizes Cordierite for diesel particulate filters (DPFs) and catalytic substrates, driven more by volume and thermal shock resistance than by ultra-low CTE requirements, though the growing EV segment demands high-reliability thermal management substrates.

From an end-user perspective, the market is highly centralized among key industries. The Electronics and Semiconductor industry is the single largest consumer due to the continuous cycle of technology upgrades and the foundational role of these materials in advanced manufacturing. The Aerospace and Defense sector acts as a stable, high-value customer base, prioritizing performance and reliability over cost. Emerging sectors like advanced energy storage (solid-state batteries) and specialized medical instrumentation are poised for rapid growth, driving demand for novel material formulations that offer thermal stability combined with specific electrical or biochemical properties, diversifying the market's risk profile away from dependence solely on microelectronics.

- Material Type:

- Glass-Ceramics (e.g., Zerodur, ULE)

- Cordierite (Magnesium Aluminum Silicate)

- Lithium Aluminum Silicate (LAS)

- Specialized Composites (e.g., SiC reinforced)

- Other Ceramics (e.g., Zirconium Phosphate)

- Application:

- Optical Systems (Mirror Substrates, Domes)

- Semiconductor Processing Equipment (Wafer Chucks, Fixtures)

- Thermal Management Substrates

- Aerospace Structural Components

- Catalytic Converters and Filters

- End-User Industry:

- Electronics and Semiconductor

- Aerospace and Defense

- Automotive (Including EV Thermal Management)

- Industrial and Furnace Applications

- Medical and Scientific Instrumentation

Value Chain Analysis For Regional Low CTE Ceramic Material Market

The value chain for Low CTE Ceramic Materials is highly specialized, beginning with the procurement of ultra-high-purity raw materials, often sourced globally due to scarcity and quality requirements. Upstream activities involve specialized mineral processing of elements such as lithium, aluminum, silicon, and magnesium, transforming them into specific precursor powders. The quality and homogeneity of these precursor materials are paramount, directly dictating the final CTE characteristics of the finished product. Key upstream challenges include maintaining consistent purity levels (often 99.99% or higher) and managing the volatility of rare earth or specialized mineral commodity prices. Only a few specialized chemical processing firms globally possess the necessary capabilities to supply these niche, high-specification ceramic precursors, creating a bottleneck in the initial stages of the chain.

The midstream processing stage, which involves material synthesis (e.g., solid-state reaction, sol-gel, hot pressing, and precision sintering), represents the highest value addition point. Manufacturers must employ complex, proprietary firing schedules and atmospheric control systems to manage microstructural development, which is critical for minimizing thermal expansion. This stage demands extensive capital investment in highly specialized kilns and precision measurement tools. Distribution channels are typically dual: direct sales are essential for highly customized, high-value components (like satellite mirror blanks) where deep technical consultation between the manufacturer and the end-user is required. Indirect channels, involving specialized technical distributors or sales agents, handle lower-volume, standardized components, particularly those targeting general industrial or smaller electronic assembly houses.

Downstream analysis focuses on integration and final use within demanding applications. End-users in the semiconductor and aerospace sectors require rigorous qualification and testing, involving long lead times and adherence to stringent industry standards (e.g., ITAR compliance for defense applications). The final customer often integrates the Low CTE ceramic component into a larger, complex system, such as a photolithography machine or a guidance system. Successful market penetration relies not just on material performance but also on the manufacturer's ability to provide precise finishing, including ultra-smooth polishing (nanometer roughness) and complex geometry machining, which often requires advanced five-axis diamond grinding equipment, further complicating the downstream processing and enhancing the final product's value.

Regional Low CTE Ceramic Material Market Potential Customers

Potential customers for Low CTE ceramic materials are predominantly organizations operating at the extreme edge of precision, thermal endurance, and high reliability, where component failure due to thermal stress is catastrophic. The primary buyers are large multinational corporations within the electronics sector, specifically Original Equipment Manufacturers (OEMs) of semiconductor fabrication equipment (e.g., ASML, Applied Materials, Lam Research) who purchase components like alignment stages, electrostatic chucks (E-chucks), and thermal processing boat supports. These buyers prioritize dimensional stability and high purity above all else, often entering into long-term strategic supply agreements to ensure material availability and quality consistency for their critical machinery, where uptime and yield directly translate to billions in revenue.

The second major cohort of potential customers consists of government agencies and prime contractors within the Aerospace and Defense industries (e.g., Lockheed Martin, Boeing Defense, NASA, ESA). These organizations purchase specialized Low CTE ceramics for satellite components, missile guidance systems, infrared optical systems, and high-energy laser mirror mounts. Their procurement decisions are heavily influenced by military specifications, reliability under extreme environmental conditions (vacuum, radiation exposure), and often, domestic sourcing requirements due to security concerns. The procurement cycles here are long, characterized by intense prototyping, testing, and multi-year production commitments once a material is qualified.

Furthermore, specialized industrial machinery manufacturers and advanced scientific research institutions constitute a growing customer base. This includes companies producing high-power industrial lasers, specialized measurement systems, and advanced medical imaging devices (MRI components, high-throughput diagnostic equipment). For these customers, the unique combination of stiffness, low density, and unparalleled thermal stability offered by Low CTE ceramics allows them to push the boundaries of achievable accuracy and performance in their respective fields. The decision-makers in these organizations are typically highly specialized material scientists and design engineers seeking customized solutions rather than off-the-shelf components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., SCHOTT AG, Saint-Gobain Ceramic Materials, Coorstek Inc., Kyocera Corporation, Morgan Advanced Materials, CeramTec GmbH, Materion Corporation, OHARA Corporation, Nippon Electric Glass Co., Ltd., Heraeus Group, Precision Ceramics USA, II-VI Incorporated (Coherent Corp.), Goodfellow Corporation, Zibo Xinghe Ceramic Materials Co., Ltd., Marubeni Corporation, Rauschert GmbH, Blasch Precision Ceramics, 3M Company, Li-Fron Ceramics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Regional Low CTE Ceramic Material Market Key Technology Landscape

The technology landscape governing the Low CTE Ceramic Market is highly sophisticated, focusing primarily on achieving near-zero thermal expansion while enhancing mechanical stability and process repeatability. A foundational technology involves the precise formulation and control of crystalline phases within a glassy matrix, exemplified by the manufacturing of glass-ceramics like Zerodur or Clearceram. These materials rely on controlled nucleation and crystallization processes, often utilizing specific dopants (nucleating agents like TiO2 or ZrO2) during high-temperature annealing. The resulting microstructure contains interspersed crystalline phases with negative CTE (e.g., beta-quartz solid solutions) balancing the positive CTE of the residual glass, leading to a bulk material with a net near-zero expansion coefficient over a targeted temperature range. Advances in furnace technology, including highly uniform temperature distribution systems, are critical enablers for producing large, homogeneous blanks required for high-precision optics.

Beyond glass-ceramics, advanced processing techniques for composite ceramics represent a significant technological frontier. Reaction-bonded Silicon Carbide (RB-SiC) and chemically vapor deposited (CVD) SiC, though not intrinsically low CTE, are engineered for thermal stability through optimized density and microstructure control, offering superior stiffness and thermal diffusivity compared to traditional ceramics. For instance, techniques like the incorporation of secondary phases or the creation of porous structures allow engineers to tailor the effective CTE. Furthermore, the development of precision machining and polishing technologies, such as Computer Numerically Controlled (CNC) diamond grinding and Magnetorheological Finishing (MRF), are indispensable technologies downstream. Since the ceramic’s performance is only as good as its surface finish and dimensional accuracy, innovations in non-contact metrology and ultra-precision grinding are essential components of the market’s technological competitiveness.

Looking forward, additive manufacturing (3D printing) technologies, specifically those tailored for high-temperature ceramic slurries (e.g., Stereolithography (SLA) or Binder Jetting), are emerging as disruptive forces. These techniques offer the potential to create complex, lightweight structures with integrated functionalities (e.g., internal cooling channels) that are impossible to achieve via traditional subtractive methods. While still nascent for ultra-precision, near-zero CTE applications, the ability to rapidly prototype customized components and potentially reduce material waste by building near-net shapes is driving significant R&D investment. Additionally, advanced in-situ monitoring using thermal cameras and acoustic emission sensors during the sintering process is being integrated to ensure real-time quality assurance and immediate process correction, thereby improving yield rates for highly valuable components.

Regional Highlights

The global consumption and production landscape for Low CTE Ceramic Materials is highly regionalized, driven by localized concentrations of high-tech manufacturing, particularly in the semiconductor and aerospace sectors. Asia Pacific (APAC) currently dominates the market in terms of volume and is rapidly approaching parity in terms of value, primarily due to the concentration of major semiconductor manufacturing powerhouses (Taiwan, South Korea, China). The massive investment in new fabrication plants and the expansion of domestic supply chains in mainland China are major contributors to regional growth, focused on both high-volume Cordierite for automotive filters and sophisticated glass-ceramics for lithography components. Furthermore, India and Japan are expanding their optical and defense manufacturing capabilities, sustaining high demand for precision Low CTE components.

North America remains a crucial market, distinguished by its concentration of key aerospace contractors and advanced scientific research facilities (e.g., major observatories, laser laboratories). This region exhibits high demand for extremely specialized, high-cost materials, prioritizing performance and long-term reliability for critical national security and space exploration missions. Strong government funding for defense programs and the dominance of key players in the specialty glass and ceramics sectors ensure continuous material innovation and high-value component manufacturing within the region. The proximity of R&D facilities to end-users (like silicon valley firms) fosters rapid customization and deployment of new material solutions.

Europe, driven by nations such as Germany, France, and the UK, maintains a strong position, particularly in precision industrial machinery, high-end automotive (luxury and performance sectors adopting advanced thermal management), and optics manufacturing. European firms are often leaders in synthesizing proprietary glass-ceramic formulations and advanced composite structures. The European Union's focus on maintaining technological superiority in aerospace (Airbus/ESA) and high-precision machinery (Zeiss, ASML operations in the Netherlands) ensures a sustained, high-quality demand base for zero-expansion materials. However, the region faces increasing competition from lower-cost Asian manufacturing in the mid-range industrial applications.

- North America: Leads in value-driven segments (Aerospace, Defense, Advanced Research Optics); characterized by stringent quality standards and rapid R&D integration.

- Asia Pacific (APAC): Highest volume market; driven by massive investments in semiconductor fabrication, EV thermal management, and domestic electronics manufacturing expansion.

- Europe: Strong presence in proprietary glass-ceramics, high-precision industrial tooling, and sophisticated automotive applications (DPF substrates and EV heat shields).

- Latin America (LATAM): Emerging market, primarily reliant on imports for specialized components; growth linked to expanding industrial furnace operations and limited telecommunications infrastructure development.

- Middle East and Africa (MEA): Limited high-tech manufacturing base; demand is concentrated in defense procurement for specialized sensor windows and oil/gas industry high-temperature equipment maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Regional Low CTE Ceramic Material Market.- Corning Inc.

- SCHOTT AG

- Saint-Gobain Ceramic Materials

- Coorstek Inc.

- Kyocera Corporation

- Morgan Advanced Materials

- CeramTec GmbH

- Materion Corporation

- OHARA Corporation

- Nippon Electric Glass Co., Ltd.

- Heraeus Group

- Precision Ceramics USA

- II-VI Incorporated (Coherent Corp.)

- Goodfellow Corporation

- Zibo Xinghe Ceramic Materials Co., Ltd.

- Marubeni Corporation

- Rauschert GmbH

- Blasch Precision Ceramics

- 3M Company

Frequently Asked Questions

Analyze common user questions about the Regional Low CTE Ceramic Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Low CTE Ceramic Materials?

Low CTE ceramic materials are predominantly utilized in high-precision applications requiring extreme dimensional stability, including semiconductor manufacturing equipment (wafer chucks and fixtures), mirror substrates for advanced optical and space telescopes, and structural components in aerospace and defense systems subjected to severe thermal cycling.

Which material type within the Low CTE ceramics segment is experiencing the fastest growth?

The specialized Glass-Ceramics segment, particularly those used in ultra-precision optical systems and semiconductor lithography, is experiencing the fastest value growth due to their ability to achieve near-zero thermal expansion and meet the stringent accuracy requirements of next-generation manufacturing processes.

How does the high cost of Low CTE ceramic manufacturing affect market adoption?

The high cost, resulting from complex processing, high-purity raw material requirements, and specialized machining needs, restricts Low CTE ceramics primarily to mission-critical, high-value applications where performance requirements outweigh cost constraints, such as in aerospace, defense, and high-end electronics production.

What is the role of Cordierite in the Low CTE Ceramic Material Market?

Cordierite is a crucial high-volume segment, valued for its cost-effectiveness and excellent thermal shock resistance, primarily utilized in catalytic converters (DPFs) and industrial furnace applications rather than ultra-precision electronics, offering a lower-cost, performance-stable solution for intermediate temperature environments.

How does the APAC region influence the global Low CTE Ceramic Market?

APAC is the dominant regional consumer, driven by extensive investments in semiconductor fabrication and the expansion of consumer electronics manufacturing. This region dictates volume demand and is rapidly increasing its influence on specialized material supply chains through localized production and technological self-sufficiency efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager