Remote Flow System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437183 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Remote Flow System Market Size

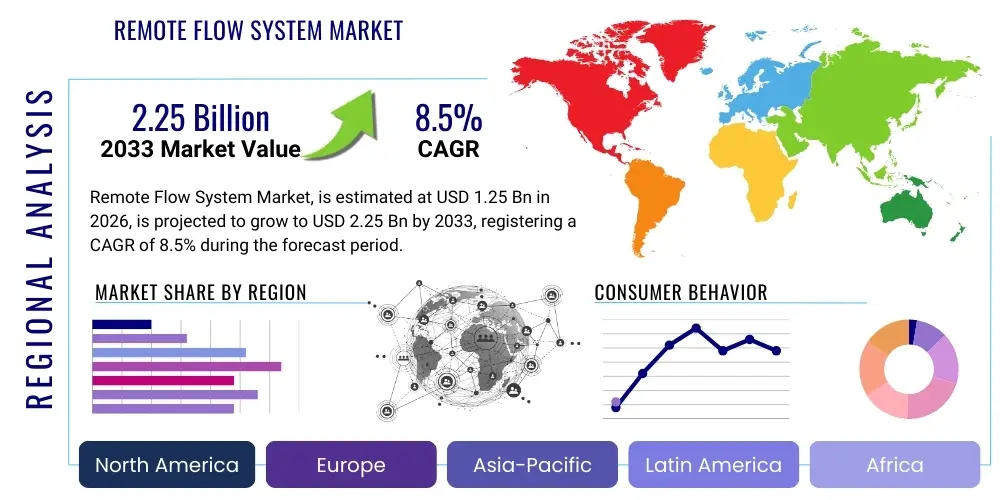

The Remote Flow System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.25 Billion by the end of the forecast period in 2033.

Remote Flow System Market introduction

The Remote Flow System Market encompasses sophisticated technologies designed for the non-contact, continuous, and precise measurement and monitoring of fluid (liquid or gas) flow rates across geographically dispersed industrial assets. These systems integrate various components, including advanced flow sensors, robust data acquisition modules, wireless communication protocols (such as cellular, satellite, or proprietary mesh networks), and centralized software platforms for data visualization and analysis. The primary applications span crucial infrastructure sectors, including oil and gas pipeline monitoring, water distribution networks, wastewater treatment facilities, chemical processing plants, and power generation utilities where timely and accurate flow data is critical for operational efficiency, regulatory compliance, and safety management. Remote flow systems offer significant benefits, such as reduced need for manual field inspections, enhanced asset utilization, early detection of leaks or anomalies, and optimized resource allocation, driving their rapid adoption across global industries.

Product descriptions typically involve robust instrumentation capable of operating in harsh environments, often incorporating technologies like ultrasonic, electromagnetic, Coriolis, or differential pressure sensing principles, paired with low-power wireless transmitters. The key driving factors for market expansion include the global focus on industrial automation (Industry 4.0), the increasing requirement for real-time data visibility in critical infrastructure, and the necessity to manage sprawling, aging pipeline infrastructure efficiently. Furthermore, regulatory mandates concerning environmental protection and water accountability necessitate advanced monitoring tools, propelling the demand for highly reliable remote flow measurement solutions. These systems provide operational intelligence, transforming raw flow data into actionable insights for predictive maintenance and process optimization, making them indispensable for modern industrial operations.

Major applications revolve around ensuring process integrity and quantifying throughput. In the oil and gas sector, remote flow systems are essential for measuring well production, monitoring custody transfer points, and detecting unauthorized taps or leaks across vast pipeline networks. For water utilities, these systems facilitate leakage reduction programs, manage reservoir levels, and optimize pump scheduling, directly contributing to resource conservation. The combination of high-precision sensing and advanced connectivity addresses the core industry challenge of minimizing non-revenue water (NRW) loss and maximizing hydrocarbon recovery rates, solidifying the market’s growth trajectory and fundamental importance in maintaining critical utility infrastructure reliability.

Remote Flow System Market Executive Summary

The Remote Flow System Market is experiencing robust expansion, driven primarily by compelling business trends focused on digital transformation and operational resilience across key industrial sectors. A major business trend involves the integration of cloud-based Supervisory Control and Data Acquisition (SCADA) systems and Industrial Internet of Things (IIoT) platforms, allowing for scalable, centralized data management from thousands of remote flow sensors. This shift is lowering the total cost of ownership (TCO) compared to traditional wired systems and enabling smaller utilities and mid-sized operators to adopt advanced monitoring capabilities. Furthermore, market innovation is centered on developing ultra-low power consumption sensors and optimizing communication protocols (like LoRaWAN and Narrowband IoT) to extend battery life in isolated locations, addressing a critical operational restraint associated with remote deployment.

Regionally, North America and Europe currently dominate the market share, attributed to stringent regulatory frameworks governing leak detection, mature infrastructure demanding continuous monitoring upgrades, and high levels of investment in smart city initiatives and digitalization projects. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This accelerated growth is fueled by rapid industrialization, massive investments in new pipeline and water infrastructure development, and governmental initiatives in countries like China and India to improve resource management efficiency and environmental oversight. The Middle East and Africa (MEA) are also showing promising growth, specifically within the oil and gas sector, driven by necessity to monitor vast desert pipeline networks and enhance operational security.

Segment trends indicate strong growth in the Software and Services segments, outpacing the traditional Hardware segment growth. Within components, the demand for sophisticated analytical software leveraging machine learning algorithms for predictive anomaly detection is particularly high. By end-user, the Water and Wastewater Management segment is witnessing a significant surge, primarily due to global pressure to address water scarcity and reduce non-revenue water. Technology-wise, ultrasonic and magnetic flow meters equipped with wireless capabilities are gaining preference over older mechanical meters due to their accuracy, minimal maintenance requirements, and capability for bidirectional flow measurement, aligning perfectly with the prerequisites of modern remote monitoring applications.

AI Impact Analysis on Remote Flow System Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the Remote Flow System Market primarily center around its potential to transition operational paradigms from reactive to predictive maintenance, optimizing data processing efficiency, and enhancing decision-making accuracy. Common questions explore how AI algorithms can handle the massive influx of data generated by thousands of distributed sensors, specifically focusing on its ability to identify subtle patterns indicative of impending equipment failure, system anomalies, or potential security breaches that human analysts might overlook. Users are also keenly interested in the scalability of AI solutions, asking whether machine learning models can be effectively deployed on edge devices for rapid, localized data processing, thus minimizing communication latency and bandwidth requirements. The prevailing expectation is that AI will dramatically reduce operational expenditure (OpEx) by minimizing false alarms, streamlining maintenance schedules, and maximizing the operational uptime of critical flow infrastructure, fundamentally changing how flow data translates into operational value.

The integration of AI into remote flow systems shifts the focus beyond mere measurement towards sophisticated, automated interpretation. AI models, particularly deep learning networks, are utilized to correlate real-time flow data with historical operational parameters, meteorological data, pressure readings, and vibration signals from other associated equipment. This holistic analysis allows the system to establish a highly granular baseline of "normal" behavior. Any deviation from this baseline is immediately flagged, providing early warnings about conditions such as pipe scaling, sensor drift, pump degradation impacting flow consistency, or transient flow events that could indicate a catastrophic failure risk. This capability significantly elevates the reliability and trustworthiness of remote flow data, making it a foundation for autonomous decision-making loops in utility and industrial processes.

Furthermore, AI plays a crucial role in optimizing the communication and energy consumption profile of remote flow devices. By intelligently analyzing data transmission needs and prioritizing critical alerts, AI algorithms can manage sensor duty cycles and data logging frequencies, prolonging the battery life of devices deployed in extremely remote or inaccessible locations. This energy optimization is vital for enhancing system longevity and reducing the high cost and logistical complexity associated with replacing power sources in widespread infrastructure. The impact of AI is transforming remote flow systems from simple data providers into self-aware, intelligent monitoring platforms capable of driving significant improvements in resource utilization, pipeline integrity management, and overall operational safety.

- AI enables predictive maintenance by analyzing flow patterns to detect early signs of sensor fouling or pump failure.

- Machine Learning (ML) algorithms filter out data noise and minimize false alarms, significantly improving operational team efficiency.

- Edge AI deployment allows for real-time anomaly detection at the sensor level, reducing latency and bandwidth usage.

- AI optimizes data transmission schedules to conserve battery life in remote, power-constrained environments (AEO/GEO optimization).

- Enhanced leak detection and localization accuracy through complex pattern recognition across multiple correlated data points (flow, pressure, temperature).

- Automated calibration and drift correction of flow meters using self-learning models, maintaining long-term measurement integrity.

DRO & Impact Forces Of Remote Flow System Market

The Remote Flow System Market is shaped by a powerful combination of Drivers, Restraints, Opportunities, and underlying Impact Forces that dictate its evolution and adoption rates across different industries and geographies. Key drivers include the global push towards smart infrastructure development, the imperative for operational efficiency improvements through digitalization (Industry 4.0), and the growing necessity for precise environmental monitoring and resource accountability, particularly for water and oil resources. Simultaneously, the market faces significant restraints, such as the high initial investment required for deploying extensive wireless sensor networks, compatibility issues between legacy systems and new IIoT protocols, and ongoing concerns regarding data security and communication network reliability in isolated areas. These countervailing forces establish a dynamic market environment where technological advancement directly addresses logistical and financial barriers to unlock significant future potential.

Opportunities for growth are abundant, centering on technological convergence and emerging geographic demands. The development of highly standardized, secure, and interoperable IIoT platforms presents an opportunity to simplify deployment and integration, broadening the addressable market to smaller municipal utilities. Furthermore, the rising adoption of specialized technologies such as Non-Intrusive Inspection (NII) flow meters combined with remote telemetry units (RTUs) minimizes disruption during installation, a major factor favoring deployment in existing, high-pressure infrastructure. Another major opportunity lies in leveraging edge computing capabilities to preprocess massive datasets locally, which not only enhances speed but also aligns with increasing regional data sovereignty regulations. The increasing global focus on reducing methane emissions and water losses acts as a strong, sustained opportunity for market expansion.

The core impact forces shaping this market are technological, economic, and regulatory in nature. Technologically, the relentless improvement in sensor accuracy, miniaturization, and low-power wireless communication standards (e.g., 5G, LoRaWAN) significantly drives down costs and increases reliability, making remote deployment more viable than ever before. Economically, the proven Return on Investment (ROI) derived from early leak detection and optimized resource consumption provides a compelling business case for adoption, especially as the cost of energy and raw materials continues to fluctuate globally. Regulatory forces, such as mandates for stricter pipeline integrity management and governmental targets for Non-Revenue Water (NRW) reduction, compel industries and municipalities to invest in advanced, remote monitoring solutions, ensuring consistent market demand irrespective of short-term economic variations.

Segmentation Analysis

The Remote Flow System Market is comprehensively segmented based on its fundamental components, the technology utilized for measurement, the type of flow being monitored, and the specific industrial application or end-user utilizing the system. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and specific technological preference. The primary segments, including Hardware, Software, and Services, reflect the increasing shift towards integrated solutions where data management and analysis capabilities (Software and Services) are becoming as crucial as the physical sensor hardware. Understanding these divisions is essential for vendors to tailor their offerings—whether they focus on developing highly robust, long-lasting physical meters, providing sophisticated cloud-based analytics, or delivering specialized installation and maintenance services critical for ensuring system reliability over expansive territories.

Segmentation by end-user illustrates the primary drivers of demand, with the Oil & Gas sector being historically dominant due to its extensive pipeline networks and high-value product transport, followed closely by the Water & Wastewater Management sector, which is increasingly focused on smart utility management. The segmentation by technology is indicative of ongoing innovation, showing a clear preference shift towards non-contact methods (Ultrasonic, Magnetic, Coriolis) that offer superior accuracy and lower maintenance compared to traditional mechanical or differential pressure methods. Geographically, the market is dissected into major regions, allowing companies to align their strategic investments with regional economic growth and regulatory requirements, such as focusing on infrastructure modernization in North America or rapid utility expansion in the Asia Pacific region.

- By Component:

- Hardware (Sensors, Transmitters, Data Loggers, RTUs)

- Software (Cloud-based Platforms, SCADA Integration, Data Analytics)

- Services (Installation, Calibration, Maintenance, Consulting)

- By Technology:

- Ultrasonic Flow Meters

- Coriolis Flow Meters

- Differential Pressure Flow Meters

- Magnetic Flow Meters

- Turbine/Mechanical Flow Meters

- By End-User:

- Oil & Gas

- Water & Wastewater Management

- Chemicals and Petrochemicals

- Power Generation (Thermal, Hydroelectric)

- Pharmaceuticals and Biotechnology

- Food & Beverage

- By Flow Type:

- Liquid Flow

- Gas Flow

- Multiphase Flow

Value Chain Analysis For Remote Flow System Market

The Value Chain for the Remote Flow System Market commences with the Upstream activities centered on the design, material sourcing, and manufacturing of core components. This stage involves the procurement of highly sensitive sensor materials, microprocessors for data processing, advanced battery technology for power autonomy, and robust enclosures capable of surviving harsh industrial and environmental conditions. Key upstream players include specialized component manufacturers, semiconductor fabricators, and specialized firmware developers. Efficiency and quality control at this stage are paramount, as the reliability and accuracy of the entire remote system depend on the integrity of the base hardware and embedded electronics. Innovations in low-power electronics and robust material science directly influence the competitiveness and longevity of the final product deployed remotely.

Moving into the Midstream and Downstream phases, the value chain involves the system assembly, integration, software development, distribution, and end-user implementation. System integrators combine the hardware components (sensors and RTUs) with communication modules and proprietary operating software, ensuring seamless data flow from the field to the centralized monitoring platform. The distribution channel is often complex, involving direct sales teams for major industrial accounts (Oil & Gas, large utilities) and indirect channels utilizing third-party distributors, system integrators, and value-added resellers (VARs) who provide localized support and expertise. Direct sales emphasize strong long-term relationships and high-level customization, crucial for complex infrastructure projects. Indirect channels ensure broader market penetration, particularly in fragmented markets like municipal water management or small industrial facilities.

The final crucial stage involves Post-Sale Services, which significantly contribute to the market's recurring revenue stream. This includes installation support, commissioning, ongoing calibration services (often required by regulation), predictive maintenance, and software updates, particularly for cloud-based platforms. The increasing reliance on subscription-based software models (SaaS) and managed service contracts highlights the growing importance of the downstream segment. Potential Customers are heavily reliant on the quality of these services to maintain the integrity and compliance of their remote assets. The value chain is constantly being optimized to reduce latency between data generation and actionable insight, emphasizing secure and reliable communication links (often provided by third-party telecommunication providers) that bridge the physical measurement point and the digital control center.

Remote Flow System Market Potential Customers

The potential customer base for the Remote Flow System Market is inherently diverse, spanning multiple critical infrastructure sectors that require meticulous measurement and integrity management of fluid transport and process flows. The primary segment comprises large-scale industrial operators and governmental entities responsible for vast, geographically spread assets. End-users/buyers are typically categorized based on their core operations: heavy process industries managing high-value or hazardous materials (Oil & Gas, Chemicals), and utility providers focusing on public service delivery (Water, Power). These customers seek remote flow solutions to achieve three main objectives: ensure compliance with environmental and safety regulations, minimize operational losses (e.g., product leakage, non-revenue water), and optimize energy consumption associated with fluid movement (pumping and compression).

Within the Oil & Gas sector, potential customers include national oil companies (NOCs), independent exploration and production (E&P) firms, and midstream pipeline operators. These entities purchase remote flow systems for wellhead monitoring, custody transfer points, and ensuring pipeline integrity across thousands of miles of often inaccessible terrain. For Water and Wastewater Management, the customers are municipal water authorities, private water concessionaires, and regional water boards who are focused on establishing District Metered Areas (DMAs) to precisely measure water consumption, rapidly locate leaks, and manage infrastructure assets under intense scrutiny regarding water accountability. The high cost of human intervention in remote locations makes the automation provided by these systems economically indispensable for large-scale operators.

Secondary potential customers include manufacturing sectors like Pharmaceuticals, Food & Beverage, and Chemicals, where flow measurement accuracy is crucial for batch consistency, quality control, and process safety. In Power Generation, remote flow systems are essential for monitoring cooling water circuits, steam flow rates, and fuel input delivery, ensuring efficient and safe plant operation, particularly in remote solar or wind farms requiring constant, unmanned utility monitoring. The buyers in all these sectors prioritize solutions that offer long battery life, secure communication, reliable measurement accuracy over extended periods without calibration, and seamless integration capabilities with existing enterprise resource planning (ERP) and SCADA systems, thus favoring comprehensive, integrated vendors who can deliver end-to-end solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., ABB Ltd., Honeywell International Inc., Siemens AG, Schneider Electric SE, Yokogawa Electric Corporation, Rockwell Automation, Endress+Hauser Group Services AG, Fuji Electric Co., Ltd., Badger Meter, Inc., Baker Hughes Company, General Electric (GE), ProMinent GmbH, Metrix Instruments, SICK AG, KROHNE Messtechnik GmbH, Teledyne FLIR LLC, Spirax Sarco Engineering plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Remote Flow System Market Key Technology Landscape

The technological landscape of the Remote Flow System Market is defined by the convergence of advanced measurement physics, robust wireless connectivity, and sophisticated data processing techniques. The foundational technology involves specialized sensor types, including ultrasonic flow meters (favored for non-intrusive, low-maintenance operation in clean fluids), Coriolis meters (offering high precision mass flow measurement essential for custody transfer), and electromagnetic/magnetic meters (ideal for conductive liquids, especially in water management). Recent advancements focus on making these meters smaller, more rugged, and highly energy efficient, facilitating long-term deployment without external power sources. Crucially, the move towards non-intrusive and clamp-on technologies reduces installation complexity and pipeline downtime, accelerating adoption across existing infrastructure where physical modifications are costly or impossible.

A second critical technology pillar is the communication infrastructure connecting remote meters to central control rooms. This involves Remote Telemetry Units (RTUs) and modern wireless protocols. While legacy systems used specialized radio frequency (RF) communications, the market is rapidly embracing standard IIoT protocols such as LoRaWAN, Narrowband IoT (NB-IoT), and dedicated cellular standards (4G/5G). These protocols provide secure, wide-area coverage with minimal power consumption, addressing the challenge of monitoring extremely dispersed assets efficiently. Edge computing capabilities are increasingly being embedded directly into RTUs, allowing for local data aggregation, analysis, and immediate anomaly detection, thereby minimizing the volume of data transmitted and reducing reliance on continuous, high-bandwidth connections, optimizing both speed and cost efficiency.

The final pillar is the software and analytical technology stack, which provides the interface between raw data and actionable operational intelligence. This includes specialized SCADA platforms that are now migrating to the cloud for enhanced scalability and accessibility. Furthermore, the deployment of advanced analytics, including Machine Learning (ML) algorithms, is a defining trend. These algorithms interpret complex flow data patterns, identify subtle equipment wear characteristics, predict potential leakage locations before catastrophic failure occurs, and automatically manage the calibration status of deployed meters. This integrated technological environment ensures that the Remote Flow System is not merely a monitoring tool but a comprehensive, intelligent asset management solution.

Regional Highlights

- North America: This region maintains a leading market share driven by extensive, aging pipeline infrastructure in the Oil & Gas sector and robust regulatory demands for pipeline integrity and safety, particularly in the US and Canada. High technological readiness and significant investment in smart grid and smart water initiatives propel the continuous replacement and upgrade of legacy monitoring systems, favoring advanced IIoT-enabled remote flow solutions.

- Europe: Europe is characterized by stringent environmental regulations, high utility standards, and a powerful regional focus on reducing Non-Revenue Water (NRW). Countries such as the UK and Germany are pioneering the implementation of comprehensive smart metering and remote monitoring strategies in water distribution. The regional market growth is stable, focused on efficiency optimization and adherence to EU directives regarding sustainable resource management.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, massive infrastructure development (new pipelines, utility networks), and growing industrialization, particularly in China, India, and Southeast Asia. The adoption is driven by the necessity to manage newly built, large-scale systems and governmental efforts to modernize utility operations, often leapfrogging older technologies directly to advanced wireless and cloud-based solutions.

- Middle East and Africa (MEA): Growth in MEA is primarily dictated by the Oil & Gas industry, where remote flow systems are critical for monitoring vast desert pipelines and ensuring accurate custody transfer of high-value hydrocarbons. Water scarcity issues also drive demand for remote monitoring in water transportation and desalination facilities, emphasizing ruggedness and satellite communication capabilities for remote installations.

- Latin America (LATAM): The LATAM market is experiencing moderate growth, driven by investments in utility modernization and addressing high leakage rates in existing water infrastructure. Economic volatility and varying levels of industrial maturity pose challenges, but long-term investment in mining, petrochemicals, and renewable energy projects consistently sustains demand for reliable remote monitoring equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Remote Flow System Market.- Emerson Electric Co.

- ABB Ltd.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Yokogawa Electric Corporation

- Rockwell Automation

- Endress+Hauser Group Services AG

- Fuji Electric Co., Ltd.

- Badger Meter, Inc.

- Baker Hughes Company

- General Electric (GE)

- ProMinent GmbH

- Metrix Instruments

- SICK AG

- KROHNE Messtechnik GmbH

- Teledyne FLIR LLC

- Spirax Sarco Engineering plc.

- Xylem Inc.

- Sierra Instruments

Frequently Asked Questions

Analyze common user questions about the Remote Flow System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Remote Flow System Market?

The increasing global emphasis on industrial digitalization (Industry 4.0) and the critical need for real-time asset visibility to ensure operational efficiency and compliance are the primary market growth drivers. Remote flow systems reduce manual inspection costs and enable predictive maintenance.

Which industrial sector is the largest end-user of remote flow monitoring systems?

The Oil & Gas sector is currently the largest end-user, primarily due to the extensive need for reliable monitoring of vast pipeline networks, custody transfer points, and ensuring prompt leak detection across challenging and isolated terrains.

What technological challenge is most significant in remote flow deployment?

The most significant challenge involves ensuring long-term power autonomy and communication reliability for devices placed in inaccessible locations. Market solutions focus on leveraging ultra-low power IIoT protocols like LoRaWAN and embedded battery systems for multi-year operation.

How does AI improve the functionality of remote flow systems?

AI significantly enhances functionality by providing predictive maintenance capabilities, analyzing massive datasets to identify subtle anomalies, minimizing false alarms, and optimizing data transmission to conserve energy, transforming raw data into actionable intelligence.

Which geographical region is projected to have the highest market CAGR?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid industrial expansion, massive government investments in new utility and pipeline infrastructure, and escalating regulatory pressure for resource efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager