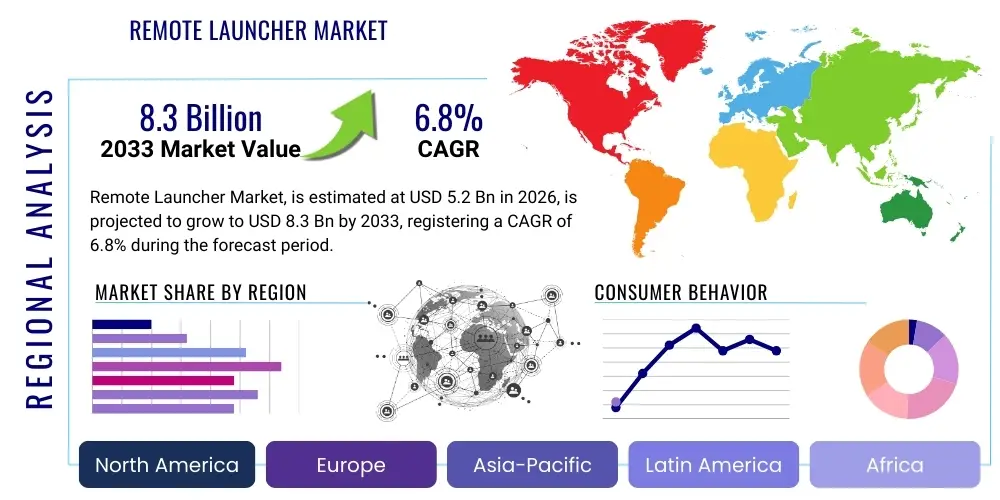

Remote Launcher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437860 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Remote Launcher Market Size

The Remote Launcher Market, encompassing systems utilized across defense, aerospace, and commercial satellite deployment sectors, is witnessing substantial growth driven by geopolitical instability and the rapid advancement of miniaturization technologies. These specialized systems, ranging from tactical missile platforms to mobile satellite deployment apparatus, are becoming indispensable assets for nations prioritizing swift and secure deployment capabilities. The market dynamics are largely influenced by multi-year defense procurement cycles and increasing private sector investment in low Earth orbit (LEO) constellations, necessitating flexible and remote operational capabilities for launch infrastructure and payloads. This technological shift towards mobile and highly automated launch infrastructure defines the current market trajectory.

The strategic importance of remote launch capabilities in modern warfare, coupled with the escalating demand for high-frequency satellite replenishment, underpins the robust valuation of this sector. Governments globally are investing heavily in upgrading legacy systems to incorporate advanced remote command and control features, ensuring operational safety and strategic advantage during conflict or rapid response missions. Furthermore, the commercial space sector’s transition towards smaller, modular launch vehicles and associated ground support equipment relies heavily on remote execution protocols to maximize launch window efficiency and minimize operational staffing costs at hazardous launch sites. This synergistic public-private investment forms the bedrock of future market expansion.

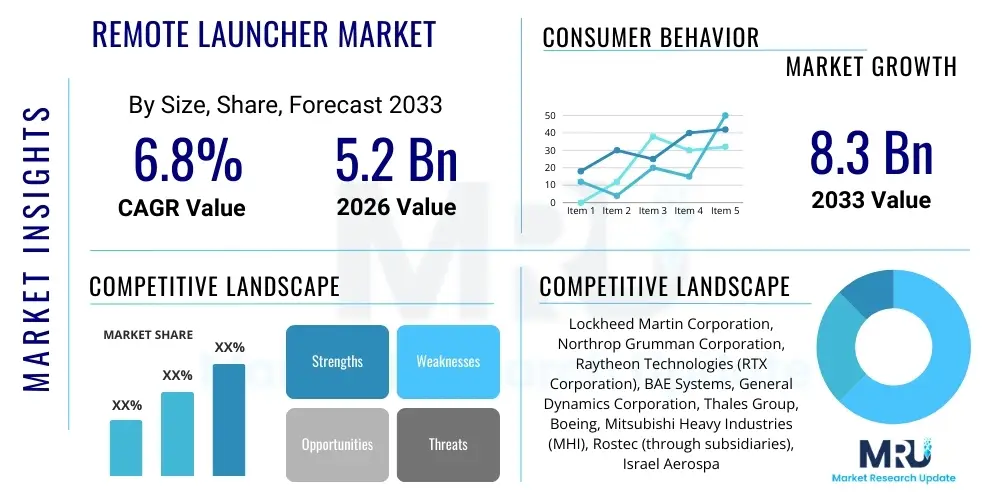

The Remote Launcher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.3 Billion by the end of the forecast period in 2033.

Remote Launcher Market introduction

The Remote Launcher Market comprises highly sophisticated systems designed for initiating, controlling, and executing launch sequences for missiles, rockets, projectiles, or specialized payloads from a safe, geographically separated control center. These products are fundamentally defined by their ability to operate autonomously or through remote human supervision, utilizing encrypted communication links and advanced sensor suites for target acquisition, trajectory computation, and final deployment. Major applications span tactical missile defense systems (surface-to-air, surface-to-surface), strategic missile silo operations, and commercial/military mobile space launch vehicles, particularly those focused on rapid deployment of small satellites (smallsats). Key benefits include enhanced personnel safety by removing operators from hazardous launch zones, improved operational flexibility allowing for quick relocation and redeployment, and increased secrecy and survivability of launch assets during contested operations. The market’s primary driving factors are sustained global defense modernization efforts, the proliferation of LEO satellite constellations requiring responsive launch capabilities, and the integration of advanced automation and connectivity technologies (5G/6G) into defense infrastructure, making remote operations increasingly reliable and latency-free.

Remote Launcher Market Executive Summary

The Remote Launcher Market is characterized by intense technological innovation, driven by geopolitical tensions and the commercialization of space access. Current business trends indicate a strong shift towards modular and multi-platform compatible launchers capable of handling diverse missile types or varying satellite sizes, favoring scalable, software-defined hardware architectures. Regionally, North America maintains market dominance due to robust defense budgets and leadership in aerospace technology, although the Asia Pacific region is demonstrating the highest growth trajectory, fueled by accelerated military modernization programs, particularly in China and India, alongside significant regional investment in commercial space capabilities. Segmentation trends highlight the superiority of ground-based mobile launcher platforms over fixed installations due to improved survivability and rapid deployment potential, while the defense sector remains the largest end-user segment, consistently prioritizing high-fidelity remote command and control systems to secure critical national assets and maintain strategic deterrent capabilities.

AI Impact Analysis on Remote Launcher Market

User inquiries regarding AI's influence on the Remote Launcher Market predominantly center on the ethical implications of autonomous decision-making, the reliability and cyber resilience of AI-driven launch systems, and the efficiency gains derived from automated trajectory optimization and maintenance predictions. Key user concerns revolve around the potential for 'launch without human intervention' scenarios and the necessity for robust validation and verification processes (V&V) for mission-critical AI algorithms. Users also express high expectations concerning AI's capability to enhance mission success rates by optimizing complex, real-time launch parameters that exceed human calculation capacity, specifically in highly dynamic environments or contested electromagnetic spectrums. The prevailing themes underscore a desire for AI augmentation rather than complete autonomy, focusing on predictive maintenance, enhanced situational awareness, and optimizing resource allocation within launch command centers, ensuring that human oversight remains central to strategic decision-making while leveraging AI for technical execution and fault detection.

The integration of Artificial Intelligence (AI) fundamentally transforms the operational paradigm of remote launchers, shifting the focus from manual control to automated predictive systems. AI algorithms are crucial in real-time trajectory calculation, especially for systems operating in unpredictable environments, improving accuracy and reducing the time required between target identification and launch command issuance. Furthermore, AI contributes significantly to predictive maintenance protocols. By continuously analyzing performance data from thousands of sensors embedded within the launcher hardware—such as hydraulic pressure, thermal profiles, and electronic component health—AI can accurately forecast potential system failures before they occur, drastically improving the readiness rate and lifecycle management of these high-value assets. This predictive capability minimizes unexpected downtime, which is critical for military deterrent systems and tightly scheduled commercial space missions.

However, the ethical and regulatory challenges surrounding AI in kinetic systems, often referred to as Lethal Autonomous Weapon Systems (LAWS), impose significant constraints and require extensive international policy deliberation. While AI excels at the tactical execution layer (e.g., flight path correction, optimizing fuel burn), strategic launch decisions generally remain under strict human supervision (Human-in-the-Loop). The most immediate and practical application of AI is in augmenting command and control functionality: improving sensor fusion for better target discrimination, optimizing communication routing in jammed environments, and rapidly assessing collateral risk before final human approval for launch. The evolution of AI within this market is intrinsically linked to establishing trust through rigorous cyber security measures and transparent machine learning models, ensuring operational integrity against sophisticated adversarial attacks that target autonomy systems.

- AI optimizes launch window calculation by processing vast atmospheric and orbital data points rapidly.

- Predictive maintenance driven by machine learning algorithms drastically reduces system downtime and increases operational readiness.

- Enhanced situational awareness via AI-driven sensor fusion improves target identification and tracking for tactical launchers.

- AI algorithms are employed for autonomous fault detection and self-correction protocols within the launch sequence hardware.

- Cyber defense systems leverage AI to detect and neutralize unauthorized access attempts to remote control interfaces.

- Trajectory optimization for complex, multi-stage rockets is achieved through reinforcement learning techniques, maximizing payload delivery efficiency.

DRO & Impact Forces Of Remote Launcher Market

The Remote Launcher Market is primarily propelled by aggressive global defense spending aimed at modernizing aging arsenals and establishing multi-domain deterrence capabilities, alongside the rapid growth of the small satellite sector demanding flexible and high-cadence launch services. These drivers are tempered by significant restraints, chiefly the extremely high capital expenditure required for research and development (R&D) of sophisticated systems, stringent international export controls (such as the Missile Technology Control Regime, MTCR), and the inherent complexity of integrating various systems across different military branches or space agencies. Opportunities arise through technological advancements such as hypervelocity capabilities, the miniaturization of launch control units, and the increasing trend toward modular, standardized launch interfaces that facilitate interoperability. The combined effect of these forces creates a high-barrier-to-entry market dominated by established defense contractors, where strategic partnerships and technological differentiation are essential for gaining a competitive edge and mitigating the risks associated with multi-billion dollar platform development cycles. The impact forces indicate a highly regulated yet high-growth environment, especially in areas touching upon strategic military capability.

Drivers: The most prominent driver is the ongoing geopolitical competition, compelling major global powers to invest in advanced, survivable strike capabilities. Remote launchers enhance force projection by enabling rapid, distributed deployments from geographically disparate locations, making assets harder to neutralize by adversaries. Secondly, the 'Space Race 2.0,' characterized by massive investment in commercial and military low Earth orbit (LEO) satellite constellations, necessitates responsive launch services. Remote and mobile launchers are ideal for providing the high-frequency, resilient launch infrastructure required for satellite constellation deployment and replenishment. Furthermore, the push towards network-centric warfare mandates systems that can be seamlessly integrated into broader digital command structures, a capability inherent to advanced remote launch technologies that rely on secure digital communication protocols.

Restraints: The prohibitive cost associated with R&D, coupled with the long development and testing cycles inherent to aerospace and defense hardware, acts as a primary restraint. Developing a reliable, certified remote launcher system requires immense upfront investment, limiting new entrants. Regulatory hurdles, particularly international treaties governing missile and space technology proliferation, significantly restrict sales and collaboration across borders, constraining market reach. Technical limitations related to ensuring robust, low-latency, and highly secure communication links between the remote operator and the launcher in severely contested environments (e.g., under heavy electronic jamming) also pose significant engineering challenges that must be consistently overcome to maintain operational reliability.

Opportunities: Significant market opportunities lie in the development of modular and standardized launch systems (often termed 'universal launchers') that can accommodate various payloads, reducing logistical overhead and increasing flexibility for operators. The burgeoning domain of hypersonic weapon systems requires specialized, ultra-high-velocity remote launch platforms, presenting a lucrative niche for advanced technology providers. Moreover, the increasing demand for civilian and commercial launch infrastructure, separate from traditional military requirements, particularly for supporting burgeoning space tourism and orbital manufacturing industries, offers a new avenue for diversification and growth beyond purely defense-related applications.

- Drivers:

- Escalating Global Defense Spending and Modernization Programs.

- Rapid Proliferation and Replenishment Needs of LEO Satellite Constellations.

- Demand for Enhanced Operational Safety and Personnel Protection.

- Advancements in Secure, Low-Latency Communication Technologies (5G, Satellite Comms).

- Shift towards Network-Centric and Distributed Military Operations.

- Restraints:

- High Research, Development, Test, and Evaluation (RDT&E) Costs.

- Strict International Regulatory and Export Control Regimes (e.g., MTCR).

- Complexity and Requirement for High System Reliability Certification.

- Cybersecurity Vulnerabilities associated with Remote Command Links.

- Limited Pool of Highly Specialized Technical Expertise.

- Opportunities:

- Development of Universal, Modular Launch Interfaces for Multi-Role Capability.

- Emerging Market for Hypersonic Missile Launch Platforms.

- Integration of Advanced Automation and AI for Pre-Launch Sequence Optimization.

- Expansion into Commercial Spaceport Infrastructure and Ground Support Systems.

- Retrofitting Existing Fixed Launch Sites with Advanced Remote Control Kits.

Segmentation Analysis

The Remote Launcher Market segmentation provides a critical view of the diverse applications and technological requirements shaping its trajectory. The market is primarily divided based on Platform Type (Fixed vs. Mobile/Transportable), Application (Defense vs. Commercial/Civil), and End-Use Component (Control Systems vs. Launch Hardware). Understanding these segments is vital as technological investments differ significantly. For instance, the mobile segment, crucial for survivability and rapid deployment in defense applications, demands ruggedized, resilient control systems, whereas commercial segments focus more on cost-efficiency and payload flexibility. The convergence of military and commercial requirements, especially concerning standardization and miniaturization, is a major trend influencing how resources are allocated across these defined market categories.

- By Platform Type:

- Fixed Launchers (Silos, Permanent Launch Pads)

- Mobile/Transportable Launchers (Truck-Mounted, Ship-Based, Rail-Based)

- By Application:

- Defense & Military (Tactical, Strategic Missile Systems)

- Commercial & Civil Space (Satellite Launch Vehicles, Experimental Platforms)

- By Component:

- Remote Command & Control Systems (C2 Software, Consoles, Communication Links)

- Launch Hardware (Erector/Launcher Mechanisms, Power Units, Integration Kits)

- By Range Capability:

- Short Range (SR)

- Medium Range (MR)

- Intermediate Range (IR)

- Intercontinental Range (ICR)

Value Chain Analysis For Remote Launcher Market

The value chain for the Remote Launcher Market is characterized by high integration and rigorous certification processes, starting with highly specialized upstream suppliers and culminating in complex, governmental downstream integration. Upstream activities involve R&D and the provision of niche technologies, including advanced composite materials for launch tubes, secure encryption hardware, and high-precision sensor systems (e.g., inertial measurement units). These suppliers, often few in number, hold significant bargaining power due to the critical nature and proprietary knowledge associated with their components. The core manufacturing and integration stage is dominated by large defense prime contractors who assemble the complex mechanical and electronic systems, conducting extensive testing and certification required by military or space agencies. The downstream segment involves installation, training, long-term maintenance, and software updates provided directly to end-users (governments/space agencies).

Distribution channels for remote launchers are predominantly direct due to the strategic nature of the product and the necessity for continuous support and security clearance. Direct distribution ensures tight control over technology transfer, installation standards, and customized operator training, typically involving contracts negotiated directly between the prime contractor and the Ministry of Defense or national space authority. Indirect distribution, while rare, may occur through government-authorized third-party system integrators for ancillary commercial components or through certified maintenance providers operating under highly restricted licenses. The stringent regulatory environment dictates that the flow of goods and services must be meticulously documented and secured, prioritizing security and reliability over traditional commercial efficiencies achieved through broad intermediary networks.

The high complexity of the final product mandates robust post-sales support and system modernization contracts, which often constitute a significant portion of the total value chain revenue over the system’s lifecycle. Upstream analysis focuses on securing supply chains for highly regulated, mission-critical components, especially propulsion and guidance systems, where geopolitical stability can influence access to raw materials. Downstream efficiency hinges on rapid deployment training and ensuring the remote control software is interoperable with existing military command structures, emphasizing secure data links and standardized interfaces crucial for cross-platform integration and successful mission execution.

Remote Launcher Market Potential Customers

The primary end-users and buyers of remote launcher systems are national governments and their respective military branches, particularly ground forces, naval forces, and air defense units that require mobile, survivable, and rapidly deployable strike or air defense capabilities. These governmental agencies prioritize systems offering enhanced survivability against pre-emptive strikes, improved command flexibility in dispersed operations, and compatibility with standardized ammunition stockpiles. The contracts secured with these entities are typically long-term, high-value procurement agreements spanning decades, characterized by requirements for indigenous technology transfer and sovereign control over crucial system software updates and maintenance protocols.

A rapidly growing segment of potential customers includes governmental and commercial space agencies, alongside private sector aerospace companies focused on satellite deployment services. These customers demand highly reliable, remote-controlled ground support equipment (GSE) and launch pads, especially for small-to-medium lift launch vehicles (SMLVs). Commercial space operators are increasingly adopting remote operations to minimize operational costs, maximize launch frequency, and adhere to safety regulations by limiting personnel exposure at volatile launch sites. These buyers seek modularity, speed of setup, and cost-effective operational expenditure (OPEX), favoring systems designed with commercial off-the-shelf (COTS) components where permissible, balanced with necessary aerospace grade reliability.

Furthermore, specialized research institutions and university-affiliated labs conducting experimental rocketry or hypersonics research also constitute a niche customer base. While their volume demand is low, they require highly specialized, flexible, and often customized remote firing and telemetry control systems suitable for R&D purposes. These customers emphasize safety protocols, data acquisition capabilities, and rapid reconfigurability of the launch sequence parameters. The convergence of commercial launch aspirations and traditional defense requirements necessitates vendors to offer scalable product lines that can meet the stringent security demands of military clients while offering the competitive pricing structures preferred by private launch service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies (RTX Corporation), BAE Systems, General Dynamics Corporation, Thales Group, Boeing, Mitsubishi Heavy Industries (MHI), Rostec (through subsidiaries), Israel Aerospace Industries (IAI), Saab AB, L3Harris Technologies, Aerojet Rocketdyne (now part of RTX), Space Exploration Technologies Corp. (SpaceX), Blue Origin, Firefly Aerospace, Rocket Lab, Kongsberg Gruppen, Rheinmetall AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Remote Launcher Market Key Technology Landscape

The core technological evolution in the Remote Launcher Market centers on achieving enhanced command reliability, maximizing operational mobility, and facilitating standardized multi-payload integration. Modern systems rely heavily on robust, redundant, and highly encrypted digital communication protocols, often incorporating satellite-based communication links (SATCOM) and advanced mesh networking capabilities to ensure continuous connectivity even under severe electronic warfare attacks. These communication systems must maintain ultra-low latency to guarantee the real-time execution of critical trajectory adjustments or abort commands, making advanced signal processing and error correction essential. Furthermore, the shift towards transportable systems necessitates the widespread adoption of ruggedized electronics designed to withstand extreme thermal, shock, and vibrational stress during transit and launch preparation, differentiating them significantly from fixed-site equipment.

Material science and mechanical engineering advancements play a critical role, particularly in reducing the weight and setup time of mobile launchers. The utilization of advanced composite materials (e.g., carbon fiber reinforced polymers) in launch tubes and supporting structures enhances system mobility without compromising structural integrity or thermal resistance during ignition. A parallel development is the emphasis on standardized interfaces, notably the integration of universal payload adapters or canister systems (elike the Multi-Mission Launcher concept), which allow a single remote launch platform to fire a variety of different munitions or deliver various satellite sizes, thereby significantly improving logistical efficiency and tactical flexibility for military and commercial operators alike. The use of advanced telemetry and real-time health monitoring systems, often utilizing AI-driven analytics, ensures optimal performance across diverse operational theatres.

Another crucial technological pillar is the evolution of autonomous and semi-autonomous pre-launch checks and readiness assessment software. These advanced systems can rapidly diagnose mechanical faults, verify calibration parameters, and confirm target acquisition accuracy without requiring human intervention at the physical launch location. This high degree of automation reduces the necessary crew size, minimizes human error, and dramatically cuts down the time required for weapon systems to achieve operational readiness (known as 'shoot-and-scoot' capability in military context). Looking forward, the integration of quantum-resistant encryption methodologies and edge computing capabilities into the remote command units is being pursued to preemptively address future cybersecurity threats and further enhance real-time decision-making capabilities at the point of launch.

Regional Highlights

The market dynamics are significantly influenced by regional defense policies, economic capabilities, and the maturity of indigenous aerospace industries, leading to distinct growth patterns across the globe.

- North America (NA)

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

North America, led by the United States, holds the dominant share in the Remote Launcher Market due to massive defense expenditure and unparalleled technological leadership in complex missile systems and commercial space technology. The region benefits from robust R&D infrastructure and key players (Lockheed Martin, Northrop Grumman) securing multi-billion-dollar defense contracts for modernization of missile defense (e.g., THAAD, Patriot upgrades) and strategic deterrent systems. The U.S. commercial space sector, spearheaded by private companies like SpaceX and Blue Origin, is a powerful demand generator for remote launch systems designed for rapid satellite deployment and testing. The focus here is on resilience, system integration across multi-domain operations, and achieving near-autonomous control capabilities.

The U.S. military's commitment to distributed lethality and the deployment of mobile, survivable launchers across multiple domains (land, sea) ensures sustained procurement. Canada also contributes through sophisticated component manufacturing and integration into NATO defense frameworks. Regulatory stability and substantial governmental support for dual-use technologies further solidify the region's position, pushing innovation into areas like advanced miniaturized launch units and highly secure command link encryption. The market is highly mature, characterized by fierce competition for major government contracts.

Europe represents a stable yet moderately growing market, primarily driven by NATO member nations seeking to meet defense spending targets and enhance regional deterrence capabilities, particularly in Eastern Europe following recent geopolitical shifts. Key players like BAE Systems, Thales, and MBDA (a consortium) focus on developing advanced tactical systems, including long-range surface-to-air missile launchers and naval launch platforms. The European Space Agency (ESA) provides a foundation for commercial launch demand, though this segment is relatively smaller compared to the US. Growth is often constrained by fragmented defense procurement across various EU member states.

Countries such as the UK, France, and Germany are heavily investing in upgrading their legacy platforms with modern remote control capabilities to improve responsiveness and reduce operational footprint. There is a strong emphasis on joint development programs to achieve economies of scale and standardize equipment across European armed forces. The market leans towards advanced anti-access/area denial (A2/AD) systems and missile defense, necessitating high-fidelity remote command systems and secure, interoperable communication architectures compatible with allied defense networks.

The Asia Pacific region is forecast to experience the highest growth rate during the forecast period, fueled by aggressive military modernization programs in China, India, Japan, and South Korea, driven by territorial disputes and increasing regional geopolitical instability. China's rapid advancement in missile technology and space capability, including indigenous development of mobile tactical launchers and complex satellite launch infrastructure, serves as a major market catalyst. India's focus on self-reliance (Atmanirbhar Bharat) is driving substantial investment in domestically manufactured remote launch systems for ballistic and cruise missiles.

Beyond defense, the commercial space market in APAC is burgeoning, with nations like Japan, South Korea, and Australia investing in establishing competitive launch service providers, requiring new remote launch infrastructure. The high population density and complex geography of the region necessitate highly mobile, dispersed launcher units capable of rapid deployment in diverse environments (mountainous terrain, island nations). This demand fuels innovation in compact, containerized remote launch systems and associated ground control stations that are easy to conceal and operate remotely.

The Remote Launcher Market in Latin America is relatively nascent, characterized primarily by procurement of established foreign systems for national defense, rather than significant indigenous development. Countries like Brazil and Argentina are the main spenders, focusing on missile defense systems and naval modernization, often through technology transfer agreements with European or Israeli defense contractors. Market growth is stable but slow, heavily dependent on commodity prices and governmental budget fluctuations. The limited indigenous aerospace R&D capacity means the region acts predominantly as a buyer of imported remote launch hardware and control software, focusing on basic maintenance and operational training rather than advanced system development.

The MEA region, particularly the Gulf Cooperation Council (GCC) states (Saudi Arabia, UAE), is a crucial import market for advanced remote launcher systems, primarily driven by substantial defense budgets, regional conflicts, and the perceived need for advanced air and missile defense capabilities. Major procurements focus on proven, high-performance systems from the US and Europe (e.g., THAAD, Patriot, Iron Dome technology). These nations prioritize integrated, turn-key solutions that include the launcher hardware, advanced remote command centers, and comprehensive training packages. Africa, outside of South Africa and certain northern African nations, remains a smaller market, mainly focused on basic artillery and older missile systems, with limited deployment of sophisticated remote launcher technology due to fiscal constraints and limited technological infrastructure. The market in MEA is highly reliant on international political alignments and technology transfer agreements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Remote Launcher Market.- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies (RTX Corporation)

- BAE Systems

- General Dynamics Corporation

- Thales Group

- Boeing

- Mitsubishi Heavy Industries (MHI)

- Rostec (through subsidiaries)

- Israel Aerospace Industries (IAI)

- Saab AB

- L3Harris Technologies

- Aerojet Rocketdyne (now part of RTX)

- Space Exploration Technologies Corp. (SpaceX)

- Blue Origin

- Firefly Aerospace

- Rocket Lab

- Kongsberg Gruppen

- Rheinmetall AG

- Hanwha Aerospace

Frequently Asked Questions

Analyze common user questions about the Remote Launcher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased adoption of mobile remote launcher platforms?

The adoption of mobile remote launchers is driven primarily by the need for enhanced survivability and operational flexibility in contested military environments. Mobile systems, such as truck-mounted platforms, can rapidly relocate ('shoot and scoot'), preventing targeting by adversaries and supporting the military shift toward distributed force projection and multi-domain operations.

How do cybersecurity risks impact the reliability of remote command and control (C2) systems?

Cybersecurity is critical, as remote C2 systems rely on encrypted digital links for operation. Potential impacts include system hijacking, data integrity corruption leading to launch failure or unintended targeting, and denial-of-service attacks. Mitigation involves multilayered encryption, quantum-resistant algorithms, and robust physical security for ground control stations.

Which application segment (Defense or Commercial) holds the largest market share?

The Defense and Military application segment currently holds the largest market share due to significantly higher procurement budgets allocated for strategic deterrent capabilities, missile defense systems, and tactical strike platforms. However, the Commercial Space segment, driven by LEO satellite deployment, is the fastest-growing application area.

What role does Artificial Intelligence (AI) play in next-generation remote launchers?

AI is essential for optimizing complex operational tasks, including real-time trajectory calculation, predictive maintenance scheduling, and advanced sensor fusion for improved target identification. AI augmentation enhances the speed and accuracy of the launch sequence while maintaining crucial human oversight for final authorization.

What is the primary technological challenge facing manufacturers of remote launch systems?

The primary technological challenge is ensuring absolute operational reliability and low-latency communication over vast distances, particularly in environments subject to severe electronic jamming or atmospheric interference. Achieving this balance between remote connectivity, high performance, and system resilience remains the core focus of R&D efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager