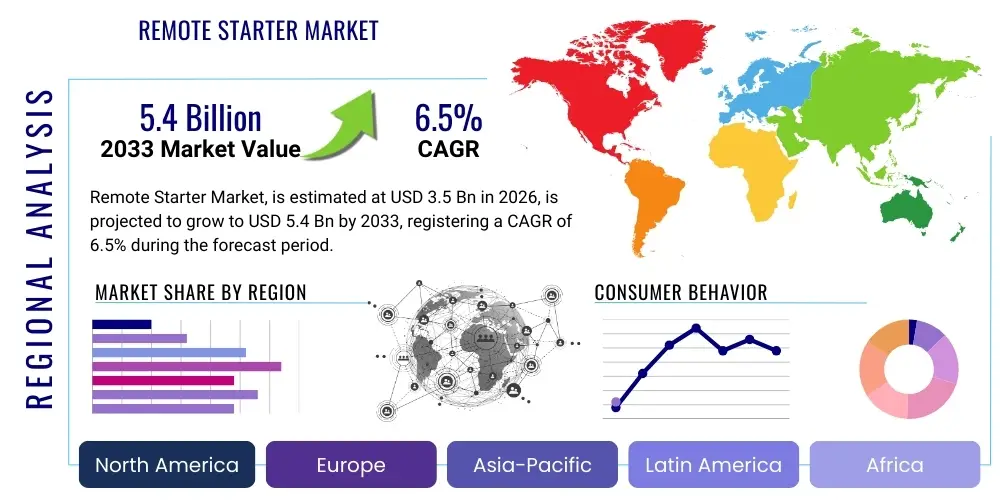

Remote Starter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435307 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Remote Starter Market Size

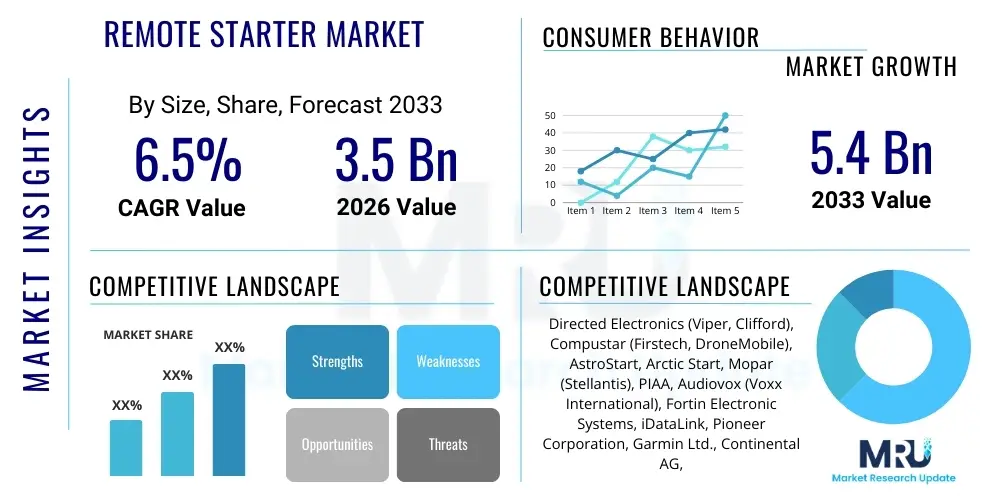

The Remote Starter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Remote Starter Market introduction

The Remote Starter Market encompasses the design, manufacturing, distribution, and installation of electronic devices that enable users to remotely start the engine of a vehicle. This convenience feature, initially prevalent in extreme climate regions, has rapidly gained acceptance globally due to technological advancements integrating secure encryption and advanced telematics. The primary function involves bypassing the ignition cylinder and security systems (like immobilizers) through specialized interface modules, ensuring the vehicle starts safely while remaining locked. Key market components include the primary control unit, RF (Radio Frequency) transmitters (fobs), and sophisticated data interface modules necessary for seamless integration with modern vehicle communication protocols, such as Controller Area Network (CAN) bus systems.

Product sophistication ranges from basic one-way systems, which only transmit the start command, to advanced two-way systems that provide feedback regarding the vehicle’s status (e.g., whether the engine is running, door lock status, interior temperature). A significant driver of market evolution is the shift towards cellular-based or smartphone-integrated remote start solutions, often bundled with broader telematics services. These high-end systems eliminate range limitations associated with traditional RF fobs, allowing vehicle control from virtually any distance via mobile applications, which enhances user convenience and connectivity. This integration often leverages cloud-based platforms for command routing and status reporting, adding a layer of sophisticated software dependency to the hardware market.

Major applications of remote starters extend beyond mere engine ignition. They are crucial for optimizing cabin comfort by pre-conditioning the climate control system (heating or cooling) prior to occupancy, especially vital in regions experiencing harsh winters or intense summers. Furthermore, remote starters are increasingly valued for their security features, often incorporating alarm systems, GPS tracking, and vehicle immobilization capabilities, positioning them as an integral part of modern vehicle security and convenience architecture. The benefits, including fuel efficiency through optimized starts and reduced idle time, along with enhanced vehicle safety, continue to drive consumer adoption across both the Original Equipment Manufacturer (OEM) fitted and aftermarket segments, necessitating stringent adherence to vehicle electronics standards and robust cybersecurity protocols.

- Product Description: Electronic system enabling remote ignition of a vehicle engine and climate control activation.

- Major Applications: Vehicle pre-conditioning (heating/cooling), enhanced security, and convenient engine startup.

- Benefits: Improved comfort, time savings, extended vehicle security range, and potential compliance with idle reduction regulations.

- Driving Factors: Extreme weather conditions, growing adoption of smartphone-based controls, increasing integration of telematics, and rising disposable income facilitating luxury feature adoption.

Remote Starter Market Executive Summary

The Remote Starter Market is characterized by robust growth, primarily driven by the increasing consumer demand for convenience features and the rapid technological transition from traditional RF-based systems to sophisticated cellular and telematics solutions. Business trends indicate a strong competitive dynamic between established aftermarket specialists and major automotive OEMs that are increasingly integrating remote start functionality directly into factory-installed vehicle packages. This dual-market structure necessitates continuous innovation in data interface module technology to ensure compatibility with complex and proprietary vehicle communication architectures, often involving collaborations between component manufacturers and software developers to manage complex digital keys and security protocols.

Regional trends highlight North America as the dominant market, particularly due to the prevalence of severe climate conditions across the United States and Canada, which makes vehicle pre-conditioning a necessity rather than a luxury. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rising vehicle ownership, urbanization, and increasing consumer awareness regarding vehicle comfort and connectivity technologies, particularly in major automotive hubs like China and India. European penetration remains comparatively lower due to regulatory restrictions on vehicle idling in many urban centers, though demand is growing for systems that offer minimal idle time coupled with engine diagnostic data via connected services.

Segmentation trends reveal a strong shift toward cellular-based and smartphone-controlled systems, which are eclipsing the market share of traditional one-way RF systems due to their superior range and integrated service capabilities (such as GPS tracking and roadside assistance integration). While the Aftermarket segment traditionally held dominance, the OEM segment is rapidly gaining ground, offering factory-warranty integration and seamless user experience, appealing to consumers prioritizing reliability and system integrity. Within the component segment, the demand for sophisticated CAN bus interface modules, essential for secure integration without cutting into factory wiring, is witnessing substantial growth, reflecting the overall digitalization and complexity of modern vehicle electronics.

- Business Trends: Increased OEM integration, intensified competition between aftermarket and factory solutions, and growing focus on software-as-a-service (SaaS) models for cellular connectivity subscriptions.

- Regional Trends: North America dominance, accelerated growth in Asia Pacific, and regulatory constraint navigation in Europe influencing system design towards minimal idle functionality.

- Segments Trends: Rapid expansion of Smartphone-based/Cellular control systems, strong growth in the OEM segment, and increasing criticality of data interface and bypass modules.

AI Impact Analysis on Remote Starter Market

User queries regarding AI's influence on the Remote Starter Market frequently center on themes of predictive comfort, enhanced security, and the transition from reactive commands to proactive vehicle management. Key concerns revolve around how AI can optimize energy usage during pre-conditioning, personalize vehicle settings based on learned user behaviors and environmental factors, and fortify security against smart hacking attempts. Users are keenly interested in whether AI integration will lead to fully autonomous pre-start processes, eliminating the need for manual inputs, and how these smart systems will interact with existing smart home and mobile ecosystems, thereby seeking a seamless, integrated user experience.

The incorporation of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the remote starter from a simple command relay device into an intelligent vehicle companion. AI algorithms are being leveraged to develop predictive pre-conditioning features. Instead of waiting for a user command, the system learns the driver's schedule, preferred departure times, location, and the current weather forecast (often integrating real-time external data) to automatically initiate climate control cycles. For example, if the system learns the driver typically leaves for work at 7:30 AM and the temperature is forecasted below freezing, the system can autonomously start the engine 10 minutes prior, optimizing the temperature and battery life, significantly enhancing user comfort and efficiency.

Furthermore, AI is crucial for fortifying the security architecture of cellular-based remote start systems. Machine Learning models are employed for anomaly detection, monitoring unusual patterns in vehicle access, connection requests, or geographical movements that might indicate a security breach or unauthorized usage. This allows the system to proactively flag or even shut down remote access if suspicious activity is detected, moving beyond traditional static encryption methods. In terms of energy management, AI algorithms can optimize the duration and intensity of the remote start based on the desired cabin temperature and ambient conditions, ensuring minimal fuel consumption or battery drain, which is particularly relevant for electric vehicles where maximizing range is paramount, thereby addressing significant environmental and efficiency concerns expressed by consumers.

The future iteration of remote starter technology, heavily influenced by AI, will focus on holistic integration with the vehicle’s operating system. AI will manage complex scenarios such as integrating remote charging management for electric vehicles, prioritizing charging based on predicted needs and peak/off-peak energy costs, all initiated remotely or autonomously. This move towards cognitive telematics solutions elevates the remote starter system from a convenience accessory to a critical component of the smart mobility ecosystem, driving significant innovation in software development and data processing capabilities within the automotive aftermarket and OEM supply chain.

- List AI impacts in concise points:

- Predictive Pre-conditioning: AI learns user patterns, schedule, and external climate data to autonomously initiate engine start and climate control, maximizing efficiency.

- Enhanced Cybersecurity: ML algorithms detect connection anomalies and suspicious access patterns, improving system security against unauthorized remote access attempts.

- Optimized Energy Management: AI minimizes idle time and optimizes climate control settings based on ambient conditions to reduce fuel consumption or battery drain, particularly for EVs.

- Personalized User Experience: System automatically adjusts interior settings (seat heaters, mirror positions) based on driver recognition and learned preferences upon remote start activation.

- Integration with Smart Ecosystems: Facilitation of seamless communication and command execution between vehicle remote start functionality and broader smart home devices and virtual assistants.

DRO & Impact Forces Of Remote Starter Market

The Remote Starter Market dynamics are primarily shaped by the intersection of escalating consumer convenience demands, stringent regulatory environments, and rapid technological advancements in vehicle security systems. The central driving forces include the global increase in vehicle ownership coupled with the demand for luxury and comfort features, particularly in regions experiencing weather extremes. Simultaneously, regulatory challenges, particularly anti-idling laws in dense urban areas across Europe and North America, act as significant restraints, pressuring manufacturers to develop systems with limited idle duration and superior efficiency monitoring. Opportunities largely reside in the untapped potential of electric vehicles (EVs) and the integration of remote functions into subscription-based mobility services, offering recurring revenue streams and deeper customer engagement.

Key drivers propelling market growth include the robust expansion of the automotive aftermarket, where consumers seek advanced features for existing vehicles, and the seamless integration offered by OEM solutions. The proliferation of affordable smartphones and widespread cellular network coverage has enabled the commercial viability of long-range, two-way control systems, making remote access far more accessible and functional than traditional RF fobs. Conversely, significant restraints include the technical complexity and inherent security risks associated with bypassing sophisticated factory immobilizer systems (known as transponder bypass). Installation complexity often requires highly skilled technicians, leading to higher labor costs and potential issues if installation is performed incorrectly, impacting consumer trust. Furthermore, the mandatory cellular subscription required for high-end systems represents a long-term cost barrier for some price-sensitive consumers.

Impact forces currently shaping the competitive landscape are centered around technological standardization and cybersecurity vulnerability mitigation. The transition to advanced vehicle architectures (like CAN-FD and Ethernet) demands continuous development of new, proprietary interface modules, raising R&D costs. The opportunity to establish strategic partnerships between telematics providers and vehicle manufacturers is substantial, aiming to create holistic connected car platforms where remote start is merely one feature among many, including diagnostics and maintenance scheduling. The market is also heavily influenced by fluctuating raw material costs, particularly semiconductor components and wiring harnesses, which impacts the final price points across both aftermarket and OEM channels, compelling companies to optimize supply chain resilience and leverage standardized, modular designs.

- Drivers, Restraints, Opportunity, Impact forces This Points summarize in a brief paragraph.

- Drivers (D): Demand for enhanced comfort and pre-conditioning, rapid adoption of smartphone/cellular control technology, increasing vehicle sales globally, and continuous innovation in vehicle integration modules.

- Restraints (R): Strict anti-idling regulations, high technical complexity of installation and integration with modern security systems, and the ongoing cost associated with cellular subscription services.

- Opportunities (O): Expansion into the rapidly growing Electric Vehicle (EV) market for battery pre-conditioning, development of AI-driven predictive control systems, and integration into broader subscription-based mobility and insurance telematics platforms.

- Impact Forces (IF): Cybersecurity threats necessitating robust encryption, high dependency on global semiconductor supply chains, competitive pressure leading to pricing strategy changes, and continuous technological obsolescence of data interface modules due to new vehicle models.

Segmentation Analysis

The Remote Starter Market is analyzed across various critical dimensions including component type, technology utilized, vehicle type, and the channel of sales (OEM vs. Aftermarket). This segmentation provides a granular understanding of consumer preferences and technological maturity within specific market niches. Component segmentation, covering control units, wiring harnesses, and transmitters, is crucial for assessing supply chain focus, with control modules and sophisticated data bypass modules seeing the highest value growth due to complexity. Technology-wise, the pivotal shift from traditional Radio Frequency (RF) based systems to Cellular/Telematics solutions dominates the revenue growth narrative, driven by enhanced user functionality and global accessibility.

The sales channel distinction highlights a competitive struggle: the aftermarket segment, historically the innovator and volume leader, is facing increasing penetration from the Original Equipment Manufacturer (OEM) segment. OEM-fitted remote starters offer guaranteed compatibility, seamless warranty integration, and often leverage the vehicle’s factory hardware (like existing telematics antennas), appealing to consumers prioritizing reliability. Conversely, the aftermarket remains vital for older vehicles, specialized needs (like commercial fleet management), and offering advanced features often before OEMs adopt them, ensuring diverse product availability for different consumer budgets and vehicle models.

Vehicle type analysis confirms that Passenger Vehicles constitute the largest market share, predominantly driven by consumer comfort demand. However, the Commercial Vehicle segment (including delivery vans, trucks, and fleet operations) represents a fast-growing niche. Remote starting in commercial applications often integrates engine diagnostics, geo-fencing, and fuel management capabilities, moving beyond simple convenience to become a crucial tool for operational efficiency and asset management. The segmentation analysis underscores the need for manufacturers to diversify their product portfolio, offering modular systems that can cater to the low-cost RF market while simultaneously competing with sophisticated, digitally integrated OEM offerings.

- List all key segments in bullet format:

- By Technology:

- RF-based (1-Way and 2-Way)

- Cellular/Telematics (Smartphone-based control)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Trucks)

- Commercial Vehicles (Fleets, Heavy Duty Trucks)

- By Component:

- Control Modules

- Data Interface/Bypass Modules

- Transmitters (Key Fobs)

- Wiring Harnesses and Accessories

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Remote Starter Market

The value chain for the Remote Starter Market is intricate, spanning from raw material sourcing, semiconductor manufacturing, sophisticated software development, to specialized distribution and installation. The upstream segment is dominated by electronic component suppliers, particularly those providing microcontrollers, specialized RF chips, and complex wiring harnesses. Critical to this stage is the fabrication of highly secure, proprietary data interface modules (bypass modules) that require constant R&D investment to decode and interface with new vehicle data protocols introduced by OEMs, making the supplier relationships in the electronic components sector highly strategic and often collaborative.

The midstream phase involves the core activities of manufacturing, assembly, and software integration. Manufacturers, both dedicated aftermarket brands and OEM component divisions, focus on integrating hardware with proprietary firmware and operating systems. For cellular-based solutions, this stage includes negotiating agreements with Mobile Network Operators (MNOs) to secure favorable data rates and reliable connectivity, thereby transforming a purely hardware product into a connected service requiring continuous software updates and security patching. Efficiency in assembly and quality control are paramount to minimize failure rates given the sensitive electronic environment within vehicles.

The downstream distribution channels are bifurcated between the OEM path and the aftermarket path. The OEM channel is highly centralized, involving direct supply to vehicle assembly plants or authorized dealer networks, benefiting from large volume contracts and factory warranty backing. The aftermarket channel is significantly more fragmented, relying on independent distributors, specialized automotive electronics retailers, certified professional installers, and e-commerce platforms. This channel requires extensive sales support and training for installers, as proper installation is crucial for system performance and vehicle integrity. Direct-to-consumer sales via e-commerce are growing, but often rely on professional installation networks for fulfillment, ensuring the highly technical nature of the product is correctly handled.

- Upstream Analysis: Dominated by suppliers of semiconductors, specialized communication chips (RF/GPS/Cellular), plastics, and advanced wiring materials. High R&D pressure on data bypass module manufacturers.

- Downstream Analysis: Characterized by fragmented aftermarket distribution (independent retailers, specialized installers) and consolidated OEM distribution (direct to assembly plants and dealerships).

- Distribution Channel: Aftermarket relies on certified third-party installers; OEM relies on established factory logistics and authorized service centers.

- Direct and Indirect: Direct sales occur through OEM vehicle sales packages. Indirect sales dominate the aftermarket through retail stores, installers, and e-commerce platforms requiring specialized fulfillment services.

Remote Starter Market Potential Customers

The Remote Starter Market’s customer base is extensive, ranging from individual vehicle owners seeking enhanced comfort to large commercial fleet operators prioritizing efficiency and asset security. The largest segment of potential customers comprises private vehicle owners residing in geographic areas prone to extreme temperatures, both hot and cold. These individuals view remote starting as a key comfort feature, significantly improving the daily usability of their vehicle during adverse weather conditions. Adoption is particularly high among owners of premium or luxury vehicles where connectivity features are expected, and also among utility vehicle owners (trucks and SUVs) who utilize the vehicles year-round in various climates, often valuing the ability to defrost windows or cool the cabin before entry.

Another major demographic of potential customers includes operators of commercial fleets, spanning delivery services, logistics companies, and rental agencies. For commercial use, the remote starter is often integrated with a broader telematics suite, providing functionalities far beyond engine starting. These systems enable remote diagnostics, GPS tracking for route optimization, detailed idle time logging for fuel consumption monitoring, and sophisticated asset security measures. Fleet managers leverage these capabilities to enforce company policies, ensure driver safety, and reduce operational costs, making them a high-value customer segment focused on return on investment (ROI) rather than mere convenience.

Furthermore, technology-savvy consumers who prioritize vehicle connectivity represent a rapidly growing segment, specifically driving the demand for smartphone-based and AI-integrated systems. These users are typically early adopters of mobile technology and are willing to pay a premium for features like long-range control, vehicle health status updates via app, and integration with home automation systems (e.g., using a voice assistant to start the car). The market also includes owners of Electric Vehicles (EVs), for whom remote start translates directly into pre-conditioning the battery pack and cabin, which is critical for maximizing driving range and battery longevity, positioning EVs as a crucial future customer base for advanced remote starter solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Directed Electronics (Viper, Clifford), Compustar (Firstech, DroneMobile), AstroStart, Arctic Start, Mopar (Stellantis), PIAA, Audiovox (Voxx International), Fortin Electronic Systems, iDataLink, Pioneer Corporation, Garmin Ltd., Continental AG, Bosch Group, Valeo, Mid City Engineering, CarLink, AutoPage. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Remote Starter Market Key Technology Landscape

The technological evolution of the Remote Starter Market is characterized by a dynamic shift towards connected, software-defined systems, moving away from purely hardware-centric solutions. Initially, the core technology relied on simple RF signaling for one-way communication, utilizing proprietary frequencies and encryption to transmit the start command. Current technology is dominated by advanced two-way RF systems that utilize spread spectrum technology for extended range and signal confirmation, often integrated with complex security protocols. However, the most disruptive technology landscape involves the utilization of embedded cellular modems and GPS chips, facilitating global control via telematics networks and allowing for features like real-time location tracking and detailed vehicle diagnostics, fundamentally transforming the product into an IoT device.

The primary technological challenge and area of intense R&D investment is the development of robust, non-invasive data interface modules (often referred to as CAN bypass modules). Modern vehicles rely heavily on Controller Area Network (CAN) bus systems for communication between various electronic control units (ECUs), including the engine immobilizer. Remote starters must securely interface with and temporarily override these systems without compromising the vehicle’s security or damaging factory electronics. This requires specialized cryptographic keys and firmware that must be continually updated to keep pace with new vehicle models and their increasingly complex, proprietary digital architectures, demanding significant expertise in automotive cybersecurity and diagnostics.

Future technology focuses heavily on integrating AI and edge computing capabilities within the control module itself. This allows for predictive analysis and localized decision-making, reducing reliance on constant cloud connectivity for basic functions and improving responsiveness. Furthermore, there is a push towards standardization, particularly through protocols that facilitate seamless integration with broader vehicle telematics platforms and third-party applications, such as those used by insurance companies or roadside assistance providers. The adoption of robust, low-power wide-area network (LPWAN) technologies, like LTE-M or NB-IoT, is crucial for maintaining the viability and cost-effectiveness of cellular subscriptions, ensuring long-term product sustainability in the evolving connected car ecosystem.

- Technology used for the Remote Starter market. This Points summarize in a brief paragraph.

- RF Technology: Use of high-frequency radio waves (e.g., 900MHz or 433MHz) for short to medium-range one-way and two-way communication via key fobs.

- Cellular Telematics: Integration of embedded modems (e.g., 4G LTE) and GPS for long-range control and tracking via mobile applications, requiring data subscription services.

- CAN Bus Integration: Utilization of proprietary Data Interface Modules (Bypass Modules) and flashing tools to safely and securely interface with the vehicle's electronic network and immobilizer system.

- AI and Machine Learning: Implementation of predictive algorithms for optimized, autonomous pre-conditioning and enhanced anomaly detection for security monitoring.

- Cloud Computing Infrastructure: Essential for routing commands, storing vehicle data, and enabling over-the-air (OTA) software updates for control modules and interface firmware.

Regional Highlights

Regional analysis of the Remote Starter Market reveals significant geographical variations in adoption rates, driven primarily by climate, regulatory environment, and economic factors. North America maintains the dominant market share, largely attributed to the extremely cold winters in Canada and the northern United States, making remote starting a near-essential feature for consumer vehicles. High disposable incomes and a strong, established aftermarket distribution and installation network further cement its leadership position. The consumer preference in this region is rapidly skewing towards long-range, two-way cellular solutions that offer added security and diagnostic features, leading to competitive innovation in telematics integration.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This acceleration is underpinned by rising vehicle production and ownership, particularly in emerging economies like China, India, and Southeast Asia, where rapid urbanization leads to demand for comfort features. Furthermore, the diverse climate across APAC, featuring both cold mountainous regions and intensely hot tropical zones, ensures robust demand for both heating and cooling pre-conditioning functionalities. The challenge in APAC lies in navigating complex regulatory landscapes and catering to a highly price-sensitive consumer base, favoring manufacturers that can offer robust, feature-rich systems at competitive price points.

Europe presents a unique market scenario characterized by moderate growth due to stringent anti-idling regulations prevalent in many Western European nations, which restrict the usage duration of remote starters. However, demand exists for sophisticated, efficient systems that comply with these limits, focusing on minimal-idle pre-heating or cooling, often leveraging hybrid or electric vehicle capabilities where regulatory constraints are less severe. The Latin America and Middle East & Africa (MEA) regions exhibit steady growth, primarily driven by luxury vehicle adoption in key economic hubs and the necessity for vehicle cooling in hot climates (MEA), where enhanced security features and GPS tracking capabilities bundled with the remote starter functionality also prove highly appealing due to higher regional vehicle theft rates.

- North America: Dominant market share due to extreme climate, high consumer disposable income, mature aftermarket distribution, and strong adoption of cellular-based systems.

- Asia Pacific (APAC): Fastest growing region, driven by increasing vehicle sales, urbanization, diverse climate zones, and rising middle-class expenditure on vehicle connectivity and comfort.

- Europe: Moderate growth rate constrained by strict anti-idling regulations; market focus on compliance, efficiency, and integration with EV pre-conditioning systems.

- Latin America: Steady growth, characterized by demand for enhanced vehicle security features integrated with remote start capabilities alongside climate control.

- Middle East and Africa (MEA): Growth driven by necessity for cooling pre-conditioning in high-temperature regions and increasing adoption of luxury vehicles and fleet telematics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Remote Starter Market.- Directed Electronics (Viper, Clifford, AstroStart)

- Compustar (Firstech, DroneMobile, Arctic Start)

- VOXX International (Prestige, Audiovox)

- Mopar (Stellantis)

- General Motors (OnStar Telematics)

- Ford Motor Company (FordPass Telematics)

- Continental AG

- Robert Bosch GmbH

- Valeo

- Fortin Electronic Systems

- iDataLink (ADS)

- Pioneer Corporation

- Garmin Ltd.

- Mid City Engineering

- P.S.I. Systems Inc.

- CarLink (T&A Mobile)

- AutoPage

- Crimestopper Security Products

- Acumen Automotive

- Global Remote Technologies

Frequently Asked Questions

Analyze common user questions about the Remote Starter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between 1-Way, 2-Way, and Cellular Remote Starters?

1-Way systems transmit the start command but provide no feedback. 2-Way systems confirm the command execution back to the remote fob, often displaying vehicle status (running, locked). Cellular (Smartphone-based) systems use telematics networks for long-distance control via a mobile app, eliminating range restrictions and offering extensive diagnostics, usually requiring a subscription fee.

Are remote starters safe, and do they void vehicle warranties?

Modern remote starters, especially those utilizing specialized data interface modules (bypass modules), are designed to safely interface with the vehicle's immobilizer without compromising factory security. Installation by a certified professional is critical. While the Magnuson-Moss Warranty Act generally prevents warranting parts from being voided, unauthorized modifications can affect specific electrical systems. OEM-fitted systems carry full factory warranty coverage, minimizing risk.

How does the integration of AI impact the efficiency and user experience of remote starters?

AI improves efficiency by implementing predictive pre-conditioning, learning the user's schedule and local weather to optimize the engine start time and duration, minimizing fuel usage. It enhances the user experience through personalized settings and proactive security monitoring, transforming the system from a manual convenience into an intelligent vehicle management tool.

What is a CAN bypass module and why is it essential for modern remote starter installation?

A CAN (Controller Area Network) bypass module is a sophisticated electronic component that intercepts and interprets communication signals on a vehicle's data bus. It is essential because it allows the remote starter system to securely mimic the factory ignition process and temporarily disable the immobilizer without requiring physical keys or irreversible modifications to the vehicle's complex wiring, maintaining system integrity.

Which regions are driving the growth of the remote starter market?

North America is currently the dominant market due to severe climate conditions and high adoption rates. However, the Asia Pacific region, fueled by rising vehicle ownership and urbanization, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), reflecting increasing demand for comfort and connectivity features in emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Remote Starter Market Size Report By Type (One-way Remote Starter, Two-way Remote Starter, One-button Remote Starter), By Application (Passenger Vehicles, Commercial Vehicles, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Remote Starter Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (One-Way Remote Starter, Other), By Application (Passenger Car, Commercial Vehicle), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager